With oil at 100$ per barrel, the real crisis staring us in the eyes now is not Ukraine but energy. We were saved 5 years ago by the uneconomic shale oil boom which bought us time. There won't and can't be another miracle this time as this article argues: Where would the oil come from?

Thankfully, we also know from our recent experience that demand destruction starts more or less around 100$... So, with or without war, it is safe to assume that we are heading first into a recession, then into permanent decline. (Renewable are too late, too marginal and mostly, too uneconomical, to make any difference.)

And this is the positive scenario! History proves that usually, we wildly overshoot on the downside. Brace for impact!

Here are the numbers:

by Capitalist Exploits

Stop staring at your gains from the energy stocks for a second here. Take a seat in a nice quiet place and ask yourself this one really simple question: if oil demand continues to grow at ~1 million b/d for the next 8-10 years, where is the oil supply coming from to meet it?

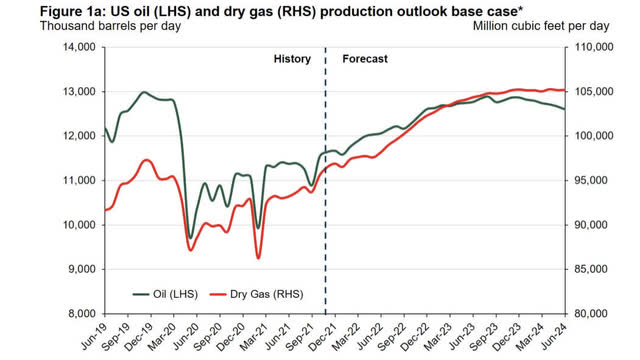

Rystad Energy, along with many others, including my friend Tracy Shuchart as well as the work of Josh Young over at Bison, show that US oil production will peak in 2023/2024. Outside of OPEC’s core members, Saudi Arabia, UAE, and Kuwait, there’s no spare capacity (with the exception of Iran).

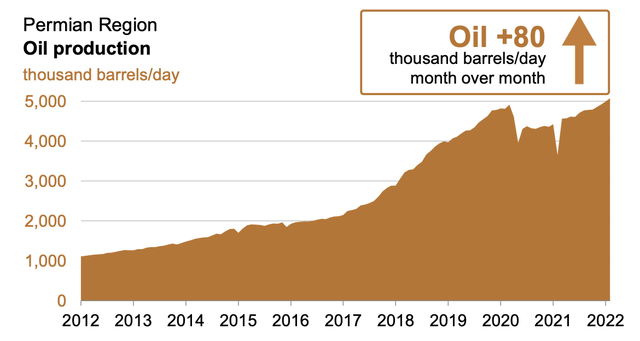

Part of the reason we’re in this situation is because of the shale boom. If it wasn’t for the Permian back in 2016, we would already be deep into an oil supply crisis. We need another Permian, and that’s unlikely. Furthermore, we also know that shale as an industry never produced a profit. Those investors who got in and didn’t get out in time (most) all lost their shirts. Trying to kick that dead horse back to life will require horse-sized steroids. They will come with higher oil prices, but it’s not gonna happen for some time and it’s not gonna solve the immediate problem.

Without demand destruction, this oil supply deficit is going to be hard to control, and with it, oil prices though due a pullback here and now are going higher and for longer than many think.

Just look at the broader landscape in the oil market today. You can list the number of countries that can actually grow oil production on one hand:

- OPEC (Saudi, UAE, Kuwait), Iraq, and Russia are now tapped out (e.g. under compliance to OPEC+ agreement)

- US

- Canada

- Brazil

- Norway

Aside from the first three countries, Brazil, and Norway’s low-hanging fruits are done. The big projects came online in 2018 and 2019 and there’s no more runway in the future. So that leaves the rest of the world scrambling about for a savior. Who is left? Well, five countries: Saudi Arabia, UAE, Kuwait, the US, and Canada. Canada is going to see very muted production growth because :

- pipeline constraint, and

- producer discipline

All of the oil sand majors have already said they’re not going to invest in long-lead projects because of a lack of takeaway capacity, so without new pipelines, there’s no growth.

And looking at Saudi Arabia, UAE, and Kuwait, the combined total has another ~2.5 to ~3 million b/d of spare capacity (if we are really stretching it).

That leaves the rest to the US. And what’s incredible about all of this is that Rystad Energy, one of the biggest US shale bulls, came out in recent weeks noting that there’s a good chance US oil production will peak at ~13 million b/d by 2025 because of inventory constraints.

In addition, there was a good WSJ article out earlier this month about the constrained inventories of US shale.

Now, to be fair, inventory is a function of what’s economical and what’s not. The higher oil prices go, all that lousy drilling inventory all of a sudden becomes more economical. So it’s largely dependent on price, but because of the higher cost, it would take more money just to get the same amount of barrels out. As a result, the drop in efficiency will be a limiting factor, and why it’s important to focus on tier 1 drilling locations. This is nothing new to you. We’ve been rabbiting on about this for yonks now.

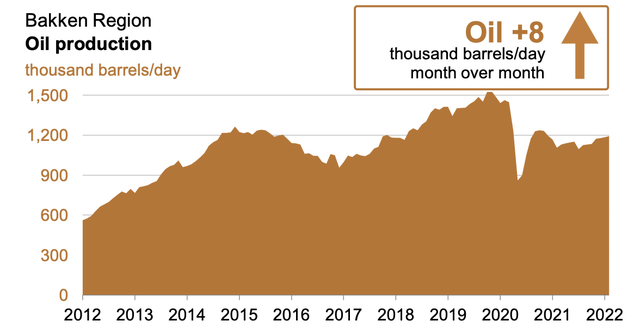

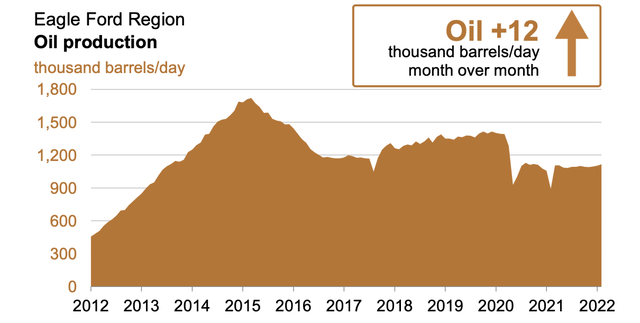

With that said, if US shale does peak by 2025, it’s pretty much game over. There’s really no other region in the world that can supply the type of growth the US did over the last 7-8 years. Think about what I just said in another way. If you look at Eagle Ford and Bakken, Eagle Ford peaked in 2014 and Bakken peaked in 2018, according to EIA.

And if it wasn’t for the Permian region in 2016, US oil production today would be sitting at 8.5 million b/d.

The whole world would have already been in an energy crisis five years ago. But the reality is that the Permian pretty much saved the world. And without another Permian, the world is going to run out of oil.

Think long-term here…

At the start of every cycle, there are the hardcore believers that focus on the data and analyze everything. We are one of them. And while the old adage, low commodity prices cure low commodity prices is true, you have to think in reverse now. Will high commodity prices in this case actually cure high commodity prices?

Without demand destruction, this oil supply deficit is going to be hard to control, and with it, oil prices will remain high for years to come.

No comments:

Post a Comment