Authored by vittorio on X,

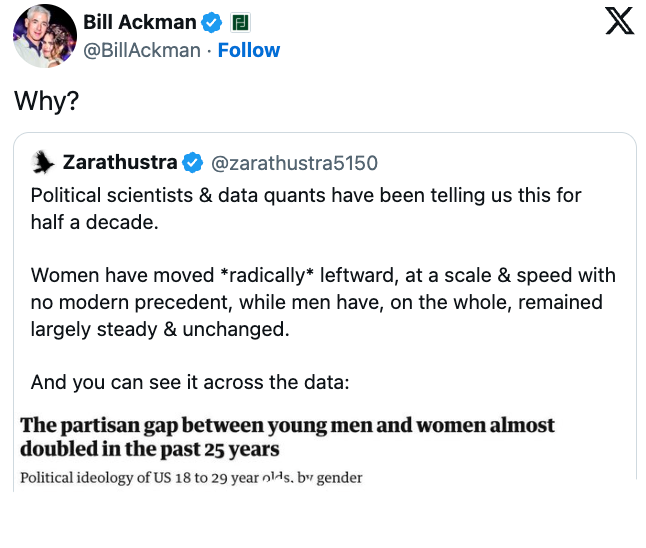

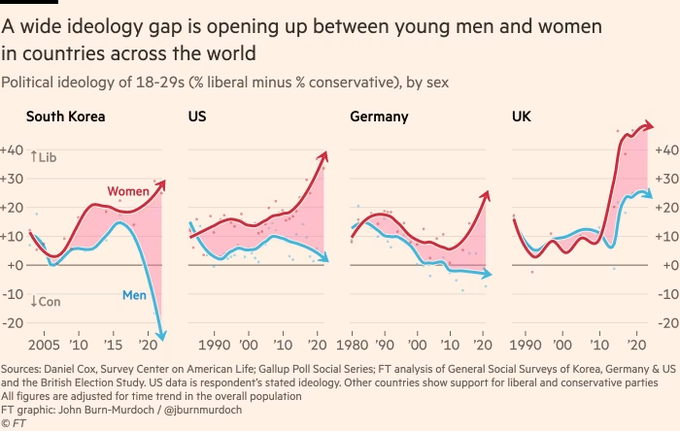

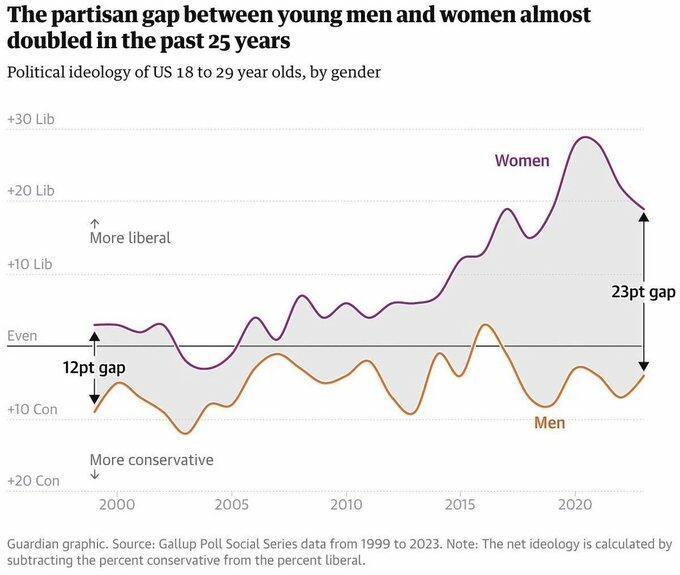

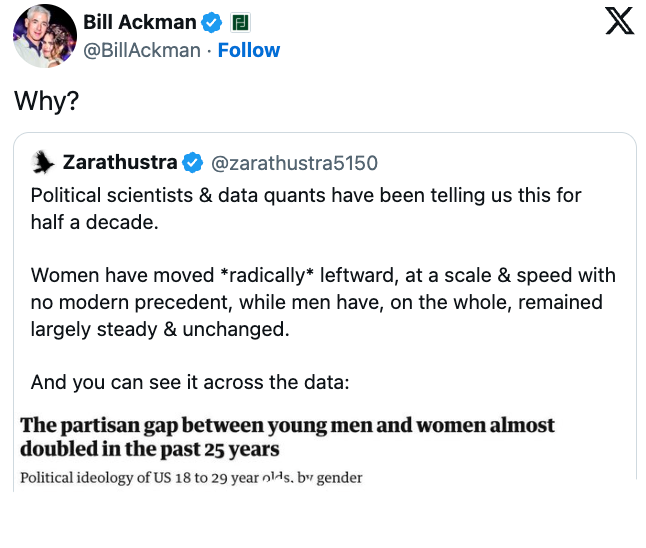

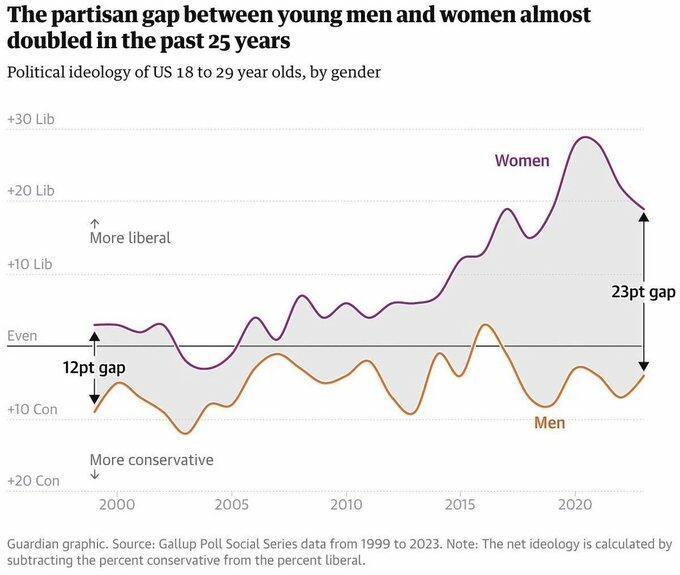

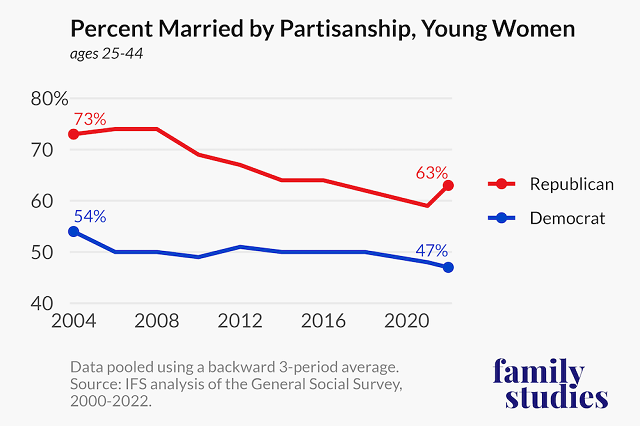

Bill Ackman quote-tweeted a graph showing the partisan gap between young men and women almost doubled in 25 years.

Women moved radically left. Men stayed roughly where they were.

Good question. Most answers I've seen are either tribal ("women are emotional") or surface-level ("social media bad"). Neither traces the actual mechanism.

Let me try.

First, notice what Wanye pointed out:

We've

been told for a decade that men are "radicalizing to the right" and

that this is dangerous. The actual data shows the opposite. Men barely

moved. Women moved 20+ points leftward.

The

story we are told is exactly inverted from reality. And when female

leftward movement does get discussed, it's framed as progress: "women

becoming more educated, more independent, more enlightened."

They'll tell you the graph shows enlightenment and progress.

Wrong.

What the graph shows is capture.

This Isn't Just America

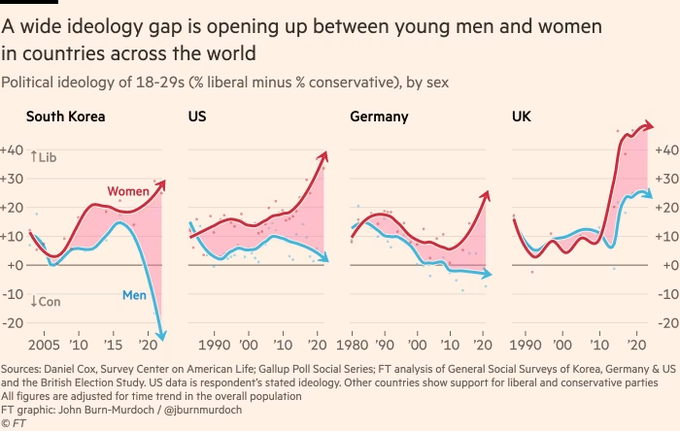

Before getting into the mechanism, something important: this pattern isn't only American. It's global.

The

Financial Times documented last year that the gender ideology gap is

widening across dozens of countries simultaneously. UK, Germany,

Australia, Canada, South Korea, Poland, Brazil, Tunisia. Young women

moving left on social issues, young men either stable or drifting right.

This

matters because it rules out explanations specific to American

politics. It's not Title IX policy. It's not #MeToo. It's not the

specific culture war of US campuses. Something bigger is happening,

something that rolled out globally at roughly the same time.

South

Korea is the extreme case. Young Korean men are now overwhelmingly

conservative. Young Korean women are overwhelmingly progressive. The gap

there is even wider than the US. Contributing factors include mandatory

military service for men (18 months of your life the state takes, while

women are exempt) and brutal economic competition. But the timing of

divergence still tracks with smartphone adoption.

Whatever is causing this, it's not American. The machine is global.

The Substrate

Start with the biological hardware.

Women evolved in environments where social exclusion carried enormous survival costs.

You can't hunt pregnant. You can't fight nursing. Survival required the

tribe's acceptance: their protection, their food sharing, their

tolerance of your temporary vulnerability. Millions of years of this and

you get hardware that treats social rejection as a serious threat.

Men faced different pressures.

Hunting parties gone for days. Exploration. Combat. You had to tolerate

being alone, disliked, outside the group for extended periods. Men who

could handle temporary exclusion without falling apart had more options.

More risk-taking, more independence, more ability to leave bad

situations.

(Male status still mattered enormously for

reproduction, low-status men had it rough. But men could recover from

temporary exclusion in ways that were harder for pregnant or nursing

women.)

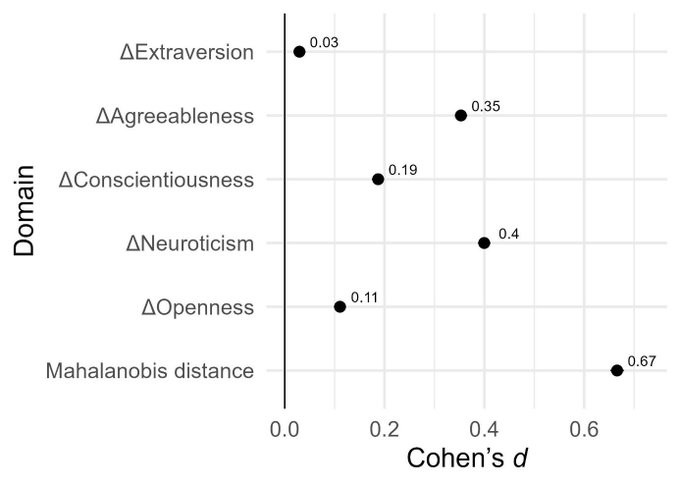

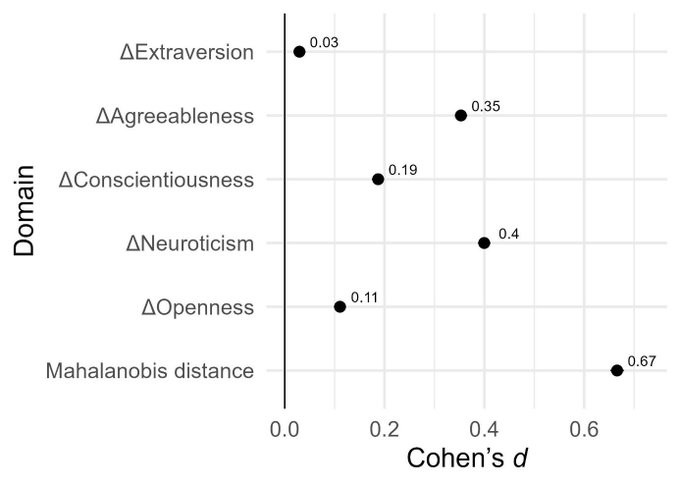

This shows up in personality research. David

Schmitt's work across 55 cultures found the same pattern everywhere:

women average higher agreeableness, higher neuroticism (sensitivity to

negative stimuli, including social rejection cues). Men average higher

tolerance for disagreement and social conflict. The differences aren't

huge, but they're consistent across every culture studied.

Not better or worse. Different selection pressures, different adaptations.

But it means the same environment affects them differently. Consensus pressure hits harder for one group than the other.

The Machine

Now look at what we built.

Social media is a consensus engine. You can see what everyone believes in real time. Disagreement is visible, measurable, and punishable at scale. The tribe used to be 150 people. Now it's everyone you've ever met, plus a world of strangers watching.

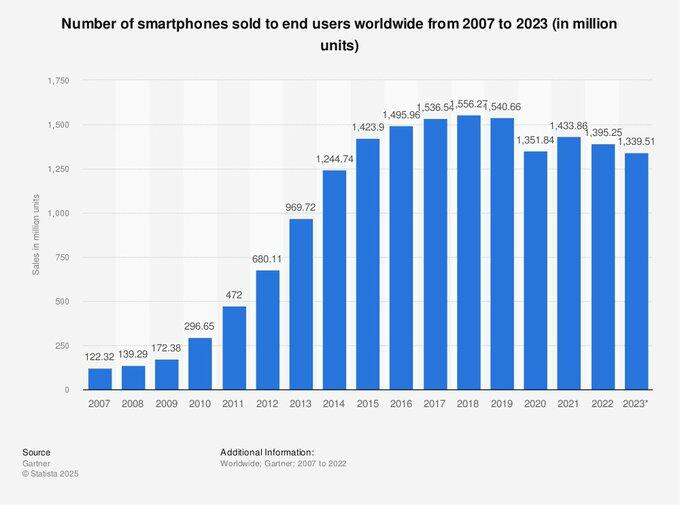

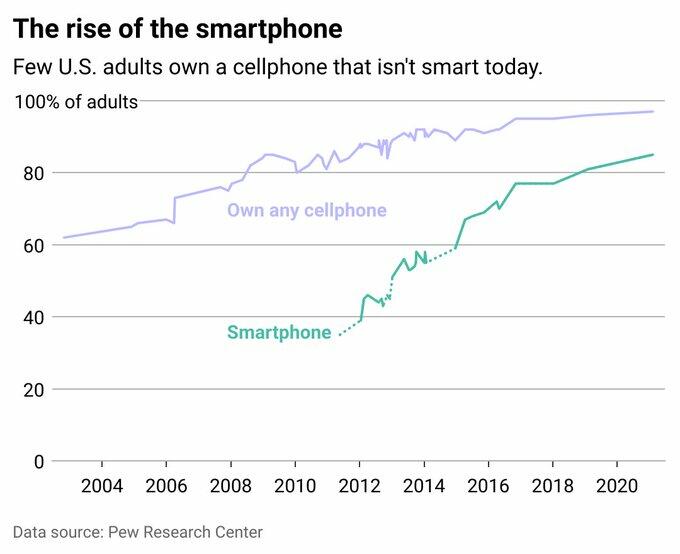

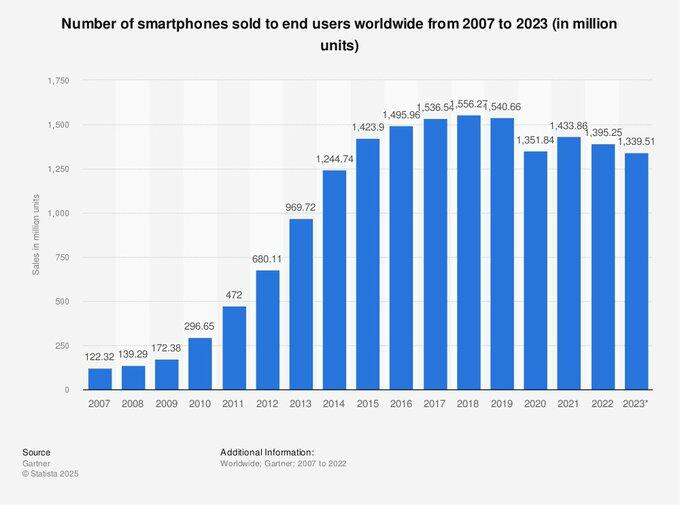

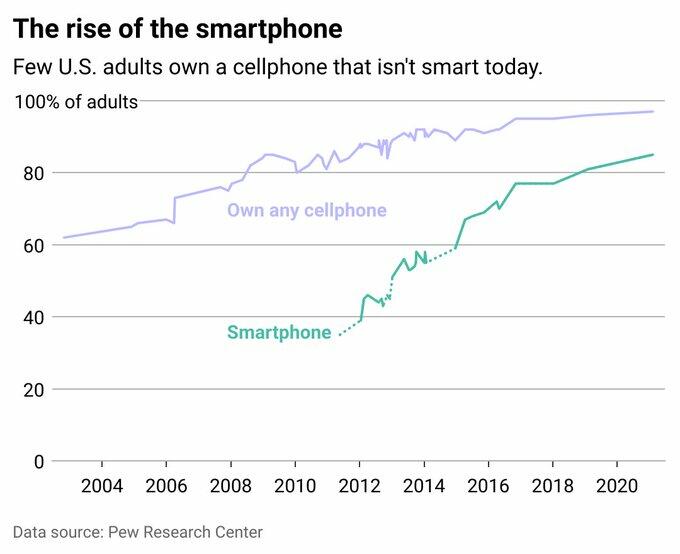

And

look at the timeline. Facebook launched in 2004 but was college-only

until 2006. The iPhone was launched in June 2007. Instagram in 2010.

Suddenly, social media was in your pocket and in your face, all day,

every day.

Look at the graph again. Women were roughly stable through the early 2000s. The acceleration starts around 2007-2008.

The curve steepens through the 2010s as smartphones became universal and platforms became more sophisticated.

Women are by nature more liberal, but the radicalization coincides with the rise in smartphone adoption.

The machine turned on and the capture began.

The

mental health collapse among teenage girls tracks almost perfectly with

smartphone adoption, with stronger effects for girls than boys. The

same vulnerability that made social exclusion more costly in ancestral

environments made the new consensus engines more capturing.

This

machine wasn't designed to capture women specifically. It was designed

to capture attention. But it captures people more susceptible to

consensus pressure more effectively. Women are more susceptible on

average. So it captured them more.

Add a feedback loop:

women complain more than men. Scroll any platform and it looks like

women are suffering more. Institutions respond to this because visible

distress creates liability, PR risk and regulatory pressure. In

addition, women are weaker and inevitably seen as the victim in most

scenarios. The institutional response is to make environments "safer".

Which means removing conflict. Which means censoring disagreement. Which

means the consensus strengthens.

The counterarguments get removed or deplatformed and the loop closes.

The Institutions

Universities flipped to 60% female while simultaneously becoming progressive monoculture.

The institution young women trust most, during the years their

worldview forms, feeds them a single ideology with no serious

opposition.

FIRE's campus speech surveys show the pattern clearly:

students self-censor, report fear of expressing views, cluster toward

acceptable opinions. This isn't unique to women, but women are more

embedded in higher education than men now, and the fields they dominate

(humanities, social sciences, education, HR) are the most ideologically

uniform.

Four years surrounded by peers who all believe

the same thing. Professors who all believe the same thing. Reading lists

pointing one direction. Disagreement is not even rare, it's socially

punished. You learn to pattern-match the acceptable opinions and perform

them.

Then they graduate into female-dominated fields:

HR, media, education, healthcare, non-profits, where the monoculture

continues. From 18 to 35, many women never encounter sustained

disagreement from people they respect. The feedback loop never breaks.

Men

took different paths. Trades. Engineering. Finance. Military. Fields

where results matter more than consensus. Fields where disagreement is

tolerated or even rewarded. The monoculture didn't capture them because

they weren't in the institutions being captured. (mostly because they

were kicked out of them, but that's a different piece)

The Economics

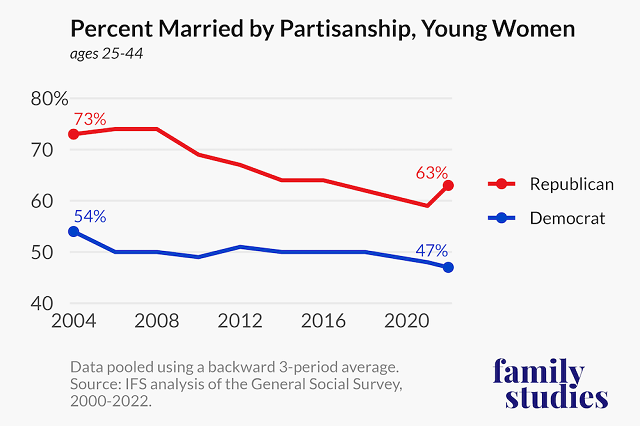

Marriage collapsed. This probably matters more than people think.

Single

women vote more left than married women. This is consistent across

decades of exit polls. Part of this is likely economic: single

women interact with government more as provider of services, married

women interact with government more as taker of taxes. The incentives point different directions.

The

marriage gap in voting is one of the most consistent predictors. And

marriage rates have collapsed precisely during the period of divergence.

Men

saw marriage collapse differently. Family courts. Child support.

Alimony. The rational response was skepticism of expanding state power.

Same phenomenon, different positions in it, different political responses.

The Algorithms

Algorithms optimize for engagement. Engagement means emotional response. Time on platform. Clicks. Shares. Comments.

Women

respond more strongly to emotional content on average, they are more

empathetic, they can be more easily manipulated with sad stories. That

higher neuroticism again, higher sensitivity to negative stimuli. The

machine learned this. It fed them content calibrated to their response

patterns. Fear. Outrage. Moral panic. Stories about danger and injustice

and threat and wars and "victims".

Men got different feeds because they responded to different triggers.

The algorithm doesn't really have a gender agenda. It has an engagement

agenda. But engagement looks different by demographic, so the feeds

diverged.

Women ended up in information environments optimized for

emotional activation. Men found alternatives: podcasts, forums, cars,

wars, manosphere etc.

The Ideology

Feminism told women

their instincts and biology were oppression and wrong. Wanting children

was brainwashing. Wanting a provider husband was internalized misogyny.

Their natural desires were false consciousness installed by patriarchy.

Many believed it. Built lives around it. Career first. Independence. Freedom from traditional constraints.

Now

they're 35, unmarried, measuring declining fertility against career

achievements. And here's the trap: the sunk cost of admitting the

ideology failed is enormous. You'd have to admit you wasted your fertile

years on a lie. That the women who ignored the ideology and married

young were right. That your mother was right.

I think this

is why you see so little defection. Not because the ideology is true,

but because the psychological cost of leaving is higher than the cost of

staying. Easier to double down. Easier to believe the problem is that society hasn't changed enough yet.

The Other Capture

I should be honest about something: men weren't immune to capture. They were captured differently.

Women

got ideological conformity. Men got withdrawal. Porn. Video games.

Gambling apps. Outrage content. The male capture wasn't "believe this or

face social death." It was "here's an endless supply of dopamine so you

never have to build anything real."

Different machines, different failure modes. Women got compliance. Men got passivity.

The

male line on that graph staying flat through 2020 isn't necessarily

health. It might just be a different kind of sickness, men checking out

instead of being pulled in. Or it may be that everyone and everything

moved more left and women moved lefter.

The Line Is Moving Now

Here's the update: the male line isn't flat anymore.

Post-2024 data shows young men shifting right. Recent surveys all show the same thing. Young men are now actively moving more conservatively.

My

read: women got captured first because they were more susceptible to

consensus pressure. The capture was fast (2007-2020). Men resisted

longer because they were less susceptible and less embedded in captured

institutions. But as the gap became visible and culturally salient, as

"men are the problem" became explicit mainstream messaging, as men

started being excluded from society because of lies, as masculinity, or

the very thing that makes men men became toxic, men had to start

counter-aligning.

The passivity is converting into opposition. The withdrawal is becoming active rejection.

This

doesn't mean men are now "correct" or "free". It might just mean

they're being captured by a different machine, one optimized for male

grievance instead of female consensus. Andrew Tate didn't emerge from

nowhere. Neither did the manosphere. Those are capture systems too, just

targeting different psychological vulnerabilities.

The graph is

now two lines diverging in opposite directions. Two different machines

pulling two different demographics toward two different failure modes.

Some

people will say this is just education: women go to college more,

college makes you liberal, simple as that. There's something to this.

But it doesn't explain why the gap widened so sharply post-2007, or why

it's happening in countries with very different education systems.

Some

will say it's economic: young men are struggling, resentment makes you

conservative. Also partially true. But male economic struggles predate

the recent rightward shift, and the female leftward move happened during

a period of rising female economic success.

Some will

point to cultural figures: Tate for men, Taylor Swift for women. But

these are symptoms, not causes. They filled niches the machines created.

They didn't create the machines.

The multi-causal model

fits better: biological substrate (differential sensitivity to

consensus) + technological trigger (smartphones, algorithmic feeds) +

institutional amplification (captured universities, female-dominated

fields) + economic incentives (marriage collapse, state dependency) +

ideological lock-in (sunk costs, social punishment for defection).

No single cause. A system of interlocking causes that happened to affect one gender faster and harder than the other.

So What

If this model is right, some predictions follow.

The

gap should be smaller in countries with later smartphone adoption or

lower social media penetration. (This seems true: the divergence is less

extreme in parts of Eastern Europe and much of Africa, though South

Korea is a major exception due to other factors.)

The gap should

narrow among women who have children, since parenthood breaks the

institutional feedback loop and introduces competing priorities. (Exit

polls consistently show this: mothers vote more conservative than

childless women.)

The gap should continue widening until the machines are disrupted or the generations age out of them.

Here's

the part I don't know how to solve: these systems are self-reinforcing.

The institutions aren't going to reform themselves. The algorithms

aren't going to stop optimizing. The ideology isn't going to admit

failure. The male counter-capture isn't going to produce healthy

outcomes either.

Some women will escape.

The

ones who have children often do since reality is a powerful solvent for

ideology. The ones who build lives outside institutional capture

sometimes do.

Some men will stop withdrawing or stop rage-scrolling.

The ones who find something worth building. The ones who get tired of the simulation.

But the systems will keep running on everyone else.

The Question

Bill asked why.

The

answer isn't "women are emotional" and it isn't "social media bad." The

answer is that we built global-scale consensus engines and deployed

them on a species with sexually dimorphic psychology. The

machines captured the half more susceptible to consensus pressure. Then

they started capturing the other half through different mechanisms.

We're watching the results in real time. Two failure modes. One graph. Both lines are moving away from each other and away from anything healthy.

I don't know how this ends. I don't think anyone does. I don't think it will.

Both machines are still running.