A long, long time ago, Japan was on the verge of overtaking the American economy. Then in 1990 the bubble popped. In 2000, the Japanese income per person was still 5 times higher than Korea. Today, Korea is above Japan on PPP (purchase parity prices)... and it won't stop there.

Today the choice is between crashing the economy and crashing the Yen. As the Bank of Japan just announced: It will be the Yen. It makes sense. There is really no choice left. But in 10 years, it is Vietnam that will overtake Japan!

I wonder if Japan will congratulate Mr Kuroda by then for avoiding tough decisions for so long? In 2022 already, Japan is importing gas from Russia, manufactured goods from China and 60%+ of its food from abroad while its population and industry are crashing. The cliff ahead is already spectacular. A very likely major earthquake will make it twice as high still...

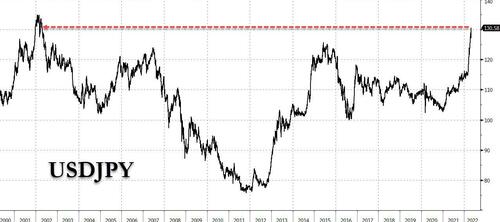

Yen Craters To 20 Year Low As BOJ Stuns Markets With Daily Fixed-Rate Operations To Defend YCC

It was a little over a month ago - on March 24 - when we first laid out the big dilemma facing the Bank of Japan, which on one hand was hoping to avoid a currency collapse (for obvious reasons) and prevent a crash in the yen, while on the other hand, was also hoping to keep the 10Y yield below its extremely dovish 0.25% yield curve control rate ceiling. The problem is that while the BOJ can control one or the other, it can't control both; this is what we said then:

Japan, that paragon of MMT crackpots everywhere, suddenly finds itself trapped in a lose-lose dilemma: intervene in the bond market and spark a furious, potentially destabilizing and uncontrolled plunge in the yen which would also lead to galloping (if not worse) inflation, which could collapse what little faith remains in the BOJ, or do nothing and contain the slump in the yen while risking far higher yields which in a country where the debt is orders of magnitude greater than GDP, could also spell fiscal and monetary doom.

As a result, the market - having long gotten used to amicable interventions from the BOJ - will now surely test one of these two outcomes, and how the BOJ responds could have dramatic consequences for this original MMT test case. Should the BOJ's reaction spark further erosion of faith in either Japan's fiscal or monetary policies, the outcome for the world's most indebted nation would be disastrous.

Sure enough, the market did test both outcomes, and after pushing the 10Y JGB yield to the upper bound of the YCC corridor of 0.25% and finding the BOJ willing to defend Japanese yields from further spikes, decided to focus its hammering on the yen instead, pushing it to two decade lows.

It's also why we were paying particularly close attention to what the BOJ would announce in its decision early on Thursday - would it double down on Yield Curve Control defense, or would it finally turn its attention to the crashing yen and prop it up, perhaps by extending the YCC ceiling from 0.25% to 0.50% or higher (in line with what all other developed central banks are doing)?

Well, we got the answer and it was a doozy: the Bank of Japan on Thursday sparked a furious sell-off in the yen (and also the yuan) after shocking the market by doubling down on its Yield Curve Control and keeping its loose monetary policy intact, despite the crashing of the yen and growing pressure of inflation due to costlier imports.

The yen cratered below 130 against the U.S. currency for the first time in 20 years in afternoon trading in Tokyo, when rather than introducing flexibility to its monetary policy, the central bank in a statement reiterated its commitment to the 10-year yield target, saying it will conduct an unlimited fixed-rate operation to buy 10-year Japanese government bonds at 0.25% every day, effectively ensuring a currency collapse.

Specifically, the BOJ maintained the status quo across all monetary policy parameters, including yield curve control (YCC), asset purchase programs, and forward guidance (some market observers were expecting adjustments to forward guidance). The central bank decided by an 8-1 majority vote to maintain the YCC, and by a unanimous vote to maintain guidelines for asset purchases. In regard to YCC, BOJ member Kataoka cast the dissenting vote (as he usually does), saying that it was desirable to lower short- and long-term interest rates "with a view to encouraging firms to make active business fixed investment for the post-COVID-19 era."

In a separately released economic outlook report, the board members offered a median forecast of sharply higher inflation coming at 1.9% for fiscal 2022, compared with 1.1% predicted just three months ago, and 1.1% for the next fiscal year. Economic growth is forecast to slow sharply to 2.9% for the current fiscal year, versus 3.8% predicted three months ago. The BOJ’s outlook assumes core CPI inflation will continue to fall short of the inflation target of +2%, calling for +1.1% in both FY2023 and FY2024, while it expects new core CPI inflation (excludes fresh food and energy) to grow steadily, calling for +0.9% in FY2022, +1.2% in FY2023, and +1.5% in FY2024, respectively.

But the highlight, as noted above, is what the BOJ said regarding YCC, where it explicitly added to the statement that “the Bank will offer to purchase 10-year JGBs at +0.25% every business day through fixed-rate purchase operations, unless it is highly likely that no bids will be submitted” cementing the bank's commitment to keeping yields in the world' most indebted country (relatively speaking) at or below 0.25%

On policy rates, the BOJ maintained forward guidance indicating that it “expects short- and long-term policy interest rates to remain at their present or lower levels.” Commenting on the move, Goldman said that "while the BOJ introduced daily fixed-rate operations to keep consistency with this forward guidance, in our view, we think the market is likely to view it as a strong dovish message. Indeed, post the MPM, the 10-year yield is down and the yen depreciated against the US dollar."

It sure is, but more on that in a second.

- Speaking at a press conference later in the day, BOJ Governor Kuroda focused on the two key issues: inflation and the daily fixed-rate ops. Here are the highlights:

- Kuroda said "It Will Take Some Time to Get Sustainable Inflation" adding that current cost-push inflation will not be sustained as oil prices won’t keep rising.

- Kuroda said that "while inflation will rise temporarily to 2%, it won’t last as the effect of energy prices will ease", that ""Inflation expectations are rising, but are centered on the short-term"

- The BOJ governor emphasized that the surge in inflation is not sustainable, saying "cost-push inflation isn’t sustainable'' and that the "current rise in inflation expectations is also not sustainable"

- And even though risks are tilted to the upside for prices right now, and are tilted to the downside for the economy, there is no need to seek an exit from monetary stimulus now given the BOJ’s outlook for prices today

In short, the BOJ is quadrupling down on the wrong assumption that inflation is transitory. It won't be the first catastrophic mistake the BOJ has made.

Moving on, the BOJ's senile governor explained that the central bank's Fixed-Rate Bond operations are meant to stabilizing not jolt markets.

- "The Bank of Japan’s decision to clarify its bond purchasing plans is designed to prevent speculation", Kuroda said.

- Kuroda also said that "the clarification on fixed ops doesn’t mean the BOJ wants to buy fewer bonds" which is good beause soon the BOJ will be flooded with sellers.

- Finally, the central bank chief, said - or rather hoped - that fixed-rate ops aren’t causing excessive market moves

The outcome of this shocking announcement which basically cemented the BOJ's commitment to low rates at the expense of a plunging currency, was immediate and brutal: the Japanese currency immediately tumbled, sliding below 130 vs the USD...

... and sending the USDJPY to the highest level since 2002!

Not even vigorous if futile attempts by the Ministry of Finance to talk the yen up had any success. Moments after the BOJ broke 131 vs the USD, a Japanese finance ministry official says recent forex moves warrant extreme concern, adding that it was important that currencies move stably in line with fundamentals.

The USDJPY briefly dipped 75 pips and resumed its blow out.

Putting the move in context, since the Fed started raising rates on March 16, the yen has fallen from 118 to 131 versus the dollar, hitting a 20-year low earlier today, as investors moved out of yen and into dollars for better investment yields. Kuroda has argued that a weaker yen is "a net positive" for the economy, even as the public becomes increasingly frustrated with BOJ policy, according to Nikkei Asia.

"The latest policy statement has left me with an impression that Kuroda has even hardened his stance," said Hideo Kumano, chief economist at Dai-ichi Life Research Institute. He sure has, and as we said recently, the BOJ has found itself caught between a rock and a hard place. If it sticks to the loose monetary policy, it will exacerbate import-driven inflation. If it raises rates, it could hurt Japan's sluggish recovery from COVID.

Commenting on the BOJ announcement, Noriatsu Tanji, chief bond strategist at Mizuho Securities in Tokyo said that the BOJ's announcement to buy bonds with no limit was a surprise: "To make the announcement of buying unlimited bonds at a fixed rate in the policy statement, the BOJ is sending a very strong message that it is firmly committed to continuing the super-easy policy." He added that “as days go by, players will cease to sell to the BOJ and will stop challenging the 0.25% level, driving down 10 year yields” and said that “this commitment should also help ease upward pressure on super-long yields” which are outside the BOJ’s YCC.

He' may be right, but he didn't say anything about what happens next to the crashing yen. And it is here that the move to 150 is now certain.

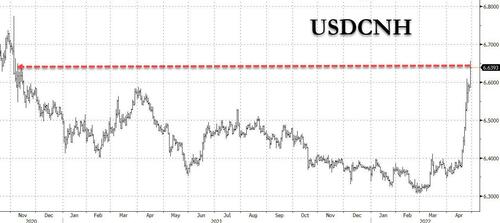

And while the collapse in the yen was viewed aken favorably by Japanese stocks, with the Topix spiking over 2% following the announcement, the Japanese decision to let the yen plunge was immiedately noted by its far bigger and more important neighbor China, whose offshore yuan also tumbled yen 0.8% lower, sending the USDCNH above 6.65, the highest level since November 2020...

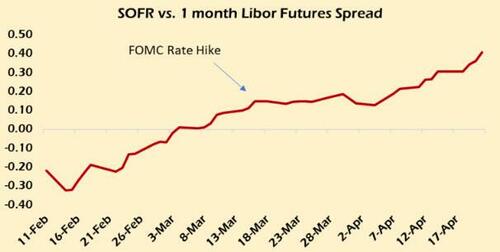

... as suddenly the "The Biggest Story No-One Is Talking About" is what everyone is talking about - namely how long before the unprecedented easing divergence in Japan and China vs the tightening in the US and the west, leads to a historic crash.

As a reminder, in a note published late last week (available to all professional subscribers), SocGen' Albert Edwards looked at the moves in the yen and yuan, and wrote that "surely all of us working in finance realize by now that something is likely to snap in the financial system and probably quite soon."

Why? Because according to the SocGen strategist, "the rapidity of current market moves and the polarisation of the now extreme Fed (hawkish) and BoJ (dovish) policies almost guarantees that outcome.... Maybe the outcome wouldnt be so ugly if central bankers had not spent recent decades ramping up asset prices to todays grotesque levels through their monetary incontinence. But they did."

Comparing the monetary policy divergence between the US and Japan to "a car crash in slow motion", Edwards writes that polarization in central bank monetary policy between the US Federal Reserve and Bank of Japan is being stretched ever wider to the point where "at some point soon your life might even flash before you ."

If he is right, today's BOJ decision may have just planted the seeds for the next monetary collapse. If so, keep a close eye on gold and cryptos, both of which will likely be trading far, far higher by the time the market realizes what just happened.