Another victim of the predominant "woke" culture. His crime? Denouncing the fake climate emergency while trying to pursue green investments. So "green" but not green enough. Whoever doesn't accept the dogma whole is now branded heretic.

As the economy unravel, it is amazing to see the fanaticism getting worse, especially in places such as Germany. The less it works, the more you need to apply the remedy and believe in the cure.

"No Place For Virtue-Signaling In Finance" - HSBC 'Responsible Banking' Head Quits from Zero Hedge

It has been just over a month since HSBC reportedly suspended a senior executive after he questioned the risk climate change plays on financial markets, arguing investors shouldn't worry about it, according to Financial Times.

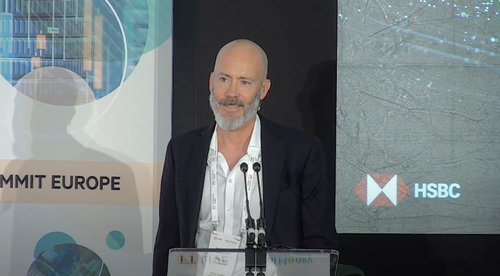

Stuart Kirk, global head of responsible investing at HSBC Asset Management, told an audience in late May in London at a Financial Times Moral Money conference, "there always some nut job telling me about the end of the world."

In a resignation letter, posted to LinkedIn, Kirk explained that HSBC’s behaviour towards him since the speech has made staying in the role, ironically, “unsustainable”.

Kirk’s post on LinkedIn highlighted issues around freedom of speech and the damage caused by cancel culture.

“Investing is hard. So is saving our planet. Opinions on both differ. But humanity’s best chance of success is open and honest debate. If companies believe in diversity and speaking up, they need to walk the talk. A cancel culture destroys wealth and progress,” he wrote.

“There is no place for virtue signalling in finance. Likewise as a writer, researcher and investor, I know that words or trading shares can only achieve so much. True impact comes from the combination of real-world action and innovative solutions.”

Read the full letter below: (emphasis ours)

Today I wish to announce that I have resigned as global head of responsible investing at HSBC Asset Management.

Ironically given my job title, I have concluded that the bank’s behaviour towards me since my speech at a Financial Times conference in May has made my position, well, unsustainable.

Funny old world.

Over a 27-year unblemished record in finance, journalism and consulting I have only ever tried to do the best for my clients and readers, knowing that doing so helps my employer too.

Investing is hard. So is saving our planet. Opinions on both differ. But humanity’s best chance of success is open and honest debate. If companies believe in diversity and speaking up, they need to walk the talk. A cancel culture destroys wealth and progress.

There is no place for virtue signalling in finance. Likewise as a writer, researcher and investor, I know that words or trading shares can only achieve so much. True impact comes from the combination of real-world action and innovative solutions.

Which is why I’ve been gathering a crack group of like-minded individuals together to deliver what is arguably the greatest sustainable investment idea ever conceived. A whole new asset class. Sounds fanciful – but I am not one for hyperbole, as viewers of my presentation know well.

To be announced later this year, the first project will underline the central argument in my speech: that human ingenuity can and will overcome the challenges ahead, while at the same time offering huge investment opportunities.

Meanwhile, I will continue to prod with a sharp stick the nonsense, hypocrisy, sloppy logic and group-think inside the mainstream bubble of sustainable finance. Follow me on LinkedIn if you want to learn the right way to think about ESG – and let me tell you, most of what’s out there is bonkers.

Finally, can I take this opportunity to thank the tens of thousands of people – from chief executives and congressmen to scientists and mom and pop investors – who contacted me from around the world offering their support and solidarity over the past two months.

You have given me strength during what has been a tumultuous time for me and my family. It is for you that the next chapter in my career will be devoted. Please forward this to anyone you know who cares about money and planet earth.

No comments:

Post a Comment