A rather long but accurate analysis of post Covid America.

For anyone who understand a modicum of finance and economic theory, the direction looks ominous. A war with Russia or China is not winnable but what if the goal is not winning but just "war". Permanent war to justify bloated budgets, restricted freedoms and "free" money?

A good question which looks more and more pertinent.

Authored by Matthew Piepenburg via GoldSwitzerland.com,

American

policy has been acting in ways which suggest either a desperate

ignorance or a sinister restructuring of the national narrative.

Surveying the Senseless

The

USA is now staring down the barrel of four-decade high inflation, an

inverted yield curve and the highest debt levels in its history as Wall

Street recently enjoyed the strongest relief rally since 2020 on the bad

news of yet another Fed rate hike (75bp) into a percolating liquidity

crisis.

Huh?

In a Fed-led dystopia marked by years of

printed rather than earned liquidity, bad news is now good news to

markets who nervously seek pretexts for central bank stimulus rather

than actual earnings or GDP.

In such distorted landscapes, positive jobs data creates sell offs and crippling rate hikes induce rising stocks.

For almost 2 years, while we and other candid market observers were warning of crippling inflation, our central bankers were describing it as “transitory” with a dishonesty similar to the current recession is not a recession meme.

Huh?

Meanwhile in DC, we see growing signs of a political culture less about public service and more about self-service.

Wealth

disparity in the home of the brave has passed the highest levels ever

recorded and points directly to the slow and empirical death of the

American middle class.

The suburbs around DC are growing richer

with lobbyist and polo-playing defense contractors buying concessions

and second homes from politicians who openly sell votes for reelection

in a democracy that more resembles an auction house than a house of

representation.

A former tobacco tsar at the FDA, for example,

recently took an executive role at Phillip Morris while an executive at

Raytheon (America’s second largest defense contractor) just took a key

post at the Department of Defense.

Alas, the foxes not only guard the hen house, they run it.

The Land of the Free?

If fascism is defined as “the perfect merger of the state and corporate powers” (See Mussolini circa 1936), then the USA may still be the land of the brave, but it no longer resembles the land of the free.

JP Morgan, led by a $35M/year Jamie Dimon, just paid a $96M “fine” for a $20B profit garnered from openly manipulating the gold market.

Huh?

At

the same time, once great (and now police-defunded) cities like

Chicago, NYC, and San Francisco are seeing tumbleweeds blowing past

office vacancy rates as high as 40% following an historically disastrous

COVID lockdown policy which did far more psychological, criminal and

financial damage ($7T and counting) to America than a flu with less than

a 1% Case Fatality Rate.

Huh?

Turning to foreign policies,

having failed to deliver “freedom and democracy” to Vietnam, Iraq,

Libya, Syria, and Afghanistan at the cost of America’s best sons and

daughters, one wonders why the US has spent another $60B to bring

“freedom” to the Ukraine when millions of US children live in poverty.

All

Americans hate to see civilians suffer in needless wars. But many who

blindly wave Ukrainian flags in moments of ad-water, instant-virtue

signaling from a government-led media can’t place Ukraine on a map nor

bother to examine the complex history of its Russian tensions which date

back to the 1750s.

Furthermore, sending an IQ, history and

geography challenged Kamila Harris to pre-war Ukraine with a NATO

narrative only accelerated the February drums of war (and the

financially disastrous sanctions that followed) in the same way that

Pelosi’s recent trip to Taiwan seems to be more about flaming rather

than cooling the war hawks.

Does the US, with over 800 military

bases in 70 countries actively seek war, or does it seek peace?

Thousands are dying in the East for what many professional US statesmen

believe was an easily avoidable war.

Has

the military industrial complex, against which Eisenhower (no stranger

to war) warned in January of 1961, hi-jacked American politics?

Meanwhile, as American monetary and fiscal policy reached new levels of open insanity in the seemingly deliberate fear-campaign led

by “experts” like Fauci in the dramatically-described “war against

COVID,” the latest boogieman out of DC is an equally unaffordable war

against an equally-hyped climate change.

If passed, “The Inflation

Adjustment Act of 2022,” now sitting on Biden’s desk (or pillow), seeks

further dollars that America does not earn yet which the White House

assures won’t be inflationary.

Huh?

Do the foregoing samples of questionable policy failures evidence open stupidity, or is there something more systemic at play?

The Fed: “Advancing the Few at the Expense of the Many”

My take on the Fed is only that: My take.

It is based upon the premise (and bias) that the Fed is driven, as

Andrew Jackson warned, to serve the few and not the many.

This

presumption comes not only from personal observations, but a careful

study of the Fed’s illegitimate practices and origins, far too complex

to unpack here but detailed in Gold Matters.

The Ongoing Inflation Lie

As I’ve been writing and saying for months, the Fed’s current inflation narrative as well as “solution” is as openly bogus as a 42nd Street Rolex.

There

is little about the current inflation narrative that compares to the

1970’s, and hence little about Powell’s current policies which remotely

compare to the so-called Volcker era of 1980, which ended, by the way,

in a recession.

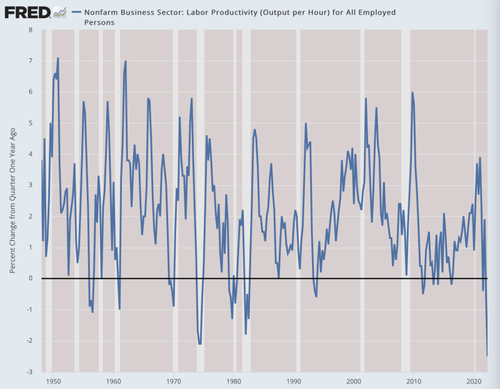

Nevertheless, I am fascinated by the extensive time, brain-power and pundit attention given to explaining current inflation.

Fancy

concepts from “demand-pull” to “supply shocks,” or “extraneous shocks”

and “accelerants” to even “black swans” are used to explain a 9.1% CPI

inflation scale (which, if DC truly wishes to be “Volcker-like,” is

closer to 18% using the metrics of his era…).

The Simple Inflation Truth

Inflation, which was already steadily rising pre-Putin and percolating pre-COVID, is nothing more than the direct consequence of USD debasement driven by: 1) years of openly addictive mouse-click money (>10X since 2008) from the Eccles Building and, 2) fatal fiscal spending from the White House, be it red or blue.

In

just the last 24 months, the Fed created 50% more mouse-click money

than all the money that ever existed in the 256 years of its national

existence.

Such numbers are a tad “inflationary,” no? Alas, costs are rising because our grotesquely inflated/de-valued dollar is tanking.

Between 1776 and the un-immaculate conception of the Fed in 1913, a USD was once a USD.

Since 1913, however, a USD is really (worth) nothing more than a Nickle.

Why?

Broken Faith vs. Store of Value

Because

when a central bank creates trillions of those dollars out of thin air

with no link to an underlying real asset or an equivalent exchange for a

good or service (as Germans like Alfred Lansburgh, Austrians like von Mises and Americans like Andrew Dickson White argued), that dollar is nothing more than a symbol of broken faith rather than a store of genuine value.

Like

a glass of wine filled with a swimming pool of water, the dollar is

diluted; it’s flavor, color and value ruined. Since 1971, and when

measured against a single milligram of gold, the USD, like all other

fiat currencies, has lost greater than 95% of its value.

The Fed: Blaming vs. Accountability

Rather

than confess the toxic reality (and complicity) of the fatal and

inflationary expansion of the broad money supply, the DC elites first

tried to call it “transitory,” and when that failed, they tried to call

it “Putin’s inflation.”

Really?

There’s no doubt that the

sanctions against Putin sent gas prices and the CPI higher—especially in

Europe. And there’s also no doubt that the trillions of fiscal and

monetary dollars used to “fight” COVID were CPI tailwinds.

But a tailwind does not mean a cause.

Take the “war on COVID” and the $7T+ in combined fiscal and monetary dollars used to combat it.

I’m not here to end the COVID debate with medicine or science, of which I’m clearly no expert. But many of us (including Rand Paul or Christine Anderson) would agree that neither was Fauci, the CDC, the WHO or the NIH.

Almost

everyone (vaxed or un-vaxed, masked or un-masked) has already caught

the virus; it’s fairly clear that locking the country down for well over

a year did nothing but cost money and freedoms while destroying

businesses who deserved to choose for themselves whether to stay open or

shut.

There will be others who disagree, but in my legally,

historically and financially educated mind, not since the oxy-moronic

Patriot Act have I seen a greater crime (or psy op) against a nation’s

own citizens and their once inalienable rights and civil liberties as that which was embodied by the 2020 lockdowns.

As Ben Franklin warned, a nation which surrenders its freedoms in the name of security deserves neither.

Critical Thinking Locked Down

As

a kid who won athletic scholarships to some of the finest schools (from

Choate to Harvard) in America, I learned the trade of critical

thinking, which any of us can acquire, with or without a shiny diploma.

What particularly sickened me,

however, was that the very schools (prep to grad level) who taught me

the history, laws and methods of thinking critically, independently and

openly, were the same knee-bending schools who collectively insulted

those same principals by shutting their doors to the un-vaxed and

censoring alternative views from professors and students who thought

differently.

Were these lockdowns proof of humanitarian concern or were they test-drives for increasingly centralized control over national and international markets, currencies and populations?

From the very beginning of the pandemic, expert virologists, physicians and even vaccine creators (as evidenced by the meetings at the AIER in Great Barrington) with equal if not far superior credentials than

Dr. Fauci, were openly censored, gas-lighted and criminalized by the

media as flat-earth “conspiracy theorists”—the now favorite term of art

for anyone who disagrees with DC’s often comically official narrative on

anything from WMD to the current definition of a recession.

Thus,

when considering the current inflation narrative and its causes, was

the US merely stupid in imposing financially crippling lockdowns or were

there sinister forces engineering fear as a means of pushing the masses

into dependency while the Fed printed more dollars for the repo and

bond markets (a hidden “bailout’) than for Main Street?

Saudi Did It?

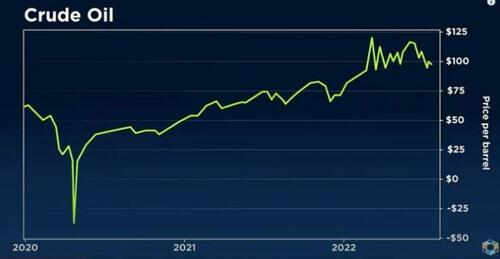

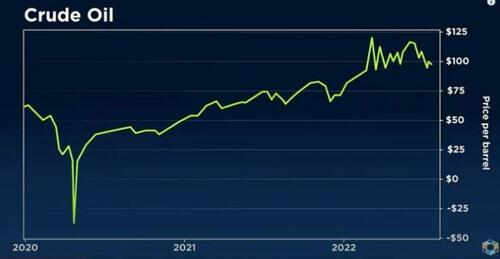

Others may want to blame the Saudis and the high oil prices for the inflation we see today.

It’s worth reminding, however, that today’s oil price is roughly the same as it was in April of 2020.

The Solution Narrative

As far as combatting inflation, that too creates a great deal of space for debate, error and comedy.

Many, including the Fed’s James Bullard, Lael Brainard or Neel Kashkari have been arguing for aggressive rate hikes to kill inflation.

But

with inflation already at 9.1%, such “above-neutral” would require the

Fed to follow the IMF’s recommendation that interest rates be at least

1% above inflation rates. In an honest world, that would require a 10.1%

interest rate policy, which would immediately bankrupt Uncle Sam.

Instead,

Powell is boasting of an “aggressive” 2.25-50% Fed Fund Rates to fight

9.1% inflation, the policy equivalent of storming the beaches of

Normandy with squirt-guns.

Meanwhile, the Cleveland Fed, as per my recent articles, is using dishonest math to publicly claim positive 1% real rates despite

the fact that when measuring even a 3% yield on the 10Y UST against a

9.1% inflation rate, the USA is in fact living in a world of at least

-6% rather than +1% real rates.

Like the CPI scale itself, the Fed is openly lying about negative real rates.

Sadly,

such clever math is now the new DC normal. The Fed won’t say what the

rest of us know, namely: The only tool to fight Fed-made inflation is a

Fed-made recession, which they will deny in plain sight.

The Recession Narrative

The

latest lie from on high, of course, is the valiant attempt by Powell,

Biden and Yellen to downplay 2 consecutive quarters of negative GDP as a

non-recessionary “transition” despite such data effectively confirming

the very definition of a recession.

Instead, DC would now have us believe that positive labor and unemployment data is non-recessionary.

In

particular, the BLS is boasting 528,000 newly created jobs in July (and

2M year-to-date), which places US unemployment at an admirable 3.5%,

the lowest level seen in 50 years.

Unfortunately, a little bit of

honest math indicates that those “new jobs” don’t represent new folks

finding work, but sadly, just folks already-employed who are taking on

second or third jobs to survive rising inflation costs.

The July labor force participation rate actually went down, which means there are less not more people in the work force.

In April of 2019, I did a more extensive report on the DC math used to artificially puff US labor data (U3 and U6) which is far worse than officially reported.

But who needs real math or honest data when DC’s comforting words feel so much better?

Such consistent trends of sanctioned dishonesty, however, force us to question the intelligence and desperation of our so-called “leadership.”

From Fake Math to Real Wars

I’ve written and spoken extensively about the avoid-ability of the war in Ukraine as well as the foreseeable stupidity of the Western sanctions against Putin, all of which have empirically backfired at every level– from the slow collapse of the petrodollar (and hence USD) to the slow rise of a stronger, Eastern-lead trading block among the BRICS.

The

petrodollar is no laughing matter. Since de-coupling from the gold

standard, the US relies on the forced global purchase of oil in US

Dollars to prevent this already debased currency from losing even more

demand, and hence value and power.

Only two global leaders have

since tried to stand up to the petrodollar power in the past. Saddam

Hussein wanted to buy oil in euros and Khaddaffi wanted to buy oil in

gold; and just look what happened to them…

Unfortunately for the

US, both China and Russia have nuclear weapons. Hence, the US playbook

of fighting wars or indirectly eliminating leaders to keep its financial

interests secure got a little bit messier this February when poking at

Putin.

The Dollar Fairytale: Another Open Lie from On High

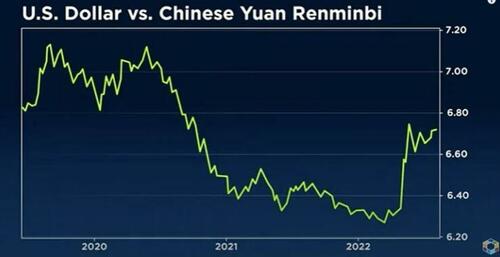

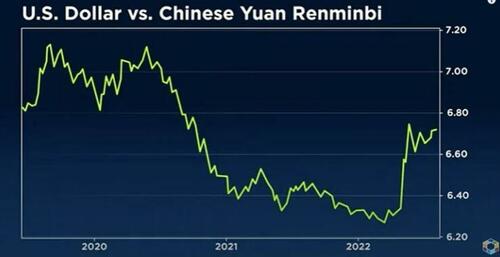

Despite openly objective evidence of an increasingly unloved USD, DC continues to boast of the relative strength of the USD on the DXY.

What

DC won’t say, however, is that this “strength” is only measured against

a tanking yen and euro, two debt-soaked currencies who don’t have

enough reserve currency clout to afford a currency-boosting rate hike.

Against the Chinese Yuan, however, the US has less of which to boast…

In short, the USD is anything but strong.

As discussed above, its inherent purchasing power has been neutered by over a century of devaluation and is little more than the best horse in the Western glue factory.

Profitable War Drums

Given

the failings and open lies above, from inflation realism and

recessionary word-smithing to dying currencies and rising, unpayable

debts, why on earth would the US now be saber rattling over the Ukraine

or pinching the Chinese bear over Taiwan?

Is it to spread democracy and freedom by helping the underdog, whatever the sacrifice?

Well,

one of our most famous underdogs, military generals and presidents,

George Washington, warned over 2 centuries ago to precisely avoid such

foreign entanglements. “Truly enlightened and independent patriots,” he

argued, focused on prosperity within their borders not peripheral wars

outside them.

Despite such warnings, the US has spent a lot of time fighting outside its borders rather building unity within them.

Why?

One sad but empirically proven argument is that war is historically good for tanking GDP and struggling stock markets.

In March of 2018, I penned an eerily prescient analysis of how US stocks love global war, and warned of escalations against Russia and China.

In

particular, I addressed the historical data of the “war dividend,”

which tracked US markets reacting favorably to de-stabilization outside

its borders.

Thus, even if Generals Washington and Eisenhower

warned against such conflicts, Wall Street and the defense contractors

who lobby DC love a good war.

Why?

Because war feeds US markets. Conflicts overseas create massive capital flows into the relative safety of the US.

During

the Iraq War, hundreds of billions in Middle Eastern assets rushed into

US markets while NATO bombs landed in Iraq. Between 2003 and 2008, the

Dow rose steadily upwards.

During the Vietnam War (which killed

58,000 Americans and 1.2 million Vietnamese), the Dow gained 53%. When

the war ended, the markets promptly fell, and fell hard.

During

the Great War of 1914-1918, the Dow nearly doubled. As for WW2, the Dow

rose by 164% between Pearl Harbor in 1941 and VJ day in 1945.

Given

such numbers, was the recent idea of sending a kindergarten-level

intellect like Kamila Harris to negotiate peace (?) with Putin in early

2022 deliberately set up to fail?

Was Pelosi’s recent flight to

Taiwan a commitment to ensure freedom? Or is there a more sinister, yet

hidden, motive to push for war in a time of economic disaster at home?

Is America Heading in the Opposite Direction of Its Founding Fathers?

History confirms that every debt

crisis leads to a financial crisis, a market crisis, a currency crisis,

social unrest, a political crisis, and ultimately extreme authoritarian

and centralized control from the far political left of right.

Given

how increasingly centralized our openly broken yet centrally controlled

markets, economies and politics have become, and given the acceleration

and scope of the open lies, backfiring polices and unpayable costs and

debts which have emerged in the post-COVID and post-sanction new normal,

is it possible that the USA is headed toward a similarly authoritarian

fate?

Is it possible that the by ignoring the clear warnings of

figures like George Washington, Thomas Jefferson, Andrew Jackson,

Benjamin Franklin and Dwight Eisenhower, that America is heading in the opposite direction of its founding principles?

Is

it possible that the openly failing inflation, recessionary, domestic

and foreign polices listed above are more than just a list of stupid

mistakes, but indicators of a set-up for something more sinister?

Are

our markets, economies, currencies and individual freedoms being

sacrificed to the altar of order, control, safety and security?

Is DC creating an intentional class of American lords and serfs, in which the former hand out stimulus checks to prevent the later from reaching for pitch forks?

As

we learned in the Europe of the 1930’s or the lockdowns of the 2020’s,

fear (be it viral, militant or economic) is a potent tool of control—it

turns revolutionary anger into malleable subservience.

Just a thought.