In the early 1930s, the military government of Japan forbade the taking of pictures above cities in Japan to prevent spying. Later, likewise, the Soviet Union of the 1960s published false maps with misplaced cities and roads. Today of course satellites can take pictures of any location in the world. Strategic information has changed from geography to the economy. And so has the concealment of data.

To say that the Chinese economy is not doing as well as advertised is an understatement. But the real problem is that following the bursting of the Chinese real estate bubble 10 years ago, nobody probably including Chinese official knows what's really going on with the economy.

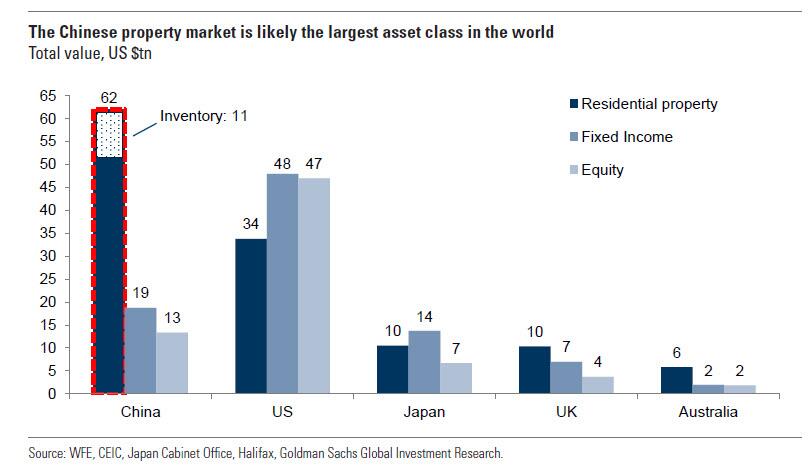

As for Japan in the 1990s, China has a large economy so identifying underlying "problems" can take time. Since the collapse of Evergrande last year, real estate over-investment has been kept under wrap. But the financial strain from local authorities who cannot sell land to suppliers who are not being paid must be acute. Eventually as in Japan, the Chinese government will not let the big banks fail. But this will cost a king's ransom, and investment will decline. In the end, it is extremely difficult to see how China can avoid Japan's fate.

Authored by Jeffrey Tucker via The Epoch Times,

There is a social contract of sorts among all governments of the world to share economic data on prevailing conditions. Behind that practice is a collegial contest to see which nation has the healthiest system, which in turn serves the capital markets by helping to direct resources where they are needed.

Sometimes the data is inaccurate. Sometimes there are lies. But in general, there is at least an attempt to play along with the expectation. This allows agencies and investors to make better assessments and prognostications, plus assist policy makers and central bankers in particular to make better judgments.

There is a general rule in operation. The more transparent governments are with the data they collect, and the more freedom of speech that is permitted to interpret the data in different ways, the more credible it is. It is also likely that governments which share and discuss also have numbers of which they can feel pride.

Rarely do nations go entirely silent on the market, as in turning off the switches and making the data rooms go dark. It is an ominous sign.

This is precisely what has happened in China.

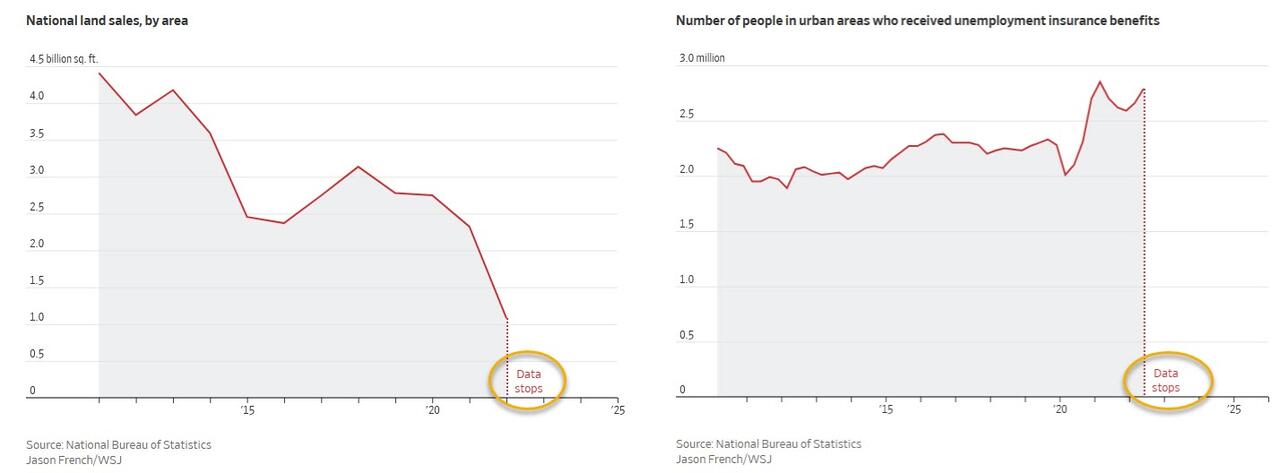

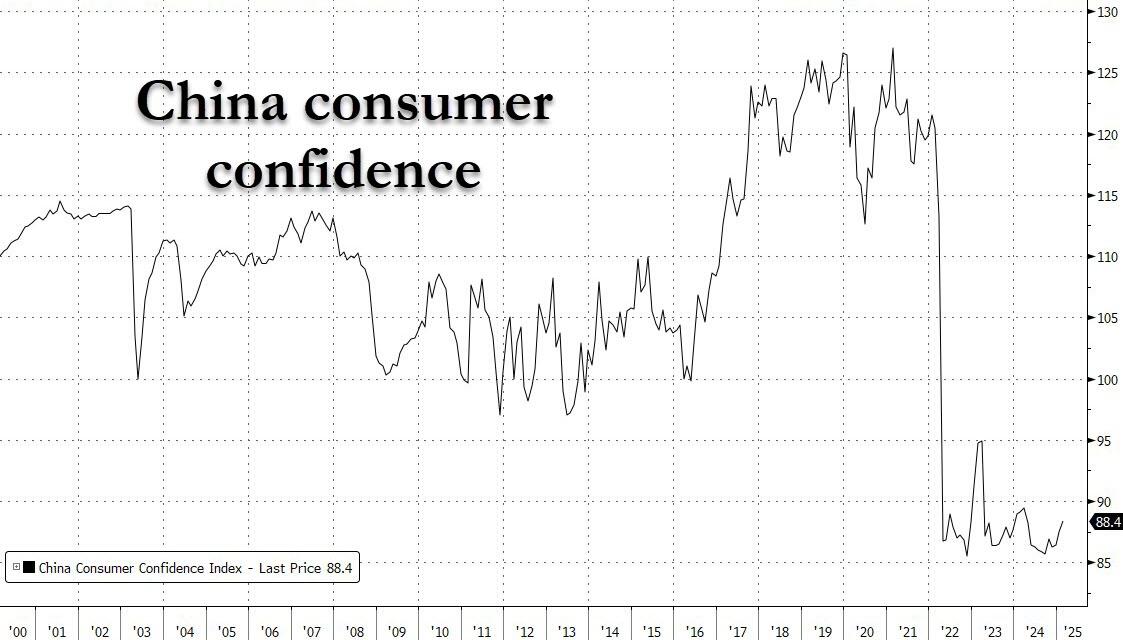

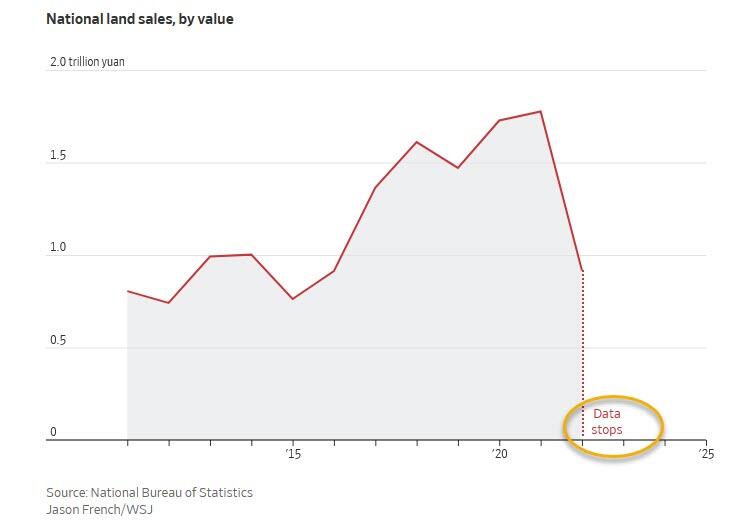

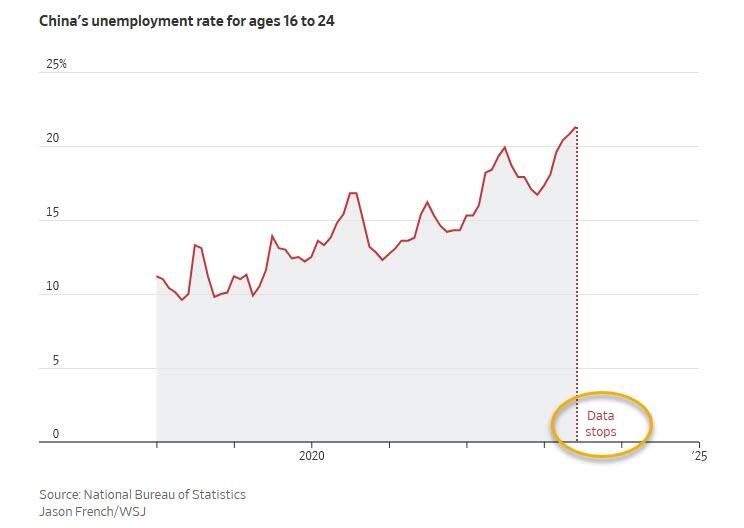

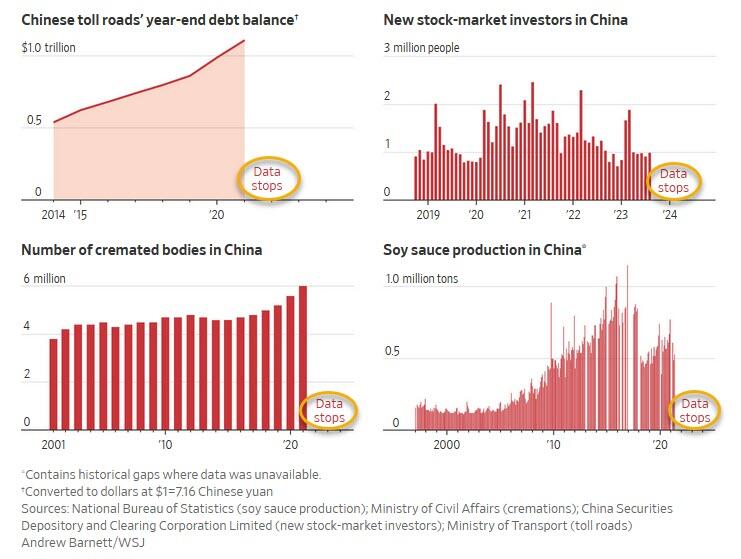

Starting the last several months, and, in some cases, dating back several years, China has gone dark in reporting the following: land sales, foreign investment, unemployment numbers, business confidence, numbers of investors in financial markets, real estate valuation, retail sales, and even vital data on cremations so that health authorities have no idea what is going on. The bureaus have simply stopped reporting.

With the second largest economy, and widespread doubt about the country’s economic health, this is gravely concerning.

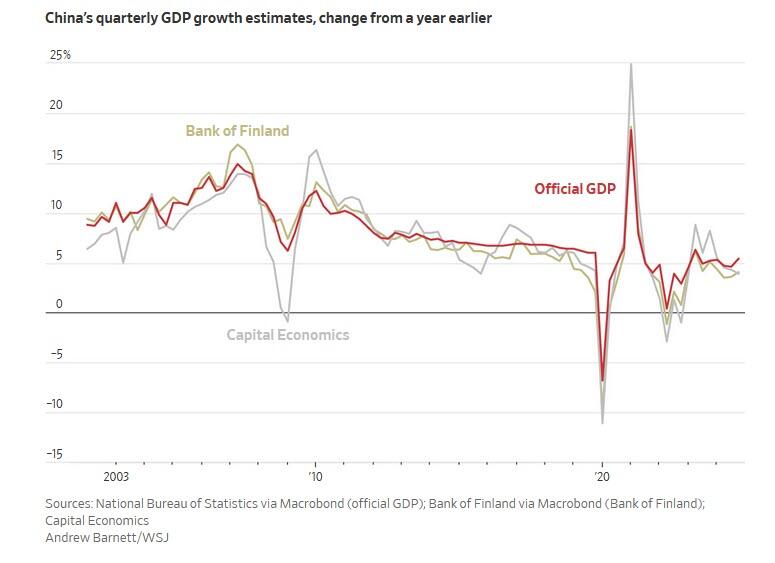

Close watchers have long raised doubts about China’s GDP data. We are told that the economy grew 5 percent last year, which would be extremely impressive. But such huge measures are subject to manipulation in every country but especially in one that has made the promise of extreme economic growth central to the power and permanent control by the CCP. Experts have suggested that growth rates have been exaggerated by 2 to 3 percentage points.

This past December, a highly regarded Chinese economist, Gao Shanwen, was visiting Washington, D.C. colleagues at the Peterson Institute and sat on an expert panel. Thinking that perhaps he should speak his mind, he said very plainly that no one knows for sure what the growth rates in China are. He speculated that they might be about 2 percent.

“My own speculation is that in the past two to three years,” he said, “the real GDP number on average might be around 2 percent even though the official number is close to 5 percent.”

No one in the room thought anything about it. The speaker seems to have temporarily forgotten that he is not an independent actor and was in no position to offer his objective assessment.

But word got out immediately in Beijing. He was immediately disciplined and silenced. He no longer holds a job in his old securities firm. His comments have been scrubbed from any sites accessible within China. He has lost his license to speak about economic affairs. Meanwhile, the Securities Association of China has instructed all people who speak about China’s economic health only to say nice things.

We can gather from the above that the data that was once routinely reported is not saying nice things. It’s one thing to silence the economists but to silence the underlying data only ends in raising alarm bells.

And those alarms have been rung, and now observers are considering the worst. There might be a hidden real estate crisis, and a major problem with unemployment added to it. Investment might be collapsing and government finances might be in major trouble.

For decades, China has developed a stable system for economic growth that relied on five main pillars:

Lower-cost manufacturing to compete and ultimately displace manufacturing in the West;

U.S. consumers hungry to get ahead of their own falling wages and salaries with cheaper consumer products and intermediate goods;

Central bank credits for business development built on large holdings of U.S. denominated debt;

A domestic currency trading far below the trade-weighted average of the U.S. dollar, the world reserve currency, thus favoring exports over imports;

State-directed and funded infrastructure development that calibrated investment based on national goals.

It was never the free market that pundits imagined that it would become in the 1990s and beyond. But it was also helped by a loose regulatory environment that minimized the litigation overhang that vexes Western economies, and its agency impositions were tolerant of enterprise insofar as it never threatened political priorities.

Crucially, China was able to benefit from the presumption that the global system of trade would never raise foundational questions about low tariffs and cross-border investment.

That last presumption has dramatically changed. The first Trump administration began the process of reevaluation. This was in 2018 and the result was a documented decline in U.S. imports from China. This was reversed two years later with the pandemic onset that called upon China to provide vast goods back into the United States. Mass numbers of Americans found themselves mandated to wear masks, for example, most of which were imports from China.

Five years later, the push to decouple the United States from dependence on China’s manufacturing sector is back on. The second Trump administration has wholesale reversed 80 years of U.S. precedent in trade policy with a turn toward tariffs. The hope is that these will help settle accounts, boost U.S. manufacturing, and provide a revenue stream to reduce reliance on high income taxation.

Whether and to what extent this dramatic shift has this effect domestically in the United States, it has likely had a major impact on China’s economic prospects, simply because it challenges a long-running assumption that the U.S. would forever serve as China’s consumer marketplace.

We should pause to consider the great irony of this whole situation. For centuries, businessmen have fantasized about the sheer size of China as a consumer, and imagined ways to invent products and services to sell.

“A pair of shoes for every Chinese foot;” “China’s market will make us rich;” “A market of 400 million customers”—these slogans were bandied about for a century.

But when it came right down to it, and herein we find the essence of the unpredictability of economic affairs, it was not China as consumer but China as manufacturer that dominated the landscape for decades following its opening.

Only now do we see full consciousness dawn in the United States concerning the implications for U.S. manufacturing.

What is to be done? A better path than protectionism is mass deregulation, a dollar more powerful at home and more competitive abroad, and lower costs of doing business through a renewal of the American entrepreneurial spirit. This will need to come one way or another. Trade barriers alone cannot hold back the tide.

Meanwhile, China suddenly faces its own grave economic challenges, which could grow so substantially as to threaten even the political stability of the country. Right now, outside observers have been largely blinded as to how serious the situation has become. We just don’t have the data.