Colonel Douglas Macgregor is brilliant both in his analysis and conclusions. I am afraid he is right too, if we don't get things right in Ukraine and especially Israel we may indeed have a global war sooner that people expect.

Making sense of the world through data The focus of this blog is #data #bigdata #dataanalytics #privacy #digitalmarketing #AI #artificialintelligence #ML #GIS #datavisualization and many other aspects, fields and applications of data

Friday, March 29, 2024

Colonel Douglas Macgregor We Are On the Brink of Total War The Time To Act Is Now (Video - 45mn)

Heart-Scarring Detected Over 1 Year After COVID-19 Vaccination: Studies

It is much worse than we were told! When you were injected with the mRNA vaccine, the RNA didn't necessarily stay in your arm as it was supposed to do. Often it migrated and infected cells randomly. These cells started producing the spikes and were of course immediately destroyed by your immune system. Whenever this was in the heart, it would cause irremediable inflammations. Worse, we now know that the mRNA technology is not yet mature and consequently, the samples contain huge numbers of RNA "debris". What effects do these have on the body? Well, your guess is as good as mine. Except of you look at which type of diseases have been exploding since 2021: Myocarditis, Turbo cancers and a litany of rare diseases we hardly ever saw before. Coincidence or correlation?

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Heart scarring was detected more than one year after COVID-19 vaccination in some people who suffered myocarditis following receipt of a shot, researchers reported in new studies.

A third of 60 patients with follow-up cardiac imaging done more than 12 months after their myocarditis diagnosis had persistent late gadolinium enhancement (LGE), which is, in the majority of cases, reflective of heart scarring, Australian researchers reported in a preprint of a new study, published on March 22.

Myocarditis is a form of heart inflammation.

The median time from receipt of a vaccine to follow-up imaging was 548 days, with the longest interval being 603 days.

“We found that the incidence of persistent myocardial fibrosis is high, seen in almost a third of patients at >12 months post diagnosis, which could have implications for the management and prognosis of this predominantly young cohort,” the researchers wrote.

“The long-term clinical implications of LGE in this condition are as yet unknown, but LGE has been demonstrated to confer worse prognosis in non-COVID-19 vaccine-associated myocarditis, especially if it persists beyond six months,” they added later, pointing to several previous papers.

Researchers in one of the previous papers, for instance, found that LGE was a “powerful prognosticator” of adverse outcomes in myocarditis patients.

Before the new testing, nine patients were determined to definitely have myocarditis, and 58 patients were labeled as probably having myocarditis. The findings of persistent LGE resulted in reclassifying 16 of the cases from probable myocarditis to definite myocarditis.

Exclusions included patients who were pregnant or allergic to agents used in gadolinium testing.

Among a subset of 20 patients who underwent imaging shortly after vaccination, 19 had LGE. In follow-up imaging, LGE was no longer visible in 10 of those patients. In five, it was reduced, but in four it was unchanged.

Andrew Taylor, a professor at Monash University’s Central Clinical School, and his co-authors conducted the study by recruiting patients who were diagnosed with myocarditis associated with COVID-19 vaccination between August 2021 and March 2022. The patients were invited to undergo imaging at Alfred Hospital or Royal Children’s Hospital in Melbourne, Australia.

The study population with follow-up imaging included 44 adults and 16 adolescents.

Most of the patients had received a Pfizer-BioNTech shot. A minority had received a Moderna or AstraZeneca vaccination. The companies did not respond to requests for comment.

Limitations of the paper, which was published ahead of peer review, included possible selection bias, since participation in the study was voluntary. Authors listed no conflicts of interest or funding.

Another Paper

In the other recent paper, researchers in Canada reported finding about half of patients referred for imaging due to possible post-vaccination myocarditis had persistent LGE in follow-up imaging.

Overall, 60 patients were included in the retrospective study. Of those, seven reported persistent symptoms.

In a subset of 21 patients for whom follow-up MRIs were available, 10 had persistent LGE, the researchers said. On the other hand, function of the left ventricle, which pumps blood, had normalized in all patients.

The persistent LGE “likely reflects replacement fibrosis,” or heart scarring, Dr. Kate Hanneman, with the University of Toronto’s Department of Medical Imaging, and her co-authors wrote. They cited some of the same papers as the Australian group, including the study that found patients with persistent LGE had a higher risk of adverse outcomes, as well as a paper on what it represents when LGE is found on MRI in patients with myocarditis.

“However, the significance of LGE is uncertain in patients post-myocarditis with recovered normal left ventricular systolic function,” the researchers said. They called for additional studies to evaluate patients with persistent LGE and a recovered left ventricle.

The study included adult patients who were referred to a hospital network with suspected myocarditis and had new cardiac symptoms such as chest pain within 14 days of COVID-19 vaccination. The patients all received either the Pfizer or Moderna shot.

Limitations of the study, which was published by the Journal of Cardiovascular Magnetic Resonance, included a lack of biopsy-confirmed myocarditis.

The authors declared no funding and listed only one competing interest, that an author is an associate editor of the journal.

The corresponding authors for the two papers did not respond to requests for comment.

“My concern from reading these two studies is that myocardial damage and scarring is present in a significant number of COVID vaccine injured individuals at up to 18 months after vaccination. This suggests potential for permanent heart damage from the vaccines,” Dr. Danice Hertz, the research lead for the U.S. group React19, told The Epoch Times in an email. “The long-term implications are not yet known but need to be studied carefully.”

Earlier Findings

The new papers add to earlier studies, which found that LGE persists for months in some people following a COVID-19 shot.

Researchers in Washington state reported in 2022 that LGE persisted in children for up to eight months after vaccination. Later that year, the U.S. Centers for Disease Control and Prevention (CDC) said that more than half of 151 patients with follow-up imaging had residual LGE, which was described as “suggestive of myocardial scarring.”

The CDC has longer-term data on the patients, the agency confirmed to The Epoch Times in January, but has not yet published another paper describing that data. The CDC, which failed to warn the public about the risk of post-vaccination myocarditis, declined to comment on the new Australian and Canadian papers.

Hong Kong researchers in 2023 reported finding that about half of 40 patients with follow-up MRIs months after vaccination had LGE.

Symptoms have also persisted in some patients with post-vaccination myocarditis.

The CDC, describing preliminary updated results from its longer-term study, said in early 2023 that there were patients still suffering from symptoms more than one year after a shot. Researchers in Australia in late 2023 said that symptoms persisted at least six months after a shot in a majority of patients they followed. And some patients also told The Epoch Times they have lingering health issues years after vaccination.

Thursday, March 28, 2024

What's Wrong With America's 'Elites'?

Sure enough America has an "elite" problem. Having spent a life discussing and negotiating with these people first in Finance then in the data business, I have been amazed by their utter lack of general education. Porsche engines in Volkswagen bodies! Bright people without proper background knowledge meaning that mostly they are not in a position to take proper decisions. And then there's the rest of course, prejudices and woke policies which completely skew their reasoning as discussed below. The tittle of the article should be "The sorry state of American education!" Money has not improved higher education, quite the contrary, it has only favored nepotist and promoted the wrong values as discussed below.

Authored by Laura Hollis via The Epoch Times,

It is becoming increasingly clear that some of America’s most serious problems can be traced back to our colleges and universities - or at least the ones educating the country’s most powerful people.

The Vietnam War era aside, it has traditionally been uncommon for events at universities to make national headlines. Absent something extraordinary, like a president giving a commencement address, a dramatic scientific breakthrough or the award of a prominent international prize to faculty, headlines with university names in them have tended to relate more to national championships in sports.

Not anymore.

Over the past few years, news items about events on college campuses have come to dominate headlines. The subjects are some of the country’s most fabled institutions. And the stories are often negative, if not outright shocking.

Last December, the congressional testimony of three university presidents—Claudine Gay from Harvard University, Elizabeth Magill from the University of Pennsylvania, and Sally Kornbluth of the Massachusetts Institute of Technology—set off a firestorm. Under questioning by Rep. Elise Stefanik (R-N.Y.) about anti-Semitic speech and conduct on their campuses, the three women dodged and deflected, unwilling to state definitively that calls for the genocide of Jews violated university policies and codes of conduct.

The response was swift. Within days, Magill resigned. Gay survived the initial maelstrom, but the bad publicity prompted critics to start digging through her professional past, and she resigned less than a month later, following accusations of plagiarism in her research publications. Some of the nation’s largest donors to these universities—many of them Jewish—began announcing that they would cease or pull back donations totaling in the tens and even hundreds of millions of dollars.

The chaos on campuses has only increased since, with pro-Palestine protests and marches at dozens of colleges and universities, and horrific rhetoric bumping up against speech codes and demands for free speech. Across the country, Jewish students describe themselves as “living in a climate of hatred and fear” amid dramatic increases in anti-Semitic conduct, threats, slurs, and actual violence.

This week, Stanford University sophomore Theo Baker published “The War at Stanford” in The Atlantic, in which he describes how the Israel-Hamas war has affected his campus. One Arab American graduate student told Baker that he thinks President Joe Biden “should be killed” and that Hamas should rule America. Pro-Palestine protesters set up sit-in “camps” for months and shouted for the destruction of Israel, chanting, “We don’t want no two-state; we want all of ’48!” Guest speakers brought in to facilitate campus discussion of the complex issues have been shouted down. Stanford employees have been threatened (“We know where you live!”), the interim president’s home has been vandalized, and his effigy was carried around campus covered in fake blood. The administration, Baker says, seems paralyzed, indecisive and defeated.

This isn’t an isolated incident at Stanford, and the Israel-Hamas war hasn’t caused it. Last March—months before the Oct. 7 attack on Israel—Stanford Law School students shut down a talk being given by federal judge Kyle Duncan, shouting at him every time he attempted to speak or engage the audience, screaming epithets and holding up signs with vulgar accusations and calls for violence against Duncan’s daughters.

Similar behavior has been displayed at other schools, having nothing to do with claims of colonialism in the Middle East.

Swimmer and activist Riley Gaines was cornered and forced to hide in a classroom at San Francisco State University last year, prevented from giving her talk about limiting participation in women’s sports to biological women.

In 2017, author Charles Murray’s scheduled talk at Middlebury College was interrupted by a mob that later physically attacked him and his faculty host Allison Stanger. Stanger’s hair was pulled so hard by a protester that she suffered a concussion.

The poisonous rhetoric, intolerance, and violence is just the tip of the iceberg.

In an interview with The Daily Signal podcast host Rob Bluey last week, national pollster Scott Rasmussen described what he called “the most terrifying poll result I’ve ever seen.” A recent Rasmussen poll asked Americans “to suppose there was an election and it was close but your candidate lost. And if their campaign team knew they could win by cheating and not get caught, would you want them to do so?”

According to Rasmussen, only 7 percent of American voters overall said they’d rather cheat to win. But among the group that he calls “the elite,” that number jumped to 35 percent. Among the “politically obsessed elite” (those who “talk politics daily”), it was a staggering 69 percent!

So who are these “elite”?

Rasmussen explains that they are the top 1 percent of the population. They make more than $150,000 a year. They live in densely populated urban areas. They have not only college but postgraduate degrees. And large numbers of them “went to one of 12 elite schools.”

He doesn’t name them, but we can hazard a pretty good guess which schools they are.

“The reason I bring that up,” he continues, “is about half the policy positions in government, half the corporate board positions in America, are held by people who went to one of these dozen schools.” And, he says, they also shape “the mainstream media narrative.”

Not only does this group think it’s acceptable to cheat to win an election, but 70 percent believe there is too much individual freedom in the United States, and an equal number trusts the government—which, of course, they control. “They really believe,” Rasmussen says, “that if they could just make the decisions and get us out of the way, we would be a lot better off.”

What’s going on at our most prestigious and exclusive universities? How have they produced generations of amoral, condescending authoritarians? And how do we put a stop to it?

Those are questions Americans need answers to.

On The Brink Of A Dramatic Change: The Digitalization Of Money

The arrival of CBDC is, short of a nuclear war, THE most important change on the immediate horizon as well as the most dangerous one for individual freedom.

When introduced, there will be no turning back. My personal (educated) guess, is that it will be almost impossible to get it right (reason why it is not already here.)

You can get familiar with the subject bellow in this well argumented explanation of the system as well as issues related to its implementation.

Authored by Efrat Fenigson via Bitcoin Magazine,

The current state of Central Bank Digital Currency Projects globally summarized by Efrat Enigson, independent journalist and host of the "You're The Voice" podcast...

“What underpins a world order is always the financial system.

We are on the brink of a dramatic change where we are about to, and I'll say this boldly, abandon the traditional system of money and accounting and introduce a new one. And the new one is what we call blockchain.

It means digital. It means having an almost perfect record of every single transaction that happens in the economy, which will give us far greater clarity over what's going on. It also raises huge dangers in terms of the balance of power between states and citizens. In my opinion, we're going to need a digital constitution of human rights if we're going to have digital money.

Most people think that digital money is crypto and private, but what I see are superpowers introducing digital currency. The Chinese were the first. The US is on the brink of moving in the same direction. The Europeans have committed to that as well.”

This revolutionary speech about a new financial system, was delivered at the World Government Summit in March 2022 in Dubai, by Philippa "Pippa" Malmgren, a member of the Council on Foreign Relations (CFR) and Chatham House; her father, Harald Malmgren served as a senior advisor to US Presidents Kennedy, Nixon, Ford and others. She’s a technology entrepreneur and economist, who served as Special Assistant to President George W. Bush, for Economic Policy on the National Economic Council and is a former member of the President's Working Group on Financial Markets and Corporate Governance.

Her words about the transition to a new world order that requires a new financial structure correspond well with the words of French President Emmanuel Macron in June 2023 at the Global Finance Summit in Paris: "The world needs a public financial shock to fight global warming, and the current system is not suitable for dealing with the world's challenges." The president of Brazil, Lula da Silva, also called for "a clean slate" and said the Bretton Woods organizations (World Bank, International Monetary Fund) do not serve their goals nor respond to society's needs.

The Summit for a New Global Financing Pact. Photo: Ricardo Stuckert/PR

“THE NEW BRETTON WOODS MOMENT”

“A

new international monetary system is taking shape, some call it the new

Bretton Woods moment that needs to be seized to create a new global

financial governance,” says the investigative journalist Whitney Webb in a recent sitdown interview,

where she mention that according to Mark Carney, former governor of the

Bank of England & Bank of Canada and the UN Special Envoy for

Climate Action and Finance, the three pillars of the new multi-polar

world are Digital IDs, CBDCs and ESG, through a global carbon market.

All world governments are pushing this agenda, that in order for it to

succeed, all monetary systems and supporting systems must become digital

and rely on digital data.

A good example of this was revealed at an event of the Central Bank of

Israel with the Bank for International Settlements (BIS) – which I

attended – in September 2023 in Tel Aviv, where the “Genesis Project”

was presented. As part of this project, "green" bonds are issued, based

on carbon quotas in the CBDC infrastructure. This is how the climate

agenda is linked to financial markets.

“DEBT SERFDOM”

“Stablecoins

could be the way in which the US is further globalizing the dollar,

spreading its adoption directly to the world’s general public in order

to continue increasing its debt and encourage uptake and usage of the

dollar”, says Mark Goodwin, Editor in Chief of Bitcoin Magazine, in this

interview with Whitney Webb. He suggests that the politician’s outcry

of de-dollarization and the weakening of the dollar are a distraction

from perpetuating the dollar as the world’s reserve currency.

“While CBDCs are what people are becoming fearful and aware of, it may

just be the red herring, and the real strategy of the US dollar's

survival is highly regulated stablecoins (such as Tether), which can

easily be programmable, even more than CBDCs, as well as seized,

regulated and controlled indirectly by governments. 100 billion dollars

in treasuries were already purchased by Tether, its subsidiaries and

owners. Tether is positioned alongside the top 20 nation states buying

debt from the US, with around one tenth of China or Japan that have a

trillion dollars debt to the US”.

Whitney Webb & Mark Goodwin. Source: https://www.youtube.com/watch?v=yC9dJYqDZ9c

This theory, together with the words of Mark Carney, Pippa Malmgren, Emmanuel Macron & Lula Da Silva, join the calls of global leaders and heads of states, pointing to the replacement of the monetary and financial world order, to introduce a new monetary system. Many experts say that we are reaching the end of the current fiat monetary system experiment, which is destined to collapse. Since world leaders are aware of this, they prefer to engineer a controlled demolition, to maintain control and steer the course, and enter the new era with power firmly within their grasp.

CENTRAL BANK DIGITAL CURRENCY SYSTEM (CBDC)

Central Bank Digital Currencies (CBDC), tie the financial freedom of citizens to the government and the banking establishment. The central bank issues its centralized digital currencies, and essentially creates a new monetary system, "fiat on steroids", a system that takes everything that is bad in the fiat system, and adds more of it; surveillance, control, censorship, and enforcement capabilities. A modern prison? Indeed, the CBDC is the ultimate prototype of a prison without physical chains. By connecting CBDCs to digital identity cards, and to government systems such as universal basic income, social credits and more, we get the ultimate control apparatus. This apparatus will dictate to citizens what they’re allowed to purchase, what the permitted quotas are while limiting consumption according to rules and use cases, at programmed times, places and cadences. The system is able to determine the use of a geographic radius (geo-fencing), and to determine expiration dates on the money. Each remote controlled digital wallet can also be switched on and off by its operators. More than 130 countries are in the initial stages of piloting CBDC systems, of which 36 countries are in advanced pilots, and 3 countries have already launched systems (Nigeria, Jamaica and the Bahamas).

WILL RIPPLE (XRP) BE THE CHOSEN PLATFORM FOR CBDC?

Ripple, a digital payment network and transaction protocol that owns the cryptocurrency XRP, is considered one of the most popular cryptocurrencies, and is strategically positioning itself at the heart of government financial innovation, aiming to be the cornerstone of future CBDCs.

The company is in talks with about twenty governments around the world to develop their CBDCs using Ripple's technology. In May 2023, Ripple launched a dedicated CBDC platform to assist central banks, governments and financial institutions around the world in issuing CBDCs and stablecoins. To date, Ripple has partnered with six governments for CBDC pilot projects: Georgia, Colombia, Montenegro, Hong Kong, Bhutan and the Republic of Palau.

The National Bank of Georgia, for example, has chosen Ripple as its technology partner for its CBDC pilot last year, citing Ripple's technical expertise and team capabilities. Its interest in CBDCs is in leveraging modern technologies, such as the programmability aspect of CBDCs, aiming to create a platform with smart contract and programmable token capabilities to stimulate innovation in the financial sector.

In the case of Bhutan, Ripple’s technology was chosen in 2021 for the country’s CBDC project to enable advanced cross-border payments, and assist in “financial inclusion” - in line with Bhutan’s mission to increase financial inclusion in Bhutan to 85% by 2023.

In 2022, Ripple reached the final stage of the G20 Techsprint CBDC Hackathon, hosted by Indonesia and the Bank of International Settlements (BIS), and in August 2023, the Republic of Palau launched a USD-backed digital currency, developed by Ripple.

Promoting its platform as an infrastructure for a CBDC, Ripple advocates for government regulation of cryptocurrencies, and tries to position itself as the preferred solution for CBDC projects. Its claim to fame of being the ideal CBDC partner for governments is the combination of speed, efficiency, a sustainable and "green" blockchain network that uses little energy (compared to the Bitcoin network), and interoperability - the ability to communicate and work with CBDC solutions in other countries on the Ripple infrastructure. The company warns that there is a risk for CBDC adoption by the public, caused mainly by a lack of market education, and it encourages the programming and expiration dates capabilities, which are perceived by most of the public as particularly Orwellian features of CBDCs.

Ripple encourages the abolition of cash (and a move to a cashless society), and unsurprisingly, it promotes the climate agenda; The company's website presents its commitment to a clean, prosperous and secure low-carbon future, with a plan to reach carbon net-zero by 2030.

Apparently, in line with Ripple’s expansion strategy vis-a-vis governments, the company makes sure to recruit employees who came from central and commercial banks. One of the company's top executives is Andrew Whitworth, policy director at Ripple, who previously worked at the Bank of England. At the same time as his role in Ripple, Whitworth also serves as a Director of the "Digital Pound Foundation", an organization that has declared itself the authority on the Digital Pound; it advises and influences the government's decisions regarding CBDC projects and deployments. Clearly an inside connection such as this might give Ripple an advantage in shaping digital currency policies to fit their platform and solutions. Does this hint a conflict of interests, or at least an unfair play?

Another avenue through which institutional influence and implicit control over Ripple could manifest is via a legal battle with the SEC (U.S. Securities and Exchange Commission) concerning the XRP cryptocurrency. Engaging in such legal disputes inevitably positions Ripple in a scenario where maintaining a positive relationship with institutions becomes crucial. Consequently, it's no surprise that Ripple prioritizes governments, central banks, and financial institutions as its primary target audience in its market strategy.

Photo: Lord XRP Twitter account

INTERESTING DEVELOPMENTS IN CBDC

China spent a couple of years rolling out relatively failed CBDC projects without widespread adoption, while injecting 30 million yuan as free money to encourage user adoption. Transactions using the digital yuan hit 1.8 trillion yuan (US$249 billion) in June 2023.

Recently, significant progress has been made: the two main payment services and applications in China - WeChat and Alipay - which have a traffic of about 3-4 trillion dollars per year, integrated the Chinese CBDC service into their applications. The central bank regulator made it clear that digital yuan isn’t meant to compete with the two payments giants. Rather, it’s supposed to play a complementary role.

Elon Musk, who owns, among other things, the Twitter/X platform, has stated that he wants to make the platform an "everything app" like the Chinese WeChat, including payment management. Will X also follow the Chinese route and integrate the CBDC solution into it, or will it try to become a CBDC infrastructure itself with the help of Musk's favorite cryptocurrency, the Dogecoin?

The CBDC pilot in Nigeria didn't exactly take off either, after the citizens took to the streets to protest the abolition of cash in the country, and resented the introduction of an unneeded digital solution, while demanding the return of cash. After a long and painful protest, the cash was returned alongside the new digital currency, which was not canceled and became part of reality. Furthermore, a new stablecoin is in preparation in Sandbox mode in Nigeria. The cNGN is a Naira stablecoin which some claim has more potential than the e-Naira to be widely adopted. “The stablecoin will be more broadly interoperable than the CBDC, which is only available in the central bank’s wallet. At launch, the central bank’s wallet usability was weak, although it is now quite good”, said Bolu Abiodun, a reporter at Techpoint Africa.

The UK saw a strong public backlash to Prime Minister Rishi Sunak last year, with more than 50,000 responses sent to the Bank of England following a public hearing on the Digital Pound, aka the UK's national CBDC.

GERMANY - AWARENESS OF "EXCESSIVE SURVEILLANCE"

In Germany, the technical guidelines document for a digital currency of a central bank was published in January 2024. Below are several quotes from the document, reflecting the tyrannical nature of the new currency, and the awareness of the central bank for trust issues it can create:

- Programmability is

the institution’s authority to dedicate your money for certain uses,

and to prohibit the use of your wallet when it is "outside the permitted

scope".

- "The central bank can revoke CBDC notes, e. g. as

an instrument of monetary control. Revocation of CBDC notes is performed

by an authorized entity, the revocation authority, controlled and

operated by the central bank." This sounds like a technique to

confiscate and apply a shelf life to money.

- "Payments

permitted under certain restrictions.. if the central bank sees fit to

impose them" - the document lists restrictions that can be applied to

wallets, depending on the amount of personal information that will be

provided. For example, the amount of money in the wallet, the number of

payments per day, the amount of money per transaction or per day.

- The good news: The German central bank is aware of the possibility of public opposition to a surveillance system: "Many of these design choices are general decisions on the trade-off between excessive surveillance and legitimate monitoring functions for AML and KYC purposes in conjunction with measures for mitigating fraud and misconduct. These decisions are extremely sensitive in nature and can strongly influence the level of trust that users place into the CBDC”.

ISRAEL - THE DIGITAL SHEKEL WILL BE DISTRIBUTED THROUGH COMMERCIAL BANKS

Israel takes an extensive and active part in various CBDC pilots, such as the Sela project, Eden, Icebreaker and more, which I have reported on extensively in the past. The Deputy Governor of the Bank of Israel announced that in December 2024 a technical design document for the Digital Shekel will be published, and its implementation will then begin in partnership with the private sector.

The Bank of Israel's latest document from last week covers the proposed architecture of the Digital Shekel. Here are some interesting points from the document:

The distribution of the Digital Shekel will be two-tiered: instead of direct contact between consumers and the central bank for funding and defunding, an indirect method similar to the distribution of cash today will be used. The banks will purchase digital shekels from the central bank in large quantities and transfer them to customers upon wallet charging.

The system will be able to apply and enforce limits, for example limits on the balance that users are allowed to hold in the Digital Shekel.

The system will support the possibility of applying interest on the Digital Shekel.

Users will be able to access the Digital Shekel through several payment providers, including credit cards, Google/Apple Pay, wearables, payment apps and more.

Unlike most retail CBDC solutions, Israel's model allows users to open a wallet with a payment service provider (PSP) and connect to multiple third-party banks to fund and defund balances.

Another interesting development in Israel is the announcement of a plan to launch a new stablecoin pegged to the shekel, called BILS, by the exchange platform, Bits Of Gold. Crypto Jungle website reports that the Israeli Capital Market Authority approved the pilot, according to the draft principles published by the Central Bank of Israel. Interesting to note that the company providing the infrastructure for the issuance and custody of the currency is the Israeli technology giant "FireBlocks", which took part in the "Eden" pilot project of the Tel Aviv Stock Exchange for the issuance of digital bonds, built to adapt in the future to a potential CBDC infrastructure.

NO INTERNET? DON'T WORRY, GOVERNMENTS WILL TAKE CARE OF CONNECTIVITY ANYWAY

A number of CBDC pilots, like in India, the European Union and more, focus on the adoption of the system by everyone, even amongst people without internet access. The washed-up name "financial inclusion" implies that the system will not skip anyone, not even citizens without Internet connectivity in remote areas, or without reception. In India for example, there are 683 million people living without an internet connection and largely outside the control of the state. The Reserve Bank of India (RBI) plans to bring these remote areas into a new surveillance network through various technological means. A successful launch of CBDC in India also corresponds with the government's overarching goal of reducing cash usage and improving financial monitoring.

THAILAND - FREE MONEY FOR THE MASSES

In September 2023, the Thai government announced that any Thai citizen over the age of 16 who chooses to participate in the CBDC pilot, will receive free CBDC worth $280 (10,000 baht) - quite a lot of money in Thai terms. This digital money will be loaded into the digital wallet application and will be available for use within 6 months, and within a radius of 4 km from the residence of the registered citizens. The pilot targets low-income citizens as a first stage, and later expands to entrepreneurs and small business operators - provided they are registered in the tax system. In Thailand many citizens are not registered in the government systems and not everyone has a bank account. It seems that air-dropping "free money" is another tactic to lure citizens into government systems, with the bait of “free” controlled government money. But is there such a thing as “free lunch”?

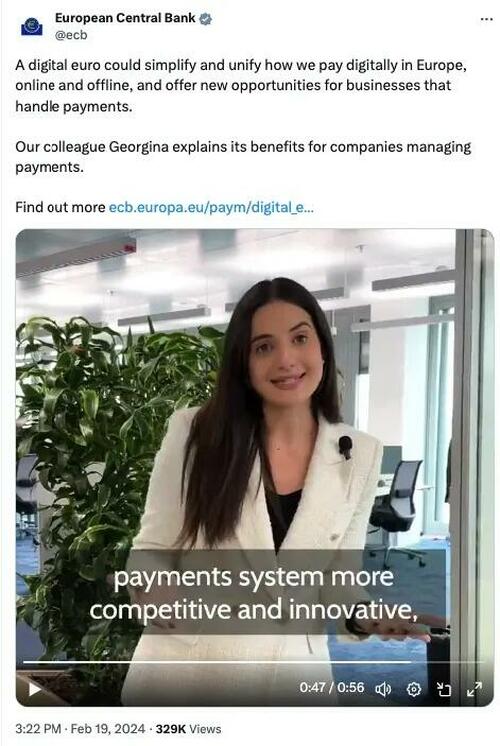

THE EUROPEAN UNION - A POSITIVE MARKETING CAMPAIGN IN HIGH GEAR

The European Union launched a marketing campaign to promote the digital euro about six months ago, to start educating the European public about a reality where that they will be obliged to use a supervised digital euro, led by Christine Lagarde, who was previously convicted of crimes and was promoted to serve as the governor of the European Central Bank, the ECB.

The Digital Euro new marketing campaign. Source: Christine Lagarde’s Twitter account

At the same time, a charade is going on in the European Union Parliament where the dangers of CBDCs are being discussed, only thanks to the public awareness and discourse, while Lagarde rushes forward and kicks off the marketing campaign to instill in the public the following messages: the digital euro is easy, safe, fast and reliable. Not a word about its Orwellian capabilities to track, program, limit and condition activity through expiration dates, geo-fencing, and remote on and off switching.

Another ECB campaign video for the Digital Euro

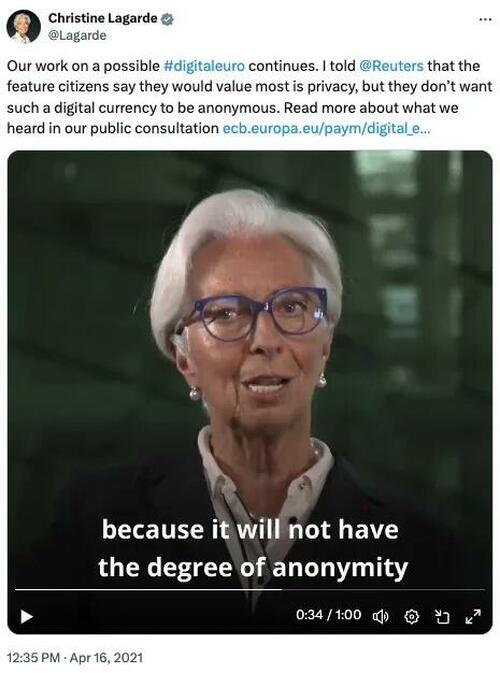

THE DIGITAL EURO WILL NOT BE ANONYMOUS

In a discussion at the European Union Council in 2023, Lagarde emphasizes a point: the digital euro will not be anonymous. Privacy will exist in the system, but not anonymity. Let’s break this up in a different way: for the banks, the key to surveillance and control is identification. The bank must know who the citizen is and verify their identity, in order to exercise law enforcement or regulations, through technological restrictions. Lagarde's claim that the technology will allow privacy but not anonymity is unfounded: apparently the central bank considers itself and the financial service providers some kind of God, since in front of them the citizen will be identified, and therefore it is not clear what kind of privacy can exist, without anonymity.

Source: Christine Lagarde’s Twitter account

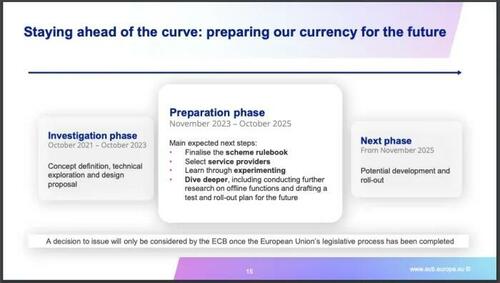

In a presentation from March 2024, the ECB presents a timetable for the Digital Euro. In November 2025, the development and implementation phase will begin, with the completion of the "democratic" legislative process.

The timing of the launch of the Digital Euro corresponds well with the European Union's initiative to issue digital identity cards to all EU residents between now and 2030, to enable the necessary government identification and tracking of its citizens. Identical initiatives are enacted and promoted in many other countries around the world at the same time. Where I live, in Israel, ID cards and passports have been mandatory and digital for many years, and also biometric since 2013 - therefore there is no need to start the marketing campaign for the Digital Shekel yet, as the digital infrastructure exists hence the first step of digitalization is already done.

The timetable of the Digital Euro by the ECB

This phase of the project is the "preparation phase", the ECB reveals, in which they are preparing for the launch phase of the Digital Euro. Of course, we are reassured that no final decision has yet been made regarding the launch of the CBDC, and this will only happen with the approval of the "Government Council" after the completion of the democratic legislative process of the European Union. Therefore, in parallel with the democratic debate for or against the Digital Euro, the development of the technology will continue, in order to be prepared for the launch.

Central bank governors such as Lagarde and Bank of Israel Governor Amir Yaron insist that the CBDC is digital cash, and also insist that physical cash will not be abolished. It is possible that these central bankers feel the need to make a U-turn from the incriminating speech of the head of the Bank for International Settlements (BIS), Augustin Carstens, who caused a public outcry when he stated in 2020 that the CBDC technology, unlike cash, will allow monitoring of financial transactions and will be a means of enforcement by the establishment:

“The key difference with the CBDC is the central bank will have absolute control of the rules and regulations that will determine the use of that

expression (money) of central bank liability, and also we will have the technology to enforce that.”

Agustín Carstens - BIS General Manager

THE FUTURE: CENTRALIZED AND CONTROLLED, OR FREE, DECENTRALIZED AND SECURE?

Ayn Rand, author and philosopher, said that "We can ignore reality, but we cannot ignore the consequences of ignoring reality." Are we taking giant steps towards a new monetary reality, where the fiat currencies we know become fiat on steroids, aka CBDCs? Or into the reality of "stable" and closely regulated cryptocurrencies, tethered to fiat? Either way, the feeling is that the establishment is doing everything to preserve the debt economy, and its inherent modern slavery. The only way to break these fiat-matrix boundaries is to opt out and enter into a new system, which seems to run in a parallel reality, the Bitcoin system. On the Bitcoin standard, under self-custody, no third party has the ability to confiscate, program or take over private assets. Not even the government or the state. Bitcoin uses a lot of energy for its mining, but this proof-of-work mechanism makes the blockchain network extremely secure and the Bitcoin currency very valuable. Bitcoin is "safe money", which is out of reach for the establishment. Unlike most other cryptocurrencies, Bitcoin is a digital currency without intermediaries or third parties (peer-to-peer) in a decentralized and secure network, which allows everyone to be their own bank, instead of relying on banks and external parties. With a fixed and known supply, it represents the most powerful digital asset on the market as a store of value and as a unit of account, and in the future will also be used as a medium of exchange.

In my recent interview with the media and finance expert, and one of the most famous Bitcoiners, Max Keiser, he compared the CBDC to a parasitic and centralized cancer: "If you were to look at the amount of energy that Bitcoin uses and the rate at which it's increasing, you would say good is triumphing over evil. So this gives me a lot of hope. And I don't think centralization in anything works at all, except cancer. Cancer is the only thing that seems to work to be overly centralized and parasitic. That's the cancer model, but I think we're gonna win against the cancer of CBDCs.”

Follow Efrat's work here.

If Americans Just Ate Healthy & Exercised, Then Politicians Wouldn't Be Clamoring About $1,000 Weight Loss Drugs "Bankrupting" Medicare

Remember the 70s? Nobody was fat then. Since health has gone south while some people made a lot of money in the meantime from the food industry to the medical system. So much so that the life expectancy in America has been declining for years now. Something which never happened in the past outside wars and pandemics.

Exploding obesity, excess mortality related to mRNA, fentanyl out of control crisis. All are contributing to this catastrophe but the real source is deeper, related to social decay, political over-reach and greed. Who can take care of the disease when the patient is the system itself?

If Americans Just Ate Healthy & Exercised, Then Politicians Wouldn't Be Clamoring About $1,000 Weight Loss Drugs "Bankrupting" Medicare

If the food-industrial complex had not flooded the nation's food supply with junk, if the government actively encouraged healthy lifestyles, and if efforts to address the obesity crisis didn't rely solely on 'miracle weight loss drugs' pushed by the pharmaceutical industry, then maybe - just maybe - politicians wouldn't be clamoring on Capitol Hill, or the elderly (somewhat senile) president in the White House, about out-of-control drug prices.

But since common sense has vanished in America and folks have given up on Peloton bikes for $1,000 monthly injections of "Wegovy," the blockbuster weight loss treatment (also a diabetes drug called "Ozempic") from Novo Nordisk, then socialists, such as Sen. Bernie Sanders (I-Vt.), wouldn't be reviving the discussion about high drug prices.

"Today, a new Yale study found that Ozempic costs less than $5 a month to manufacture. And yet, Novo Nordisk charges Americans nearly $1,000 a month for this drug, while the same exact product can be purchased for just $155 a month in Canada and just $59 in Germany," Sanders said in a statement.

Sanders cited the study "Estimated Sustainable Cost-Based Prices for Diabetes Medicines," conducted by researchers at Yale University, King's College Hospital in London, and the nonprofit Doctors Without Borders. It was published in the journal JAMA Network Open on Wednesday.

In the study, researchers found Novo could produce the blockbuster drug for 89 cents to $4.73 per month, as opposed to the monthly retail price of about $1,349 for Wegovy, a semaglutide injection.

"As Chairman of the Senate Committee on Health, Education, Labor, and Pensions (HELP), I am calling on Novo Nordisk to lower the list price of Ozempic — and the related drug Wegovy — in America to no more than what they charge for this drug in Canada," Sander said.

He added: "The American people are sick and tired of paying, by far, the highest prices in the world for prescription drugs while the pharmaceutical industry enjoys huge profits."

Sanders warned: "This outrageously high price has the potential to bankrupt Medicare, the American people and our entire health care system.

Analysts have forecasted that the market for weight-loss drugs could reach at least $100 billion a year by the end of the decade, with the production of Wegovy and Eli Lilly's Zepbound and Mounjaro. And a decent chunk of the weight loss drugs will likely be covered by Medicare.

"The profit margin is immense" on weight loss drugs like Ozempic, Melissa Barber, a public health economist at Yale and the study's lead author, told Bloomberg. She added, "There should be a conversation in policy about what is a fair price."

Rounding back to the intro of this note, Americans should eat better and exercise. Then, we don't have to rely on the pharmaceutical-industrial complex. What's odd is the government does not promote 'common sense' healthy lifestyles. Why is that? Are their donors pharma companies?

Hard Rock Hotel Collapse New Orleans (Video - 19mn)

The Baltimore Bridge disaster which just unfolded in the US this week is not the exception, it is a symptom of a literally crumbling system. Leaning brand new towers in San Francisco and New York, a crashing hotel in New Orleans (in the video below). Everywhere, incompetence, stinginess and greed are undermining what until recently worked smoothly. Think about United Airlines which had one incident a day last week and Boeing which can't make airplanes anymore. Factories exploding on a weekly basis and trains derailing almost on a daily basis.

If you add the social and fentanyl crisis on top of this infrastructure mess and construction defects, it is easy to understand that America has a problem. It is not a bridge crumbling which destroyed the Roman Empire nor will these defects do much damage to the economy as a whole but make no mistake, all these events are the symptoms of a much deeper problem which will eventually bring the empire to its knees ending up what will have been a fascinating experiment.

PS: By the way, you can take this opportunity to watch carefully how a tower crumbles in real life. Now watch again the World Trade Center Towers, especially the 3rd one, WTC-7 and remember that over a thousand architects asked for a detailed investigation after 9/11. We are still waiting!

Expect A Financial Crisis In Europe With France At The Epicenter

The good thing about politics is that there always seems to be a way to pass the hot potato to the next guy although of course eventually the game has to stop.

The Maastricht rules have always been wishful thinking. Without transfer mechanism between different countries, you cannot maintain a unique currency and interest rate for very long if nobody obeys the rules. Now not only are most countries not obeying the rules but they are creating extra hurdle like the green agenda or support for Ukraine which makes even the pretense ludicrous.

As we approach the end, expect extreme behavior and statements from leaders like Macron. France like England lives in the delusion of its former grandeur. The reconciliation between wishful thinking and reality will be painful.

Authored by Mike Shedlock via MishTalk.com,

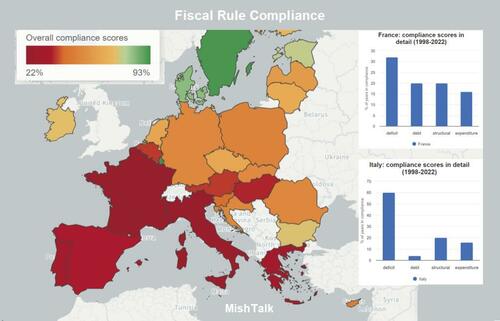

The EU never enforced its Growth and Stability Pact or Maastricht Treaty rules. The crisis is coming to a head with France and Italy in the spotlight. The first casualty will be Green policy.

Image composite by Mish from the European Commission Compliance Tracker

Compliance Rules

Deficit rule: a country is compliant if (i) the budget balance of general government is equal or larger than -3% of GDP or, (ii) in case the -3% of GDP threshold is breached, the deviation remains small (max 0.5% of GDP) and limited to one year.

Debt rule: a country is compliant if the general government debt-to-GDP ratio is below 60% of GDP or if the excess above 60% of GDP has been declining by 1/20 on average over the past three years.

Structural balance rule: a country is compliant if (i) the structural budget balance of general government is at or above the medium-term objective (MTO) or, (ii) in case the MTO has not been reached yet, the annual improvement of the structural balance is equal or higher than 0.5% of GDP, or the remaining distance to the MTO is smaller than 0.5% of GDP.

Expenditure rule: a country is complaint if the annual rate of growth of primary government expenditure, net of discretionary revenue measures and one-offs, is at or below the 10-year average of the nominal rate of potential output growth minus the convergence margin necessary to ensure an adjustment of the structural budget deficit in line with the structural balance rule.

Deficit Disaster Zones

France and Italy are major disasters right now on the budget deficit rule. France has a budget deficit of 7 percent and Italy 5 percent.

France needs to reduce its deficit by a whopping 4 percent of GDP!

Neither Italy nor Greece should never have been allowed in the EMU (European Monetary Union – Eurozone) in the first place.

Greece has a debt-to-GDP ratio of 170 percent. The target is 60 percent.

But the lead chart tells the picture. Only the Scandinavian countries are in compliance.

Looser Rules Postpone the Crisis

On February 10, the EU agreed to Looser Fiscal Rules to Cut Debt, Boost Investments.

The latest revamp of two-decades-old rules known as the Stability and Growth Pact came after some EU countries racked up record high debt as they increased spending to help their economies recover from the pandemic, and as the bloc announced ambitious green, industrial and defense goals.

The revised rules allow countries with excessive borrowing to reduce their debt on average by 1% per year if it is above 90% of gross domestic product (GDP), and by 0.5% per year on average if the debt pile is between 60% and 90% of GDP.

Countries with a deficit above 3% of GDP are required to halve this to 1.5% during periods of growth, creating a safety buffer for tough times ahead.

Defense spending will be taken into account when the Commission assesses a country’s high deficit, a consideration triggered by Russia’s invasion of Ukraine.

The new rules give countries seven years, up from four previously, to cut debt and deficit starting from 2025.

Note that the EU can tweak enforcement but not the baseline Stability and Growth Pact targets themselves without unanimous agreement, and a new treaty.

With that background, let’s look ahead to the crisis that looms as described by Eurointelligence.

Europe’s Next Financial Crisis

We would like to alert our readers to a theme that has been preoccupying us for a while – the possibility of another financial crisis in Europe. We have generally been restrained in our warning of financial crises. The main exception was the global financial crisis and its cousin, the euro area’s sovereign debt crisis. Fifteen or so years later, we see another financial crisis ahead here in Europe: a crisis of the European social and political model with deep consequences for fiscal and financial stability.

The canary in the coalmine is the overshooting budget deficits in France and Italy, at over 7% and over 5% for 2024 respectively. These numbers are a symptom, not a cause. Behind them lies a lack of economic growth needed to sustain Europe’s social model. Germany’s fiscal policy could not be more different than that of France or Italy, and yet Germany is afflicted by the exact same problem.

The European model was powered by oligopolistic industrial companies, which were heavily supported by the state through regulation that tilted the level-playing field in their favor. The German car industry is a classic example, but everybody did this.

What is killing this model now is a shift in technology and geopolitical fragmentation. Of the two, we would argue the first is the more important. More and more functions in our lives that were previously the realm of purely mechanical processes are nowadays wholly or partially digitalized. Barriers of entry have collapsed. China went from zero to the world leader in electric cars.

European companies no longer generate sufficient profits to fuel the social model – and to fund long-term research. It is no surprise that Europe has only very few tech companies. In short, Europe’s oligopolistic old-tech model no longer works in a digital world. We have been reporting on the attempts by the EU to stem against technological developments through regulation. But this is a way of addressing symptoms, not causes.

After the multiple global shocks of this decade, the consequences of Europe’s technological decline translate into lower potential growth rates. Italy came first. Its productivity growth has been near zero since it joined the euro. The UK’s productivity growth slumped after the global financial crisis, and never recovered since. Germany’s productivity growth is unlikely to recover, even if the economic cycle does. The German Council of Economic Experts see a potential growth of around 0.5% until the end of the decade. With productivity growth that low, Europe’s model has become financially unsustainable. It is unsurprising that the political system is fragmenting everywhere. The argument for sustained deficits, in France for example, is that you need them to keep Marine Le Pen out of power. This means they will persist.

We have a fiscal crisis ahead, caused by a combination of falling productivity growth and political gridlock. Technology is the main cause of the decline. Geopolitics is what accelerated it. The solutions we have been advocating over the years – a joint fiscal capacity, a capital markets union, joint defense procurement to neutralize the rise in defense spending – are further away than ever. Unless one of these parameters change, a financial crisis is a very plausible scenario.

Spotlight France

France has a budget deficit of 7 percent but wants to fund a European army to fight Russia.

How is that supposed to work?

Spotlight Green Fantasies

The EU has adopted ambitious Green policies that will cost much more money than has been budgeted.

How is that supposed to work?

Targets Won’t Be Met

You can take those Green targets and throw then into the ashcan of ideas that never should have been set in the first place.

Even if you give France 7 years to be deficit compliant, how is France supposed to cut back a whopping 4 percent of GDP?

What’s the Basic Problem?

Eurointelligence says “Technology is the main cause of the decline. Geopolitics is what accelerated it.”

Technology is not the problem. The Maastricht treaty that created the Eurozone is flawed. And it cannot be fixed without unanimous agreement.

Given productivity and work rule differences, one interest rate set by the ECB cannot serve Italy, France, Greece, and Germany.

Add to that, EU nannycrat rules. The EU is more interested in cracking down on Google (Now Alphabet GOOG), Apple (AAPL), Facebook (now Meta Platforms META), and Microsoft (MSFT) for alleged monopolies than developing anything.

The EU Is Dysfunctional

In a single word, the EU is dysfunctional. That’s the problem, not technology. The Maastricht treaty itself is a big part of the reason the EU is dysfunctional. The Euro itself, with one common interest rate, is fundamentally flawed.

Companies like Alphabet, Meta, Microsoft, and Apple could not exist in the EU because in the name of competition and diversity, the EU would kill them before they ever got big enough to matter.

EU rules make it impossible to fix the basic problem. So the EU has resorted to nannycrat rules to regulate US and Chinese companies instead of fixing anything.

Technology, including AI, and geopolitics is now accelerating the basic problem, the EU is dysfunctional by treaty. It’s showing up in polls everywhere.

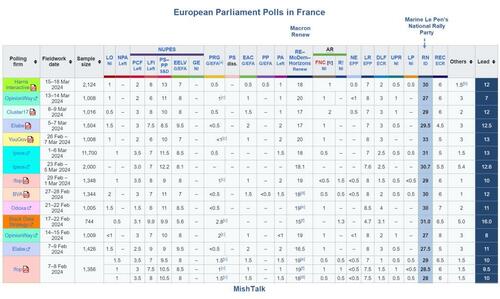

European Parliament Polls in France

EP France Polls from Wikipedia

Marine Le Pen’s National Rally is clobbering Renew/Modem by a whopping 12 percentage points, 30-18.

This chart is for France only, not the entire parliament, but it reflects on French President Emmanuel Macron’s sinking popularity and the sinking centrists in general.

A War Economy

As a way to create jobs, EC President Charles Michel promotes a war economy.

In a preposterous proposal to deal with growth, The European Council President Calls on Europe to Switch to a War Economy

I have a suggestion. Let US senator Lindsey Graham and EC president Charles Michel lead the charge.

Instead of fixing Germany’s aging infrastructure, attempting to compete with the US on AI, or competing with China on anything, EC President Charles Michel promotes war as growth.

It’s Time for a New Strategy

Please note German Chancellor Olaf Scholz is refusing to send Taurus cruise missiles to Ukraine.

On March 16, I commented Ukraine Won’t Win the War, It’s Time for a New Strategy

There’s Solidarity, Then There’s Solidarity

Poll after poll shows support for Ukraine. Every one of then is flawed because they fail to ask “how much are you willing to pay.”

There’s solidarity in the EU, but it stops with wheat and weapons. In the US, Biden is desperate for the war to go on. But he still has no goal. Is Biden’s goal the same as Zelensky’s: “The war will not be over as long as Crimea is occupied.”

We don’t know because Biden won’t say. Biden also will not say how much he is willing to commit. Is it another $150 billion or is it $1 trillion or more?

Meanwhile, prepare for carnage of the center, Greens, and warmongers in the next European Parliament elections.

A fiscal crisis awaits. The first casualty will be Green energy policies.

Wednesday, March 27, 2024

NSF Paid Universities To Develop AI Censorship Tools For Social Media

Step by step a totalitarian system is taking shape. When it's built, there will be no escape.

NSF Paid Universities To Develop AI Censorship Tools For Social Media

By Daniel Nuccio of The College Fix

"Used by governments and Big Tech to shape public opinion by restricting certain viewpoints or promoting others’: report

The National Science Foundation is paying universities using taxpayer money to create AI tools that can be used to censor Americans on various social media platforms, according to members of the House.

University of Michigan, the University of Wisconsin-Madison, and MIT are among the universities cited in the House Judiciary Committee and the Select Subcommittee on the Weaponization of the Federal Government interim report.

It details the foundation’s “funding of AI-powered censorship and propaganda tools, and its repeated efforts to hide its actions and avoid political and media scrutiny.”

“NSF has been issuing multi-million-dollar grants to university and non-profit research teams” for the purpose of developing AI-powered technologies “that can be used by governments and Big Tech to shape public opinion by restricting certain viewpoints or promoting others,” states the report, released last month.

Funding for the projects began in 2021 and was issued through the NSF’s Convergence Accelerator grant program, which was initially launched in 2019 to develop interdisciplinary solutions to major challenges of national and societal importance such as those pertaining to AI and quantum technology, it states.

In 2021, however, the NSF introduced “Track F: Trust & Authenticity in Communication Systems.”

The NSF’s 2021 Convergence Accelerator program solicitation stated the goal of Track F projects was to “develop prototype(s) of novel research platforms forming integrated collection(s) of tools, techniques, and educational materials and programs to support increased citizen trust in public information of all sorts (health, climate, news, etc.), through more effectively preventing, mitigating, and adapting to critical threats in our communications systems.”

Specifically, the grant solicitation singled out the threats posed by hackers and misinformation.

That September, the select subcommittee report notes, the NSF awarded “twelve Track F teams $750,000 each (a total of $9 million) to develop and refine their project ideas and build partnerships.” The following year, the NSF selected six of the 12 teams to receive an additional $5 million each for their respective projects, according to the report.

Projects from the University of Michigan, University of Wisconsin-Madison, MIT, and Meedan, a nonprofit that specializes in developing software to counter misinformation, are highlighted by the select subcommittee.

Collectively, these four projects received $13 million from the NSF, it states.

“The University of Michigan intended to use the federal funding to develop its tool ‘WiseDex,’ which could use AI technology to assess the veracity of content on social media and assist large social media platforms with what content should be removed or otherwise censored,” it states.

The University of Wisconsin-Madison’s Course Correct, which was featured in an article from The College Fix last year, was “intended to aid reporters, public health organizations, election administration officials, and others to address so-called misinformation on topics such as U.S. elections and COVID-19 vaccine hesitancy.”

MIT’s Search Lit, as described in the select subcommittee’s report, was developed as an intervention to help educate groups of Americans the researchers believed were most vulnerable to misinformation such as conservatives, minorities, rural Americans, older adults, and military families.

Meedan, according to its website, used its funding to develop “easy-to-use, mobile-friendly tools [that] will allow AAPI [Asian-American and Pacific Islander] community members to forward potentially harmful content to tiplines and discover relevant context explainers, fact-checks, media literacy materials, and other misinformation interventions.”

According to the select committee’s report, “Once empowered with taxpayer dollars, the pseudo-science researchers wield the resources and prestige bestowed upon them by the federal government against any entities that resist their censorship projects.”

“In some instances,” the report states, “if a social media company fails to act fast enough to change a policy or remove what the researchers perceive to be misinformation on its platform, disinformation researchers will issue blogposts or formal papers to ‘generate a communications moment’ (i.e., negative press coverage) for the platform, seeking to coerce it into compliance with their demands.”

Efforts were made via email to contact senior members of the three university research teams, as well as a representative from Meedan, regarding the portrayal of their work in the select subcommittee’s report.

Paul Resnick, who serves as the WiseDex project director at the University of Michigan, referred The College Fix to the WiseDex website.

“Social media companies have policies against harmful misinformation. Unfortunately, enforcement is uneven, especially for non-English content,” states the site. “WiseDex harnesses the wisdom of crowds and AI techniques to help flag more posts [than humans can]. The result is more comprehensive, equitable, and consistent enforcement, significantly reducing the spread of misinformation.”

A video on the site presents the tool as a means to help social media sites flag posts that violate platform policies and subsequently attach warnings to or remove the posts. Posts portraying approved COVID-19 vaccines as potentially dangerous are used as an example.

Michael Wagner from the University of Wisconsin-Madison also responded to The Fix, writing, “It is interesting to be included in a report that claims to be about censorship when our project censors exactly no one.”

According to the select subcommittee report, some of the researchers associated with Track F and similar projects, however, privately acknowledged efforts to combat misinformation were inherently political and a form of censorship.

Yet, following negative coverage of Track F projects, depicting them as politically motivated and their products as government-funded censorship tools, the report notes, the NSF began discussing media and outreach strategy with grant recipients.

Notes from a pair of Track F media strategy planning sessions included in Appendix B of the select subcommittee’s report recommended researchers, when interacting with the media, focus on the “pro-democracy” and “non-ideological” nature of their work, “Give examples of both sides,” and “use sports metaphors.”

The select subcommittee report also highlights that there were discussions of having a media blacklist, although at least one researcher from the University of Michigan objected to this, citing the potential optics.

Germany's Murder Of Europe

It looks more like a suicide to me! But this is what you get when a majority of uneducated imbeciles elect clowns to represent them. Whatever Europe does, it will not affect the climate nor other countries. Like the boycott of Russia, the green agenda will have exactly the opposite effect of what was expected. Better, the failure of the policies will be because Europe didn't do enough and they will double down on the hysteria. Is this how civilizations decline and finally crash?

Authored by Drieu Godefrei via The Gatestone Institute,

In a preparatory impact report, a copy of which has been obtained by the Financial Times before official release, the European Commission estimates that to achieve the target of reducing greenhouse gas emissions by 90% by 2040 then 100% in 2050 — the main objective of the "European Green Deal" — Europe will need to invest €1.5 trillion a year from 2031 to 2050.

1.5 trillion euros a year. That is equivalent to 10% of the Europe Union's entire GDP for 2022 -- every year! Apart from a war effort, there is no objective of any kind that has ever required the diversion of 10% of a continent's GDP by political decree.

The new German utopia

This number shows us that, while Germany has had to give up imposing

its hatred of nuclear power on its European partners, it is determined

to inflict on Europe the rest of the environmental utopia, i.e. total

decarbonization, even at the cost of economic collapse and freedoms.

You may say that the European Commission is not Germany, but anyone who has worked in the Commission will tell you that there are two insurmountable lobbies at this level: Germany, by far is the most powerful country in Europe, followed by the environmental NGOs, such as Greenpeace and Friends of the Earth, which have permanent offices in the Berlaymont, the headquarters building of the European Commission. The fact that the current president of the Commission, Ursula von der Leyen, is German is just the icing on the apfelstrudel.

All the same, everything in this delirious report by the German Commission is wrong.

The Commission's pseudo-savvy calculations

The report states that the cost of inaction would be much higher than €1.5 trillion a year. In fact, explains the report, the European plan will save up to 1% of GDP per year. It should be noted, however, that this figure runs counter to all the IPCC's projections on the cost of global warming — which is 0.03 % of GDP per year, not 1%.

Annex 8 of the impact report just published by the Commission states:

"The IPCC AR6 Working Group II report (2022) confirms that global aggregate economic impacts generally increase with higher degree of global warming. However, due to the wide range of damage estimates and lack of comparability between methodologies, the report does not provide a robust range of estimates but recognizes that global aggregate economic impacts could be higher than estimated in the previous report."

In short, the IPCC's sixth report states that the cost of global warming could actually be greater than that stated in the fifth report.

Unfortunately (for lack of time? space? ink?) the Commission does not bother to reiterate what was said in the fifth report, which was voluble and precise on the question of the cost of global warming. Let us make up for this shortcoming: according to the fifth IPCC report AR5, chapter 10:

"For most economic sectors, the impact of climate change will be small relative to the impacts of other drivers... Changes in population, age, income, technology, relative prices... and many other aspects of socioeconomic development will have an impact on the supply and demand of economic goods and services that is large relative to the impact of climate change."

Above all, the Paris Agreement, of which the Commission claims to be part, aimed to limit global warming to only 1.5 degrees Celsius by 2100. Achieving this objective presupposed a drastic global reduction in human greenhouse global gas emissions, not just Europe. However, since 2015, these global emissions have continued to rise, and there is no realistic scenario in which global emissions will decrease. China, which still builds roughly two new coal-power plants a week, and India continue to lay waste to these projections.

Climate, of course, is a global issue: if Europe reduces its emissions to zero, while the rest of the world continues to increase them, the effect on the climate will be zero. As a result, the German plan will not save a single euro in terms of the damage caused by global warming and extreme events.

So, the investment needed each year would not be €1.5 trillion invested to save 0.03% of GDP per year. It would be €30 trillion — €1.5 trillion per year for 20 years — invested to change absolutely nothing in the climate of Europe.

There are no serious analysts left who still maintain that the objective of the Paris Agreement will be achieved; the Paris Agreement is obsolete and to pretend otherwise, as the European Commission is doing, is misleading, irresponsible, and not even scientific.

In addition, the report goes on to say that reducing European imports of fossil fuels would result in savings of up to €2.8 trillion between 2031 and 2050. At present there is no technical or scientific way of overcoming the intermittent nature of renewable energies such as wind, solar. As a result, Europe's energy mix will have to continue to rely on fossil fuels in addition to nuclear power, as demonstrated by Germany, the champion of lignite coal and CO2 emissions – and releasing ten times more CO2 than France, per unit of energy produced -- in 2024. What is more, this pseudo-savvy calculation presupposes that we know the prices of oil and gas in advance, and that we persist in banning the exploitation of the shale gas that lies beneath Europe's soil.

The report by the European Commission shows a frightening headlong rush. The situation in Europe is already dramatic. Since 2008, American GDP has doubled, meaning that Americans earn twice as much as they did in 2008. Since 2008, Europe's GDP has stagnated. This means that Europeans are increasingly taxed and harassed, and forbidden to move, build, undertake, innovate and start a family as they see fit, while their incomes are not increasing.

The shale revolution means that America now could be the world's largest producer of oil and gas, if President Joe Biden had not hobbled domestic energy production on his first day in office. The beneficiaries of his move were Russia, Iran -- and China, which can now more easily sell its cheap coal, thereby polluting the climate even more.

"Meanwhile," according to Gideon Rachman, chief foreign affairs commentator of the Financial Times, "energy prices in Europe have soared."

"The Ukraine war and the loss of cheap Russian gas mean that European industry typically pays three or four times as much for energy as their American competitors. Gloomy European bosses say this is already leading to factory closures in Europe".

In practical terms, whole swathes of our populations have entered into a pattern that is the ultimate dream of environmentalists: degrowth. In other words, their impoverishment. Giorgos Kallis, a prominent figure in the field of environmental economics, asserted recently the necessity of adopting a "degrowth" paradigm over the conventional GDP-based model. He contends that economies can and must thrive while simultaneously diminishing inequality and enhancing overall well-being.

Scenarios

Three possible scenarios emerge.

In the first scenario, the EU will persist in its German ecological utopia, which will throw the whole of Europe even more deeply into the recession in which Germany is already languishing. In the context of its current economic stagnation, Europe cannot afford to divert 10% of its GDP per year to unaffordable, unreliable and intermittent energy sources. Popular revolts will multiply, making the current farmers' revolt look like "Pat the Bunny." It should be obvious that our democracies will not be able to withstand the impoverishment deliberately organized by "elites" who have gone mad trying to promote an insufficiently substantiated green ideology.

In the second scenario, the EU would not undo the "European Green Deal," but its entry into force would simply be rescheduled (meaning postponed). This scenario condemns Europe to what economists Lawrence Summers and Henri Lepage name "secular stagnation," a condition when there is negligible or no economic growth in a market-based economy, on the model of Japan.

A third scenario would see a new majority come to power through the European elections in June -- after all, what is the point of democratic elections if not to allow a change of course? -- and deconstruct (repeal) every piece of legislation in a European Green Deal that has become irrelevant or economically harmful to the most destitute among us in the current global context.

Ironically, if the IPCC's projections are to be believed, global warming may occur, and we will adapt to it through innovation. All the resources that Europe is burning up in a phantasmatic "energy transition", which has failed and will fail -- will just burn through money that we will then not have for innovation. What will Europe do when these misguided ideologies have permanently broken the back of its economy?

Germany's Geopolitical Freefall: Beijing Shows Berlin The Red Card

The spiral downward for Europe and especially Germany is accelerating. Whatever Brussels or Washington may announce to shore up financial...

-

A rather interesting video with a long annoying advertising in the middle! I more or less agree with all his points. We are being ...

-

In a sad twist, from controlled news to assisted search and tunnel vision, it looks like intelligence is slipping away from humans alm...

-

A little less complete than the previous article but just as good and a little shorter. We are indeed entering a Covid dystopia. Guest Pos...