In retrospect this sounds obvious, but if you can issue as much money as you want without any (short term) consequences, what will stop you from buying the world?

What indeed? And this is unfortunately what we have been witnessing for over 50 years now. Since 1971 exactly, when the dollar (the world money) was dissociated from gold "temporarily" by Richard Nixon.

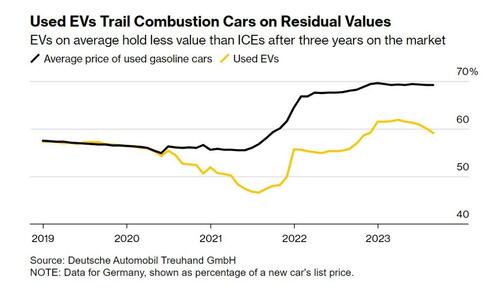

The theory says that issuing too much money will create inflation and destroys the economy. This is true if you are Zimbabwe but it doesn't work that way if you are the US because the money doesn't flow to the economy, it flows to assets creating bubbles enriching cronies and well connected people who have access to low interest loans. This is what we have witnessed over the last decades, slowly at first and then in an accelerated manner recently. The rich gets richer and the poor (almost everybody else) gets poorer. The last parameter of the equation is to control tightly the numbers and massively under-represent inflation. This started happening in the 1990s when governments realized they could "adjust" inflation with "hedonist" parameters and absorb the 1.5% of yearly technological progress as well as "convenience" factors to massively subtract to actual inflation. The result? Americans and Europeans are about half as rich today as they were in 1980. Good job!

The problem with all great ideas like this one is that sooner or later you hit a wall. We had a hint of this in 2008 when the virtual economy needed re-floating urgently. Then again in 2020 but this time the money needed was 10 times larger. And so we had a pandemic to justify the trillions. You won't start counting the beans for your own health, will you? Now for the final takeover, they will need a few hundred trillions. Basically ALL the money in the world. The CBDC! Think how convenient this will be!

Can they pull it off? I don't know. I think not but who knows.

Authored by Mark Jeftovic via BombTh.com,

The Great Taking: The Latest “Anti-Mainstream” Conspiracy

A

new book has exploded on the alternative / conspiracy / fringe

landscape over the past few weeks – I don’t mean that in a derogatory

sense. Zerohedge, Bombthrower Media, et al, we all occupy this space.

Let’s call it, “anti-mainstream”.

The book is called “The Great Taking” and there is now a YouTube video documentary of it here. You can’t actually find it on Amazon (deliberate choice by author, I presume); I bought my copy via Lulu, but you can download the PDF for free here.

At the risk of oversimplifying it:

The Great Taking puts forth a warning that a virtually unknown entity

called “The Depository Trust & Clearing Corporation” (DTCC) is

effectively the “owner” of all the publicly traded companies in the

world, and in fact all debt-based assets of any kind:

“It

is about the taking of collateral (all of it), the end game of the

current globally synchronous debt accumulation super cycle. This scheme

is being executed by long-planned, intelligent design, the audacity and

scope of which is difficult for the mind to encompass.

Included

are all financial assets and bank deposits, all stocks and bonds; and

hence, all underlying property of all public corporations, including all

inventories, plant and equipment; land, mineral deposits, inventions

and intellectual property. Privately owned personal and real property

financed with any amount of debt will likewise be taken, as will the

assets of privately owned businesses which have been financed with

debt.”

Over the course of the book, the

author describes a 50-year process by which ownership of shares in

public companies, and all debt collateral has been “dematerialized”.

In

the olden days, you invested in a company – they gave you physical

share certificates – and you were now part owner of the company. This is

still how many value investors including me think of stock ownership.

We’re not invested in all of these companies in The Bitcoin Capitalist Portfolio simply

because we’re trying to time the oscillations in the price movements.

We think of ourselves as partial owners of these businesses.

Michael

Saylor, Brian Armstrong, Mike Novogratz, Frank Holmes, Jamie Leverton

et al, aren’t just celebrity CEOs in this space (Bitcoin)… they’re our

partners. Granted, we’re the minority partners, silent ones, betting the

jockeys and just along for the ride; but we don’t think of these

positions as just stock charts and price gyrations – we think of them as

businesses in which we are part owners.

At least I do.

According to The Great Taking, author David Rogers Webb, this is not true. We

don’t own small pieces of these companies, we own claims on those

pieces, because – over the course of decades, through the exigencies of

ever-increasing trading volumes, combined with the machinations behind

the scenes of diabolical manipulators – stock ownership has been

supplanted by “security entitlements”.

Webb posits that

when the debt super-cycle culminates in its ultimate blow up; the trap

will be sprung, and actual ownership over all these companies and assets

will be subsumed by the clearing houses. An infinitesimal cadre of

elites will effectively own everything, and the masses of the world will

be reduced to serfdom.

Which sounds familiar; it seems to be the

common theme from The Great Taking to the WEF’s Great Reset (or

Stakeholder Capitalism, or whatever they’re calling it these days).

It’s

the mother of all wealth transfers, one that makes the ongoing wealth

transfer of inflation and the Cantillon Effect – or the sharp shock

heists that occur during every crisis from the dot-com bust through the

GFC to the Covid Panic (the last of which saw an overt war on small

business as those deemed “non-essential” were shut down while the megacorps were propped up by the central banks) – seem tame.

Here’s my thoughts on The Great Taking:

Modernity

could be described as humanity’s accelerating pace of technological

advancement. Part of that advancement is the ever increasing level of intellectual abstraction.

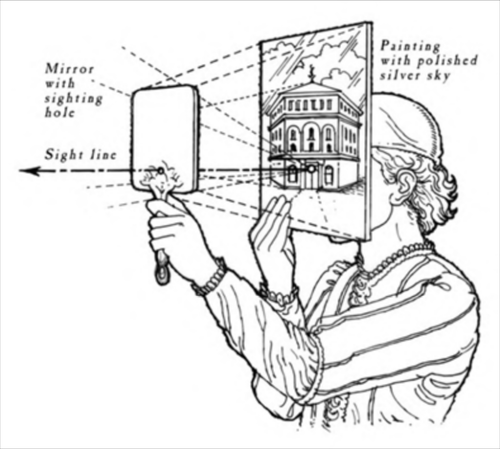

If

you’ve been a member or following my writings long enough, you’ll have

heard me talk about the W R Clement book, Quantum Jump; written in 1998,

it ascribed the entire scientific revolution from the Enlightenment

onwards, to the discovery of perspective (then called “God’s space”), in

art:

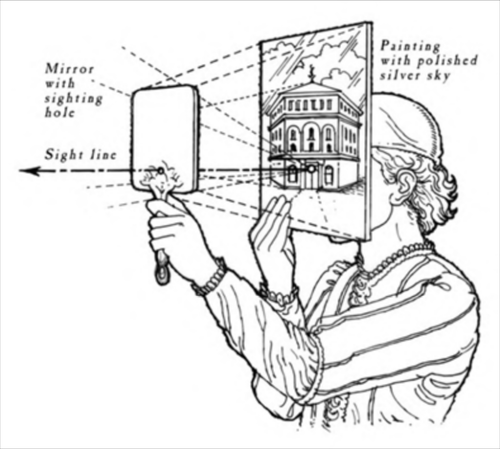

Brunelleschi and the re-discovery of Linear Perspective circa 1400’s

That

“quantum leap” began the process of rewiring all our brains for ever

higher levels of intellectual abstraction. It enabled us to go from

ownership of a coal mine, for example, being ascribed to whomever

physically occupied the space – including militarily – to people, and

even corporatized entities like pension funds or investment clubs,

owning fractional pieces of that mine, from far off places, even other

countries.

Initially we did this using physical pieces of paper to

represent that ownership. There is a scene in an Agatha Christie “Miss

Marple” mystery, “The Moving Finger”, where a man of leisure (played by

William D’Arcy) takes to convalesce in a small cottage in a country

town, and he visits the local barrister to register his securities with

him, reaching into the inside pocket of his sport jacket and handing him

the physical share certificates.

Today, he’d just handle everything from a smart phone he carries around in his jeans.

That’s increasing abstraction.

What

The Great Taking is warning us about, is that this increasing level of

abstraction comes with a price – that we’re no longer really fractional

owners of these businesses, we’re owners of claims on these businesses.

And he may be right.

Webb

is a former high level financier and an expert in the legislation and

regulatory framework that governs the space. The book looks to be

meticulously documented and the legalities well researched.

This is no different, I might add, from our mantra: “Not your keys, not your coins”.

In

fact as I read through The Great Taking, I found myself marvelling at

how closely everything Webb was describing resembled what happened

during the crypto carnage of 2022-23, when hapless users who had

deposited their crypto with exchanges found their assets rehypothecated,

collaterized – even appropriated from under them.

It drove home the lesson, hard.

Holding

shares of Amazon in your E*Trade account may, when the chips are down,

be no different from keeping your stack of BTC on an exchange (please

don’t).

The businesses to survive an event like The Great Taking, may end up being privately held ones.

The assets you keep may be the ones with no counter-party risk – sound

familiar? It’s only a core tenet of the entire Bitcoin philosophy.

It

is possible that in the event of an even larger financial crisis than

we’ve seen prior (and in case you haven’t noticed, each one is typically

an order of magnitude larger than the previous), everybody holding

publicly traded stocks on platforms gets rug-pulled – and some

mysterious and shadowy entity winds up with all the marbles.

Should

that occur, I would expect it to signify the end of the global

financial system as we know it, and not in a way wherein the society

simply continues as a world of penniless serfs, subservient to about

0.001% of the elites.

It would be more of a “last gasp of Globalism” than a final takeover of the world.

Some closing thoughts from the book’s author seems to concur:

I will make a startling assertion. This is not because the power to control is increasing. It is because this power is indeed collapsing. The “control system” has entered collapse.

Their power has been based on deception. Their

two great powers of deception, money and media, have been extremely

energy-efficient means of control. But these powers are now in rampant

collapse.

This is why they have moved urgently

to institute physical control measures. However, physical control is

difficult, dangerous and energy-intensive. And so, they are risking all.

They are risking being seen. Is this not a sign of desperation?

This has also been my read on it from

fairy early in the pandemic, and more so since – especially after the

#FreedomConvoy. Official narrative aside, that event sounded the death

knell for not only Covid Tyranny, but for WEF-inspired globalism itself.

Within

a year of that happening, all Covid emergency measures had ended

worldwide, vaccination uptake rates went into secular decline, and the

mainstream media entered into a full-on death spiral.

Webb continues:

“We

have entered a time in which their nature is being recognized.

Knowledge of their existence has become unavoidable. Their grasping will

come to an end, because all of humanity cannot allow it to continue.

Once it is recognized, humans will bond against a common existential threat.

People from all walks of life will join in common cause. We have witnessed this already.”

It

follows a theme I’ve been developing for a few years now, one that I

didn’t originally conceive but came across and feel is accurate:

That

theme is that the next, worldwide conflict (“World War III”, in

essence) will not be a geo-political struggle of the US vs China, or

West vs East, or NATO vs China/Russia: it will be populations against

their own governments.

When you think about it, it almost

fits the historical definition of the Marxist “class struggle”, only we

– hopefully – don’t get a Communist “utopia” at the end of it.

In

fact, I think that’s what everybody will be rebelling against: the

imposition of a technocratic socialism that attempts to hoover up the

property rights of the rest of humanity.

Those attempting to

capitalize on this, the elites and the technocrats, have only really had

one superpower with which to build their position over time:

“They promote the belief that they are all-powerful. They are not.

All they have had is the power to print money.

The rest, they have usurped from humanity.”

Of

course, Bitcoin is the kryptonite to this superpower, the one thing

elites had which enabled them to rig the entire system in their favour

is basically finished, and they know it.

At the risk of

going on too long about it here, but wanting to do the topic some

justice, The Great Taking scenario isn’t incompatible with what we’ve

been calling The Great Bifurcation since the onset of the pandemic, encapsulated by my glib, cynical quip:

“In the future, there will only be one occupation: managing one’s wealth. And most people, are gonna be unemployed.”

We see The Great Bifurcation happening all around us already:

tent cities from Burnaby to Toronto, fentanyl zombies roving San

Francisco, increasing masses behaving like savages; this isn’t because

of race, politics, religion or even a far-reaching global conspiracy to

impoverish humanity or depopulate the earth (although there are almost

certainly cells of elites who would wish that) – it’s because we’re

using debt for money, we can’t stop, and the level of intellectual

abstraction that is required to operate, let alone thrive, within a

hyper-financialized world, is leaving larger and larger chunks of the

population behind.

Anytown of the future.

It’s

Alvin Toffler’s “Future Shock” (tl;dr: the rate of technological change

will accelerate and compound) released in 1971, combined with Clement’

“Quantum Jump” (intellectual abstraction will become increasingly more

complex) from 1998, writ large.

These two accelerating dynamics

conspire to create a veritable “Breakaway society” where those who are

positioned and have the cognitive ability to front run the technology

live in the future, and the rest, who can’t, fall behind into the past.

The

main difference that I see is Webb’s Great Taking is a deliberate

conspiracy driven by successive generations of insular elites, whereas

my concept of The Great Bifurcation is, as I always say, more the result

of perverse incentives and dynamics than outright conspiracy.

The reality is probably elements of both.

Having said all that, we should be clear in our motivations and strategies for what we are holding in our equities portfolios:

We hold Bitcoin, in proper self-custody, so nobody can take it from us in the event of a catastrophic collapse of the financial system.

We may hold some physical gold, silver, junk silver for the same reasons, and we may have property somewhere,

farmland, anything that we can lay physical claim to – although we may

find ourselves in a situation where we have to somehow enforce those

claims.

Stocks, ETFs, even Bitcoin stocks or weird crypto

moonshots, we don’t hold these to survive the collapse of the system. We

hold these to try and garner out-sized investment returns within the

system so long as it continues to function.

I don’t know

about you, but I actually don’t want the financial system to collapse. I

don’t want society to go off the rails, I am not an accelerationist.

I’m

not hoping for a hyper-inflationary flameout of the entire global

economy. That would suck, and I’d prefer to be wrong about that.

In

other words, were The Great Taking scenario to play out and come true,

it would be a permutation of a catastrophic collapse we’ve been

positioning for anyway – and we never really considered our equities

portfolio (at least we shouldn’t) as part of our toolkit for navigating

the collapse of the financial system.

One way or another,

should the entire system collapse, I expect our stocks to be among the

first casualties, via bail-ins, capital controls, forced conversions

into government debt, recapitalizing zombie banks or after all those –

if we’re unfortunate enough to have been wildly correct about our

positions – “windfall taxes” taking much of what’s left. (I am not alone

in thinking this; any of you who also read Mark Faber’s Gloom Boom Doom

report know he expects to have upwards of 25% of his wealth confiscated

by technocrats during some future, exigent crisis).

That’s why I said in the November letter, on this cycle (or the next) we

will have to individually make our exits from the equities based on our

own financial goals. While we keep our Bitcoin stack forever and make

plans for inter-generational succession – and we may do that

with some of our stocks (I could see *** and *** being legacy, dynastic

holdings) – for the most part we’re in these to strategically profit

within the existing system and cash out to meet our financial

objectives.

Everybody knows I want my lake-house in the Muskokas, and you should know what it is that you want.