Another good article from Zero Hedge, one of the very few regular non-propaganda media left in the West. For how long, I wonder?

By Eric Peters, CIO of One River Asset Management

“Defending freedom is going to cost,” declared President Biden, announcing an import ban on Russian oil. And no doubt our Commander-in-Chief is right. Everything we do comes at a cost. The goal in peacetime, of course, is to engage in activities where the beneficial returns exceed the price of our inputs.

War is no such pursuit. Everyone loses. The victors simply suffer less than the vanquished. In Europe’s last major conflict, the Allies defeated Germany. Russia’s victory cost it 20-40 million lives and economic devastation, a cost indelibly etched into Russia’s psyche.

War forces us to determine what we are willing to pay for the things we most value. Afghanistan’s puppet regime was unwilling to pay a penny when attacked by the Taliban. Putin expected the Ukrainians to be similarly stingy. His gross miscalculation has raised costs of this conflict, drawing us all into Europe’s latest senseless war.

And so, the search has begun for what each nation is willing to pay. The costs will be wide ranging and have started with energy.

“Europe consumes about 500bln cubic meters of gas per year. Russia provides 40% of that. Europe consumes about 500mm tons of oil, and Russia supplies around 30% of it, that is 150mm tons, and 80mm tons of petrochemicals on top of that,” explained Putin’s deputy prime minister, threatening to halt European exports.

“It is obvious that foregoing Russian oil will have catastrophic consequences for the world market. The price surge will be unpredictable, up to $300 per barrel, or even more,” he added, sowing uncertainty, trying to frighten his adversaries.

“In this case European politicians should level with their citizens and consumers about what they will face, about how the cost of petrol, electricity and heating will skyrocket,” continued Putin’s deputy prime minister. “If you want to cut off supplies of energy resources from Russia, go ahead, we are ready for that. We know where we will reroute these volumes. The question is – who benefits? And what is the point?”

* * *

Golden Eras: “The coronavirus pandemic will mark the dividing line between the deflationary forces of the last 30-40yrs and the resurgent inflation of the next two decades,” said economist Charles Goodhart, author of The Great Demographic Reversal. He sees inflation in developed economies settling in at 3-4% by the end of 2022 and remaining elevated for years. The addition of hundreds of millions of inexpensive Chinese and Eastern European workers, together with Western baby boomers and women led to a doubling of the workforce supplying advanced economies from 1991-2018.

Golden Eras II: The working-age population is shrinking across developed economies (in China by 100mm in the next 15yrs). Businesses will manufacture and invest more locally, re-designing supply chains. Global savings fall as older people consume more than they produce -- spending particularly on healthcare. US manufacturing wages are less than 4x those in China (versus 26x when China joined the WTO in 2001). With global debt at record levels and asset prices elevated, Goodhart expects central bankers will struggle to tame inflation without causing a deep recession. “A golden era for central banking is ending, life will become a lot harder.”

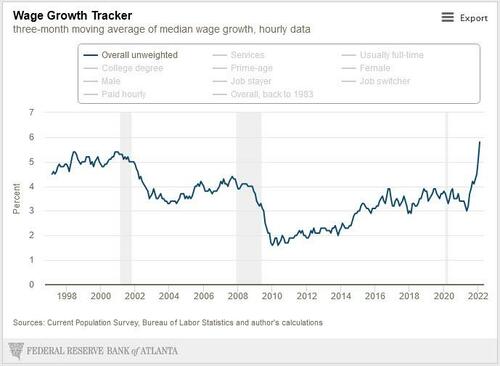

Squiggles: “I posted the wage growth tracker yesterday without enough explanation,” wrote Lindsay Politi, One River’s Head of Inflation Strategies.

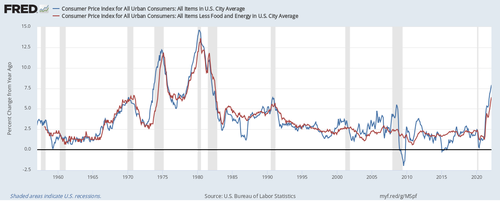

“I think the parallels to the early 1970s should be becoming very uncomfortable to policy makers,” continued Lindsay to our trading team on the One River internal market chat. “With the way core inflation is following headline higher with almost a perfect correlation and a lag is a relationship we haven’t seen since the 1970s and 80s,” she wrote.

Reap: Ukraine is the world’s 5th largest wheat exporter, accounting for 7% of global sales (in 2019). 71% of the nation is land is agricultural. It has 25% of the globe’s “black soil”,” which is amongst the most fertile. And still, in 1932, the nation suffered the Holodomor (Great Famine), as Stalin confiscated and collectivized farms. Today, and unsurprisingly, Ukraine announced a food export ban until the conflict ends. Russia is earth’s largest wheat exporter, accounting for 18% of global sales. So Russia and Ukraine account for 25% of global wheat sales. Prices are near record highs.

Sow: Russia’s Minister of Industry and Trade announced his nation is suspending fertilizer exports. The market is already in short supply, prices have surged. Russia is the globe’s largest fertilizer exporter, accounting for 18% of the potash market in 2017, 20% of ammonia exports and 15% of Urea. Putin said the fertilizer export ban is a move to ensure stable domestic food prices. He mentioned that fertilizer markets are deteriorating, making food a lot more expensive, and added that Russia has agreements with “friendly countries” on fertilizers.

Anecdote:

Everything is connected, one moment naturally following another. And so it is tempting to think that by retracing each step we can explain why we have arrived at a particular place. Perhaps this is sometimes true, over very short periods at least. But the world is infinitely complex, and the truth is that we often arrive at a destination for reasons we can’t possibly understand, let alone have predicted. That doesn’t stop us from trying. We spin compelling tales that appear so obviously true that we come to accept them as fact. In a Feb 15 video that is making the rounds [click here], Professor John Mearsheimer explains why the West and Russia are clashing in Ukraine, even as he failed to foresee an actual war.

Vladimir Putin’s Feb 25 public address [click here], that was a precursor to the invasion, presents his story of what led us here. Like all such tales, both are presented so as to appear logical, linear, evident, inevitable, and their authors might even believe they explain the path properly. If only it were so simple, we might stand a chance to avoid the collisions that litter history. Who knows, perhaps the issue is that we seek conflict for reasons we’ll never quite understand.

But at any rate, it appears Europe’s latest conflict was unlikely to have occurred were it not for the inflation that has taken hold across the globe. Russia, after all, has a small and failing economy. It is poorly positioned to exert outsized influence but for its ability to exacerbate global energy, food, and metal price inflation. This, in turn, can inflict horrible damage on Western economies during a time when their central banks have few tools to tame inflation other than to crash their economies. It can also divide the world between rich nations and the hungry/poor. And exactly why we got to such a fragile state is itself a story we may want to tell ourselves we understand, but we will never fully know.

No comments:

Post a Comment