Do people realize the size of the asteroid coming our way?

Already in March 2020 with the Covid restrictions in place, we knew the world would never be the same. But nobody then could foresee the day after tomorrow waiting for us. And here we are, exactly 2 years later staring at the abyss.

The global elites wanted a great reset? The devil granted their wish!

Looking at what is currently taking place for Russia, who in his right mind will invest one more dollar in London or New York? It cannot be anything but the beginning of the end for the dollar based international monetary system.

We will also discover another basic truth concerning commodities: What counts is not the maximum number of people the earth can feed but the minimum. Try spending a month without food! With or without global warming, the Summer will be hot!

Out of this mess, the most scarce resource in 2022 will be "order" as Western countries discover that it is much more difficult to build countries than disorganize them. Think Iraq, Libya, Yemen, Syria...

I often take some flak for my doom and gloom predictions but as discussed earlier complex systems necessarily devolve at some point to a simpler level of organization. And although with perspective it is possible to observe the corkscrew path of evolution, from our linear point of view, it will be difficult to see anything but a crash of civilization. It can be benign if the current order is quickly replaced by a new one, but what could be this new order? In-between too much constructive destruction may quickly look like Armageddon!

The article below documents how it all started on the market...

Submitted by Doomberg

“One mustn't look at the abyss, because there is at the bottom an inexpressible charm which attracts us.” – Gustave Flaubert

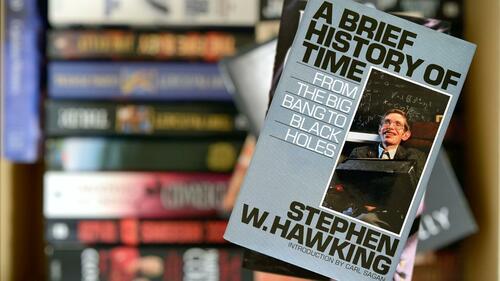

In 1988, Stephen Hawking published one of the best-selling science books of all time. In A Brief History of Time, Hawking made the impossibly complex topics of astronomy and modern physics accessible to a lay audience, inspiring countless young students (and at least one green chicken) to pursue a career in the sciences. It is estimated that the book has sold an incredible 25 million copies worldwide.

In Chapter 3 of the book, Hawking introduces the reader to the Big Bang Theory and the concept of a gravitational singularity, which Wikipedia describes as “a condition in which gravity is so intense that spacetime itself breaks down catastrophically.” Essentially, since the laws of physics are eviscerated at a singularity, what happened before it is both irrelevant and unknowable, and one could consider such an event as having reset the universe’s clock. Here's how Hawking describes it in his book (emphasis added throughout):

“This means that even if there were events before the big bang, one could not use them to determine what would happen afterward, because predictability would break down at the big bang. Correspondingly, if, as is the case, we know only what has happened since the big bang, we could not determine what happened beforehand. As far as we are concerned, events before the big bang can have no consequences, so they should not form part of a scientific model of the universe. We should therefore cut them out of the model and say that time had a beginning at the big bang. Many people do not like the idea that time has a beginning, probably because it smacks of divine intervention.”

The simple truth of a singularity applies whether it occurred in the past or will in the future: what transpires on the other side is unknowable from here.

Given the horrific and still-unfolding events of Vladimir Putin’s invasion of Ukraine and the West’s collective response to it, one can’t help but wonder whether we are on the cusp of an economic singularity in which the laws and bedrock beliefs that formed the foundation of international economic order for decades break down. The consequences are similarly unknowable, but we suspect a great reset may indeed be upon us. Even if a ceasefire is announced moments after we publish this piece, shocking damage to the global economic system has undoubtedly already been done and certain genies won’t easily be put back into their bottles.

Before proceeding, we should state clearly that what follows is not a critique of the Western response to the invasion but rather an assessment of the potential first- and second-order consequences of these historic moves, as well as speculation on where some of the harshest economic crises might manifest in the near future. While we join in the hope that these measures achieve their desired direct effect, there’s no denying these are truly unprecedented times.

The most stunning move by the US and its allies was cutting off the Russian central bank’s access to most of its $630 billion of foreign reserves. Without access, one wonders if these funds are really “its” reserves at all? What is ownership without access? No matter how justified that move might seem today, there’s no escaping that this action will reverberate for years to come. In a blunt opinion piece in the Wall Street Journal titled “If Russian Currency Reserves Aren’t Really Money, the World Is in for a Shock,” reporter Jon Sindreu had this to say about how central banks everywhere must now view their reserves:

“Many economists have long equated this money to savings in a piggy bank, which in turn correspond to investments made abroad in the real economy. Recent events highlight the error in this thinking: Barring gold, these assets are someone else’s liability—someone who can just decide they are worth nothing. Last year, the IMF suspended Taliban-controlled Afghanistan’s access to funds and SDR. Sanctions on Iran have confirmed that holding reserves offshore doesn’t stop the U.S. Treasury from taking action. As New England Law Professor Christine Abely points out, the 2017 settlement with Singapore’s CSE TransTel shows that the mere use of the dollar abroad can violate sanctions on the premise that some payment clearing ultimately happens on U.S. soil.”

In for a shock, indeed. In essence, Sindreu’s piece argues that this move substantially increases the risk that the US dollar loses its privileged status as the global reserve currency and, at a minimum, likely ensures a polarization of the global economy into at least two camps – the West in one and Russia/China/Iran/Saudi Arabia plus other targeted or aligned countries in the other. If $20-30 trillion or more of global GDP spurns the preexisting reserve currency, is it still the reserve currency? If reserves can be negated overnight, are they even reserves? How many other countries must hedge against the possibility of similar sanctions? Should we add India to the list?

“The Biden administration is weighing whether to impose sanctions against India over its stockpile of and reliance on Russian military equipment as part of the wide-ranging consequences the West is seeking to impose on Moscow over its invasion of Ukraine.

Donald Lu, the assistant secretary of State for South Asian affairs, on Thursday told lawmakers in a hearing that the administration is weighing how threatening India's historically close military relationship with Russia is to U.S. security.”

Another eyebrow-raising development is the US Department of Justice’s establishment of the ominously-named Task Force KleptoCapture, which has the stated intent of seizing (not freezing) the assets of Russian oligarchs. Here’s how the New York Times describes it:

“The creation of the task force reflects the harsh scrutiny cast on Russian oligarchs, many of whom built their fortunes because of their ties to Mr. Putin. Even though they may not be directly involved in Russia’s invasion of Ukraine, they enable Mr. Putin by helping him conceal his own assets and remain in power.

Russia’s oligarchs have invested their fortunes in assets around the world, and their ties to Mr. Putin have helped them gain influence and connections in the worlds of fine art, real estate, Wall Street and Silicon Valley.”

We are the first to admit that “Russian oligarch” is a less sympathetic faction than “Canadian trucker,” and perpetrating a war on another sovereign nation is way more serious than honking horns in downtown Ottawa, but many of the same questions we raised about the consequences of Justin Trudeau’s impulses seem apropos here. Who gets to define oligarch? What qualifies as enabling? Do the accused have any recourse? If assets in the West are subject to swift confiscation without due process for even indirectly enabling a currently unpopular-with-us national political leader – no matter how justified that unpopularity might be – what sane foreign asset owner wouldn’t at least consider liquidating assets now and onshoring what wealth they can preserve? Have we thought through the dominos that fall by fundamentally rewriting property laws?

Further down in the same New York Times article, we find another interesting passage. We’ve long argued that a crackdown on cryptocurrencies is imminent. Will the US use the Russian invasion of Ukraine as a pretext for doing so? It sure seems like it:

“The task force will target people and companies that are trying to evade anti-money laundering laws, hide their identities from financial institutions and use cryptocurrencies to evade sanctions and launder money. The Justice Department said that it would use civil and criminal asset forfeiture to seize assets belonging to people subject to sanctions.

The department said that its work would complement that of a trans-Atlantic task force announced this past weekend to identify and seize the assets of penalized Russian individuals and companies around the world.”

Yet another meaningful development is the move by multinational corporations to self-sanction all aspects of their business activity tied to Russia, undoubtedly motivated by the disturbing images coming out of Ukraine and pressured by their stakeholders to do something about it. This is not the first time corporations have been called to action after certain political events – Western governments have a long history of trying to implement controversial policies by leaning on business leaders to do their dirty work for them – but these recent developments likely cause concern even among Western leaders. Perhaps naïvely, the US and its NATO allies specifically tried to carve out Russian oil and gas from the reach of sanctions, recognizing our critical need for these essential supplies (a weakness we’ve been writing about for many months). But as the Financial Times describes in a recent report, if the zeitgeist uniformly labels an entity toxic – even an entire G20 country – there can be no carve-outs:

“In reality, however, many western banks, refineries and shipowners are in effect ‘self-sanctioning’ — behaving as if Russian oil has already been placed under sanctions. ‘Russia’s oil has effectively become toxic,’ said one banker.

Some of the biggest buyers of Russian crude have cancelled shipments and orders as companies from banks to insurers and shippers retreat from Russian business.

Roughly 70 per cent of Russian crude was ‘struggling to find buyers,’ according to consultancy Energy Aspects. As proof, Russia’s flagship Urals crude, a staple for refiners in north-west Europe and the Mediterranean, was quoted at a record discount of more than $18 a barrel on Wednesday.”

Here are just some of the potentially catastrophic economic consequences to ponder if these events continue to snowball down a steepening slope. The obvious place to start is in the energy sector, where European natural gas prices have been trading like a crypto scam coin, rising and plunging by unthinkable amounts on a daily basis. The economic impact of both the elevated price and the volatility of energy on Europe’s manufacturing sector will be revealed in the coming weeks and months – we suspect the results will stun many.

Similarly, Russia and Ukraine are among the most prolific producers and exporters of critical foodstuffs in the world, and prices of agricultural goods are flashing red. In a piece we wrote all the way back in October of last year called Starvation Diet, we predicted a global mass starvation event was nearly inevitable, and that was before war broke out in Ukraine. Here’s how the piece opened:

“We are on the cusp of a significant mass starvation event of our own making. Soon, tens of millions of the world’s most impoverished people will die from an inability to feed themselves, while many of those comfortably getting by now – especially in the Western World – are in for a shock.”

Unsurprisingly, wheat has traded limit up for several days in a row and prices are reaching levels that condemn vast swaths of the global population to the fate we reluctantly described above. Food inflation is the catalyst for many popular uprisings, and the path from empty shelves to the guillotine has historically been a direct one. Now consider further that the West has outsourced the production of energy and critical mining materials to impoverished countries. What happens when those governments get overthrown and the production assets get nationalized?

There are countless other alarming consequences which we could document here – ahem, Russia produces 40% of global Palladium supplies and, ahem, Ukraine is responsible for the majority of global Neon gas exports (critical for the production of lasers used to make microchips, which are already in chronically short supply) – but even we are losing the capacity to ponder the totality of the economic doom that awaits.

Recent statements by US political leaders don’t inspire much confidence in our ability to navigate this crisis without substantial further economic and political escalation. In a single 24-hour period, House Speaker Nancy Pelosi called for a ban on Russian oil imports while simultaneously stating her opposition to the development of US oil to replace them. Meanwhile, Republican Senator Lindsay Graham went on live television and flippantly called for the assassination of the President of Russia. To drive his reckless point home, he then took to Twitter and amplified his message.

No comments:

Post a Comment