This may not be the Lehman moment of the next crisis yet. But it is definitively the Bear Stearns shot across the bow as a warning of worse to come. Which bank can you trust? Where should you move your money? Gold? Commodities?

As we have argued many times on this blog, in the end, Covid was little more than a pretext to refinance massively a floundering financial system. but the solution was temporary. Now, banks worldwide need many more trillions to stay afloat. Where will these come from? It is too late for inflation alone to be the answer. We would need hyper-inflation. Any sudden move may create a run on the dollar. Because the stakes are so high, we may finally be approaching the unavoidable conclusion of 50 years of financial profligacy. (52 years actually since the "temporary" suspension of the convertibility of the dollar into gold in 1971.)

Following the agreement between Iran and Saudi Arabia last week, Xi Jinping is rushing to Moscow next week. History is on the move. They know it...

1. Market Summary

The week started out sleepy enough but late Thursday we got tremors in banking that decimated the industry’s stocks. Let’s just get to the main show, Silicon Valley Bank (SVB). Here is a play-by-play recap for Friday’s activity.

At 11:30 the headlines changed markedly from hope to despair. The FDIC closed the bank.

- *FDIC: SVB BANK CLOSED BY CALIFORNIA REGULATOR

- *FDIC: SVB BANK IS FIRST INSURED INSTITUTION TO FAIL THIS YEAR

- *FDIC: NAMED FEDERAL DEPOSIT INSURANCE FDIC AS RECEIVER

- SILICON VALLEY BANK INSURED DEPOSITORS TO HAVE ACCESS MONDAY

And with that the US experienced its second largest bank failure in history. It was noted SVB’s stock price went from $763 to zero in 16 months.

The FDIC released a full statement. Here is an excerpt.

Silicon Valley Bank, Santa Clara, California, was closed today by the California Department of Financial Protection and Innovation…All insured depositors will have full access to their insured deposits no later than Monday morning, March 13, 2023. The FDIC will pay uninsured depositors an advance dividend within the next week. Uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds. As the FDIC sells the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors. Customers with accounts in excess of $250,000 should contact the FDIC toll-free at 1-866-799-0959- FDIC

There are so many second and third tier effects of this event as well as speculation that the bank-run was instigated by some well-heeled depositors and possibly even condoned by a large commercial banks like JPM.

Normally this would be conspiracy stuff. But it is not. We received and answered may questions on this. Here are the most relvant ones re-answered.

What happened to cause this?

Why was JPM poaching depositors before it went under?

This happened days after California and the broader US ended its Covid pandemic exceptions for bank risk- How much of that was a factor?

The FDIC took over very quickly. Quicker than Lehman. Why?

What will the Fed do with interest rates?

Did the SVB executives do anything?

What is one thing you can say with large confidence?

Is there contagion risk?

Anything Else?

Addendum

1- What happened to cause this?

First off, the key here is banking reserves. A bank must have so much money in it at all times. Even if nothing is happening, if their loan portfolio drops, then their assets drop and thus their reserves drop. Regional banks are low on reserves right now. Meanwhile, the big banks have over $2TT in the Feds RRP program earning 4.75% or so.

SVB is a large bank but it is regional. Therefore it depends more on customer deposits than mega banks like JPM. A lot of their depositors are (were) tech company people in the San Fran area.

Commercial real estate crashed in the area, and is getting worse. They hold mortgages on these

The Covid pandemic emergency permitted banks to keep loans that were in arrears in the “ok” column. When that emergency was recently lifted, they had to then show they were losing money on defaulted mortgages etc…

QT and rate hikes hit tech stocks, forcing the bank to pay higher rates for deposits while customers drew down money- costs went up and deposits went down. (See here also)

Their “good” investment portfolio also went underwater. Many of their investments are Held to Maturity (HTM) types. So as rates climbed, they could not take advantage of the better revenues. They also got marked to market

Their remaining big Tech company depositors got spooked by JPM, spoke to each other, and pulled their money out.

In one day they went from looking for investors, to looking for a buyer, to shut down forever.

2- Why was JPM poaching depositors before it went under?

Here’s why: Smaller banks depend on depositors to keep their balances up to reserve requirement code. But QT shrank many investors’ balance sheets and appetite for floating cash. Bigger commercial banks do not depend on their retail clients to fund them. In many instances, they do not even want that type of business. They give the lowest savings rates in the country.

…while mega institutions such as JP Morgan Chase & Co sought to convince some SVB customers to move their funds Thursday.

Like any trader who is overleveraged and underfunded, Big banks like it when a regional bank goes under. And if they can help it along faster, they will do it. By doing this, they cherry pick the clients they want while before the ship sinks

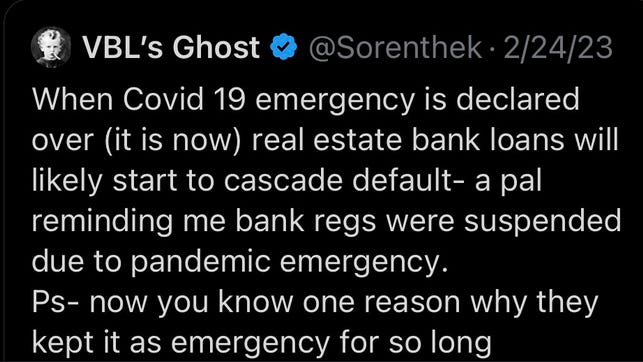

3- This happened days after California and the broader US ended its Covid pandemic exceptions for bank risk- How much of that was a factor?

We asked this Feb 24th after having a chat with a GoldFix Founder on the topic:

February 28th it happened.

4- The FDIC took over very quickly. Quicker than Lehman. Why?

The obvious and at least partially correct take: There is a much bigger problem out there and they want to get ahead of it. Simple enough. Our own lesser obvious but equally likely take: There may be something bigger out there, but they knew this was going to happen based on JPM’s behavior, the end of Covid exceptions, and how other credit facilities were trading.Like the Bitcoin bubble, they had to let it happen to send 2 signals: 1) The Fed bailout is not happening again on a mass scale 2) They will show they are in control by taking charge.

5- What will the Fed do with interest rates?

Our bias is the Fed will not pivot unless something they cannot fix behind the scenes breaks. We have to admit this is something that will at least give them reason to pause. They could definitely pivot and lower rates, but it will be a later resort than usual.

They want the fiscal side to handle this stuff while they fight inflation. Yellen is at bat. So will they pivot? They might. Does that matter? Yes. It would be a sign that the Fed cannot fight inflation without destroying the economy. And given the fiscal purse is wide open now, that is very very bad. Think of the Fed as the last defense against inflation as we enter an era of bigger government and more spending.

Put it this way. If they have to pivot (not pause.. literally pivot) it is all over. That will mean they have exhausted every behind the scenes tool they can. Powell does not want to pivot. Gold and Silver will scream. Inflation will go through the roof on goods. They may use capital controls and new rules to keep things out of the ionosphere. This would explode geopolitical risk as well.

6- Did the SVB executives do anything?

Yes.

They sold their stock just as the pandemic emergency was ending.

7- What is one thing you can say with large confidence?

We thought that the inflation target would be raised from 2% to 3% before.. we think it a hell of a lot more now. Here is what we wrote about that Friday

One thing that’s starting to make sense. Is if this bank crisis remains a crisis and the Fed doesn’t pivot or do something special, and Yellen can’t fix it from her side—It just brings us that much closer to raising the inflation target from 2% to three or 4%.

This type of event gives the Fed cover to change their tune on the inflation target. Meaning Powell can say

“We firmly want to get to 2% but if we continue to pursue 2% at this rate, we could cause some serious harm in the economy.

Therefore, we are going to change our target to 4% and then after six months we will lower to 3%. Then after six months will lower to 2%.

We’re going to do this because the expectations of the market are becoming very fearful because banks are having depositors pull their money in fear of the further rate hikes, continuing and certain entities need to unwind risk“

Something like that. But this definitely give them cover to raise the target.

We absolutely believe that the inflation target will be raised. The Fed will then start YCC1

(a QE effect to keep a lid on bond yields, but not stocks). When? Not for months, until after the crisis is handled. You do not make announcements like this in the middle of it all.

8- Is there contagion risk?

Yes. MS and GS do not think there is much risk. ZH does. We think there is risk, and they already know who is going to need help or go under. Here is MS:

We do not expect that other banks in our coverage will need to raise capital: This is because we do not expect the same level of deposit outflows at the other banks in our coverage. Therefore, we do not expect any meaningful sale of AFS securities that will result in a large capital hit, which would necessitate a capital raise.

9- Anything Else?

Yes. Jim Cramer should be fired

After telling everyone Bear Stearns was safe before it went belly up years ago…

Cramer then told investors to buy SVB on February 8th….

If that wasn’t bad enough.. Now he’s telling us JPM is safe…

10- Addendum:

This is credit related stuff. Their no denying it is the most important part of the financial economy. Without commercial credit, there is no real economy. Once banks and companies stop lending to each other everything stops. This smells like a much bigger version of the merchant energy collapse precipitated by Enron back in the day when none trusted each other to do business. Back then the physical market almost shut down. Nobody’s credit was trusted anymore. This is where we are now, but much bigger.

No comments:

Post a Comment