This article is food for thoughts. Tom Luongo tends to be pro-Russian and some of the ideas are speculative. Still, interesting...

I do agree that the European Union is shooting itself in the foot and the Summer will be hectic before all hell breaking lose in the Autumn. Is this calculated? This would imply brilliance from politicians who do not display much intelligence in real life. Rather unlikely in other words.

Inflation, monetary turmoils and social disruption were all baked in the cake long before the Ukraine crisis but none of this is due to irresponsible politicians. In 1913 it was the Huns (Germans), the Jews in 1939. The Russians in 2022?

Authored by Tom Luongo via Gold, Goats, 'n Guns blog,

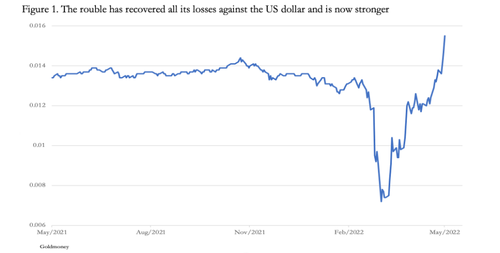

This week the European Union is expected to announce a complete import ban on Russian oil. Hungary, in its first real act of defiance, is threatening to veto this; Germany, after some hemming and hawing, has finally decided it can survive such a ban.

Assuming Hungary’s objections are eventually overcome, at first blush this looks like yet another energy “own goal” by the people obsessed with soccer. The U.S. has already issued this ban.

Because European industry is heavily dependent on Russian oil and gas, the conventional wisdom is that the EU Commission is just petulant and incompetent.

Are they petulant? Yes. Incompetent? Possibly? But only if you think in conventional terms of doing the right thing for their people. What is clear to any serious observer of EU politics is that they are not interested in what their people have to say or want.

Theirs is an agenda which will brook no opposition, even if it means destroying its own economy to bring a rival to its knees.

That said, I sincerely doubt there will be a “buyers embargo” on natural gas because there is no viable substitute for it.

Hungary is using the need for unanimous consent within the European Council to block any ‘gas ban’ in any new economic sanctions package. There are at least three other countries which are happy Hungary is willing to suffer Brussels’ wrath.

But banning Russian oil, on the other hand, is different.

So, it is interesting that Hungary would do this, given they import no oil from Russia. {Ed. this is wrong, Hungary imports 65% of its oil through the Druzhba pipeline} This veto was predicted by me the morning after the Hungarians overwhelmingly rejected George Soros’s anti-Viktor Orban coalition and handed it an ignominious defeat.

Hungary, on the other hand, has energy independence from Brussels by having contracted directly with Gazprom for natural gas via Turkstream’s train that goes into Serbia and Hungary. This should give you some context as to why the EU is trying to sanction Serbia and cut off the flows of that pipeline where it crosses EU territory in Bulgaria.

With a fiscally, monetarily (they are not on the euro) and energy independent Hungary there is little argument for them staying in the EU if Brussels is going to treat them as second class members. Orban and his government have been resolute in their refusal to get involved in the Russia/Ukraine conflict even though there has been serious pressure applied by NATO.

It is almost as if Orban and the Hungarians are now daring the EU to advance Article 7 procedures to kick them out. The problem with that is, if they do, it would begin the fracturing of the EU.

So, what is more likely to happen now is Hungary will use this veto to get the EU to back off on the ‘rule-of-law’ violations which are justifying cutting off Hungary from its EU budget distributions. The horse trade here should be obvious.

Because Brussels and their behind-the-scenes backers absolutely want this ban on Russian oil as much as the U.S. and the UK want it. It is part of their long-term strategy to bleed Russia out, after turning Ukraine into Afghanistan 2.0.

And it is in the differences between the oil industry and the natural gas industry where they think they can achieve this goal.

Of Pipes and Populi

In both the oil and gas industries, pressurizing a well is, for the most part, a one-way process. You dig a well and pull the oil and/or gas out. It produces until the well is depleted. You replace the well’s natural decay in production by drilling a new well.

But even if there is a big demand shock to the downside, rarely an issue in the oil industry in the aggregate, then those wells keep producing. The market is temporarily glutted with oil, the price drops and old wells are not replaced until such time as supply-and-demand balance is restored.

Oil futures curves get constructed by traders to anticipate these effects on prices. And for normal volatility of oil demand, these curves should be reasonably predictable.

Unfortunately, we are living through a time where the most powerful people in the world (at least in their minds) are openly trying to destroy the petroleum market for their own purposes and agenda. They are actively working to make oil and gas prices volatile to the point of destroying investment in the industry.

They make no bones about this. Oil is the bane of the planet!

I call these people The Davos Crowd (for a description of them see my podcast, Episodes 75, 76, and 77 for the background information). They are the unelected oligarchs, bankers, hereditary power and newly Made Men (in the mafia sense) who gather at Davos, Switzerland, every year to decide on the future of humanity.

And it is their agenda, using Climate Change and international threats like biowarfare and terrorism as their justifications for a massive expansion of the surveillance state and their control over all things, but especially money.

Russia’s massive natural resource pile and sovereigntist-minded government stands wholly in the way of that. If you believe otherwise, you have been gaslit by Davos propaganda. I urge you to put away childish things, some rabbit holes are just holes, not warrens.

Back to the oil industry. Capping either a gas or oil well is dangerous because there is no guarantee it can be re-opened. Wells can be damaged and the oil/gas they contain lost without drilling a new one.

With gas you can just “flare it off” by burning the excess if your storage is full, rather than capping the well and wait for demand to return. With oil, on the other hand, you cannot really do that. You have to store the stuff somewhere. From all accounts so far, Russia’s oil storage capacity is already full, if not overflowing.

The oil industry in general is not geared for massive long-term storage due to supply/demand shocks because there is literally no need for it. What expands is the capacity to move oil around to consume it, not store it in big tanks hoping someone will buy it.

The industry has all the spare capacity it needs to coordinate supply and demand within pretty tight tolerances. It is not “just in time” delivery tight, but it is not capable of absorbing a 20% demand shock.

And this is where the West thinks it has a big lever to use against Russia right now. By all accounts, Europe is one of Russia’s biggest oil customers, with the port at Rotterdam taking in and refining as much as 1.4 million barrels per day before the war.

Believe it or not, The Washington Post had a decent article breaking down where Russia’s exports go. Of the approximately 7.2 million barrels per day Russia exports to the world, 4.8 million go to countries, most of them in Europe, that say they no longer want to buy it from there.

Lack of storage capacity should not be a big deal if Russia exported most of the oil to Europe by ship, which it does. According to a recent report by Transport & Environment, an NGO which is wholly geared to convincing Europe to get off Russian energy, the Druzhba pipeline only supplies around 10% of Russian oil to the European market.

This is a paltry 250,000 barrels per day. The U.S. embargo is more dangerous to the Russian economy, where in 2021 the U.S., having to replace barrels sanctioned from Venezuela by former President Trump, imported an average of 600,000 barrels per day.

Those imports began drying up in 2022, well before Russia invaded Ukraine, so chalk that up as another data point that this war between the West and Russia was planned well in advance of the actual start date back in late February.

The point is that the talking point going around the press today is that Russia does not have the storage capacity to deal with a European embargo and as such will have to cut production. Estimates of production cuts from Russia are around 1.8 million barrels per day, while the West is hoping for 3 million.

Similar to what Trump did in 2018 against Iran, the shock-and-awe campaign of sanctions froze many oil trading firms in their tracks, not knowing what the future would hold, and refused to do business with Russia for fear of running afoul of sanctions.

From Shell to Glencore to Trafigura, Russian oil tenders have become persona non grata and it created a complete mess of their trading books and the commodities-trading industry as a whole, as Credit Suisse’s Zoltan Pozsar’s note from last month described.

Because of this financial dislocation in what should be a boring, brain-dead stable industry—trading the most important commodity in the world with the biggest infrastructure to service it—chaos ensued.

The collective West, following Davos’s game plan, is hoping for even more.

Pozsar’s conclusion was that all these firms will either need a bailout at some point (with possible nationalization the price they pay) or be allowed to go bankrupt to serve the plan of radically overhauling the global energy economy away from petroleum of Davos.

At the same time, they would put a major dent in Russia’s economic prospects. Viewed that way, this is a kind of Evil Mastermind Two-fer.

But, if backing up the pipeline oil is not that big a hit to Russia’s production, what is the EU trying to accomplish here?

By disrupting the routes oil normally takes around the world, there is now a structural shortage of tankers to move oil demanded. Since many of those barrels, more than 2 million per day, now must go on much longer voyages.

Instead of the coffee and cake run from St. Petersburg to Rotterdam, those same ships now, at a minimum, must go to storage facilities in the Bahamas and the Caribbean, if not all the way to China or India, their final destination.

Read Pozsar’s post, or the ZeroHedge article linked above, to get a sense of the scale of the disruption.

This supply shock within the tanker market and the downstream effects of the added costs to the voyages, it is hoped, will create a cascading back-up within the Russian oil industry, forcing the forecasted production hits.

This will, in turn, eat into its positive trade balance which is “fueling Putin’s war machine.” It will also present the opportunity for Russia’s competitors to come in and steal market share from them.

Through this mechanism and efforts in the West to change Europe’s energy usage, the long-term effect is to destroy Russia’s ability to continue the war by starving it of needed capital.

Davos Rhymes with Thanos

The U.S. is happy to push Europe to this point and many commentators are happy to end the conversation there: Pick your epithet, but the line is the “Empire of Lies” or “Zone A” or whomever, feels their hegemony is threatened and they are bullying everyone, especially Europe, into their preferred strategy.

But I think that story is more of the “Made for TV” version than it is an accurate representation of reality.

It leaves out the larger goal structure of the people behind this mess in the first place. Rather than be captives of a hyper-belligerent U.S., the EU nations are absolutely willing partners in this.

Davos’s Great Reset strategy is built on the same mistakes about resource scarcity that Thomas Malthus made back in the early 19th century. Theirs is an economic model which does not believe people respond in real time to incentives, pro and con, which moderate their behavior. Rather, they see humans as a virus unleashed upon the world that needs to be controlled.

The entire Great Reset can be boiled down to the same argument the villain in the Marvel films, Thanos, made about having to kill off half the life in the Universe to make things “sustainable.”

And the power center of this type of thinking is not in the U.S. and the U.S. Empire. We are the hyper-capitalists growing the virus in our Petri dish of individualism.

No, this thinking comes squarely out of European critiques of capitalism. To be reductionist it is just Marxism warmed over and given a fresh gloss of rhetorical paint—sustainability, stakeholder capitalism, Environmental, Social and Governance (ESG), shared purpose, etc.

The proof that the EU is just as happy with war in Ukraine as neoconservative forces in the U.S. and UK is evident in their unwillingness to end the war through diplomacy.

But Europeans are the ones who will suffer the most from this strategy.

Bad Scripts Beget Bad Policy

If EU leadership, owned by Davos, were acting on average Europeans’ behalf, they would be using the obvious costs of cutting Europe off from Russian energy to tell the US and U.K. to go scratch.

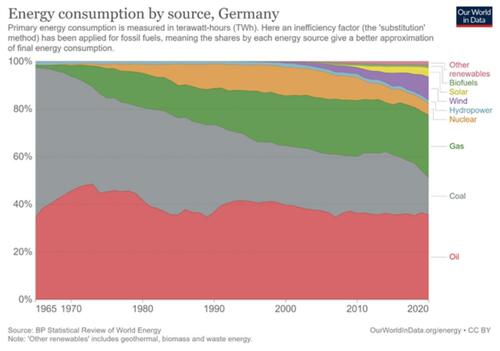

Instead, all we hear from them is how Germany can wean itself off Russian energy completely within a year.

It does not matter that this is not good for German industry or the German people in the long run. Russian energy is by far the cheapest solution for them, making their labor the most competitive it can be.

Instead, after helping manufacture the crisis in Ukraine, they now uphold the notion that it is a moral imperative for Germans to suffer without food, heat and other basic necessities of a supposed advanced first-world society to defeat the evil Russians.

In the years leading up to this conflict they would have worked to implement the Minsk Accords. They would have lifted the economic sanctions on Russia and come to an agreement about Crimea and the Donbas politically, and let the U.S. and the UK twist in the wind.

Former German Chancellor Angela Merkel and French President Emmanuel Macron did the opposite. They blew smoke up Putin’s ass while running the clock out until Macron was re-elected and Merkel could exit the scene, leaving a weak Davos-approved coalition to blame the collapse on.

Deepened trade between Russia and the EU would have eventually ground out the animosity and the U.S.’s insistence on arming Ukraine would have become an albatross politically while Europe would be staring at a potential renaissance, instead of an economic black hole.

France and Germany would not have betrayed their own attempts at diplomacy.

This, I believe, is much closer to the real story of the conflict, which serves a far larger purpose clearly stated by the architects of our misery than the simplistic framework of just blaming the U.S. for everything.

The idea that Europe fears a Russian invasion of Poland or even Germany, which necessitates NATO’s expansion to its border in the Donbas, is ludicrous. Russia’s military is not built along these lines nor is its performance in Ukraine evidence it is capable of such an operation.

What is unfolding now is a script that was written a long time ago. The war by the West against Russia has long been in the planning stages.

The Russians understand this better than many are willing to accept. Their leadership, Putin and Foreign Minister Sergei Lavrov, have articulated this very clearly at every stage of the war to date.

They are under no illusions about where the West and Davos are willing to take this conflict, which is why they have made serious threats about striking out at the real “decision centers” who give the Ukrainian Armed Forces their marching orders.

These are warnings not to our politicians, but to us. This is where things lead.

They have asked for a parting of the ways, peaceably, between East and West, but that is not part of the agenda. Like classic narcissists with the burning need to control everything, Russia and the rest of Asia will not be allowed to walk away from Davos and their Eurocrat quislings, because they are the righteous saviors of humanity.

And we are just, at best, “the help” and at worst an inconvenience.

The bigger Davos plan of destroying the old global order to Build it Back Better, where they own everything and you will own nothing and like it or else, is the script.

They are now committed to this plan. It does not matter now whether it will work or not. This is what we have to realize in all of our analyses. Do the Russians and their friends in Asia and across the Global South have the means and the tools to come out on top? Possibly.

But the bigger question is whether or not this conflict escalates to the point where winning is an irrelevant concept. When you see a bloc as powerful as the European Union willing to commit acts of domestic vandalism this big—and blaming the victim of their unbridled aggression—it tells you we are far past the point of rational settlement.