Authored by Gail Tverberg via Our Finite World blog,

How today’s energy problem is different from peak oil

Many people believe that the economy will start going badly wrong when we “run out of oil.” The problem we have today is indeed an energy problem, but it is a different energy problem. Let me explain it with an escalator analogy.

Figure 1. Holborn Tube Station Escalator. Photo by renaissancechambara, CC BY 2.0 https://creativecommons.org/licenses/by/2.0, via Wikimedia Commons.

The economy is like a down escalator that citizens of the world are trying to walk upward on. At first the downward motion of the escalator is almost imperceptible, but gradually it gets to be greater and greater. Eventually the downward motion becomes almost unbearable. Many citizens long to sit down and take a rest.

In fact, a break, like the pandemic, almost comes as a relief. There is suddenly a chance to take it easy; not drive to work; not visit relatives; not keep up appearances before friends. Government officials may not be unhappy either. There may have been demonstrations by groups asking for higher wages. Telling people to stay at home provides a convenient way to end these demonstrations and restore order.

But then, restarting doesn’t work. There are too many broken pieces of the economy. Too many bankrupt companies; too many unemployed people; too much debt that cannot be repaid. And, a virus that really doesn’t quite go away, leaving people worried and unwilling to attempt to resume normal activities.

Some might describe the energy story as a “diminishing returns” story, but it’s really broader than this. It’s a story of services that we expect to continue, but which cannot continue without much more energy investment. It is also a story of the loss of “economies of scale” that at one time helped propel the economy forward.

In this post, I will explain some of the issues I see affecting the economy today. They tend to push the economy down, like a down escalator. They also make economic growth more difficult.

[1] Many resources take an increasing amount of effort to obtain or extract, because we use the easiest to obtain first. Many people would call this a diminishing returns problem.

Let’s look at a few examples:

(a) Water. When there were just a relatively few humans on the earth, drinking water from a nearby stream was a reasonable approach. This is the approach used by animals; humans could use it as well. As the number of humans rose, we found we needed additional approaches to gather enough potable water: First shallow wells were dug. Then we found that we needed to dig deeper wells. We found that lake water could be used, but we needed to filter it and treat it first. In some places, now, we find that desalination is needed. In fact, after desalination, we need to put the correct minerals back into it and pump it to the destination where it is required.

All of these approaches can indeed be employed. In theory, we would never run out of water. The problem is that as we move up the chain of treatments, an increasing amount of energy of some kind needs to be used. At first, humans could use some of their spare time (and energy) to dig wells. As more advanced approaches were chosen, the need for supplemental energy besides human energy became greater. Each of us individually cannot produce the water we need; instead, we must directly, or indirectly, pay for this water. The fact that we have to pay for this water with part of our wages reduces the portion of our wages available for other goods.

(b) Metals. Whenever some group decides to mine a metal ore, the ore that is taken first tends to be easy to access ore of high quality, close to where it needs to be used. As the best mines get depleted, producers use lower-grade ores, transported over longer distances. The shift toward less optimal mines requires more energy. Some of this additional energy could be human energy, but some of the energy would be supplied by fossil fuels, operating machinery in order to supplement human labor. Supplemental energy needs become greater and greater as mines become increasingly depleted. As technology advances, energy needs become greater, because some of the high-tech devices require materials that can only be formed at very high temperatures.

(c) Wild Animals Including Fish. When pre-humans moved out of Africa, they killed off the largest game animals on every continent that they moved to. It was still possible to hunt wild game in these areas, but the animals were smaller. The return on the human labor invested was smaller. Now, most of the meat we eat is produced on farms. The same pattern exists in fishing. Most of the fish the world eats today is produced on fish farms. We now need entire industries to provide food that early humans could obtain themselves. These farms directly and indirectly consume fossil fuel energy. In fact, more energy is used as more animals/fish are produced.

(d) Fossil Fuels. We keep hearing about the possibility of “running out” of oil, but this is not really the issue with oil. In fact, it is not the issue with coal or natural gas, either. The issue is one of diminishing returns. There is (and always will be) what looks like plenty left. The problem is that the process of extraction consumes increasing amounts of resources as deeper, more complex oil or gas wells need to be drilled and as coal mines farther away from users of the coal are developed. Many people have jumped to the conclusion that this means that the price that buyers of fossil fuel will pay will rise. This isn’t really true. It means that the cost of production will rise, leading to lower profitability. The lower profitability is likely to be spread in many ways: lower taxes paid, cutbacks in wages and pension plans, and perhaps a sale to a new owner, at a lower price. Eventually, low energy prices will lead to production stopping. Without adequate fossil fuels, the whole economic system will be disrupted, and the result will be severe recession or depression. There are also likely to be many job losses.

In (a) through (d) above, we are seeing an increasing share of the output of the economy being used in inefficient ways: in creating deeper water wells and desalination plants; in drilling oil wells in more difficult locations; in extracting metal ores that are mostly waste products. The extent of this inefficiency tends to increase over time. This is what leads to the effect of an escalator descending faster and faster, just as we humans are trying to walk up it.

Humans work for wages, but they find that when they buy a box of corn flakes, very little of the price actually goes to the farmer growing the corn. Instead, all of the intermediate parts of the system are becoming overly large. The buyer cannot afford the end products, and the producer feels cheated by the low wholesale prices he is being paid. The system as a whole is pushed toward collapse.

[2] Increasing complexity can help maintain economic growth, but it too reaches diminishing returns.

Complexity takes many forms, including more hierarchical organization, more specialization, longer supply chains, and development of new technology. Complexity can indeed help maintain economic growth. For example, if water supply is intermittent, a country may choose to build a dam to control the flow of water and produce electricity. Complexity tends to reach diminishing returns, as noted by Joseph Tainter in The Collapse of Complex Societies. For example, economies build dams in the best locations first, and only later build them at less advantageous sites. These are a few other examples:

(a) Education. Teaching everyone to read and write has significant benefits because it allows the use of books and other written materials to disseminate information and knowledge. Teaching a few people advanced subjects has significant benefits as well. But after a certain point, the need for additional people to study a subject such as art history is low. A few people can teach the subject but doing more research on the subject probably won’t increase world GDP very much.

When we look at data from about 1970, we find that people with advanced education earned much higher incomes than those without advanced degrees. But as we add an increasing large share of people with these advanced degrees, jobs that really need these degrees are not as plentiful as the new graduates. Quite a few people with advanced degrees end up with low-paying jobs. The “return on investment” for higher education drops increasingly lower. Some students are not able to repay the debt that they took out in order to pay for their education.

(b) Medicines and vaccines. Over the years, medicines and vaccines have been developed to treat many common illnesses and diseases. After a while, the easy-to-find medicines for the common unwanted conditions (such as diabetes, high blood pressure and inflammation) have already been found. There are medicines for rare diseases that haven’t been found, but these will never have very large total sales, discouraging investment. There are also conditions that are common in very poor countries. While expensive drugs could be developed for these conditions, it is likely that few people could afford these drugs, so this, too, becomes less attractive.

If research is to continue, it is important to keep expanding work on expensive new drugs, even if it means completely ignoring old inexpensive drugs that might work equally well. A cynical person might think that this is the reason why vitamin D and ivermectin are generally being ignored in the prevention and treatment of COVID-19. Without an expanding group of high-priced new drugs, it is hard to attract capital and young workers to the field.

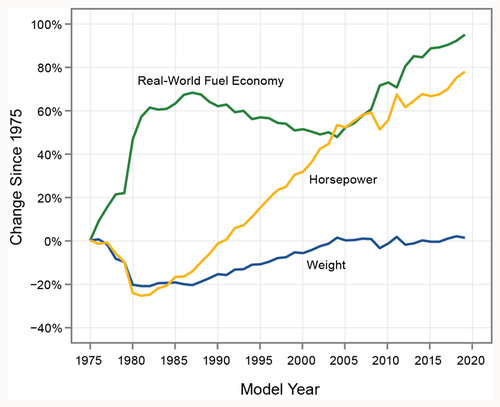

(c) Automobile efficiency. In the US, the big fuel efficiency change that took place was that which took place between 1975 and 1983, when a changeover was made to smaller, lighter vehicles, similar to ones that were already in use in Japan and Europe.

Figure 2. Estimated Real-World Fuel Economy, Horsepower, and Weight Since Model Year 1975, in a chart produced by the US Environmental Protection Agency. Source.

The increase in fuel efficiency between 2008 and 2019 (an 11 year period) was only 22%, compared to the 60% increase in fuel efficiency between 1975 and 1983 (an 8 year period). This is another example of diminishing returns to investment in complexity.

[3] Today’s citizens have never been told that many of the services we take for granted today, such as suppression of forest fires, are really services provided by fossil fuels.

In fact, the amount of energy required to provide these services rises each year. We expect these services to continue indefinitely, but we should be aware that they cannot continue very long, unless the energy available to the economy as a whole is rising very rapidly.

(a) Suppression of Forest Fires. Forest fires are part of nature. Many trees require fire for their seeds to germinate. Human neighbors of forests don’t like forest fires; they often encourage local authorities to put out any forest fire that starts. Such suppression allows an increasing amount of dry bush to build up. As a result, future fires spread more easily and grow larger.

At the same time, humans increasingly build homes in forested areas because of the pleasant scenery. As population expands and as fires spread more easily, forest fire suppression takes an increasing amount of resources, including fossil fuels to power helicopters used in the battles. If fossil fuels are not available, this type of service would need to stop. Trying to keep forest fires suppressed, assuming fossil fuels are available for this purpose, will take higher taxes, year after year. This is part of what makes it seem like we are trying to move our economy upward on a down escalator.

(b) Suppression of Illnesses. Illnesses are part of the cycle of nature; they disproportionately take out the old and the weak. Of course, we humans don’t really like this; the old and weak are our relatives and close friends. In fact, some of us may be old and weak.

In the last 100 years, researchers (using fossil fuels) have developed a large number of antibiotics, antivirals and vaccines to try to suppress illnesses. We find that microbes quickly mutate in new ways, defeating our attempts at suppression of illnesses. Thus, we have ever-more antibiotic resistant bacteria. The cost of today’s US healthcare system is very high, exceeding what many poor people can afford to pay. Introducing new vaccines results in an additional cost.

Closing down the system to try to stop a virus adds a huge new cost, which is disproportionately borne by the poor people of the world. If we throw more money/fossil fuels at the medical system, perhaps it can be made to work a little longer. No one tells us that disease suppression is a service of fossil fuels; if we have an increasing quantity of fossil fuels per capita, perhaps we can increase disease suppression services.

(c) Suppression of Weeds and Unwanted Insects. Researchers keep developing new chemical treatments (based on fossil fuels) to suppress weeds and unwanted insects. Unfortunately, the weeds and unwanted insects keep mutating in a way that makes the chemicals less effective. The easy solutions were found first; finding solutions that really work and don’t harm humans seems to be elusive. The early solutions were relatively cheap, but later ones have become increasingly expensive. This problem acts, in many ways, like diminishing returns.

(d) Recycling (and Indirectly, Return Transport of Empty Shipping Containers from Around the World). When oil prices are high, recycling of used items for their content makes sense, economically. When oil prices are low, recycling often requires a subsidy. This subsidy indirectly goes to pay for fossil fuels used to facilitate the recycling. Often this goes to pay for shipment to a country that will do the recycling.

When oil prices were high (prior to 2014), part of the revenue from recycling could be used to transport mixed waste products to China and India for recycling. With low oil prices, China and India have stopped accepting most recycling. Instead, it is necessary to find actual “goods” for the return voyage of a shipping container or, alternatively, pay to have the container sent back empty. Europe now seems to have a difficult time filling shipping containers for the return voyage to Asia. Because of this, the cost of obtaining shipping containers to ship goods to Europe seems to be escalating. This higher cost acts much like diminishing returns with respect to the transport of goods to Europe from Asia. This is yet another part of what is acting like a down escalator for the world economy.

[4] Another, ever higher cost is pollution control. This higher cost also exerts a downward effect on the world economy, because it acts like another intermediate cost.

As we burn increasing amounts of fossil fuels, increasing amounts of particulate matter need to be captured and disposed of. Capturing this material is only part of the problem; some of the waste material may be radioactive or may include mercury. Once the material is captured, it needs to be “locked up” in some way, so it doesn’t pollute the water and air. Whatever approach is used requires energy products of various kinds. In fact, the more fossil fuels that are burned, the bigger the waste disposal problem tends to be.

Burning more fossil fuels also leads to more CO2. Unfortunately, we don’t have suitable alternatives. Nuclear is probably as good as any, and it has serious safety issues. In my opinion, the view that intermittent wind and solar are a suitable replacement for fossil fuels represents wishful thinking. Wind and solar, because of their intermittency, can only partially replace the coal or natural gas burned to generate electricity. They cannot be relied upon for 24/7/365 generation. The unsubsidized cost of producing intermittent wind and solar energy needs to be compared to the price of coal and natural gas, not to wholesale electricity prices. There are a lot of apples to oranges comparisons being made.

[5] Among other things, the growth of the economy depends on “economies of scale” as the number of participants in the economy gradually grows. The response to COVID-19 has been extremely detrimental to economies of scale.

The economies of many countries changed dramatically, with the initial spread of COVID-19. Unfortunately, we cannot expect these changes to be completely reversed anytime soon. Part of the reason is the new virus mutation from the UK that is now of concern. Another reason is that, even with the vaccine, no one really knows how long immunity will last. Until the virus is clearly gone, vestiges of the cutbacks are likely to remain in place.

In general, businesses do well financially, as the number of buyers of the goods and services they provide rises. This happens because overhead costs, such as mortgage payments, can be spread over more buyers. The expertise of the business owners can also be used more widely.

One huge problem is the recent cutback in tourism, affecting almost every country in the world. This cutback affects both businesses directly related to tourism and businesses indirectly related to tourism, such as restaurants and hotels.

Another huge problem is social distancing rules that lead to office buildings and restaurants being used less intensively. Businesses find that they tend to have fewer customers, rather than more. Related businesses, such as taxis and dry cleaners, find that they also have fewer customers. Nursing homes and other care homes for the aged are seeing lower occupancy rates because no one wants to be locked up for months on end without being able to see other members of their family.

[6] With all of the difficulties listed in Items [1] though [5], debt based financing tends to work less and less well. Huge debt defaults can be expected to adversely affect banks, insurance companies and pension plans.

Many businesses are already near default on debt. These businesses cannot make a profit with a much reduced number of customers. If no change is possible, somehow this will need to flow through the system. Defaulting debt is likely to lead to failing banks and pension plans. In fact, governments that depend on taxes may also fail.

The shutdowns taken by economies earlier this year were very detrimental, both to businesses and to workers. A major solution to date has been to add more governmental debt to try to bail out citizens and businesses. This additional debt makes it even more difficult to maintain promised debt payments. This is yet another force making it difficult for economies to move up the growth escalator.

[7] The situation we are headed for looks much like the collapses of early civilizations.

With diminishing returns everywhere, and inadequate sources of very inexpensive energy to keep the system going, major parts of the world economic system appear headed for collapse. There doesn’t seem to be any way to keep the world economy growing rapidly enough to offset the down escalator effect.

Citizens have not been aware of how “close to the edge” we have been. Low energy prices have been deceptive, but this is what we should expect with collapse. (See, for example, Revelation 18: 11-13, telling about the lack of demand for goods of all kinds when ancient Babylon collapsed.) Low prices tend to keep fossil fuels in the ground. They also tend to discourage high-priced alternatives. Unfortunately, all the wishful thinking of the World Economic Forum and others advocating a Green New Deal does not change the reality of the situation.

No comments:

Post a Comment