Remember the Repo market crisis of late 2019? Everything was on the verge of exploding... Then magically the Corona virus appeared and suddenly monetary constrains were not a problem anymore. Trillions of Dollars, Euros and Yens were suddenly available and a crisis replaced another one.

But monetary crisis never go away. They can be delayed but then come back with a vengeance. And here we are 3 years later, with giant deficits and rising interest rates...

Authored by John Rubino via Substack,

Gold bugs and other long-suffering critics of fiat currency and endless credit expansion have for decades been predicting that soaring debt would eventually blow up the financial world.

As the story went, governments with unlimited printing presses would spend and borrow too much, forcing their central banks to keep interest rates unnaturally low to make interest costs manageable, which would encourage even more credit growth, causing inflation to spike, and so on, until everyone loses faith in fiat currencies and the misbegotten things fall to their intrinsic value of zero.

That’s a bit hard to visualize when it’s explained in long, convoluted sentences. But it’s a lot clearer when you line up the relevant charts. So let’s start with US government debt, which has gone parabolic.

Ever-increasing debt is manageable if interest rates fall concurrently so the interest on that debt doesn’t change. And that’s what happened between 1980 and 2021. The Fed pushed down interest rates, which minimized interest costs, which lulled a shockingly gullible investment community and political class into the belief that this process could continue forever.

But of course it couldn’t continue forever.

As the critics predicted, soaring debt required ever greater currency creation which eventually caused the cost of living to jump by 10% in 2022, leading regular people to demand that it stop. So the Fed now has to raise interest rates to counter inflation. You can see this happening on the far right of the above chart.

Here’s where the death spiral kicks in

As the US borrows more money and its existing debts roll over at higher rates, the cost of that debt is soaring. This year the government’s annual interest bill will break $1 trillion. Combine that with the soaring cost of Medicare and Social Security as millions of Baby Boomers retire, and Washington is looking at $2 trillion a year just in just interest and entitlements, which it will have to borrow to fund, which will send interest costs even higher, which will require more borrowing, and so on, until it all comes crashing down.

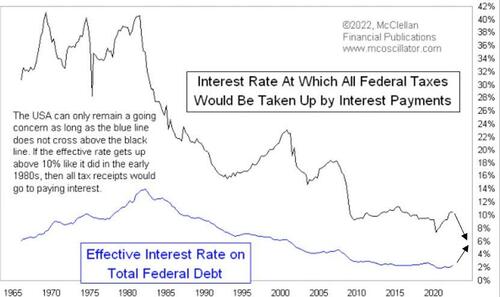

Here’s another useful way of visualizing the problem. As debt rises, the interest rate required to keep debt service costs from eating all of a government’s tax receipts falls. In the US case, those two lines are in danger of crossing in the next few years. No society has ever survived that kind of fiscal crisis.

To the extent that the Fed knows anything, it knows this, and really, really wants to force that blue line down into negative territory if possible. But it also knows that doing so will send prices spiraling out of control – which is another way of saying the dollar will crash (not necessarily against the euro and the yen, which have similar problems, but against oil, lumber, eggs, milk, cars, and all the other things voters buy regularly). The result? Political and financial chaos.

And there’s nothing that the monetary authorities can do to stop it, because either choice – keep interest rates high or push them back down – leads to the same place, which is a currency crisis. Meanwhile, each turn of the wheel makes the problem more intractable and the collapse more imminent. That’s what the term “death spiral” refers to: a process that feeds on itself until the system implodes.

No comments:

Post a Comment