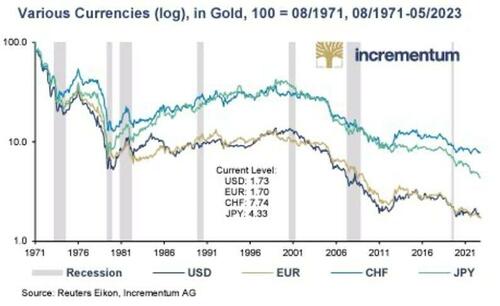

The analogy between waist line and Central Banks is interesting although the consequences will be strikingly different. Inflating money away has always been the demise of Empires in History. Think Denarius, the Roman coin, but with no silver whatsoever inside! The Euro and Dollar won't escape this fate. It is technically impossible. But Central Banks will delay, burn more furniture in the castle until the rooms are bare. A look at Union Square in San Francisco these days, a city which used to be one of the most magnificent and nice to live in America is a snapshot of what is in store for the rest of us.

Since 1975 worldwide obesity has nearly tripled and it is now one of the leading causes of death. Despite this, rarely does someone have ‘obesity’ recorded as the cause of death on their death certificate. Instead, it might read ‘complications from Type 2 Diabetes’ or ‘cardiovascular disease’: conditions that obesity has led to.

The rise in obesity is thanks to changing diets and the ready availability of ultra processed foods, as well as changing lifestyles. Despite knowing such diets and lifestyle changes can be deadly, people still consume such foodstuffs and choose not to exercise because the negative impact of doing so is not immediate.

In fact, the immediate feedback one gets from living an unhealthy lifestyle is very often positive. Your taste buds signal to your brain that the Snickers bar is really good, or choosing to watch your favourite show rather than go for a run gives you pleasure faster than going for a run does.

To see the positive results of a healthy lifestyle is one that takes time. To see the negative results of an unhealthy lifestyle is also one that takes time. It’s not like you eat some deep fried chicken and wham! You’re struck down by a heart attack. No, that takes years of solid, poor choices.

It’s only when you find yourself unable to run around with your grandkids or walking around with an oxygen canister do you wish you’d taken better, incremental decisions that would have led to a different outcome. It is only after years of poor decisions that you really feel the true impact.

Central Banks and the Expanding Waistline

This is basically how it works for central banks. The economy starts to look a bit shaky, or governments make promises they can’t afford or ‘peacekeeping’ missions are declared and the likes of the FOMC decide that rather than save and budget within their means, a big hit of ultra processed credit is what’s needed to help things along.

Of course, they do this and everything starts to feel pretty good. Employment rates pick up, consumer spending rallies, startups are turning into unicorns, the S&P 500 is smashing through records and the housing market is booming. Everyone loves this approach to money that costs them very little and as a result they get addicted to it.

The problem is the economy no longer knows how to function and stay energised without it. None of the economic policies that seemingly 'helped' the economy keep going have added to its overall long-term health.

Central banks, recognizing that they have created an inflationary environment on purpose, willing the waistband of the economy to expand so that everyone ‘feels good’, then tries to tell everyone that these health issues are just ‘transitory’. But the truth is the expanding waistband is a fraud. Inflation is theft of wealth from the economy’s future.

What’s the Excuse Now?

Pretty soon food prices become difficult to manage, people can’t afford to heat their homes, the cost of materials climb and people are struggling to make ends meet.

But, in the same way, we justify our weight to ourselves (it’s in my genes, I had a big meal last night), and the central bankers try to justify inflation to us. And they strip out the key components to measure inflation as if they can be easily ignored - we’re talking about food and energy prices here, i.e. two of the biggest costs to the household budget.

Only in the last year have the likes of FOMC started to realise there is a big cost to all of this unhealthy economic policy of the last fifteen plus years. They tried to make amends for this by coming down hard on interest rates, and getting the economy to work harder to shift some of this inflation.

But actually, how much has changed? ‘Core’ inflation is coming down ever so slightly- but that’s easy to do when food and energy prices aren’t included and costs for services continue to rise faster than anyone would like. As ZeroHedge pointed out, the US unemployment rate is exactly where it was when the FOMC started hiking rates, so is the S&P 500.

Very little has improved. All that seems to have been achieved is a near-collapse of the US banking system (more on that shortly) and unsustainable debt levels.

“...arguably the most significant consequence of this relentless creep higher in rates is that the annual payment on US Federal debt is about to hit $1 trillion, surpassing how much the US pays every year on defence!” ZeroHedge.

The only tool left: words

Yesterday Jay Powell announced that the Federal Reserve was raising rates to a 22-year high of a target range of between 5.25 and 5.5 per cent. Markets are assuming that this is the final rate rise this cycle. Bless him, Powell did try in the press conference to wag his finger at the economy and declare that if it didn’t pipe down he’d be back in there to raise rates some more, but no one was really listening.

“We have to be ready to follow the data…And given how far we’ve come, we can afford to be a little patient as well as resolute as we let this unfold.”

Well, that’s a relief that the FOMC are now looking at the data to guide the way. Interestingly enough Christine Lagarde used near-exact the same phrasing earlier today during the ECB press conference.

We’re not convinced that they hope data will drive the way as so far it seems to us that most central bankers now try to influence inflation expectations rather than inflation itself. Jay Powell uses his press conferences and FOMC reports as an inflation-reduction tool more than they seem to use monetary policy tools.

As a result, the market is mostly playing along, now pricing this to be the last FOMC hike in the current cycle of hikes with rates being cut as early as 2024.

A slow-down in hikes and ultimately a fall in official rates is good for gold, a non-interest bearing asset, as it reduces the opportunity cost of holding it.

But, this isn’t mainstream financial media here. Nothing is ever as simple as “this metric went one way, so this commodity will go that way”. This also isn't’ the last 15 years where the world has become accustomed to low inflation rates and near-zero interest rates.

As investors read the headlines that the Fed is likely to start cutting rates as early as 2024, there will be two expectations - one is that they will gradually cut back down to zero, the other is that inflation really was merely transitory. In other words, the Fed was right all along.

Spoiler alert - neither of these things are correct. But what these assumptions do show is how addicted the market has come to low rates and the assumption that central banks really are the puppet master to the economy’s marionette.

The truth of the matter is that inflation really isn’t going anywhere. Damage has been wreaked on the health of the economy. The drip, drip, drip of cheap credit and overheating has left us with a situation that sees negative real rates at best and financial turmoil at worst.

Nothing, nothing repeat nothing that central banks around the world are doing should be giving anyone any confidence that they are on the right track to reducing our dependence on cheap credit. Therefore no one should have any expectations that real value will be returned to their currencies and savings in the mid to long-term future.

Interest rates might be up again, but like an expensive diet plan, the promises are better than the results.

Furthermore: high interest payments are clearly not just affecting US Fed’s annual payments. Remember that US banking crisis that arrived with a bang at the beginning of the year? Oddly enough it hasn’t gone away, although you wouldn’t think it looking at the news.

Earlier this week US regional banks PacWest and Bank of California agreed to a merger. More deals between the 4,000 banks are expected, as increasing numbers struggle under unsustainable deposit outflows. One has to ask why this wasn’t bigger news.

Granted the merger (unlike others this year)

didn’t happen under regulator supervision, but it is clearly a sign that

the embers of a banking crisis continue to burn.