So "no inflation", "foreign producers should absorb the tariff!" Right?

In reality, it has been known almost forever that different type of products react differently to tariff and inflation.

The first category is manufactured goods for which the principle holds. Competition for these products is fierce and the opportunity to raise prices and keep market share almost non existent. We are talking about Japanese cars and Chinese "Walmart" goods. And we are indeed beginning to see these companies in Japan and China suffer mightily from the tariffs, without even mentioning German manufacturers which margins are being hammered.

But then there is food and especially those items like coffee which cannot easily be substituted. Here the price tend to be controlled internationally by offer and demand. And in this case the tariff will almost completely be absorbed by importers who must therefore raise their prices.

And then there is this more fundamental cause of inflation which is too much money chasing too few goods. And for this, the deficit of the US Government is the key. As long as foreigners absorb the surplus of dollar, somehow inflation is being exported and prices in the US can stay flat. But as soon as demand for the dollar goes down, which is the case now, then the US ends up with a surplus of currency and consequently residual inflation. This is unavoidable.

All this is the reason why we warned earlier that the impact of the tariffs would be complex and need time to unfold. What we will see in the coming months is the following: Inflation will rise, mildly but it will be an average between low inflation for manufactured products and very high inflation for food. This usually is a sign of stagflation. The FED will lower rates but it will have exactly zero effect on inflation unless the US plunges in a deep recession and demand crashes in which case the Trump administration will be obliged to shower people with cash (the tariff dividends they are already thinking about) which will further increase the discrepancy between manufactured goods and food & energy.

In the end, the US like Europe and so many other countries will end up controlling the message but not inflation. "Listen to what we are telling you, not to your lying eyes!" "Inflation is 3%. The 38% you are seeing is not real, it's a monthly fluke. Eventually prices will come down!" And so they will... by a few %. They will still be 25% up year on year!

Authored by Michael Snyder via The Economic Collapse blog,

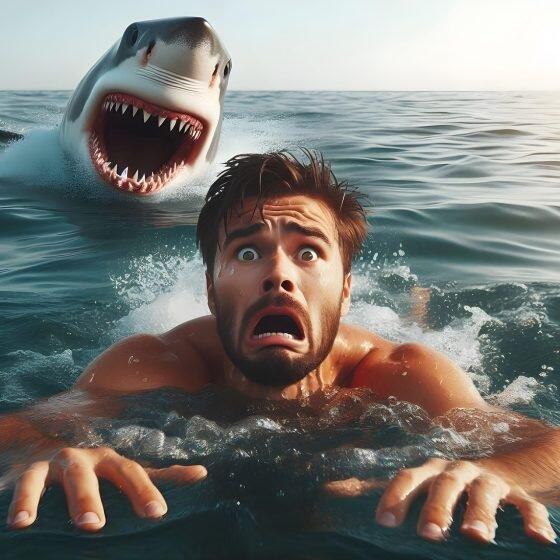

Do you feel knots in your stomach due to financial stress? If so, you certainly have lots of company. All of a sudden, everyone is talking about the cost of living and prices are rising by double-digit percentages all around us. There are so many people out there right now that feel like they are “drowning” because no matter how hard they try there simply isn’t enough money for everything. Unfortunately, we are being warned to brace ourselves for even more inflation in the months ahead.

When I heard that the cost of vegetables in the United States had gone up by 40 percent in one month, I thought that there was no way that it could be true.

So I looked it up, and I discovered that the cost of vegetables in the United States didn’t go up by 40 percent in one month.

The real figure was 38.9 percent…

A 38.9% increase in prices for fresh and dry vegetables from June to July was the major driver of a higher index for “final demand goods” (things that are done and ready to be sold to a consumer, as opposed to things that go into a later production process).

That is nuts!

How can the cost of vegetables go up by 38.9 percent in a single month?

Apparently this was the largest spike that we have ever witnessed in a summer month “in figures that go back to 1947”…

Per Bureau of Labor Statistics data, it’s also the largest monthly increase ever recorded in a summer month (June-August), in figures that go back to 1947.

The other day, I wrote about how beef has become so expensive that it is now considered to be a “luxury”.

Well, now vegetables are a “luxury” too.

And let’s not forget coffee.

The price of coffee went up by 25 percent in just three months, and that was before coffee exports from Brazil were hit with a 50 percent tariff…

Coffee prices were already up before a 50 percent tariff on Brazil, the top coffee importer to the U.S., went into effect last week.

Coffee prices sharply rose 25 percent over the past three months, according to inflation data released Tuesday. Reuters reported Tuesday that Brazilian coffee exports have started seeing postponements to their U.S. shipments.

About two-thirds of all U.S. adults drink coffee.

This is one of the most basic things that Americans buy.

But now a lot of people are either going to have to cut back or stop drinking it entirely because it has become so ridiculously expensive.

Air conditioning is rapidly becoming a “luxury” as well.

Electricity prices have been rising twice as fast as the overall rate of inflation, and some seniors must now choose between paying the electricity bill and paying for medication…

Across the country, electricity prices have jumped more than twice as fast as the overall cost of living in the last year. That’s especially painful during the dog days of summer, when air conditioners are working overtime.

In Pembroke Pines, Fla., Al Salvi’s power bill can reach $500 a month.

“There’s a lot of seniors down here that are living check to check. They can barely afford prescriptions such as myself,” says Salvi, who’s 63 and uses a wheelchair. “Now we got to decide whether we’re going to pay the electric bill or are we going to buy medication. And it’s not fair to us. You’re squeezing us between a rock and a hard place.”

As our leaders were borrowing trillions upon trillions of dollars that we did not have, I warned that this was going to cause rampant inflation, but a lot of people out there didn’t want to listen.

And as the Federal Reserve was pumping trillions upon trillions of dollars that they created out of thin air into the financial system, I warned that this was going to cause rampant inflation, but a lot of people out there didn’t want to listen.

At first it seemed like our leaders were totally getting away with it.

But now look at what has happened.

There are countless videos on TikTok right now of people breaking down emotionally over the rising cost of living.

In one video, a woman that feels like she is “drowning” explains that no matter how hard she works “she can’t afford to live anymore”…

The video made by “diannaallen5” for TikTok was shared on X by @WallStreetApes to their 1 million X followers, writing, “Americans are breaking down, a grown woman crying because she can’t afford to live anymore.”

The woman in the video, who said she is from Illinois, was distraught and in tears as she spoke, saying that “gas prices and the electric bills and the prices of food is just so overwhelming.”

“I’m wondering if anybody else is feeling like they’re drowning and they can’t get out,” she said. “I work overtime, and I cannot get above water. I mean, I literally have no gas for next week.”

“I’m just wondering if anybody else feels like they’re drowning,” she said is despair.

Can you identify with her?

I think that a lot of us can.

At this stage, 83 percent of all Americans are experiencing “stressflation”…

A LifeStance Health survey released today reveals “stressflation” is affecting most Americans, with 83% reporting financial stress driven by inflation, mass layoffs, the rising cost of living and recession fears. Millennials and Gen Z report the most significant mental health impacts.

The number of respondents who have been deterred from seeking mental health care due to financial constraints remains consistently high (60%), increasing two percentage points from 2024. Those experiencing high financial stress levels are more than twice as likely to forgo mental health treatment due to cost, highlighting a mental health gap where financial strain exacerbates mental health challenges while limiting access to care.

We should have seen this coming way in advance, because we were specifically warned that this was coming.

And if we stay on the same road that we have been traveling, conditions will get a whole lot worse.

A lot of people out there don’t seem to understand that consequences do not always show up immediately.

What we are experiencing now is the result of decades of bad decisions.

It took time for the consequences of those bad decisions to materialize, but now they have officially started to arrive.

No comments:

Post a Comment