Could this work? Could mega projects as the dam below reflate the Chinese economy?

Unfortunately, the answer is: No! This has been tried, most recently by Japan following their big real estate bubble. It didn't work. It will create "some" economic activity by increasing demand for iron and cement, temporarily, but what China needs is not to consume more cement or iron. And then it will explode the debt further.

The problem of a bubble is that as prices of real estate are inflated, the debt explodes in parallel. Debt which is backed up by... real estate. So when conversely, the value of apartments and mansions starts falling, the debt remains high and dry with nothing to back it up, often exceeding the total assets of people and companies.

This is what normally should be called bankruptcy although a nicer name is negative equity. The assets should be sold at a discount and the banks should absorb the loss. Except that when a bubble pops this becomes impossible because all the money available in the country would not be enough to reflate the banks. The country itself would have to declare bankruptcy and re-denominate the money. If you can avoid it, which both Japan before and China now can, this is the very last option on the menu list.

Another possibility would be to distribute cash to the population. This too has been tried on a small scale in Japan. It only creates inflation in proportion to the total amount distributed. As for the debt, it keeps rising, only faster. In-between, you can also give money to cities and villages to invest wisely. This also has been tried in Japan. Almost everything failed. Small villages ended up with international swimming pools that they could not even heat in Winter and which consequently had to close three or four years later. And the debt kept piling.

All this is why, a bubble should be avoided at all costs. Short of a jubilee, total bankruptcy and hyper inflation, we have tried for over 5,000 years since Babylon and haven't yet found a painless solution. The probability that there is none must be very high!

Buzz This Week Has Been Around China's Mega Hydro Power Project

China's policymakers are locked in a fight with the deflation monster, and any path to economic recovery hinges on cutting excess supply and production capacity, while reviving the ailing property sector. Tariff tensions with the U.S. have further clouded the outlook this year, adding urgency to the need for targeted stimulus. Also, authorities may ramp up fiscal support, and one of the boldest ways to do that was recently launched in the country's most ambitious infrastructure project since the Three Gorges Dam.

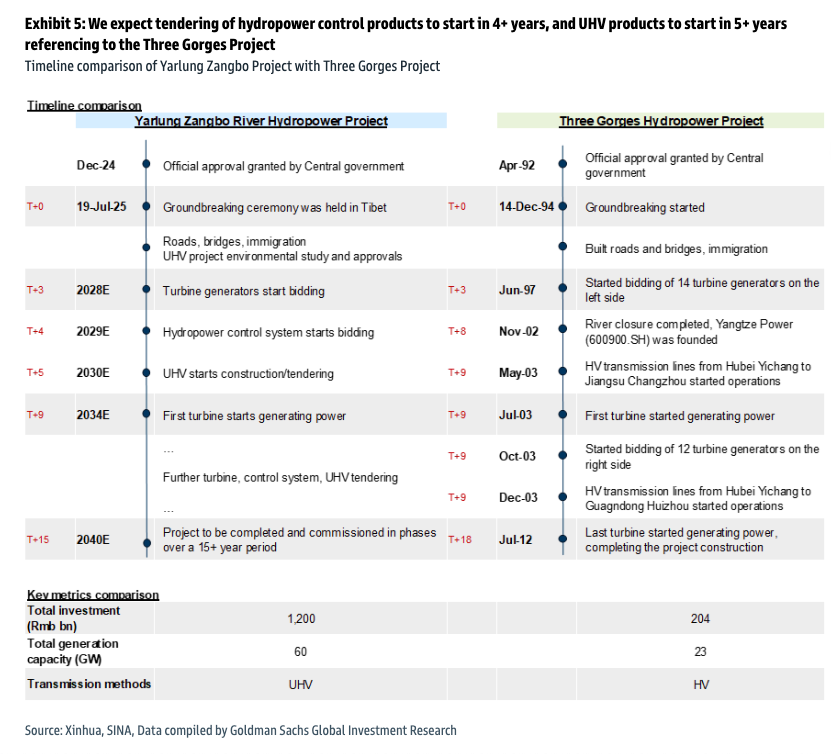

According to the state-run media outlet Xinhua News Agency, Chinese Premier Li Qiang launched construction of the world's largest dam project, with a total planned investment of 1.2 trillion yuan ($167 billion).

Li described the multi-decade Yarlung Zangbo River dam as a "project of the century" and said special focus "must be placed on ecological conservation to prevent environmental damage."

On Wednesday, Guo Jiakun, China's Foreign Ministry spokesperson, told reporters, "To build the hydropower project in the lower reaches of the Yarlung Tsangpo River is fully within China's sovereignty," adding, "China acts with a high sense of responsibility in harnessing cross-border rivers, and has rich experience in hydropower projects. The planning, design and construction of this newly announced project strictly follows the highest national industrial standards."

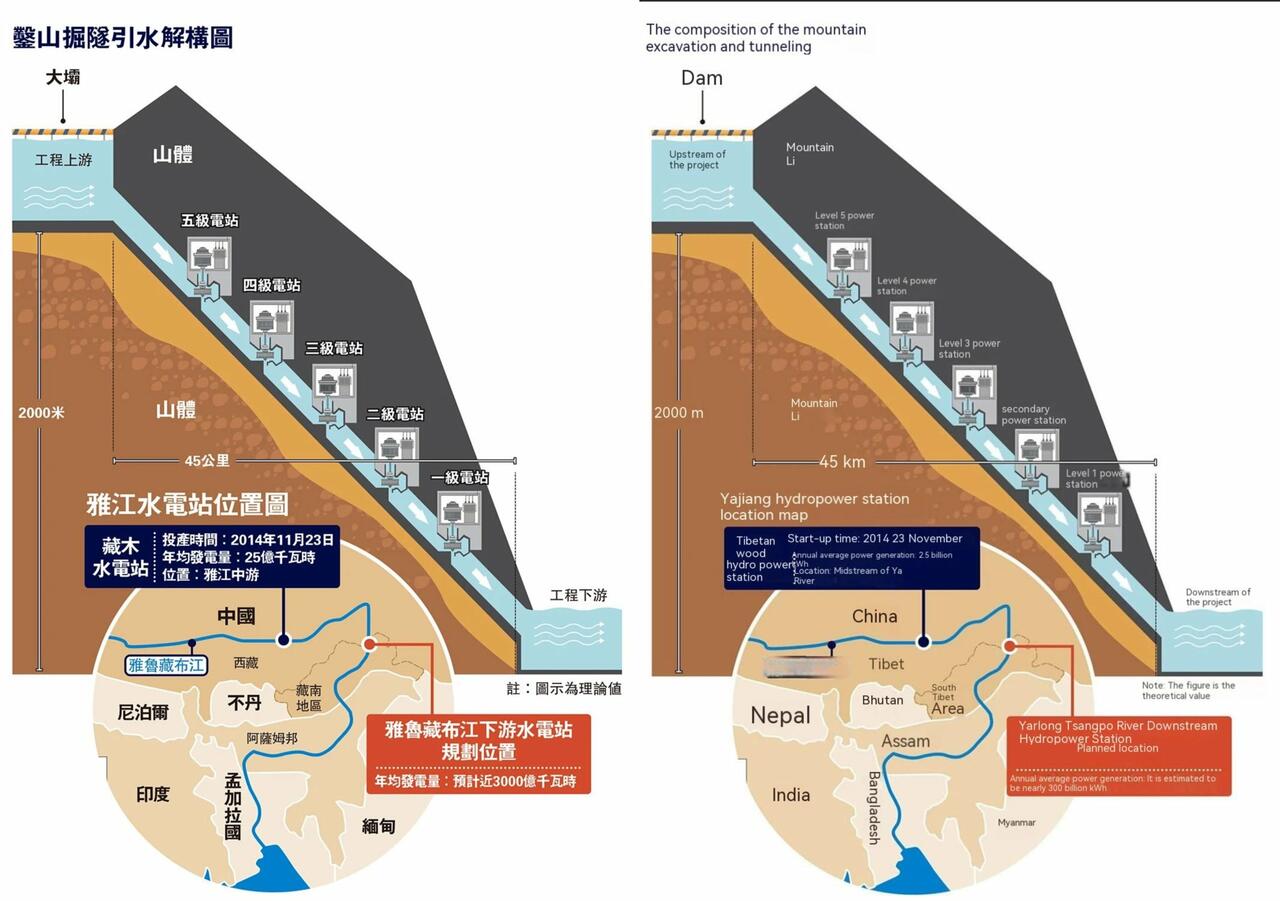

The dam will comprise five cascade hydropower stations and is expected to begin operating in the early 2030s.

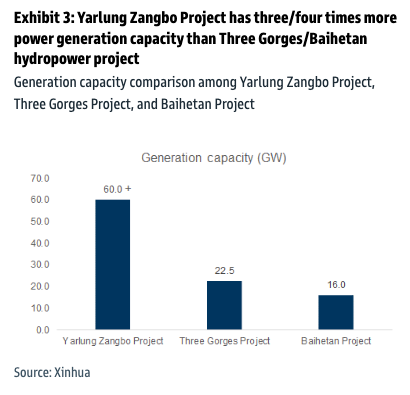

Once its generators come online, the project will dwarf the electrical output and scale of China's Three Gorges Dam.

Via Goldman

Timeline comparison of the Yarlung Zangbo Project vs. Three Gorges Project

In a separate note, UBS analyst Sunny Zhang highlights major sector and stock-specific beneficiaries of this new mega project.

"We detailed the sector-specific implications of the Yarlung Zangbo Dam project, highlighting key opportunities and expected impacts across Heavy Duty Trucks, Materials, Infrastructure, and Power equipment," the analyst noted, adding, "The key stock beneficiaries are Weichai Power, SInotruk, CNBM, Tibet Tianlu, NARI, CCCC, China Railway Group."

Highlights of the note:

Heavy Duty Trucks: The project could boost annual HDT sales by 3–4%, with an estimated 35,000 additional units driven by long-cycle engineering demand. Sinotruk and Shaanxi Automobile (Weichai Power) are well positioned to benefit, especially amid strong electric HDT momentum and trade-in subsidies.

Basic Materials: The dam's construction is expected to drive annual demand of 4.3mt cement and 0.6mt steel, significantly lifting Tibet's cement consumption and supporting steel producers. While earnings impact is modest, CNBM stands out with a buy rating due to its valuation and exposure, compared to neutral ratings on Conch and steel names.

NARI: NARI could gain Rmb69 bn in revenue from the project by 2033, with contributions from hydropower equipment and ultra-high voltage infrastructure. Despite recent share gains, the long-term upside is not fully priced in; buy rating maintained with Rmb28 price target, supported by strong order growth and margin improvement.

Construction: Around 60–70% of the Rmb1.2 trn investment will go to construction, with annual spend of Rmb80–120 bn over 10–15 years, representing 0.3–0.5% of China's infrastructure investment. While revenue impact on covered firms is limited, policy support and low H-share valuations (0.2–0.3x PB) with 5–6% dividend yields support a cautiously optimistic outlook for the construction sector.

Another note from the bank, featuring analyst Ryoya Wakamatsu, noted:

"While the trade truce is a plus for markets, it is also true that market participants are becoming immune to trade headlines. Sentiment is good at the moment with anti-involution focused over the last month. This week the buzz word has been the mega hydro power project on the Yarlung Zangbo River. This is a 10-year 1.2tn Yuan project to build the world's largest dam."

Beijing is once again turning to its playbook of infrastructure-led stimulus to combat deflation and shore up its domestic economy. Let's see how that works out...

No comments:

Post a Comment