While the world is on the brink of Armageddon, the BRICS move on step by step.

Be certain that at some stage, the project will be interfered with by the G7. This is unavoidable.

In the meantime here's a very complete assessment of the BRICS' project and where they are going.

Authored by Peter Hanseler via VoiceOfRussia.com,

The

Western media are prioritizing the Ukraine conflict, the green

revolution and the woke revolution. In the shadow of this media

coverage, BRICS is changing the world.

We bring you the latest figures and place them in the current geopolitical environment. – An analysis.

Introduction

One

of the main topics of this blog is BRICS. We have written numerous

articles, followed and analyzed the development of this organization.

Significantly, the first independent post on this blog was dedicated to

BRICS on November 18, 2022 “The unstoppable rise of the East“.

Our last dedicated BRICS-only article from 24 September 2023 “BRICS will change the world – slowly”

gave an overview of the development and summarized the results of the

BRICS summit in South Africa in August 2023. This article was published

by ZeroHedge, the GloomBoomDoom report by Dr. Marc Faber and Weltwoche

(print and online).

From the density of our coverage, it is clear

that we ascribe paramount importance to BRICS for the geopolitical and

geo-economic development of the world. Based on the facts, we have come

to the conclusion that BRICS will change the world more than all other

developments of the last 100 years put together. The developments around

BRICS have already triggered a tectonic shift in the geopolitical

balance of power; the Ukraine conflict and the accelerating crisis in

the Middle East are merely pieces of the mosaic by comparison.

The

Western media are setting their priorities differently and focusing on

topics that we believe are of lesser importance: Mortal enemy Russia,

wokeness and green ideology.

Reporting on BRICS in the West, if it

takes place at all, is limited to portraying BRICS either as an

instrument of China to achieve world power – as the Financial Times put

it,

«How the BRICS nations risk becoming satellites of China»

FINANCIAL TIMES – 26 JULY 2023

or to trivialize the success of BRICS – according to the NZZ,

“We explain in the video why this extension only promises limited success.”

NZZ, 14 DECEMBER 2023

Preliminary remarks on the figures

We proceed as we always do and develop a fact-based foundation for a discussion.

Membership doubled as of January 1

Since

January 1, Saudi Arabia, Iran, the United Arab Emirates, Egypt and

Ethiopia have joined the existing members (Brazil, Russia, India, China

and South Africa) as new members.

Argentina not participating

In

August 2023, Argentina was invited to become the sixth member. However,

the new president of Argentina, Javier Milei, decided not to accept

this invitation and to rely on the USA and Donald Trump to rescue his

economy.

It is impossible to judge at this point whether this

decision will prove to be the right one. For the second largest country

in South America, which was once one of the richest countries in the

world, it is to be hoped that Milei can pull the cart out of the deep

mire. Milei is fighting against the establishment in Argentina, which

has driven the country economically to the wall. These former rulers are

serious opponents who are fighting for sinecures that Milei must wrest

from them if he wants to save Argentina. We hope that Javier Milei can

prevail and wish him every success and good luck. The first signs of

success appear to be emerging: The country was able to report a positive

budget for the first time last month. It seems to be heading in the

right direction.

Saudi Arabia

According to Western media

reports, Saudi Arabia is not yet fully on board. South African Foreign

Minister Naledi Pandor is reported to have told Reuters that “Saudi

Arabia has not yet responded to the invitation to join BRICS. It is

still being considered”.

Saudi Arabia, or rather the ruling Saud

family, has been an ally of the USA since the end of the Second World

War, and this relationship has been further strengthened since the

agreement of the ” Petrodollar” in 1974.

Since

President Biden has been in power, the relationship with the USA has

suffered massively, while at the same time cooperation with China and

Russia has strengthened to an unprecedented level.

The problem

that Saudi Arabia now has is the gigantic investments that the state and

private individuals have made, particularly in the USA and the UK.

Government investments in the USA alone amount to over USD 35 billion and investments in the UK are said to be around USD 75 billion.

Due to the geopolitical situation in the world and the West’s

aggressive sanctions policy, the concerns of Saudi Arabia that these

investments could be confiscated in the event of a BRICS accession are

definitely justified. As Saudi Arabia is important to BRICS and China

has overtaken the US as Saudi Arabia’s largest trading partner, we

expect Saudi Arabia to join BRICS as soon as China might make

commitments to the Saudis in the event of Western expropriation.

BRICS-10 in numbers

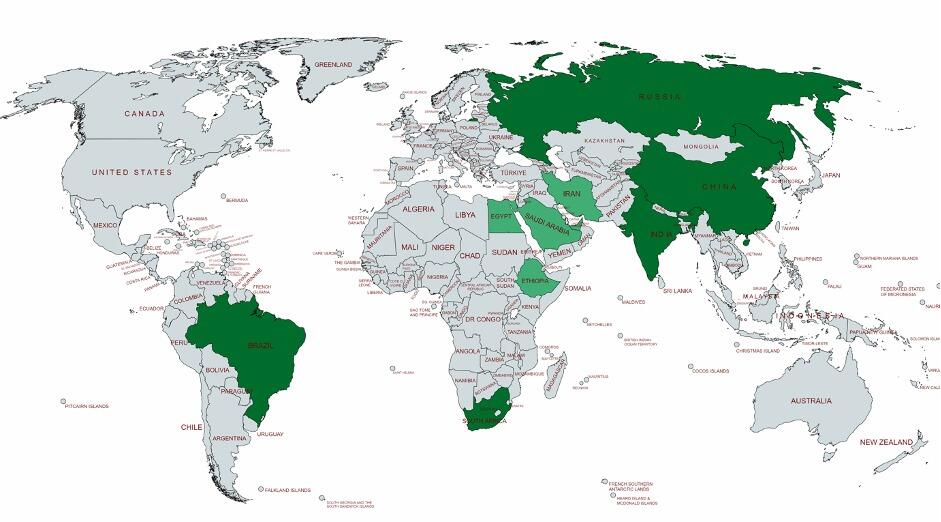

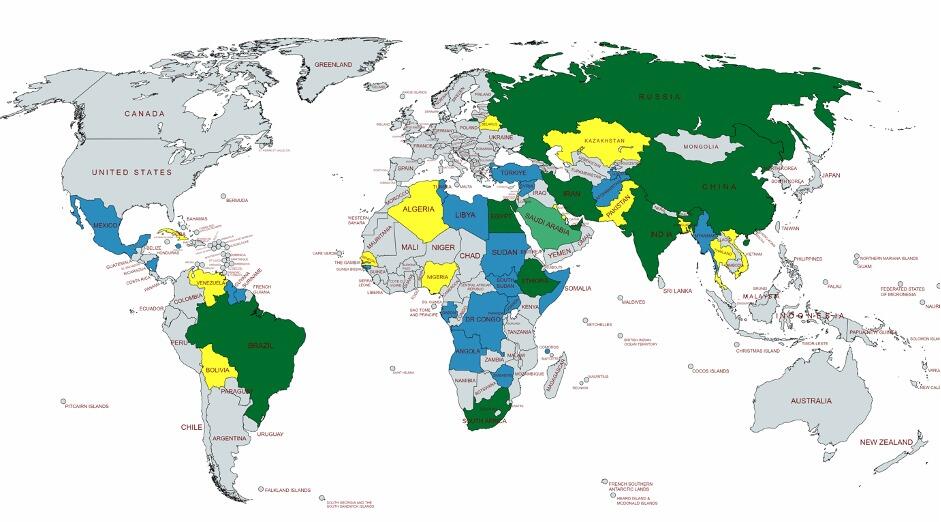

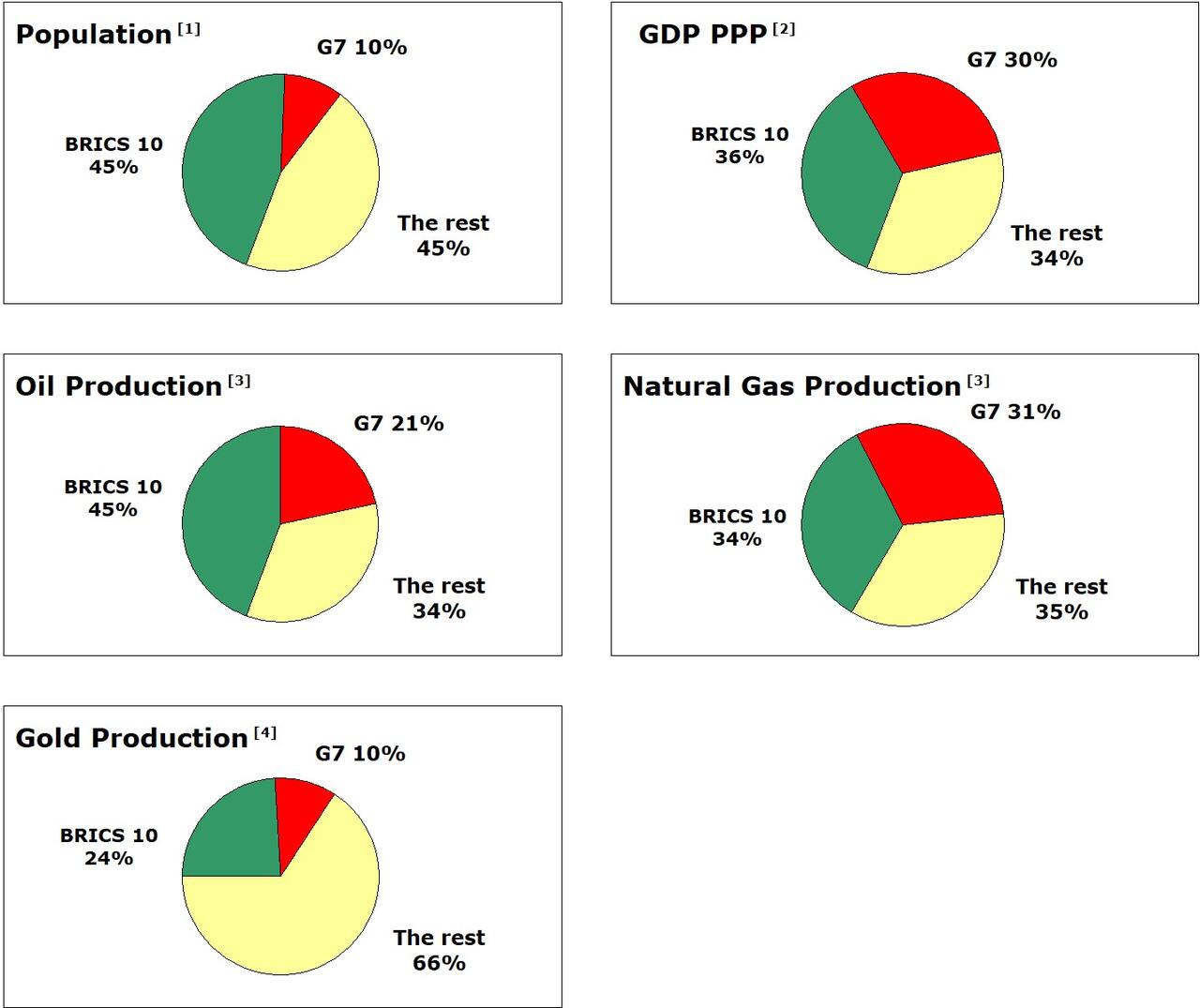

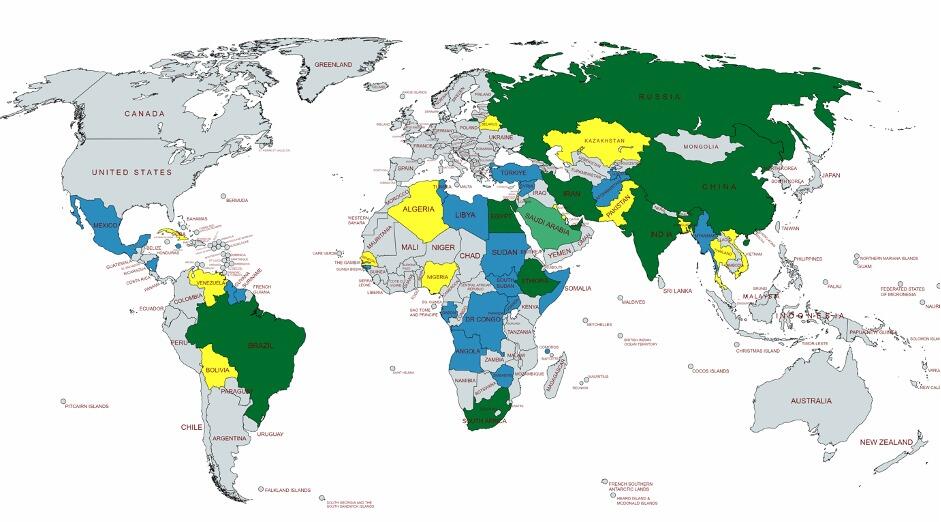

Map

Dark green BRICS until August 2023 – light green – the new BRICS members – Source: VoicefromRussia

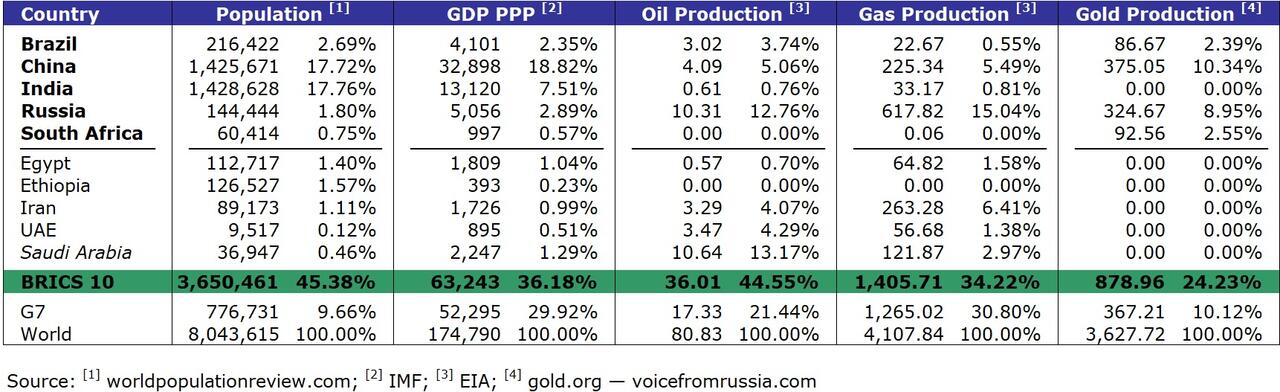

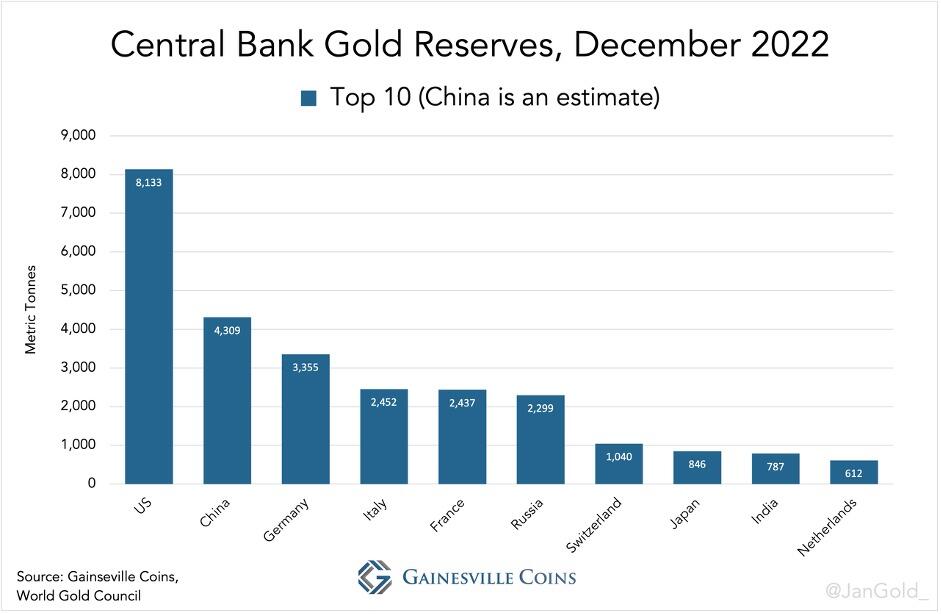

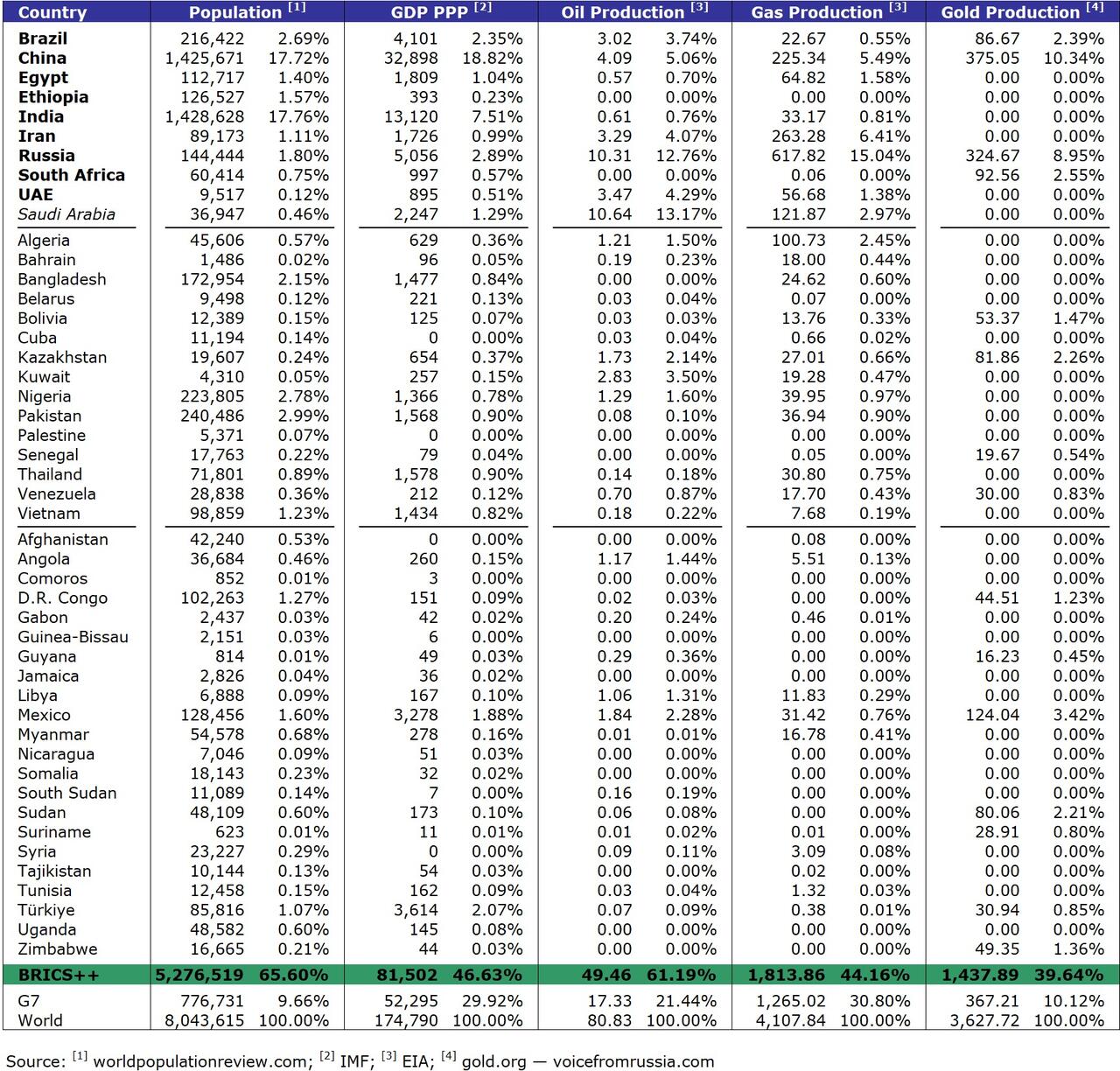

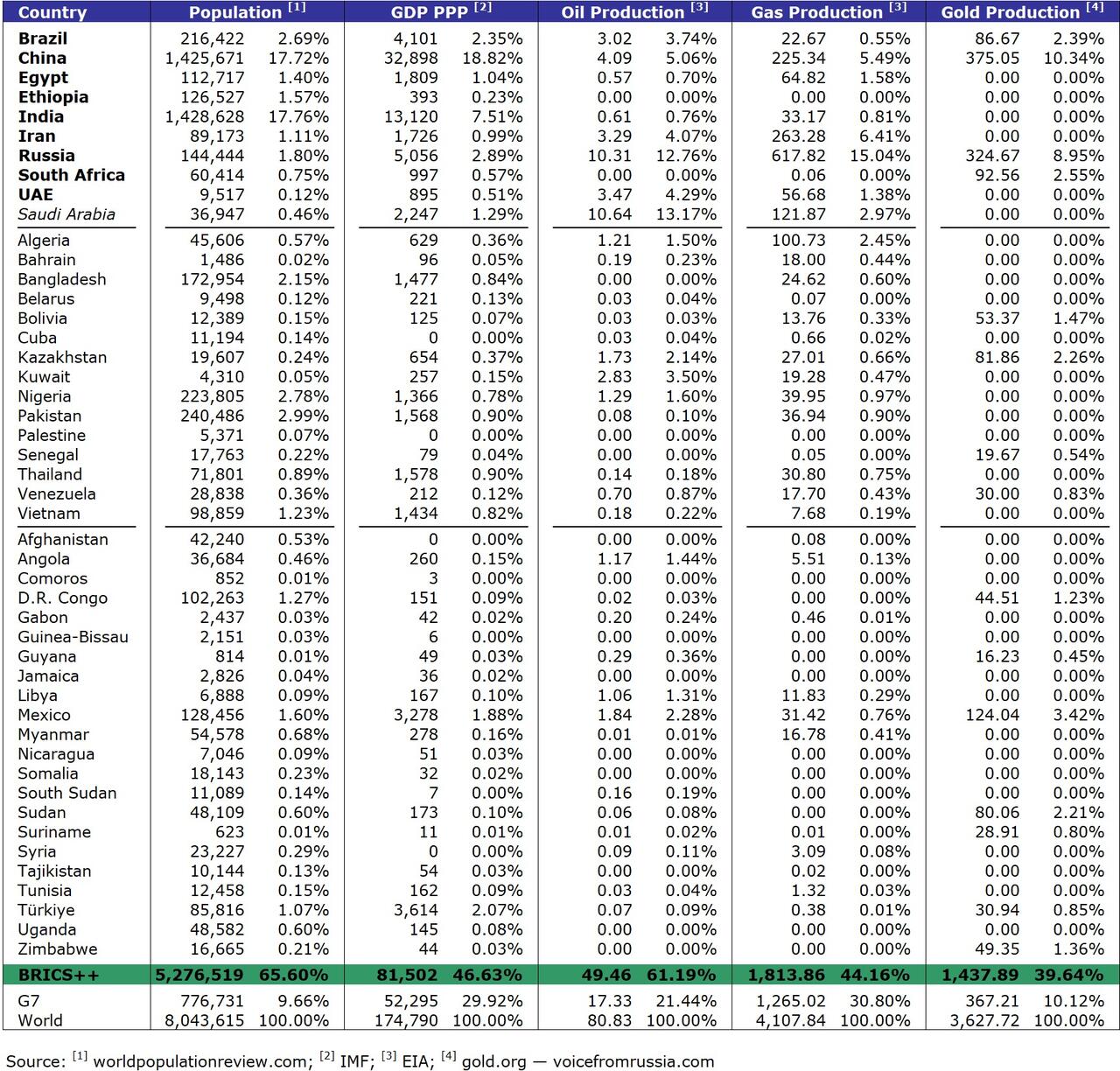

Numbers

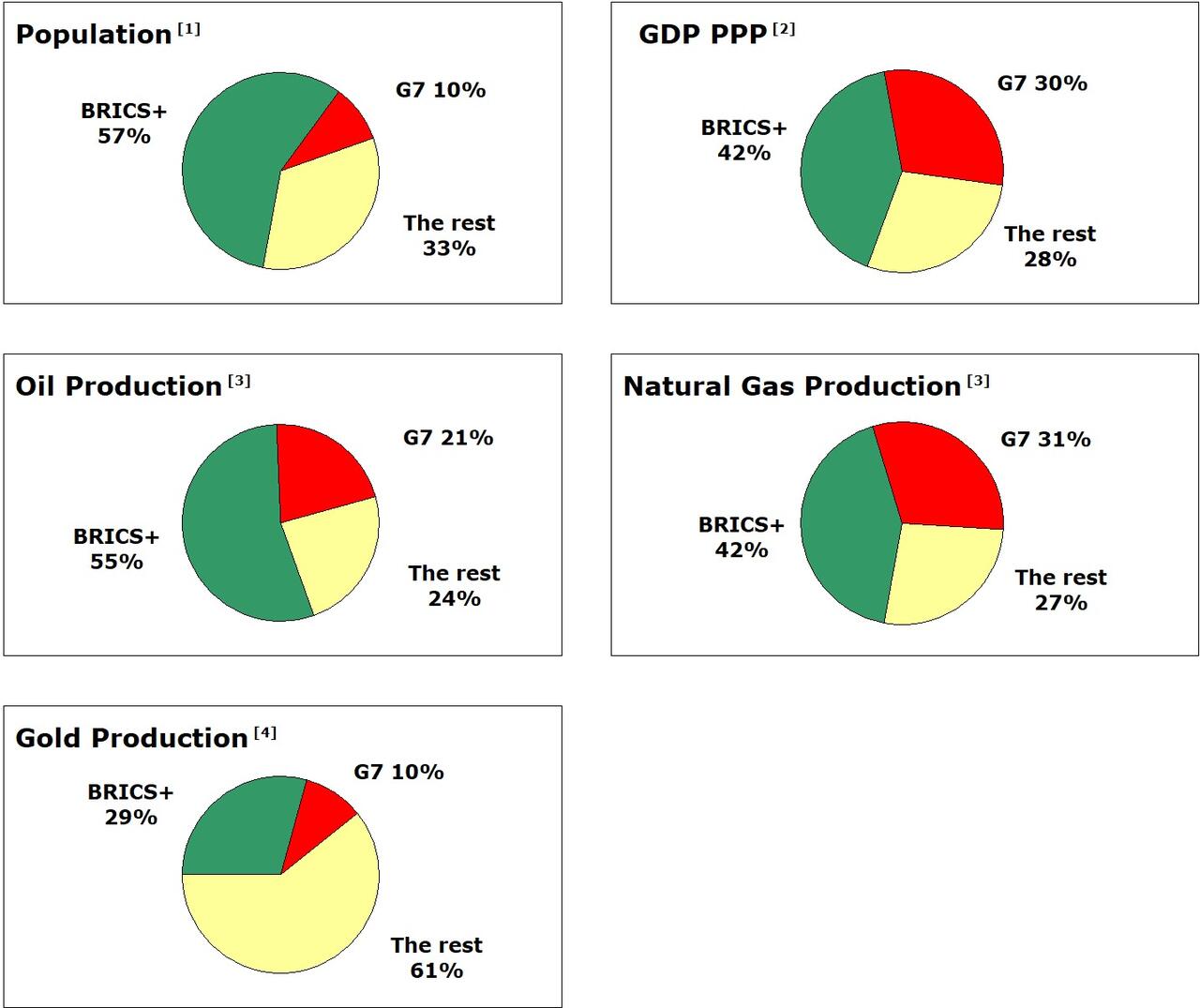

In

our figures, we compare the BRICS-10 with the G7 and the world as a

whole to give you a feel for the ratios. The parameters we use are

population, GDP (adjusted for purchasing power), oil production, gas

production and gold production.

We

show the gross national product adjusted for purchasing power. If you

use the US dollar as a measure of GDP, the economic power of a country

is distorted: if you want to measure financial strength realistically,

it makes a big difference whether, for example, a Big Mac in US dollars

costs twice as much in one place as elsewhere. The so-called Big Mac Index is

reason enough to use purchasing power-adjusted figures when comparing

GDP figures. The reason why Western media use the unadjusted figures is

pure marketing to disguise the devaluation of the US dollar and make it

appear stronger than it is.

Charts

Graphical representation of the figures – Source: VoicefromRussia.

Interim result

All

factors show that the BRICS 10 far outstrip the G7 and it seems

incomprehensible that the West is simply suppressing this fact. A look

beneath the surface reveals facts that reinforce the impression of the

bare figures.

Assessment of these figures

Oil production

The following additional facts should be taken into consideration when evaluating the oil production figures:

Firstly,

although the USA is still the largest oil producer in the world,

accounting for around 18% of global production, it also consumes the

most oil, with a share of over 20%. This means that the USA is currently

not even able to cover its own consumption. This fact alone is a

compelling reason for the US to pressure Saudi Arabia not to join BRICS.

Secondly,

the major oil-producing members of BRICS have a great deal of influence

or even control over OPEC. As BRICS thus also controls OPEC and

therefore controls the price and distribution of a large proportion of

oil, BRICS can be said to have an (indirect) monopoly position.

Thirdly, the production costs for US oil are around 2.5 times higher than the production costs for Saudi oil.

These factors therefore further strengthen the BRICS’ position of power with regard to oil.

Natural gas

With

regard to natural gas, it should be noted that with Iran’s accession to

BRICS, the two largest natural gas producers in the world are joint

members of BRICS: Russia and Iran.

The largest non-BRICS gas

producer is Qatar, which is (still) allied with the USA. BRICS is

therefore also a real center of power when it comes to natural gas.

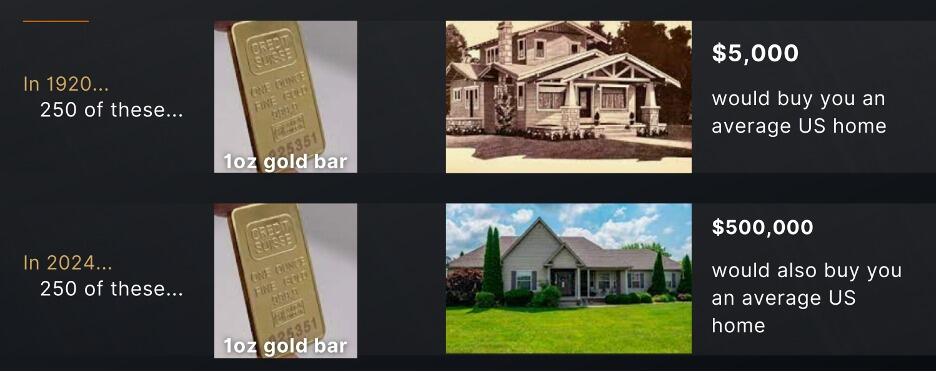

Gold

With

regard to gold, it should be briefly mentioned that China and Russia

are number 1 and 2 in global gold production respectively. I mention

gold here because there is a good chance that gold will again play an

important role in future monetary systems at some point – more on this

below.

Russia holds the BRICS chairmanship in 2024

Over

220 BRICS conferences will be held in Russia over the course of 2024.

The topics are diverse: science, high technology, healthcare,

environmental protection, culture, sport, youth exchange and civil

society.

President Putin’s statements at the beginning of the year

at the opening event of BRICS 2024 in Moscow were interesting. He

mentioned several times the closer cooperation between the members on

security issues. It seems that BRICS will therefore not only focus on

economic aspects, but also on security-related aspects more and more.

The apparent coordination of the BRICS states in connection with the

Middle East conflict at the UN in New York clearly indicates close

cooperation on non-economic issues.

Various non-official sources

have reported that the SCO (Shanghai Cooperation Organization) is moving

closer to BRICS and may even merge with it. In addition to China,

India, Kazakhstan, Kyrgyzstan, Pakistan, Russia, Tajikistan and

Uzbekistan, Iran has also been a member of the SCO since July 2023.

This

is extremely important due to the heightened geopolitical tensions and

the two major conflicts in Ukraine and the Middle East. If these two

organizations were to merge, there would be a new counterweight to NATO.

NATO is already increasingly being characterized by experts as a mere

chattering club, particularly due to its performance in the Ukraine

conflict, which was not a success. As a result, NATO has almost lost its

threatening potential. If the BRICS-SCO merger becomes a reality, NATO

would finally degenerate into an empty shell.

Formal applications for admission – BRICS+

Candidates

Algeria,

Bahrain, Bangladesh, Bolivia, Kazakhstan, Cuba, Kuwait, Nigeria,

Pakistan, Palestine, Senegal, Thailand, Venezuela, Vietnam and Belarus

have formally applied for membership.

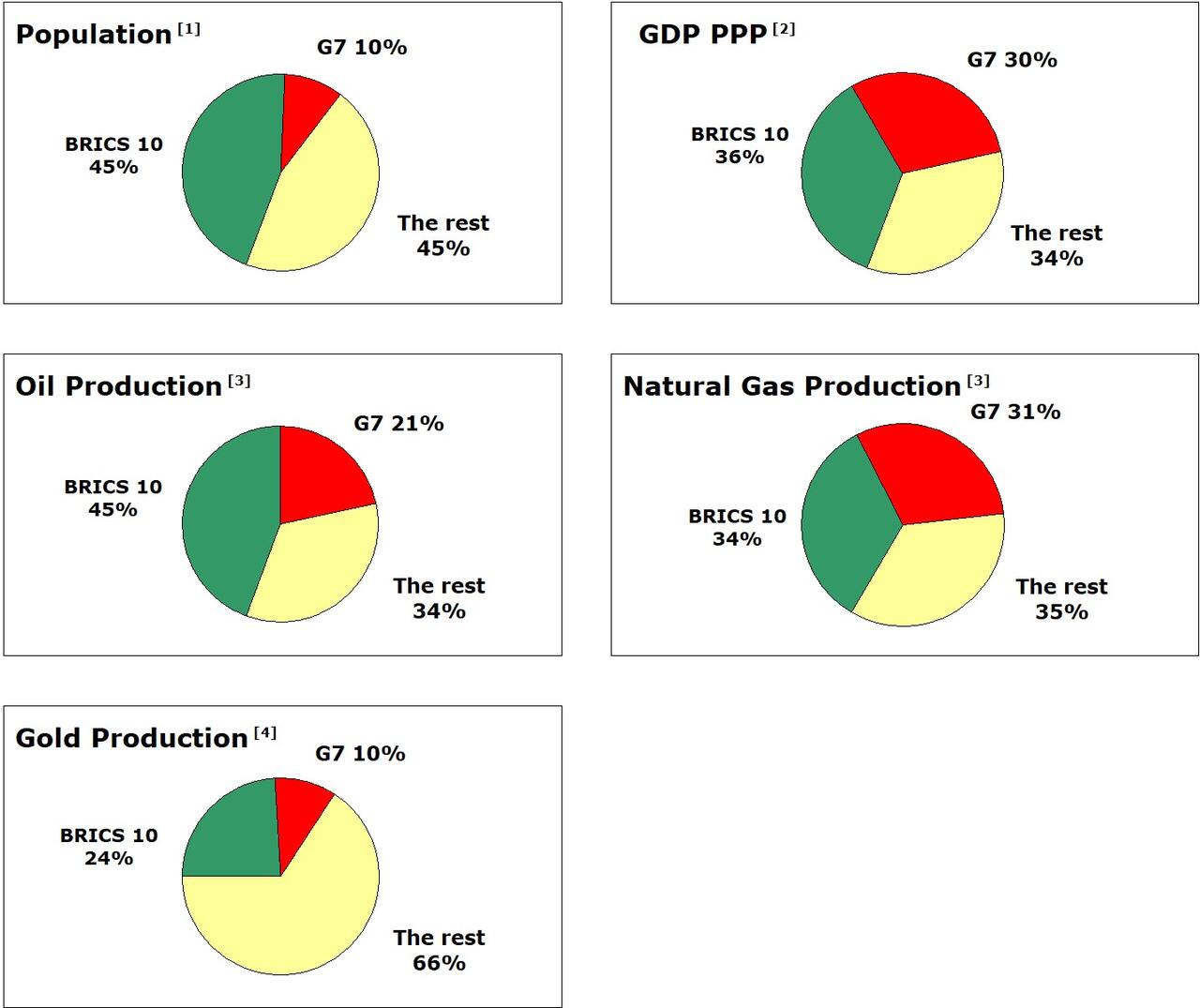

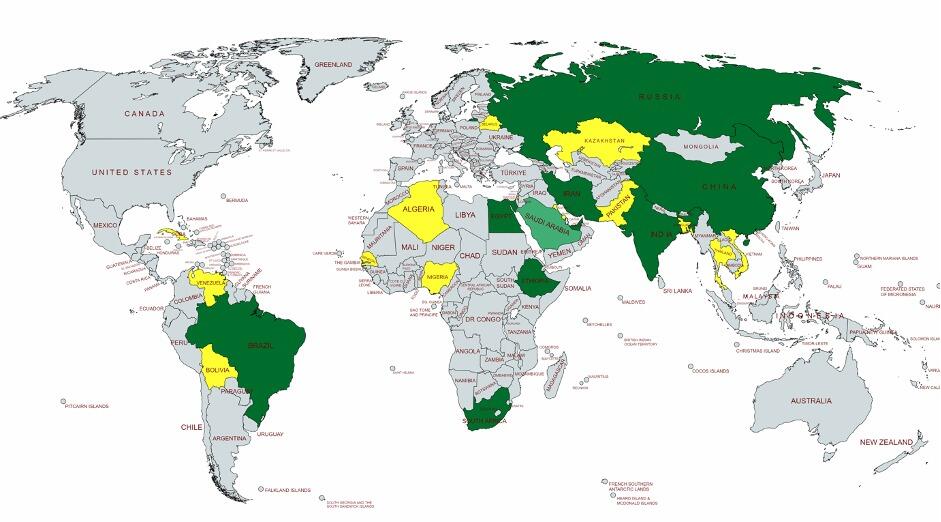

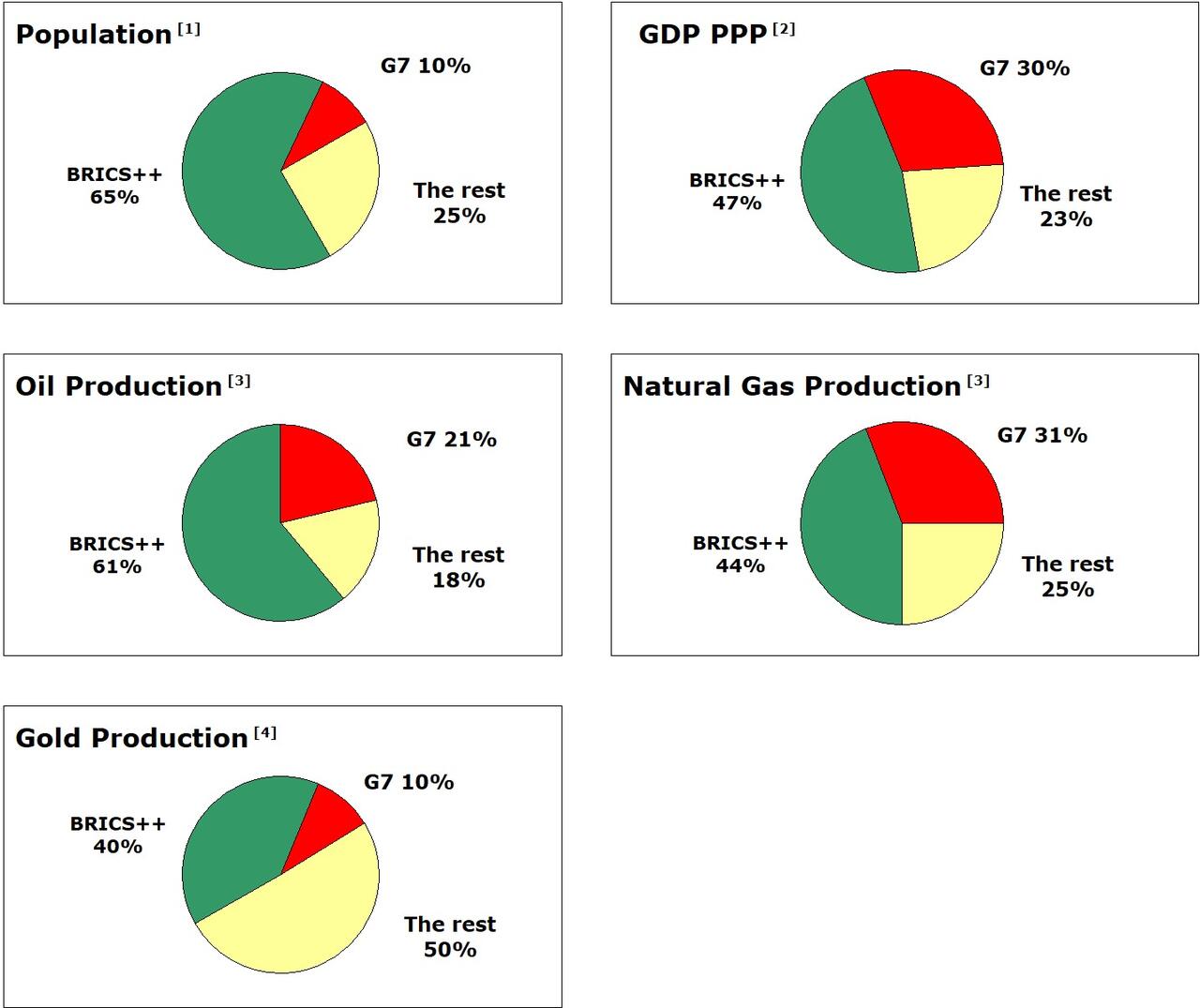

Green: BRICS 10 (light green Saudi Arabia) – Yellow: formal membership applications

Figures

Charts

Assessment

It

should be noted in this list that the formal applicants will probably

not all be admitted in 2024. This illustration shows the maximum and the

broad formal interest in this organization. The applications for

admission from some countries harbor great potential for conflict with

the USA.

In my opinion, the greatest potential for conflict from

an American perspective is the possible accession of Mexico, Cuba and

Venezuela. Mexico’s membership would be seen by the USA in the same way

as the Soviet stationing of nuclear missiles in Cuba in 1962 – “enemy on

the doorstep of the USA”. This is probably also the reason why it was

reported on March 3 that

Mexico had not submitted a formal application for membership. Fear is

breathing down the necks of the Mexicans and the USA is exerting

pressure in the background.

In Venezuela, the country with the

world’s largest oil reserves, the US has been trying for years to

overthrow President Maduro and install a puppet.

Last August, it was not enough to gain admission and

the USA will do everything in its power to prevent this oil giant from

joining. However, the USA has a losing hand with the Venezuelan

population, as it is imposing sanctions on the beleaguered country to

bring about a collapse and accepting that the Venezuelan people are

suffering from hunger.

The

list of formal applications for admission could therefore change

considerably between now and October, when the decisions on who will be

invited to Kazan are made. What is certain, however, is that the G7 –

especially the United States – is devoting huge energies to slowing down

the development of BRICS. In my opinion, however, this organization is

already too powerful to be weakened by the West.

BRICS turns its back on the US dollar

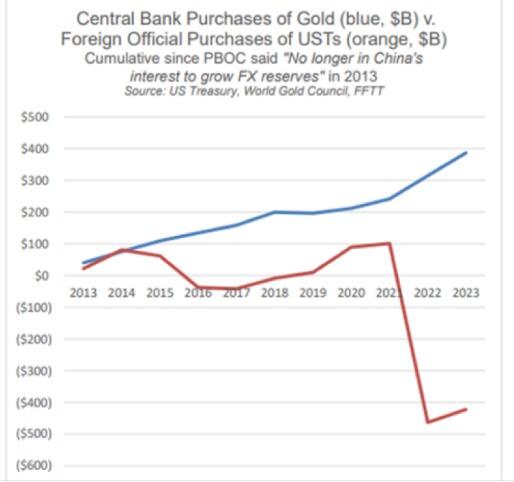

The petrodollar – US dollar as a reserve currency

The

greatest danger of this ever stronger community is to the USA. We have

discussed many times that the Petrodollar is the real foundation of

American supremacy and not the American armed forces.

It is of

existential importance for the USA that international trade, especially

commodity trade, is conducted in US dollars. We explain why.

The

US dollar as a global trading currency means that practically all

countries have to hold US dollars in reserve in order to be able to

settle their trade invoices. This makes the US dollar a reserve

currency.

However, central banks do not hold the US dollar in

cash, but in US government securities in order to earn interest. This

makes the world’s central banks the biggest buyers of US government

securities, regardless of whether they think they are a good investment.

As a result, the US can refinance its debt on terms that are not based

on the strength of the US economy, but on these systemic purchases.

French President Giscard d’Estaing rightly described the petrodollar in

the 1970s as an “exorbitant privilege”, as it leads to the automatic

refinancing of the USA.

Abuse of this exorbitant privilege

However,

the USA has been abusing this privilege for decades. Whenever a country

implements something that the US does not like, it is cut off from the

US dollar. The US can implement this without any problems, as all US

dollar transactions go through the US. The consequences for the country

concerned are catastrophic, as it is effectively banned from the

commodities trade.

Theft of Russian central bank reserves

However,

by blocking the foreign currency reserves of the Russian central bank

in March 2023, the US has overstepped the mark, because now the entire

Global South is afraid to hold US dollars, as they may suffer the same

fate. Although every legal expert declares that the freeze was already

carried out without an international legal basis, the West is about to

go one step further and prepare the confiscation. This is the

unequivocal statement made by Janet Yellen on February 27:

“I

also believe it is necessary and urgent for our coalition to find a way

to unlock the value of these immobilized assets to support Ukraine’s

continued resistance and long-term reconstruction.”

JANET YELLEN AT THE PRESS CONFERENCE BEFORE THE G20 ON FEBRUARY 27, 2024

The

EU under Ms. von der Leyen and even exponents in Switzerland are

preparing to put this planned raid into practice and thus not only

continue to block these funds, but to steal them.

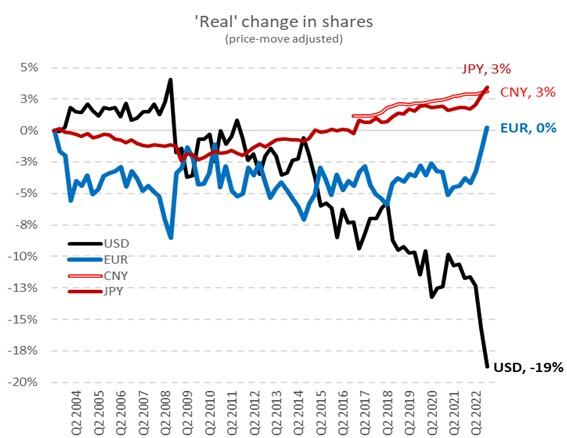

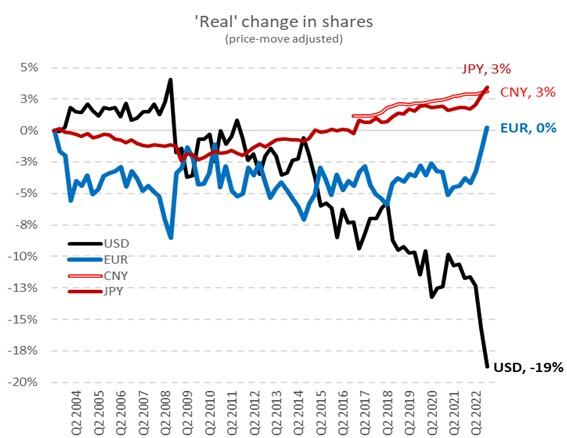

De-dollarization is already here

Until 2022, Russia conducted 80% of its trade in USD and EUR, 50% in US dollars. Today it is only 13%.

In the same period, Russia’s trade activity in roubles and yuan rose from 3% to 34% for both currencies.

These

figures are clearly the result of the sanctions against Russia.

However, it is a declared goal of all BRICS countries to no longer trade

with each other in US dollars, but in the respective local currencies.

If

you look at the current size of BRICS – 36% of global GDP – this will

herald a tectonic development away from the US dollar; if you add the

formal applicants, this figure rises to 42% of global GDP.

According to Bloomberg, the use of the US dollar as a reserve currency is collapsing.

Source: Bloomberg

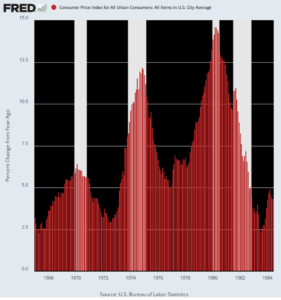

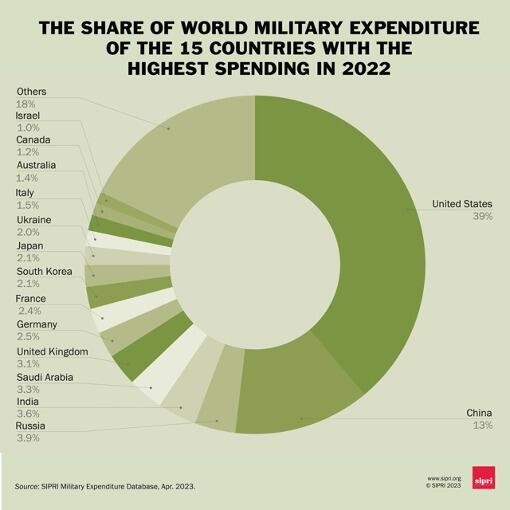

Consequences for the US

De-dollarization

poses an existential threat to the USA, as it will result in the loss

of buyers of US government bonds and thus the USA’s ability to refinance

its highly deficit-ridden national budget. As US government bonds are a

product like any other, whose price is determined by supply and demand,

a collapse in demand also leads to a collapse in the price of US

government bonds. As the interest rate on bonds moves inversely to the

price, the interest rate on bonds and therefore inflation will rise.

Debt

in the USA is currently accelerating at an unprecedented rate. Debt

currently amounts to over USD 34 trillion. It will soon take just one

month to accumulate the next trillion in debt – apocalyptic. When

President Reagan was in power, the total US debt amounted to less than

one trillion. It therefore took just under 200 years to build up the

first trillion in debt; soon this amount of debt will be a reality

within a month.

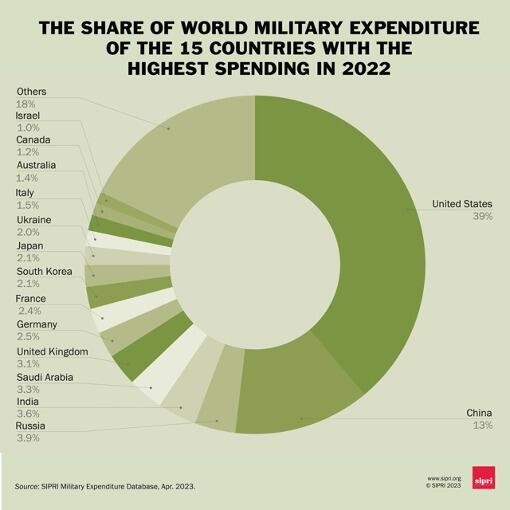

One of the reasons for this is that the USA will

already have to pay one trillion US dollars (1,000,000,000,000) in

interest payments on its own debt this year alone. This is more than the

USA spends on its entire military expenditure, which is gigantic in

itself, as the USA spends more money on its military than the next 13

countries combined.

Source: Wikipedia

If

the willingness of the countries of the Global South, and in particular

the BRICS members, to buy decreases, the USA will sooner or later find

itself in an existentially dangerous situation.

BRICS’ own currency

Trading currency

There

is a lot of talk about a new currency that would serve as a payment and

financing instrument for the BRICS. There were voices – including James Rickards –

who were convinced last August that a BRICS single currency would be

created as early as 2023. We were skeptical about this timing and took

the view that it would take longer, and we were right. However, this

does not mean that James Rickards was wrong, he was just a little early.

We

have seen above that the BRICS countries are in fact hardly using the

US dollar among themselves any more, instead using their local

currencies.

Use of local currencies

The consequence of

this is that the BRICS members accumulate currencies of their trading

partners over the course of a trading year if they sell more goods than

they buy. Example: Russia and India use Roubles and Rupees in their

trade. Since Russia sells more to India (especially raw materials) than

India sells to Russia, the Russians are sitting on large amounts of

Rupees at the end of the year. This problem arises regularly throughout

the BRICS region among the various members in bilateral trade when

deficits or surpluses build up.

Settlement with gold

I

believe that the bilateral use of national currencies will continue for

the time being, but that the first step will be to look for a mechanism

to balance these surpluses or deficits at the end of a trading year.

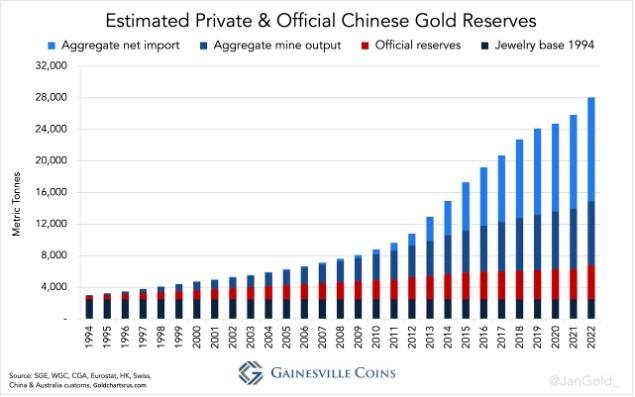

Gold

is an obvious choice here, not gold calculated in US dollars, Rupees or

Roubles, but gold in units of weight. The trade differences at the end

of a year or month would be settled in gold (kg or tons). Whether in

this case the gold is actually physically delivered or merely recorded

in a ledger depends on the trust between the parties. I also assume that

in such a case, gold warehouses would be opened in various locations in

the BRICS region, where the member countries would store their gold and

their holdings would be confirmed by a BRICS auditing company.

A

final issue would then be to determine the exchange rate of the local

currencies. This seems to be one of the major sticking points so far.

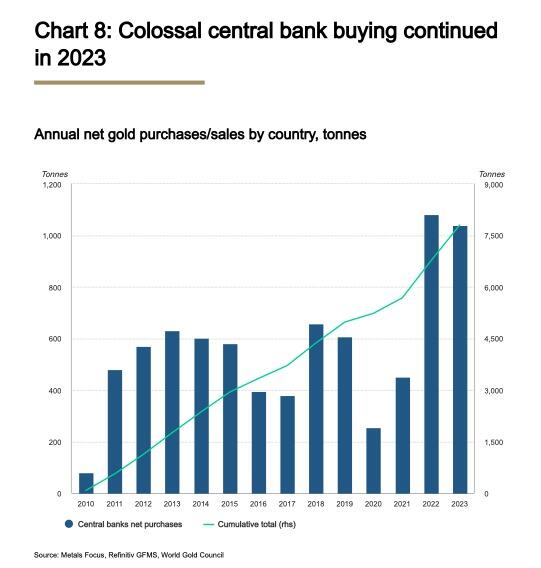

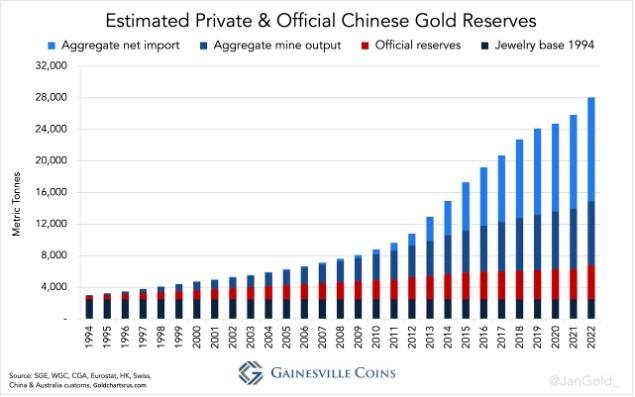

Indications that the trend is towards gold

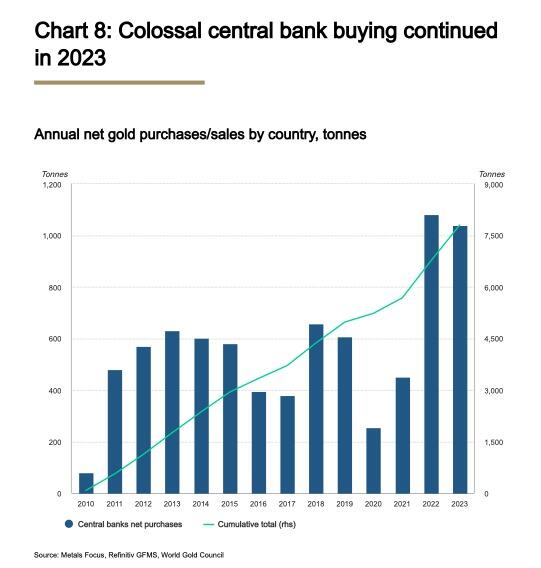

Evidence always comes from the facts. The world produces around 3,000 tons of gold per year.

According

to the World Gold Council, central banks have been net buyers of gold

since 2010 and the trend in gold purchases has increased steadily in

recent years.

The Chinese bought the most gold (225 tons).

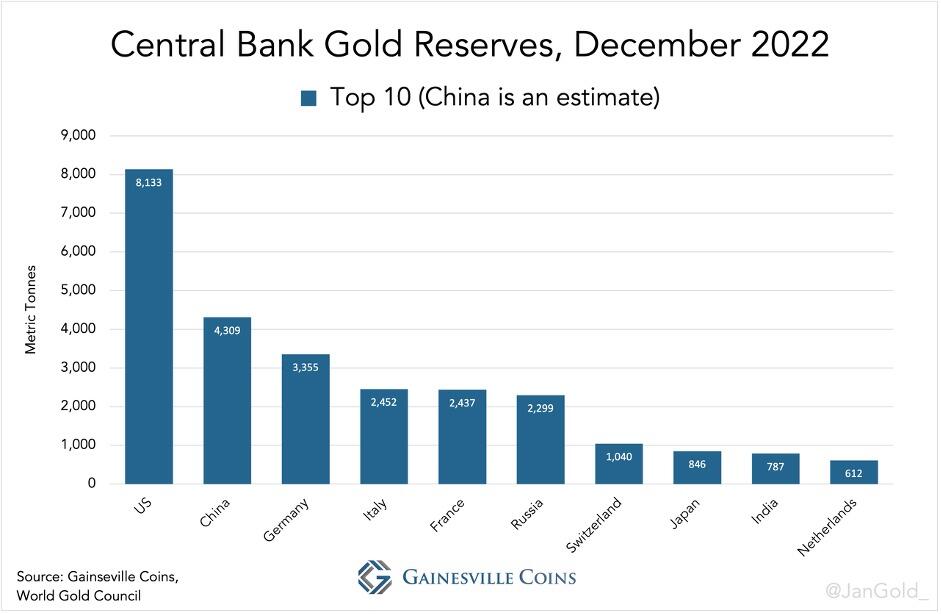

Caution is advised with regard to the official reported gold reserves.

It

is very possible – and in my opinion probable – that the gold reserves

of China and Russia are much larger than officially reported.

It

is clear that central banks are buying more gold than they have since

the 1960s. This is an indication that they are not only arming

themselves against inflation, but also for the settlement of

commodities.

It will be interesting to see what exactly will

happen this year, but I assume that at the next BRICS summit, which will

take place in Kazan in October, announcements will be made that will

surprise the West. In addition to new members, I believe that a trade

clearing system as described above or even more is within the realm of

possibility.

Future of BRICS – many new members

Preliminary remarks

Looking

to the future, BRICS has the potential to unite many countries of the

Global South and completely eclipse the Collective West.

We have

compiled the data of those countries that are interested in joining.

This is for the future, but in times of geopolitical tensions and

military conflicts, history teaches us that a lot can happen in a short

time, especially after decades, without major changes. For this reason,

we are merely providing a framework below and are not making any

predictions regarding the timeline, but rather letting the figures speak

for themselves and refraining from commenting at this stage.

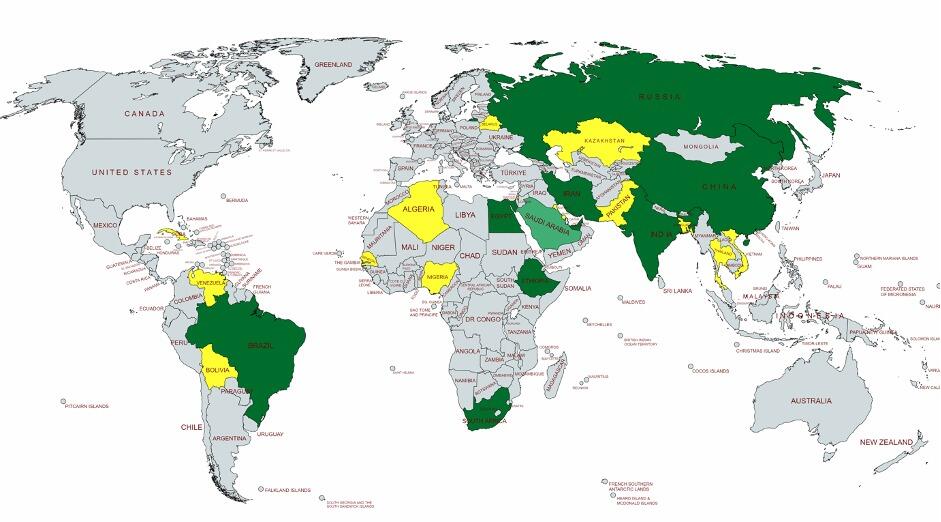

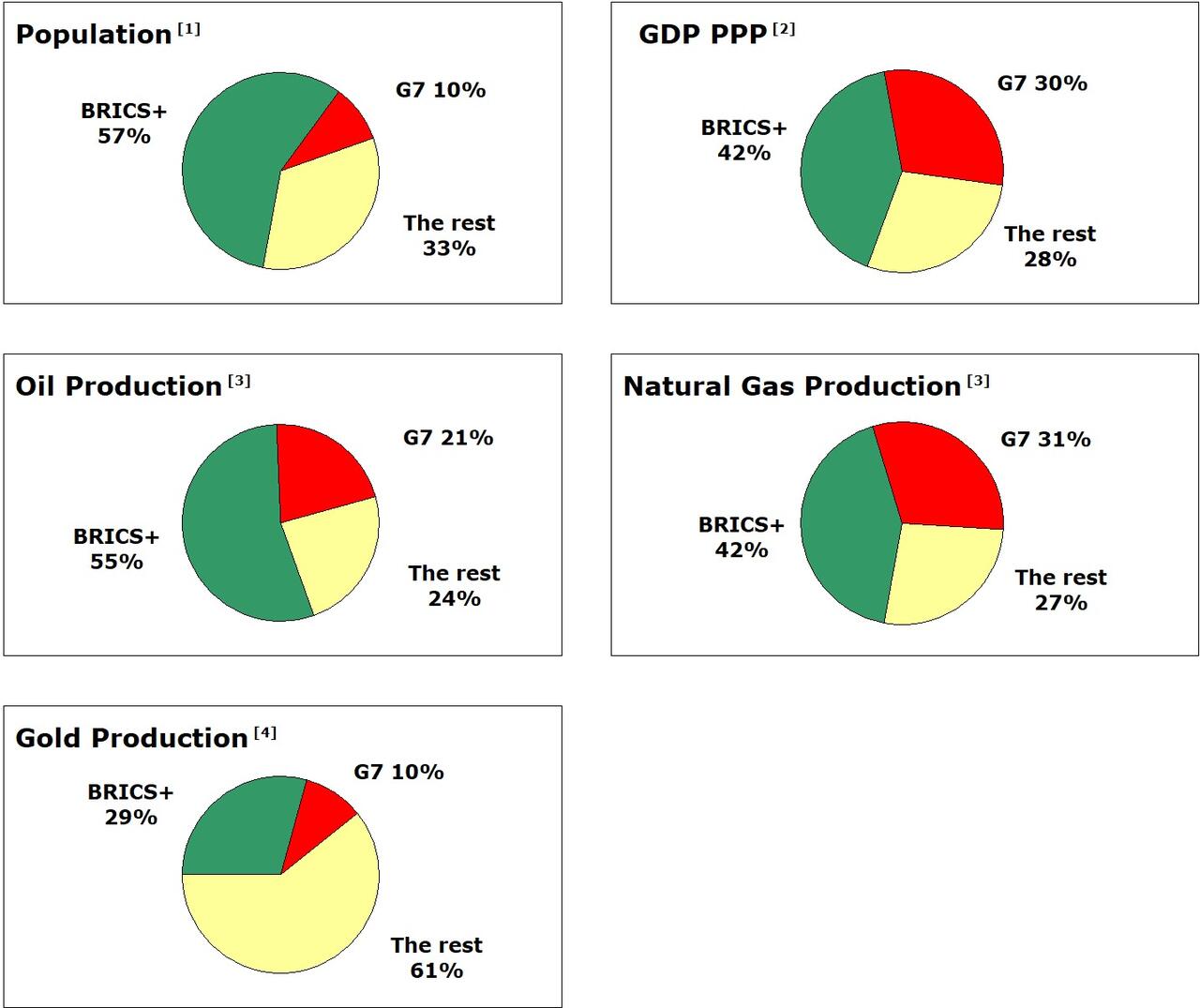

Map

Green: BRICS 10 – Yellow: formal requests for membership – Blue: countries that show interest

Numbers

Charts

Conclusion

After

BRICS became BRICS-10 last August by doubling its membership and thus

far outstripping the previous economic colossus G7, the current year is

set to continue in giant strides. The gap to the G7 will definitely

widen further at the BRICS summit in Kazan. It is still uncertain which

of the formal applicants will actually be invited and thus become new

members on January 1, 2025.

In my opinion, however, one thing is

already a fact: the hegemony of the USA will come to an end as a result

of de-dollarization. The combination of astronomical debts, rampant new

borrowing and the fact that more and more countries in the Global South

are turning away from the US dollar is accelerating the demise of the

hegemon that ascended to the throne in 1945 and is increasingly harming

itself through its aggressive geopolitics.

No world power has ever

left voluntarily and peacefully. The aggressive stance of the USA

towards Russia and China and its adherence to the alliance with Israel

are de facto proof of the aggressive behavior of the sick hegemon.

This

attitude could lead to a war between Russia and NATO in Ukraine, where a

local conflict is still taking place, all the more so as the Americans

have so far been on the way to inciting France, Great Britain and

Germany to wage war against the giant empire.

In the Middle East,

the attitude is downright perverse. In order not to alienate the Jewish

lobbies in the USA, which traditionally have a major influence on

presidential elections, the USA is supporting a genocide that has been

clearly designated as such by the International Court of Justice.

In addition to purely electoral considerations in the USA, the USA also

supports Israel in order not to lose its last power base in the Middle

East. These two ends obviously justify the means – and the means is

genocide. The Israeli attack on Hezbollah in Lebanon has already begun

and so there is ever less in the way of a burning Middle East.

Finally,

they are also trying to provoke a conflict over Taiwan – a conflict

that would be fought between Chinese and would therefore be a civil war.

China’s intention to reach a diplomatic agreement with Taiwan in the

next 20 to 30 years – that was the plan – is in jeopardy due to

Washington’s aggressive stance.

The behavior of the US is

unfortunately typical – the downfall is predetermined, the facts and

figures in this article prove it. Whether the smouldering fires already

blazing in American society will bring about a change and whether they

will be aggressive or more balanced cannot yet be guessed. We will have

to wait for the presidential elections in the USA, but a lot can still

happen between now and November.

For a geopolitician,

the world could hardly be more exciting – but for humanity, a little

less tension and pressure would be a blessing. After all, people under

pressure, especially politicians, have a tendency to make big mistakes.