A Don Quijote fight against CO2 while importing everything from China and cutting down tropical forests is no way to mitigate whatever is coming our way. But by now, it should be obvious to anyone that the purpose of Global Warming has very little to do with the planet and everything with upward redistribution of wealth speeded up by QE.

Last week, Bank of America sparked a firestorm of reaction amid both the pro and contra climate change camps, when it published one of its massive "Thematic Research" tomes, this time covering the "Transwarming" World (available to all ZH pro subs), and which serves as a key primer to today's Net Zero reality, if for no other reason than for being one of the first banks to quantify the cost of the biggest economic, ecologic and social overhaul in modern history.

The bottom line: no less than a stunning $150 trillion in new capital investment would be required to reach a "net zero" world over 30 years - equating to some $5 trillion in annual investments - and amounting to twice current global GDP.

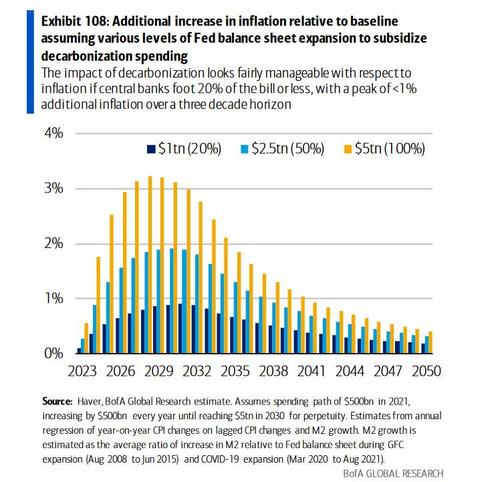

Needless to say, the private sector has nowhere near the capital required to complete this investment which is why Bank of America generously estimate that all or parts of the bill would have to be footed by central banks in the form of tens of trillions in QE. And since QE is essentially debt monetization, and since $150 trillion in new debt would have devastating consequences on the economy, BofA was kind enough to share its calculation of just how inflationary this billionaire pet project would be: the "full monetization" scenario, where central banks inject $5 trillion in liquidity every year via QE for 30 years, would result in incremental 3% of inflation for a good decade. This is inflation over and above whatever is already coming down the pipeline.

Which is where we get to the punchline, because as BofA admits, the crusade against climate change, the ESG doctrine, the "Net Zero" world, whatever one wants to call it, it's all about greenlighting the biggest QE episode in history, one wrapped in the "noble" veneer of fighting for the most important cause in the history of civilization, but in reality it's just the biggest wealth transfer scheme in history:

We just see a peak of <1% additional inflation a year over a three decade horizon. Under more aggressive scenarios where central banks opt to absorb either half or the full decarbonization bills through quantitative easing, the risks of an inflation shock grow. Still, we think our third case is the most likely scenario, as it would be politically difficult to justify a much more expansive monetary impulse. True, while central bankers have expressed a desire to help green the economy, their corporate bond purchases have historically been restricted to crisis time policies through quantitative easing and remain well below purchases of sovereign debt. As such, any purchases of corporate green bonds would likely be limited both by the size of future purchase programs and their proportion relative to the overall corporate bond market, with slightly higher allocations under more progressive purchase policies that highlight environmental concerns

At this point alarm bells should be going off even among the most brain-dead progressives because for all its touted benefits, the costs are starting to emerge and - at least when it comes to the next two or three generations - they will be absolutely crushing for the middle class, while allowing the top 1% to plunder and pillage virtually all the world's assets. Think of it as the biggest mandated theft in world history, and suddenly one can understand why every private-jet setting billionaire is oh so very vocally in support of a "net zero" world.

It gets worse.

Now that the genie is out of the bottle, and the hard questions like "who gets to pay for all this" are being asked, Bank of America had a follow up report in which it made it abundantly clear that "contrary to some arguments, we think climate mitigation efforts are likely to hurt growth in the next decade or so."

In his note titled "A hot take on climate change" (once again available to professional subscribers in the usual place), Bank of America chief economist Ethan Harris first goes through all the familiar steps of just why it is so imperative - and noble - to do something to fight greenhouse gases (similar to what we have read for much of the early part of the 20th century, when article after article starting in 1912 lamented the catastrophe that is global warming, at least until the 1970s when the lack of actual global warming prompted "scientists" to suggest that global cooling and "a new ice age" is inevitable instead). At least the scientists could agree that it's "global something" (turns out it would really mean "global money printing"), and as Harris laid it out, this is what "scientific consensus" appears to agree on now:

- Human behavior is having a significant impact on climate change and climate events.

- Even under optimistic assumptions—such as achieving net zero emissions by 2050—the impacts will likely grow over this century.

- Early action is much more effective than waiting until later.

- Uncertainty about the exact impact is not an excuse for inaction: a wide range of outcomes means more, not less urgency in acting.

None of the above is new as the mainstream media has been bombarding its audience for the past decade with emotional platitudes and qualitative appeals as to why something has to be done.

However, as we first touched upon last week, any discussion of the economics of climate change should start and end with the fact

that it is the ultimate example of “externalities”—private

activities (usually for corporations who scions and shareholders are by

now in the top 0.01% of global wealth) that create public costs. Indeed,

as Harris writes, climate change is the ultimate externality because

activity in one place impacts the whole world. The fact that climate

change is global in nature and that so much of the benefit of actions

accrues to everyone else has some powerful implications.

First, unlike other technology “races”, climate mitigation is more of a cooperative “game” than a competition. When countries like the US and China “compete” to develop new technologies, two points of conflict often tend to arise—a fight for market share and a fight for geopolitical superiority. By contrast, countries that develop efficient climate mitigation technologies have a strong incentive to share the benefits. If they hoard the technology, the impact on their own climate will be much smaller.

This is great... if only it weren't a pipe dream. Why? Because as the recent refusal by China's Xi Jinping - incidentally the world's largest polluter - to join his fellow "climate change crusading" world leaders at the COP26 Net Zero summit in Italy later this month, it's all one giant spectacle meant for the masses. Because if the world's largest polluter is making it clear he has no interest in actually reducing his own CO emissions, then anyone preaching some bullshit about a "cooperative game" can shove it.

Still, where Harris is somewhat correct, is in pointing out the "depressing consensus out of the climate change literature" that even if everyone cooperates, the earth will continue to warm as there are lags in the link between GHG and global warming. Indeed, under the best of outcomes—with every country hitting aggressive mid-century goals—the policy shift will mitigate, not stop the problem. Hence in BofA's view, "climate events will be a rising downside risk—of varying intensity—under almost any plausible scenario."

In other words, the net zero theater of the absurd is one where the actors' motives clearly diverge - when only a convergence from the start could make it work - yet where even a best case scenario of complete cooperation has no chance of actually stopping the problem, just mitigating it. Oh, and meanwhile, the world is set to incur some $150 trillion in costs.

Which then brings us to BofA's core assessment: will all this be good or bad for growth? Here, we find some unexpected truth...

In BofA's view, both press reports and many of the studies of climate change focus on the wrong side of the economy—the impact on aggregate demand rather than on productive capacity. For example, the latest report from the International Energy Agency (IEA) argues that pushing toward net zero emissions would lower employment in the traditional energy sector by 5 million by 2030, but would add 14 million jobs in the clean energy sector. They also argue that “the increase in jobs and investment stimulates economic output, resulting in a net increase in global GDP to 2030.” Global GDP growth averages 0.4 higher over the 2020 to 2030 period. The downside would be that some countries would be winners and others would be losers, and that inflation - once one factors in the trillions and trillions of central bank QE needed to fund this whole crusade - could be 1-to-3% higher.

Here Bank of America disagrees, writing that by the time serious climate mitigation efforts are underway the global economy will likely be close to full employment. This will likely be the case in the US. Hence staffing up the industry means drawing workers out of the rest of the economy. At the same time, building up green energy infrastructure will require more than a doubling of investment in the sector, from roughly 2% of GDP now to a 4.5% average over the 2020-30 period. Where is that 2.5% of GDP going to come from? (spoiler alert: money printing, and everyone knows this).

Or maybe note: Harris admits that in the short run, central banks could in effect accommodate the surge in demand, allowing their economies to overheat. Hence the IEA estimate of 1-to-3% higher inflation. However, the BofA economist disagrees with that estimate as well. If the Fed allows a permanent overshoot of economic potential, inflation will not just increase, it would trend higher. As in the 1970s there will be a feedback loop between price inflation, wage inflation and price expectations.

Translation: the "net zero" crusade against climate change really is.... the necessary and sufficient condition to trigger the hyperinflation that the world's massively indebted nations need to inflate away their debt.

But wait, there's more, because as Harris concedes next, in reality, while inflation is set to soar, climate mitigation is "also likely to slow the supply side of the economy, particularly in the ramping up phase." He explains further:

Big structural changes in the economy tend to create big transitional challenges. Workers need to move from one sector to another, some industries will boom while others shrink, and as regulations and taxes increase, capital that had been invested in producing and using dirty energy will rapidly become obsolete.

All of this means lower trend growth during the transition from a dirty to a green economy. And, as noted above, there isn't even any assurance that a transition to a green economy will ever be completed once it has begun; at best, we may be stuck in the "mitigation" phase for ever.

The highly asymmetric payoff - BofA concedes - comes in the very long-run, with the benefits accreting here and now to those who stand to reap the generosity of central bank printing, which naturally will be those who own the inflation-resistant assets such as stocks, commodities and, of course, cryptos; while the pain borne by everyone else which - sadly - means the shrinking middle and lower classes, who however are "in it for the long run", and for the benefits that a cleaner climate will (perhaps) provide their grandchildren and great grandchildren. Their generation, however, will be sacrificed at the altar of the 0.1% good. Because like every true religion, "climate change" also requires a sacrifice so a handful of chosen ones can live better.

Just the tip of the iceberg

So much for theory, what is happening on the ground? As Harris explains, the progress on policy is painfully slow as some policies continue to worsen rather than help the problem. Consider two examples. First, according to IEA, countries spend more than $400BN per year subsidizing mainly oil, but also gas and electricity consumption. In many instances there is a conflict between helping the poor and helping the environment. Second, despite what BofA calls "rising sea levels and increased hurricane activity," some countries incentivize locating houses in harm’s way through subsidized insurance and disaster relief. Almost as if the countries themselves, and certainly the Malibu beachfront billionaires, don't actually believe in - gasp - rising sea levels. Again there is a conflict between two goals—helping vulnerable people and reducing the cost of climate events.

Meanwhile, climate change and mitigation efforts already appear to be impacting the global economy. While scientists are very careful to avoid assigning a causal relationship between climate change and individual climate events - perhaps for the same reason that "science" emerged as a politically-motivated farce when reaching rash, ideologically-driven conclusions during the covid spectacle - but they point to some disturbing trends. Consider two examples highlighted by BofA: "First, data published by the Environmental Protection Agency show that the number of wildfires in the US has shown no trend from 1983 to 2020. However, when they focus only on large fires, the amount of acres burned seems to have shifted up significantly starting in about 2000. Second, the Geophysical Fluid Dynamics Laboratory collates studies of hurricanes and tropical cyclones. Its report is sprinkled with the usual qualifiers (medium to high confidence) but the evidence points to an increase in the intensity of storms in recent years." Dear Bank of America - this is called tortured goal seeking: squeeze the data hard enough and any pattern you want will eventually emerge.

More importantly, BofA admits that there is now evidence that climate change and mitigation play "some role" in the recent rise in energy prices (to this we would counter that not only does climate change mitigation play "some role" but that the chief reason for the global energy crisis is the idiotic push for a ESG utopia, something which we warned would happen back in June in "Will ESG Trigger Energy Hyperinflation").

But where it gets worse is that given the regulatory outlook, and the now prevailing stigma associated with any fossil fuels, investment in dirty energy capacity will be low and depend on high prices. Meanwhile green energy is not ramping up fast enough to fill the gap. Hilariously, changes in wind and rain patterns seem to have affected the supply of wind and hydro power. The same wind and hydro power that was supposed to lead the world out of its fossil fuel addiction. Because so blind were the scientists in pushing their political agenda, they failed to see what was right in front of their noses, the same way Reuters figured out last week that European and U.S. cities planning to phase out combustion engines over the next 15 years first need to plug a charging gap for millions of residents who park their cars on the street. Oops - perhaps in retrospect, the policymakers and scientists should have though of the blindingly obvious first, instead of rushing to goalseek the agenda to makes them the most monetary benefits...

No comments:

Post a Comment