Are all the stars lining up for a momentous 2022 year?

If growth falter and resentment explodes in China, will a takeover of Taiwan suddenly look like an acceptable risk?

Authored by Niall Ferguson, op-ed via Bloomberg.com,

The developer’s collapse isn’t leading to global contagion, but China’s looming economic disaster might...

A major mistake of the Cold War was the tendency of Western observers to overestimate the Soviet Union. I have often wondered if the same mistake is being repeated with the People’s Republic of China. Then again, for every article over the last 10 years that predicted China’s economy would overtake that of the U.S., there were at least two prophesying a “China crisis.”

“The endgame of Chinese communist rule has now begun,” wrote David Shambaugh in 2015.

Wisely, he added: “Its demise is likely to be protracted.”

That same year, Jim Chanos of Kynikos Associates warned, “We’re getting inexorably to a tipping point in China.”

Last week began with yet another China tipping point. The impending collapse of the giant property developer China Evergrande Group, we were warned, could be China’s “Lehman Moment.” For 24 hours, global stock markets retreated by a couple of percentage points. By Tuesday morning, however, the story appeared to be over. The jitters subsided and investors got back to parsing the utterances of U.S. Federal Reserve Chair Jay Powell to make sure that nothing he said was surprising.

So if the China crisis never happens — no matter how many times China permabears like Chanos predict it — does China eventually overtake the U.S.? Thus far, it has done so only in terms of gross domestic product adjusted on the basis of “purchasing power parity,” which allows for the fact that a meal in Chongqing is quite a bit cheaper than one in Chicago. On a current dollar basis, China’s GDP last year was still just 72% of U.S. GDP, even with Hong Kong included.

Will China surpass America? No, I don’t think so. Nearly three years ago, in the heat of a lively debate in Seoul, I bet the Chinese economist Justin Yifu Lin 20,000 yuan (roughly $3,000) that China’s economy — defined as GDP in current dollars — would not overtake that of the U.S. in the next 20 years. I am sticking with that bet, even if the Lehman Moment for the Chinese financial system never comes. Here’s why.

Let’s begin by recalling how many experts believed the Soviets would overtake America. In successive editions, the economist Paul Samuelson’s hugely influential economics textbook carried a chart projecting that the gross national product of the Soviet Union would exceed that of the U.S. at some point between 1984 and 1997. The 1967 edition suggested that the great overtaking could happen as early as 1977. By the 1980 edition, the time frame had been moved forward to 2002-2012. The graph was quietly dropped after that.

Samuelson was by no means the only American scholar to make this mistake. A late as 1984, Harvard’s liberal guru John Kenneth Galbraith could still insist that “the Russian system succeeds because, in contrast with the Western industrial economies, it makes full use of its manpower.” Economists who discerned the miserable realities of the planned economy, such as G. Warren Nutter of the University of Virginia, were few and far between — almost as rare as historians, such as Robert Conquest, who grasped the enormity of the Soviet system’s crimes against its own citizens.

We know now how wrong Samuelson, Galbraith et al. were. After 1945, according to the late Angus Maddison’s estimates, the Soviet economy was never more than 44% the size of that of the U.S. By 1991, Soviet GDP was less than a third of U.S. GDP.

China has of course learned lessons from the Soviet experience. Beginning in the late 1970s with Deng Xiaoping, China’s leaders understood that the Communist Party could harness market forces for the perpetuation of their own power, but they must never relax the party’s political grip. If there is one thing the CCP can be relied on never to produce, it is a Chinese Mikhail Gorbachev.

In the same way, the Chinese have learned from the American experience. I remember vividly how, in the wake of the 2008 collapse of Lehman Brothers, eminent Chinese economists visited Harvard (where I taught at the time) and doubtless many other institutions to research the causes of the global financial crisis. Somewhere in President Xi Jinping’s office there must be a copy of the report they subsequently wrote. If there is another thing the CCP can be relied on never to produce, it is a Chinese Lehman Moment.

Yet, as the great English historian A.J.P. Taylor once observed of the French Emperor Napoleon III, he “learned from the mistakes of the past how to make new ones.” As I contemplate Xi, I find myself wondering if the Communist Party has inadvertently produced a Chinese version of Napoleon III, whose reign was also marked by rampant real estate development. (The Paris you see today was in large measure the achievement of his prefect of the Seine, Georges-Eugene Haussmann.)

Evergrande is mainly significant as an illustration of how the Chinese economic model has evolved over the past decades of urbanization on steroids. It is China’s second-largest property developer, with an estimated $355 billion of assets across 1,300 developments. It has around 200,000 employees, and usually hires 3-4 million laborers a year for construction work.

It is also the most-indebted property developer in the world, with on-balance-sheet liabilities equivalent to nearly 2% of China’s annual GDP, and off-balance-sheet obligations equal to another 1%. Among its liabilities are $37 billion in bills and trade payables owed to suppliers and contractors, and an estimated $6 billion in high-yielding wealth management products, which it has sold to more than 80,000 retail investors.

Evergrande is just one of many such leveraged real estate companies in China. It just happens to be the most overstretched, so it was the first to get in trouble when the government introduced its “three red lines.” These specified that a property developer’s ratio of liabilities to assets must be below 70%; its ratio of net debt to equity below 100%; and its ratio of cash to short-term debt at least 100%. Evergrande was on the wrong side of all three lines, but it was in good company. Of the country’s 15 biggest developers, only one is fully compliant with the new rules, according to data in the South China Morning Post.

When the Chinese government decides to make an example of an over-leveraged player, we know what happens next, and it’s not a global financial crisis — not even a domestic one. There will be some more brinkmanship, as there was last week, with some bondholders (onshore) getting paid and others (offshore) being asked to wait. But at some point soon — probably before the October holiday — the government will force through a formal restructuring and bankruptcy process. Those considered politically important will get off lightly; the politically disposable will lose their shirts; a few top executives will face jail. That was what happened with the travel conglomerate HNA Group Co. in 2018. It was what happened to Baoshang Bank Co. in May 2019.

The most sanguine take I read last week came from the always interesting MacroPolo series of papers published by the Paulson Institute, founded by former Treasury Secretary Hank Paulson (himself something of an authority on Lehman Moments). According to Houze Song, the Evergrande crisis was the result of a policy error, because “China’s financial regulators … preoccupied with stifling a property and land sales bubble … mandated banks to cut back on mortgage loans.” Fewer mortgages drove down housing prices, pushing Evergrande to the brink of insolvency. However, everything will turn out fine because:

1) The central bank will further relax mortgage policy to alleviate the liquidity crunch for the property sector;

2) Property sales will rebound as demand for housing remains healthy;

3) The more vulnerable firms will be able to sell their assets (e.g., land) to raise cash.

“These dynamics will be mutually reinforcing,” he concludes, “and will help to stabilize the property sector as it muddles through this year.”

The People’s Bank of China has already taken action. On Thursday, it sought to alleviate the financial stress with the equivalent of $17 billion in the form of seven- and 14-day reverse repurchase agreements, its largest open-market operation since January. Evergrande shares in Hong Kong duly rallied. Crisis over. Stand down the plunge protection team.

All this goes to show that a Lehman Moment was never in the cards. China’s state-controlled financial system has state-controlled crises, which are targeted at particular firms “pour encourager les autres”— not to trigger the kind of generalized bank run that drove the global financial system to the point of collapse in the winter of 2008-2009.

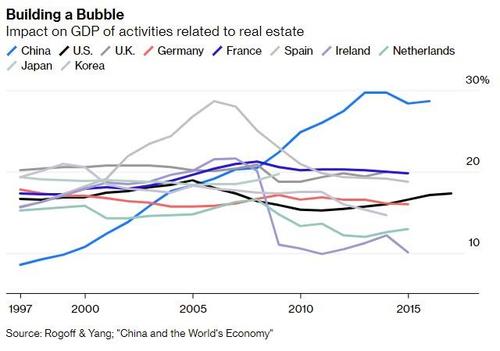

Nevertheless, it is possible to avoid financial contagion without necessarily avoiding a more insidious macroeconomic contagion. As the Harvard economist Ken Rogoff showed last year in a paper co-authored with Yuanchen Yang of Beijing’s Tsinghua University, real estate plays an even bigger role in China’s economy today than it did in the U.S. economy on the eve of the financial crisis. The impact of real estate-related activities amounted to 18.9% of U.S. GDP in 2005, its pre-crisis peak. The equivalent figure for China in 2016 was 28.7%. None of the 10 other countries in their sample come close, except Spain on the eve of the financial crisis (28.7% in 2006).

The detail is eye-popping. In all, around 27% of Chinese bank loans come from the real estate sector. Real estate is the main form of collateral for loan securitization. In 2017, almost 18% of the urban labor force was employed in real estate and related industries. In 2018, the sale of land by local governments accounted for as much as 35% of their revenues.

Much as happened in Japan in the housing bubble of the late 1980s, the market value of China’s housing stock is now more than double that of the U.S. and triple that of Europe. This means that housing wealth forms a significantly larger share of overall assets in China (78%) than it does in the U.S. (35%). Rogoff and Yang conclude that Chinese households’ consumption is therefore “significantly more sensitive to a decline in housing prices” than that of their American and Japanese counterparts. A “20% fall in real estate activity could lead to a 5-10% fall in GDP, even without amplification from a banking crisis, or accounting for the importance of real estate as collateral.”

To put it simply, China’s growth has been boosted for many years by the construction of an excess supply of housing units. This has been financed by an unsustainable mountain of debt. As the Beijing-based economist Michael Pettis noted last week, “China’s official debt-to-GDP ratio has soared by nearly 45 percentage points in the past five years, leaving it with among the highest debt ratios for any developing country in history.”

Relative to the size of the economy, nonfinancial corporate debt in China is now even bigger than it was in Japan in the late 1980s. And both tower blocks and debts have been going up at a time when the Chinese workforce has begun to come down. With the birthrate falling, the total population is forecast by the United Nations to shrink by around 25% by the end of the century — conceivably even by 50%.

The result is not so much the proverbial bridges to nowhere as homes for no one. Between a fifth and a quarter of Chinese housing stock is estimated to be empty. Last week, the Rhodium Group’s Logan Wright estimated that there was enough empty property in China to house more than 90 million people.

Of course, no “China crisis” article for the past 20 years has been complete without images of uninhabited ghost cities. But there was always the counterargument: “If you build it, they will come.” Well, they built 15 high-rise apartment blocks in the southwestern city of Kunming back in 2013. Unfortunately, the developer ran out of money and the buildings turned out to be defective. Last month, “Sunshine City II” was spectacularly demolished in a succession of controlled explosions. That one video clip impressed me more than all the ghost city videos I’ve seen over the years. Nothing says “wealth destruction” quite like toppling tower blocks.

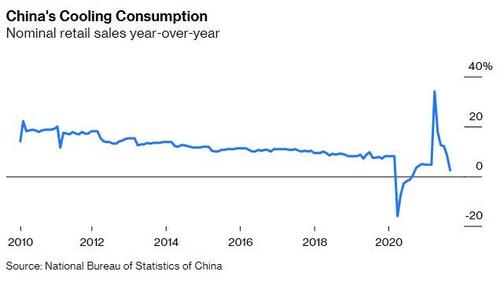

The crisis in real estate has much wider ramifications than the inevitable restructuring of Evergrande. Other developers are under pressure (the fact that one is called Fantasia says it all). Housing sales are down. So are land sales by local governments. Exposed banks are under pressure, as are the steel producers and iron-ore exporters who for so long grew rich on Chinese construction. And, as falling apartment prices reduce household wealth — just as Rogoff and Yang foresaw — we can expect a significant impact on consumption. The August data already showed a decline in year-on-year retail sales growth from 8.5% in July to 2.5%, though this partly reflected the effects of anti-Covid restrictions. That slowdown seems likely to persist through September and October.

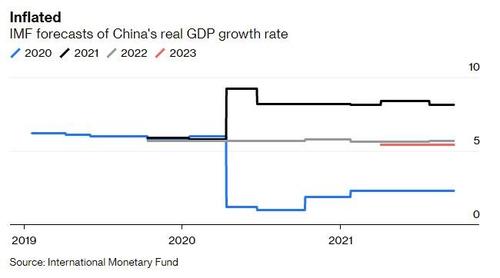

For years, Pettis and others have argued that China’s growth rates were artificially inflated and that the steroid-free growth rate was probably half the official target. Some China economists quoted in the press last week suggested a growth rate closer to 4% in the coming decade. Leland Miller, of China Beige Book, even suggested a rate of 1% or 2% 10 years from now.

It will be interesting to see if the International Monetary Fund revises down its growth projections for China in next month’s World Economic Outlook. Back in the summer of 2020, the IMF thought China’s economy would grow 9.2% this year and 5.7% next year. The 2021 figure has since been lowered to 8.1%. The most recent 2023 projection was 5.4%. All these numbers look on the high side to me, even allowing for the unreliability of Chinese statistics. (Thank heavens the managing director of the IMF would never contemplate overstating China’s economic performance! Oh wait, that’s precisely what Kristalina Georgieva is accused of having done when she was at the World Bank.)

Many foreign investors have been on the wrong side of all this. In the 15 months through June 2021, they poured $527 billion into Chinese stocks and bonds. A good deal of that money found its way via the offshore dollar bond market into high-yielding real estate debt. Among the funds known to hold Evergrande debt are Fidelity International Ltd., UBS Asset Management, Amundi Asset Management SA, and BlackRock Inc. Last week it fell to Ray Dalio of Bridgewater Associates to rally the China bulls. The Evergrande crisis was “all manageable,” he said. The system would be “protected.” But it Is striking that on Aug. 3, George Soros warned investors in China that they faced “a rude awakening,” and on Sept. 6, he called out “BlackRock’s China Blunder.” When Soros and Kyle Bass are on the same side, things get interesting. (Bass’s fund, Hayman Capital Management, has been short China for years.)

“The regime which is destroyed by a revolution is almost always an improvement on its immediate predecessor,” wrote Alexis de Tocqueville in “The Old Regime and the Revolution.” “And experience teaches that the most critical moment for bad governments is the one which witnesses their first steps toward reform.” I often thought of that passage as I watched Gorbachev inadvertently destroy the Soviet Union by trying to reform it. Only recently did it occur to me that it might also apply to Xi, the anti-Gorbachev. Although his reforms go in the opposite direction from Gorbachev’s — turning back the political clock to Marxism-Leninism, rather than forward to liberalism — the effect may be the same.

Xi’s crackdown on the property developers is just the latest blow he has struck against “capitalism with Chinese characteristics.” First in line were the big tech companies — Alibaba Group Holding Ltd., Tencent Holdings Ltd. and ride-sharing leader Didi Global Inc. Then it was the turn of the for-profit education sector. All of this reflects Xi’s conviction that China needs to move from “fictional growth” to “genuine growth,” and his determination to make the old CCP slogan of “common prosperity” a meaningful antidote to the rampant inequality of the “get rich quick” era. Investors who have ignored this anticapitalist turn in China have only themselves to blame if they have lost money.

Likewise, analysts who continue to predict a Chinese economic takeover of the world have only themselves to blame if they have failed to learn the lessons of the Soviet collapse. Perhaps, to paraphrase Taylor, Xi has learned from the crises of others only how to make a crisis of his own.

No comments:

Post a Comment