As an oil and gas specialist in London 30 years ago, I analyzed models which clearly indicated a breakdown of supply after the year 2020. Here we are today, facing an uncertain future with no clear workable policies. The article below outlines the dilemma most clearly. There will be no free lunch! Energy is complex and requires tradeoffs. Our green energy policies are pulling us straight into a third major energy crisis. We urgently need intelligent and knowledgeable leaders to solve such a difficult conundrum. Where are they?

Authored by David Hay via Everegreen Gavekal blog,

“You

see what is happening in Europe. There is hysteria and some confusion

in the markets. Why?…Some people are speculating on climate change

issues, some people are underestimating some things, some are starting

to cut back on investments in the extractive industries. There needs to

be a smooth transition.”

- Vladimir Putin (someone with whom this author rarely agrees)

“By

a continuing process of inflation, governments can confiscate, secretly

and unobserved, an important part of the wealth of its citizens.”

–

John Maynard Keynes (an interesting observation for all the modern day

Keynesians to consider given their support of current inflationary US

policies, including energy-related)

Introduction

This week’s EVA provides another sneak preview into David Hay’s book-in-process, “Bubble 3.0” discussing what he thinks is the crucial topic of “greenflation.” This

is a term he coined referring to the rising price for metals and

minerals that are essential for solar and wind power, electric cars, and

other renewable technologies.

It also centers on the reality that as

global policymakers have turned against the fossil fuel industry,

energy producers are for the first time in history not responding to

dramatically higher prices by increasing production.

Consequently, there is a difficult tradeoff that arises as the world

pushes harder to combat climate change, driving up energy costs to

painful levels, especially for lower income individuals.

What we are currently seeing in Europe is a vivid example of this dilemma.

While it may be the case that governments welcome higher oil and

natural gas prices to discourage their use, energy consumers are likely

to have a much different reaction.

Summary

BlackRock’s

CEO recently admitted that, despite what many are opining, the green

energy transition is nearly certain to be inflationary.

Even

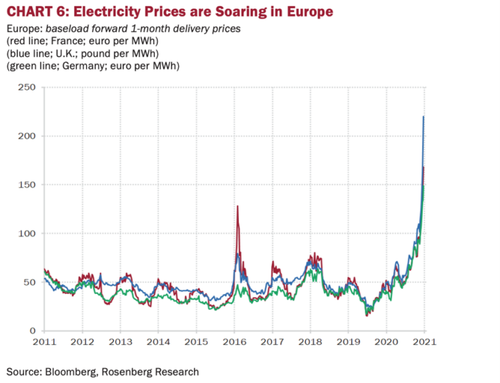

though it’s early in the year, energy prices are already experiencing

unprecedented spikes in Europe and Asia, but most Americans are unaware

of the severity.

To that point, many British residents

being faced with the fact that they may need to ration heat and could be

faced with the chilling reality that lives could be lost if this winter

is as cold as forecasters are predicting.

Because of the

huge increase in energy prices, inflation in the eurozone recently hit a

13-year high, heavily driven by natural gas prices on the Continent

that are the equivalent of $200 oil.

It used to be that

the cure for extreme prices was extreme prices, but these days I’m not

so sure. Oil and gas producers are very wary of making long-term

investments to develop new resources given the hostility to their

industry and shareholder pressure to minimize outlays.

I

expect global supply to peak sometime next year and a major supply

deficit looks inevitable as global demand returns to normal.

In

Norway, almost 2/3 of all new vehicle sales are of the electric variety

(EVs) – a huge increase in just over a decade. Meanwhile, in the US,

it’s only about 2%. Still, given Norway’s penchant for the plug-in auto,

the demand for oil has not declined.

China, despite

being the largest market by far for electric vehicles, is still

projected to consume an enormous and rising amount of oil in the future.

About

70% of China’s electricity is generated by coal, which has major

environmental ramifications in regards to electric vehicles.

Because

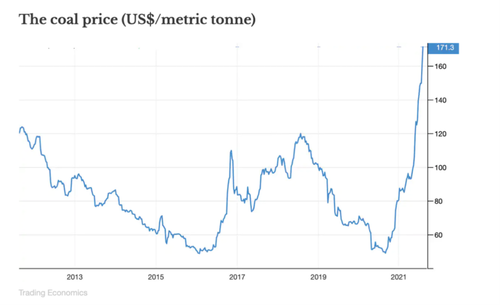

of enormous energy demand in China this year, coal prices have

experienced a massive boom. Its usage was up 15% in the first half of

this year, and the Chinese government has instructed power providers to

obtain all baseload energy sources, regardless of cost.

The

massive migration to electric vehicles – and the fact that they use six

times the amount of critical minerals as their gasoline-powered

counterparts –means demand for these precious resources is expected to

skyrocket.

This extreme need for rare minerals, combined with rapid demand growth, is a recipe for a major spike in prices.

Massively

expanding the US electrical grid has several daunting challenges– chief

among them the fact that the American public is extremely reluctant to

have new transmission lines installed in their area.

The

state of California continues to blaze the trail for green energy in

terms of both scope and speed. How the rest of the country responds to

their aggressive take on renewables remains to be seen.

It

appears we are entering a very odd reality: governments are expending

resources they do not have on weakly concentrated energy. And the result

may be very detrimental for today’s modern economy.

If

the trend in energy continues, what looks nearly certain to be the Third

Energy crisis of the last half-century may linger for years.

Green energy: A bubble in unrealistic expectations?

As I have written in past EVAs, it

amazes me how little of the intense inflation debate in 2021 centered

on the inflationary implications of the Green Energy transition.

Perhaps it is because there is a built-in assumption that using more

renewables should lower energy costs since the sun and the wind provide

“free power”.

However, we will soon see that’s not the case, at

least not anytime soon; in fact, it’s my contention that it will likely

be the opposite for years to come and I’ve got some powerful company.

Larry Fink, CEO of BlackRock, a very pro-ESG* organization, is one of

the few members of Wall Street’s elite who admitted this in the summer

of 2021. The story, however, received minimal press coverage and was

quickly forgotten (though, obviously, not be me!).

This

EVA will outline myriad reasons why I think Mr. Fink was telling it like

it is…despite the political heat that could bring down upon him.

First, though, I will avoid any discussion of whether humanity is the

leading cause of global warming. For purposes of this analysis, let’s

make the high-odds assumption that for now a high-speed green energy

transition will continue to occur. (For those who would like a

well-researched and clearly articulated overview of the climate debate, I

highly recommend the book “Unsettled”; it’s by a former top energy

expert and scientist from the Obama administration, Dr. Steven Koonin.)

The

reason I italicized “for now” is that in my view it’s extremely

probable that voters in many Western countries are going to become

highly retaliatory toward energy policies that are already creating

extreme hardship. Even though it’s only early autumn as I write

these words, energy prices are experiencing unprecedented increases in

Europe. Because it’s “over there”, most Americans are only vaguely

aware of the severity of the situation. But the facts are shocking…

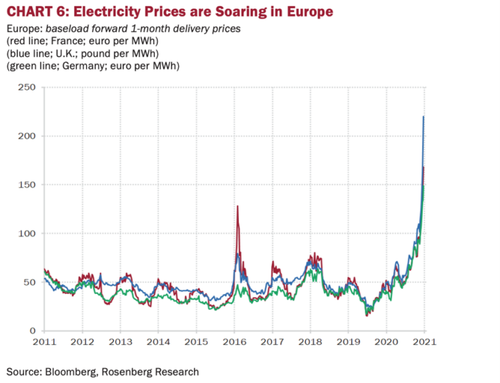

Presently,

natural gas is going for $29 per million British Thermal Units (BTUs)

in Europe, a quadruple compared to the same time in 2020, versus “just”

$5 in the US, which is a mere doubling. As a consequence, wholesale

energy cost in Great Britain rose an unheard of 60% even before summer

ended. Reportedly, nine UK energy companies are on the brink of failure

at this time due to their inability to fully pass on the enormous cost

increases. As a result, the British government is reportedly on the

verge of nationalizing some of these entities—supposedly, temporarily—to

prevent them from collapsing. (CNBC reported on Wednesday that UK

natural gas prices are now up 800% this year; in the US, nat gas rose

20% on Tuesday alone, before giving back a bit more than half of that

the next day.)

Serious food shortages are expected after

exorbitant natural gas costs forced most of England’s commercial

production of CO2 to shut down. (CO2 is used both for stunning animals

prior to slaughter and also in food packaging.) Additionally, ballistic

natural gas prices have forced the closure of two big US fertilizer

plants due to a potential shortfall of ammonium nitrate of which “nat

gas” is a key feedstock.

*ESG stands for Environmental,

Social, Governance; in 2021, Blackrock’s assets under management

approximated $9 ½ trillion, about one-third of the total US federal

debt.

With

the winter of 2021 approaching, British households are being told they

may need to ration heat. There are even growing concerns about the

widespread loss of life if this winter turns out to be a cold one, as

2020 was in Europe. Weather forecasters are indicating that’s a

distinct possibility.

In Spain, consumers are paying

40% more for electricity compared to the prior year. The Spanish

government has begun resorting to price controls to soften the impact of

these rapidly escalating costs. (The history of price controls is that

they often exacerbate shortages.) Naturally, spiking power prices hit

the poorest hardest, which is typical of inflation whether it is of the

energy variety or of generalized price increases.

Due

to these massive energy price increases, eurozone inflation recently

hit a 13-year high, heavily driven by natural gas prices that are the

equivalent of $200 per barrel oil. This is consistent with what I

warned about in several EVAs earlier this year and I think there is much

more of this looming in the years to come.

In

Asia, which also had a brutally cold winter in 2020 – 2021, there are

severe energy shortages being disclosed, as well. China has instructed

its power providers to secure all the coal they can in preparation for a

repeat of frigid conditions and acute deficits even before winter

arrives. The government has also instructed its energy distributors to

acquire all the liquified natural gas (LNG) they can, regardless of

cost. LNG recently hit $35 per million British Thermal Units in Asia,

up sevenfold in the past year. China is also rationing power to its

heavy industries, further exacerbating the worldwide shortages of almost

everything, with notable inflationary implications.

In India,

where burning coal provides about 70% of electricity generation (as it

does in China), utilities are being urged to import coal even though

that country has the world’s fourth largest coal reserves. Several

Indian power plants are close to exhausting their coal supplies as power

usage rips higher.

Normally, I’d say that the cure for

such extreme prices, was extreme prices—to slightly paraphrase the old

axiom. But these days, I’m not so sure; in fact, I’m downright

dubious. After all, the enormously influential International Energy

Agency has recommended no new fossil fuel development after 2021—“no

new”, as in zero.

It’s because of pressure such as this

that, even though US natural gas prices have done a Virgin Galactic to

$5 this year, the natural gas drilling rig count has stayed flat. The

last time prices were this high there were three times as many working

rigs.

It is the same story with oil production. Most Americans

don’t seem to realize it but the US has provided 90% of the planet’s

petroleum output growth over the past decade. In other words, without

America’s extraordinary shale oil production boom—which raised total oil

output from around 5 million barrels per day in 2008 to 13 million

barrels per day in 2019—the world long ago would have had an acute

shortage. (Excluding the Covid-wracked year of 2020, oil demand grows

every year—strictly as a function of the developing world, including

China, by the way.)

Unquestionably, US oil companies could

substantially increase output, particularly in the Permian Basin,

arguably (but not much) the most prolific oil-producing region in the

world. However, with the Fed being pressured by Congress to punish

banks that lend to any fossil fuel operator, and the overall extreme

hostility toward domestic energy producers, why would they?

There

is also tremendous pressure from Wall Street on these companies to be

ESG compliant. This means reducing their carbon footprint. That’s

tough to do while expanding their volume of oil and gas.

Further,

investors, whether on Wall Street or on London’s equivalent, Lombard

Street, or in pretty much any Western financial center, are against US

energy companies increasing production. They would much rather see them

buy back stock and pay out lush dividends. The companies are embracing

that message. One leading oil and gas company CEO publicly mused to

the effect that buying back his own shares at the prevailing extremely

depressed valuations was a much better use of capital than drilling for

oil—even at $75 a barrel.

As reported by Morgan Stanley, in the

summer of 2021, an US institutional broker conceded that of his 400

clients, only one would consider investing in an energy company!

Consequently, the fact that the industry is so detested means that its

shares are stunningly undervalued. How stunningly? A myriad of US oil

and gas producers are trading at free cash flow* yields of 10% to 15%

and, in some cases, as high as 25%.

In Europe, where the same

pressures apply, one of its biggest energy companies is generating a 16%

free cash flow yield. Moreover, that is based up an estimate of $60

per barrel oil, not the prevailing price of $80 on the Continent.

*Free

cash flow is the excess of gross cash flow over and above the capital

spending needed to sustain a business. Many market professionals

consider it more meaningful than earnings.

Therefore, due to the

intense antipathy toward Western energy producers they aren’t very

inclined to explore for new resources. Another much overlooked fact

about the ultra-critical US shale industry that, as noted, has been

nearly the only source of worldwide output growth for the past 13 years,

is its rapid decline nature.

Most oil wells see their production

taper off at just 4% or 5% per year. But with shale, that decline rate

is 80% after only two years. (Because of the collapse in exploration

activities in 2020 due to Covid, there are far fewer new wells coming

on-line; thus, the production base is made up of older wells with slower

decline rates but it is still a much steeper cliff than with

traditional wells.)

As a result, the US, the world’s most

important swing producer, has to come up with about 1.5 million barrels

per day (bpd) of new output just to stay even. (This was formerly about

a 3 million bpd number due to both the factor mentioned above and the 2

million bpd drop in total US oil production, from 13 million bpd to

around 11 million bpd since 2019). Please recall that total US oil

production in 2008 was only around 5 million bpd. Thus, 1.5 million

barrels per day is a lot of oil and requires considerable drilling and

exploration activities. Again, this is merely to stay steady-state,

much less grow.

The foregoing is why I wrote on multiple

occasions in EVAs during 2020, when the futures price for oil went below

zero*, that crude would have a spectacular price recovery later that

year and, especially, in 2021. In my view, to go out on my familiar

creaky limb, you ain’t seen nothin’ yet! With supply extremely

challenged for the above reasons and demand marching back, I believe

2022 could see $100 crude, possibly even higher.

*Physical oil,

or real vs paper traded, bottomed in the upper teens when the futures

contract for delivery in April, 2020, went deeply negative.

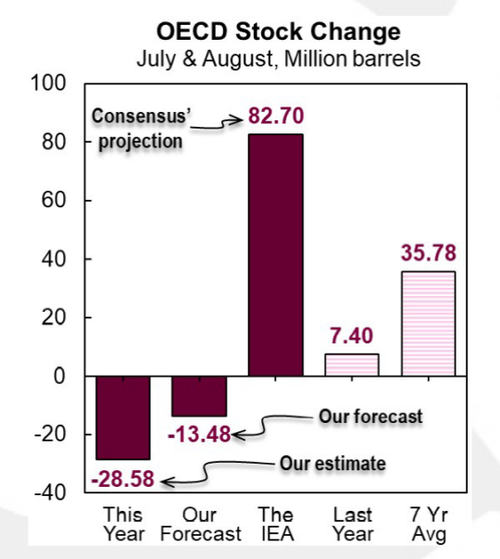

Mike

Rothman of Cornerstone Analytics has one of the best oil price

forecasting records on Wall Street. Like me, he was vehemently bullish

on oil after the Covid crash in the spring of 2020 (admittedly, his

well-reasoned optimism was a key factor in my up-beat outlook). Here’s

what he wrote late this summer: “Our forecast for ’22 looks to see

global oil production capacity exhausted late in the year and our

balance suggests OPEC (and OPEC + participants) will face pressures to

completely remove any quotas.”

My expectation is that

global supply will likely max out sometime next year, barring a powerful

negative growth shock (like a Covid variant even more vaccine resistant

than Delta). A significant supply deficit looks inevitable as global

demand recovers and exceeds its pre-Covid level. This is a

view also shared by Goldman Sachs and Raymond James, among others;

hence, my forecast of triple-digit prices next year. Raymond James

pointed out that in June the oil market was undersupplied by 2.5 mill

bpd. Meanwhile, global petroleum demand was rapidly rising with

expectations of nearly pre-Covid consumption by year-end. Mike Rothman

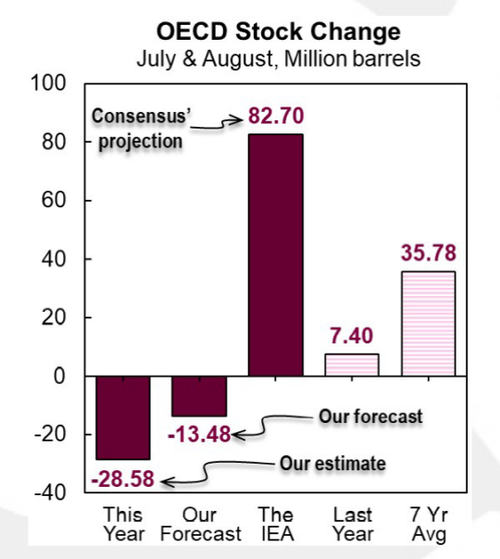

ran this chart in a webcast on 9/10/2021 revealing how far below the

seven-year average oil inventories had fallen. This supply deficit is

very likely to become more acute as the calendar flips to 2022.

In

fact, despite oil prices pushing toward $80, total US crude output now

projected to actually decline this year. This is an unprecedented

development. However, as the very pro-renewables Financial Times (the

UK’s equivalent of the Wall Street Journal) explained in an August 11th,

2021, article: “Energy companies are in a bind. The old solution

would be to invest more in raising gas production. But with most

developed countries adopting plans to be ‘net zero’ on carbon emissions

by 2050 or earlier, the appetite for throwing billions at long-term gas

projects is diminished.”

The author, David Sheppard, went

on to opine: “In the oil industry there are those who think a period of

plus $100-a-barrel oil is on the horizon, as companies scale back

investments in future supplies, while demand is expected to keep rising

for most of this decade at a minimum.” (Emphasis mine) To which I say,

precisely!

Thus, if he’s right about rising demand, as I believe

he is, there is quite a collision looming between that reality and the

high probability of long-term constrained supplies. One of the most

relevant and fascinating Wall Street research reports I read as I was

researching the topic of what I have been referring to as “Greenflation”

is from Morgan Stanley. Its title asked the provocative question:

“With 64% of New Cars Now Electric, Why is Norway Still Using so Much

Oil?”

While almost two-thirds of Norway’s new vehicle

sales are EVs, a remarkable market share gain in just over a decade, the

number in the US is an ultra-modest 2%. Yet, per the Morgan Stanley

piece, despite this extraordinary push into EVs, oil consumption in

Norway has been stubbornly stable.

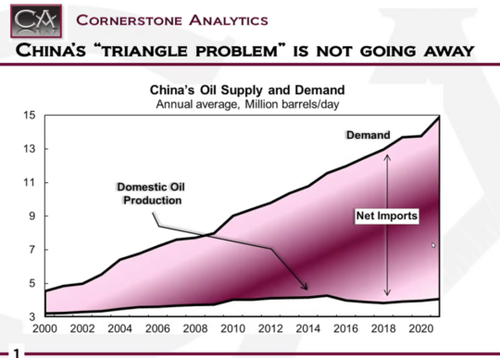

Coincidentally,

that’s been the experience of the overall developed world over the past

10 years, as well; petroleum consumption has largely flatlined. Where

demand hasn’t gone horizontal is in the developing world which includes

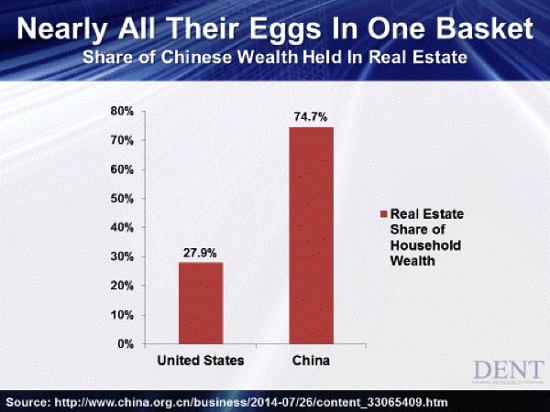

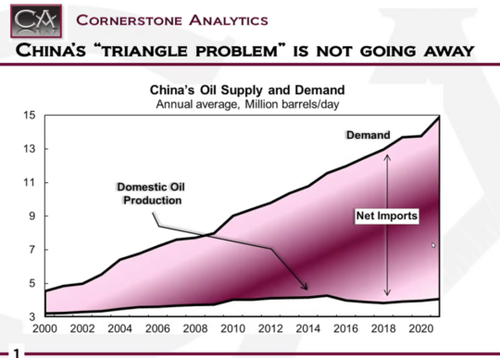

China. As you can see from the following Cornerstone Analytics chart,

China’s oil demand has vaulted by about 6 million barrels per day (bpd)

since 2010 while its domestic crude output has, if anything, slightly

contracted.

Another

coincidence is that this 6 million bpd surge in China’s appetite for

oil, almost exactly matched the increase in US oil production. Once

again, think where oil prices would be today without America’s shale oil

boom.

This is unlikely to change over the next decade. By 2031,

there are an estimated one billion Asian consumers moving up into the

middle class. History is clear that more income means more energy

consumption. Unquestionably, renewables will provide much of that power

but oil and natural gas are just as unquestionably going to play a

critical role. Underscoring that point, despite the exponential growth

of renewables over the last 10 years, every fossil fuel category has

seen increased usage.

Thus, even if China gets up to

Norway’s 64% EV market share of new car sales over the next decade, its

oil usage is likely to continue to swell. Please be aware that China

has become the world’s largest market for EVs—by far. Despite that, the

above chart vividly displays an immense increase in oil demand.

Here’s

a similar factoid that I ran in our December 4th EVA, “Totally Toxic”,

in which I made a strong bullish case for energy stocks (the main energy

ETF is up 35% from then, by the way):

“(There was) a

study by the UN and the US government based on the Model for the

Assessment of Greenhouse Gasses Induced Climate Change (MAGICC). The

model predicted that ‘the complete elimination of all fossil fuels in

the US immediately would only restrict any increase in world temperature

by less than one tenth of one degree Celsius by 2050, and by less than

one fifth of one degree Celsius by 2100.’ Say again? If the world’s

biggest carbon emitter on a per capita basis causes minimal improvement

by going cold turkey on fossil fuels, are we making the right moves by

allocating tens of trillions of dollars that we don’t have toward the

currently in-vogue green energy solutions?”

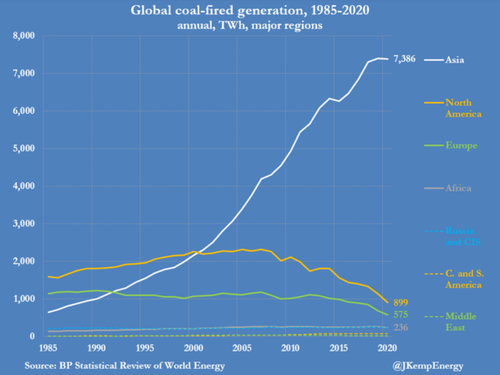

China's voracious power appetite increase has been true with all of its energy sources.

On

the environmentally-friendly front, that includes renewables; on the

environmentally-unfriendly side, it also includes coal. In 2020, China

added three times more coal-based power generation than all other

countries combined. This was the equivalent of an additional coal

planet each week. Globally, there was a reduction last year of 17

gigawatts in coal-fired power output; in China, the increase was 29.8

gigawatts, far more than offsetting the rest of the world’s progress in

reducing the dirtiest energy source. (A gigawatt can power a city with a

population of roughly 700,000.)

Overall, 70% of China’s

electricity is coal-generated. This has significant environmental

implications as far as electric vehicles (EVs) are concerned. Because

EVs are charged off a grid that is primarily coal- powered, carbon

emissions actually rise as the number of such vehicles proliferate. As

you can see in the following charts from Reuters’ energy expert John

Kemp, Asia’s coal-fired generation has risen drastically in the last 20

years, even as it has receded in the rest of the world. (The flattening

recently is almost certainly due to Covid, with a sharp upward

resumption nearly a given.)

The

worst part is that burning coal not only emits CO2—which is not a

pollutant and is essential for life—it also releases vast quantities of

nitrous oxide (N20), especially on the scale of coal usage seen in Asia

today. N20 is unquestionably a pollutant and a greenhouse gas that is

hundreds of times more potent than CO2. (An interesting footnote is

that over the last 550 million years, there have been very few times

when the CO2 level has been as low, or lower, than it is today.)

Some

scientists believe that one reason for the shrinkage of Arctic sea ice

in recent decades is due to the prevailing winds blowing black carbon

soot over from Asia. This is a separate issue from N20 which is a

colorless gas. As the black soot covers the snow and ice fields in

Northern Canada, they become more absorbent of the sun’s radiation, thus

causing increased melting. (Source: “Weathering Climate Change” by

Hugh Ross)

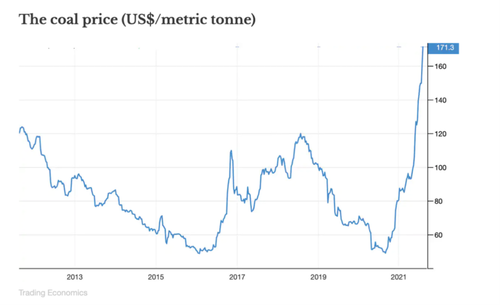

Due to exploding energy needs in China this

year, coal prices have experienced an unprecedented surge. Despite this

stunning rise, Chinese authorities have instructed its power providers

to obtain coal, and other baseload energy sources, such as liquified

natural gas (LNG), regardless of cost. Notwithstanding how pricey coal

has become, its usage in China was up 15% in the first half of this year

vs the first half of 2019 (which was obviously not Covid impacted).

Despite

the polluting impact of heavy coal utilization, China is unlikely to

turn away from it due to its high energy density (unlike renewables),

its low cost (usually) and its abundance within its own borders (though

its demand is so great that it still needs to import vast amounts).

Regarding

oil, as we saw in last week’s final image, it is currently importing

roughly 11 million barrels per day (bpd) to satisfy its 15 million bpd

consumption (about 15% of total global demand). In other words, crude

imports amount to almost three-quarter of its needs. At $80 oil, this

totals $880 million per day or approximately $320 billion per year.

Imagine what China’s trade surplus would look like without its oil

import bill!

Ironically, given the current hostility between the

world’s superpowers, China has an affinity for US oil because of its

light and easy-to-refine nature. China’s refineries tend to be

low-grade and unable to efficiently process heavier grades of crude,

unlike the US refining complex which is highly sophisticated and prefers

heavy oil such as from Canada and Venezuela—back when the latter

actually produced oil.

Thus, China favors EVs because they can be de facto coal-powered, lessening its dangerous reliance on imported oil.

It also likes them due to the fact it controls 80% of the lithium ion

battery supply and 60% of the planet’s rare earth minerals, both of

which are essential to power EVs.

However, even for China,

mining enough lithium, cobalt, nickel, copper, aluminum and the other

essential minerals/metals to meet the ambitious goals of largely

electrifying new vehicle volumes is going to be extremely daunting.

This is in addition to mass construction of wind farms and enormously

expanded solar panel manufacturing.

As one of the planet’s leading energy authorities Daniel Yergin writes: “With

the move to electric cars, demand for critical minerals will skyrocket

(lithium up 4300%, cobalt and nickel up 2500%), with an electric vehicle

using 6 times more minerals than a conventional car and a wind turbine

using 9 times more minerals than a gas-fueled power plant. The

resources needed for the ‘mineral-intensive energy system’ of the future

are also highly concentrated in relatively few countries. Whereas the

top 3 oil producers in the world are responsible for about 30 percent of

total liquids production, the top 3 lithium producers control more than

80% of supply. China controls 60% of rare earths output needed for wind

towers; the Democratic Republic of the Congo, 70% of the cobalt

required for EV batteries.”

As many have noted, the

environmental impact of immensely ramping up the mining of these

materials is undoubtedly going to be severe. Michael Shellenberger, a

life-long environmental activist, has been particularly vociferous in

his condemnation of the dominant view that only renewables can solve the

global energy needs. He’s especially critical of how his fellow

environmentalists resorted to repetitive deception, in his view, to

undercut nuclear power in past decades. By leaving nuke energy out of

the solution set, he foresees a disastrous impact on the planet due to

the massive scale (he’d opine, impossibly massive) of resource mining

that needs to occur. (His book, “Apocalypse Never”, is also one I

highly recommend; like Dr. Koonin, he hails from the left end of the

political spectrum.)

Putting aside the environmental

ravages of developing rare earth minerals, when you have such high and

rapidly rising demand colliding with limited supply, prices are likely

to go vertical. This will be another inflationary “forcing”, a favorite

term of climate scientists, caused by the Great Green Energy

Transition.

Moreover, EVs are very semiconductor

intensive. With semis already in seriously short supply, this is going

to make a gnarly situation even gnarlier. It’s logical to expect that

there will be recurring shortages of chips over the next decade for this

reason alone (not to mention the acute need for semis as the “internet

of things” moves into primetime).

In several of the

newsletters I’ve written in recent years, I’ve pointed out the present

vulnerability of the US electric grid. Yet, it will be essential not

just to keep it from breaking down under its current load; it must be

drastically enhanced, a Herculean task. For one thing, it is

excruciatingly hard to install new power lines. As J.P. Morgan’s Michael

Cembalest has written: “Grid expansion can be a hornet’s nest of cost,

complexity and NIMBYism*, particularly in the US.” The grid’s frailty,

even under today’s demands (i.e., much less than what lies ahead as

millions of EVs plug into it) is particularly obvious in California.

However, severe winter weather in 2021 exposed the grid weakness even in

energy-rich Texas, which also has a generally welcoming attitude toward

infrastructure upgrading and expansion.

Yet it’s the

Golden State, home to 40 million Americans and the fifth largest economy

in the world, if it was its own country (which it occasionally acts

like it wants to be), that is leading the charge to EVs and seeking to

eliminate internal combustion engines (ICEs) as quickly as possible.

Even now, blackouts and brownouts are becoming increasingly common.

Seemingly convinced it must be a role model for the planet, it’s trying

desperately to reduce its emissions, which are less than 1%, of the

global total, at the expense of rendering its energy system more similar

to a developing country. In addition to very high electricity costs

per kilowatt hour (its mild climate helps offset those), it also has

gasoline prices that are 77% above the national average.

*NIMBY stands for Not In My Back Yard.

While

California has been a magnet for millions seeking a better life for 150

years, the cost of living is turning the tide the other way.

Unreliable and increasingly expensive energy is likely to intensify that

trend. Combined with home prices that are more than double the US

median–$800,000!–California is no longer the land of milk and honey,

unless, to slightly paraphrase Woody Guthrie about LA, even back in the

1940s, you’ve got a whole lot of scratch. More and more people, seem to

be scratching California off their list of livable venues.

Voters

in the reliably blue state of California may become extremely restive,

particularly as they look to Asia and see new coal plants being built at

a fever pitch. The data will become clear that as America keeps

decarbonizing–as it has done for 30 years mostly due to the displacement

of coal by gas in the US electrical system—Asia will continue to go the

other way. (By the way, electricity represents the largest share of

CO2 emission at roughly 25%.)

California has always

seemed to lead social trends in this country, as it is doing again with

its green energy transition. The objective is noble though, extremely

ambitious, especially the timeline. As it brings its power paradigm to

the rest of America, especially its frail grid, it will be interesting

to see how voters react in other states as the cost of power leaps

higher and its dependability heads lower. It’s reasonable to speculate

we may be on the verge of witnessing the Californication of the US

energy system.

Lest you think I’m being hyperbolic,

please be aware the IEA (International Energy Agency) has estimated it

will cost the planet $5 trillion per year to achieve Net Zero

emissions. This is compared to global GDP of roughly $85 trillion.

According to BloombergNEF, the price tag over 30 years, could be as high

as $173 trillion. Frankly, based on the history of gigantic cost

overruns on most government-sponsored major infrastructure projects, I’m

inclined to take the over—way over—on these estimates.

Moreover,

energy consulting firm T2 and Associates, has guesstimated electrifying

just the US to the extent necessary to eliminate the direct consumption

of fuel (i.e., gasoline, natural gas, coal, etc.) would cost between $18

trillion and $29 trillion. Again, taking into account how these

ambitious efforts have played out in the past, I suspect $29 trillion is

light. Regardless, even $18 trillion is a stunner, despite the reality

we have all gotten numb to numbers with trillions attached to them.

For perspective, the total, already terrifying, level of US federal debt

is $28 trillion.

Regardless, as noted last week, the

probabilities of the Great Green Energy Transition happening are

extremely high. Relatedly, I believe the likelihood of the Great

Greenflation is right up there with them.

As Gavekal’s

Didier Darcet wrote in mid-August: ““Nowadays, and this is a great

first in history, governments will commit considerable financial

resources they do not have in the extraction of very weakly concentrated

energy.” ( i.e., less efficient) “The bet is very risky, and if it

fails, what next? The modern economy would not withstand expensive

energy, or worse, lack of energy.”

While I agree this an

historical first, it’s definitely not great (with apologies for all the

“greats”). This is particularly not great for keeping inflation

subdued, as well as for attempting to break out of the growth quagmire

the Western world has been in for the last two decades. What we are

seeing in Europe right now is an extremely cautionary case study in just

how disastrous the war on fossil fuels can be (shortly we will see who

or what has been a behind-the-scenes participant in this conflict).

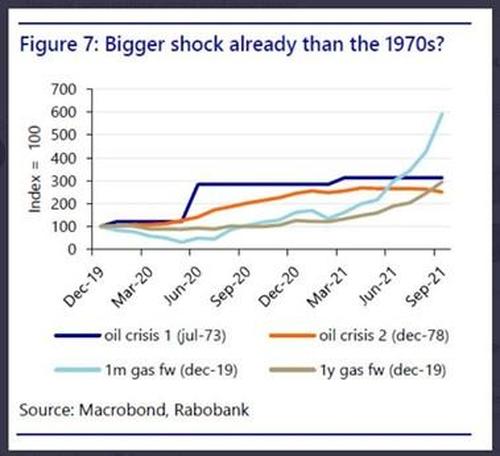

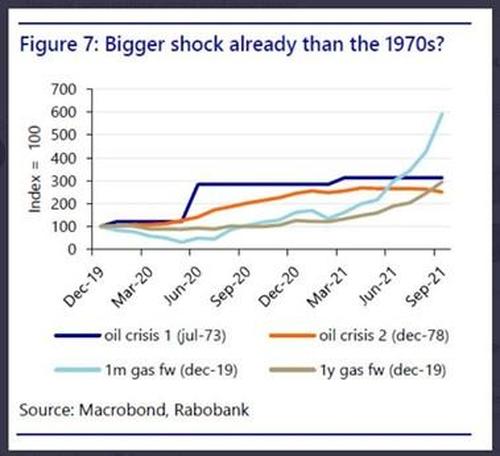

Essentially,

I believe, as I’ve written in past EVAs, we are entering the third

energy crisis of the last 50 years. If I’m right, it will be

characterized by recurring bouts of triple-digit oil prices in the years

to come. Along with Richard Nixon taking the US off the gold standard

in 1971, the high inflation of the 1970s was caused by the first two

energy crises (the 1973 Arab Oil Embargo and the 1979 Iranian

Revolution). If I’m correct about this being the third, it’s coming at a

most inopportune time with the US in hyper-MMT* mode.

Frankly,

I believe many in the corridors of power would like to see oil trade

into the $100s, and natural gas into the teens, as it will help catalyze

the shift to renewable energy. But consumers are likely to have a much

different reaction—potentially, a violently different reaction, as I

noted last week.

The experience of the Yellow Vest

protests in France (referring to the color of the vest protestors wore),

are instructive in this regard. France is a generally left-leaning

country. Despite that, a proposed fuel surtax in November 2018 to fund a

renewable energy transition triggered such widespread civil unrest that

French president Emmanuel Macron rescinded it the following month.

*MMT

stands for Modern Monetary Theory. It holds that a government, like

the US, which issues debt in its own currency can spend without concern

about budgetary constraints. If there are not enough buyers of its

bonds at acceptable interest rates, that nation’s central bank (the Fed,

in our case) simply acquires them with money it creates from its

digital printing press. This is what is happening today in the US.

Many economists consider this highly inflationary.

The sharp

and politically uncomfortable rise in US gas pump prices this summer

caused the Biden administration to plead with OPEC to lift its volume

quotas. The ironic implication of that exhortation was glaringly

obvious, as was the inefficiency and pollution consequences of shipping

oil thousands of miles across the Atlantic. (Oil tankers are a

significant source of emissions.) This is as opposed to utilizing

domestic oil output, as well as crude from Canada (which is actually

generally better suited to the US refining complex). Beyond the

pollution aspect, imported oil obviously worsens America’s massive trade

deficit (which would be far more massive without the six million

barrels per day of domestic oil volumes that the shale revolution has

provided) and costs our nation high-paying jobs.

Further,

one of my other big fears is that the West is engaging in unilateral

energy disarmament. Russia and China are likely the major beneficiaries

of this dangerous scenario. Per my earlier comment about a stealth

combatant in the war on fossil fuels, it may surprise you that a past

NATO Secretary General* has accused Russian intelligence of avidly

supporting the anti-fracking movements in Western Europe. Russian TV

has railed against fracking for years, even comparing it to pedophilia

(certainly, a most bizarre analogy!).

The success of the

anti-fracking movement on the Continent has essentially prevented a

European version of America’s shale miracles (the UK has the potential

to be a major shale gas producer). Consequently, the European Union’s

domestic natural gas production has been in a rapid decline phase for

years.

Banning fracking has, of course, made Europe heavily reliant on Russian gas shipments with more than 40% of its supplies coming from Russia. This

is in graphic contrast to the shale output boom in the US that has not

only made us natural gas self-sufficient but also an export powerhouse

of liquified natural gas (LNG).

In 2011, the Nord Stream system

of pipelines running under the Baltic Sea from northern Russia began

delivering gas west from northern Russia to the German coastal city of

Greifswald. For years, the Russians sought to build a parallel system

with the inventive name of Nord Stream 2. The US government opposed its

approval on security grounds but the Biden administration has dropped

its opposition. It now appears Nord Stream 2 will happen, leaving

Europe even more exposed to Russian coercion.

Is it

possible the Russian government and the Chinese Communist Party have

been secretly and aggressively supporting the anti-fossil fuel movements

in America? In my mind, it seems not only possible but probable. In

fact, I believe it is naïve not to come that conclusion. After all,

wouldn’t it be in both of their geopolitical interests to see the US

once again caught in a cycle of debilitating inflation, ensnared by the

twin traps of MMT and the third energy crisis?

*Per

former NATO Secretary General, Anders Fogh Rasumssen: Russia has

“engaged actively with so-called non-governmental

organizations—environmental organizations working against shale gas—to

maintain Europe’s dependence on imported Russian gas”.

Along

these lines, I was shocked to listen to a recent podcast by the New

Yorker magazine on the topic of “intelligent sabotage”. This segment

was an interview between the magazine’s David Remnick and a Swedish

professor, Adreas Malm. Mr. Malm is the author of a new book with the

literally explosive title “How To Blow Up A Pipeline”. Just as it

sounds, he advocates detonating pipelines to inhibit fossil fuel

distribution.

Mr. Remnick was clearly sympathetic to his

guest but he did ask him about the impact on the poor of driving energy

prices up drastically which would be the obvious ramification if his

sabotage recommendations were widely followed. Mr. Malm’s reaction was a

verbal shrug of the shoulders and words to the effect that this was the

price to pay to save the planet.

Frankly, I am appalled that the venerable New Yorker would

provide a platform for such a radical and unlawful suggestion. In an

era when people are de-platformed for often innocuous comments, it’s

incredible to me this was posted and has not been pulled down. In my

mind, this reflects just how tolerant the media is of attacks on the

fossil fuel industry, regardless of the deleterious impact on consumers

and the global economy.

Surely, there is a far better way

of coping with the harmful aspects of fossil fuel-based energy than this

scorched earth (literally, in the case of Mr. Malm) approach, which

includes efforts to block new pipelines, shut existing ones, and

severely restrict US energy production. In America’s case, the result

will be forcing us to unnecessarily and increasingly rely on overseas

imports. (For example, per the Wall Street Journal, drilling

permits on federal land have crashed to 171 in August from 671 in

April. Further, the contentious $3.5 trillion “infrastructure” plan

would raise royalties and fees high enough on US energy producers that

it would render them globally uncompetitive.)

Such

actions would only aggravate what is already a severe energy shock, one

that may be worse than the 1970s twin energy crises. America has it

easy compared to Europe, though, given current US policy trends, we

might be in their same heavily listing energy boat soon.

Solutions

include fast-tracking small modular nuclear plants; encouraging the

further switch from burning coal to natural gas (a trend that is,

unfortunately, going the other way now, as noted above); utilizing and

enhancing carbon and methane capture at the point of emission (including

improving tail pipe effluent-reduction technology); enhancing pipeline

integrity to inhibit methane leaks; among many other mitigation

techniques that recognize the reality the global economy will be reliant

on fossil fuels for many years, if not decades, to come.

If

the climate change movement fails to recognize the essential nature of

fossil fuels, it will almost certainly trigger a backlash that will

undermine the positive change it is trying to bring about. This is

similar to what it did via its relentless assault on nuclear power which

produced a frenzy of coal plant construction in the 1980s and 1990s.

On this point, it’s interesting to see how quickly Europe is

re-embracing coal power to alleviate the energy poverty and rationing

occurring over there right now - even before winter sets in. When the

choice is between supporting climate change initiatives on one hand and

being able to heat your home and provide for your family on the other,

is there really any doubt about which option the majority of voters will

select?