As discussed earlier: The real war is not in Ukraine and no China is not in the Western camp. It would be madness. The Chinese may be wicked but they are not mad! Whoever has a modicum of financial understanding must scramble now to untangle it's currency and resources from the West. A crash is coming and it will be historic.

Authored by Alasdair Macleod via GoldMoney.com,

Commentators are trying to make sense of Russian moves... However, there is a back story which differs from much of the speculation, which this article addresses.

The Russians have not put

the rouble on some sort of gold standard. Instead, they have repeated

the Nixon/Kissinger strategy which created the petrodollar in 1973 by

getting the Saudis to agree to accept only dollars for oil. This time,

nations deemed by Russia to be unfriendly will be forced to buy roubles –

roughly 2 trillion by the EU alone based on last year’s natural gas and

oil imports from Russia — driving up the exchange rate. The rouble has

now doubled against the dollar from its low point of RUB 150 to RUB 75

yesterday in just over three weeks. The Russian Central Bank will soon

be able to normalise the domestic economy by reducing interest rates and

removing exchange controls.

The Russians and Chinese

will be acutely aware that Western currencies, particularly the yen and

euro, are likely to be undermined by recent developments. The financial

war, which has always been in the background, is emerging into plain

sight and becoming a battlefield between fiat currencies, and it is full

on.

The winner by default is almost certainly

gold, now the only reliable reserve asset for those not aligned with

Russia’s “unfriendlies”. But it is still a long way from backing any

currency.

Putin is losing the battle for Ukraine

President

Putin is embattled. His army as let him down — it turns out that his

generals lack the necessary leadership qualities, the squaddies are

suffering from lack of food, fuel, and are suffering from frostbite. It

is reported that one brigade commander, Colonel Yuri Medvedev, was

deliberately run down by one of his own men in a tank, a measure of the

chaos at the front line. And Putin is not the first national leader to

have misplaced his confidence in military forces.

Conventional

wisdom (from Carl von Clausewitz, no less) suggested Putin might win the

battle for Ukraine but would be unable to hold the territory. That

requires the willingness of the population to accept defeat, and a

lesson the Soviets had learned in Afghanistan, with the same experience

repeated by America and the UK. But Putin has not even won the battle

and word from the Kremlin is of accepting a face-saving fall-back

position, perhaps taking Donetsk and the coast of the Sea of Azov to

join it up with Crimea.

There was little doubt that if Putin came

under pressure militarily, he would probably step up the commodity and

financial war. This he has now done by insisting on payments in roubles.

The mistake made in the West was to believe that Russia must sell

commodities, and even though sanctions harm the West greatly, the

strategy is to put maximum pressure on the Russian economy for a quick

resolution. It is obviously flawed because Russia can still trade with

China, India, and other significant economies. And thanks to rising

commodity prices the Russian economy is not in the bad place the West

believed either.

Besides nations representing 84% of the world’s

population standing aside from the Western alliance’s sanctions and with

some like India sorely tempted to buy discounted Russian oil, we would

profit from paying attention to some very basic factors. Russia can

certainly afford to sell oil at significant discounts to market prices,

and there are buyers willing to break the American-led embargoes. The

non-Western world is no longer automatically on-side with American

hegemony; that is a rotting hulk which the Americans are desperately

trying to keep afloat. Observing this, the Kremlin seems relaxed and has

said that it is willing to accept currencies from its friends, but

Western enemies (the “unfriendlies”) would have to pay for oil in

roubles or, it has also been suggested, in gold.

On 23 March the

Kremlin drew up a list of these unfriendly countries, which includes the

27 EU members, Switzerland, Norway, the United States, the United

Kingdom, Canada, Australia, New Zealand, Japan, and South Korea.

Payment

in roubles is easy to understand. We can assume that all oil and

natural gas long-term supply contracts with the unfriendlies have force

majeure clauses, because that is normal practice. In the light of

sanctions, the Russians are entitled to claim different payment terms.

And it is this that the Russians are relying upon for insisting on

payment in roubles.

Germany, for example, would have to buy

roubles on the foreign exchanges to pay for her gas. Buying roubles

supports the currency, and this was the tactic that created the

petrodollar in 1973 when Nixon and Kissinger persuaded the Saudis to

take nothing else but dollars for oil. It was that single move which

more than anything confirmed the dollar as the world’s international and

reserve currency in the aftermath of the temporary suspension of the

Bretton Woods Agreement. That’s not quite the objective here; it is to

not only underwrite the rouble, but to drive it higher relative to other

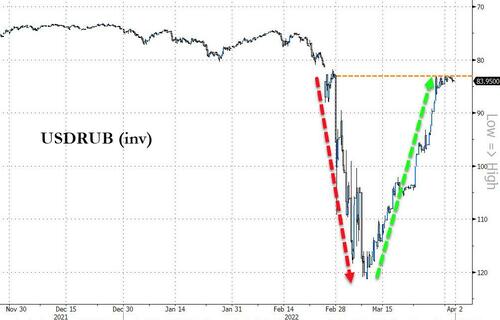

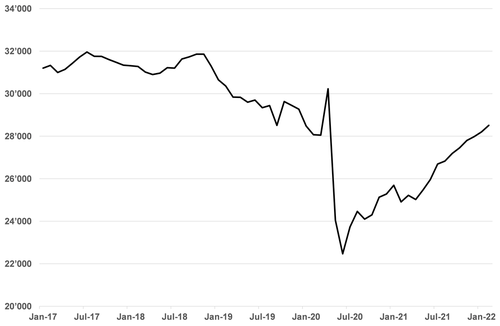

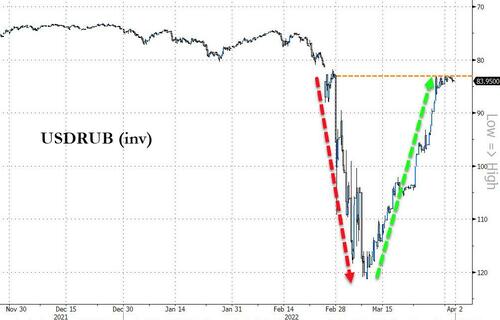

currencies. The immediate effect has been clear, as the chart from Bloomberg below shows.

Having halved in value against the dollar on 7 March, all the rouble’s fall has been recovered. And that’s even before Germany et al buy roubles on the foreign exchanges to pay for Russian energy.

The

gold issue is more complex. The West has banned not only Russian

transactions settling in their currencies but also from settling in

gold. The assumption is that gold is the only liquid asset Russia has

left to trade with. But just as ahead of the end of the cold war Western

intelligence completely misread the Soviet economy, it could be making a

mistake again. This time, intel seems to be misled by full-on Keynesian

macro analysis, suggesting the Russian economy is vulnerable when it is

inherently stronger in a currency shoot-out than even the dollar. There

is no need for Russia to sell any gold at all.

The Russian

economy has a broadly non-interventionist government, a flat rate of

income tax of 13%, and a government debt of 20% of GDP. There are flaws

in the Russian economy, particularly in the lack of respect for property

rights and the pervasive problem of the Russian Mafia. But in many

respects, Russia’s economy is like that of the US before 1916, when the

highest income tax rate was 15%.

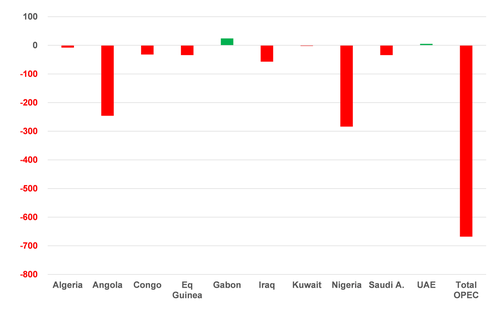

An important difference is that

the Russian government gets substantial revenues from energy and

commodity exports, taking its income up to over 40% of GDP. While export

volumes of energy and other commodities are being hit by sanctions,

their prices have risen substantially. But it remains to be seen what

form of money or currency for future payments will be used for over

$550bn equivalent of exports, while $297bn of imports will be

substantially reduced by sanctions, widening Russia’s trade surplus

considerably. Euros, yen, dollars, and sterling are ruled out, worthless

in the hands of the Central Bank. That leaves Chinese renminbi, Indian

rupees, weakening Turkish lira and that’s about it. It’s hardly

surprising that Russia is prepared to accept gold. Putin’s view on the

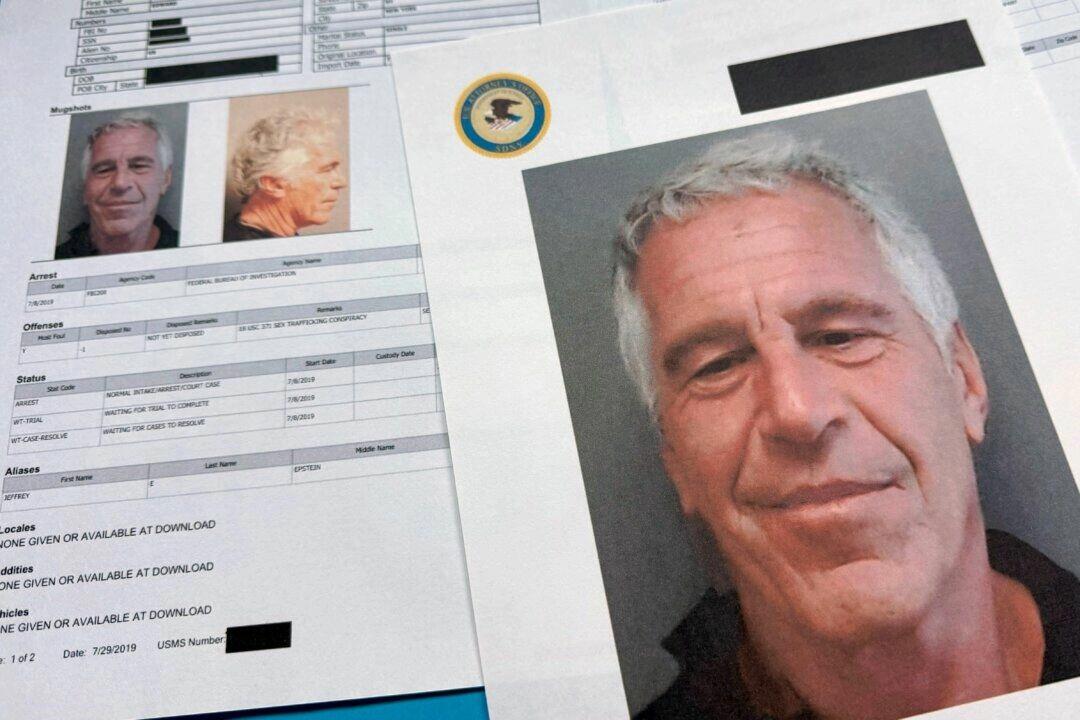

subject is shown in Figure 1 of stills taken from a Tik Tok video

released last weekend.

Furthermore,

Russia’s official reserves are only a small part of the story. Simon

Hunt of Simon Hunt Strategic Services, who I have found to be

consistently well informed in these matters, is convinced based on his

information that Russia’s gold reserves are significantly higher than

reported — he thinks 12,000 tonnes is closer to the mark.

The

payment choice for those on Russia’s unfriendly list, if we rule out

gold, is effectively of only one — buy roubles to pay for Russian

energy. By sanctioning the world’s largest energy exporter, the effect

on energy prices in dollars is likely to drive them far higher yet.

Additionally, market liquidity for roubles is likely to be restricted,

and the likelihood of a bear squeeze on any shorts is therefore high.

The question is how high?

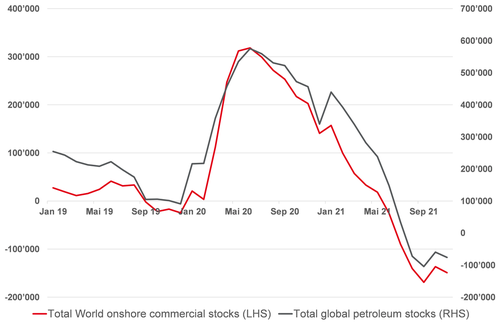

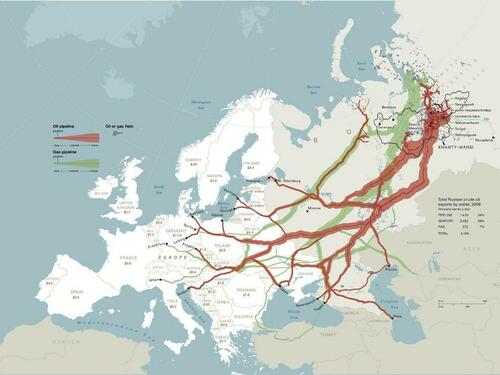

Last year, the EU imported 155 billion

cubic meters of natural gas from Russia, valued at about $180bn at

current volatile prices. Oil exports from Russia to the EU were about

2.3 million barrels per day, worth an additional $105bn for a combined

total of $285bn, which at the current exchange rate of RUB 75.5 is RUB

2.15 trillion. EU Gas consumption is likely to fall as spring

approaches, but payments in roubles will still drive the exchange rate

significantly higher. And attempts to obtain alternative sources of LNG

will take time, be insufficient, and serve to drive natural gas prices

from other suppliers even higher.

For now, we should dismiss ideas

over payments to the Russians in gold. The Russian gold story,

initially at least, is a domestic issue. Though it might spill over into

international markets.

On 25 March, Russia’s central bank

announced it will buy gold from credit institutions at a fixed rate of

5,000 roubles per gramme starting this week and through to 30 June. The

press release stated that it will enable “a stable supply of gold and

smooth functioning of the gold mining industry.” In other words, it

allows banks to continue to lend money to gold mining and related

activities, particularly for financing new gold mining developments.

Meanwhile, the state will continue to accumulate bullion which, as

discussed above, it has no need to spend on imports.

When the

RCB’s announcement was made the rouble was considerably weaker and the

price offered by the central bank was about 20% below the market price.

But that has now changed. Based on last night’s exchange rate of 75.5

roubles to the dollar (30 March) and with gold at $1935, the price

offered by the central bank is at a premium of 7.2% to the market.

Whether this opens the situation up to arbitrage from overseas bullion

markets is an intriguing question. And we can assume that Russian banks

will find ways of acquiring and deploying the dollars to do so through

their offshore facilities, until, under the cover of a strong rouble,

the RCB removes exchange controls.

There is nothing in the RCB’s

statement to prevent a Russian bank sourcing gold from, say, Dubai, to

sell to the central bank. Guidance notes to which we cannot be privy may

address this issue but let us assume this arbitrage will be permitted,

because it might be difficult to stop. And if Russia does have

undeclared bullion reserves more than those allegedly held by the US

Treasury, then given that the real war is essentially financial, it is

in Russia’s interest to see the gold price rise in dollars.

Not

only would Eurozone banks be scrambling to obtain roubles, but the

entire Western banking system, which takes the short side of derivative

transactions in gold will find itself in increasing difficulties.

Normally, bullion banks rely on central banks and the Bank for

International Settlements to backstop the market with physical liquidity

through leases and swaps. But the unfortunate message from the West to

every central bank not on Russia’s unfriendly list is that London’s or

New York’s respect for ownership rights to their nation’s gold cannot be

relied upon. Not only will lease and swap liquidity dry up, but it is

likely that requests will be made for earmarked gold in these centres to

be repatriated.

In short, Russia appears to be initiating a

squeeze on gold derivatives in Western capital markets by exploiting

diminishing faith in Western institutions and their cavalier treatment

of foreign property rights. By forcing the unfriendlies into buying

roubles, the RCB will shortly be able to reduce interest rates back to

previous policy levels and remove exchange controls. At the same time,

the inflation problems faced by the West will be ameliorated by a strong

rouble.

It ties in with the politics for Putin’s survival.

Together with the economic benefits of an improving exchange rate for

the rouble and the relatively minor inconvenience of not being able to

buy imports from the West (alternatives from China and India will still

be available) Putin can retreat from his disastrous Ukrainian campaign.

Senior figures in the Russian army will be disciplined, imprisoned, or

disappear accused of incompetence and misleading Putin into thinking his

“special operation” would be quickly achieved. Putin will absolve

himself of any blame and dissenters can expect even greater clampdowns

on protests.

Russia’s moves are likely to have been thought out in

advance. The move to support the rouble is evidence it is so, giving

the central bank the opportunity to reverse the interest rate hike to

20% to protect the rouble. Foreign exchange controls on Russians can

shortly be lifted. Almost certainly the consequences for Western

currencies were discussed. The conclusion would surely have been that

higher energy and other Russian commodity prices would persist, driving

Western price inflation higher and for longer than discounted in

financial markets. Western economies face soaring interest rates and a

slump. And depending on their central bank’s actions, Japan and the

Eurozone with negative interest rates are almost certainly most

vulnerable to a financial, currency, and economic crisis.

The

impact of Russia’s new policy of only accepting roubles was, perhaps,

the inevitable consequence of the West’s policies of self-immolation.

From Russia’s failure in Ukraine, Putin appears to have had little

option but to go on the offensive and escalate the financial, or

commodity-currency war to cover his retreat. We can only speculate about

the effect of a strong rouble on the international gold price, but if

Russian banks can indeed buy bullion from non-Russian sources to sell to

the RCB, it would mark a very aggressive move in the ongoing financial

war.

China’s position

China will be learning unpalatable

lessens about its ambition to invade Taiwan, and Taiwan will be

encouraged mightily by Ukraine’s success at repelling an unwelcome

invader. A 100-mile channel is an enormous obstacle for a Chinese

invasion that Russia didn’t have to navigate before Ukrainian locals

exploited defensive tactics to repel the invader. There can now be

little doubt of the outcome if China tried the same tactics against

Taiwan. President Xi would be sensible not to make the same mistake as

Putin and tone down the anti-Taiwan rhetoric and try the softer approach

of friendly relations and economic integration to reunite Chinese

interests.

That has been a costless lesson for China, but another

consideration is the continuing relationship with Russia. The earlier

Chinese description of it made sense: “We are not allies, but we are

partners”. What this means is that China would abstain rather than

support Russia in the various supranational forums where the world’s

leaders gather. But she would continue to trade with Russia as normal,

even engaging in currency swaps to facilitate it.

More recently, a

small crack has appeared in this relationship, with China concerned

that US and EU sanctions might be extended to Chinese entities in joint

ventures with Russian businesses linked to sanctioned oligarchs and

Putin supporters. The highest profile example has been the suspension of

a joint project to build a petrochemical plant in Russia involving

Sinopec, because of the involvement of Gennady Timchenko, a close ally

of Putin. But according to a report from Nikkei Asia, Sinopec has

confirmed it will continue to buy Russian crude oil and gas.

As

always with its geopolitics, we can expect China to play its hand with

great care. China was prepared for the consequences of US monetary

policy in March 2020 when the Fed reduced its funds rate to zero and

instituted quantitative easing of $120bn every month. By its actions it

judged these moves to be very inflationary, and began stockpiling

commodities ahead of dollar price rises, including energy and grains to

project its own people. The yuan has risen against the dollar by about

11%, which with moderate credit policies has kept annualised domestic

price inflation subdued to about 1% currently, while consumer price

inflation in the West is soaring out of control.

China is not

therefore in the weak financial position of Russia’s “unfriendlies”; the

highly indebted governments whose finances and economies are likely to

be destabilised by rising energy prices and interest rates. But it does

have a potential economic crisis on its hands in the form of a

collapsing property market. In February, its response was to ease the

credit restrictions imposed following the initial pandemic recovery in

2021, which had included attempts to deleverage the property sector.

Property

aside, we can assume that China will not want to destabilise the West

by her own actions. The West is doing that very effectively without

China’s assistance. But having demonstrated an understanding of why the

West is sliding into an inflation crisis of its own making China will be

keen not to make the same mistakes. Her partnership with Russia, as

joint leaders in the Shanghai Cooperation Organisation, is central to

detaching herself from what its Maoist economists forecast as the

inevitable collapse of imperial capitalism. Having set itself up in the

image of that imperialism, it must now become independent from it to

avoid the same fate.

Gold’s wider role in China, Russia, and the SCO

Gold

has always been central to China’s fallback position. I estimated that

before permitting its own people to buy gold in 2002, the state had

acquired as much as 20,000 tonnes. Subsequently, through the Shanghai

Gold Exchange the Chinese public has taken delivery of a further 20,000

tonnes, mainly through imports from outside China. No gold escapes

China, and the Chinese government is likely to have added to its hoard

over the last twenty years. The government maintains a monopoly on

refining and has stimulated the mining industry to become the largest

national producer. Together with its understanding of the West’s

inflationary policies the evidence is clear: China is prepared for a

world of sound money with gold replacing the dollar’s hegemony, and it

now dominates the world’s physical market with that in mind.

These

plans are shared with Russia, and the members, dialog partners and

associates of the Shanghai Cooperation Organisation — almost all of

which have been accumulating gold reserves. Mine output from these

countries is estimated by the US Geological Survey at 830 tonnes, 27% of

the global total.

The move away from pure fiat was confirmed

recently by some half-baked plans for the Eurasian Economic Union and

China to escape from Western fiat by setting up a new currency for

cross-border trade backed partly by commodities, including gold.

The

extent of “off balance sheet” bullion is a critical issue, because at

some stage they are likely to be declared. In this context, the Russian

position is important, because if Simon Hunt, quoted above, is correct

Russia could have more gold than the US’s 8,130 tonnes, which it is

widely thought to overstate the latter’s true position. Furthermore,

Western central banks routinely lease and swap their gold reserves,

leading to double counting, which almost certainly reduces their actual

position in aggregate. And if fiat currencies continue to decline we

could find that the two ringmasters for the SCO have more monetary gold

than all the other central banks put together — something like

30,000-40,000 tonnes for Chinese and Russian governments, compared with

perhaps less than 20,000 tonnes for Russia’s adversaries (officially

,the unfriendlies own about 24,000 tonnes, but we can assume that at

least 5,000 of that is double counted or does not exist due to leasing

and swaps).

The endgame for the yen and the euro

Without

doubt, the terrible twins in the major fiat currencies are the yen and

the euro. They share much in common: negative interest rates, major

commercial banks highly leveraged with asset to equity ratios averaging

over twenty times, and central bank balance sheets overloaded with bonds

which are collapsing in value. They now face rising interest rates

spiralling beyond their control, the consequences of the ECB and Bank of

Japan being trapped under the zero bound and being in denial over

falling purchasing power for their currencies.

Consequently, we

are seeing capital flight, which has accelerated dramatically this month

for the yen, but in truth follows on from relative weakness for both

currencies since the middle of 2021 when global bond yields began

rising. Statistically, we can therefore link the collapse of both

currencies on the foreign exchanges with rising bond yields. And given

that rising interest rates and bond yields are in their early stages,

there is considerable currency weakness yet to come.

Japan and its yen

The

Bank of Japan has publicly stated it would buy an unlimited amount of

10-year Japanese Government Bonds at a 0.25% yield to contain the bond

sell-off. A higher yield would be more than embarrassing for the BOJ,

already requiring a recapitalisation, presumably with its heavily

indebted government stumping up the money. Figure 2 shows that the

10-year JGB yield is already testing the 0.25% yield level (charts from Bloomberg).

Fig 2. JGB yields hits BoJ Limit and Yen collapsing

As avid Keynesians, the BOJ is following similar policies to that of John Law in 1720’s France. Law issued fresh livres which

he used to prop up the Mississippi venture by buying shares in the

market. The bubble popped, the venture survived, but the livre was destroyed.

Today,

the BOJ is issuing yen to prop up the Japanese government bond market.

As the issuer of the currency, the BOJ is by any yardstick bankrupt and

in desperate need of new capital. Since it commenced QE in 2000, it has

accumulated so much government and corporate debt, and even equities

bundled into ETFs, that the falling value of the BOJ’s holdings makes

its liabilities significantly greater than its assets, currently to the

tune of about ¥4 trillion ($3.3bn).

Ignoring the cynic’s

definition of madness, the BOJ is doubling down on its commitment,

announcing on Monday further unlimited purchases of 10-year JGBs at a

fixed yield of 0.25%. In other words, it is supporting bond prices from

falling further, echoing Mario Draghi’s “whatever it takes” and

confirming its John Law policy. Last Tuesday’s Summary of Opinions at the Monetary Policy Meeting on March 17 and 18 had this gem:

“Heightened

geopolitical risks due to the situation surrounding Ukraine have caused

price rises of energy and other items, and this will push down domestic

demand while raising the CPI. Under the circumstances, it is necessary

to improve labour market conditions and provide stronger support for

wage increases, and therefore it is increasingly important that the bank

persistently continue with the current monetary easing.”

No,

this is not satire. In other words, the BOJ’s deposit rate will remain

negative. And the following was added from Government Representatives at

the same meeting:

“The budget for fiscal 2022

aims to realise a new form of capitalism through a virtual circle of

growth and distribution and the government has been making efforts to

swiftly obtain the Diet’s approval.”

A

virtuous circle of growth? It seems like intensified intervention.

Meanwhile, Japan’s major banks with asset to equity ratios of over

twenty times are too highly geared to survive rising interest rates

without a bank credit crisis threatening to take them down. It is hardly

surprising that international capital is fleeing the yen, realising

that it will be sacrificed by the BOJ in the vain hope that it can

continue to maintain bond prices far above where they should be.

The euro system and its euro

The

euro system and the euro share similar characteristics to the BOJ and

the yen: interest rates trapped under the zero bound, Eurozone G-SIBs

with asset to equity ratios of over 20 times and market realities

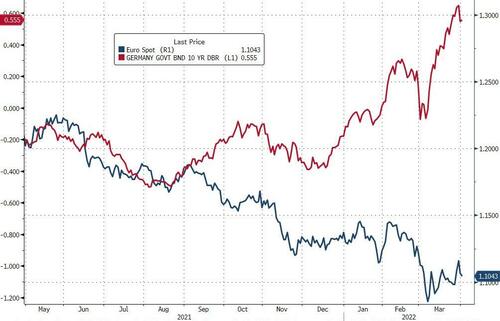

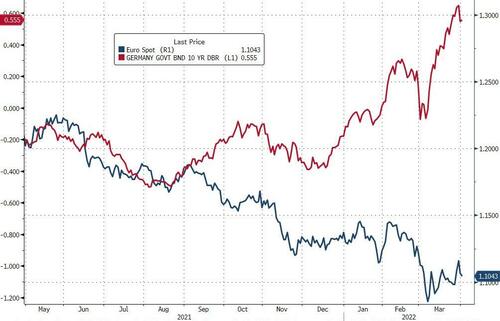

forcing interest rates and bond yields higher, as Figure 3 shows.

Furthermore, Eurozone banks are heavily exposed to Russian and Ukrainian

debt due to their geographic proximity.

Fig 3: Euro declining as bond yields soar

There

are two additional problems for the Eurosystem not faced by the BOJ and

the yen. The ECB’s shareholders are the national central banks in the

euro system, which in turn have balance sheet liabilities more than

their assets. The structure of the euro system means that in

recapitalising itself the ECB does not have a government to which it can

issue credit and receive equity capital in return, the normal way in

which a central bank would refinance its balance sheet by turning credit

into equity. Instead, it will have to refinance itself through the

national central banks which being insolvent themselves in turn would

have to refinance themselves through their governments.

The second

problem is a further complication. The euro system’s TARGET2 settlement

system reflects enormous imbalances which complicates resolving a

funding crisis. For example, on the last figures (end-February),

Germany’s Bundesbank was owed €1,150 billion through TARGET2, while

Italy owed €568 billion. It would be in the interests of a

recapitalisation for the Italian government to want its central bank to

write off this amount, while the Bundesbank is already in negative

equity without writing off TARGET2 balances. Germany’s politicians might

demand the balances owed to the Bundesbank be secured. This problem is

not insoluble perhaps, but one can see that political and public

wrangling over these imbalances will only serve to draw attention to the

fragility of the whole system and undermine public trust in the

currency.

With Germany’s CPI now rising at 7.6% and Spain’s at

9.8%, negative deposit rates are wildly inappropriate. When the system

breaks it can be expected to be sudden, violent and a shock to those in

thrall to the euro system.

Conclusion

For decades, a

showdown between an Asian partnership and hegemonic America has been

building. We can date this back to 1983, when China began to accumulate

physical gold having appointed the Peoples’ Bank for the purpose. That

act was the first indication that China felt the need to protect itself

from others as it ventured into capitalism. China has navigated itself

through increasing American assertion of its hegemony and attempts to

destabilise Hong Kong. It has faced obstacles to its lucrative export

trade through tariffs. It has been cut off from Western markets for its

advanced technology. China has resented having to use the dollar.

After

Russia’s ill-advised invasion of Ukraine, it now appears that the

invisible war over global financial resources and control is

intensifying. The fuse has been lit and events are taking over. The

destabilisation of the yen and the euro are now as certain as can be.

While the yen is the victim of John Law-like market-rigging policies and

likely to go the same way as France’s livre, perhaps the

greater danger is for the euro. The contradictions in its set-up, and

the destruction of Germany’s sound money principals in favour of the

inflationism of the PIGS was always going to be finite. The ECB has got

itself into a ridiculous position, and no amount of conjuring and

cajoling of financial institutions can resolve the ECB’s own insolvency

and that of all its shareholders.

History shows that there are two

groups involved in a currency collapse. International holders take

fright and sell for other currencies and assets they believe to be more

secure. They drive the exchange rate lower. The second group is the

public in a nation, those who use the currency for transactions. If they

lose confidence in it, the currency can rapidly descend into

worthlessness as ordinary people accelerate its disposal for anything

tangible in a final crack-up boom.

In the past, an alternative

currency was always the sounder one, one backed by and exchangeable for

gold coin. That is so long ago that we in the West have mostly forgotten

the difference between money, that is gold and silver, and unbacked

fiat currencies. The great unknown has been how much abuse of money and

credit it would take for the public to relearn the difference.

Cryptocurrencies have alerted us, but they are not a widely accepted

medium of exchange and don’t have the legal standing of gold and gold

substitutes.

War is to be our wake-up call — financial rather than physical in character. Western

central banks and their governments have been fiddling the books,

telling us that currency debasement is good for us. That debasement has

accelerated in recent years. But by upping the anti against Russia with

sanctions that end up undermining the purchasing power of all the West’s

major currencies, our leaders have called an end to the reign of fiat.