So who is right? Will there be inflation or deflation in the US?

To understand how this mighty fight between the two opposing force of the market will play, it is once again to Japan that you should go.

Japan for the obvious reason of having had a gigantic bubble before everybody else, is probably the best example of what will happen both in China, concerning its real estate bubble, as we have discussed countless times on this channel and in the US now concerning inflation or rather the lack of it.

So what happens to inflation in a deflationary environment? To have inflation, you need two factors, excess demand and rising salaries to feed this demand. As simple as that. If you have no demand, then prices cannot rise or products do not sell and soon enough disappear from shelves. Japan has been in a deflationary environment for most of the last 3 decades so both salaries and prices didn't rise.

But not quite. In fact during the same period, the Japanese Yen has been losing ground against foreign currencies so inevitable Japan ended up with imported inflation. This gave rise to two consequences: The price of imported products did rise but since people could not afford them, they slowly disappeared from the shelves. Problem solved; no inflation. But the price of some raw commodities also did rise sharply and for those the answer mechanism could no be so easy. (Japan imports 60% of its food and most of its energy and raw materials.) Here inflation did trickle down to domestic prices and in the end started having a significant effect on actual retail prices.

And this is where the magic of complex compound indexes do their magic. Add rice 50% with computer ships -20%, subtract some hedonistic adjustment every year and you arrive to the 3% +/- something that end up being the official inflation rate of Japan. Quite acceptable? Except that after years of this regimen the average Japanese is now half as rich as he was 20 years ago. A painful and dramatic lowering of the standard of living with few equivalent in the world outside wars, major crisis and natural catastrophes.

This is very likely what will happen in the US in the coming months. The recession which already started earlier this year will create the necessary deflationary environment, which month after month will be announced to the great relief of Wall Street while indispensable products and services, especially food will see double digit inflation. "Sure enough but these indexes tend to vary a lot anyway so they should not be included in the official numbers." And they won't be so inflation will creep up but still stay relatively low while the middle class will melt like snow in a hot Summer day.

Will the dreaded tariff-flation show up this time? Or will the excuse factory be required to spin the Trump-policy-driven price hike expectations as coming next time?

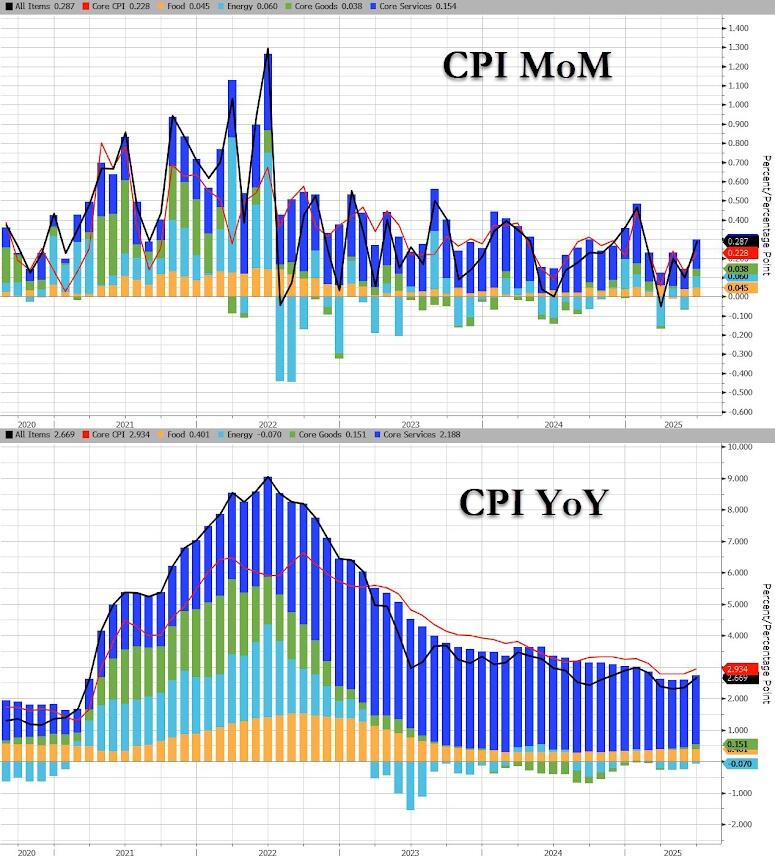

Expectations were for a modest acceleration in prices in June and headline Consumer Prices did just that rising 0.3% MoM (as expected) and +2.7% YoY (up from +2.4% prior and hotter than the +2.6% YoY expected)...

Source: Bloomberg

The MoM acceleration was driven by a flip from deflation to inflation for Energy prices...

Source: Bloomberg

New and Used Car prices are dropping!!!

That's not supposed to happen...

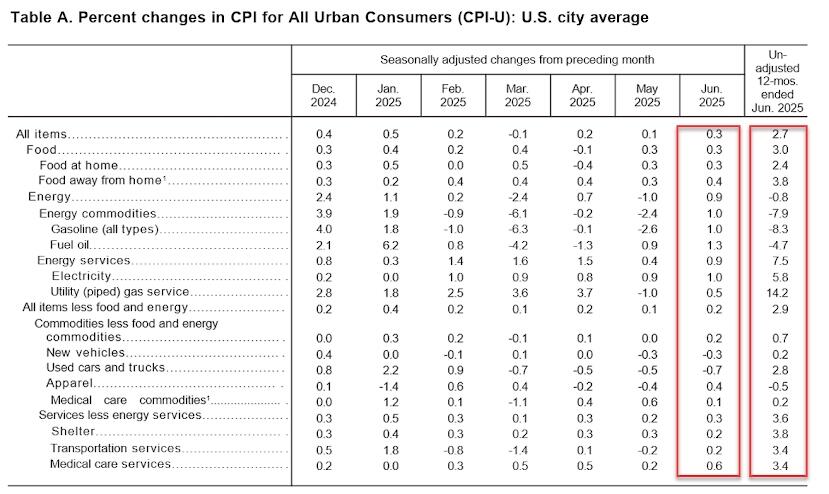

CPI Highlights: the index for shelter rose 0.2% in June and was the primary factor in the all items monthly increase. The energy index rose 0.9% in June as the gasoline index increased 1.0% over the month. The index for food increased 0.3% as the index for food at home rose 0.3% and the index for food away from home rose 0.4% in June.

The index for all items less food and energy rose 0.2% in June, following a 0.1% increase in May. Indexes that increased over the month include household furnishings and operations, medical care, recreation, apparel, and personal care. The indexes for used cars and trucks, new vehicles, and airline fares were among the major indexes that decreased in June.

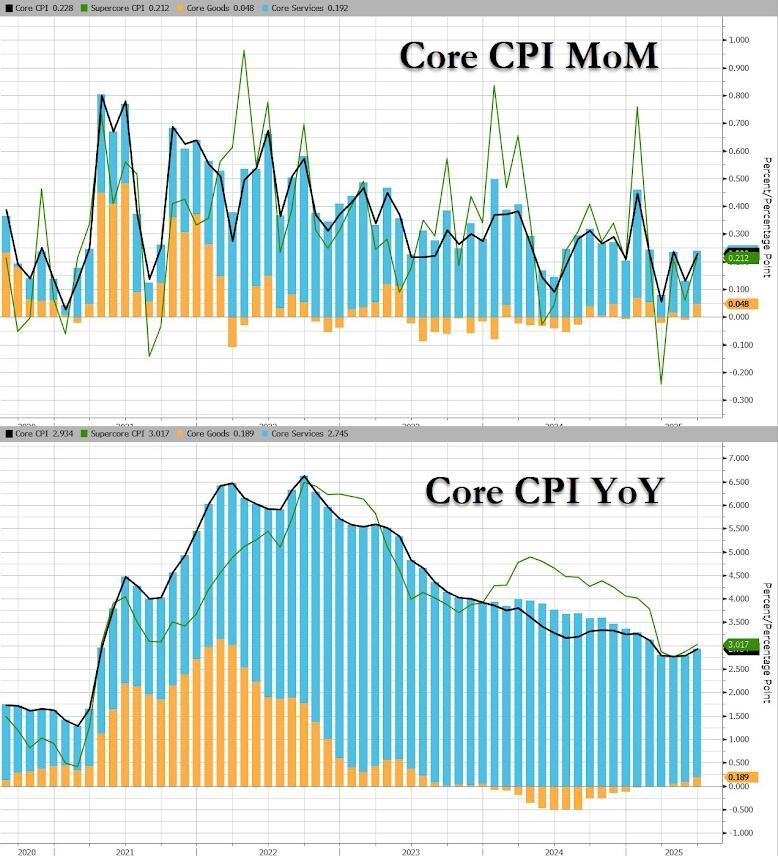

The headline CPI YoY is the hottest since February but Core CPI printed cooler than expected (+0.1% MoM vs +0.2% MoM exp) with the YoY rise higher at +2.9% (as expected)...

Source: Bloomberg

Core Goods prices are accelerating on a YoY basis...

Source: Bloomberg

More details on Core CPI which rose 0.2%, below the 0.3% 3 estimate:

The shelter index increased 0.2% over the month. The index for owners’ equivalent rent rose 0.3% in June and the index for rent increased 0.2%.

Conversely, the lodging away from home index fell 2.9% in June.

The household furnishings and operations index rose 1.0% in June, after rising 0.3% in May.

The index for recreation increased 0.4% over the month.

The apparel index increased 0.4% in June and the personal care index rose 0.3%.

In contrast, the index for used cars and trucks fell 0.7% in June after declining 0.5 percent in May.

The new vehicles index fell 0.3 percent over the month, and the airline fares index declined 0.1 percent.

The medical care index increased 0.5% over the month, following a 0.3-percent increase in May.

The index for hospital and related services increased 0.4 percent in June as did the index for prescription drugs.

The physicians’ services index rose 0.2 percent over the month.

The index for all items less food and energy rose 2.9% over the past 12 months. The shelter index increased 3.8% over the last year. Other indexes with notable increases over the last year include medical care (+2.8%), motor vehicle insurance (+6.1%), household furnishings and operations (+3.3%), and recreation (+2.1%).

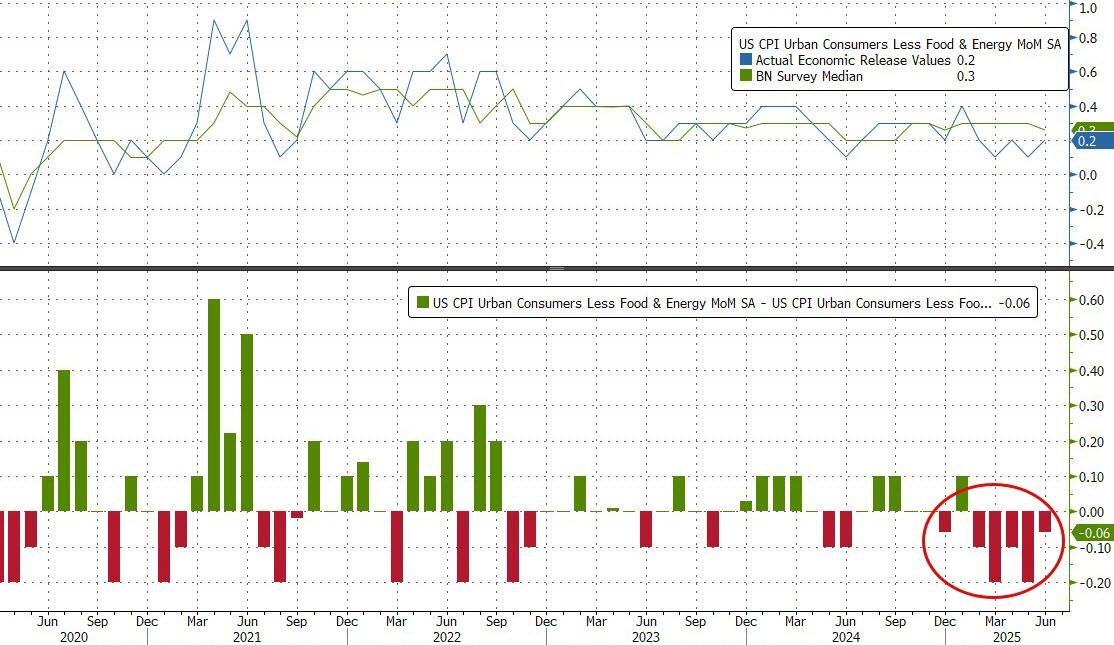

This is the 5th monthly 'miss' for Core CPI in a row - the sky is falling analyst crowd continues to be wrong...

Source: Bloomberg

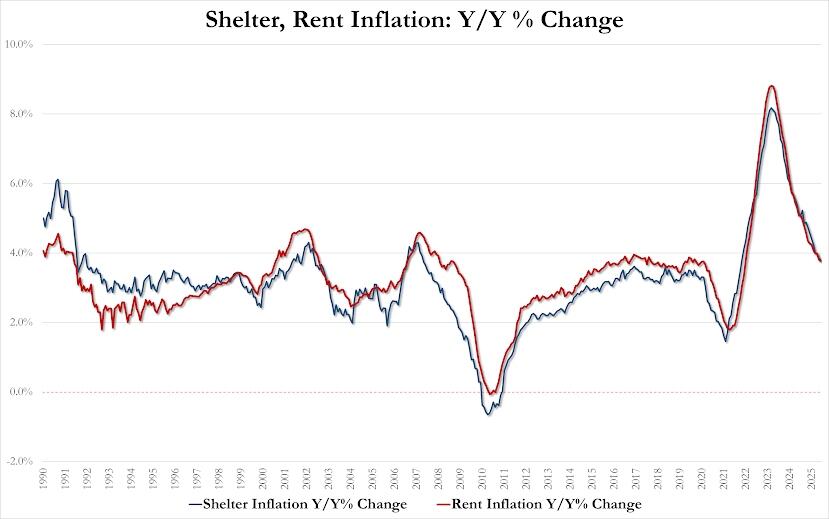

Rent/Shelter inflation slowed in June...

Rent inflation June 3.77% YoY, down from 3.80% in May and the lowest since Jan 2022

Shelter inflation June 3.80% YoY, down from 3.86% in May and the lowest since Oct 2021

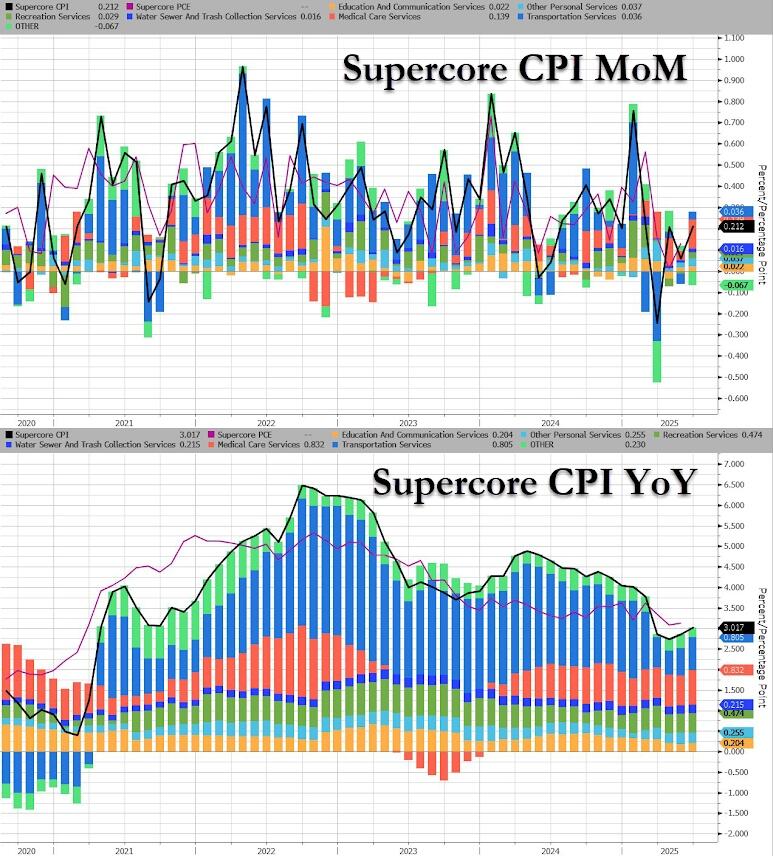

SuperCore CPI (Services ex-shelter) rose 0.36% MoM, lifting prices 3.34% YoY - highest since feb but well off the YTD highs

Source: Bloomberg

Medical Care Services costs are also starting to accelerate (not exactly tariff-driven)...

Source: Bloomberg

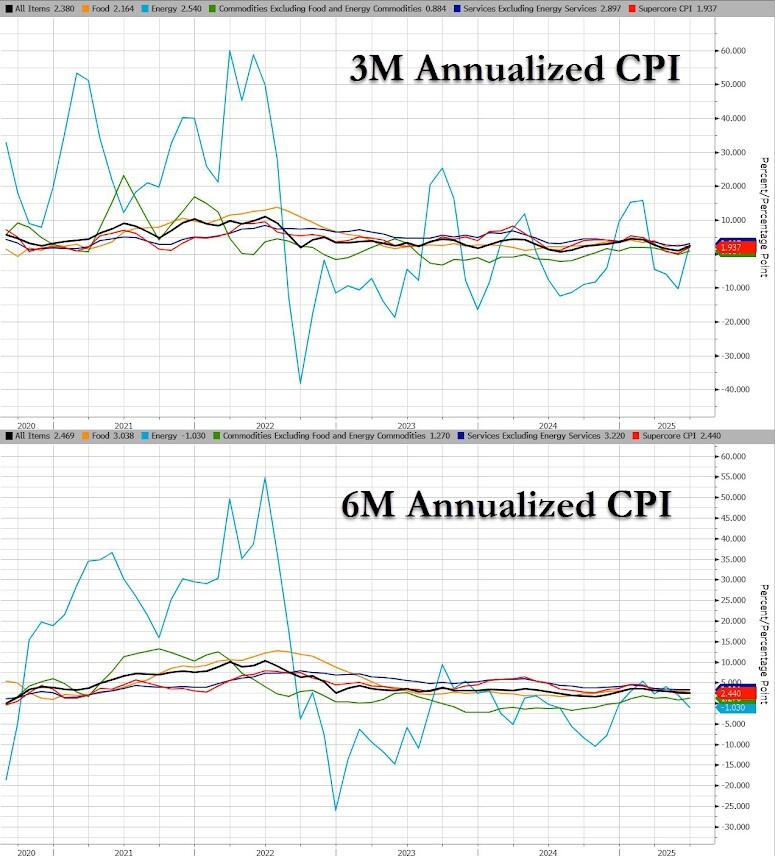

On a 3m- and 6m- annualized basis, there are no signs of the tariff-driven price hikes as yet...

Source: Bloomberg

Not exactly the damning evidence of terrifying tariff-flation that the establishment wants us to believe is coming...

No comments:

Post a Comment