This to my opinion is the most complete story you'll ever read about the "pandemic" with all the financial background without which it is so difficult to understand the urgency and zeal of the last two years. The control of the Media and narrative is so complete that no counter arguments was possible. Just the narrative and censorship of whoever diverge from it.

But since the financial breakdown was not a consequence but the cause of the pandemic, there is no escape. The last two years were only a short monetary respite. This is why, as the pandemic shrill starts receding, the Media are in full swing, singing the odes of war in Ukraine...

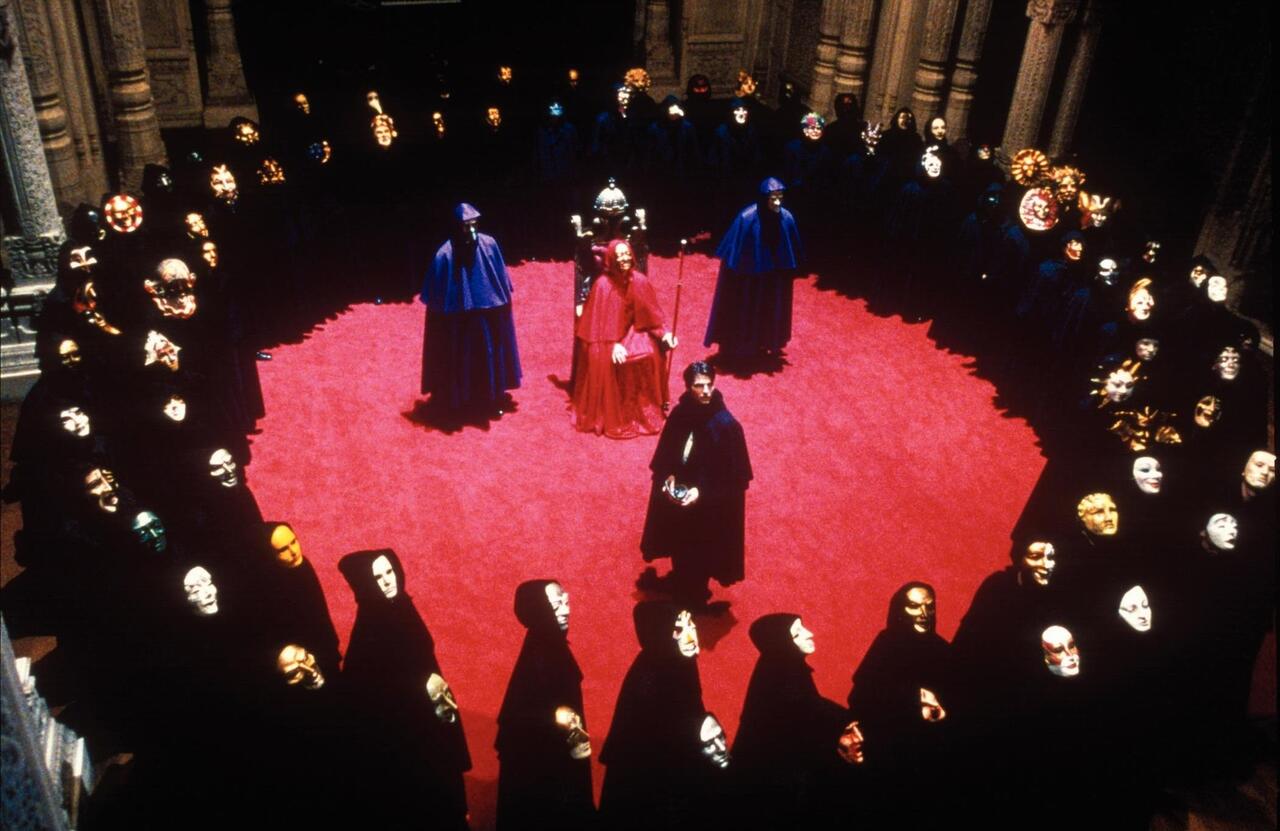

A year and a half after the arrival of Virus, some may have started wondering why the usually unscrupulous ruling elites decided to freeze the global profit-making machine in the face of a pathogen that targets almost exclusively the unproductive (over 80s). Why all the humanitarian zeal? Cui bono? Only those who are unfamiliar with the wondrous adventures of GloboCap can delude themselves into thinking that the system chose to shut down out of compassion. Let us be clear from the start: the big predators of oil, arms, and vaccines could not care less about humanity.

Follow the money

In pre-Covid times, the world economy was on the verge of another colossal meltdown. Here is a brief chronicle of how the pressure was building up:

June 2019: In its Annual Economic Report, the Swiss-based Bank of International Settlements (BIS), the ‘Central Bank of all central banks’, sets the international alarm bells ringing. The document highlights “overheating […] in the leveraged loan market”, where “credit standards have been deteriorating” and “collateralized loan obligations (CLOs) have surged – reminiscent of the steep rise in collateralized debt obligations [CDOs] that amplified the subprime crisis [in 2008].” Simply stated, the belly of the financial industry is once again full of junk.

9 August 2019: The BIS issues a working paper calling for “unconventional monetary policy measures” to “insulate the real economy from further deterioration in financial conditions”. The paper indicates that, by offering “direct credit to the economy” during a crisis, central bank lending “can replace commercial banks in providing loans to firms.”

15 August 2019: Blackrock Inc., the world’s most powerful investment fund (managing around $7 trillion in stock and bond funds), issues a white paper titled Dealing with the next downturn. Essentially, the paper instructs the US Federal Reserve to inject liquidity directly into the financial system to prevent “a dramatic downturn.” Again, the message is unequivocal: “An unprecedented response is needed when monetary policy is exhausted and fiscal policy alone is not enough. That response will likely involve ‘going direct’”: “finding ways to get central bank money directly in the hands of public and private sector spenders” while avoiding “hyperinflation. Examples include the Weimar Republic in the 1920s as well as Argentina and Zimbabwe more recently.”

22-24 August 2019: G7 central bankers meet in Jackson Hole, Wyoming, to discuss BlackRock’s paper along with urgent measures to prevent the looming meltdown. In the prescient words of James Bullard, President of the St Louis Federal Reserve: “We just have to stop thinking that next year things are going to be normal.”

15-16 September 2019: The downturn is officially inaugurated by a sudden spike in the repo rates (from 2% to 10.5%). ‘Repo’ is shorthand for ‘repurchase agreement’, a contract where investment funds lend money against collateral assets (normally Treasury securities). At the time of the exchange, financial operators (banks) undertake to buy back the assets at a higher price, typically overnight. In brief, repos are short-term collateralized loans. They are the main source of funding for traders in most markets, especially the derivatives galaxy. A lack of liquidity in the repo market can have a devastating domino effect on all major financial sectors.

17 September 2019: The Fed begins the emergency monetary programme, pumping hundreds of billions of dollars per week into Wall Street, effectively executing BlackRock’s “going direct” plan. (Unsurprisingly, in March 2020 the Fed will hire BlackRock to manage the bailout package in response to the ‘COVID-19 crisis’).

19 September 2019: Donald Trump signs Executive Order 13887, establishing a National Influenza Vaccine Task Force whose aim is to develop a “5-year national plan (Plan) to promote the use of more agile and scalable vaccine manufacturing technologies and to accelerate development of vaccines that protect against many or all influenza viruses.” This is to counteract “an influenza pandemic”, which, “unlike seasonal influenza […] has the potential to spread rapidly around the globe, infect higher numbers of people, and cause high rates of illness and death in populations that lack prior immunity”. As someone guessed, the pandemic was imminent, while in Europe too preparations were underway (see here and here).

18 October 2019: In New York, a global zoonotic pandemic is simulated during Event 201, a strategic exercise coordinated by the Johns Hopkins Biosecurity Center and the Bill and Melinda Gates Foundation.

21-24 January 2020: The World Economic Forum’s annual meeting takes place in Davos, Switzerland, where both the economy and vaccinations are discussed.

23 January 2020: China puts Wuhan and other cities of the Hubei province in lockdown.

11 March 2020: The WHO’s director general calls Covid-19 a pandemic. The rest is history.

Joining the dots is a simple enough exercise. If we do so, we might see a well-defined narrative outline emerge, whose succinct summary reads as follows: lockdowns and the global suspension of economic transactions were intended to 1) Allow the Fed to flood the ailing financial markets with freshly printed money while deferring hyperinflation; and 2) Introduce mass vaccination programmes and health passports as pillars of a neo-feudal regime of capitalist accumulation. As we shall see, the two aims merge into one.

In 2019, world economy was plagued by the same sickness that had caused the 2008 credit crunch. It was suffocating under an unsustainable mountain of debt. Many public companies could not generate enough profit to cover interest payments on their own debts and were staying afloat only by taking on new loans. ‘Zombie companies’ (with year-on-year low profitability, falling turnover, squeezed margins, limited cashflow, and highly leveraged balance sheet) were rising everywhere. The repo market meltdown of September 2019 must be placed within this fragile economic context.

When the air is saturated with flammable materials, any spark can cause the explosion. And in the magical world of finance, tout se tient: one flap of a butterfly’s wings in a certain sector can send the whole house of cards tumbling down. In financial markets powered by cheap loans, any increase in interest rates is potentially cataclysmic for banks, hedge funds, pension funds and the entire government bond market, because the cost of borrowing increases and liquidity dries up. This is what happened with the ‘repocalypse’ of September 2019: interest rates spiked to 10.5% in a matter of hours, panic broke out affecting futures, options, currencies, and other markets where traders bet by borrowing from repos. The only way to defuse the contagion was by throwing as much liquidity as necessary into the system – like helicopters dropping thousands of gallons of water on a wildfire. Between September 2019 and March 2020, the Fed injected more than $9 trillion into the banking system, equivalent to more than 40% of US GDP.

The mainstream narrative should therefore be reversed: the stock market did not collapse (in March 2020) because lockdowns had to be imposed; rather, lockdowns had to be imposed because financial markets were collapsing. With lockdowns came the suspension of business transactions, which drained the demand for credit and stopped the contagion. In other words, restructuring the financial architecture through extraordinary monetary policy was contingent on the economy’s engine being turned off. Had the enormous mass of liquidity pumped into the financial sector reached transactions on the ground, a monetary tsunami with catastrophic consequences would have been unleashed.

As claimed by economist Ellen Brown, it was “another bailout”, but this time “under cover of a virus.” Similarly, John Titus and Catherine Austin Fitts noted that the Covid-19 “magic wand” allowed the Fed to execute BlackRock’s “going direct” plan, literally: it carried out an unprecedented purchase of government bonds, while, on an infinitesimally smaller scale, also issuing government backed ‘COVID loans’ to businesses. In brief, only an induced economic coma would provide the Fed with the room to defuse the time-bomb ticking away in the financial sector. Screened by mass-hysteria, the US central bank plugged the holes in the interbank lending market, dodging hyperinflation as well as the ‘Financial Stability Oversight Council’ (the federal agency for monitoring financial risk created after the 2008 collapse), as discussed here. However, the “going direct” blueprint should also be framed as a desperate measure, for it can only prolong the agony of a global economy increasingly hostage to money printing and the artificial inflation of financial assets.

At the heart of our predicament lies an insurmountable structural impasse. Debt-leveraged financialization is contemporary capitalism’s only line of flight, the inevitable forward-escape route for a reproductive model that has reached its historical limit. Capitals head for financial markets because the labour-based economy is increasingly unprofitable. How did we get to this?

The answer can be summarised as follows: 1. The economy’s mission to generate surplus-value is both the drive to exploit the workforce and to expel it from production. This is what Marx called capitalism’s “moving contradiction”.[1] While it constitutes the essence of our mode of production, this contradiction today backfires, turning political economy into a mode of permanent devastation. 2. The reason for this change of fortune is the objective failure of the labour-capital dialectic: the unprecedented acceleration in technological automation since the 1980s causes more labour-power to be ejected from production than (re)absorbed. The contraction of the volume of wages means that the purchasing power of a growing part of the world population is falling, with debt and immiseration as inevitable consequences. 3. As less surplus-value is produced, capital seeks immediate returns in the debt-leveraged financial sector rather than in the real economy or by investing in socially constructive sectors like education, research, and public services.

The bottom line is that the paradigm shift underway is the necessary condition for the (dystopian) survival of capitalism, which is no longer able to reproduce itself through mass wage-labour and the attendant consumerist utopia. The pandemic agenda was dictated, ultimately, by systemic implosion: the profitability downturn of a mode of production which rampant automation is making obsolete. For this immanent reason, capitalism is increasingly dependent on public debt, low wages, centralisation of wealth and power, a permanent state of emergency, and financial acrobatics.

If we ‘follow the money’, we will see that the economic blockade deviously attributed to Virus has achieved far from negligible results, not only in terms of social engineering, but also of financial predation. I will quickly highlight four of them.

1) As anticipated, it has allowed the Fed to reorganise the financial sector by printing a continuous stream of billions of dollars out of thin air; 2) It has accelerated the extinction of small and medium-sized companies, allowing major groups to monopolise trade flows; 3) It has further depressed labour wages and facilitated significant capital savings through ‘smart working’ (which is particularly smart for those who implement it); 4) It has enabled the growth of e-commerce, the explosion of Big Tech, and the proliferation of the pharma-dollar – which also includes the much disparaged plastic industry, now producing millions of new facemasks and gloves every week, many of which end up in the oceans (to the delight of the ‘green new dealers’). In 2020 alone, the wealth of the planet’s 2,200 or so billionaires grew by $1.9 trillion, an increase without historical precedent. All this thanks to a pathogen so lethal that, according to official data, only 99.8% of the infected survive (see here and here), most of them without experiencing any symptoms.

Doing capitalism differently

The economic motif of the Covid whodunit must be placed within a broader context of social transformation. If we scratch the surface of the official narrative, a neo-feudal scenario begins to take form. Masses of increasingly unproductive consumers are being regimented and cast aside, simply because Mr Global no longer knows what to do with them. Together with the underemployed and the excluded, the impoverished middle-classes are now a problem to be handled with the stick of lockdowns, curfews, mass vaccination, propaganda, and the militarisation of society, rather than with the carrot of work, consumption, participatory democracy, social rights (replaced in collective imagination by the civil rights of minorities), and ‘well-earned holidays.’

It is therefore delusional to believe that the purpose of lockdowns is therapeutic and humanitarian. When has capital ever cared for the people? Indifference and misanthropy are the typical traits of capitalism, whose only real passion is profit, and the power that comes with it. Today, capitalist power can be summed up with the names of the three biggest investment funds in the world: BlackRock, Vanguard and State Street Global Advisor. These giants, sitting at the centre of a huge galaxy of financial entities, manage a mass of value close to half the global GDP, and are major shareholders in around 90% of listed companies. Around them gravitate transnational institutions like the International Monetary Fund, the World Bank, the World Economic Forum, the Trilateral Commission, and the Bank for International Settlements, whose function is to coordinate consensus within the financial constellation. We can safely assume that all key strategic decisions – economic, political and military – are at least heavily influenced by these elites. Or do we want to believe that Virus has taken them by surprise? Rather, SARS-CoV-2 – which, by admission of the CDC and the European Commission has never been isolated nor purified – is the name of a special weapon of psychological warfare that was deployed in the moment of greatest need.

Why should we trust a mega pharmaceutical cartel (the WHO) that is not in charge of ‘public health’, but rather of marketing private products worldwide at the most profitable rates possible? Public health problems stem from abysmal working conditions, poor nutrition, air, water, and food pollution, and above all from rampant poverty; yet none of these ‘pathogens’ are on the WHO’s list of humanitarian concerns. The immense conflicts of interest between the predators of the pharmaceutical industry, national and supranational medical agencies, and the cynical political enforcers, is now an open secret. No wonder that on the day COVID-19 was classified as a pandemic, the WEF, together with the WHO, launched the Covid Action Platform, a “protection of life” coalition run by over 1,000 of the world’s most powerful private companies.

The only thing that matters for the clique directing the health emergency orchestra is to feed the profit-making machine, and every move is planned to this end, with the support of a political and media front motivated by opportunism. If the military industry needs wars, the pharmaceutical industry needs diseases. It is no coincidence that ‘public health’ is by far the most profitable sector of the world economy, to the extent that Big Pharma spends about three times as much as Big Oil and twice as much as Big Tech on lobbying. The potentially endless demand for vaccines and experimental gene concoctions offers pharmaceutical cartels the prospect of almost unlimited profit streams, especially when guaranteed by mass vaccination programmes subsidised by public money (i.e., by more debt that will fall on our heads).

Why have all Covid treatments been criminally banned or sabotaged? As the FDA candidly admits, the use of emergency vaccines is only possible if “there are no suitable, approved and available alternatives”. A case of truth hidden in plain sight. Moreover, the current vaccine religion is closely linked to the rise of the pharma-dollar, which, by feeding on pandemics, is set to emulate the glories of the ‘petro-dollar’, allowing the United States to continue to exercise global monetary supremacy. Why should the whole of humanity (including children!) inject experimental ‘vaccines’ with increasingly worrying yet systematically downplayed adverse effects, when more than 99% of those infected, the vast majority asymptomatic, recover? The answer is obvious: because vaccines are the golden calf of the third millennium, while humanity is ‘last generation’ exploitation material in guinea pig modality.

Given this context, the staging of the emergency pantomime succeeds through an unheard-of manipulation of public opinion. Every ‘public debate’ on the pandemic is shamelessly privatised, or rather monopolised by the religious belief in technical-scientific committees bankrolled by the financial elites. Every ‘free discussion’ is legitimised by adherence to pseudo-scientific protocols carefully purged from the socio-economic context: one ‘follows the science’ while pretending not to know that ‘science follows the money’. Karl Popper’s famous statement that “real science” is only possible under the aegis of liberal capitalism in what he called “the open society”,[1] is now coming true in the globalist ideology that animates, among others, George Soros’s Open Society Foundation. The combination of “real science” and “open and inclusive society” makes the Covid doctrine almost impossible to challenge.

For COVID-19, then, we could imagine the following agenda. A fictitious narrative is prepared based on an epidemic risk presented in such a way as to promote fear and submissive behaviour. Most likely a case of diagnostic reclassification. All that is needed is an epidemiologically ambiguous influenza virus, on which to build an aggressive tale of contagion relatable to geographical areas where the impact of respiratory or vascular diseases in the elderly and immunocompromised population is high – perhaps with the aggravating factor of heavy pollution. There is no need to make much up, given that intensive care units in ‘advanced’ countries had already collapsed in the years preceding the arrival of Covid, with mortality peaks for which no one had dreamed of exhuming quarantine. In other words, public health systems had already been demolished, and thus prepared for the pandemic scenario.

But this time there is method in madness: a state of emergency is declared, which triggers panic, in turn causing the clogging up of hospitals and care homes (at high risk of sepsis), the application of nefarious protocols, and the suspension of medical care. Et voilà, the killer Virus becomes a self-fulfilling prophecy! The propaganda raging across the main centres of financial power (especially North America and Europe) is essential to maintaining the ‘state of exception’ (Carl Schmitt), which is immediately accepted as the only possible form of political and existential rationality. Entire populations exposed to heavy media bombardment surrender through self-discipline, adhering with grotesque enthusiasm to forms of ‘civic responsibility’ in which coercion morphs into altruism.

The whole pandemic script – from the ‘contagion curve’ to the ‘Covid deaths’ – rests on the PCR test, which was authorised for the detection of SARS-CoV-2 by a study produced in record time on commission from the WHO. As many will know by now, the diagnostic unreliability of the PCR test was denounced by its inventor himself, Nobel laureate Kary Mullis (unfortunately passed away on 7 August 2019), and recently reiterated by, among others, 22 internationally renowned experts who demanded its removal for clear scientific flaws. Obviously, the request fell on deaf ears.

The PCR test is the driving force behind the pandemic. It works through the infamous ‘cycle thresholds’: the more cycles you make, the more false positives (infections, Covid-deaths) you produce, as even guru Anthony Fauci recklessly admitted when he stated that swabs are worthless above 35 cycles. Now, why is it that during the pandemic, amplifications of 35 cycles or more were routinely carried out in laboratories all over the world? Even the New York Times – certainly not a den of dangerous Covid-deniers – raised this key question last summer. Thanks to the sensitivity of the swab, the pandemic can be turned on and off like a tap, allowing the health regime to exert full control over the ‘numerological monster’ of Covid cases and deaths – the key instruments of everyday terror.

All this fearmongering continues today, despite the easing of some measures. To understand why, we should return to the economic motif. As noted, several trillions of newly printed cash have been created with a few clicks of a mouse by central banks and injected into financial systems, where they have in great part remained. The aim of the printing-spree was to plug calamitous liquidity gaps. Most of this ‘magic-tree money’ is still frozen inside the shadow banking system, the stock exchanges, and various virtual currency schemes that are not meant to be used for spending and investment. Their function is solely to provide cheap loans for financial speculation. This is what Marx called ‘fictitious capital’, which continues to expand in an orbital loop that is now completely independent of economic cycles on the ground.

The bottom line is that all this cash cannot be allowed to flood the real economy, for the latter would overheat and trigger hyperinflation. And this is where Virus continues to come in handy. If it initially served to “insulate the real economy” (to quote again from the BIS paper), it now oversees its tentative reopening, characterized by submission to the vaccination dogma and chromatic methods of mass regimentation, which may soon include climate lockdowns. Remember how we were told that only vaccines would give us back our ‘freedom’? All too predictably, we now discover that the road to freedom is littered with ‘variants’, that is to say, iterations of Virus. Their purpose is to increase the ‘case count’ and therefore prolong those states of emergency that justify central banks’ production of virtual money aimed at monetizing debt and financing deficits. Rather than returning to normal interest rates, the elites opt to normalize the health emergency by feeding the contagion ghost. The much-publicised ‘tapering’ (reduction of monetary stimulus) can therefore wait – just like Pandexit.

In the EU, for instance, the European Central Bank’s €1.85 trillion ‘pandemic emergency purchase program’, known as PEPP, is currently set to continue until March 2022. However, it has been intimated it might need to be extended beyond that date. In the meantime, the Delta variant is wreaking havoc on the travel and tourism industry, with new restrictions (including quarantine) disrupting the summer season. Again, we seem to be caught within a self-fulfilling prophecy (especially if, as Nobel laureate Luc Montagnier and many others have intimated, variants, however mild, are the consequence of aggressive mass vaccination campaigns). Whatever the case, the fundamental point is that Virus is still needed by senile capitalism, whose only chance of survival depends on generating a paradigm shift from liberalism to oligarchic authoritarianism.

While their crime is far from perfect, the orchestrators of this global coup must nevertheless be credited with a certain sadistic brilliance. Their sleight of hand succeeded, perhaps even beyond expectations. However, any power aiming at totalisation is destined to fail, and this applies also to the high priests of the Covid religion and the institutional puppets they have mobilised to roll out the health emergency psyop. After all, power tends to delude itself about its omnipotence. Those sitting in the control room fail to realise the extent to which their dominance is uncertain. What they do not see is that their authority depends on a ‘higher mission’, to which they remain partly blind, namely the anonymous self-reproduction of the capitalist matrix. Today’s power lies with the profit-making machine whose only purpose is to continue its reckless journey, potentially leading to the premature extinction of Homo sapiens. The elites who have conned the world into Covid-obedience are the anthropomorphic manifestation of the capitalist automaton, whose invisibility is as cunning as that of Virus itself. And the novelty of our era is that the ‘locked-down society’ is the model that best guarantees the reproducibility of the capitalist machine, irrespective of its dystopian destination.

No comments:

Post a Comment