The everything bubble; China Real Estate, US Office Building, Tokyo second bubble and many others worldwide will burst eventually. They always do. The only thing which cannot be predicted is when. The behavior is similar to that of a sand pile. You cannot predict which grain of sand will start the crash but you can with certainty predict that one will. Ed Dowd believes this will happen before the end of the year. I agree. In fact most people agree which may be why there is a sense of panic in Brussels and Washington. A new world order is being born. This might be the signal!

By Greg Hunter’s USAWatchdog.com

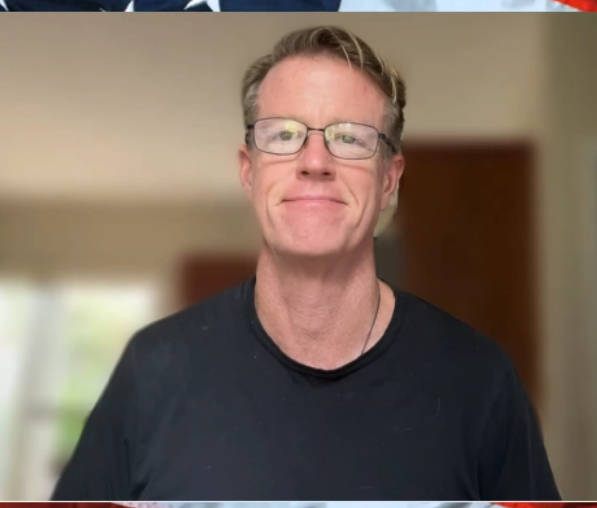

Former Wall Street money manager Ed Dowd is a skillful financial analyst. Even though he has a wildly popular book on CV19 vax deaths and injuries called “Cause Unknown,” he is now turning his attention back to the economy. Dowd warns the economy can fall out of bed at any time. Dowd explains, “What’s coming up next is a credit cycle. We are going to see commercial real estate go into problem mode. There are a lot of loans that need to be rolled over in 2024 and 25. A lot of these properties are down 80% . . . . There is huge credit risk coming. The prediction of bank failures is accurate. We are going to see, over the next 12 to 24 months, banks go belly-up. Then, they will have to get merged with bigger banks.”

What happens to the Biden economy? Dowd says, “The economy is going to take a nosedive sometime in the next 12 months. The real economy is not doing well. . . . The only thing that has been holding up the GDP growth is government spending. We are spending $1 trillion every 100 days. That’s adding $1 trillion to the deficit. The only job creation is government jobs, and they don’t actually add to the economy. . . . Reports are coming out now that the low-income consumer is getting absolutely hammered. McDonald’s talked about it in their most recent earnings call. . . . So, low-income and the middle-class are getting squeezed while the rich continue to plug along.”

Dowd told me off camera that the economy could get into trouble without warning. Dowd explains, “You’ve got to look at history. In 2008 and 2009, everyone talks about the crisis, but bank failures started showing up in 2007. . . . I suspect as we roll through time in the real economy and the money supply issues start to hit the economy, we will see more bank failures and more businesses shut down. 46% of small businesses are having problems paying their rent. There is going to come a time in the next 6 to 12 months this huge shock that we saw in the 2008 financial crisis, and the 2000 bubble where massive layoffs start to happen–it’s inevitable. This is what happens when you crank up interest rates from 0% to 5.5%. There is a lag in the real economy, and it’s hitting right now. It’s only going to intensify as time goes on.

No comments:

Post a Comment