This is an interesting article concerning gold and especially the time it will take for a gold peg to be implemented. (I agree with the explanation but not with the timing as a financial crash would/will accelerate the process.)

Here’s the Massive Difference Between a Theoretical Russian Gold Put and an Actual Russian Gold Put

I originally published this article here on 6 April 2022, but since conditions have drastically changed since then, I’ve provided the brief update below. To read all my articles when first published, please sign up here.

9 April 2022 UPDATE: What a difference 23-hours make. Though the Bank of Russia announced that they had intended to keep the peg of 5,000 rubles to 1g of gold for the next three months, on 7 April, 2022, one day after I published this article, they released a statement that they will now buy gold at market prices due to a “significant change in market conditions”. No doubt, one reason for this decision to end this peg prematurely was the massive discount in Russia to purchase gold versus futures and spot prices granted by the fixed price of 5000 rubles to 1g of gold. Another significant contributing factor to the Bank of Russia’s decision was the manifestation of my explanation written on 6 April that “the ruble would only have to strengthen, against the USD, by another 3.42% to bring the gold price in Russia up to parity with the USD equivalent price”.

Over the last 24-hours, the ruble has risen by more than this percentage against the USD, which would have raised the USD equivalent price of gold in Russia, if the peg were maintained, to a premium above current global future/spot gold prices. This development also modifies my "gold prices likely to remain dampened in the immediate term" comment below, as the unpegging of the rising ruble to gold allows global spot prices to rise without creating ridiculous discounts in the gold ruble price in Russia. Although the Bank of Russia was somewhat cryptic in its reference to a vague “significant change in market conditions”, there is no doubt in my mind that my aforementioned explanations were the conditions that caused them to dissolve a peg that they had originally planned to maintain for three months . Despite this, all the points I make below, to a large degree, still remain true. Below is the entirety of the article I published on 6 April, 2022.

There has been a lot of buzz in the gold community surrounded Russia’s decision to price gold in rubles regarding the creation of a “Russian gold put”, a floor in gold prices, similar to the Greenspan and Bernanke puts placing a floor beneath US stock markets. However, I don’t think the manifestation of a Russian gold put in the immediate to intermediate term is realistic.

Why? To begin, China launched a Yuan-denominated gold contract in Shanghai six years ago in April 2016. Back then, even Bloomberg Intelligence participated in the propaganda hype of this development by penning an article stating that gold prices could rise to $64,000 an ounce if China decided to even partially back the yuan with gold. Of course, after a series of articles in mass financial media touted the “Shanghai gold put”, gold ended the year much lower than its price at the time of the SGE launched the Yuan-based gold contract. Furthermore, after the yuan denominated gold contracts started trading on the SGE, gold took another four years just to challenge the 2011 highs of $2,000 per troy ounce after falling to about $1,100 at the end of 2016. In hindsight, to justify their narrative of a “Shanghai gold put”, some claimed the launch of yuan-denominated gold contracts placed a floor of $1,000 in the price of gold. However, clients of my former consulting/research firm knew that I stated gold prices would never sink below $1,000 again once it breached this mark at the end of 2009, six years before the Shanghai Gold Exchange launched its Yuan-denominated gold contracts. So again, the narrative of the Shanghai gold put creating a floor of $1,000 dollars was a false one.

If the launch of yuan-denominated gold contracts available for global trading did not create a floor for gold (as I believe the rise in gold prices over time created a natural $1,000 floor as a consequence of Central Bankers destroying the purchasing powers of fiat currencies around the world), then expectations of ruble-denominated gold sales achieving a feat that yuan-denominated gold contracts could not (in a short period of time) is improbable. Yuan-denominated gold trading should have far stronger influence over global gold prices than ruble-denominated gold trading, as China possesses the second largest GDP in the world while Russia comes in at number eleven, but yet yuan denominated gold trading could not even keep gold prices over a paltry $2,000 per ounce. In addition, because of the sanctions against NATO nations/allies buying Russian gold, the amount of global Russian gold exports will be curtailed, though certainly non-NATO allies may make up for the decline in NATO nation buying. Furthermore, though Russians certainly understand the utility of gold as a means to store and preserve purchasing power over decades of time due to the wild historical volatility in ruble purchasing power, I still would not judge Russian’s love for gold over that of the Chinese.

Misinformation Surrounds the Russian Gold Narrative

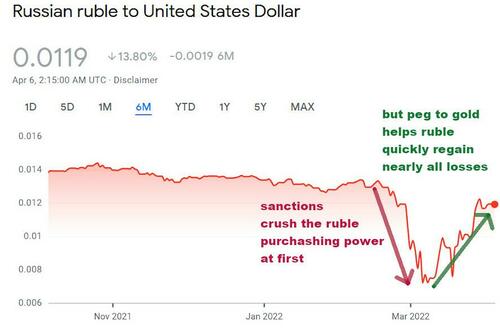

A lot of misinformation is being peddled all over the world about Russia’s decision to peg 1 gram of gold to a price of 5,000 rubles. While it is correct to claim that this decision helped the ruble to rapidly regain its purchasing power after imposed economic sanctions caused it to crash, as of 5 April, gold in Russia at the above peg is still trading at a massive $64 discount per troy ounce to its 5 April CME front month gold futures contract of $1,930. In other words, it is far cheaper now to buy physical gold in Moscow than to buy a CME gold futures contract and stand for delivery. And the ruble would only have to strengthen, against the USD, by another 3.42% to bring the gold price in Russia up to parity with the USD equivalent price. Thus, after all the NATO economic sanctions imposed on Russia, the attempt to collapse the ruble has completely failed.

For those that still believe BTC is a more sound form of money than is gold, there is a reason the Russian government/banking complex decided to peg the ruble to gold and not BTC. Further, all BTC hodlers should be grateful that Russia decided to peg the ruble to a fixed gold weight instead of a fixed BTC amount, because had they fixed the ruble to BTC, you can bet that bankers would have expedited new regulatory laws and forced BTC below $10,000 over the next few months.

Now, on to the misinformation. I’ve seen quite a few articles that reference the peg of 5,000 rubles to a gram of gold as a return to the gold standard. Stating that a peg of a fiat currency price to a weight of gold is a gold standard displays a complete lack of understanding of a true gold standard. A true gold standard can never peg the weight of gold to a fiat currency price for the same reason that cryptocurrencies priced in fiat currencies can never “save the world”.

Secondly, in 2019, 2020 and 2021, Russia exported roughly $5.7B, $18.5B and $18.7B worth of gold. In 2020 and 2021, at their respective annual average gold prices of $1,770 and $1,799, Russia’s exported gold tonnage amounted to roughly 325 tonnes in each of those years. This is an amount that will not only be easily absorbed by China, India and Russia’s Central Banks, but also more importantly, an amount now unavailable to back gold derivative markets in New York and London. For example, China only imported about 354 tonnes of Swiss gold last year, well under their 600 tonne average of Swiss gold imports from 2012-2019 (combined numbers of Hong Kong and China). If Russia doesn’t decide to keep their domestic gold production completely in-house, which is also a possible outcome of sanctions against Russian gold, China alone could easily absorb Russian gold exports banned by NATO nations if it decides to return to gold import tonnages of previous years. And if a drastic drop of Russian gold to Western nations becomes a permanent, instead of just a temporary situation, in future years, then indeed, the NY and London gold derivative markets may be exposed as “Emperors that have no clothes”.

Furthermore, in 2020, most of Russia’s exported gold ended up in the UK and in turn, was forwarded to Switzerland where it was refined and then exported to the US. The US, by a large margin, was the largest importer of Swiss gold, importing $32B that year (click the following link to view Swiss gold imports by nation from 2012 to 2021). Thus, by following the money, it appears that the US, by sanctioning Russian gold that eventually ended up in US vaults in previous years, is cutting off its nose to spite its face. For those wondering how much gold is $32B, at the 2020 average gold price of $1,770 per troy ounce, $32B amounted to roughly 18M AuOzs, or roughly the amount that currently sits in COMEX vaults backing gold futures trading as of 4 April 2022.

Thus, beware of analysts that don’t even understand the definition of a gold standard that issue warnings that Russia’s peg of its ruble to gold will become a game changer in global gold pricing mechanisms, because their understanding of the banker perception management game, as is their understanding of a gold standard, is likely severely distorted (to view the very significant returns we just delivered to skwealthacademy patrons this past month using our understanding of how perception differs from reality in the investment world, click here).

Gold’s Price Likely to Remain Dampened, Not Elevated, in the Immediate Term

As the situation stands now, Russia’s decision to peg 5,000 rubles to 1 gram of gold has likely sealed gold’s immediate price fate at sub-$1,900 in direct contradiction to the opinion of many analysts that predict the Russian gold put will imminently push gold above the $2,000 mark for the third time this year. And should this prediction of mine, published first on my news site on 5 April 2022 (while gold was trading at $1,930) and then on my substack platform the next day, come true, such a development should buttress the argument for the need to entirely scrap the unethical, immoral system of global gold pricing that exists right for a free and fair pricing system actually based upon global physical supply and demand determinants.

Is a Russian Gold Put Possible At All?

Of course the development of a Putin or Russian gold put is possible, but the likelihood is that it will take years, not months, to develop. Gold soaring above $2,000 again will not be due to the Russian gold put when it happens but it will simply be just another step in gold’s naturally higher price progression. Long term, as other nations not on the NATO friendly list realize that gold should be the number one asset held by their Central Banks, then the Russian gold put will slowly come into play. Furthermore, as other non-NATO nations (in which more than half the world’s population live, see the map below) gain an understanding of how Russia’s massive gold reserves saved the ruble from purchasing power devastation after a coordinated attack by NATO nations’ imposed economic sanctions, then many of these nations will also ratchet up their sovereign physical gold purchases.

But such a process will take time as other non NATO nations have observed the NATO killing of Libya’s Muammar Gaddafi after he proposed creating a pan-African gold and silver currency to compete with Western fiat currencies and Goldman Sachs;s funding and support of a corrupt Malaysian PM Najib Razak, in which Goldman Sachs bankers helped raise billions of dollars for Malaysia’s sovereign 1MDB fund through a shady deal that led to billions raised in a bond offering embezzled by Razak. It was Razak’s illegitimate rise to power in Malaysia, funded directly by a shady Goldman Sachs bond offering, that delayed the return of popular former Malaysian PM Mahathir Mohamad to the Prime Minister office. This multi-year delay was critical in effectively killing Mahathir’s proposed plan of a common gold-backed currency for all SE Asian nations (if you are not familiar with the above story, I highly encourage you to learn about it at the above link because you will learn how important it is to remain abreast of such situations to invest wisely when banker meddling is significantly altering asset prices).

Thus, for the Russian gold put to spread to other non-NATO nations, the leaders of these other nations will likely need to receive some assurances from Russia of military protection against illegal assassinations and coups ousting them from power before they agree to join any Russia-Africa-Asia-South America gold alliance that could genuinely place a floor underneath the price of gold as gold prices continue to rise against collapsing fiat currencies. This will likely develop as a result of sanctions against Russian gold imports, but the development of this alliance is far more complex than is being presented by most outlets today, and thus the Russian gold put is something that, in my opinion, will not materialize in months, but take years to build. Many geopolitical alliances will have to be formed and strengthened for a real Russian gold put to materialize. Certainly it may develop, and it likely will develop over time, but as Gaddafi’s and Mahathir’s failures to implement an African and Asian gold put illustrated, doing so is not without consequences of sparking military and/or economic wars against such “offending” nations so such alliances necessary to form a regional “gold put” are not ones that will be formed quickly and easily.

Since economic sanctions against any nation that joins a Russian gold put alliance, enforced by NATO nations, are likely, resource and energy agreements between Russia and other nations most likely must be consummated to assure other nations that would join a gold put initiative that their energy and commodity (including food) needs can and will be met in spite of such punitive sanctions.

No comments:

Post a Comment