Clearly the war in Ukraine is a proxy war and the stakes are much higher than a corrupt country that very few people care much about, save Hunter Biden... maybe?

The protagonists are New York and the City of London on the Western side, and Russia and China on the multi-polar side. China, maybe reluctantly as the country needed another two or three years of strengthening before such a direct challenge to the Occidental world order.

But now that the dices are rolling, all the protagonists will have to take the gloves off. China of course, but also India, Saudi Arabia, South Africa and all the other raw material producers who will less and less accept valueless currencies for actual resources. This is the real start of the real war of the 21st century. Buckle up for the ride!

Authored by Tom Luongo via Gold, Goats, 'n Guns blog,

I don’t think everyone has yet caught the significance of Russia announcing they are putting a floor under the price of gold.

But, to be clear, Russia just broke the paper gold suppression scheme.

On Friday the Bank of Russia announced:

RUB5000 to the ounce at an exchange rate of 100 RUB/USD implies a $1550 per ounce gold price.

For a few days previous to this announcement, which they knew was coming, The West was running around with multiple bits of legislation to try and keep the Russians from selling their gold.

The G7 think the sanctions are hitting so hard that Putin will be forced to sell his gold to evade sanctions to pay for things. They are literally running a script in their heads that is not actually playing out in the real world.

But, whatever, Neocons never met an ugly stick that they didn’t want to use to beat someone over the head with. Too bad all they’re doing is hitting a rubber tire.

Boing!

Because here’s the gig, Russia won’t be selling any gold. They’re buying it.

These are supposed to be the architects of the global monetary system and you would think they are the ones that understand it the best. But, clearly they do not.

What they think they understand is that they still control the flow of commodities around the world through price suppression schemes on the CRIMEX, LBMA and ICE.

They do not.

Ultimately, ‘outside money’ trumps ‘inside money.’

Austrians, like myself, have always understood that eventually Inside Money [money that exists within the financial system] fails because it is ultimately nothing more than a Ponzi Scheme built on top of Outside Money — money that exists outside the financial system, like commodities and bitcoin.

Money, It’s a Hit!

Let’s start with the basics. Why do we create money? To act as a way to mitigate the time risk between selling what we have and buying what we want. So we sell our labor today to buy gasoline, printer paper or blow jobs tomorrow. In the meantime we hold money.

It is a way to turn thought and personal application of energy and time into a token which can procure for us real goods in the real world.

With that in mind, now think about the current financial system where all inside money is created by first selling a debt instrument to someone willing to hold it for a vig.

Back to the ruble and gold. Because once I lay out the new incentive structure it will be clear as to why the G7 has no friends in this fight anymore.

Davos’ power rests on the ability to create credit and sell it at a positive interest carry to commodity producers. Since base commodity production in any kind of efficient market should be a very low margin enterprise, think 1-4% real annual return, selling them debt to extract oil or gold out of the ground at higher rates than that ultimately sucks all the profit out of the venture.

Free markets when allowed to function properly grind out profit through competitive arbitrage. It is both brutal and the spark of new innovations and efficiencies.

It is the desire for higher profits over baseline that does this.

In base commodities that is difficult, at best, to do. Why? Because they aren’t anything more than a second order good. First order would be the ore or timber harvested. Second order would be the ingot or lumber produced. The higher order the good, the more specialized it is and the higher opportunity for profit through product differentiation on something other than price emerges.

That’s most difficult to do in improving resource extraction because, it follows, most of the major gains in efficiency occurred in the past when the economy was less specialized.

Confusion Over ‘The System’

If the banks are on both sides of the trade setting the price of money, then they ultimately control who wins and who loses while this goes on. And let’s not mince words, it’s them. The profit rolls up to those that produce the highest order goods with the most complex supply chains.

The banks plough the profits from getting interest on the original debt into the very companies producing the higher order goods needed to ensure the lower order goods produce no wealth through the grinding out of profit via arbitrage throughout the supply chain.

Don’t believe me? Ask cattle farmers.

In this respect the current financing of these industries is nothing more than a virtualized version of the colonial economic model of the 15th through 19th centuries.

Instead of using physical men to subjugate the locals through superior weaponry and bribes to get them to extract the mineral wealth which the colonialists take back home, today we use the post-WWII institutions to run that same system through debt issuance for capex and the interest payments (in this case pure economic rent – unearned wealth).

The producer countries of all the mineral wealth in the world are nothing but debt slaves to the money masters in Brussels, City of London and New York. That’s the gig.

Since we’ve reached the point of debt saturation where no more debt can be issued to extract mineral wealth and have the markets believe it could ever be paid back at these real yields, the system has to be reset.

The whole Great Reset is a way to crash the existing system but leave the same colonialists in power legally.

It’s not really more complicated than that.

When you understand that dynamic now you can understand why Russia, in particular, is the vanguard of the Global South’s desire to change the System of the World.

It is also the one country that has the commodity production power to expose the vulnerabilities of this System.

That’s Nice… #GotRubles?

And that’s where pegging the ruble to gold comes in.

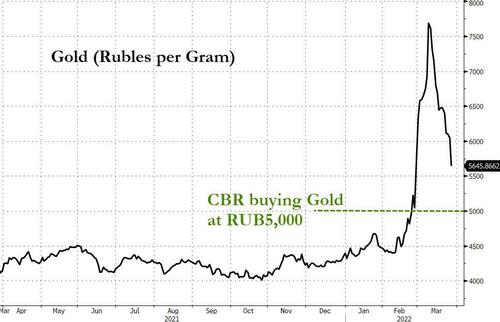

The Bank of Russia is now a buyer of gold at 5000 rubles to the gram, or 155,500 rubles to the troy ounce. At a Friday March 25th closing price of RUB96.62 vs. the USD that implies a gold price of $1610 per ounce.

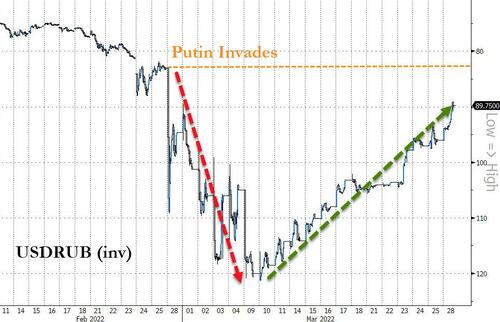

The ruble is now freely strengthening versus the US dollar.

Now, that is not that remarkable on its own.

As I explained on Twitter that day:

1: At $1550 per ounce the first order effect here is that is implies a RUB/USD rate of around 75. Incentivizing those holding RUB to continue and those needing them to bid up the price from current levels.

2: This creates a positive incentive loop to bring the ruble back to pre-war levels. Then after that market effects take over as ruble demand becomes structural, based on Russia’s trade balance.

3: Once that happens and the RUB/USD falls below 75, then the USD price of gold rises structurally draining the paper gold markets and collapsing the financial system based on leveraged/hypothecated gold. Now we’re into the arb. phase @Lukegromen postulated w/ 1000bbls/oz.

So, this scheme incentivizes Russians to hold savings in rubles, because the ruble is undervalued. It also incentivizes foreign traders to hold rubles because the ruble is undervalued relative to an overvalued open gold price.

Clearly currency speculators in Moscow, Shanghai, Singapore, Mumbai and Hong Kong are having a field day with this.

Coupled with Putin demanding ‘unfriendly countries’ paying for their Russian imports with either gold or the ruble, the natural choice is for them to buy rubles until such time as the price of gold and the ruble are in sync on international markets.

The howls of pain from the G-7 and Germany in particular are equal parts pathetic and hilarious as they complain that Putin is in ‘breach of contract’ for demanding a different payment currency for gas other than the euros stipulated in the contract.

Earlier Monday German Economy Minister Robert Habeck said from Berlin that the Kremlin demand for natural gas contracts to be paid in rubles is a “one-sided and clear breach of contracts” – saying the contracts must be honored under prior conditions, according to Bloomberg. “That means that a payment in rubles is not acceptable and we urge the relevant companies not to comply with Putin’s demand,” Habeck said. “Putin’s effort to drive a wedge between us is obvious but you can see that we won’t allow ourselves to be divided and the answer from the G-7 is clear: the contracts will be honored.”

The Kremlin’s quick shooting down of the German economy minister’s comments and the G-7’s stance on the ruble came Monday via a Russian lawmaker to state-run RIA Novosti: “Russian lawmaker Abramov says G7’s refusal to pay in Russian roubles for gas will definitely lead to a halt in supplies.”

Pissed off Russians certainly have a way with words, as a writer, I appreciate this greatly. According to TASS:

Moscow is handling the details of its gas delivery plans to unfriendly countries for payment in rubles, but it won’t engage in charity if Europe refuses to pay in the Russian currency, Kremlin Spokesman Dmitry Peskov told reporters on Monday.

…The Kremlin spokesman remained tight-lipped on what measures Russia might take if Europe refused to pay for gas in rubles, noting that these “issues should be sorted out as they develop.” “But we will definitely not supply gas for free, that’s for sure. It is hardly possible and reasonable to engage in charity in our situation,” he emphasized.

Do you hear that Davos? That’s the sound of the ticking clock.

The Trade’s the Thing…

The reason why this current scheme is already working is that Russia runs a positive trade balance mostly in base commodity exports. Davos doesn’t want them making any money selling those commodities to the world and will continue to put sanctions on to get people to not use rubles.

They are however fighting the invisible hand of Adam Smith’s market. The demand for the ruble will rise above the pre-war exchange rate of around 75:1 vs. the USD.

The price point for gold/ruble implies that exchange rate. Russia will revisit this at the end of Q2. This also implies they expect the ruble/dollar rate to fall to 75 by the end of Q2, if not earlier.

After that if the ruble strengthens beyond that they can adjust the gold buying price.

If the ruble/dollar rate dips below their pegged price, buyers are getting oil at a discount when paying in gold. That will force the CRIMEX and LBMA into a supply shortage situation or they will have to end the expansion of paper gold versus real gold and allow real price discovery to the upside.

If the sanctions are successful in scaring everyone into not using rubles gold Russian

commodities then the exchange rate will stay stubbornly above 75 and

the boycotting world will lose competitive advantage versus those

willing to brave the US’s ire by getting Russian commodities on the

cheap.

As I talked about in previous articles, this sets up the opportunity to end the suppression of the price of gold through rehypothecation of physical gold in the paper markets which is the basis for the entire financial colonization system I described above.

FYI, this same scenario is going to play out in Bitcoin now that Russia has said ‘friendly countries’ can pay for imports with Bitcoin. Has anyone noticed the current rally in the World’s Most Hated Cryptocurrency?

We now have a full gold/bitcoin/ruble (and soon Yuan) interconversion system that completely and utterly cuts out Davos and destroys their colonial debt model while also taking away their power to crash economies through hot money in and out flows.

Because the next step in all of this is for Russia to close their capital account and nationalizing the Bank of Russia making the only source of international rubles be the Russian government.

Internally, the ruble will be de facto backed by gold and can circulate freely.

The War Without End, Ended

The war is over folks. Russia, China and the rest of the Global South have already won. As Luke Gromen replied to me., “in the end there’s nothing they can do about it.”

What scares me is the last thing I tweeted out in that thread:

“Other than widen the war on the ground. That’s the part that scares me.”

And that’s exactly what I expect to happen next, sadly. Biden is in Brussels saying the quiet parts out loud talking with the 82nd Airborne about going into Ukraine and calling for regime change in Moscow.

These people still believe their own bullshit to the point where they think this becomes a war the Russians can’t win.

Putin let the world down easy with this announcement. He could have walked right in and said 8000 rubles to the gram or $2575/oz and that would have broken the markets Friday going into the weekend, by selling his oil and gas at a steep discount.

He waited until after OpEx last Friday and the Fed’s interest rate hike plan was announced.

Timing matters guys.

But, by doing this he has very subtly also supported the Fed and it’s plan to withdraw dollars from Europe, because this will keep the price of gold in check for a little while and keeping the ECB from offsetting spiking Eurobond yields with higher gold reserves on its balance sheet.

Putin on the left arm, Powell on the right and Lagarde is about to get pulled apart at the seams if Davos doesn’t play ball and give up.

The problem there is the unquenchable arrogance of these European elites who simply do not believe they could be bested by the “colonies” in the US and the “dirty slavs” in Russia. I’ve told you for years now that it is their inherent racism that drives their actions.

So, do not be surprised if they empower the neocons in the UK and US to escalate from here. The signs are piling up that the Pentagon and the White House are at odds over the planned escalations. The State and Treasury Depts. are nests of vipers having usurped Congress to wage war without declaring it.

I can only hope that serious and adult people within the Pentagon will finally end this nonsense before we wind up in a war no one wants except a bunch of inbred Eurotrash well past their ‘use-by’ date.

I always say that spooks start civil wars but militaries end them. Let’s hope that we never get to the point of needing any other military than the Russians’ to end this war.

In the meantime, the message is clear, #GotGoldorRubles?

No comments:

Post a Comment