Are we at the very edge of the "real" war against the deep state? If that's the case it will be spectacular since everyone has something dirty on everyone else. It will be a fight to the finish with no truce in sight between the different tentacles of the octopus.

America could win in the long term if a true clean-up takes place although this is very, very unlikely.

What is certain is that confusion and mayhem at the top will continue and amplify. Then it could be the turn of Europe and finally, just like that we will have entered "interesting times!"

'Betrayal Of Every American' - Barack Obama Now Squarely In Russiagate Crosshairs

New disclosures from a Tulsi Gabbard-led working group point directly to the top, as the legacy of "Hope and Change" begins a plunge to the ocean floor...

As Matt Taibbi writes for Racket News, Barack Obama entered national politics with a smile that looked like Hope and Change. Amid rumors of family discord and disarray within the political party he once led, his face has hardened. He lately looks bitter, resentful, exhausted by the act.

In the wake of reports released by fellow Hawaiian and former Democrat Tulsi Gabbard, he also has a new problem. It once seemed a lock that Obama would be remembered as the winsome hero of Shepard Fairey’s portrait, but Gabbard’s documents place him at the center of an unprecedented act of political sabotage, committed in his last Oval Office days as a humiliated lame-duck in the winter of 2016-2017. The new Director of National Intelligence is targeting Obama’s legacy and maybe even his freedom, detailing a “treasonous conspiracy committed by officials at the highest level of our government,” announcing that everyone involved “must be investigated and prosecuted to the fullest extent of the law.”

Ten days ago, news broke that Donald Trump’s Justice Department opened criminal investigations into two of Obama’s top deputies, former FBI chief James Comey and former CIA head John Brennan. Last Sunday, Gabbard’s ODNI hosted an “urgent” meeting to discuss “new information on Russiagate” with members of the Justice Department and the President’s Intelligence Advisory Board.

All week, Washington buzzed with rumors about imminent document releases, but what came out wasn’t what many expected. Gabbard’s documents show the Obama White House overruling months of reports downplaying Russian interference and ordering subordinates to set a time bomb of manipulated intelligence, with the aim of trying to, as Gabbard described it, “usurp” an incoming president. No longer a tertiary character, Obama is now “center square” in the Russiagate scam, as one source put it.

Mainstream press outlets like the New York Times and Politico have already run pieces quoting Democratic Party mouthpieces shrugging off Gabbard’s reports as “baseless” and an attempt to “change the subject,” but coverage may not matter, as the investigation into the Trump-Russia hoax is no longer about trying to change hearts and minds. Multiple sources say Gabbard’s team is focused on “accountability” by gathering evidence for court-ready cases. The matter may soon need a special prosecutor, putting Obama in the same position Trump occupied in the first two years of his presidency, on the run from a high-profile fox hunt.

The information from Gabbard’s office was not the only news on the Russiagate front. This investigation is not just about “ten-year-old news,” as has been a common talking point, but may also involve never-reported Biden-era issues. A source close to the investigation said yesterday that the DOJ is focusing on conspiracy charges and looking at conduct “from 2016 to 2024.” Another with ties to the administration said “President Trump’s national security team is looking at evidence that members of his 2024 campaign were spied on as well.”

All of that is yet to be determined.

...

Not everyone in Trumpworld is thrilled with the new developments. The failure of senior intelligence officials who served in Trump’s last term to find and/or release these documents has a number of high profile figures upset. “So much corruption,” said one disgusted former Trump official. Another expressed skepticism that anything of significance would come of these investigations, and pointed to Special Counsel John Durham’s ill-fated probe: “It’s always something.” Thanks to the investigation kicked off by this ICA and the subsequent probe by Special Counsel Robert Mueller, there are people who went to jail, fell ill, went through family crises, and dealt with other serious problems. As a result, there are a lot of eyes on this investigation, and high expectations. Failure for Gabbard’s team to deliver real consequences would bring heavy criticism from both sides.

Gabbard’s team seems to understand they will be judged on the “accountability” question, and remain determined to continue.

As we detailed earlier, Director of National Intelligence, Tulsi Gabbard, has declassified documents revealing "overwhelming evidence" showing how then-President Barack Obama and his national security team laid the groundwork for what would become the years-long Trump-Russia collusion investigation after President Trump won the 2016 election.

"This is surreal," says General Mike Flynn...

Americans will finally learn the truth about how in 2016, intelligence was politicized and weaponized by the most powerful people in the Obama Administration to lay the groundwork for what was essentially a years-long coup against President Trump, subverting the will of the American people and undermining our democratic republic.

Here’s how:

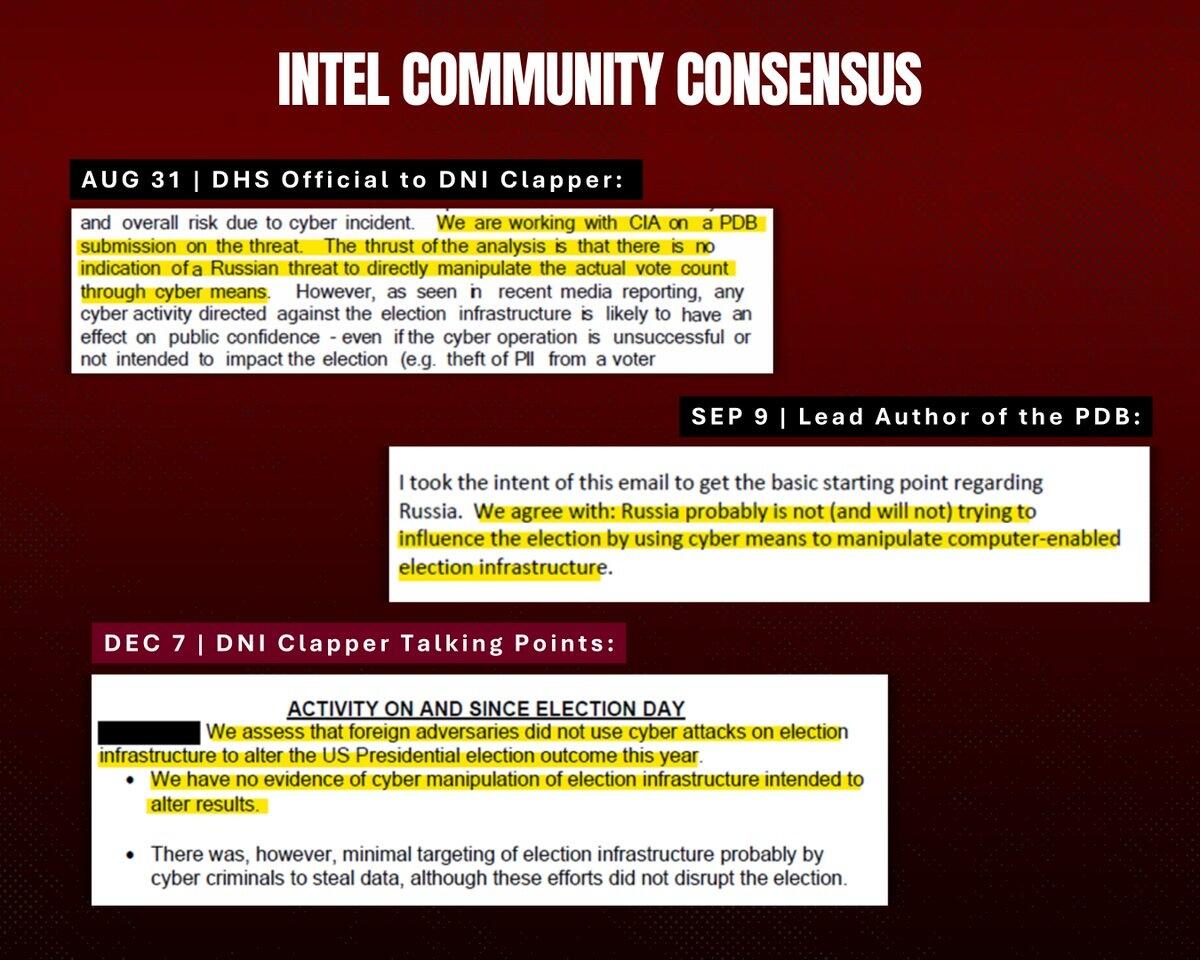

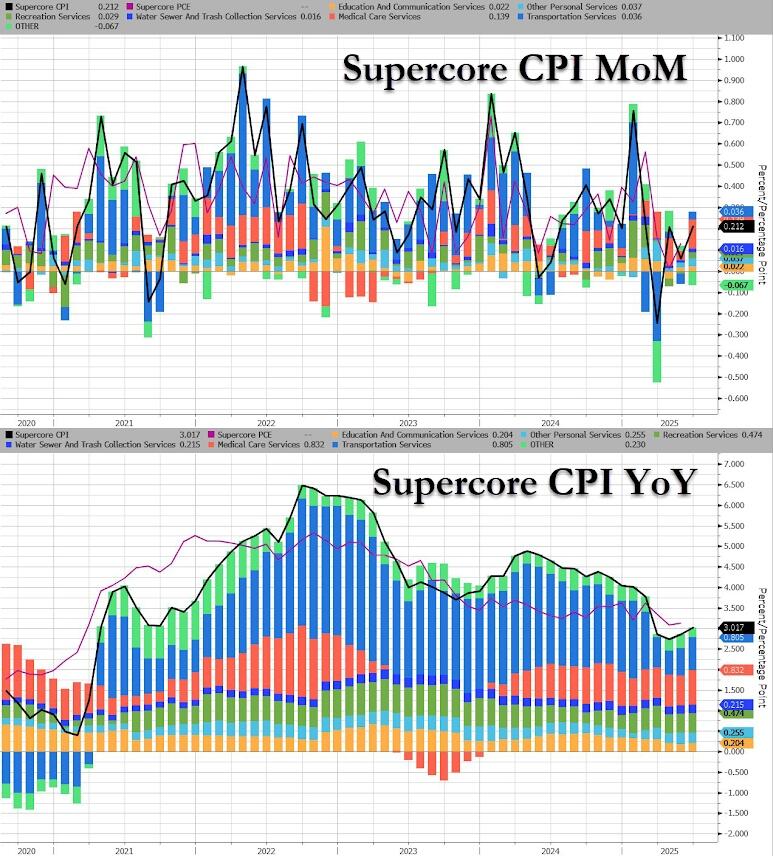

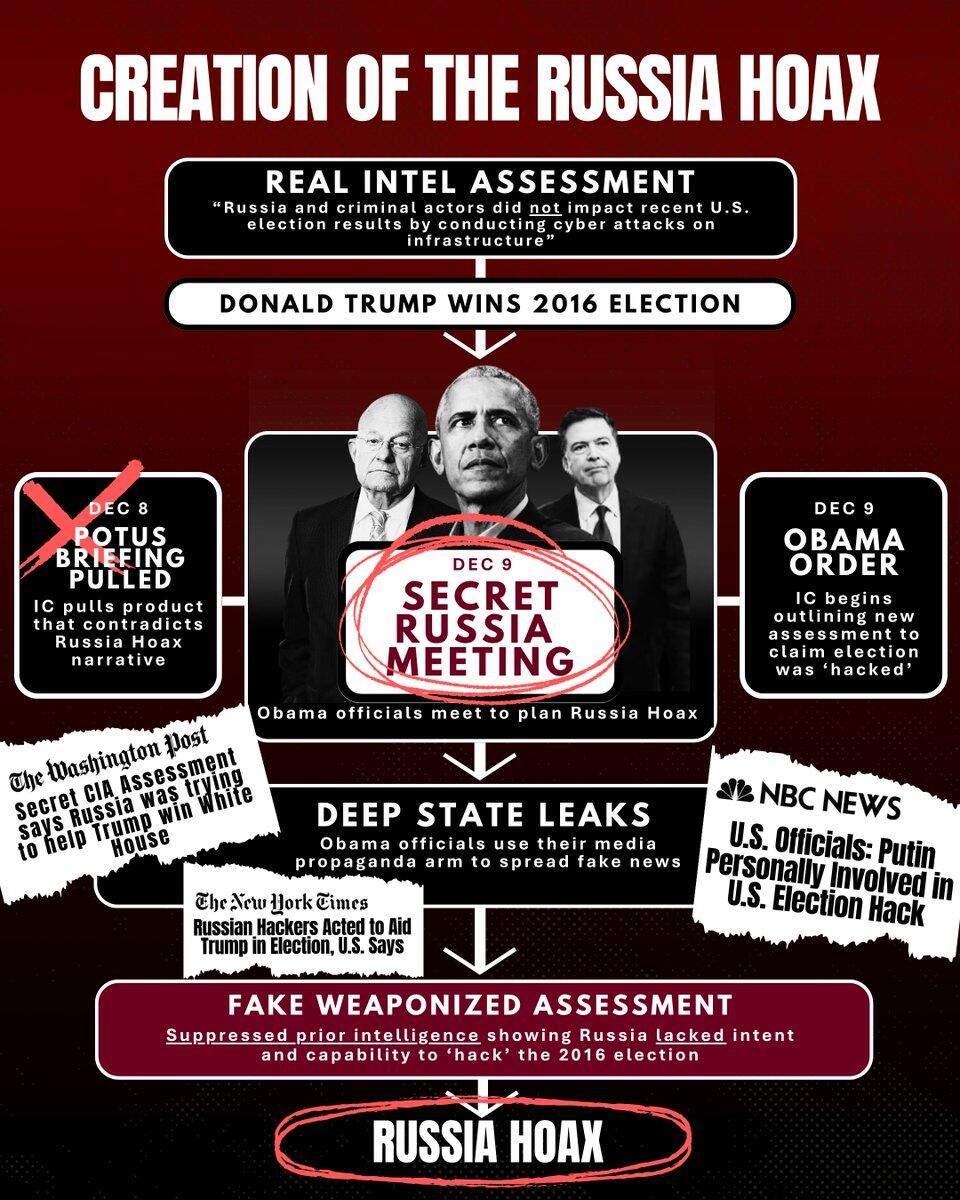

For months preceding the 2016 election, the Intelligence Community shared a consensus view: Russia lacked the intent and capability to hack U.S. elections.

But weeks after President Trump’s historic 2016 victory defeating Hillary Clinton, everything changed.

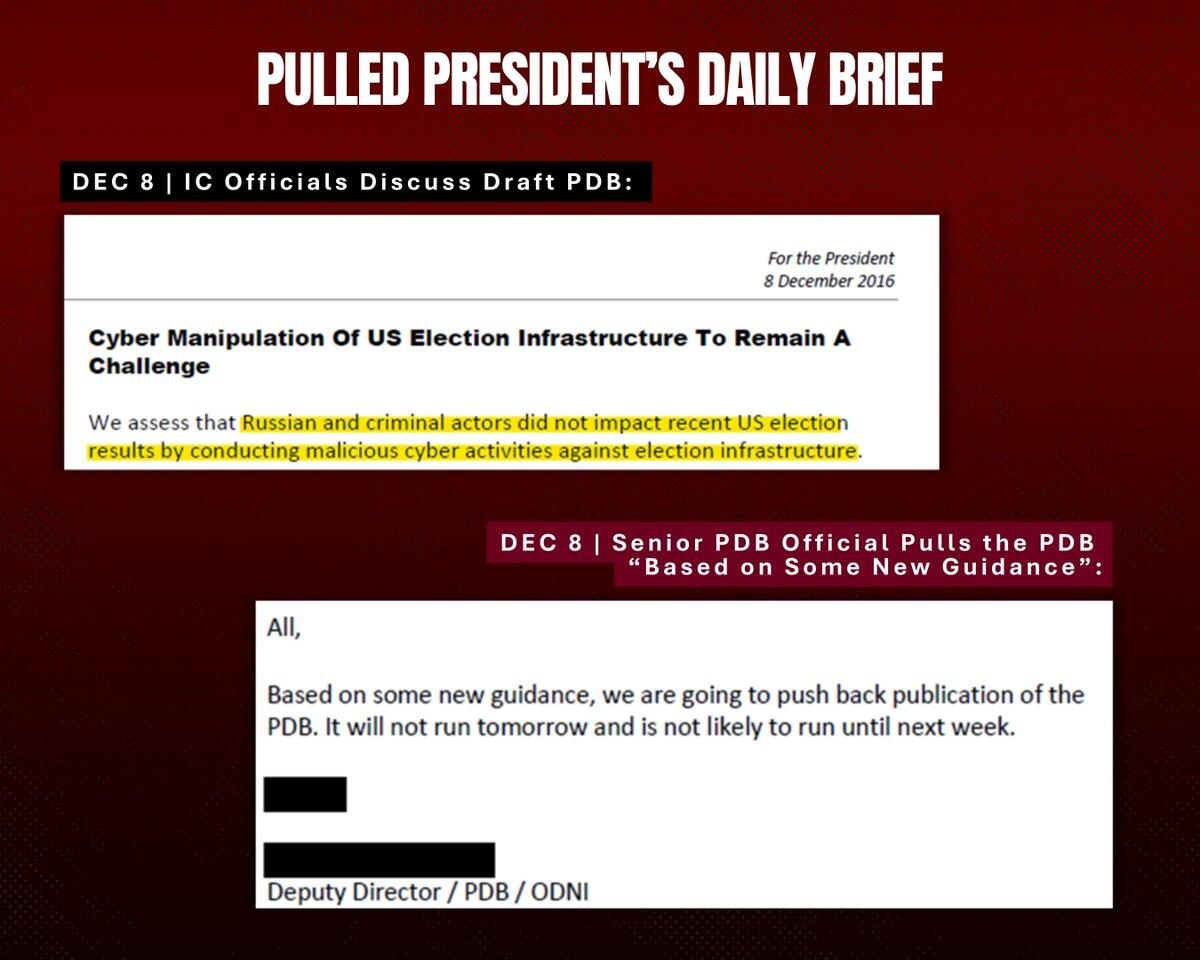

On Dec 8, 2016, IC officials prepared an assessment for the President's Daily Brief, finding that Russia "did not impact recent U.S. election results" by conducting cyber attacks on infrastructure.

Before it could reach the President, it was abruptly pulled “based on new guidance.” This key intelligence assessment was never published.

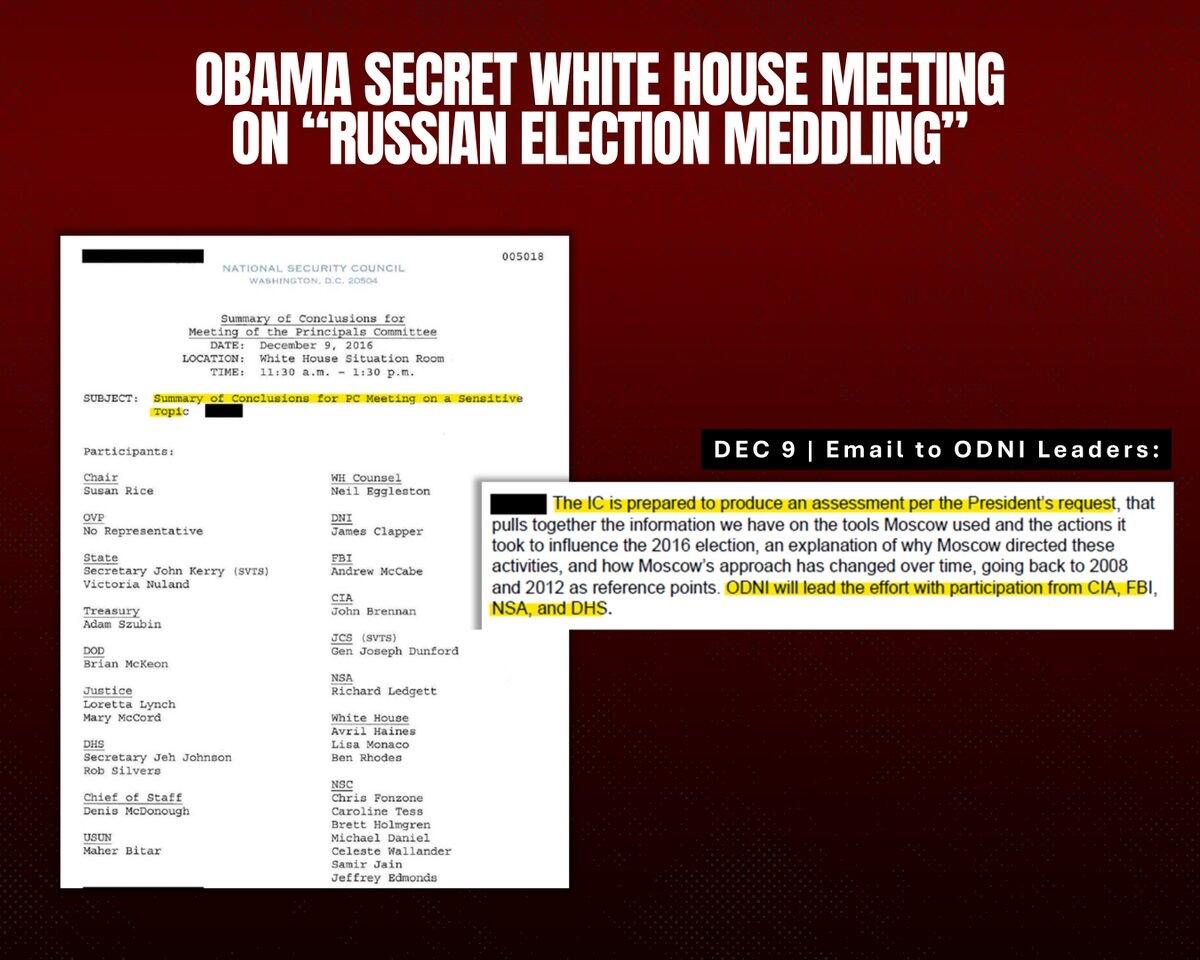

The next day, top national security officials including FBI Dir James Comey, CIA Dir John Brennan and DNI James Clapper gathered at the Obama White House to discuss Russia.

Obama directed the IC to create a new intelligence assessment that detailed Russian election meddling, even though it would contradict multiple intelligence assessments released over the previous several months.

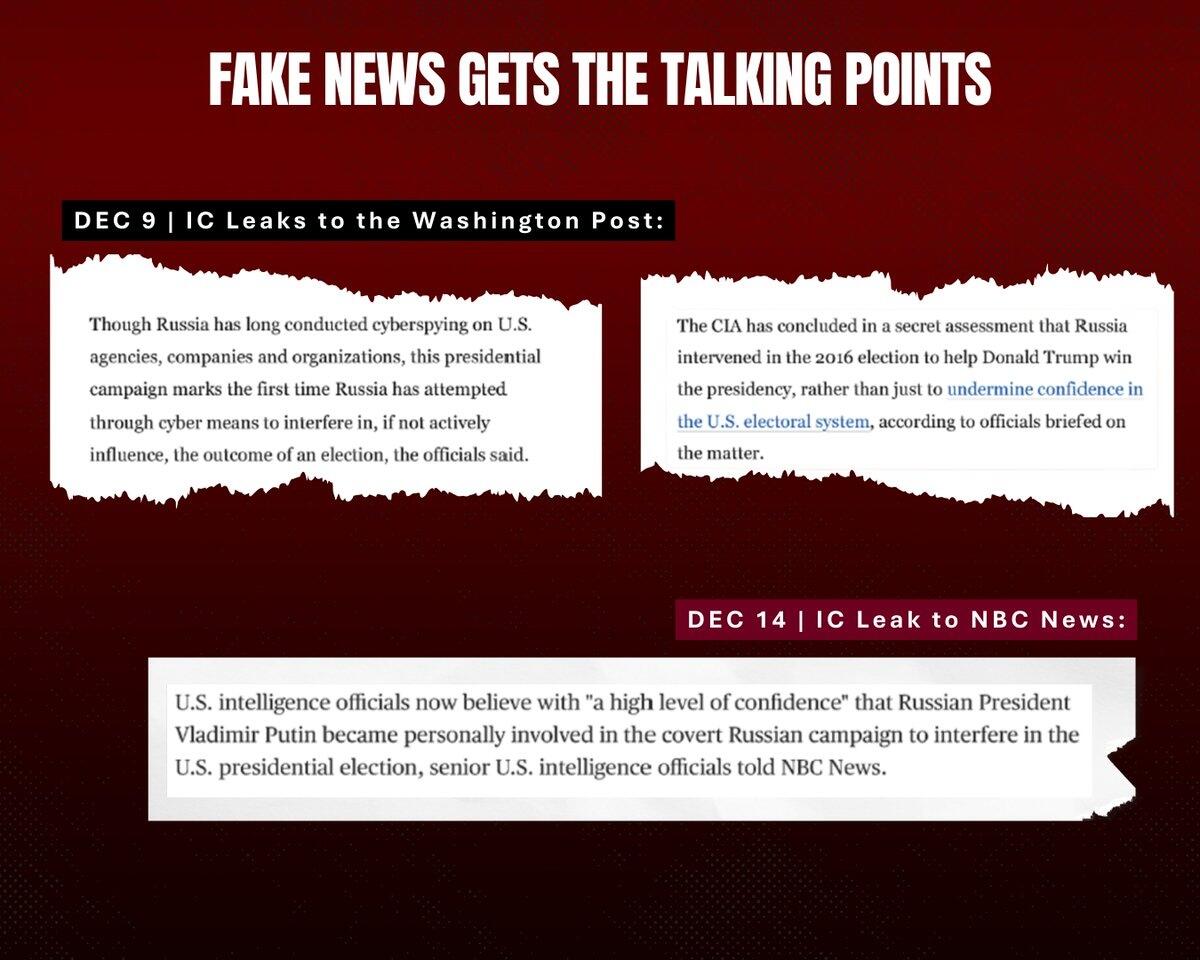

Obama officials immediately leaned on their allies in the media to advance their falsehoods.

Anonymous IC sources leaked classified information to the Washington Post and others that Russia had intervened to hack the election in Trump's favor.

On

January 6, 2017, just days before President Trump took office, DNI

Clapper unveiled the Obama-directed politicized assessment, a

gross weaponization of intelligence that laid the groundwork for a

years-long coup intended to subvert President Trump’s entire presidency.

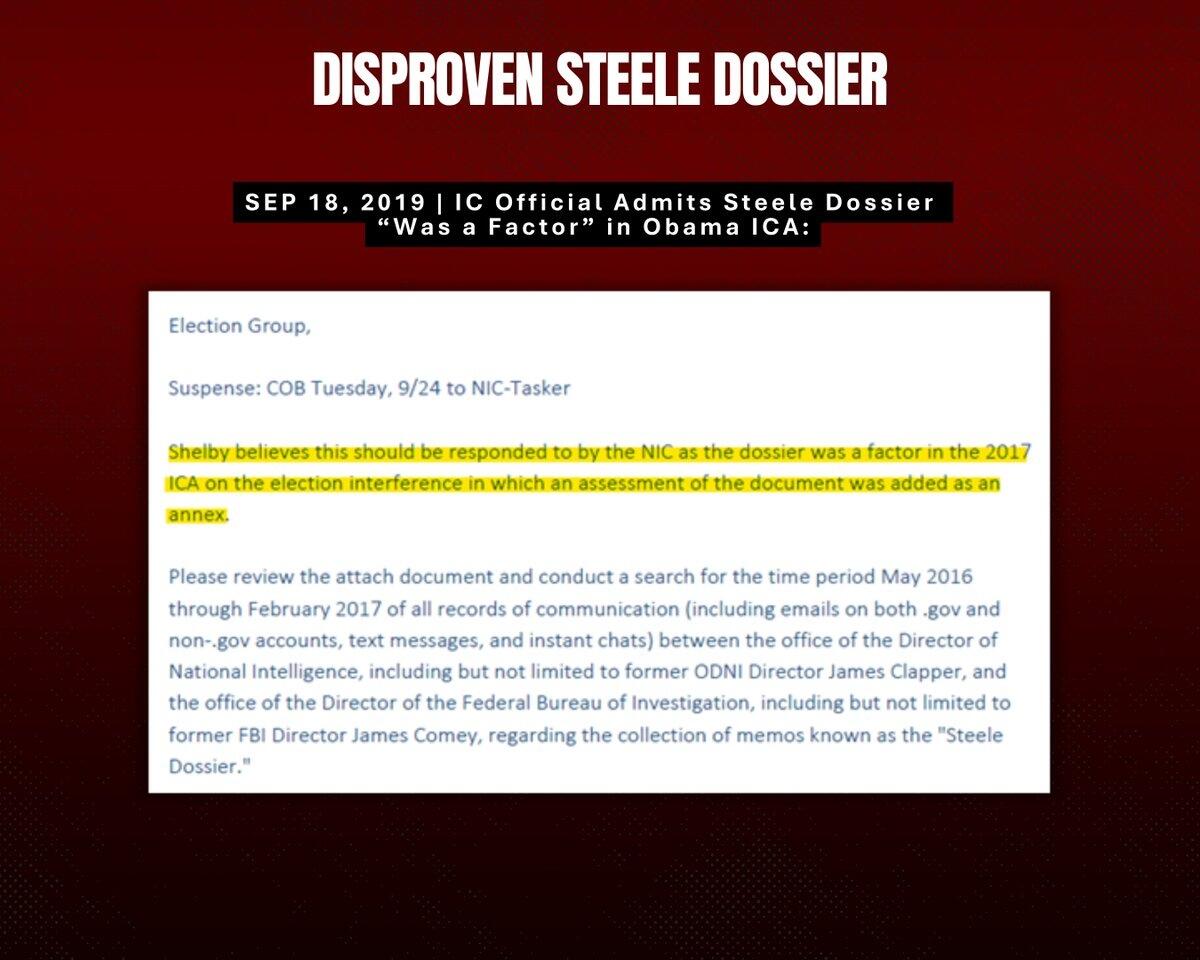

According to whistleblower emails shared with us today, we know Clapper

and Brennan used the baseless discredited Steele Dossier as a source to

push this false narrative in the intelligence assessment.

These documents detail a treasonous conspiracy by officials at the highest levels of the Obama White House to subvert the will of the American people and try to usurp the President from fulfilling his mandate.

This betrayal concerns every American.

The integrity of our democratic republic demands that every person involved be investigated and brought to justice to prevent this from ever happening again.

I am providing all documents to the Department of Justice to deliver the accountability that President Trump, his family, and the American people deserve.

You can read Tulsi's full press release (with links to all the supporting documents) here...

Distraction from Epstein or not... there's a lot here!