The question now is how long before it all comes crashing down?

The WEF and Central Banks believe that everything will be fine with their controlled demolition project. Who could blame them? They control the governments, the medias, and almost everything that really counts. I would argue that they are deeply mistaken. What they do not control will destroy their project.

We are quickly approaching the waterfall so we will soon know. Although for now, it looks suspiciously like a replay of 2008, I expect things to unfold very differently. No Bear Stearns this time. No single bank will be allowed to collapse but this may quickly create panics at another level and scale. September?

Authored by Brandon Smith via Alt-Market.us

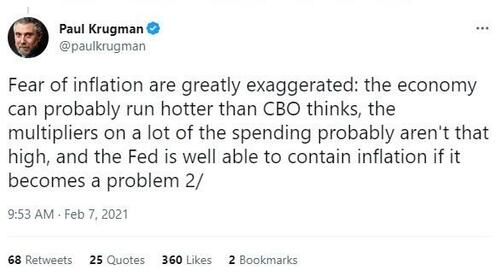

The one thing about the financial world that never ceases to amaze me is how far behind the curve mainstream economists always seem to be. Not long ago we had Janet Yellen and Paul Krugman, economists supposedly at the front of the pack, both proving to be utterly ignorant (or strategically dishonest) on the effects of central bank stimulus measures and the threat of inflation. In fact, they both consistently denied such a threat existed until they were crushed by the evidence.

This tends to be the modus operandi of top establishment analysts, and the majority of economists out there simply follow the lead of these gatekeepers – Maybe because they’re vying for a limited number of cushy positions in the field, or perhaps because they’re afraid that if they present a contradictory theory they’ll be ostracized. Economics is often absurdist in nature because Ivy League “experts” can be wrong time and time again and yet still keep their jobs and rise up through the ranks. It’s a bit like Hollywood in that way; they fail upwards.

In the meantime, alternative economists keep hitting the target with our observations and predictions, but we’ll never get job offers from establishment publications because they’re not looking for people who are right, they’re looking for people that toe the line.

And so it goes. I look forward to the fast approaching day when all of these guys (and girls) proclaim frantically that “no one saw this crisis coming.” After things get even worse, they’ll all come out and say they actually “saw the crisis coming and tried to warn us.”

The hope is not so much to get credit where credit is due (because that’s not going to happen), but to wake up as many people who will listen as possible to the dangers ahead, and maybe save a few lives or inspire a few rebels in the process. In the case of establishment yes-men, the hope is that they eventually get that left hook to the face from reality and lose credibility in the eyes of the public. They deserve to go down with the ship – Either they are disinformation agents or they’re too ignorant to see the writing on the wall and should not have the jobs they have.

The latest US bank failures seem to be ringing their bell the past couple of months, that’s for sure. In a survey managed by the World Economic Forum, over 80% of chief economists now say that central banks “face a trade-off between managing inflation and maintaining financial sector stability.” They now warn that price pressures look likely to remain higher for longer and they predict a prolonged period of higher interest rates that will expose further frailties in the banking sector, potentially compromising the capacity of central banks to rein in inflation. This is a HUGE reversal from their original message of a magical soft landing.

Imagine that. The very thing alternative economists including myself have been “ranting” about for years, the very thing they used to say was “conspiracy theory” or Chicken Little doom mongering, is now accepted as fact by a majority of surveyed economists.

But where does this leave us? After acceptance usually comes panic.

The credit crunch is just beginning and the absorbing of the insolvent First Republic Bank into JP Morgan is a median step to a larger crash. The expectation is that the Federal Reserve will step in to dump more stimulus into the system to keep it afloat, but it’s too late. My position has always been that the central banks would deliberately initiate a liquidity crisis through steady interest rate hikes. This has now happened.

The Catch-22 scenario has been accomplished. Just like the lead up to the 2008 credit crisis, all the Fed needed to do was raise rates to around 5% to 6% and suddenly all systemic debt becomes untenable. Now it’s happening again and they KNEW it would happen again. Except this time, we have an extra $20 trillion in national debt, a banking network completely addicted to cheap fiat stimulus and an exponential stagflation problem.

If the Fed cuts rates prices will skyrocket even more. If they keep rates at current levels or raise them, more banks will implode. Most mainstream analysts will expect the Fed to go back to near-zero rates and QE in response, but even if they do (and I’m doubtful that they will) the outcome will not be what the “experts” expect. Some are realizing that QE is an impractical expectation and that inflation will annihilate the system just as fast as a credit crisis, but they are few and far between.

The World Economic Forum report for May outlines this dynamic to a point, but what it doesn’t mention is that there are extensive benefits attached to the coming crisis for the elites. For example, major banks like JP Morgan will be able to snatch up smaller failing banks for pennies on the dollar, just like they did during the Great Depression. And, globalist institutions like the WEF will get their “Great Reset,” which they hope will frighten the public into adopting even more financial centralization, social controls, digital currencies and a cashless society.

For the average concerned citizen out there, this narrative change matters because it’s a signal that things are about to get much worse. When the establishment itself is openly acknowledging that gravity exists and that we are falling instead of flying, it’s time to get ready and take cover. They never admit the truth unless the worst case scenario is right around the corner.