Via VigilantFox.com,

It’s not every day an active HHS Secretary sits down for 90 minutes straight with Tucker Carlson.

But that’s exactly what happened, and Kennedy instantly seized Carlson’s attention with a chilling story of CDC corruption.

He revealed that the health agency buried a 1999 internal study led by researcher Thomas Verstraten, which showed an alarming 1135% increase in autism risk from the hepatitis B vaccine.

Kennedy said the researchers were “shocked” by the findings.

So what did they do? They covered it up, according to Kennedy.

“They

got rid of all the older children essentially and just had younger

children who are too young to be diagnosed [with autism].”

RFK Jr. then explained the real reason why your pediatrician will kick you out of their practice for refusing vaccines.

“There’s a published article out there now that says that 50% of revenues to most pediatricians come from vaccines.”

It’s all about the money. The higher the vaccination rate, the bigger the bonus.

“And

that’s why your pediatrician, if you say I want to go slow on the

vaccines… will throw you out of his practice because you’re now

jeopardizing that bonus structure.”

To

the claim that the vaccine–autism link has been “debunked,” Kennedy had

a message for Anderson Cooper, Jake Tapper, and everyone who smugly

insists on it.

“None of the vaccines given to children in the first six months of life have ever been studied for autism.”

Let that sink in.

He went further, revealing that the CDC actually did find a link when they studied the DTaP vaccine.

But

they dismissed it. Kennedy said they claimed it “didn’t count” because

the data came from VAERS—the very system they use to track vaccine

injuries.

So when the evidence pointed to harm, they simply claimed their own system wasn’t reliable enough and took no steps to fix it.

The

vaccine corruption didn’t end there. Kennedy attested that the CDC

killed off a vaccine injury reporting system that actually

worked—because it worked too well.

It showed that 1 in 37 vaccines caused an injury.

Tucker was stunned.

“Of all vaccines?” he asked.

“Yeah,” Kennedy confirmed.

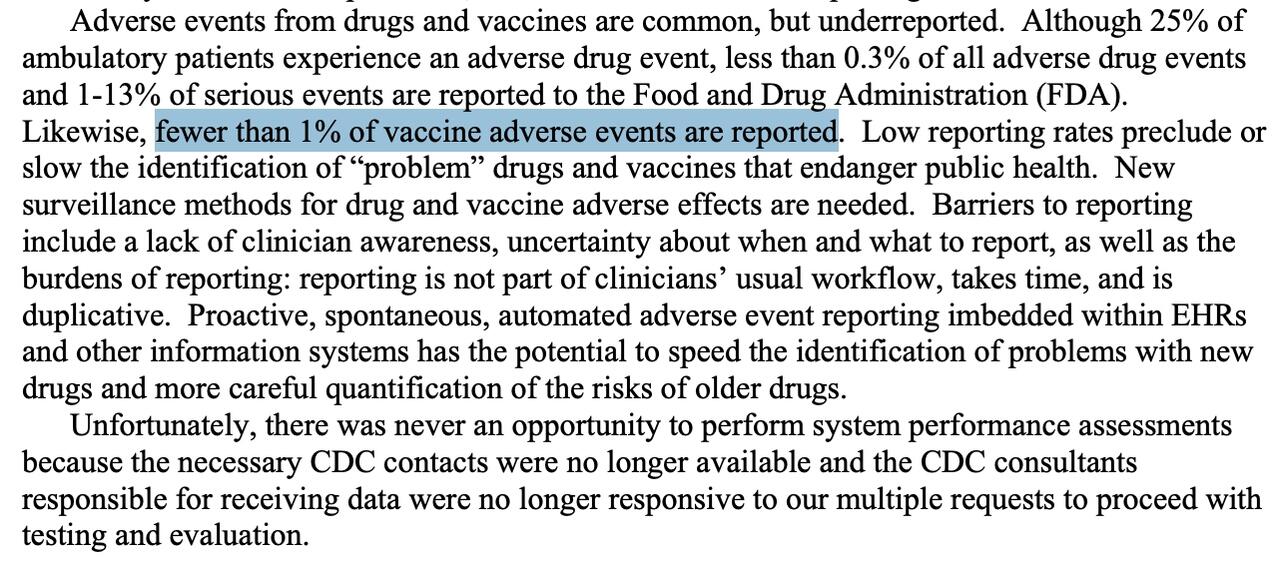

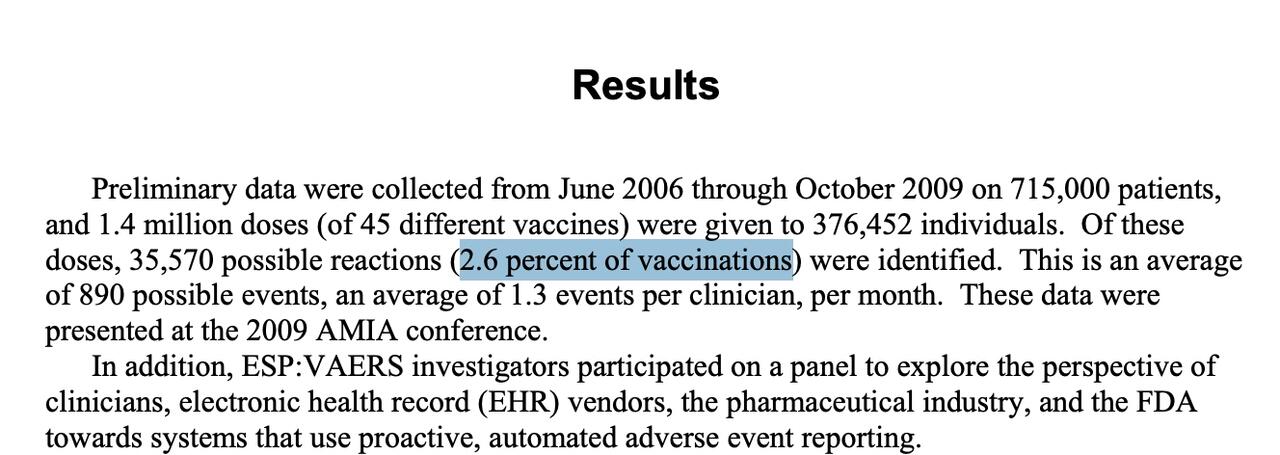

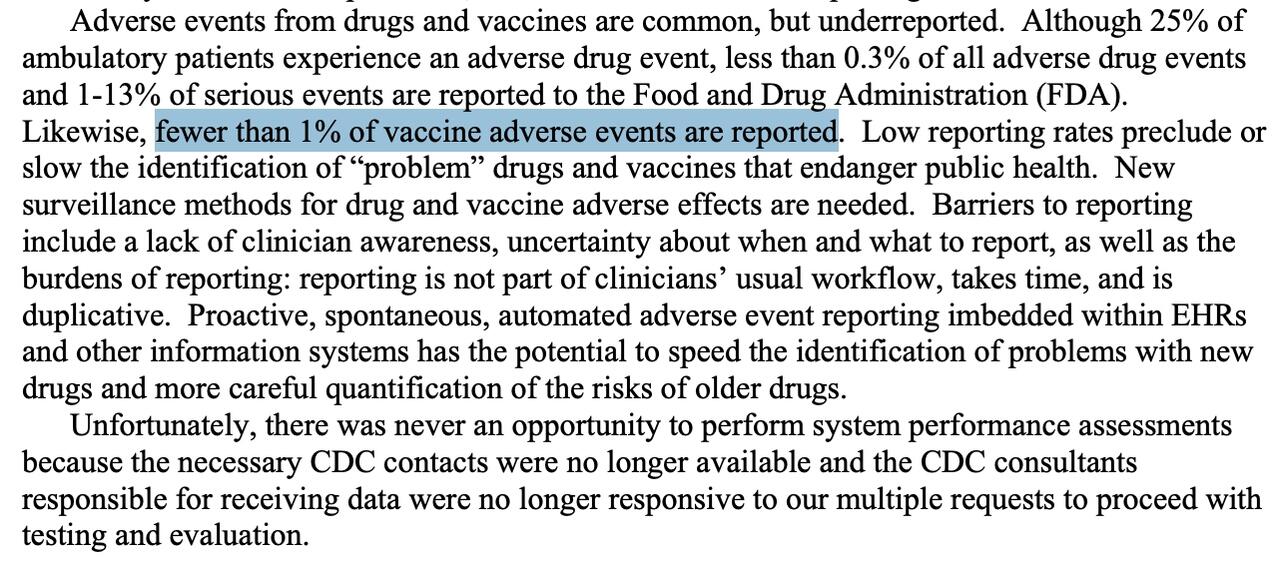

RFK Jr. explained that the CDC funded a study led by researcher Ross Lazarus. It compared a sophisticated machine-counting system to VAERS.

What did they find? VAERS was failing to catch over 99% of vaccine injuries.

The new system also revealed that 2.6% of all vaccinations resulted in an injury.

So

what did the CDC do? They shut it down in 2010. And they’re still using

VAERS today—even though it’s a completely inadequate system.

But Kennedy didn’t stop at old vaccine scandals. He also broke down Pfizer’s own COVID vaccine trial data. That trial showed a 23% higher death rate in the vaccinated group.

Pfizer gave 21,720 people the vaccine and 21,728 the placebo.

One

vaccinated person died of COVID. Two placebo recipients died. They used

this tiny difference to claim “100% effective” based on relative risk

reduction.

But in absolute terms, it took 22,000 vaccinations to save one life.

Over six months, 21 vaccinated participants died of all causes, compared to 17 in the placebo group—a 23.5% higher death rate.

And then there’s vaccine spokesperson Paul Offit, often seen on CNN and other mainstream networks.

Kennedy shared an infuriating story about how he literally “voted himself rich” on the rotavirus vaccine.

While

serving on the CDC’s ACIP committee, Offit voted to add rotavirus

vaccination to the childhood schedule—even as he was developing his own

competing vaccine. He guaranteed demand for his product.

The first

approved rotavirus vaccine, RotaShield, was yanked from the market for

causing dangerous intussusception. Offit’s vaccine, RotaTeq, eventually

replaced it.

He and his partners later sold their rights to Merck for $186 million. As RFK Jr. said, Offit literally “voted himself rich.”

When Carlson mentioned Fauci, Kennedy revealed how Fauci funded research that helped scientists hide evidence of lab-made viruses.

The

technique, called “seamless ligation,” allowed researchers to engineer

viruses in a lab without leaving telltale genetic fingerprints.

RFK Jr. explained:

“One

of his fundees, Ralph Baric, from the University of North Carolina,

developed a technique called the seamless ligation technique, which is a

technique for hiding the laboratory origins of a manipulated virus.”

“…

normally if there’s a virus manipulated, researchers can look at the

DNA sequences and they can say this thing was created in a lab. Ralph

Baric had developed a technique that he called the no-see technique and

its technical name was seamless ligation, and it was a way of hiding

evidence of human tampering.”

He called it the exact opposite of what real public health work should be. Carlson cut in, saying, “That’s what you would do if you’re creating viruses for biological warfare.”

The conversation shifted to Trump, leading to one of the biggest highlights of the entire interview.

First, Kennedy explained that Trump chose his cabinet in an unorthodox way: he wanted to see three clips of each candidate performing on TV before considering them for the job.

“One

of the things with President Trump is that he really knows how to pick

talent… For every one of the positions that he picked, he wanted to see

three clips of them performing on TV. He’s very conscious of the fact

that these people are going to be out selling his program to the

public,” Kennedy said.

That’s when Kennedy ended the interview

with a bang, sharing his genuine thoughts about Trump for three straight

minutes. It was one of the standout moments of the entire conversation.

If you’re on the fence about Trump, listen to Kennedy here. It might just change how you see him.

“I

had him pegged as a narcissist, when narcissists are incapable of

empathy. And he’s one of the most empathetic people that I’ve met,” Kennedy said.

“He’s

immensely curious, inquisitive, and immensely knowledgeable. He’s

encyclopedic in certain areas that you wouldn’t expect,” he continued.

Kennedy

added that Trump genuinely cares about soldiers who go to war, citing

how Trump “always talks about the casualties on both sides” of the

Russia–Ukraine conflict.

“Whether it’s vaccines or Medicaid or

Medicare, he’s always thinking about how this impacts the little guy.

And the Democrats have him pegged as a guy who’s sort of sitting in the

Cabinet meeting talking about how can we make billionaires richer. He’s

the opposite of that. He’s a genuine populist,” Kennedy said.

Here’s the clip. Trust me, watching this is better than reading it.

There’s so much more in this conversation, and it might change the way you think about vaccines forever. For the full picture, watch the entire interview below.