With this interesting article, you won't learn much about Covid-19 that you did not already know but it is conversely extremely well documented to understand how propaganda works.

Propaganda is de facto not a haphazard process but a well built articulation of different elements: Arguments without counter arguments, ideas without explanation (follow the science), character assassination to weaken one side of the debate, silence or outright cut of good points which do not fit the narrative...

The truth is that all this is not new. These techniques have been honed over half a century of trial and error since the second World War, on radio first, television later, and more recently the Internet. The good thing is that we understand much better how it works. The bad thing is that it is far more sophisticated and potent than it used to be. The ugly one is that it is more and more used for nefarious purposes.

A Critique of the BBC Documentary: Unvaccinated

By Nicholas Creed republished via The Daily Bell

I watched it so you don’t have to, although should you choose to, it can be watched on Odysee.com here.

This author’s mind has been blown.

The narrator introduces the documentary as “an eye opening investigation led by Professor Hannah Fry.” Well, it certainly was eye opening, it made me want to gouge my eyes out. Incredibly uncomfortable viewing.

Let’s get into it.

It starts off with a montage of a few of the (unjected) participants and summarises their concerns or ‘hesitancy’.

Chanelle is pregnant, worried about how the injection could affect her unborn child.

Naomi is worried about future fertility issues if she were to take the COVID-19 experimental gene therapy injection.

Mark is for freedom of choice over coercion.

Luca is immediately portrayed as a ‘conspiracy theorist’ and they hone in on his concerns over 5G and microchips being in the jabby-jabs. It’s a twisted attempt to discredit him and tar him with the tiresome ‘conspiracy theorist’ brush.

Fry wants to get to the heart of the issue (I think that is myocarditis, isn’t it?).

Vicky proudly didn't follow restrictions during lockdowns etc, she is a “normal person who doesn’t want to take part in a trial.”

Vicky, I salute you.

A psychologist named Clarissa (I think) is brought in to tell Fry that the ‘vax hesitancy’ is about a crisis of confidence. Advises Fry to find the root cause of the so called hesitancy. She bleats that if one person changes their mind it can have a positive viral effect. Yay!

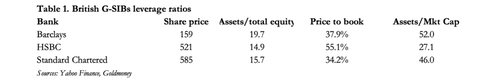

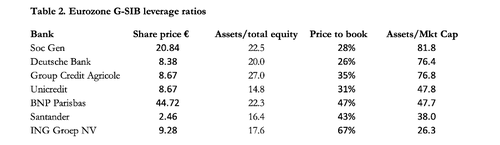

Fry smugly declares they have conducted the largest ever survey in the UK on vax hesitancy with a study sample of a mere 2,500 humans, with 600 unjected. Biased much? Is this total sample size even representative for the UK with an estimated population of 68,623,948 humans?

Fry cites the main concern of the unjected being the adverse reaction of blood clots. Apparently 50% of those surveyed cited this.

She then tells the group that 1 in 10 people who take the gene therapy will experience headaches, and segues into ‘a study from the US’ (source??) whereby 76% of participants experienced adverse reactions / symptoms, as a placebo effect, because of their expectation to receive such an effect, even though they did not receive the medication.

Hmmmm.

We have our first strawman argument on placebo groups and psycho-somatic symptoms being generated from some non-cited study in the US.

The pregnant lady Chanelle wants more information, camera pans to Fry whose face lights up with a beaming smile.

Fry:

I am not trying to trick you, not trying to catch you out. Let’s see the gold standard evidence.

Ah, that old chestnut.

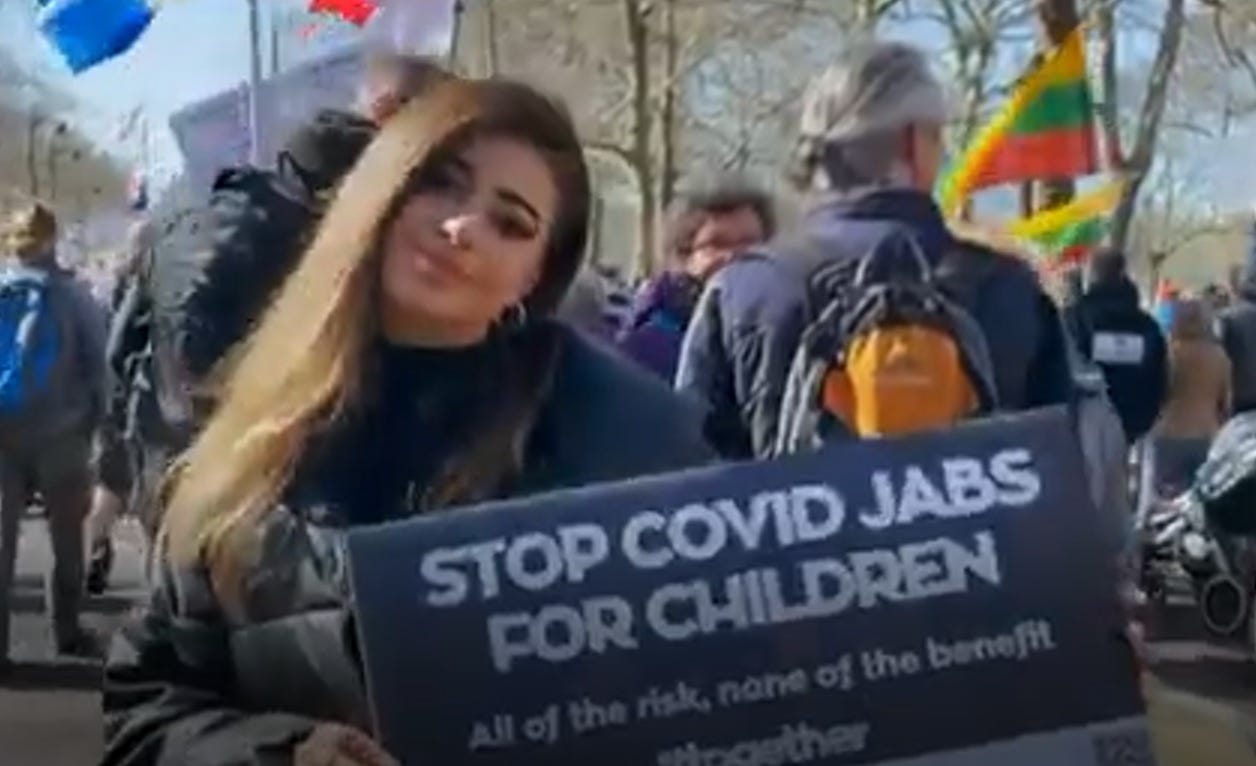

Nazarin Veronica spends her free time doing outreach to warn people of

the dangers of the COVID-19 injections. What a wonderful Woman.

Nazarin Veronica spends her free time doing outreach to warn people of

the dangers of the COVID-19 injections. What a wonderful Woman.

Nazarin cites the recent Pfizer report with 9 pages of data on adverse reactions. Fry says it's terrifying but moves on to her next strawman argument as a coincidence theorist.

The adverse reaction could take place afterwards coincidentally. Just imagine, a doctor answers the phone (when he’s about to inject a child with the jab), then the little boy has a fit, but he didn’t even get jabbed.

Wait, what?

Fry:

There are indeed some rare side effects such as Anaphylaxis, Myocarditis, and blood clots. Blood clots linked to AstraZeneca. Bells palsy & Guillain-Barre syndrome flagged as potential rare side effects. There are only 29 more cases per million.

We move onto Ethan who is fearful of side effects. He wants to be a Father one day.

Fry brings on a GP called Dr. Aurora, who says that all research done shows no impact on fertility in male or female patients. Interestingly, she speaks very quickly and mumbled, as if to betray her inner belief and knowledge of what is true.

The doctor then flips the script and tells young Ethan that it is in fact COVID that can cause infertility. Sources? Data? Trust the science™.

*I have reams of information to counter all these bold pronouncements. I will link to a previous article where I covered this in detail, as well as further recommended reading at the end of this piece.

The focus here is to review the documentary and call things out as bizarrely, propagandised, and gas-lit as they are. I will link to a few sources as necessary throughout.

Naomi is brought on for a one-to-one with Fry. Naomi had long COVID, and is still suffering the after effects.

GP Dr. Aurora says there have been reports of irregularities in menstrual cycles following Women having the COVID-19 injection. Again she speaks very fast and mumbles this part. Then her speech pattern slows down with emphatically clear pronunciation, to tell Naomi that this side effect is temporary; everything will be fine by the second or third menstrual cycle.

Would it not have been opportune and honourable to the hippocratic oath, to responsibly explain why the menstrual cycle irregularities happen in the first place as a common side effect after taking the injection??

Fry confidently states that Ethan & Naomi are open to Dr. Aurora's advice…

Nazarin explains how her friend had a stroke and three suspected heart attacks shortly after taking the injection. Nazarin shows Fry a video on her phone of her friend having a seizure.

Fry, seemingly devoid of empathy and switching into narrative protectionism mode, casually asks Nazarin:

How can you be sure that was the vax?

Nazarin replies that her friend had been healthy then days later she began experiencing seizures & paralysis, and she is so young, this is not possible (that it was unrelated to the injection).

Nazarin:

You know in your heart, that’s what caused it.

Fry looks to the left, pauses, thinking, says there is not enough evidence to say so, bites her nails…

Fry:

We know the vaxeeens aren't without risk, but I want to help the group to think about the chance of side effects versus the disease itself. As humans we are most affected by stories. We need to step outside of our emotional engagement with topics.

Interesting. I recall how the UK Government’s SAGE team wrote in black and white how to manipulate people through their emotions during the early part of the scamdemic.

Fry focuses on Myocarditis. Tells the group the (incidence rate) numbers post-injection, recommends them to “anchor your mind, visualise”….Then we move onto jelly bean roulette. This is an actual game she makes the participants play. Treating them like infants.

The master jellybean represents the risk of you getting Myocarditis if you have the injection. Round one of the joyful little game had a higher chance of them ‘getting’ Myocarditis, but Fry says that:

Round two is a much more attractive proposition!

Cue Fry swings a few sackfuls of jellybeans onto the table. She adds 33,000 beans to convey the correct level of risk (being 1 in 33,000).

You are playing a game of jellybean roulette!

Nazarin points out that other jelly beans could be (representing) other side effects. Fry interjects that Myocarditis is the most common severe side effect. Oh. That serves as a strange yet perhaps unintentionally stated fact. Oops. Contradicted her goals and objectives of the documentary much?

*Nazarin is consistently talked over and interrupted when she is calmly presenting facts on adverse reactions; allegedly a lot of her talking points were edited out by the BBC. More on that later.

Fry says the most at risk are 18-29 yr olds! Apparently only 1 in 33,000.

Fry tells Nazarin that she is tapped into stories of people negatively affected / vax injured, due to the communities she is surrounded by. Very distasteful and dismissive of Fry.

Vicky walks out of the room and says the jellybean roulette game is insulting, people are dying and injured, this is not a serious debate.

Vicky, I concur.

Fry acknowledges vax deaths mostly linked to AstraZeneca blood clots. *Note this is the second time that Fry has openly called out and demonised the AZ injection…almost seems perceptible at driving the great unwashed towards the mRNA poison instead?

Nah, that would be conspiratorial thinking, wouldn’t it?

Fry announces that up to may 2021, the number of blood clots were in the 10s not 100s (check MHRA, links at bottom of article for truth).

The group is taken to meet scientists who trialed and tested the injections.

Fry tells the camera how it is frustrating that Vicky and Nazarin won't join as they are “too committed to their beliefs, getting in the way of others in the group wanting to ask questions and find out more information.”

Those damn pesky anti-vaxxers!

Luca is ridculed questioned by Fry on his belief that there could be a

microchip in the vax. Fry says 5% adults believe this. Luca cites

himself being banned from Facebook. Luca thinks the vax is for

depopulation.

Mike Yeadon and Reiner Fuellmich of the corona investigative committe would certainly agree with Luca on the depopulation agenda.

They arrive to see the scientists and Fry asks Luca to wear a mask upon entering the building; he says and that he’s exempt. Well done Luca.

A masked Professor Finn says the vax is very good at stopping you from getting seriously ill, not good at stopping you passing it on.

They look at samples with antibody colour changes comparing injected / unjected (but no mention of antibody dependent enhancement or immune imprinting).

Ethan wants to know the risk of someone who has had COVID twice compared to someone who has been vaxd.

Prof. Finn stutters:

Um, we think that the immunity you get is more consistent and usually stronger if you've had the vax than if you’ve had the infection. We find that people who have had the vax and get infected have a strong immune response.

Alas, no mention of natural immunity.

Sat outside on the grass, Professor Finn is now unmasked. COVID theatre is situational specific, don’t you know?

Prof. Finn:

The way (the trials were done) was not by missing out any steps we normally do.

Okay Finny, let me pause you there.

The clinical trials are still ongoing. Although several countries issued "emergency use authorization" allowing these companies to begin distributing these vaccines to the public, the stage III trials of the vaccines are ongoing, with several of the planned "endpoints" for the data not being collected for 24 months after injection.

As a result, as even the UK's own "Information for UK Healthcare Professionals" pamphlet regarding Pfizer's vaccine points out:

Animal reproductive toxicity studies have not been completed.

Ethan asks what is in the vax. Prof. Fin doesn’t answer the question, just says they “got the code from china to make the spike protein”…

Prof. Fin says Moderna made a fortune knocking out the vax batches, calls it a bonanza, but proudly says that:

Capitalism is the way we want to go!

Oh my days, I could not make this stuff up.

*Update - revelation that Professor Finn works at Bristol University the Pfizer vaccine control center for excellence.

No conflict of interest at all there then?

Now we go to the St. George's vaccine institute in London. Chanelle wishes to find out how the injection affects fertility.

Prof. Khalil assuredly states:

What we know for sure is the vax does not cause miscarriage.

Did she really say that on camera?!

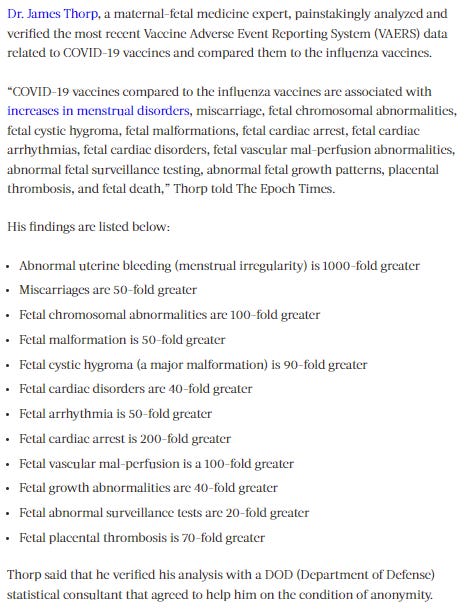

The most recent new information that has come to light on how the injections affect pregnant mothers-to-be and their fetuses, is detailed in an analysis of the United State’s Vaccine Adverse Event Reporting system (VAERS), by Dr. James Thorp - covered by the Epoch Times here.

Extract from aforementioned Epoch Times article.

Extract from aforementioned Epoch Times article.

Back to the documentary.

The Professor goes on:

We know it does not cause still-birth, we have good safety data. The vax is useful for you and your baby, could reduce risk of stillbirth by 15%.

I don’t think the Professor and I are looking at the same data here…

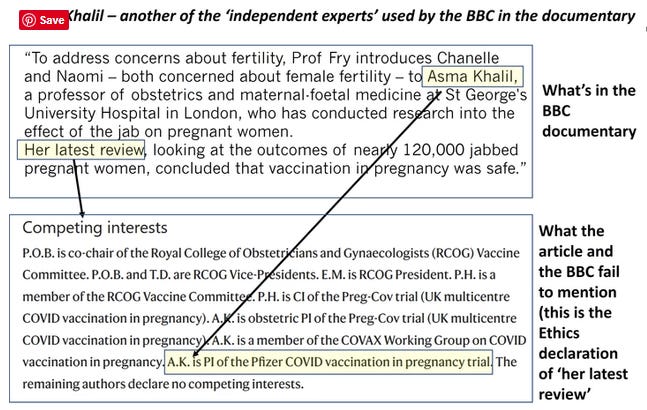

*Update - Professor Khalil has been revealed to be the Principal Investigator of the Pfizer COVID vaccine in pregnancy trial:

So much for all these “independent experts” then.

Fry asks Nazarin & Vicky about why they did not come to the vax institute. Nazarin cites that she's done her research on both sides and is well informed.

Fry patronises Vicky and tells her that she gets the impression that Vicky is very 'passionate' about what's happened (to the countless vax-injured and deceased).

When Vicky asks Fry if this is an approved vax, Fry evades the question, mumbles about scientists running different versions of different vaccines. Fry references phase 4 trials are normal after a jab rollout.

Fry brings up a fake NHS vaccine checklist someone made for distribution with warnings about adverse reactions built into the checklist. She says it is all a hoax.

Then we’re taken through a few more surveys…

The UK public’s perception of the COVID vax development process.

We also learn from Fry that 30% of the surveyed respondents have little trust in the mainstream media, including Sky, ITV, and the BBC.

Nice.

The survey sample size is 1,894 (664 unjected) in relation to COVID perceptions.

Meet Will Moy.

Will Moy from Full Fact meets the group. Fry cites social media posts being taken down. Moy brings out a ridiculously irrelevant fact check of golf reducing chance of early death.

The next fact check is about the Ukraine / Russia conflict being a hoax. This is a weird segue.

Fry wants to talk about Ukraine to Luca and basically intimidate and mock him about his social media posts. Nazarin intervenes and is clearly angered, stating how irrelevant this is, rightly points out that the topic of focus here is the COVID-19 injection.

Nazarin says she wants an equal discussion about both sides of the story. Will Moy blew my mind with this little gem:

Let's be careful about ‘equal’, there is very good evidence that the vaccines are (*drum roll please*) SAFE AND EFFECTIVE"

When the topic of free speech crops up, Moy ‘profoundly’ says:

In a world where you believe in free speech, telling someone they are wrong when they are wrong, is the right response.

Those fact checkers are like patron saints, unsung heroes I tell thee.

In closing, all the participants are asked by Fry if they would now take the injection, and they all say NO!

Nazarin is a beautiful human being and her response is measured, thought provoking and compassionate:

It is unethical to risk young people’s lives to protect those of older people, it is not moral.

Indeed.

When in the history of humanity have we ever before sacrificed the health of our children on the altar of the ‘greater good’, in order to protect the elderly and the vulnerable?

It is the opinion of this author that the countless lies and omissions of the truth throughout this documentary have sealed the fate of the BBC.

Roll on Nuremberg 2.0 trials.

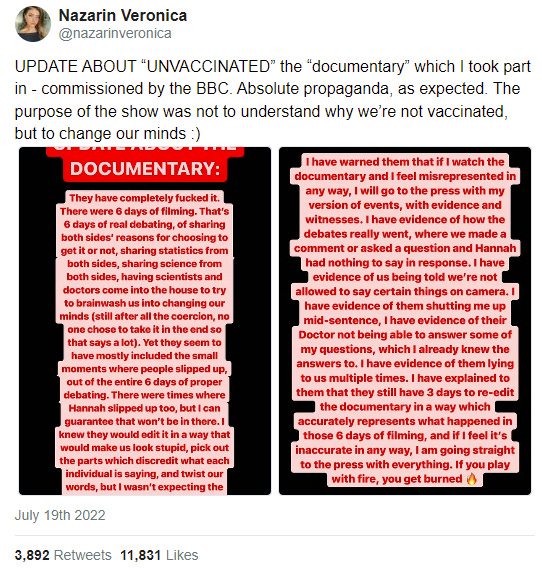

Nazarin has since been tweeting about her experience filming the documentary and the posts are rather illuminating.