This is a long Post so if you don't have the time to read the full article, here's the conclusion: "It is the financial war which is going

“nuclear”. Talk in the West of the military war escalating towards a

physical nuclear war misses this point. China and Russia now realise

they must protect themselves from the West’s looming currency and

economic crisis as a matter of urgency. To fail to do so would simply

ensure the crisis overwhelms them as well."

The risks of a nuclear war are not nil as the possibilities for miscalculations are numerous but for now the key to understand the crisis is financial as this article explains in details.

Authored by Alasdair Macleod via GoldMoney.com,

The chasm between Eurasia and the Western defence groupings (NATO, Five-eyes, AUKUS etc.) is widening rapidly. While

media commentary focuses on the visible side of the conflict in

Ukraine, the economic and financial aspects are what really matter.

There is an increasing inevitability about it all. China

has been riding the inflationist Western tiger for the last forty years

and now that it sees the dollar’s debasement accelerating wonders how

to get off. Russia perhaps is more advanced in its plans to do without

dollars and other Western currencies, hastened by sanctions. Meanwhile,

the West is increasingly vulnerable with no apparent alternative to the

dollar’s hegemony.

By imposing sanctions on

Russia, the West has effectively lined up its geopolitical opponents

into a common cause against an American dollar-dominated faction. Russia

happens to be the world’s largest exporters of energy, commodities, and

raw materials. And China is the supplier of semi-manufactured and

consumer goods to the world. The consequences of the West’s sanctions

ignore this vital point.

In this article, we look at the current state of the world’s financial system and assess where it is headed.

It summarises the condition of each of the major actors: the West,

China, and Russia, and the increasing urgency for the latter two powers

to distance themselves from the West’s impending currency, banking, and

financial asset crisis.

We can begin to see how the financial war will play out.

The West and its dollar-based pump-and-dump system

The

Chinese have viewed the US’s tactics under which she has ensured her

hegemony prevails. It has led to a deep-seated distrust in her

relationship with America. And this is how she sees US foreign policy in

action.

Since the end of Bretton Woods in August 1971, for

strategic reasons as much as anything else America has successfully

continued to dominate the free world. A combination of visible military

capability and less visible dollar hegemony defeated the communism of

the Soviets and Mao Zedong. Aid to buy off communism in Africa and Latin

America was readily available by printing dollars for export, and in

the case of Latin America by deploying the US banking system to recycle

petrodollars into syndicated loans. In the late seventies, banks in

London would receive from Citibank yards-long telexes inviting

participation in syndicated loans, typically for $100 million, the

purpose of which according to the telex was invariably “to further the

purposes of the state.”

Latin American borrowing from US

commercial banks and other creditors increased dramatically during the

1970s. At the commencement of the decade, total Latin American debt from

all sources was $29 billion, but by the end of 1978, that number had

skyrocketed to $159 billion. And in early-1982, the debt level reached

$327 billion.[i] We

all knew that some of it was disappearing into the Swiss bank accounts

of military generals and politicians of countries like Argentina. Their

loyalty to the capitalist world was being bought and it ended

predictably with the Latin American debt crisis.

With consumer

price inflation raging, the Fed and other major central banks had to

increase interest rates in the late seventies, and the bank credit cycle

turned against the Latins. Banks sought to curtail their lending

commitments and often (such as with floating-rate notes) they were

paying higher coupon rates. In August 1982, Mexico was the first to

inform the Fed, the US Treasury, and the IMF that it could no longer

service its debt. In all, sixteen Latin American countries rescheduled

their debts subsequently as well as eleven LDCs in other parts of the

world.

America assumed the lead in dealing with the problems,

acting as “lender of last resort” working with central banks and the

IMF. The rump of the problem was covered with Brady Bonds issued between

1990—1991. And as the provider of the currency, it was natural that the

Americans gave a pass to their own corporations as part of the recovery

process, reorganising investment in production and economic output. So,

a Latin American nation would have found that America provided the

dollars required to cover the 1970s oil shocks, then withdrew the

finance, and ended up controlling swathes of national production.

That

was the pump and dump cycle which informed Chinese military strategists

analysing US foreign policy some twenty years later. In 2014, the

Chinese leadership was certain the riots in Hong Kong reflected the work

of American intelligence agencies. The following is an extract

translated from a speech by Major-General Qiao Liang, a leading

strategist for the Peoples’ Liberation Army, addressing the Chinese

Communist Party’s Central Committee in 2015:

“Since

the Diaoyu Islands conflict and the Huangyan Island conflict, incidents

have kept popping up around China, including the confrontation over

China’s 981 oil rigs with Vietnam and Hong Kong’s “Occupy Central”

event. Can they still be viewed as simply accidental?

I

accompanied General Liu Yazhou, the Political Commissar of the National

Defence University, to visit Hong Kong in May 2014. At that time, we

heard that the “Occupy Central” movement was being planned and could

take place by end of the month. However, it didn’t happen in May, June,

July, or August.

What happened? What were they waiting for?

Let’s

look at another timetable: the U.S. Federal Reserve’s exit from the

Quantitative Easing (QE) policy. The U.S. said it would stop QE at the

beginning of 2014. But it stayed with the QE policy in April, May, June,

July, and August. As long as it was in QE, it kept overprinting dollars

and the dollar’s price couldn’t go up. Thus, Hong Kong’s “Occupy

Central” should not happen either.

At the end of September, the

Federal Reserve announced the U.S. would exit from QE. The dollar

started going up. Then Hong Kong’s “Occupy Central” broke out in early

October.

Actually, the Diaoyu Islands, Huangyan Island, the 981

rigs, and Hong Kong’s “Occupy Central” movement were all bombs. The

successful explosion of any one of them would lead to a regional crisis

or a worsened investment environment around China. That would force the

withdrawal of a large amount of investment from this region, which would

then return to the U.S."

For the Chinese, there was

and still is no doubt that America was out to destroy China and stood

ready to pick up the pieces, just as it had done to Latin America, and

South-East Asia in the Asian crisis in 1997. Events since “Occupy

Central” will have only confirmed that view and explains why the Chinese

dealt with the Hong Kong problem the way they did, when President Trump

mounted a second attempt to derail Hong Kong, with the apparent

objective to prevent global capital flows entering China through

Shanghai Connect.

For the Americans the world is slipping out of

control. They have had expensive wars in the Middle East, with nothing

to show for it other than waves of displaced refugees. For them, Syria

was a defeat, even though that was just a proxy war. And finally, they

had to give up on Afghanistan. For her opponents, America has lost

hegemonic control in Eurasia and if given sufficient push can be removed

from the European mainland entirely. Undoubtedly, that is now Russia’s

objective. But there are signs that it is now China’s as well, in which

case they will have jointly obtained control of the Eurasian land mass.

Financial crisis facing the dollar

The

geopolitics between America and the two great Asian states have been

clear for all of us to see. Less obvious has been the crisis facing

Western nations. Exacerbated by American-led sanctions against Russia,

producer prices and consumer prices are not only rising, but are likely

to continue to do so. In particular, the currency and credit inflation

of not only the dollar, but also the yen, euro, pound, and other motley

fiat currencies have provided the liquidity to drive prices of

commodities, producer prices and consumer prices even higher. In the US,

reverse repos which absorb excess liquidity currently total nearly $2

trillion. And the higher interest rates go, other things being equal the

higher this balance of excess currency no one wants will rise.

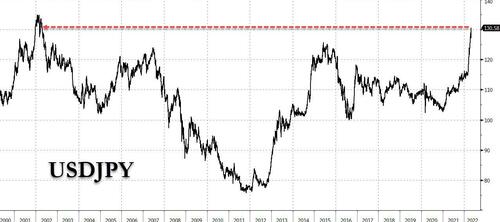

And

rise they will. The strains are most obvious in the yen and the euro,

two currencies whose central banks have their interest rates stuck below

the zero bound. They refuse to raise them, and their currencies are

collapsing instead. But when you see the ECB’s deposit rate at minus

0.5%, producer prices for Germany rising at an annualised rate of over

30%, and consumer prices already rising at 7.5% and sure to go higher,

you know they will all go much, much higher.

Like the Bank of

Japan, the ECB and its national central banks through quantitative

easing have assembled substantial portfolios of bonds, which with rising

interest rates will generate losses which will drive them rapidly into

insolvency. Furthermore, the two most highly leveraged commercial

banking systems are the Eurozone’s and Japan’s with assets to equity

ratios for the G-SIBs of over twenty times. What this means is that less

than a 5% fall in the value of its assets will bankrupt the average

G-SIB bank.

It is no wonder that foreign depositors in these

banking systems are taking fright. Not only are they being robbed

through inflation, but they can see the day when the bank which has

their deposits might be bailed in. And worse still, any investment in

financial assets during a sharply rising interest environment will

rapidly lose value.

For now, the dollar is seen as a haven from

currencies on negative yields. And in the Western world, the dollar as

the reserve currency is seen as offering safety. But this safety is an

accounting fallacy which supposes that all currency volatility is in the

other fiat currencies, and not the dollar. Not only do foreigners

already own dollar-denominated financial assets and bank deposits

totalling over $33 trillion, but rising bond yields will prick the

dollar’s financial asset bubble wiping out much of it.

In other

words, there are currently winners and losers in currency markets, but

everyone will lose in bond and equity markets. Add into the mix

counterparty and systemic risks from the Eurozone and Japan, and we can

say with increasing certainty that the era of financialisation, which

commenced in the 1980s, is ending.

This is a very serious

situation. Bank credit has become increasingly secured on non-productive

assets, whose value is wholly dependent on low and falling interest

rates. In turn, through the financial engineering of shadow banks,

securities are secured on yet more securities. The $610 trillion of OTC

derivatives will only provide protection against risk if the

counterparties providing it do not fail. The extent to which real assets

are secured on bank credit (i.e., mortgages) will also undermine their

values.

Clearly, central banks in conjunction with their

governments will have no option but to rescue their entire financial

systems, which involves yet more central bank credit being provided on

even greater scales than seen over covid, supply chain chaos, and the

provision of credit to pay for higher food and energy prices. It must be

unlimited.

We should be in no doubt that this accelerating danger

is at the top of the agenda for anyone who understands what is

happening — which particularly refers to Russia and China.

Russia’s aggressive stance

There

can be little doubt that Putin’s aggression in Ukraine was triggered by

Ukraine’s expressed desire to join NATO and America’s seeming

acquiescence. A similar situation had arisen over Georgia, which in 2008

triggered a rapid response from Putin. His objective now is to get

America out of Europe’s defence system, which would be the end of NATO.

Consider the following:

America’s military campaigns on

the Eurasian continent have all failed, and Biden’s withdrawal from

Afghanistan was the final defeat.

The EU is planning its

own army. Being an army run by committee it will lack focus and be less

of a threat than NATO. This evolution into a NATO replacement should be

encouraged.

As the largest supplier of energy to the EU, Russia can apply maximum pressure to speed up the political process.

The

most important commodity for the EU is energy. And through EU policies,

which have been to stop producing carbon-based energy and to import it

instead, the EU has become dependent on Russian oil, natural gas, and

coal. And by emasculating Ukraine’s production, Putin is putting further

pressure on the EU with respect to food and fertiliser, which will

become increasingly apparent over the course of the summer.

For

now, the EU is toeing the American line, with Brussels instructing

member states to stop importing Russian oil from the end of this year.

But already, it is reported that Hungary and Slovakia are prepared to

buy Russian oil and pay in roubles. And it is likely that while other EU

governments will avoid direct contractual relationships with Russia,

ways round the problem indirectly are being pursued.

A sticking

point for EU governments is having to pay in roubles. Otherwise, the

solution is simple: non-Russian, non-EU banks can create a Eurorouble

market overnight, creating rouble bank credit as needed. All that such a

bank requires is access to rouble liquidity to manage a balance sheet

denominated in roubles. The obvious providers of rouble credit are

China’s state-controlled megabanks. And we can be reasonably sure that

at his meeting with President Xi on 4 February, not only would the

intention to invade Ukraine have been discusseded, but the role of

China’s banks in providing roubles for the “unfriendlies” (NATO and its

supporters) in the event of Western sanctions against Russia will have

been as well.

The point is that Russia and China have mutual

geopolitical objectives, and what might have come as a surprise to the

West was most likely agreed between them in advance.

The recovery

in the rouble from the initial hit to an intraday low of 150 to the

dollar has taken it to 64 at the time of writing. There are two factors

behind this recovery. The most important is Putin’s announcement that

the unfriendlies will have to pay for energy in roubles. But there was a

subsidiary announcement that the Russian central bank would be buying

gold. Notionally, this was to ensure that Russian banks providing

finance to gold mines could gold and other related assets as collateral.

But the central bank had stopped buying gold and accumulated the

unfriendlies currencies in its reserves instead. This was taken by

senior figures in Putin’s administration as evidence that the highly

regarded Governor, Elvira Nabiullina, had been captured by the West’s

BIS-led banking system.

Russia has now realised that foreign

exchange reserves which can be blocked by the issuers are valueless as

reserves in a crisis, and that there is no point in having them. Only

gold, which has no counterparty risk can discharge this role. And it is a

lesson not lost on other central banks either, both in Asia and

elsewhere.

But this sets the rouble onto a different course from

the unbacked fiat currencies in the West. This is deliberate, because

while rising interest rates will lead to a combined currency, banking,

and financial asset crisis in the West, it is a priority of the greatest

importance for Russia to protect herself from these developments.

A new backing for the rouble

Russia

is determined to protect herself from a dollar currency collapse. So

far as Russia is concerned, this collapse will be reflected in rising

dollar prices for her exports. And only last week, one of Putin’s senior

advisors, Nikolai Patrushev, confirmed in an interview with Rossiyskaya Gazeta that

plans to link the rouble to commodities are now being considered. If

this plan goes ahead, the intention must be for the rouble to be

considered a commodity substitute on the foreign exchanges, and its

protection against a falling dollar will be secured.

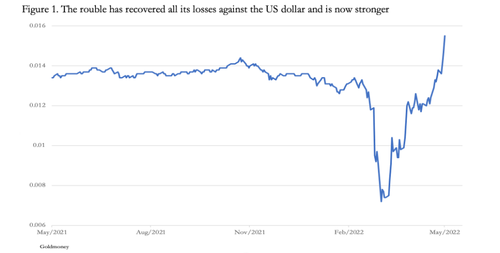

We are

already seeing the rouble trending higher, with it at 64 to the dollar

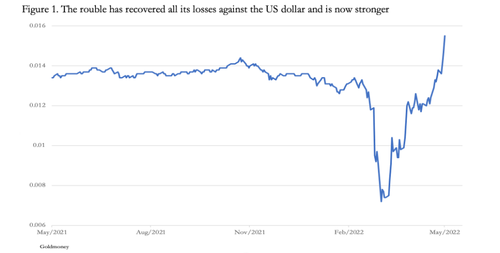

yesterday. Figure 1 below shows its progress, in the dollar-value of a

rouble.

Keynesians

in the West have misread this situation. They think that the Russian

economy is weak and will be destabilised by sanctions. That is not true.

Furthermore, they would argue that a currency strengthened by insisting

that oil and natural gas are paid for in roubles will push the Russian

economy into a depression. But that is only a statistical effect and

does not capture true economic progress or the lack of it, which cannot

be measured. The fact is that the shops in Russia are well stocked, and

fuel is freely available, which is not necessarily the case in the West.

The

advantages for Russia are that as the West’s currencies sink into

crisis, the rouble will be protected. Russia will not suffer from the

West’s currency crisis, she will still get inflation compensation in

commodity prices, and her interest rates will decline while those in the

West are soaring. Her balance of trade surplus is already hitting new

records.

There was a report, attributed to Dmitri Peskov, that the

Kremlin is considering linking the rouble to gold and the idea is being

discussed with Putin. But that’s probably a rehash of the interview

that Nickolai Patrushev recorded with Rossiyskaya Gazeta referred

to above, whereby Russia is considering fixing the rouble against a

wider range of commodities. At this stage, a pure gold standard for the

rouble of some sort would have to take the following into account:

History

has shown that the Americans and the West’s central banks manipulate

gold prices through the paper markets. To fix the rouble against a gold

standard would hold it a hostage to fortune in this sense. It would be

virtually impossible for the West to manipulate the rouble by

intervening in this way across a range of commodities.

Over

long periods of time the prices of commodities in gold grams are

stable. For example, the price of oil since 1950 has fallen by about

30%. The volatility and price rises have been entirely in fiat

currencies. The same is true for commodity prices generally, telling us

that not only are commodities priced in gold grams generally stable, but

a basket of commodities can be regarded as tracking the gold price over

time and therefore could be a reasonable substitute for it.

If

Russia has significant gold bullion quantities in addition to declared

reserves, these will have to be declared in conjunction with a gold

standard. Imagine a situation where Russia declares and can prove that

it has more gold that the US Treasury’s 8,133 tonnes. Those who appear

to be in a position to do so assess the true Russian gold position is

over 10,000 tonnes. Combined with China’s undeclared gold reserves, such

an announcement would be a financial nuclear bomb, destabilising the

West.

For this reason, Russia’s partner, China, for which

exporting semi-manufactured and consumer goods to the West is central

to her economy activities, would prefer an approach that does not add to

the dollar’s woes directly. The Americans are doing enough to undermine

the dollar without a push from Asia’s hegemons.

Furthermore,

a mechanism for linking the rouble to commodity prices has yet to be

devised. The advantage of a gold standard is it is a simple matter for

the issuer of a currency to accept notes from the public and to pay out

gold coin. And arbitrage between gold and roubles would ensure the link

works on the foreign exchanges. This cannot be done with a range of

commodities. It will not be enough to simply declare the market value of

a commodity basket daily. Almost certainly forex traders will ignore

the official value because they have no means of arbitrage.

It is

likely, therefore, that Russia will take a two-step approach. For now,

by insisting on payments in roubles by the unfriendlies domestic Russian

prices for commodities, raw materials and foods will be stabilised as

the unfriendlies’ currencies fall relative to the rouble. Russia will

find that attempts to tie the currency to a basket of currencies is

impractical. After the West’s currency, banking, and financial asset

crisis has passed then there will be the opportunity to establish a gold

standard for the rouble.

The Eurasian Economic Union

While

it is impossible to formally tie a currency which trades on the foreign

exchanges to a basket of commodities, the establishment of a virtual

currency specifically for trade settlement between jurisdictions is

possible. This is the basis of a project being supervised by Sergei

Glazyev, whereby such a currency is planned to be used by the member

states of the Eurasian Economic Union (EAEU). Glazyev is Russia’s

Minister in charge of integration and macroeconomics of the EAEU. While

planning to do away with dollars for trade settlements has been in the

works for some time, sanctions by the unfriendlies against Russia has

brought about a new urgency.

We know no detail, other than what was revealed in an interview Glazyev gave recently to a media outlet, The Cradle [ii].

But the desire to do away with dollars for the countries involved has

been on the agenda for at least a decade. In October 2020, the original

motivation was explained by Victor Dostov, president of the Russian

Electronic Money Association:

“If I want to transfer

money from Russia to Kazakhstan, the payment is made using the dollar.

First, the bank or payment system transfers my roubles to dollars, and

then transfers them from dollars to tenge. There is a double conversion,

with a high percentage taken as commission by American banks.”

The

new trade currency will be synthetic, presumably price-fixed daily,

giving conversion rates into local currencies. Operating rather like the

SDR, state banks can create the new currency to provide the liquidity

balances for conversion. It is a practical concept, which being

relatively advanced in the planning, is probably the reason the Kremlin

is considering it as an option for a future rouble.

That idea of a

commodity basket for the rouble itself is bound to be abandoned, while a

successful EAEU trade settlement currency can be extended to both the

wider Shanghai Cooperation Organisation and the BRICS members not in the

SCO.

China’s position

We can now say

with confidence that at their meeting on 4 February Putin and Xi agreed

to the Ukraine invasion. Chinese interests in Ukraine are affected, and

the consequences would have had to be discussed.

The fact that

Russia went ahead with its war on Ukraine makes China complicit, and we

must therefore analyse the position from China’s point of view. For some

time, America has attacked China’s economy, trying to undermine it. I

have already detailed the position over Hong Kong, to which can be added

other irritations, such as the arrest of Huawei’s chief financial

officer in Canada on American instructions, trade tariffs, and the sheer

unpredictability of trade policy during the Trump administration.

President

Biden and his administration have now been assessed by both Putin and

Xi. By 4 February their economic and banking advisors will have made

their recommendations. Outsiders can only come to one conclusion, and that is Russia and China decided at that meeting to escalate the financial war on the West.

Their

position is immensely strong. While Russia is the largest exporter of

energy and commodities in the world, China is the largest provider of

intermediate and consumer goods. Other than the unfriendlies, nearly all

other nations are neutral and will understand that it is not in their

interests to side with NATO, the EU, Japan and South Korea. The only

missing piece of the jigsaw is China’s commoditisation of the renminbi.

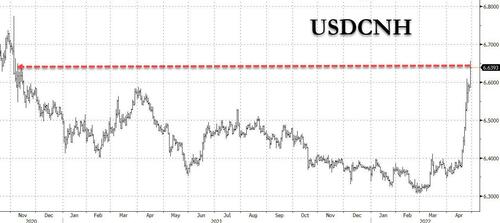

Following

the Fed’s reduction of its funds rate to the zero bound and its monthly

QE increase to $120bn per month, China began to aggressively stockpile

commodities and grains. In effect, it was a one-nation crack-up boom,

whereby China took the decision to dump dollars. The renminbi rose

against the dollar, but by considerably less than the dollar’s loss of

purchasing power. This managed exchange rate for the renminbi appears to

have been suppressed to relieve China’s exporters from currency

pressures, at a time when the Chinese economy was adversely affected

first by credit contraction, then by covid and finally by supply chain

disruptions.

With respect to supply chains, current lockdowns in

Shanghai and the logjam of container vessels in the Roads look set to

emasculate Western economies with supply chain issues for the rest of

the year. All we know is that the authorities are making things worse,

but we don’t know whether it is deliberate.

It is increasingly

difficult to believe that the financial and currency war is not being

purposely escalated by the Chinese-Russian partnership. Having attacked

Ukraine, the West’s response is undermining their own currencies, and

the urgency for China and Russia to protect their currencies and

financial systems from the consequences of a fiat currency crisis has

become acute.

It is the financial war which is going

“nuclear”. Talk in the West of the military war escalating towards a

physical nuclear war misses this point. China and Russia now realise

they must protect themselves from the West’s looming currency and

economic crisis as a matter of urgency. To fail to do so would simply

ensure the crisis overwhelms them as well.