Our 50 years old bubble is on the verge of imploding. Russia will be the catalyst but not the cause. Whoever has seen the process in Argentina, Zimbabwe or... Russia, knows. It is not pretty, but not the end of the world either. Just the end of "a" world which happens to be the one in which we have been living during these last 75 years. Get ready!

Authored by Egon von Greyerz via GoldSwitzerland.com,

A GLOBAL MONETARY & COMMODITY INFERNO OF NUCLEAR PROPORTIONS

When the sh-t hits the global fan, it often does it at the optimal time for the maximum amount of damage and with the worst kind of sh-t to soil the world.

For

years I have been clear that the world is reaching the end of an

economic, financial and monetary era which will affect mankind

catastrophically for decades.

The world will obviously blame Putin for the catastrophe which will hit every corner of our planet. But we must remember that neither Putin nor Covid is the reason for the economic cataclysm that we are now approaching.

These events are catalysts which will have a major effect because they are hitting a gigantic debt bubble of a magnitude that has never been seen before in history. And it obviously takes very little to prick this epic bubble.

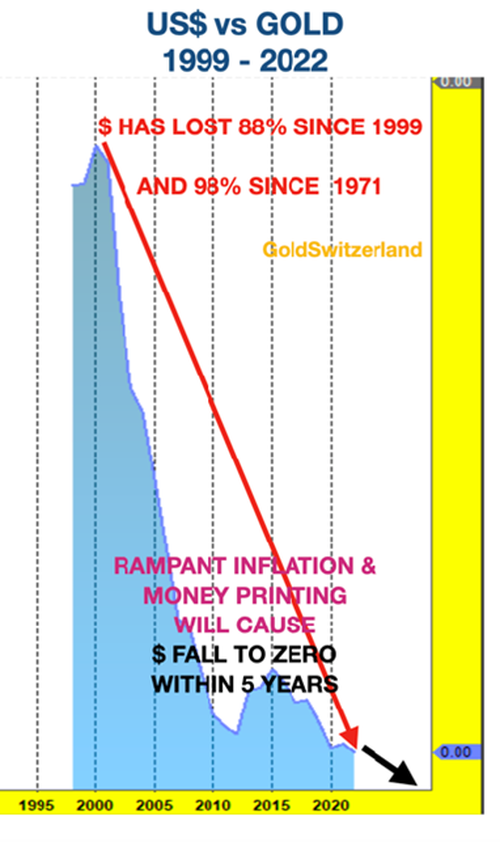

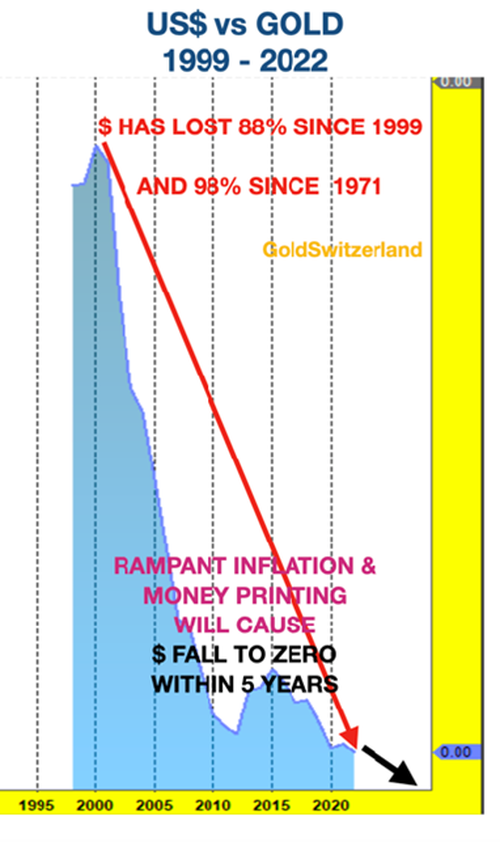

What is unequivocal is that all currencies will finish the 100+ year fall to ZERO in the next few years. It

is also crystal clear that all the asset bubbles – stocks, bonds and

property – will implode at the same time leading to a long and deep

depression.

We had the warning in 2006-9 but central banks ignored it and just added new worthless debt to existing worthless debt to create worthless debt squared – an obvious recipe for disaster.

So

as is often typical for the end of an economic era, the catalyst is

totally unexpected and worse than anyone could have forecast.

WAR CYCLES

Yes,

I and a few others have pointed out that we are in a war cycle

currently, and recent events have clearly confirmed this and hit the

world with a vengeance.

Just as nobody paid any serious attention

to the warning that the Great Financial Crisis in 2006-9 gave the world,

few people have taken Putin’s warnings seriously since the 2014 Maidan

revolution in Ukraine.

When sh-t happens at the end of an

excessive bubble era, it will always be the worst kind. And what can be

worse than a major war that could develop into a nuclear and world war.

Sadly,

wars are part of history and there is virtually no period in history

without a war. Wikipedia lists around 40 ongoing wars and conflicts

currently with most of them being relatively small and local. The

majority are in the Middle East and Africa.

Wars are horrible at

any level and Russia’s invasion of Ukraine certainly qualifies as

another grim conflict that potentially could have been avoided. In the

US backed Maidan Revolution in Ukraine in 2014, the Russian friendly

Ukrainian President Yanukovych was pushed out. Since then, Putin has

always made it clear that he could not accept being surrounded by a US

and Western backed Ukraine as well as Nato members with missile systems

pointing to Russia. The parallel with Cuba, Kennedy and Khrushchev in

1962 is obvious.

Whether anyone listened to Putin’s demands or

not, he made it very clear that he could never let Russia be cornered in

this manner. If the US and the West had focused more on critical

diplomacy for the sake of global peace, things could have been

different. But instead, all Western world leaders found nebulous and

uncontroversial areas to agree on such as Covid, climate change,

wokeism, rewriting history and creating unlimited genders.

Leaders also deliberately ignored the fact that the world was going towards an inevitable economic debt and asset collapse. Much easier to rearrange the deck chairs than to deal with real and emphatically catastrophic issues.

So

Putin is now the number one enemy of the Western world since starting a

war is always unacceptable whoever starts it. Lindsey Graham, a US

Republican senator just suggested that Putin should be taken out! But

Boris Johnson fortunately disagreed but suggested instead that Putin

should be held to account at the International (Criminal) Court.

Fair enough, war crimes are always crimes and should therefore be punished.

But

what is interesting to observe is that when the US with Allies start

unprovoked wars in Vietnam, Iraq, Libya or Syria with hundreds of

thousands of innocent victims, destroying the fabric of these societies

and also leading to anarchy, no one calls for the US president or UK

prime minister to be held to account.

Obviously, the world has never been a level playing field.

THE FED CAN NEVER GET INFLATION RIGHT

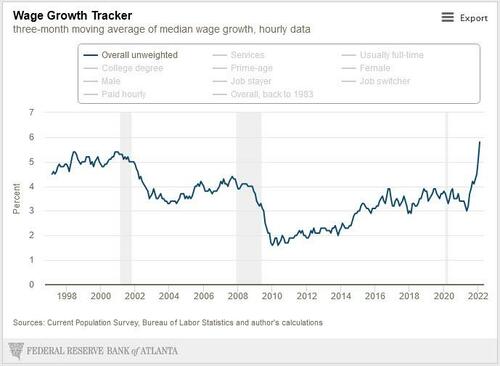

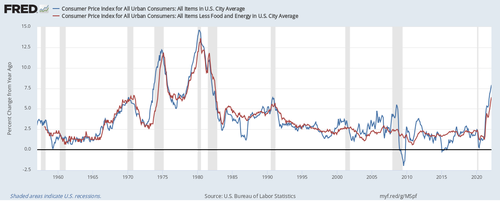

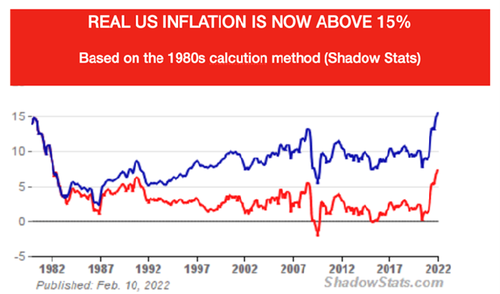

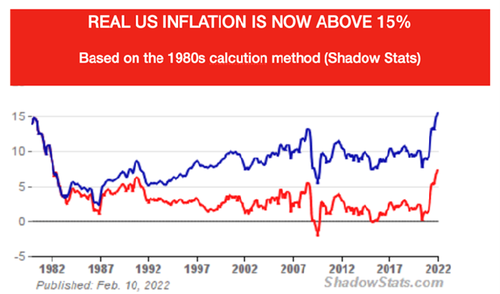

Inflation

leading to hyperinflation was always guaranteed in the current debt

infested era, although the Fed and other Western central banks have

never understood what inflation is. Just as they didn’t understand that

their fake and manipulated inflation figures couldn’t even reach the Fed

target of 2%. Now with real US inflation exceeding 15% (see graph

below), the Fed has a new dilemma that they are totally unprepared for.

The

US government conveniently changed the calculation of inflation to suit

their purpose. Had they stuck to the 1980s established method, official

inflation would be over 15% today and rising.

For

years, the US Fed unsuccessfully tried, with all the king’s horses and

all the king’s men, to get inflation up to 2%. In spite of throwing $

trillions at the problem and keeping interest rates at zero, they never

understood why they failed.

In spite of printing unlimited amounts of counterfeit money, inflation for years stayed nearer 0% than 2%.

Now

with official inflation at 7% and real at 15%, the Fed can’t understand

what has hit them as we know from their laughable “transitory”

language.

So now a quick volte face for the Fed to figure

out how to reduce inflation by 5 percentage points and more likely by 13

to get inflation down to 2% instead of up to 2%.

Clearly the Fed can never get it right but many of us have known that for a very long time.

If

the Fed studied and understood Austrian economics rather than defunct

Keynesianism, they would know that the real inflation rate depends on

growth in money supply rather than the obsolete consumer price model.

BASED ON THE GROWTH IN MONEY SUPPLY, US INFLATION IS NOW 19%

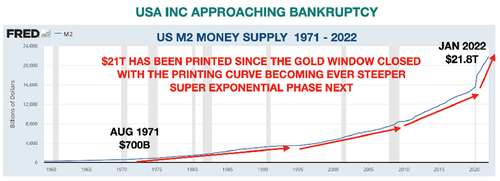

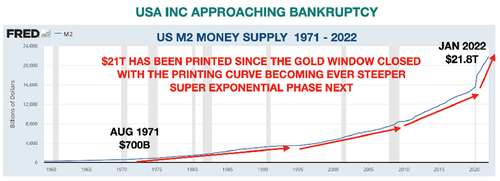

So

let’s take a look at the growth in Money Supply. Since 1971, M2 has

grown by 7% annually. A 7% growth means that prices double every 10

years. Thus 100% total inflation over 10 years rather than the 2% per

annum that is the Fed target.

But

as the chart above shows, the exponential phase started in March 2020

with M2 growing by 19% annually since then. That means a doubling of

prices every 3.8 years.

Since money supply is growing at 19% annually, this means that inflation is also 19% based on our Austrian friends.

And this is what the US and the world was facing before the Ukraine crisis. But now there is a lot of explosive fuel being poured on the global inflation fire.

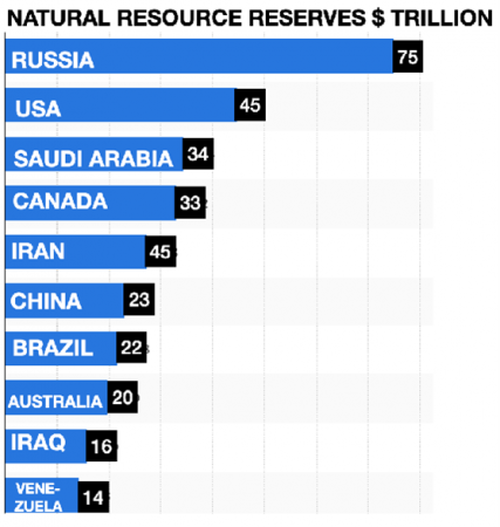

RUSSIA HAS THE BIGGEST GLOBAL NATURAL RESOURCE RESERVES

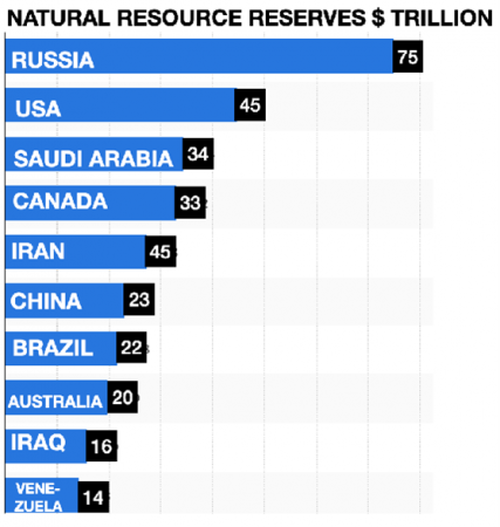

Russia

has the biggest natural resource reserves in the world which include

coal, natural gas, oil, gold, timber, rare earth metals etc. In Rubles

these reserves will obviously appreciate substantially with the falling

currency.

In total, the Russian natural resource reserves are

estimated at $75 trillion. That is 66% higher than the second country

USA and more than twice as much as Saudi Arabia and Canada.

Even

if the total Russian supply is not lost to the world, it is clear that

the West is determined to punish Russia to the furthest extent possible.

Therefore, as we have already seen in the major escalation of

oil and gas prices, the shortages will put insufferable pressure on the

prices of natural resources.

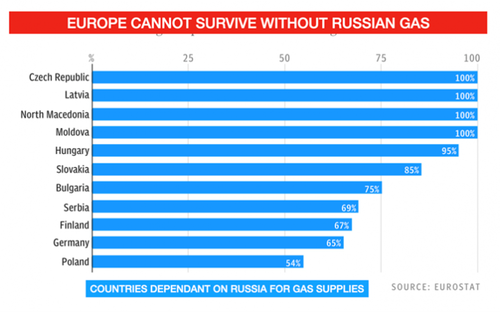

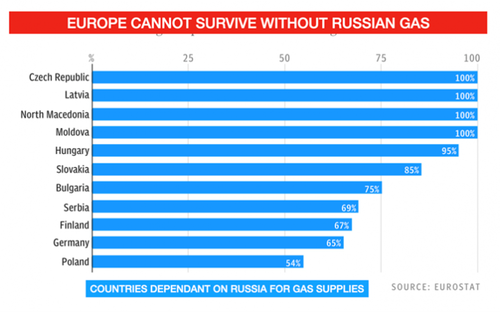

The table below shows the countries in Europe that are dependent on Russian gas for more than 50% of their total consumption.

A COMMODITY BLACK SWAN IS COMING

The global market for grains, vegetable oil and fertilisers was already extremely tight before Russia’s attack.

What is happening now is a commodity black swan across both energy and agricultural resources.

The

World Food Programme warned of a catastrophic scarcity for several

hundred million people last November. What is happening now will make

this exponentially worse.

“Everything is going up

vertically. The whole production chain is under pressure from every

side,” said UN’s ex-head of agricultural markets.

Energy

and agricultural products are interlinked. Gas is feedstock for

fertiliser production in Europe. Russia and Belarus together account for

1/3 of the world’s potash exports.

Around 33% of world exports of

barley come from Russia and Ukraine together, 30% of wheat, 20% of

maize and 80% of sunflower oil.

The consequences are unforeseeable.

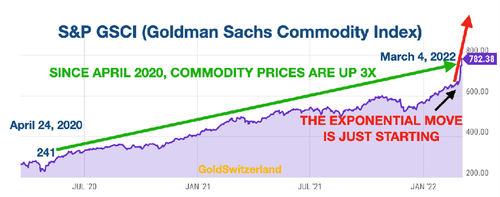

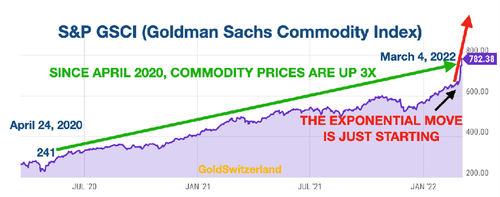

Goldman Sachs Commodity Index is up 3X since April 2020. The exponential phase of the move has just started.

UN’s Food and Agricultural Organisation (FOA) are reporting a 43% increase in food price since 2020. And remember, this was before the real problems had started.

A GLOBAL MONETARY AND COMMODITY INFERNO

I have for quite a few years warned about the coming inflation, leading to hyperinflation, based on unlimited money printing.

But

the dynamite of a global commodity crisis and shortages thrown into the

already catastrophic debt and global monetary fire will create an

inferno of nuclear proportions.

If a miracle

doesn’t stop this war very quickly (which is extremely unlikely), the

world will soon be entering a hyperinflationary commodity explosion

(think both energy, metals and food) combined with a cataclysmic

deflationary asset implosion (think debt, stocks and property).

The world will be experiencing totally unknown consequences without the ability to solve any of them for a very long time.

All

the above would most likely happen even without a global war. But if

the war spreads outside Russia and Ukraine, then all bets are off. At

this point I am not going to speculate about such an outcome since what

is standing in front of us currently certainly is bad enough.

IS THERE ANY GOOD NEWS?

So

is there any good news? Well, first of all as I often repeat, family

and a small group of friends and colleagues will be invaluable in the

coming crisis.

And since a commodity inflation is guaranteed, it

is obvious that physical gold and some silver will be a life saver

against the coming bubble-asset destruction (stocks, bonds, property.

As I have said many times:

“GOLD AND SILVER WILL REACH UNTHINKABLE HEIGHTS!”

In

a crisis of this magnitude, I would stay away from paper assets

including ETFs of any kind. It is clearly imperative to have physical

metals stored outside the financial system.

And remember not to

measure your wealth or your gold in worthless paper money. Instead

measure your gold and silver in ounces or grammes.

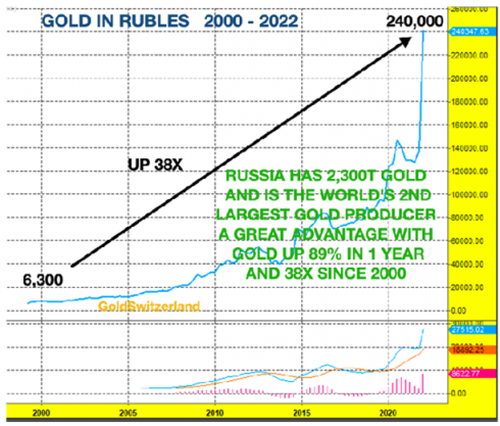

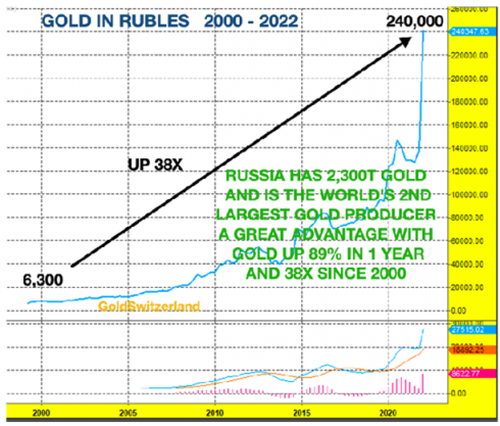

Just look at

what happens to gold when the currency collapses. The chart below shows

gold in Rubles since 2000. Gold is up 38X in the last 21 years. Just in

the last 12 months, gold is up 89% in Rubles and the problems have just began.

Russia was the world’s second largest gold producer in 2020 with 331 tonnes after China with 368 tonnes.

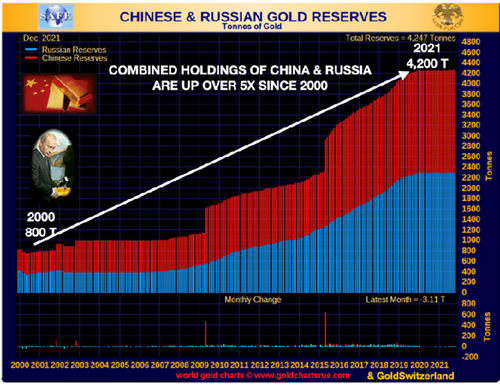

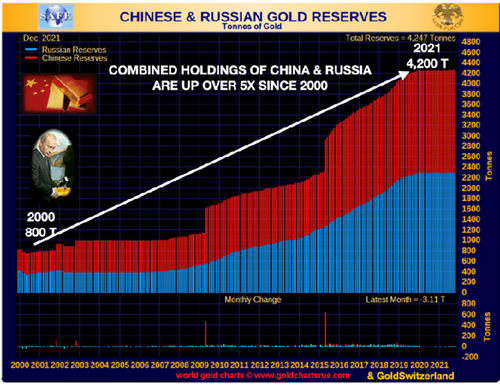

These two countries have officially accumulated 3,400 tonnes of gold since 2000 giving them a total of 4,200t.

Some

insiders estimate that China’s gold reserves could be as high as

20,000t and Russia’s also considerably higher than the 2,300t.

So

while Russia and China have increased their combined gold holdings 5X

since 2000 The US allegedly has held 8,000 since 1980. But since there

has been no official physical audit of the US gold since 1953, few

believe that they hold this amount of unencumbered gold.

Remember: “He who holds the gold makes the rules”

In

2009 I wrote an article called “The Dark Years Are Here”. I have

republished parts of it a couple of times and the last time in 2020 with

an article called “The Dark Years & The Forth Turning”

Sadly it now looks like the Dark Years are starting in earnest.

Except

for protecting your assets against collapsing currencies, I repeat that

the circle of family and friends and helping others will be absolutely

critical.