It could be long as the Author outlines below, or much more sudden if there is a strategic incident with China or Russia.

The real tragedy is that we are now at the mercy of events nobody controls...

Authored by Matthew Piepenburg via GoldSwitzerland.com,

Below we separate the hype from the sad reality of the USD in the face of a new “BRICS currency.”

Net conclusion: The real death of the USD will be domestic not foreign.

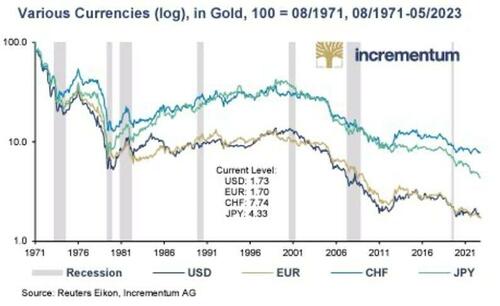

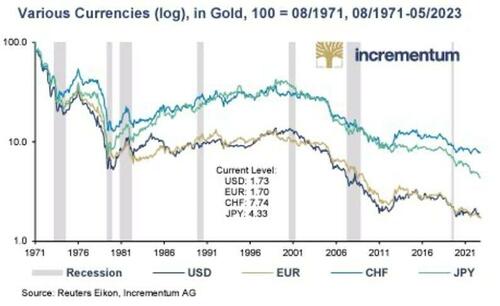

The Bell Has Been Tolling for Years

When it comes to the “bell tolling for fiat,” we

can all hear its loud chimes, but that bell has been tolling since 1971

(or frankly 1968), when the US leadership decoupled the world reserve

currency from its golden chaperone.

Like

any teenager throwing a house party, the lack of a parental chaperone

leads to lots of crazy events and lots of broken furniture.

The

same is true of post-71 politicians and central bankers suddenly freed

of a gold-backed chaperone and thus suddenly loaded with drunken power

to mouse-click currencies and expand deficits.

And since then, all kinds of things have been breaking, from banks to bonds to currencies.

And now, with all the extreme hype (and, yes, some genuine reality) behind the headlines of a revolutionary gold-backed BRICS trade currency,

many are making sensational claims that the World Reserve Currency

(i.e., USD) is nearing its end and that fiat money from DC to Tokyo is

effectively toast.

Hmmm…

Don’t Bury the Dollar Just Yet

Before

we start tossing red roses over the shallow grave of an admittedly

grotesque US Greenback in general, or fiat fantasy money in general,

let’s all take a deep breath.

That is, let’s re-think through this

inevitable funeral with a bit more, well, realism, mathematics and even

geopolitical common sense before we turn our backs on the USD, and this

is coming from an author who has never thought highly of that Dollar,

be it fiat, politicized and now weaponized.

So,

let’s take a deep breath and engage open, informed and critical minds

when it comes to debating many of the still open, un-known and critical

issues surrounding the so-called “game changer” event when the BRICS+

nations convene this August in S. Africa.

Needed Context for the “BRICS New Currency” Debate

As made clear literally from Day 1 of

the Western sanctions against Putin, the West may have been aiming for

Putin’s (or the Ruble’s) chest, but it then shot itself in the foot.

After

decades of DC exporting USD inflation from Argentina to Moscow, a large

swath of the developing countries of the world who owe greater than

$14T in USD-denominated debt were already reeling under the pain of

rate-hike gyrations which made their own debt and currency markets flip

and flop like a dying fish on the dock.

Needless to say, a

500-basis-point spike in the cost of that debt under Powell didn’t help.

In fact, it did little good (or goodwill) for USD friends and enemies

alike, from the gilt markets in London to the fruit markets in Santiago.

Adding insult to injury, DC coupled this strong-Dollar policy with a now weaponized-Dollar

policy in which a nuclear and economic power like Russia had its FX

reserves frozen and access to SDRs and SWIFT transactions blocked.

Like Napoleon at Moscow, this was going a step too far…

The

net result was an obvious and immediate distrust of that once neutral

world reserve currency, an outcome which economists like Robert Triffin

warned our congress against in 1960, and even John Maynard Keyes warned

the world against long before.

Heck, even Obama warned against such weaponization of a reserve currency as recently as 2015.

Thus,

and as I (and many others) warned from Day 1 of the sanctions, the

distrust for the USD unleashed by the sanctions in early 2022 was “a

genie that can never go back in the bottle.”

Or more simply stated, the trend toward de-dollarization was now going to come at greater speed and with greater force.

This

force, of course, is now being seen, as well as debated, under the

highly symbolic as well as substantive example of the BRICS+ nations

seeking to usher in a gold-backed trade currency to move openly away

from the USD, a move which some maintain will soon de-throne the USD as a

world reserve currency and send its value immediately to the ocean

floor.

The Trend Away from the USD Is Clear, But It’s Pace Is Not

For

me, the trajectory of this de-dollarization trend is fairly obvious;

but the speed and knowable magnitude of these changes are where I take a

more realistic (i.e., less sensational) stance.

But before I argue why, let’s agree on what we do know.

The BRICS New Currency Is Very Real

We

know, for example, that Russian finance experts like Sergei Glasyev

have real motives and sound reasons for planning a new (anti-Dollar)

financial system which not only seeks a Eurasian Economic Union for

cross boarder trade settlements backed by local currencies and

commodities, but to which gold will likely be added as a “backer” to the

same.

Glasyev has also made headlines with plans regarding the Moscow World Standard as a far more fair-playing and fair-priced gold exchange alternative to the Western LBMA exchange.

If

we take his gold backing plans seriously, we must also take seriously

the plan to expand such gold-backed trade currency plans into the

Shanghai Cooperation Organization which would make the final tally of

BRICS+ nations “going gold” as high as 41 country codes.

This

could ostensibly mean greater than 50% of the world’s population and GDP

would be trading in a gold-backed settlement currency outside of the

USD, and that, well, matters to both the demand and strength of that

Dollar…

China’s Motives Are Also Anti-Dollar

China,

moreover, has invested heavily in the Belt & Road Initiative (152

countries) as well as in massive infrastructure projects in Africa and

South America, areas of the world that are all too familiar with

America’s intentional (or at least cyclical) modus operandi of

developing nations enjoying low US rates and cheaper Dollars to create

local credit booms which later crash and burn into a local debt crisis

whenever those US rates and Dollars rise.

China therefore has a vested interest in protecting its EM investments as well as EM export markets in a currency outside of a USD monopoly.

Meanwhile,

as the US is making less and less friends with EM markets, Crown

Princes, French Presidents and EU and UK bond markets, China has been

busy brokering peace between Saudi Arabia and Iran, as well as building a

literal bridge between the latter and Iraq while simultaneously making

Yuan-trade deals with Argentina.

Other Reasons to Take the BRICS+ Currency Seriously

Tag

on the fact that Brazil, China and Iran are trading outside the

USD-denominated SWIFT payment system, and it seems fairly clear that

much of the world is leaning toward what Zoltan Poszar described as a

“commodity rather that debt-based trade settlement currency” for which

Charles Gave (and the BRICS+ nations) see gold as an “essential element”

to that global new trend.

Finally, with a strong Greenback making

USD energy and other commodity prices painfully (if not fatally) too

expensive for large swaths of the globe, it’s no secret to those same

large swaths of the globe (including petrodollar nations…) that gold holds its value far better than a USD.

Given

this fact, it’s easy to see why BRICS+ nations wish to settle trades in

a gold-backed local currency in order to ease the pressure on commodity

prices. This gives them the opportunity, as Luke Gromen reminds, to buy

time to pay down their other USD-denominated debt obligations.

In

addition to the foregoing arguments, the fact that the BRICS+ nations

are cloning IMF and World Bank swing loan and “contingency reserve

asset” infrastructure programs under their own Asian Monetary Fund and

New Development Bank, it becomes more than clear that a new BRICS+

world, trade currency and institutionalized infrastructure is as real as the trend away from a monopolar hegemony of the USD.

In

short, and to repeat: There are many, many reasons to both see and

trust the obvious and current trend/trajectory away from the USD as

warned over a year ago, all of which, no matter what the slope and

degree, will be good, very good for gold (see below).

But here’s

the rub: The speed, scope, efficiency and ramifications of this trend in

general, and the “BRICS August Game Changer” in particular, are far too

complex, fluid and unknown to make any immediate (or “sensational”)

funeral plans for the USD today.

And here’s a few reasons as to why.

Why the BRICS New Currency Is No Immediate Threat to the USD

First,

we have to ask the very preliminary question as to whether the August

BRICS summit will even involve an actual announcement of a new,

gold-backed trading currency.

So far, all we have to go on is a leak from a Russian embassy in Kenya, not an official communication from the Kremlin or CCP.

Meanwhile, India, a key BRICS member, has openly denied such a new trade currency as a fixed agenda item for this August.

But

notwithstanding such media noise, we must also look a bit deeper into

the mechanics, economics and politics of a sudden “game-changer” new

currency.

The BRICS New Currency: Many Operational Questions Still Open

Mechanically speaking, for example, who will indeed be the issuing entity of this new currency?

The new BRICS Bank?

What will be the actual gold coverage ratio? 10% 15% 20%?

Will

BRICS+ member nations/central banks need to deposit their physical gold

in a central depository, or will they enjoy (most likely) the

flexibility of pledging their domestically-held gold as an

accounting-only-unit?

Cohesion Among the Distrusting?

As important, just how much trust and cohesion is there among the BRICS+ nations?

Sure,

this collection of nations may trust gold more than they trust each

other or the US (which is why such a gold-backed trade currency may

work, as it can’t be “inflated away”), but if a BRICS member country

wishes to redeem its gold from say, Russia, years down the road, can it

realistically assume it will happen?

What if Russia (or any other trade partner) is in a nastier mood tomorrow than they are today?

Basic Math

In addition, there are certain economic/mathematical issues to consider.

We

know, for example, that the collective BRICS+ gold reserve (as of Q1

2023) is just over 5452 tones, valued today at approximately $350B.

Enough, yes to stake a new currency.

But

measured against a net global amount of $13T in total physical gold,

are the BRICS+ gold reserves enough to make a sizable dent (even at a

partial coverage ratio) to tilt the world away from the USD overnight,

when the USA, at least officially, has much, much more gold than the

BRICS+?

That said, we can’t deny that the actual gold stores in

places like Russia and China are far, far higher than officially

reported by the World Gold Council.

Additionally, the historically

unprecedented rate of central bank gold stacking in 2022-23 seems to

suggest that the enemies of the USD are indeed “loading their guns” for a

reason.

Expecting, however, all of the BRICS+ members to maintain

the discipline to continue to purchase and store more physical gold

despite the political temptations to redeem the same for later or

unexpected domestic spending needs may be a naive assumption in a real

world of ever-shifting national behaviors.

Geopolitical Considerations & the BRICS New Currency

Speaking

of such shifting behaviors, we also can’t ignore the various pro and

con forces within a geopolitical backdrop wherein much of the world,

whether it loves or hates the US, still needs its USDs and USTs.

China,

for example, may be letting maturities run and even dumping the USTs it

now owns at a fast pace (only years away from total UST liquidation),

but for now, China needs to keep the USD from growing too weak to buy

all the Chinese exports of those American products made, in well…China.

That

said, if the trend is indeed a new world of currency wars, rather than

currency cooperation, which is a more than fair assumption, then all

such liberal economic cooperation/trade arguments fall to the floor.

Nevertheless,

with over $30T worth of USDs held by non-US parties in the form of

bonds, stocks, and checking accounts, the collective desire (common

interest) to keep those USDs alive and at least relatively strong is a

major counter-force to the notion that the world and USD are coming to a

sudden change this August.

Furthermore, in such an uncertain

world of competing currencies as well as national and individual

self-interests, the trillions and trillions of off-shored USTs/USDs

tangled up within the foreign as well as US banking and derivative

markets is important.

Why?

Because any massive dislocation

in risk asset (and even currency) markets emanating from South Africa or

elsewhere, in August or much later, would more than likely (and

ironically) cause a disruption in foreign markets so dramatic that we

could easily see a flow into, rather than away from, USDs for

the simple (and again ironic) reason that the mean and ugly Greenback is

still the best/most-demanded horse in the global fiat slaughter house.

In

other words, even if all the BRICS+ plans for a gold-backed trading

currency go flawlessly, the time gap between the accepted rise of such a

settlement currency and the open fall of the USD is likely to be long,

wide and unknown enough to see the USD actually get stronger rather than

weaker before we experience any final fall in the USD as a global

reserve currency.

The USD: Supremacy (Still) vs. Hegemony (Gone)

So, no, I don’t think that the USD will fall entirely from grace or even supremacy in August of 2023, even if the trend away from its prior hegemony is becoming increasingly undeniable.

It

will take more than sensational BRICS headlines to make such a rapid

change, but yes, and as the Sam Cooke song says, “change is gonna come.”

My

only point is that for now, and for all the reasons cited above, the

trajectory and speed of those changes are likely not as sensational as

the trajectory and speed of the current headlines.

No Matter What: Gold Wins

The

case for gold, of course, does not change just because the debate about

the speed and scope of the new BRICS+ trade currency rages today.

No

matter what, the very fact that such a gold-backed trade settlement

unit will inevitably come to play will be an equally inevitable tailwind

for global gold demand and hence global gold pricing in all currencies,

including the USD.

The Dollar Will Die from Within, Not from Without

Furthermore,

and despite all the hype as well as substance behind the BRICS

headlines, I see the evolution of such a gold-backed trade currency as a

reaction to, rather than attack upon, the USD, whose real and ultimate

threat comes from within, rather than outside, its borders.

The world is losing trust in the USD because US policy makers killed it from within.

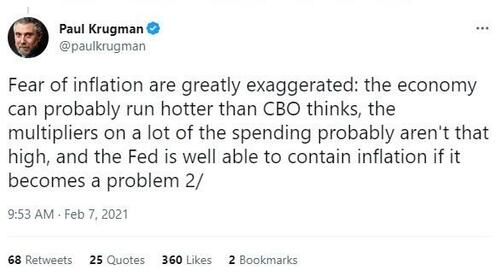

Ever

since Nixon took the gold chaperone away, politicians and central

bankers have been deficit spending like drunken high school seniors in a

room filled with beer but absent of parental consent.

The entire

world has long known what many Americans are finally seeing from inside

their own walls, namely: The US will never, ever be able to put its

fiscal house in order.

Uncle Sam is simply too far in debt and there’s simply no way out as

it approaches a wall of open and obvious fiscal dominance in which

fighting inflation will only (and again, ironically) cause more

inflation.

Or stated simply, Uncle Sam can’t afford his own

ever-increasing and entirely unpayable deficit spending habits without

having to resort to trillions and trillions of more mouse-clicked

Dollars to keep yields in check and IOUs from defaulting.

And

that, far more than a BRICS new currency, is what will put the final

rose on a fiat system (and Dollar) that is already openly but slowly

dying—first slowly, then all at once.

But I don’t think that day will be August 22.