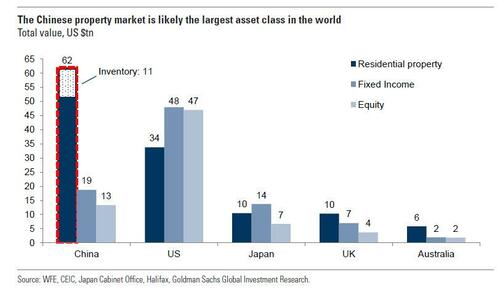

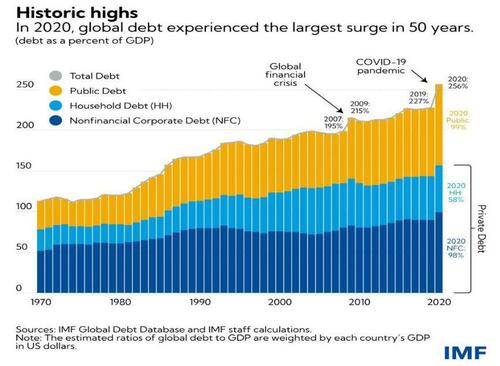

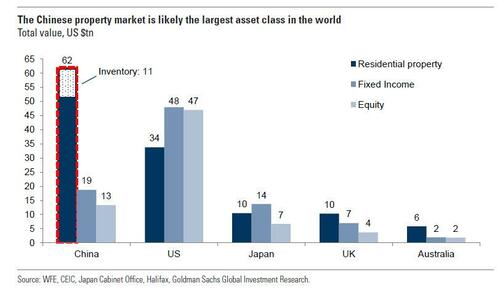

At this stage of our gigantic ponzy, the only question left to be answered is what breaks first. China by the nature of its real estate market is a prime contender as noted several times over the last few years. 20% of 60 trillion dollar invested in empty apartments is a lot of worthless assets. Investing in an empty flat in an unfinished tower in a faraway city was all very fine as long as someone was willing to buy it from you. Now you're left with your "tulip bulb" and you still need to water it so that it can blossom uselessly next year for everyone to see what a fool you were.

Xi Jinping is walking on a tightrope, high above the ground. This is the real reason why the risk of war with Taiwan is so high. Internal politics trumps geo-strategy, every time.

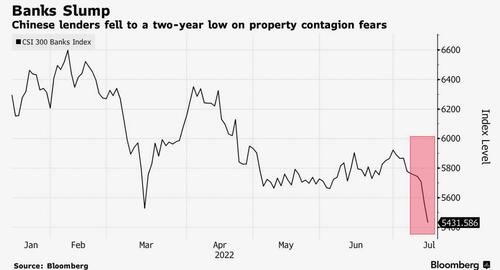

On

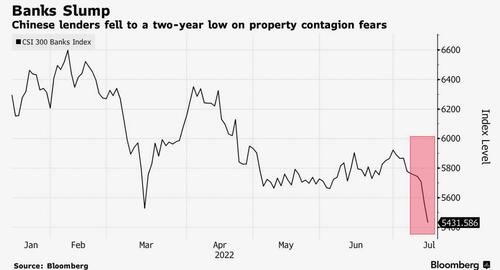

Friday, shares of China’s banks extended their slide to a two-year low

amid fears widespread mortgage non-payments would spark contagion within

the banking sector (see "China On Verge Of Violent Debt Jubilee As "Disgruntled" Homebuyers Refuse To Pay Their Mortgages")

even after the local banking and insurance regulator said it will

maintain continuity and stability of financing policies for the real

estate sector.

China

Central Television said on its WeChat page that the regulator will

guide financial institutions to participate in risk disposals based on

market conditions, after researcher China Real Estate Information Corp.

reported that home buyers had stopped mortgage payments on at least 100

projects in more than 50 cities as of Wednesday, spurring concerns that

the quality of home loans is in rapid decline and could culminate in a

2007-like credit/housing bubble blow up.

Still, as Bloomberg

Markets Live reporter Ye Xie writes, the grassroots movement of Chinese

homebuyers boycotting mortgage payments isn’t exactly akin to the US

subprime crisis of 2008. That said, no matter what Beijing does to

address the latest chapter in China’s housing crisis drama, banks are

likely to share the burden.

In the wake of a surging number of

homebuyers who refuse to pay mortgages on construction projects that

have stalled, China’s banking regulators said Thursday that they are

coordinating with other agencies to support local governments in working

to ensure the delivery of housing units. Separately, Bloomberg

reported that policy makers held emergency meetings with banks to

discuss the issue amid concern that it may worsen.

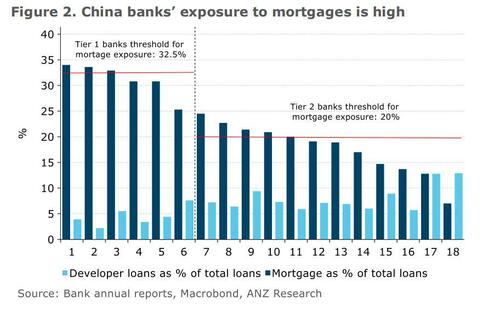

The

boycotts raise the risk of mortgage defaults, a new set of troubles for

banks that are already squeezed by exposure to ailing property

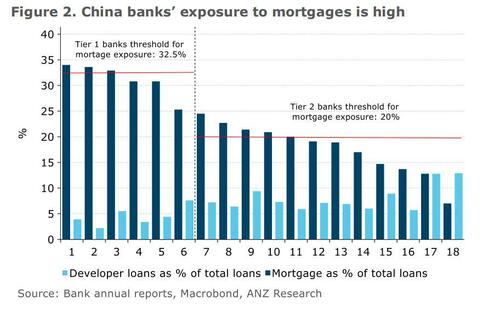

developers. Mortgages make up almost 20% of total bank loans

outstanding, amounting to about 39 trillion yuan ($5.8 trillion).

In

a rather panicked note from Morgan Stanley economist Zhipeng Cai

(available to pro subscribers), he addresses the topic of widespread

mortgage nonpayment and writes that "we estimate 188mn sqm (1.7mn units) are at risk. We expect local governments will be urged to help completion, but a national bazooka solution remains difficult in near term."

His warning: "Non-linearity is the key to watch."

To

others, however, such as Xie, this is an exaggeration. According to the

Bloomberg reporter, "it’s reasonable to argue that this is unlikely the

start of something as bad as the US subprime crisis. Unlike lending to

developers, mortgages have been regarded as the safest assets on banks’

balance sheets, as Betty Wang, an economist at ANZ, pointed out.

Mortgage defaults have been rare, and rising home prices over the years

have increased the value of banks’ collateral."

Some data: the

average non-performing mortgage-loan ratio of the six largest banks,

which accounted for 68% of China’s total home loans, was only 0.38% in

2021, compared with an NPL ratio of 2.73% for developers, according to

Wang’s calculations.

Of course, all of this assumes that the current mortgage-boycott movement can be quickly nipped in the bud. If not, the potential damage could be huge. Nomura’s economist Lu Ting and his colleagues estimated that about

4.4 trillion yuan worth of mortgages made between the end of 2020 and

March of 2022 may be tied to those home projects that have been stalled

or slow in being built.

Understandably, Chinese banks

have gotten hammered in recent days. The CSI bank index fell more than

4% over the past two days to the lowest since March 2020. Their

price-to-book ratio has dropped to an all-time low of 0.61, suggesting

investors believe a significant part of the banking system’s assets are

impaired.

At

the same time, the CSI 300 Financials Index slipped as much as 1.2% on

Friday, and is set for an 11th session of declines. Of course, the worse

it gets, the more likely Beijing will have no choice but to unleash a

powerful releveraging bazooka, even if it has to do so kicking and

screaming.

Indeed, as Xie correctly concludes, "the government is likely to step in sooner rather than later as the mortgage boycotts start to undermine social stability. Either

banks have to chip in to provide cheap funds for developers to complete

projects, or they have to allow homebuyers to delay their payments.

Neither is an attractive option."

What is the worst case scenario? Here we go back to the "non-linearity kicking in" case suggested by Morgan Stanley:

Home-buyer

confidence weakens further from a low starting point, leading to

further deterioration in property sales. This may force more developers,

even relatively strong ones today, to suspend unfinished projects,

furthering the downtrend. In the meantime, housing prices may continue

to fall, exacerbating the downward spiral. Furthermore, the

stress in the housing sector could spread to the broader economy, given

the extensive inter-sector linkages, while being magnified by the

financial system.

In short: a self-reinforcing downward cascade which ends in either a historical crash of the world's largest asset...

... or a state bailout. Here are the two most likely policy responses according to Morgan Stanley:

- Damage control:

Local governments will likely be called upon to mobilize resources on a

by-project basis, possibly with the help of SOEs and LGFVs, to

kick-start suspended projects, signaling to the public that housing

completion is the over-arching priority. SOE developers may be encouraged to conduct M&A activities, taking over stalled projects.

- Reining in systemic risk beyond the near term: Policy

makers will likely need to send a clear and strong signal that they

stand ready to be the "rescuer of the last resort" to rein in systemic

risks. Plausible moves include more meaningful demand stimulus,

more explicit guarantees on quality developers, or (less likely) a

TARP-like program. Translation: a massive firehose of liquidity and credit is about to be unleashed.

One

final though: similar to crypto lenders which generously handed out 20%

DeFi interest until it all blew up spectacularly in one giant,

cross-linked ponzi scheme, so China's 5%+ mortgage rates had been an

extremely lucrative business for banks. It's now payback time.