Japan couldn't find the exit to its real estate bubble and neither is China now. The simple reason is the scale of the bubble, usually many times that of the economy.

So what comes next for China? The 1990s in Japan were stressful financially but not yet a catastrophe. Huge projects were being completed just as in China today, while more debt was piling up. The problem was floundering growth, again just as China today and the fact that most new projects were uneconomical and would therefore bring no future growth. (Imagine what was going to happen to Olympic swimming pools in villages which didn't have the money to pay for the upkeep?)

This doesn't mean quite yet the end of China but as for economic growth, 10% certainly belongs to the past. Now money will be more scarce and investment will have to be more selective. This is where Japan failed, completely missing the digital revolution, while investing in absurd projects such as the computer 5th generation, whatever it meant for people then, which brought absolutely nothing. Hopefully China will be wiser although "wise" has its limits which is why it is often better to rely on market forces.

So much for that Chinese housing "bailout", which we correctly warned would be woefully insufficient.

A

slew of data published early Monday local time, showed that among

various other economic measures, China’s housing slump deepened in May

and triggered new calls for the government to pump cash and credit into

the economy, while industrial output, which has kept growth on track,

fell short of forecasts.

New home prices - the most important

indicator of middle-class wealth in the world's second biggest economy -

dropped at the fastest pace since October 2014, falling 0.7% m/m in May

(v/s -0.58% in April) and marking the 11th straight decline despite the government’s stimulus to support the property market.

On an annual basis, home prices slumped 4.3%, the biggest drop since

the summer of 2015. In fact, the last time home prices plunged so much

Beijing pursued a massive yuan devaluation that led to a $1 trillion in

fx outflows to stabilize and sparked the very first mega meltup in

bitcoin which sent it from $200 to far over $1000.

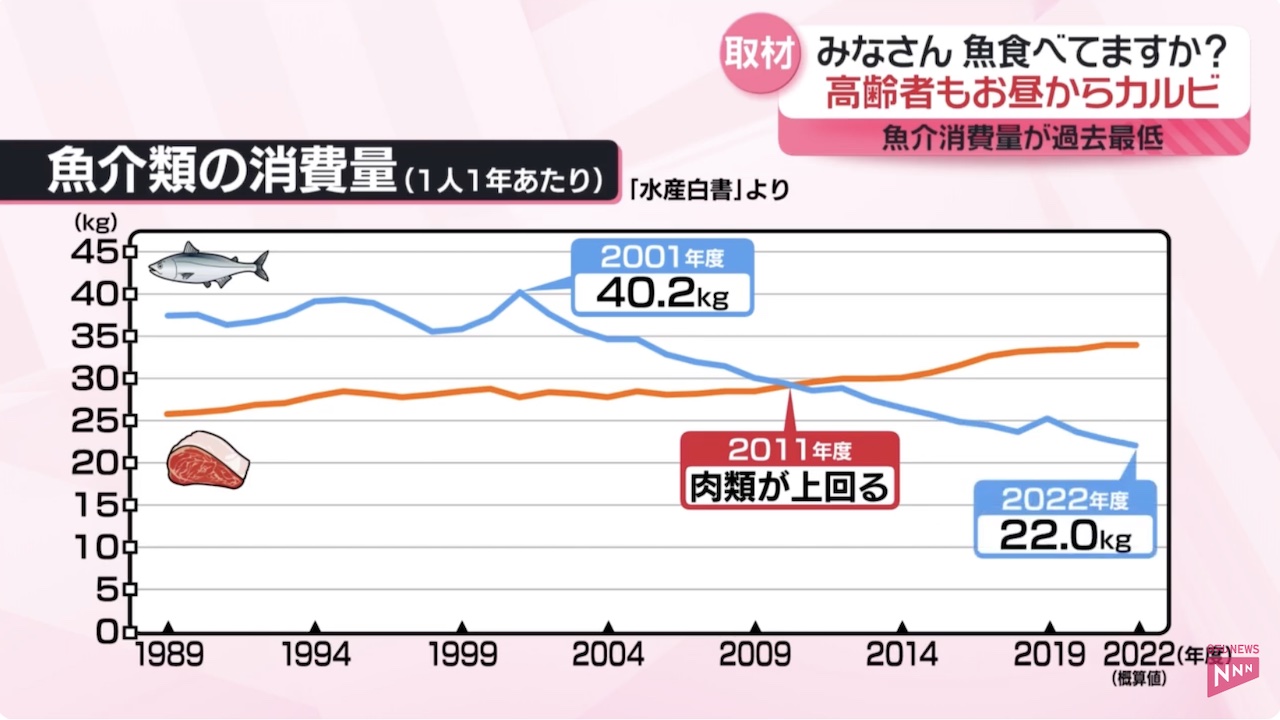

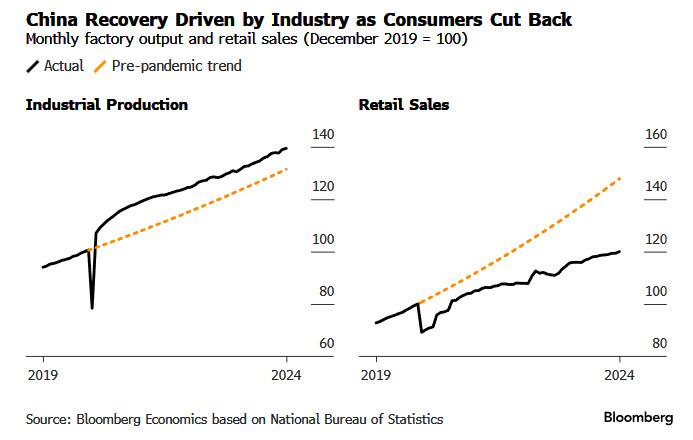

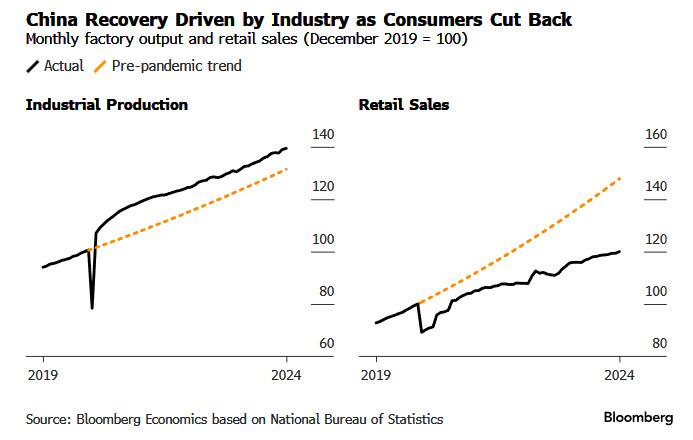

Staying

on China retail sales rose +3.7% y/y in May, exceeding market

expectations for a +3.0% gain and increasing pace from a +2.3% increase

in the previous month but Chinese shoppers remain far from recovering

their pre-pandemic mojo. However, other economic metrics failed to

surpass market forecasts with industrial output growing +5.6% y/y in May

(v/s +6.2% expected), down from an increase of +6.7% in April and

missing the median forecast in a Bloomberg survey.

Meanwhile,

the nation’s real estate crisis continued to weigh on investment in

fixed assets with the overall YTD investment figures expanding +4.0%,

also below estimates of +4.2% gain.

“The

most disappointing in May’s data is probably that property sales barely

saw any improvements even after so many supportive measures,”

said Jacqueline Rong, chief China economist at BNP Paribas SA. She said

China’s authorities need to find ways to lower the rates on existing

mortgages, closing the gap with the cost of new ones.

The numbers -

excluding the dire real estate prints - add up to a still-weak recovery

most economists said, and will likely require more action from Beijing

to bolster consumer demand and tackle imbalances, if this year’s 5%

growth target is to be met. That could take the form of stepped-up

government spending and heightened efforts by the central bank to put a

floor under housing markets and get credit flowing.

On the other

hand, if one includes China's collapsing property market - which once

upon a time was the world's largest asset class - it becomes clear that

while Beijing may pretend it does not need a huge fiscal and monetary

stimulus, it's

Late last month, China unveiled a broad

rescue package to prop up housing sales as a credit crisis was engulfing

some of the country’s biggest real estate developers. It relaxed

mortgage rules and encouraged local governments to buy unsold homes.

However, as we warned and

many others agreed, the financial incentives aren’t big enough and

trial programs in several cities have shown progress can be slow.

Subdued

demand at home and the deteriorating foreign-trade environment are

weighing on business confidence, discouraging companies from investing

and driving some to move production overseas. Credit growth has

been lackluster and the M1 money supply gauge contracted in May at the

fastest rate in data going back to 1996.

Elsewhere, the

PBOC on Monday kept a key interest rate unchanged for the

tenth straight month. Economists say the bank’s room to cut rates is

constrained by the need to prop up the yuan, which faces downward

pressure as the US Federal Reserve reinforces its high-for-longer

message.

China’s growth remains “highly uneven, with exports and

new energy-related capex as the drivers while consumption and property

as the drags,” according to economists including Larry Hu at Macquarie

Capital Ltd. Still, the slowdown isn’t severe enough to threaten the

growth target and while policymakers may take some limited action “the

urgency for a major stimulus is low,” they wrote

In a survey of

more than 400 top executives conducted by UBS Group AG over roughly a

month through mid-May, firms reported weaker prospects for orders,

revenue and margins compared with the same period of 2023. There was a

drop in the share of respondents who plan to increase capital

expenditure in the second half of this year.

“We still need to see

new stimulus coming in,” said Helen Qiao, chief Greater China economist

at Bank of America Global Research, in a Bloomberg TV interview.

“Otherwise the growth momentum could very much weaken.”