This is invisible, except through the price of gold but in the background, China is already preparing for a post dollar world. Many factors will influence our future in the coming years but this by far could be one of the most important.

Where Have Russia’s Gold Sales Gone? Breakdown and China Context

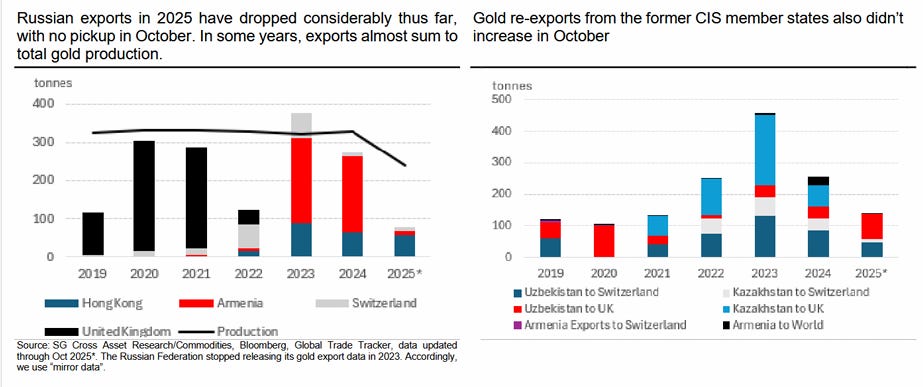

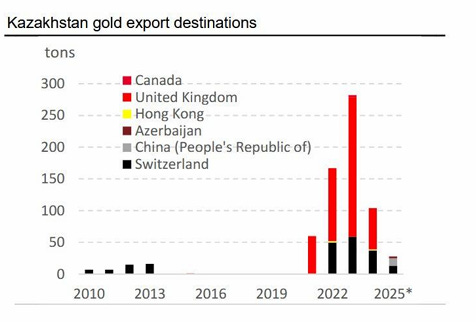

SocGen Notes: Between 2022 and 2024, Russian gold moved indirectly through Kazakhstan and Uzbekistan, which then re-exported tonnage to the UK and Switzerland. In 2025, this mechanism ceased.

Summary

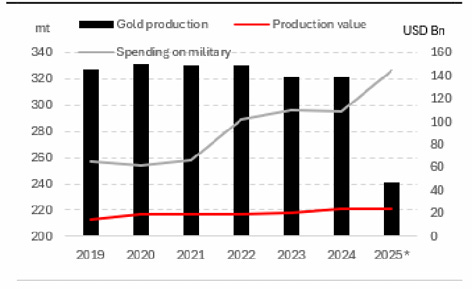

SocGen’s Commodity Compass (November 2025 via ZH) identifies a significant interruption in Russia’s gold export activity. Between 2022 and 2024, Russian output moved indirectly through Kazakhstan and Uzbekistan, which then re-exported tonnage to the United Kingdom and Switzerland. In 2025, this mechanism ceased. Both nations report export volumes below domestic output, and Russia’s central bank holdings remain stable at approximately 2,326 tonnes. Roughly 330 tonnes of annual production, valued at $24 billion, are not reflected in export or reserve data.

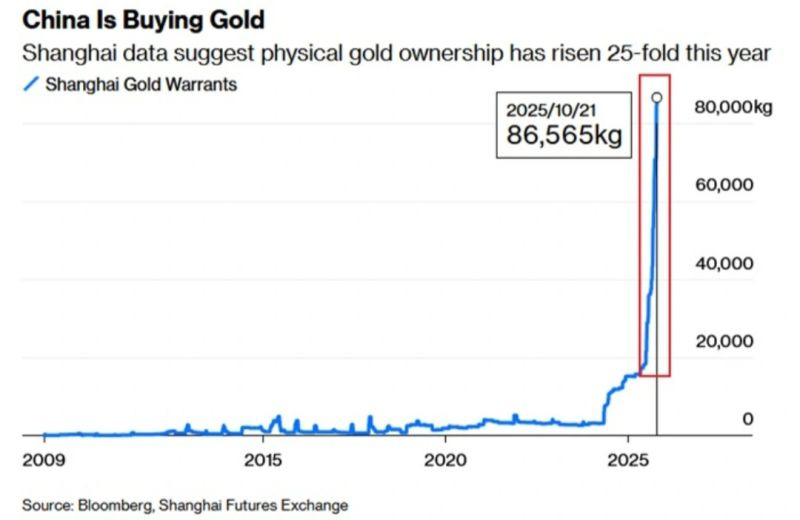

At the same time, China has expanded its physical acquisition of gold and silver, transferring holdings from state-controlled exchanges into private or offshore vaults. These developments coincide with new evidence that China is digitizing exchange-issued gold warrants for use as collateral in offshore repo markets. The combination of withheld Russian supply and expanding Chinese collateral infrastructure suggests coordinated preparation for a new liquidity framework in which gold functions as an active financial instrument.

“Roughly 330 tonnes of Russian production are unaccounted for in either exports or reserves.”

Export Behavior and Fiscal Conditions

Russia’s decision to halt exports is unusual given concurrent economic pressures. Military expenditures for 2025 are estimated at $145 billion, a 25 percent increase over 2024, while sanctions continue to restrict foreign-currency access.

Under normal conditions, these constraints would encourage higher gold exports to secure external liquidity. The decision to retain metal suggests an alternative purpose aligned with domestic or strategic financial objectives.

Kazakhstan’s 2025 production of 87 tonnes and Uzbekistan’s 129 tonnes account fully for their reported exports, implying neither is receiving Russian-sourced bullion. Re-exports that previously masked Russian flows have disappeared. The available evidence indicates a systemic withdrawal of Russian gold from international circulation.

China’s Parallel Development of Collateral Infrastructure

Evidence from Chinese financial institutions indicates that the Shanghai Gold Exchange (SGE) is digitizing physical gold warrants and integrating them with offshore interbank repo facilities through Hong Kong. The structure allows standardized, electronically transferable claims on allocated gold to serve as short-term collateral in financing transactions.

*Exclusive: China’s Next Move is HQLA/REPO Status

Under Basel III regulations, gold is recognized as a Tier-1 capital asset but is excluded from High-Quality Liquid Asset (HQLA) status. This exclusion prevents its use in repo markets on equal terms with sovereign debt. By linking gold warrants to interbank systems, China could effectively establish a mechanism that treats gold as a de facto HQLA within its domestic and offshore markets.Read full story

“Digitized warrants transform allocated gold into standardized collateral within interbank funding systems.”

The development parallels the growth of the offshore Renminbi market and represents a step toward creating liquidity instruments not dependent on U.S. Treasuries.

Analytical Framework: Gold as Substitute Collateral

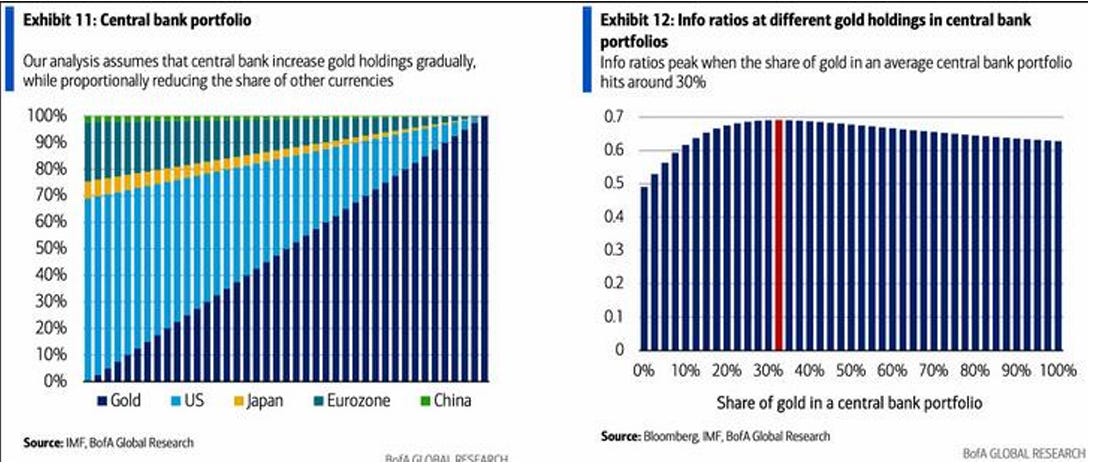

The accompanying GoldFix framework, Gold Replacing Treasuries in Repo, (PDF attached2) applies a heuristic linking central-bank reserve composition to global repo market scale. Central banks currently hold approximately 20 percent of their reserves in gold. Applying that ratio to the $17 trillion global repo market yields a baseline potential of $3.4 trillion in gold collateral, equivalent to 29,400 tonnes at $3,600 per ounce.

An upper scenario—consistent with Bank of America’s March 2025 conclusion that efficient reserve portfolios would allocate 30 percent to gold—implies $5.1 trillion in collateral, or roughly 44,000 tonnes. Both estimates exceed current official holdings of 22,000 tonnes.

No comments:

Post a Comment