The scope of this video is not as broad as the one (erased by Google) from Macgregor but is very clear nevertheless.

The whole story about Ukraine in the West is a lie! Worse, the leaders know they are lying!

Making sense of the world through data The focus of this blog is #data #bigdata #dataanalytics #privacy #digitalmarketing #AI #artificialintelligence #ML #GIS #datavisualization and many other aspects, fields and applications of data

The scope of this video is not as broad as the one (erased by Google) from Macgregor but is very clear nevertheless.

The whole story about Ukraine in the West is a lie! Worse, the leaders know they are lying!

As expected the superb geo-strategic analysis of Macgregor I posted yesterday was erased by Google within hours. This is pure censorship and criminal!

Here's a more innocuous post which should have a longer shelf life.

Nuts are good for health. That much almost everybody knows by now. What we are discovering is how good they actually are. In a nutshell: Eat more nuts! :-)

Authored by Alexandra Roach via The Epoch Times (emphasis ours),

In their many variations, nuts are a superfood praised as rich sources of minerals, vitamins, amino acids, proteins, and other bioactive compounds.

Chestnuts are champions for vitamin C, for instance. Pistachios contain the most vitamin A and potassium. Both are high in folic acid. Cashews enrich us with magnesium. The level of vitamin B3 (niacin) is the highest in peanuts, and vitamin E (tocopherol) is found in almonds.

Walnuts are especially high in alpha-linolenic acid (ALA), a neuroprotective omega-3 fatty acid important for normal growth and development. It also has been shown to induce apoptosis (programmed death of cells) in breast cancer cells.

Our bodies cannot produce ALA, hence, nutritional intake is a must, as it is with many other key nutrients.

A 2023 review published in the journal Foods, found mounting evidence that a nut-rich diet can potentially prevent numerous chronic illnesses.

According to the report, “The ingestion of phytochemicals from nuts and their positive influence on several diseases (cancer, heart disease, stroke, hypertension, birth defects, cataracts, diabetes, diverticulosis, and obesity) are established.”

In addition to the improvement of cardiovascular disease, depression, and cognitive function, nut consumption is correlated with lower cancer incidence and cancer mortality, and decreased all-cause mortality, states a 2021 review.

The World Health Organization predicts a considerable increase in cancer, with a potential of 32.6 million cases worldwide by 2045.

Effective strategies, such as increasing dietary fiber, eating more fruits and vegetables, and physical activity, could potentially reduce cancer risk factors by approximately 42 percent.

The journal Chronic Diseases and Translational Medicine published a 2023 review about the interrelation of nut consumption and different types of cancer, including women-related and gastrointestinal cancers.

Data suggests that eating nuts not only reduces “cancer-related risk and mortality,” but possibly prevents the occurrence of certain types of cancer and its advancement. Nuts contain active anticarcinogenic compounds such as “folate, phytosterols, saponins, phytic acid, isoflavones, ellagic acid, α-tocopherol, quercetin, and resveratrol,” according to the review.

The research points to certain phytochemicals and their mechanisms as preventatives for cancer.

Accordingly, walnuts, pecans, almonds, and pine nuts contain polyphenols, which inhibit carcinogenesis that is chemically induced. Likewise, hazelnuts and brazil nuts hold helpful properties, called isoflavonoids, to balance hormonal mechanisms.

Most nuts are strong antioxidants that counteract oxidative stress and guard our DNA—the health benefits list of nuts is long.

A review published in the journal Nutrition outlines the cancer-preventative properties of walnuts, as researched in animal studies with mice. It summarizes the following points:

Another interesting fact was shared in the review. Comparing the intake of whole walnuts to a diet equally rich in n-3 fatty acids, the reduction of tumors in the mammary gland was greater when ingesting whole nuts. This reinforces the idea that active components in walnuts act synergistically to suppress cancer.

Walnuts also proved their antitumorigenic qualities in an animal study in vivo in mice. Compared to the corn-oil-based control group, the walnut group featured two major improvements—the tumor growth rate was slowed by 27 percent, and the tumor weight was reduced by 33 percent.

Reducing inflammation in the body benefits many health conditions, amongst others cardiovascular disease, obesity, diabetes, and cancer. Walnuts have proven valuable in all.

A randomized controlled trial tested a daily intake of 56 grams of walnuts (366 calories) in 46 overweight adults. Another trial analyzed the same amount on diabetic patients. Both results showed that the increased nut intake improved endothelial function significantly, which is key for healthy blood and lymph vessels. In turn, endothelial cells are needed to protect from vascular malfunctions—the hallmarks of several types of malignant disorders.

Contrary to common belief, regular almond intake does not lead to weight gain, although the nuts contain almost 50 percent fat. Instead, almonds “appear to promote weight loss,” affirms a research paper published in the Journal of the Science of Food and Agriculture, which benefits obesity-related illnesses, such as cardiovascular disease and cancer.

However, almonds also contain the highly controversial and much-researched bioactive compound glycoside amygdalin. Highly controversial because its pharmaceutical development as an anti-cancer treatment continues to be a topic of discussion in the pharmaceutical world.

As a commercial drug, amygdalin is distributed under the name Laetrile but has since been shown to have serious side effects, such as damage to nerves and the liver, a lack of oxygen in the blood, and confusion. Furthermore, the U.S. Food and Drug Administration has not approved Laetrile and has said that the compound shows only little anticancer effect.

In contrast, a review in the Journal of Cancer Research and Therapeutics praises amygdalin’s few side effects, its low cost, and especially its excellent results in the battle against multidrug resistance. Furthermore, the compound can be easily naturally sourced as it occurs in the kernels of many fruits and is a compound in nuts.

A 2023 comprehensive review published in the International Journal of Molecular Science relates the same hopeful message: “Amygdalin seems to be a promising naturally occurring agent against cancer disease development and progression.”

While Amygdalin has proven its anti-tumor qualities, it is still not recommended as an extensive remedy, as some challenges need to be overcome.

Its correct dosage heavily depends on the type of bacteria present in a person’s gut. Therefore, researchers have not been able to find an across-the-board therapy. “Unfortunately, there is currently no foolproof method for determining the microbial consortium and providing a safe oral dosage for every patient,” researchers state in a 2022 review.

Scientists place their hope in modern nano-technologies as they further explore the qualities of amygdalin in cancer treatment. “There are several pieces of evidence to support the idea that amygdalin can exert anticancer effects against lung, breast, prostate, colorectal, cervical, and gastrointestinal cancers.” The compound “has been reported to induce apoptosis of cancer cells, inhibiting cancer cells’ proliferation and slowing down tumor metastatic spread,” according to the above-mentioned 2023 review.

A 2019 article published in Cancer Medicine that dials in on amygdalin, primarily found in bitter almonds, not only highlights its “antioxidative, antibacterial, anti-inflammatory and immunoregulatory activities,” but investigates the clinical value of the anticancer agent.

The compound introduces cytotoxicity and apoptosis in the body and balances the immune function, which affects especially “solid tumors” such as lung or bladder cancer and renal cell carcinoma.

Despite limiting factors, such as the “primary stage” of both clinical and experimental research and the lack of high-quality publications on the topic, researchers still believe these studies to be promising regarding cancer treatments.

Many may not be surprised that walnuts and almonds provide us with these health benefits. However, the following nut, which botanically speaking, is a legume, often gets a “bad rap” as a common allergen. Nevertheless, research shows its valuable qualities in cancer therapy.

A human study published in the journal Gynecologic and Obstetric Investigation showed that “High consumption of peanuts, walnuts, and almonds appears to be a protective factor for the development of breast cancer.”

The study group included 97 female patients suffering from breast cancer, and a control group of 104 healthy women. Researchers analyzed their seed consumption via the Mantel-Haenszel test method and found a correlation between dietary nut intake and the development of breast cancer.

Peanuts once again portrayed their qualities as functional food in a study that investigated phytosterols (PS), a natural compound that lowers cholesterol levels and prevents cardiovascular diseases. This research suggests that their sterol beta-sitosterol, in particular, holds protective anticancer effects against “colon, prostate, and breast cancer.”

With 207 milligrams PS per 100 grams, unrefined peanut oil has the highest concentration of valuable beta-sitosterol—even higher than olive oil. Peanut butter “contains 144-157 mg PS/100 g.” Further refinement of the product results in lower rates of the active compound.

Another healthy property of peanuts is the polyphenol phytochemical resveratrol—the target of a review focused on anticancer agents. In addition to peanuts, sources of resveratrol include grapes, red wine, and other berries.

Researchers point out that people benefit from the consumption of this powerful antioxidant, as it displays “strong anti-tumor activities through inhibiting tumor cell proliferation, inducing cell apoptosis, promoting tumor cell differentiation, preventing tumor invasion and metastasis, and further moderating the host immune system to kill tumor cells.”

In fact, the nickname “French Paradox” was given to resveratrol’s impact on the health of the French people, as it seems that the compound counteracts the French diet, which is often high in fats, and protects consumers from cardiovascular disease and more.

Another inconspicuous nut with plenty of healthy properties comes from the cashew family.

In comparison to other nuts, the health profile of pistachios is even more advantageous. They are low-fat, a good source of vegetable protein, contain a remarkable amount of minerals (potassium) and vitamins (C and E), and are high in dietary fiber.

Both, in vitro and in vivo models have indicated significant regulatory properties in pistachios on oxidative stress, according to a 2022 review. Consequently, eating pistachios also positively affected the risk of chronic diseases, including cancer.

Another 2022 review highlighted resveratrol in pistachios and its favorable role in breast cancer treatment.

Unfortunately, the high cost of this nut often keeps people from regular intake, which would be beneficial to their health.

It has long been known that lifestyle and diets greatly impact our health.

A 2010 review describes the multistage process of cancer as “initiation, promotion, and progression,” and explains that oxidative stress plays a role in all three phases of tumorigenesis (the formation of cancer), as does chronic inflammation in the body—conditions fought by nuts.

A diet rich in omega-3 fatty acids is beneficial to cancer survival, according to a review published in the Journal of Nutrition that examined several animal studies. In addition, it can lessen side effects that come with chemotherapy and increase the treatment’s efficacy. The review goes as far as stating that the “consumption of omega-3 fatty acids might slow or stop the growth of metastatic cancer cells,” after appropriate cancer treatment.

Walnuts contain the highest amount of omega-3 fatty acids.

As phenolic compounds in nuts are highly unstable, they may be impacted by various processing techniques.

Unfortunately, studies are rare, as certain types of nuts also react differently. Research that does exist indicates that thermal treatment negatively impacts nuts, such as hazelnuts, where most of the polyphenol content is found in the skin.

Roasting also alters the profile of nutrients in nuts, which can lead to increased allergenicity and changed protein levels, for instance in peanuts. This processing technique seems to affect almonds and pistachios less—they stay stable or might even slightly benefit from the process. In contrast, the antioxidant profile of hazelnuts and walnuts suffers.

A 2023 overview published in the journal Foods mentions that peanuts blanched in 100 degree Celsius water for 20 minutes were less allergenic. On the other hand, “boiling almonds for 10 min[utes], or cashews and pistachios for 60 min[utes] did not affect their properties.”

Authors of the overview suggest that consumers best educate themselves about the variation of bioactive compounds in nuts and the impact of food processing methods, as well as finding a quality source.

A 2020 narrative review highlights the extremely low consumption of nuts and seeds worldwide.

Although nuts are continuously praised as a superfood, and the per-capita consumption in the United States increased to 5.6 pounds per person in 2022, recommended consumption is rarely met.

The Global Burden of Disease Study found in 2017 that “global consumption was only 12 % of the recommended level” of a daily intake of 21 grams. In 2019, the Eat-Lancet Commission upped the recommended everyday consumption to 50 grams of tree nuts and/or peanuts. With an average daily intake of 7 grams of nuts, we do not come even close to that goal.

As a rule of thumb, a 2021 study comes to the conclusions that eating a “handful of nuts” is a practical way of “achieving recommended nut intakes.” Researchers explained that combining various types of nuts in a medium-size handful averages at about 36.3 g, which “resulted in a high proportion of individuals taking at least 80% of the recommended intake of nuts.”

Feel free to mix and match, bake with nuts and seeds, or add them to your salads, lunch, and dinner. Mostly though, just have fun going “nuts about nuts” and assisting your health at the same time.

An amazing analysis from Douglas Macgregor which goes far beyond Ukraine. The West elites are losing their grip on power and are therefore desperate and dangerous. A new world or Armageddon. The stakes could not be higher. We may be weeks away from a nuclear war.

PS: Listen quickly to this masterful analysis of the world as YouTube tends to censor these videos within days of their publication.

The everything bubble; China Real Estate, US Office Building, Tokyo second bubble and many others worldwide will burst eventually. They always do. The only thing which cannot be predicted is when. The behavior is similar to that of a sand pile. You cannot predict which grain of sand will start the crash but you can with certainty predict that one will. Ed Dowd believes this will happen before the end of the year. I agree. In fact most people agree which may be why there is a sense of panic in Brussels and Washington. A new world order is being born. This might be the signal!

By Greg Hunter’s USAWatchdog.com

Former Wall Street money manager Ed Dowd is a skillful financial analyst. Even though he has a wildly popular book on CV19 vax deaths and injuries called “Cause Unknown,” he is now turning his attention back to the economy. Dowd warns the economy can fall out of bed at any time. Dowd explains, “What’s coming up next is a credit cycle. We are going to see commercial real estate go into problem mode. There are a lot of loans that need to be rolled over in 2024 and 25. A lot of these properties are down 80% . . . . There is huge credit risk coming. The prediction of bank failures is accurate. We are going to see, over the next 12 to 24 months, banks go belly-up. Then, they will have to get merged with bigger banks.”

What happens to the Biden economy? Dowd says, “The economy is going to take a nosedive sometime in the next 12 months. The real economy is not doing well. . . . The only thing that has been holding up the GDP growth is government spending. We are spending $1 trillion every 100 days. That’s adding $1 trillion to the deficit. The only job creation is government jobs, and they don’t actually add to the economy. . . . Reports are coming out now that the low-income consumer is getting absolutely hammered. McDonald’s talked about it in their most recent earnings call. . . . So, low-income and the middle-class are getting squeezed while the rich continue to plug along.”

Dowd told me off camera that the economy could get into trouble without warning. Dowd explains, “You’ve got to look at history. In 2008 and 2009, everyone talks about the crisis, but bank failures started showing up in 2007. . . . I suspect as we roll through time in the real economy and the money supply issues start to hit the economy, we will see more bank failures and more businesses shut down. 46% of small businesses are having problems paying their rent. There is going to come a time in the next 6 to 12 months this huge shock that we saw in the 2008 financial crisis, and the 2000 bubble where massive layoffs start to happen–it’s inevitable. This is what happens when you crank up interest rates from 0% to 5.5%. There is a lag in the real economy, and it’s hitting right now. It’s only going to intensify as time goes on.

The Chinese real estate bubble has been imploding for a few years now. But how bad is it, really?

With over 30 years of experience with "bubbles" in Japan, I am afraid we won't know the answer for quite some time. As in Japan, the Chinese government can and will paper over the deflationary trend with huge budget deficits as the article below suggests. Eventually, just as in Japan, the potential for destroying the money his huge.

This said, as my next article explains, the West will already be in recession at that time so does it matter in the end? Just another black swan among many?

It has long been understood that most financial data provided by the Chinese government is propaganda designed to misrepresent the country's true economic circumstances. At best, their statistics provide half the truth and the rest has to be discerned through deeper investigation. When systemic crisis events take place in China it usually comes as a shock to much of the world exactly because they expend considerable resources in order to hide instability behind a thin veneer of fabricated progress.

The biggest story in China in the new millennia has been nation's debt explosion. China's debt-to-GDP ratio is currently estimated at nearly 300% (official numbers), with most of the liabilities accrued in the past 15 years. Chinese debt spending accelerated in part because of the global credit crash of 2008, but a lesser known factor is their entry into the IMF's Special Drawing Rights basket. The process started around 2011 and the IMF requires any prospective applicant to take on a wide array of debt instruments before they can be added to the global currency mechanism.

By the time of China's official inclusion in the SDR in 2016 they had nearly doubled their national debt. After 2016 debt levels skyrocketed.

The debt problem is harder to quantify in China because of their communist structure posing as a free market structure. Corporate debt in China has to be included into the national debt picture because of state funded enterprises and the level of government investment in property and industry.

It is here where we find the most blatant warning signs of deflationary crisis, particularly in property markets and infrastructure development. The CCP has put a "great information wall" in place to prevent accurate data from leaving the country, but some reports on China's failing infrastructure still escape. China's export market is crumbling in the past year, in large part because western consumers are tapped out due to inflation. However, what they prefer not to mention is the damage they did to themselves after three years of near constant covid lockdowns. This destroyed their retail sector and things have only grown worse since.

Then there is the real estate market which has suffered extreme deflation over the past decade, with a larger drop expected in the next year. China deliberately popped the housing market bubble as a means to disrupt what officials considered out of control speculation. This led to the now famous "ghost towns" dotting the Chinese landscape; thousands of neighborhoods and high rises left unfinished and empty after development companies went bankrupt.

One of the more disturbing trends in China, though, is the effort to use large infrastructure projects to hide the nation's deflationary decline. China's propaganda machine is pervasive across the world and most people in the west assume that China is on the cutting edge of progress because of videos on social media. In reality, the Chinese have been building cheaply constructed and poorly designed false-front landmarks that look technologically impressive on the surface but fall apart in a matter of months.

China is planning another 1 trillion Yuan ($137 billion) in infrastructure projects in 2024 alone, but the debt cycle and the deflationary spiral seem to be catching up with them. The IMF claims

that China's economy has stumbled but is "unlikely to fall", yet, with

their global exports falling, property markets plunging and consumer

activity in decline it's hard to see how they can continue without a

depression-like event in the near future.

Interesting Article on Social Media, the disease of our time, by Charles Hugh Smith. What else to say but highlight the artificiality of the whole edifice and its destructive effect, especially on the younger generations?

I am by essence a libertarian and would prefer by far that people decide for themselves in most matters of life, especially for things like alcohol. One valid argument against that is the fact that some things like alcohol and drugs are addictive and that consequently people cannot decide by definition since they fall into the addiction. Well, if that is true, then why not submit Social Media to the same rule since their addictive power is even stronger?

Lost in the Vast Wasteland of Social Media

May 9, 2024

Once we've made "digital visibility" the primary source of our

identity, status and self-respect, we've doomed ourselves to wandering,

compass-less, in a vast artificial wasteland.

|

|

This is one point on which I am optimistic: Censorship will fail for the simple reason that eventually a censored society becomes less efficient and therefore less competitive. (This said, it is very difficult to predict what AI could do to censorship since the hallmark of an advanced AI will be its ability to outsmart us. But by then it will also outsmart the people doing the manipulation...)

Authored by Jeffrey A. Tucker via the Brownstone Institute,

It’s not been a good week for the Censorship Industrial Complex.

The machine has been built and put into action over nearly a decade but largely in secret. Its way of doing business has been via surreptitious contacts with media and tech companies, intelligence carve-outs in “fact-checking” organizations, payoffs, and various other clever strategies, all directed toward boosting some sources of information and suppressing others. The goal has always been to advance regime narratives and curate the public mind.

And yet, based on its operations and insofar as we can tell, it had every intention of remaining secret. This is for a reason. A systematic effort by government to bully private sector companies into a particular narrative while suppressing dissent contradicts American law and tradition. It also violates human rights as understood since the Enlightenment. It was a consensus, until very recently, that free speech was essential to the functioning of the good society.

Four years ago, many of us suspected censorship was going on, that the throttling and banning was not merely a mistake or the result of zealous employees stepping out of line. Three years ago, the proof started to arrive. Two years ago, it became a flood. With the Twitter files from a year ago, we had all the proof we needed that the censorship was systematic, directed, and highly effective. But even then, we only knew a fraction of it.

Thanks to discovery from court cases, FOIA requests, whistleblowers, Congressional inquiries thanks to the very narrow Republican control, and some industrial upheavals such as what happened at Twitter, we are overwhelmed with tens of thousands of pages all pointing to the same reality.

The censors developed a belief at the highest levels of control in government that it was their job to govern what information the American people would and would not see, regardless of the truth. The actions became truly tribal: our side favors banning gatherings, closing schools, says the Hunter Biden laptop is a fake, favors masking, mass vaccination, and mail-in voting, and denies the import of voter fraud and vaccine injury, whereas their side takes the opposite approach.

It was a war over information, undertaken in total disregard for the First Amendment, as if it doesn’t even exist. Moreover, the operation was not only political. It clearly involved intelligence agencies that were already hip deep in the “all-of-society” pandemic response.

“All of Society” means all, including the information you receive and are allowed to distribute.

A vast swath of unelected bureaucrats took it upon themselves to manage all knowledge flows in the age of the Internet, with the ambition to turn the main source of news and sharing into a giant American version of Pravda. All of this occurred right under our noses – and is still going on today.

Indeed, censorship is a full-on industry now, with hundreds and thousands of cut-outs, universities, media companies, government agencies, and even young people in school studying to be disinformation specialists, and bragging about it on social media. We are just one step away from a New York Times article – as follow-ups to their recent praise of the Deep State and also government surveillance – with a headline like “The Good Society Needs Censors.”

Incredibly, the censorship is so pervasive now that it is not even reported. All these revelations should have been front page news. But so captured is the news media today that there are very few outlets that even bother to report the fullness of the problem.

Not receiving nearly enough attention is the new report from the Committee on the Judiciary and the Select Subcommittee on the Weaponization of the Federal Government of the US House of Representatives.

Running nearly 1,000 pages including documentation (however many pages are purposely blank), we have here an overwhelming amount of evidence of a systematic, aggressive, and deeply entrenched effort on the part of the federal government, including the Biden White House and many agencies including the World Health Organization, to tear out the guts of the Internet and social media culture and replace them with propaganda.

Among the well-documented facts are that the White House directly intervened in Amazon’s own marketing methods to deprecate books that raised doubts about the Covid vaccine and all vaccines. Amazon responded reluctantly but did what it could to satisfy the censors. All these companies – Google, YouTube, Facebook, Amazon – became acquiescent to Biden administration priorities, even to the point of running algorithmic changes by the White House before implementation.

When YouTube announced that it would take down any content that contradicted the World Health Organization, it was because the White House instructed them to do so.

As for Amazon, which is like every publisher in wanting full freedom to distribute, they faced intense pressure from government.

These are just a few of thousands of pieces of evidence of routine interference from government against social media companies, either directly or through various government-funded cut-outs, all designed to enforce a certain way of thinking on the American public.

What’s amazing is that this industry was allowed to metastasize to such an extent over 4-8 years or so, with no legal oversight and very little knowledge on the part of the public. It’s as if there is no such thing as the First Amendment. It’s a dead letter. Even now, the Supreme Court seems confused, based on our reading of the oral arguments over this whole case (Murthy v. Missouri).

One gets the sense when reading through all this correspondence that the companies were more than a bit rattled by the pressure. They must have wondered a few things: 1) is this normal? 2) do we really have to go along? 3) what happens to us if we just say no?

Probably every corner grocery store in any neighborhood run by a crime syndicate in history has asked these questions. The best answer is to do what you can in order to make them go away. This is precisely what they did time after time. After a while, the protocol probably begins to feel normal and no one asks anymore the basic questions: is this right? Is this freedom? Is this legal? Is this just the way things go in the US?

No matter how many high officials were involved, how many in the C-suites of big companies participated, however many editors and technicians of the best credentials played along, there can be no question that what took place was an absolute violation of speech rights that very likely exceeds anything we’ve seen in US history.

Keep in mind that we only know what we know, and that is severely truncated by the force of the machinery. We can safely assume that the truth actually is far worse than we know. And further consider that this censorship is keeping us from knowing the full story about the suppression of dissidents, whether medical, scientific, political, or otherwise.

There might be millions in many professions who are suffering right now, in silence. Or think of the vaccine-injured or those who have lost loved ones who were forced to get the shot. There are no headlines. There are no investigations. There is almost no public attention at all. Most of the venues that we once thought would police such outrages have been compromised.

To top it off, the censors are still not backing down. If you sense a lessening of the grip for now, there is every reason to believe it is temporary. This industry wants the entire Internet as we once conceived of it completely shut down. That’s the goal.

At this point, the best means of defeating this plan is widespread public outrage. That is made more difficult because the censorship itself is being censored.

This is why this report from the US House of Representatives needs to be widely shared so long as doing so is possible. It could be that such reports in the future will themselves be censored. It could also be the last such report you will ever see before the curtain falls on freedom completely.

Jeffrey Tucker is Founder, Author, and President at Brownstone Institute. He is also Senior Economics Columnist for Epoch Times, author of 10 books, including Life After Lockdown, and many thousands of articles in the scholarly and popular press. He speaks widely on topics of economics, technology, social philosophy, and culture.

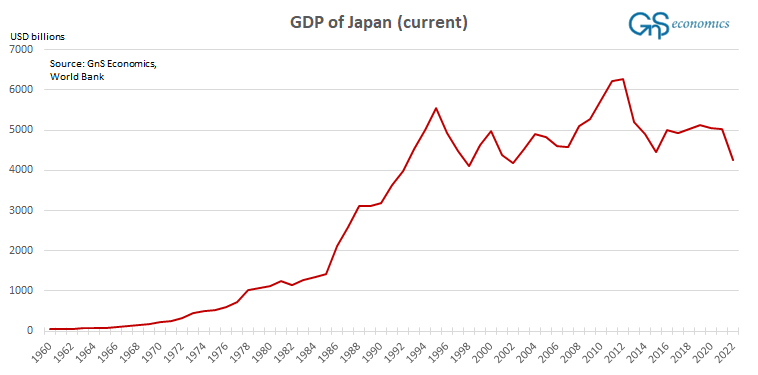

Japan is the poster's child of what you should NOT do to save a bankrupt economy after a bubble has popped.

1 - The crisis is far from over. It will in fact never be over until the underlying problem is solved. (which it cannot be now since it has been allowed to grow to such immense proportions.)

2 - This is a lesson to China of how NOT to solve a solvency problem post bubble. In a nutshell: If you allocate credit to bankrupt companies and banks instead of liquidating them and financing healthy start-ups, eventually you bankrupt your economy and reduce massively the standard of living for everyone.

By Tuomas Malinen of The MT Malinen substack

On Tuesday, we shortly commented the flash crash and the (assisted) recovery of the Japanese Yen between Friday and Monday, 26-29 April, on the GnS Economic’s Deprcon Outlook. In this entry, I will detail the reasons behind the crash, which go way back in history starting from the post-WWII growth model of the Japanese economy, leading to the the financial crash of early 1990s. They imply that the currency crisis of Japan is far from over.

The Japanese economy was devastated in the Second World War, which created a need for a major reconstruction effort. Japanese also switched their model of governance to democracy, which laid the foundation for a stable society supportive of investments. The economic boom after WWII was fueled by financial regulation that kept the nominal interest rate below inflation and successful economic reforms that supported, e.g., neutral recruiting of labor and education. The mandarins at the Ministry of Finance issued ceiling on interest rates of both lending and deposit rates, which led to a notable investment boom. Export sector grew fast with the composition of the exports changing from toys and textiles to bicycles and motorcycles and further to steel, automobiles and electronics over the decades.

Japanese government began to deregulate the financial sector in the early 1980's, following a global trend. Also, in the mid-1980's, the Bank of Japan (BoJ) tried to aggressively limit the appreciation of yen (because it decreased country's trade surplus), by cutting interest rates. These led to a rapid growth in the supplies of money and credit. A financial boom ensued.

The credit expansion led to notable gains in the real estate and stock markets, where bubbles grew to massive sizes. By the late 1980's, the price index for residential real estate in the six largest Japanese cities had 58-folded from 1955. During the 1980's alone, the price of real estate increased by a factor of six. At the peak, the value of Japanese real estate was double of that in the US. According to the chatter at the time, the market value of land under the Imperial Palace in Tokyo was greater than the market value of all real estate in California. The Nikkei stock market index rose 40000 percent from early 1949 till late 1989, with massive increase during the 1980's. In the late 1980's, the market value of Japanese equities was twice the market value of US equities.

The real estate and stock market booms were highly connected. A substantial portion of firms listed in the Tokyo Stock Exchange were real estate companies, which held considerable positions in property of major cities. Construction activity surged due to the combination of booming real estate prices and financial deregulation. Banks held large volumes of real estate and stocks, whose increasing value led to appreciation of banking stocks. Borrowers were usually required to pledge real estate as collateral, which meant that increase in the value of the real estate increased the value of the collateral enabling banks to increase their loan portfolio and grow in size. Also industrial firms bought real estate as the profit it produced was many times higher than that of, e.g., producing steel and automobiles. There was a 'perpetual motion machine' of ever-increasing prices and financial wealth, until suddenly there was not.

In the mid-1989, the BoJ started to rise interest rates, with the obvious effort to prick the asset bubbles. It succeeded. The stock market peaked at the last trading day in 1989, and fell over 38 percent in 1990. It bottomed out in Spring 2003 after falling close to 80 percent from the peak (Nikkei actually broke its previous record, set on December 29, 1989, on February 22 this year). The fall in real estate prices was slower, but extensive. For example, commercial real estate fell close to one-tenth of its peak value. Because the collateral of the banking sector was tightly connected to real estate, its value collapsed. Many industrial firms suffered crippling losses from their investments in the real estate.

The collapse of stock markets and real estate wiped out a large chunk of capital of banks, which in collaboration with the declining value of bank collateral, hurdled the banking sector into insolvency. Credit creation collapsed and the economy tumbled. A financial crisis set in.

After the crash of the real estate sector, majority of the large Japanese banks remained bankrupt for most of the 1990's. It was a tradition in Japan to socialize the losses of the banking sector, and regulatory authorities were reluctant to close banks considered bankrupt.

While the BoJ was somewhat slow to respond to the crisis, it started to lower its target interest rate in 1991, which eventually reached zero in early 1999. When the crisis intensified, the BoJ started to act as lender of last resort, the main task of a central bank in a crisis, but it also bailed out several financial institutions. This was mostly done by providing funds to different bodies, including the Housing Loan Administration assuming bad loans from the off-balance sheet, or jusen, companies banks had created to provide mortgages and the New Financial Stablization Fund, which provided capital both to banks and private financial institutions. This was very exceptional as central banks do usually provide only liquidity, not capital, to banks not to mention to private financial companies.

Facing a public anger over bank bailouts in the early stages of the crisis, the government allowed, and in some cases even encouraged, banks to extend loans to ailing businesses. Government, e.g., allowed for accounting gimmicks which, with the lacking transparency, enabled banks to downplay their loan losses and overstate their capital.

These measures saved the financial sector, but at a heavy cost. Because the banking sector was not restructured, bank lending collapsed and was diverted towards ailing unprofitable companies. The reason for this was simple: banks tried to avoid further losses from bankruptcies.

After the implosion of the asset bubbles, the domestic non-traded goods sector held the largest share of unprofitable companies. While bank lending to exporting (trading goods) sector diminished in the 1990’s, bank lending to the non-traded good sector actually increased. Thus, Japanese banks kept extending lines of credit to unprofitable firms to avoid losses that would have occurred if the firms would have gone bust. This zombified the Japanese economy.

So, while government policies were effective in restoring some trust to financial sector, they let the "zombie" banks to linger. They were kept standing without recapitalization or clearing their books. Subsidies from the government and ‘zombie-lending’ from banks kept unprofitable firms operating, but also blocked creation of new firms, because when banks use their diminished lending capacity to support ailing companies, the funding for risky new enterprises dries up. The old unprofitable firms also tie private capital, which could otherwise be used to support the creation of new businesses. This leads to a vicious loop of depressed innovation, falling production and diminishing profits. As a result, the Japanese economy stagnated. Moreover, these policies led to misallocation of credit on a massive scale, fall in the investment rate, and a prolonged slump in productivity.

When the private sector becomes infested with so called zombie companies, which are able to stand only with the help of easy credit, it becomes a serious drag to the economy. This is clearly visible in the growth of the Total Factor Productivity of Japan.

The figure above presents the three-year moving average of the growth of the TFP. We can see a rather clear collapse in the growth rate of the TFP of Japan from around 1992 lasting till 2012. In 2018, the TFP growth fell negative again, and spiked in 2023. The U.S. series provides a reference point.

You can think of the TFP as a your productivity at work. If your productivity increases, you (usually) earn more income, which makes you able increase your livings standards and, e.g. to pay back your loans. However, if your productivity stagnates, or even starts to fall, you earn less income, which starts to eat into your living standards, unless you support it (artificially) through borrowing. Moreover, if a considerable share of this borrowing does not go into productive investments, which would increase your productivity and thus income stream in the future, you just go deeper into debt with your ability pay it back hindered. This is exactly what happened to Japan. Because her productivity fell for a very long time, the only way to keep the living standards and the economy afloat was through massive government borrowing and monetary stimulus (low interest rates). Due to this, the ability of the Japanese government to pay back its debt has diminished as the economy has now grown, while the debt pile has grown to a monstrous size.

The problem Japan currently faces can thus be depicted as follows:

After the crisis of early 1990's, the leaders of Japan decided not to let the economy to crash, because of e.g. cultural issues. In Japan, bankruptcies are considered highly shameful often leading to suicides. While the bailout of the Japanese economy was understandable culturally, the fact is that the restructuring of the Japanese economy after the financial crisis was an utter failure. Another country which experienced a financial crash at the same time, but recovered quite remarkably, is Finland.

Currency and debt crises tend to be deeply intertwined. This is because the foreign exchange value of a currency reflects the trust of international investors and businesses on the keeper of the currency, i.e. the government of a country.

Essentially, a currency crisis or a crash is an “attack” on the exchange value of the currency in the markets. If the foreign exchange (FX) rate is fixed or pegged, this attack will test central banks (the monetary authority) commitment to the peg. The current view is that the timing of the attacks is not predictable (forecastable). If the FX-rate is fixed or pegged, market participants expect the policy of monetary authorities will be inconsistent with the peg and they will try to force authorities to abandon the peg, thus validating their expectations.

What matters for speculators are the internal economic conditions with respect to external conditions set for the currency (like stable FX-rate) . If these are incompatible in some meaningful way, like when the government has an unsustainable debt burden, monetary authorities face a trade-off between external and domestic goals for the exchange rate. In these circumstances, random shocks in the foreign exchange markets, called sunspots, can trigger an attack on the external value of the currency. This means that, when internal economic conditions are deteriorating, due to e.g. an unsustainable sovereign debt load, random events or shocks, can break the trust of investors leading them to sell the currency in the exchange markets causing the (external) value of the currency to drop suddenly or even to crash.

If a country holds a large external debt pile, a crashing currency will naturally increase its (foreign-currency) value threatening to create a wave of defaults. This applies to private entities, as well as to local and central governments. A currency crash is often expected to lead to interest rate rises by the monetary authority to defend the FX-rate of the currency. However, if the government holds a large amount of debt, higher interest rates can easily succumb the government under interest payments, which will eventually lead to a sovereign default. Rising interest rates would thus lead to further deterioration of trust by investors in the currency of a highly indebted government. This is why the Bank of Japan is trapped. If it would start to raise rates, the debt service burden of the Japanese government would rapidly become unsurmountable.

The bailout of the Japanese economy in early 1990s, which caused the slump in productivity leading to the very high indebtedness of the Japanese government, is the main culprit behind the ‘flash crash’ of the Japanese Yen. On April 26, it seems, a ‘sunspot’ triggered the selling. The response of the monetary authority, i.e., the BoJ, was to start to defend the yen at USDJPY pair of 160. Its intervention (buying of yen) pushed the pair to under 153 on May 3, where it has started to creep back up.

As the underlying problems of the Japanese economy have not gone anywhere, the attack on the yen in the markets is likely to continue and escalate, again, at some point. The question is, what is the breaking point in the USDJPY pair after which investors start to flee? Moreover, we should remember that monetary authorities have their limits, while markets don’t. Thus, it is very likely that the currency crisis of Japan has but just started. See my other post for analysis on its implications.

Here's the giant 2024 Guangzhou Fair. 74,000 booths. (Video - 18mn)

And here the 2024 Beijing Auto Fair. (Video - 16mn)

Now, here's my prediction: Whatever absurd and stupid measures Washington takes, Beijing will NOT attack Taipei. Why should they? China is on the bring of becoming the engine of the world. Imperial ambitions may come later but for now, Beijing means business. China is developing and needs to keep doing so for the foreseeable future. Eventually, it may represent a danger for the West, but to my opinion it would be far wiser to learn to deal with the country than systematically confront it in a way which will fare no better than the military confrontation with Russia.

China is not out of the woods yet. It still has to deal with its giant real estate bubble and a fight against pollution and land degradation which is far from won at this stage. Dealing with China means competition and cooperation. This is what we had 10 years ago to everybody's benefit. The desperate and absurd profiling of China as an enemy of the United States and therefore the West must be reversed. This is the only way we can walk away from the edge of the precipice. Will this happen? Let's be optimistic against the odds for once. The alternative will bring absolutely nothing to anyone, including the narrow minded elites who believe they can come on top of a confrontation. They can't!

Two important events will take place in the next few weeks: The G7 and the BRICS. If the G7 is conciliatory, unlikely but not impossible, the BRICS will be another "working cession". If not, the process of integration will accelerate and the confrontation will become more acute. As I predicted earlier, the world we live in from now on will be decided by the end of this month. Let's hope for the best. This may be our very last chance!

For anybody who has been following this conflict, it was easy to understand that this was a war of attrition. Russia was not moving, just creating extremely difficult conditions for the Ukrainian army which for some reasons was expected to perform miracles with the much superior armament of the West. The weapons ended up stuck in the mud, the professional army was decimated and replaced by reluctant conscripts, add incompetence and corruption and it is obvious that the Ukrainians never stood a chance. It would have been wise to understand this 2 years ago. Now somehow, the war must end.

Can the West let it end or will they up the ante? Douglas MacGregor see some signs that the war will end. I am afraid it cannot be so easy. You only need to remember how the British sunk the agreements which were about to be signed to understand that the balance is fragile and it is extremely easy for people with bad intentions to create mayhem. Other factors, the beginning of a recession?, may convince a soon to be defeated US administration that war may in the end be an option. This is only a possibility among many. Although history says this is likely, we all know that it doesn't repeat, it only rhymes.

The scope of this video is not as broad as the one (erased by Google) from Macgregor but is very clear nevertheless. The whole story ab...