Difficult to put it into better words!

Zelensky has proven to be the unlikely Braveheart of Ukraine against the Russian invaders, but who will be our Braveheart to defend our freedom against the stealth encroachment of our not so benevolent leaders?

Making sense of the world through data The focus of this blog is #data #bigdata #dataanalytics #privacy #digitalmarketing #AI #artificialintelligence #ML #GIS #datavisualization and many other aspects, fields and applications of data

Difficult to put it into better words!

Zelensky has proven to be the unlikely Braveheart of Ukraine against the Russian invaders, but who will be our Braveheart to defend our freedom against the stealth encroachment of our not so benevolent leaders?

More than science, it is our society which is dying and almost everything it stands for. Outrage for Kiev (rightfully) but not for Baghdad? For Syria but not for Saudi Arabia? Not to worry, very soon, we will all do our share against global warming by not being able to afford gas and electricity.

To my opinion, we are heading straight into a second Middle Age. A Middle Age 2.0, more technological but just as doctrinaire and narrow minded as the first one. Where the pontiffs of a new religion will decide what is "true" as they did for Covid. The virus crisis was just the appetizer. Now, with the wars coming, the main dish will be served. And yes, unfortunately: Science is dead! But with canons in the background and empty bellies, who will care?

Guest Post by Steve Kirsch

Twenty four years ago (in 1998), I donated $2.5M to MIT. They named the auditorium in the EECS building named in my honor: the Kirsch Auditorium, Room 32-123.

I’ve never asked to speak in the auditorium until now.

I wanted to give a talk at MIT about what the science is telling us about the COVID vaccines and mask wearing and how science is being censored.

I also wanted an opportunity to defend myself against unfair accusations made in MIT’s Tech Review accusing me of being a “misinformation superspreader.”

Am I a misinformation superspreader? Or is MIT one by publishing their article?

Read my rebuttal and decide for yourself who is telling the truth. There were 652 comments, nearly all of them suggesting I sue MIT for defamation.

MIT requires a faculty sponsor for all talks and they said they couldn’t find one willing to sponsor my talk.

Therefore, students will not have the opportunity to consider that there may be an alternate hypothesis that better fits the evidence on the table.

I had always believed that MIT was above politics, but it is clear I was mistaken in that belief.

My claim is important and relevant to everyone at MIT. I claim that MIT made a serious mistake in mandating vaccines for students, staff, and faculty.

As Robert Malone has often said, “where there is risk, there must be choice.” The evidence couldn’t be more clear that the COVID vaccines are the most deadly vaccines in human history.

Shouldn’t this be a topic of great interest and relevance?

Or does science dictate that anyone with opposing views must be silenced and not given a platform to speak?

There is ample evidence on the table now from credible sources that cannot be explained if the vaccines are safe.

This is why nobody will debate us. I even offered $1M to incentivize people to show up at the debate table. No takers. So I raised it to a “name your price” offer. Still no takers.

The MIT faculty doesn’t want to hear any of it. They will not let the MIT students hear any of it either.

That’s not how science is supposed to work.

Is there a single member of the MIT faculty who is the least bit curious that there might be another side of the narrative that is being unfairly suppressed?

There are many important questions that any critical thinker would have that need to be explored:

Apparently, none of the MIT faculty want to know the answer to any of these questions. It doesn’t even merit a serious discussion.

We are left with an unfortunate, but inevitable conclusion.

Institutional science is dead.This article is just a reminder about China...

I do not think that Russia and China are "plotting", I think China is the main contender behind this confrontation. The Chinese are bidding their time. More than looking at the reaction of the West, they are getting ready. Without energy from Russia and without microchips from Taiwan, the confrontation is more equal...

Authored by Eva Fu via The Epoch Times (emphasis ours),

Moscow and Beijing have been keeping each other abreast of their plans in the leadup to the Ukraine attack, according to two lawmakers.

“I think they have coordinated and I think that China is in a better position letting Russia go first, to evaluate,” Rep. Ken Buck (R-Colo.) told EpochTV’s “China Insider” program at the Conservative Political Action Conference (CPAC) on Feb. 25.

By watching the world’s reaction on Ukraine, China is trying to gauge its next steps on Taiwan, the self-ruled island that the Chinese Communist Party claims as its own territory and long planned to bring under its control, by force if necessary.

“China has designs on Taiwan,” said the lawmaker during an interview in Orlando, Florida. “And they want to see if the world imposes real sanctions on Russia, and how much it hurts Russian, and what really the willpower is to stop an aggressive nation from gaining further territory.”

Rep. Steve Chabot (R-Ohio) held a similar view.

He made a particular note of Russian leader Vladimir Putin’s meeting with China’s Xi Jinping at the Beijing Olympics’ opening day three weeks ago, which ended with the two countries forming a “no limits” partnership.

“They’ve been plotting behind the scenes,” he told NTD, an affiliate of The Epoch Times, at the CPAC event.

Ukraine was one subject discussed during “in-depth discussions” between the two nations’ foreign ministers, which took place a day prior to the Xi-Putin meeting. From the Kremlin readout, Moscow also “reaffirms its support” for Beijing’s claim that Taiwan is part of China.

Since the Russian invasion of Ukraine, the Chinese foreign ministry has been peppered with questions about whether Xi had prior knowledge about the plan and even gave Putin “his blessing,” but its officials had avoided making a direct answer.

“Russia is an independent major country,” spokesperson Hua Chunying told reporters on Thursday.

She accused the reporter of having “rich” imagination when asked if the timing of the assault, only days after the Beijing Olympics concluded, was coincidental.

The intensifying Ukraine crisis is a boon for Beijing, Buck said. A military conflict would shift the U.S. attention away from its rivalry with China, handing Beijing an opportunity to exploit.

“If the United States starts pouring troops into Europe to defend Europe and do our part as a NATO partner, we are not going to be able to do what we want to do or need to do in the Pacific,” said Buck.

“It serves as a distraction,” he added.

“In China’s view, it serves as a way of siphoning off resources that can be used in other areas,” the congressman said. “China is most interested in making sure that this is prolonged, and that Russia continues to maintain a threat to the Baltics, Poland, to Hungary, to other countries in Europe.”

Beijing has so far refrained from directly labeling Russia’s attack on Ukraine as an invasion, but at the same time has maintained that it respects “all countries’ sovereignty and territorial integrity,” an oblique reference to its insistence that Taiwan is part of China.

While the United States is not ready to engage in a ground war with Russia over Ukraine, the stakes are different when it comes to Taiwan, said Buck.

“The will to defend Taiwan is greater than the will to defend Ukraine,” he said.

“The idea that China and the way they have cheated trade relationships, the way they have stolen intellectual property, the way they have made themselves a military power in recent years, and have tried to affect shipping lanes that are necessary for trade, is different,” he said.

“Taiwan sits in a position that could impact our ability to trade with Japan, with Korea and other neighbors,” he added. “And to really embolden China to interfere with strategic trading partners … I don’t think the United States wants that to happen.”

According to a January poll by the Trafalgar Group, an overwhelming majority of Americans are against sending troops or military equipment to Ukraine in the event of a Russian invasion. Only 15 percent of those polled believed that the United States should provide troops, while 30 percent believed it should provide weapons and other supplies only.

By contrast, 58 percent of those polled believed that U.S. military assets should be used to defend Taiwan in the event of an invasion by mainland China.

To deter China from following Russia’s steps requires stronger action by the United States, both lawmakers said.

“It’s absolutely critical that they [Beijing] realize if they attack [Taiwan] that will end up in serious military confrontation with the United States,” Chabot said, in calling Washington to change its long standing policy of strategic ambiguity, in which the United States remains deliberate vague on whether it’d come to Taiwan’s defense in the event of a Chinese invasion.

“China is not being at all helpful,” Chabot added. “But that’s not unexpected because the two chief rivals on the globe right now … the worst of the bad actors are Putin and Xi—Russia and China.”

This article is the closest to what I think. The tragedy currently unfolding in Ukraine may indeed be the beginning of World War 3. The antagonism which has been building recently between the US and China/Russia is coming to a climax for control of the international world order. In this fight, it is not just Ukraine but all of Europe which could be obliterated. Now that the dice are rolling, we are all speechless spectators witnessing how a modern city like Kiev can be destroyed in a matter of days. And by this, I am not talking about the buildings, but about the infrastructure behind that makes modern life possible. Today Kiev, tomorrow Paris and London?

Authored by Michael Snyder via TheMostImportantNews.com,

We now have a war that the vast majority of us never wanted. All of our lives are going to be turned upside down, the global economy is going to be absolutely eviscerated, and countless numbers of people are going to die. I am very angry with Vladimir Putin and the Russians for launching a full-blown invasion, because it didn’t need to happen. And I am also very angry with the Biden administration because it would have been so easy to find a diplomatic solution to this crisis. Unfortunately, the time for diplomacy is now over and World War III has begun.

On Thursday, State Department spokesman Ned Price made a stunning admission regarding what this war is really all about.

According to Price, Russia and China “also want a world order”, but he warned that if they win their world order “would be profoundly illiberal”…

China has given “tacit approval” for Russian President Vladimir Putin’s latest invasion of Ukraine, in the judgment of U.S. officials, as part of a joint effort to undermine the institutions that American and allied leaders established to minimize conflict in the decades following World War II.

“Russia and the PRC also want a world order,” State Department spokesman Ned Price said Wednesday. “But this is an order that is and would be profoundly illiberal. … It is an order that is, in many ways, destructive rather than additive.”

It would take an entire book to unpack everything that Price said there.

First of all, by stating that Russia and China “also want a world order”, he was tacitly admitting that the United States and other western nations desire to have a “world order” of their own.

And he implied that what we are witnessing is a battle over who will ultimately run the “world order”.

That should deeply alarm all of us.

Wouldn’t it be nice to live in a world where nobody had global domination as their goal?

I also want to point out that Price used the term “profoundly illiberal” to describe a “world order” led by Russia and China, and that suggests that a “world order” led by the United States and other western nations would be “liberal”.

And that is actually quite an accurate statement. In virtually every western nation today, even the political parties that are supposed to be “conservative” are extremely liberal.

If you Google the phrase “liberal world order”, you will find that it has been used by elitists for many years. But I certainly don’t want a “liberal world order” and neither should you.

Of course I don’t want a “world order” run by Russia and China either.

Unfortunately, I don’t think that we get a vote in this.

Now that World War III has begun, things are going to move very quickly. NBC News is reporting that Joe Biden is considering launching “massive cyberattacks” against Russia…

President Joe Biden has been presented with a menu of options for the U.S. to carry out massive cyberattacks designed to disrupt Russia’s ability to sustain its military operations in Ukraine, four people familiar with the deliberations tell NBC News.

Two U.S. intelligence officials, one Western intelligence official and another person briefed on the matter say no final decisions have been made, but they say U.S. intelligence and military cyber warriors are proposing the use of American cyberweapons on a scale never before contemplated. Among the options: disrupting internet connectivity across Russia, shutting off electric power, and tampering with railroad switches to hamper Russia’s ability to resupply its forces, three of the sources said.

That would be an act of war, and the Russians would inevitably strike back really hard.

And needless to say, we are very vulnerable to cyberattacks.

If we start going back and forth with the Russians, eventually we will be pushed to the brink of nuclear war.

In fact, Vladimir Putin has already raised the possibility of using nukes…

Broadcast live on television at 5.45am Moscow time, President Putin said: “Whoever tries to impede us, let alone create threats for our country and its people, must know that the Russian response will be immediate and lead to the consequences you have never seen in history.”

“All relevant decisions have been taken. I hope you hear me.”

When I first saw that, I could hardly believe what I was reading.

But it is right there in black and white.

It is so simple that even a child can understand what he was saying, but this is how Biden responded when he was asked about Putin’s statements…

REPORTER: “Putin said the West will face consequences greater than any you have faced in history. Is he threatening a nuclear strike?”

BIDEN: “I have no idea.”

Are you kidding me?

Actually, considering how far Biden’s mental abilities have obviously declined, perhaps it is not surprising that he is utterly clueless at this stage.

The rest of the world can see how weak, corrupt and utterly incompetent Biden and his minions are, and so they simply are not afraid of the United States any longer.

And now that the Russian invasion of Ukraine has gone so smoothly, many are anticipating that it could be just a matter of time before China invades Taiwan…

As Russian tanks roll over Ukraine, Vladimir Putin’s crisis will reverberate around the world, possibly most dangerously in the Taiwan Strait. An attempt by Beijing to claim Taiwan by force has just become more likely. That’s not necessarily because there is a direct link between Putin’s invasion of Ukraine and Beijing’s menacing of Taiwan, but because the war for Ukraine is the most unfortunate indication yet of the frightening direction of global geopolitics: Autocrats are striking back.

And if China invades Taiwan, North Korea may decide that is a great moment to launch an invasion of South Korea.

It would be so easy for the dominoes to start falling.

The existing “world order” is starting to come apart at the seams, and a time of great chaos is directly ahead of us.

Ultimately, someone will end up dominating the entire globe once World War III is over, and all of our lives will look very different once we get to that point.

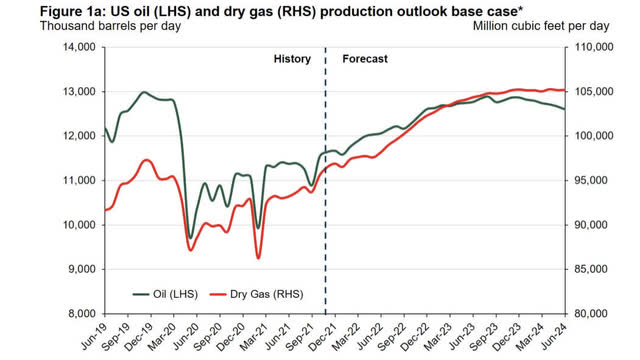

With oil at 100$ per barrel, the real crisis staring us in the eyes now is not Ukraine but energy. We were saved 5 years ago by the uneconomic shale oil boom which bought us time. There won't and can't be another miracle this time as this article argues: Where would the oil come from?

Thankfully, we also know from our recent experience that demand destruction starts more or less around 100$... So, with or without war, it is safe to assume that we are heading first into a recession, then into permanent decline. (Renewable are too late, too marginal and mostly, too uneconomical, to make any difference.)

And this is the positive scenario! History proves that usually, we wildly overshoot on the downside. Brace for impact!

Here are the numbers:

by Capitalist Exploits

Stop staring at your gains from the energy stocks for a second here. Take a seat in a nice quiet place and ask yourself this one really simple question: if oil demand continues to grow at ~1 million b/d for the next 8-10 years, where is the oil supply coming from to meet it?

Rystad Energy, along with many others, including my friend Tracy Shuchart as well as the work of Josh Young over at Bison, show that US oil production will peak in 2023/2024. Outside of OPEC’s core members, Saudi Arabia, UAE, and Kuwait, there’s no spare capacity (with the exception of Iran).

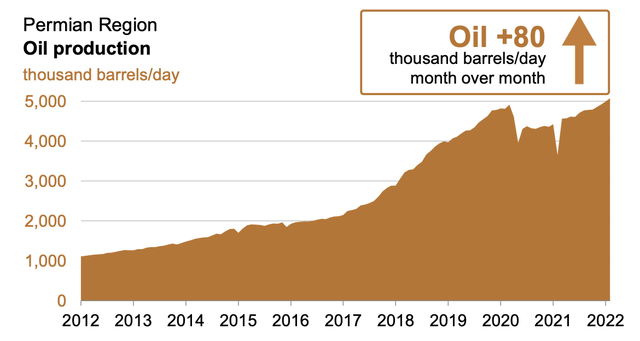

Part of the reason we’re in this situation is because of the shale boom. If it wasn’t for the Permian back in 2016, we would already be deep into an oil supply crisis. We need another Permian, and that’s unlikely. Furthermore, we also know that shale as an industry never produced a profit. Those investors who got in and didn’t get out in time (most) all lost their shirts. Trying to kick that dead horse back to life will require horse-sized steroids. They will come with higher oil prices, but it’s not gonna happen for some time and it’s not gonna solve the immediate problem.

Without demand destruction, this oil supply deficit is going to be hard to control, and with it, oil prices though due a pullback here and now are going higher and for longer than many think.

Just look at the broader landscape in the oil market today. You can list the number of countries that can actually grow oil production on one hand:

Aside from the first three countries, Brazil, and Norway’s low-hanging fruits are done. The big projects came online in 2018 and 2019 and there’s no more runway in the future. So that leaves the rest of the world scrambling about for a savior. Who is left? Well, five countries: Saudi Arabia, UAE, Kuwait, the US, and Canada. Canada is going to see very muted production growth because :

All of the oil sand majors have already said they’re not going to invest in long-lead projects because of a lack of takeaway capacity, so without new pipelines, there’s no growth.

And looking at Saudi Arabia, UAE, and Kuwait, the combined total has another ~2.5 to ~3 million b/d of spare capacity (if we are really stretching it).

That leaves the rest to the US. And what’s incredible about all of this is that Rystad Energy, one of the biggest US shale bulls, came out in recent weeks noting that there’s a good chance US oil production will peak at ~13 million b/d by 2025 because of inventory constraints.

In addition, there was a good WSJ article out earlier this month about the constrained inventories of US shale.

Now, to be fair, inventory is a function of what’s economical and what’s not. The higher oil prices go, all that lousy drilling inventory all of a sudden becomes more economical. So it’s largely dependent on price, but because of the higher cost, it would take more money just to get the same amount of barrels out. As a result, the drop in efficiency will be a limiting factor, and why it’s important to focus on tier 1 drilling locations. This is nothing new to you. We’ve been rabbiting on about this for yonks now.

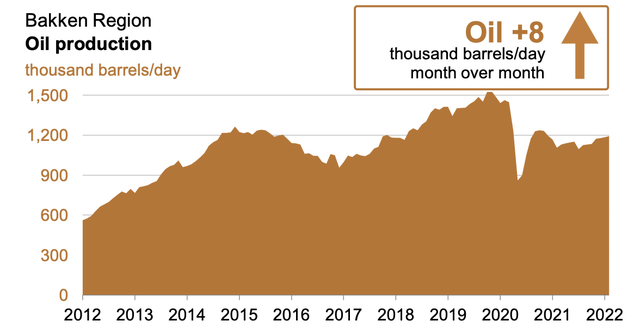

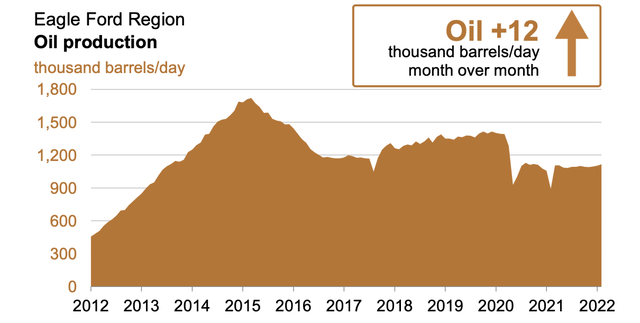

With that said, if US shale does peak by 2025, it’s pretty much game over. There’s really no other region in the world that can supply the type of growth the US did over the last 7-8 years. Think about what I just said in another way. If you look at Eagle Ford and Bakken, Eagle Ford peaked in 2014 and Bakken peaked in 2018, according to EIA.

And if it wasn’t for the Permian region in 2016, US oil production today would be sitting at 8.5 million b/d.

The whole world would have already been in an energy crisis five years ago. But the reality is that the Permian pretty much saved the world. And without another Permian, the world is going to run out of oil.

Think long-term here…

At the start of every cycle, there are the hardcore believers that focus on the data and analyze everything. We are one of them. And while the old adage, low commodity prices cure low commodity prices is true, you have to think in reverse now. Will high commodity prices in this case actually cure high commodity prices?

Without demand destruction, this oil supply deficit is going to be hard to control, and with it, oil prices will remain high for years to come.

This talk was recorded one month ago, so it has nothing to do with Ukraine, and still as Jeremy Grantham predicted, the "super bubble" was then, already, on the verge of bursting. But the brilliance of this talk is not in predicting early market moves, but in understanding that what is going on right now in the world is closely related to humanity approaching natural limits to growth and in linking skillfully this essential subject with the market and our green obsessions. Is this turning point of human history, we would need bright people to forge a new way forward. Instead, at the helm of the Western World, we have a senile grandfather and a nothing less than imbecile Vice-President who hold this key position for the simple fact that she is a woman of color! I admire Jeremy Grantham for, while understanding the problem, being able to stay so positive faced with this predicament!

As we move closer and closer to war, it is worth remembering the past...

And preparing the future?

In the year 1218 AD, Genghis Khan was knee-deep in a bloody war with the Jin Dynasty of northern China– a conflict that would last for more than two decades.

The Khan knew that China was a powerful enemy, so he took careful steps to make peace with his neighbors so that he could concentrate on winning the war against the Jin.

As part of that peace mission, the Khan sent a caravan of several hundred men to the city of Utrar in modern day Kazakhstan; at the time it was a prominent trade hub in the Khwarazmian Empire, just west of Mongolia.

Khwarazmia was an empire in decline, and Genghis is reported to have sent a message stating “I am master of the lands of the rising sun, while you rule those of the setting sun. Let us conclude a firm treaty of friendship and peace.”

But the governor of Utrar, a man named Inalchuk, had the Mongolian trade delegates arrested and killed, then seized their wares. Legend has it that a sole survivor escaped and rode a camel all way the back to Mongolia to inform the Khan.

Upon hearing the news, Genghis Khan tried again to make peace, and he sent a second mission of three ambassadors directly to Sultan Muhammad II, head of the Khwarazmian Empire.

In what may be the most idiotic diplomatic failure in human history, Muhammad beheaded one of the envoys and unmanned the other two.

It was almost as if they were deliberately trying to provoke Genghis Khan and engage him in a completely unnecessary war.

But war is exactly what they got. Genghis was so enraged that he temporarily set aside his invasion of China so that he could destroy Khwarazmia.

And he did. Within two years the Khwarazmian Empire had fallen to the Mongols thanks to their leaders’ extraordinary stupidity.

But the story doesn’t end there.

The conquest of the Khwarazmian Empire was the first time that the Mongolians had pushed westward. Up until that point they had been consumed by China and East Asia.

But now their territory was growing, and they wanted more. So they kept pushing west.

In the spring of 1223, a large Mongol army under the command of Jebe found itself in eastern Europe on the Kalka River, territory controlled by the Kievan Rus.

The Kievan Rus were a major European power at the time, comprising much of modern day Russia, Ukraine, and Belarus; coincidentally the Kalka River is near the Russia/Ukraine border where today’s diplomatic failures are playing out.

The Kievan Rus sent out an army to engage the Mongols on May 31st. But the battle wasn’t even close; the Mongols annihilated the Kievan Rus forces.

At that point the Mongols could have continued marching west, conquering everything in their path. But they didn’t. They turned back East and didn’t return for another 13 years.

You’d think that the Kievan Rus leadership would have been mortified at the discovery of their powerful new enemy. They had seen with their own eyes how devastating the Mongols were. They knew the risks.

And yet, with clear knowledge of the Mongol threat, the princes of the Kievan Rus spent the next thirteen years doing absolutely nothing to prepare.

The Mongols finally returned years later, at which point it was far too late for the Kievan Rus to prepare defenses. Within four years their entire territory belonged to the Mongols, the city of Kiev had been razed, and its population brutally slaughtered.

I’ve always thought there are so many lessons to this story, and they’re particularly appropriate these days.

For one, failures of leadership can have cascading effects.

Muhammad II and his governor in Utrar probably didn’t think much of their decision to kill the Mongolian ambassadors in 1218. But the consequences of their failure resulted in a completely unnecessary war, the slaughter of countless people, and the end of their empire.

More importantly, though, this historical episode shows how failing to prepare for obvious threats can lead to catastrophic outcomes.

In 1223 the princes of Kievan Rus knew that a second Mongolian invasion was an almost 100% certainty. They didn’t know precisely when it would take place, but they knew the risk was real. Yet they still did nothing to prepare.

This is the world we are living in today. Leaders are failing left and right, and there are clear, obvious risks everywhere.

As I write these words to you right now, the US State Department seems hellbent on deliberately provoking a completely unnecessary conflict with Russia.

Public Health officials continue to wreck havoc on everything from the economy to childhood development to people’s mental health.

And of course we have politicians who feel entitled to tell us what to wear on our faces, what chemicals to put in our bodies, what we’re allowed to say, and who we’re allowed to donate money to.

They force-feed our children an ultra-woke, Marxist curriculum in school, and then tell parents that we have no business influencing the education of our own kids.

These people are liars and cowards; they are incapable of telling the truth, treating people with dignity, or facing up to the consequences of their actions.

And like Muhammad II, they don’t consider the potentially devastating long-term implications of their decisions.

The threats they’ve created are very real. They’ve managed to push inflation to a 40+ year high. They’ve spent so much money that the US national debt recently surpassed THIRTY TRILLION dollars.

They abandoned hundreds of billions of dollars of military equipment to their sworn enemy in Afghanistan, then disgracefully turned their backs on their friends and allies.

They’ve vanquished the real economy, i.e. the actual production of goods and services by hardworking people and small businesses. They’ve corrupted the education system.

Then there’s the looming Social Security catastrophe.

In its most recent annual report, the Social Security trustees (which include the US Treasury Secretary) state that the program’s primary trust fund will be depleted in 2033– just eleven years from now.

That’s less time than it took for the Mongolians to return to Kievan Rus.

They’ve practically given you a date to circle on your calendar for when Social Security will run out of money.

And if you think that they’ll simply bail out Social Security when the time comes, you should know that Social Security estimates its own long-term funding gap at $59.8 TRILLION. That’s way beyond a bailout.

It might not be as savage as the Mongols, but Social Security is yet another of many crises they’ve managed to engineer. It just happens to be one with a very predictable outcome.

All this is a way of encouraging you to think clearly about risk.

Our weak, spineless, incompetent leaders are creating one catastrophe after another. It’s important to remain optimistic– the world is not coming to an end. But it is critical to prepare for obvious risks. It’s critical to have a Plan B. Well, maybe not so fast, the obfuscation can last a little longer then get drown in the fogs of war... But the picture is getting clearer with time: mRNA is not harmless. We are most certainly playing with fire considering that we do not yet clearly understand all the consequences of injecting the spike-making RNA in our bodies. "No risk!" as we have been told endlessly by governments know-little and media mouthpieces? Maybe so, but what when statistics say otherwise? A worldwide unexplained sudden increase of the death rate, almost for every age categories will not, cannot be pushed under the rug. Hopefully, more and more doctors will speak...

Guest Post by Raúl Ilargi Meijer

Justus R. Hope, MD, at Desert Review has a long article up on the views of former Blackrock exec, hedge funder, investment adviser Edward Dowd, along with a neverending list of podcasts. To which I will add a few at the bottom of this article. We’ve seen a few Dowd videos lately, but nothing like this. He should be on Joe Rogan ASAP.

The entire thing is so complete, devastating, shocking, that I don’t know what else to do than give you some quotes. It very much feels like the end of mRNA, and of the FDA in its present shape, because they -the government itself- are deeply complicit in outright investor fraud. Wall Street (“multiple brokerage houses”) is finding this out, Moderna stock is already down 70%, and that’s just the start.

mRNA vaccines are killing and maiming people: “..no matter the effort, one cannot hide the bodies – and “the bodies are piling up.”

Good luck with your vaxx mandates.

Pfizer & Moderna Investors Run for the Exits

Wall Street investors are dumping their Moderna and Pfizer stock faster than the world can drop the mandates. Moderna is down 70 percent from its high, while Pfizer is off 19 percent. Former Blackrock Executive and investment adviser Edward Dowd calls for Moderna to go to zero and Pfizer to end under ten dollars per share.

How is this possible given that Pfizer now enjoys record earnings per share and a market capitalization of some $270 billion, making it the 29th largest corporation globally? With nothing but profits in sight for the Pharmaceutical giant, what could be the problem?

[..] For the skeptics, consider that Pfizer stock lost $20 billion in market capitalization on February 8, 2022, when their record earnings fell short of more optimistic expectations. Also consider that Moderna’s stock is down some 70 percent from its high of $484 on August 9, 2021, wiping out almost $ 140 billion in investment. Dowd predicts Moderna will drop to zero with bankruptcy as fraud related to concealing the COVID vaccine dangers surfaces, and he predicts Pfizer will become a sub-ten-dollar stock. Dowd explains that the smart money has already left Moderna and will soon be exiting Pfizer.

Dowd foresees an avalanche of lawsuits coming as the insurance industry continues to uncover the legions of mounting deaths coming from the complications of the mRNA COVID-19 vaccines. Dowd teamed up with an insurance industry analyst and researched the life insurance claims. They found that since OneAmerica shocked the world by announcing a 40% rise in non-COVID deaths in younger working-class employees, multiple other insurance companies worldwide have seen the same thing – massive rises in non-COVID deaths. And the evidence inescapably points to the vaccines as the cause.

Meanwhile, the funeral company stocks have outperformed the S&P. “Funeral Home companies are growth stocks. They had a great year in 2021 compared to 2020, and they outperformed the S&P 500. The peer group of Funeral Home stocks was up 40 plus percent while the S&P was up 26 percent – and they started accelerating price-wise in 2021 during the roll-out of the vaccines – You don’t need to be a rocket scientist to connect the dots here.”

Other insurance companies have reported the same or worse death numbers as OneAmerica. For example, “Unum Insurance is up 36%, Lincoln National plus 57%, Prudential plus 41%, Reinsurance Group of America plus 21%, Hartford plus 32%, Met Life plus 24%, and Aegon – which is a Dutch insurer – saw in their US arm plus 57% in the 4th quarter – in the 3rd quarter they saw a 258% increase in death claims.”

“They raised (mortality) expectations 300,000 for 2022 over 2021 due to COVID plus ‘indirect COVID,’ which I think we know what that’s code for… They (Aegon) did a $1.4 billion reinsurance deal with Wilton Reinsurance…what they were reinsuring were high face amount individual policies from 1 million to 10 million… (So) I think there is an asymmetric information situation going on in the insurance industry where some people have figured out something’s going on. They are off-loading their risk – they are not going to say what it is as they don’t want that information to get out as they unload the risk.”.

“Someone is going to be the bag holder here.” And Dowd is confident it won’t be the insurance industry. A court in France has already held that a life insurance company cannot be held liable for a death because of the mRNA vaccine. But that does not explain how mRNA manufacturers can be held responsible for an emergency product they were told was liability-free. Aren’t the vaccine manufacturers immunized from lawsuits? After all, they were granted EUA, the specialized Emergency Use Authorization, which means they cannot be held legally accountable for deaths or adverse effects stemming from the experimental vaccines.

The idea is that no company – upon government request – should have to pay for unforeseen complications resulting from an emergency product that they released to the world out of their goodness of the hearts, with the best of intentions. Right? Wrong – not when your company accomplishes this through deceit, also known as fraud. Fraud undoes all these protections. If a company or person intentionally deceives another to profit, we have fraud. If Pfizer’s data showed increased all-cause mortality and hid this to motivate people to take the vaccine while claiming it was safe, then fraud exists.

Under common law, the required elements to prove fraud amount to: #1. A materially false statement or purposeful failure to state or release material facts which non-disclosure makes other statements misleading. #2. The false statement is made to induce Plaintiff to act. #3. The Plaintiff relied upon the false statement, and the injury resulted from this reliance. #4. Damages include a punitive award as a punishment that serves as a public example to discourage any future similar fraud. Punitive damages are generally proportional to the Defendant’s assets.

Dowd has been researching the COVID-19 vaccines and what he considers obvious evidence of knowing concealment of the actual risks of death – and he points to the Herculean efforts of Pfizer with FDA in withholding their data despite legal challenges to release it. He likens the FDA today to the rating agencies during the Mortgage Crisis. “FDA is the trusted third party, just like the rating agencies were. And a lot of doctors in this country, a lot of local governments are placing their trust in the FDA which gets 50 percent of its budget from large cap pharma. It wasn’t any one person…I think they overlooked things…An all-cause mortality end-point should have stopped this thing in its tracks – and it didn’t.”

There were more deaths in the vaxxed group than in the unvaxxed. Dowd assumes fraud based upon the FDA backing Pfizer in not releasing their data. He believes this is a knowing attempt to conceal the deaths. “When one party enters into a contract…and fraud was occurring when they entered into that contract, and the other party did not know that – the contract is void and null. There’s no indemnity if this can be proven, and I think it will be.” “Pfizer got blanket immunity with EUA. If fraud occurred, to my mind and what I’m seeing from their refusal to release the data – if there is fraud and it comes out – and we need whistleblowers – and it’s looking more apparent that this product is deadly – fraud eviscerates all contracts – that’s case law. So you go down the daisy chain, and that’s liability – that’s bankruptcy for Moderna, definitely Pfizer.”

Dowd remarks that no matter the effort, one cannot hide the bodies – and “the bodies are piling up.” He notes that the deaths skyrocketed after the vaccine rollout when they should have dropped. And the deaths are what distinguished the 2021-2022 vaccine scandal as far worse than what happened with Enron. “People are dying and being maimed. This is a fraud that goes beyond the pale…We have the VAERS data…We have the DoD leak…And now we have the insurance company results and the funeral home results…We don’t need to think too hard about this…Deaths should have gone down after the vaccines rolled out. This is the most egregious fraud in history of the nation – and it’s global…Pfizer’s involved, and they committed fraud,” Dowd explained.

How cool would it be if we all had a portable fusion reactor in our home, jetson's like and unlimited energy available? Although nobody will entertain such fantasies nowadays, talking about renewables in similar glowing praise is not only still possible but encouraged, so much so that voicing doubts about the potential of renewables is frowned upon. With the risk of sounding like an heretic after mass, the limits of green energy are nevertheless getting clearer, even while the real costs are obfuscated and hidden behind the curtain of "clean" which most are not.

The reality as this article makes clear with detailed numbers, is that the future of our current society cannot be "green", and if it is, it will be a rather dark future, sliced with intermittent brown-outs and horrendously expensive electricity. (The two most likely options when you read between the lines.) Of all subjects, energy is the one which does least tolerate "ideology" and short-cuts. Physics guaranties that the road to really green energy will be a long one which will require a complete re-engineering of our society, the way we live and the way we think. That social crisis will therefore arrive long before we have invested the 30 to 50 years of effort necessary for green technological development. We most certainly could have invested the hundreds of billions of dollars used for nuclear weapons over the last 70 years into energy but that option never was on the table. Now, we are facing our growing needs for energy with dwindling fossil resources, while our population is still exploding and all these not-so-clean green energies remain marginal...

Authored by Gail Tverberg via Our Finite World,

We have been told that intermittent electricity from wind and solar, perhaps along with hydroelectric generation (hydro), can be the basis of a green economy. Things are increasingly not working out as planned, however. Natural gas or coal used for balancing the intermittent output of renewables is increasingly high-priced or not available. It is becoming clear that modelers who encouraged the view that a smooth transition to wind, solar, and hydro is possible have missed some important points.

Let’s look at some of the issues:

[1] It is becoming clear that intermittent wind and solar cannot be counted on to provide adequate electricity supply when the electrical distribution system needs them.

Early modelers did not expect that the variability of wind and solar would be a huge problem. They seemed to believe that, with the use of enough intermittent renewables, their variability would cancel out. Alternatively, long transmission lines would allow enough transfer of electricity between locations to largely offset variability.

In practice, variability is still a major problem. For example, in the third quarter of 2021, weak winds were a significant contributor to Europe’s power crunch. Europe’s largest wind producers (Britain, Germany and France) produced only 14% of installed capacity during this period, compared with an average of 20% to 26% in previous years. No one had planned for this kind of three-month shortfall.

In 2021, China experienced dry, windless weather so that both its generation from wind and hydro were low. The country found it needed to use rolling blackouts to deal with the situation. This led to traffic lights failing and many families needing to eat candle-lit dinners.

In Europe, with low electricity supply, Kosovo has needed to use rolling blackouts. There is real concern that the need for rolling blackouts will spread to other parts of Europe, as well, either later this winter, or in a future winter. Winters are of special concern because, then, solar energy is low while heating needs are high.

[2] Adequate storage for electricity is not feasible in any reasonable timeframe. This means that if cold countries are not to “freeze in the dark” during winter, fossil fuel backup is likely to be needed for many years in the future.

One workaround for electricity variability is storage. A recent Reuters’ article is titled, Weak winds worsened Europe’s power crunch; utilities need better storage. The article quotes Matthew Jones, lead analyst for EU Power, as saying that low or zero-emissions backup-capacity is “still more than a decade away from being available at scale.” Thus, having huge batteries or hydrogen storage at the scale needed for months of storage is not something that can reasonably be created now or in the next several years.

Today, the amount of electricity storage that is available can be measured in minutes or hours. It is mostly used to buffer short-term changes, such as the wind temporarily ceasing to blow or the rapid transition created when the sun sets and citizens are in the midst of cooking dinner. What is needed is the capacity for multiple months of electricity storage. Such storage would require an amazingly large quantity of materials to produce. Needless to say, if such storage were included, the cost of the overall electrical system would be substantially higher than we have been led to believe. All major types of cost analyses (including the levelized cost of energy, energy return on energy invested, and energy payback period) leave out the need for storage (both short- and long-term) if balancing with other electricity production is not available.

If no solution to inadequate electricity supply can be found, then demand must be reduced by one means or another. One approach is to close businesses or schools. Another approach is rolling blackouts. A third approach is to permit astronomically high electricity prices, squeezing out some buyers of electricity. A fourth balancing approach is to introduce recession, perhaps by raising interest rates; recessions cut back on demand for all non-essential goods and services. Recessions tend to lead to significant job losses, besides cutting back on electricity demand. None of these things are attractive options.

[3] After many years of subsidies and mandates, today’s green electricity is only a tiny fraction of what is needed to keep our current economy operating.

Early modelers did not consider how difficult it would be to ramp up green electricity.

Compared to today’s total world energy consumption (electricity and non-electricity energy, such as oil, combined), wind and solar are truly insignificant. In 2020, wind accounted for 3% of the world’s total energy consumption and solar amounted to 1% of total energy, using BP’s generous way of counting electricity, relative to other types of energy. Thus, the combination of wind and solar produced 4% of world energy in 2020.

The International Energy Agency (IEA) uses a less generous approach for crediting electricity; it only gives credit for the heat energy supplied by the renewable energy. The IEA does not show wind and solar separately in its recent reports. Instead, it shows an “Other” category that includes more than wind and solar. This broader category amounted to 2% of the world’s energy supply in 2018.

Hydro is another type of green electricity that is sometimes considered alongside wind and solar. It is quite a bit larger than either wind or solar; it amounted to 7% of the world’s energy supply in 2020. Taken together, hydro + wind + solar amounted to 11% of the world’s energy supply in 2020, using BP’s methodology. This still isn’t much of the world’s total energy consumption.

Of course, different parts of the world vary with respect to the share of energy created using wind, hydro and solar. Figure 1 shows the percentage of total energy generated by these three renewables combined.

Figure 1. Wind, solar and hydro as a share of total energy consumption for selected parts of the world, based on BP’s 2021 Statistical Review of World Energy data. Russia+ is Russia and its affiliates in the Commonwealth of Independent States (CIS).

As expected, the world average is about 11%. The European Union is highest at 14%; Russia+ (that is, Russia and its Affiliates, which is equivalent to the members of the Commonwealth of Independent States) is lowest at 6.5%.

[4] Even as a percentage of electricity, rather than total energy, renewables still comprised a relatively small share in 2020.

Wind and solar don’t replace “dispatchable” generation; they provide some temporary electricity supply, but they tend to make the overall electrical system more difficult to operate because of the variability introduced. Renewables are available only part of the time, so other types of electricity suppliers are still needed when supply temporarily isn’t available. In a sense, all they are replacing is part of the fuel required to make electricity. The fixed costs of backup electricity providers are not adequately compensated, nor are the costs of the added complexity introduced into the system.

If analysts give wind and solar full credit for replacing electricity, as BP does, then, on a world basis, wind electricity replaced 6% of total electricity consumed in 2020. Solar electricity replaced 3% of total electricity provided, and hydro replaced 16% of world electricity. On a combined basis, wind and solar provided 9% of world electricity. With hydro included as well, these renewables amounted to 25% of world electricity supply in 2020.

The share of electricity supply provided by wind, solar and hydro varies across the world, as shown in Figure 2. The European Union is highest at 32%; Japan is lowest at 17%.

Figure 2. Wind, solar and hydro as a share of total electricity supply for selected parts of the world, based on BP’s 2021 Statistical Review of World Energy data.

The “All Other” grouping of countries shown in Figure 2 includes many of the poorer countries. These countries often use quite a bit of hydro, even though the availability of hydro tends to fluctuate a great deal, depending on weather conditions. If an area is subject to wet seasons and dry seasons, there is likely to be very limited electricity supply during the dry season. In areas with snow melt, very large supplies are often available in spring, and much smaller supplies during the rest of the year.

Thus, while hydro is often thought of as being a reliable source of power, this may or may not be the case. Like wind and solar, hydro often needs fossil fuel back-up if industry is to be able to depend upon having electricity year-around.

[5] Most modelers have not understood that reserve to production ratios greatly overstate the amount of fossil fuels and other minerals that the economy will be able to extract.

Most modelers have not understood how the world economy operates. They have assumed that as long as we have the technical capability to extract fossil fuels or other minerals, we will be able to do so. A popular way of looking at resource availability is as reserve to production ratios. These ratios represent an estimate of how many years of production might continue, if extraction is continued at the same rate as in the most recent year, considering known resources and current technology.

Figure 3. Reserve to production ratios for several minerals, based on data from BP’s 2021 Statistical Review of World Energy.

A common belief is that these ratios understate how much of each resource is available, partly because technology keeps improving and partly because exploration for these minerals may not be complete.

In fact, this model of future resource availability greatly overstates the quantity of future resources that can actually be extracted. The problem is that the world economy tends to run short of many types of resources simultaneously. For example, World Bank Commodities Price Data shows that prices were high in January 2022 for many materials, including fossil fuels, fertilizers, aluminum, copper, iron ore, nickel, tin and zinc. Even though prices have run up very high, this is not an indication that producers will be able to use these high prices to extract more of these required materials.

In order to produce more fossil fuels or more minerals of any kind, preparation must be started years in advance. New oil wells must be built in suitable locations; new mines for copper or lithium or rare earth minerals must be built; workers must be trained for all of these areas. High prices for many commodities can be a sign of temporarily high demand, or it can be a sign that something is seriously wrong with the system. There is no way the system can ramp up needed production in a huge number of areas at once. Supply lines will break. Recession is likely to set in.

The problem underlying the recent spike in prices seems to be “diminishing returns.” Such diminishing returns affect nearly all parts of the economy simultaneously. For each type of mineral, miners produced the easiest-t0-extract materials first. They later moved on to deeper oil wells and minerals from lower grade ores. Pollution gradually grew, so, it too, needed greater investment. At the same time, world population has been growing, so the economy has required more food, fresh water and goods of many kinds; these, too, require the investment of resources of many kinds.

The problem that eventually hits the economy is that it cannot maintain economic growth. Too many areas of the economy require investment, simultaneously, because diminishing returns keeps ramping up investment needs. This investment is not simply a financial investment; it is an investment of physical resources (oil, coal, steel, copper, etc.) and an investment of people’s time.

The way in which the economy would run short of investment materials was simulated in the 1972 book, The Limits to Growth, by Donella Meadows and others. The book gave the results of a number of simulations regarding how the world economy would behave in the future. Virtually all of the simulations indicated that eventually the economy would reach limits to growth. A major problem was that too large a share of the output of the economy was needed for reinvestment, leaving too little for other uses. In the base model, such limits to growth came about now, in the middle of the first half of the 21st century. The economy would stop growing and gradually start to collapse.

[6] The world economy seems already to be reaching limits on the extraction of coal and natural gas to be used for balancing electricity provided by intermittent renewables.

Coal and natural gas are expensive to transport so, if they are exported, they primarily tend to be exported to countries that are nearby. For this reason, my analysis groups together exports and imports into large regions where trade is most likely to take place.

If we analyze natural gas imports by part of the world, two regions stand out as having the most out-of-region natural gas imports: Europe and Asia-Pacific. Figure 4 shows that Europe’s out-of region natural gas imports reached peaks in 2007 and 2010, after which they dipped. In recent years, Europe’s imports have barely surpassed their prior peaks. Asia-Pacific’s out-of-region imports have shown a far more consistent growth long-term growth pattern.

Figure 4. Natural gas imports in exajoules per year, based on data from on data from BP’s 2021 Statistical Review of World Energy.

The reason why Asia-Pacific’s imports have been growing is to support its growing manufacturing output. Manufacturing output has increasingly been shifted to the Asia-Pacific region, partly because this region can perform this manufacturing cheaply, and partly because rich countries have wanted to reduce their carbon footprint. Moving heavy industry abroad reduces a country’s reported CO2 generation, even if the manufactured items are imported as finished products.

Figure 5 shows that Europe’s own natural gas supply has been falling. This is a major reason for its import requirements from outside the region.

Figure 5. Europe’s natural gas production, consumption and imports based on data from BP’s 2021 Statistical Review of World Energy.

Figure 6, below, shows that Asia-Pacific’s total energy consumption per capita has been growing. The new manufacturing jobs transferred to this region have raised standards of living for many workers. Europe, on the other hand, has reduced its local manufacturing. Its people have tended to get poorer, in terms of energy consumption per capita. Service jobs necessitated by reduced energy consumption per capita have tended to pay less well than the manufacturing jobs they have replaced.

Figure 6. Energy consumption per capita for Europe compared to Asia-Pacific, based on data from BP’s 2021 Statistical Review of World Energy.

Europe has recently been having conflicts with Russia over natural gas. The world seems to be reaching a situation where there are not enough natural gas exports to go around. The Asia-Pacific Region (or at least the more productive parts of the Asia-Pacific Region) seems to be able to outbid Europe, when local natural gas supply is inadequate.

Figure 7, below, gives a rough idea of the quantity of exports available from Russia+ compared to Europe’s import needs. (In this chart, I compare Europe’s total natural gas imports (including pipeline imports from North Africa and LNG from North Africa) with the natural gas exports of Russia+ (to all nations, not just to Europe, including both by pipeline and as LNG)). On this rough basis, we find that Europe’s natural gas imports are greater than the total natural gas exports of Russia+.

Figure 7. Total natural gas imports of Europe compared to total natural gas exports from Russia+, based on data from BP’s 2021 Statistical Review of World Energy.

Europe is already encountering multiple natural gas problems. Its supply from North Africa is not as reliable as in the past. The countries of Russia+ are not delivering as much natural gas as Europe would like, and spot prices, especially, seem to be way too high. There are also pipeline disagreements. Bloomberg reports that Russia will be increasing its exports to China in future years. Unless Russia finds a way to ramp up its gas supplies, greater exports to China are likely to leave less natural gas for Russia to export to Europe in the years ahead.

If we look around the world to see what other sources of natural gas exports are available for Europe, we discover that the choices are limited.

Figure 8. Historical natural gas exports based on data from BP’s 2021 Statistical Review of World Energy. Rest of the world includes Africa, the Middle East and the Americas excluding the United States.

The United States is presented as a possible choice for increasing natural gas imports to Europe. One of the catches with growing natural gas exports from the United States is the fact that historically, the US has been a natural gas importer; it is not clear how much exports can rise above the 2022 level. Furthermore, part of US natural gas is co-produced with oil from shale. Oil from shale is not likely to be growing much in future years; in fact, it very likely will be declining because of depleted wells. This may limit the US’s growth in natural gas supplies available for export.

The Rest of the World category on Figure 8 doesn’t seem to have many possibilities for growth in imports to Europe, either, because total exports have been drifting downward. (The Rest of the World includes Africa, the Middle East, and the Americas excluding the United States.) There are many reports of countries, including Iraq and Turkey, not being able to buy the natural gas they would like. There doesn’t seem to be enough natural gas on the market now. There are few reports of supplies ramping up to replace depleted supplies.

With respect to coal, the situation in Europe is only a little different. Figure 9 shows that Europe’s coal supply has been depleting, and imports have not been able to offset this depletion.

Figure 9. Europe’s coal production, consumption and imports, based on data from BP’s 2021 Statistical Review of World Energy.

If a person looks around the world for places to get more imports for Europe, there aren’t many choices.

Figure 10. Coal production by part of the world, based on data from BP’s 2021 Statistical Review of World Energy.

Figure 10 shows that most coal production is in the Asia-Pacific region. With China, India and Japan located in the Asia-Pacific Region, and high transit costs, this coal is unlikely to leave the region. The United States has been a big coal producer, but its production has declined in recent years. It still exports a relatively small amount of coal. The most likely possibility for increased coal imports would be from Russia and its affiliates. Here, too, Europe is likely to need to outbid China to purchase this coal. A better relationship with Russia would be helpful, as well.

Figure 10 shows that world coal production has been essentially flat since 2011. A country will only export coal that it doesn’t need itself. Thus, a shortfall in export capability is an early warning sign of inadequate overall supply. With the economies of many Asia-Pacific countries still growing rapidly, demand for coal imports is likely to grow for this region. While modelers may think that there is close to 150 years’ worth of coal supply available, real-world experience suggests that coal limits are being reached already.

[7] Conclusion. Modelers and leaders everywhere have had a basic misunderstanding of how the economy operates and what limits we are up against. This misunderstanding has allowed scientists to put together models that are far from the situation we are actually facing.

The economy operates as an integrated whole, just as the body of a human being operates as an integrated whole, rather than a collection of cells of different types. This is something most modelers don’t understand, and their techniques are not equipped to deal with.

The economy is facing many limits simultaneously: too many people, too much pollution, too few fish in the ocean, more difficult to extract fossil fuels and many others. The way these limits play out seems to be the way the models in the 1972 book, The Limits to Growth, suggest: They play out on a combined basis. The real problem is that diminishing returns leads to huge investment needs in many areas simultaneously. One or two of these investment needs could perhaps be handled, but not all of them, all at once.

The approach of modelers, practically everywhere, is to break down a problem into small parts, and assume that each part of the problem can be solved independently. Thus, those concerned about “Peak Oil” have been concerned about running out of oil. Finding substitutes seemed to be important. Those concerned about climate change were convinced that huge amounts of fossil fuels remain to be extracted, even more than the amounts indicated by reserve to production ratios. Their concern was finding substitutes for the huge amount of fossil fuels that they believed remained to be extracted, which could cause climate change.

Politicians could see that there was some sort of huge problem on the horizon, but they didn’t understand what it was. The idea of substituting renewables for fossil fuels seemed to be a solution that would make both Peak Oilers and those concerned about climate change happy. Models based on the substitution of renewables for fossil fuels seemed to please almost everyone. The renewables approach suggested that we have a very long timeframe to deal with, putting the problem off, as long into the future as possible.

Today, we are starting to see that renewables are not able to live up to the promise modelers hoped they would have. Exactly how the situation will play out is not entirely clear, but it looks like we will all have front row seats in finding out.

What is really going on in China?

As I have argued many times over the last two years, the Chinese real estate bubble was on the verge of blowing up. The implosion started in 2021 with Evergrande and has since gathered speed. In Japan, we call this "Hi no Kuruma", a fire wheel. Every year in late winter, now more or less, the farmers make a huge wheel of straw, lit a fire in the middle and throw it on the slope of a hill. Two minutes later a huge ball of fire rushes down the slope. A good harbinger for what is coming out way!

The problem is that the Chinese economy is now so large and intricately imbricated in the global supply chain that its implosion will quickly reverberate in the world economy, with the risk that it may (will?) topple over the Western financial ponzy system. Then what?

The Covid pandemic did not happen in a vacuum. It took place weeks after the explosion of the Repo market on Wall Street, following years of preparation. The global financial elites were not going to have another 2008. They were ready this time. Trillions of US dollars of subsidies were showered on the economy, together with a sharp slowdown of demand which bought us time. Two years exactly, to be precise.

Now the two years are passed and the next crisis is looming on the horizon. As for Covid, the Ukrainian crisis has been on a back-burner since 2014. World conflagrations usually happen by accident as in 1914 and the assassination of the Archduke Franz Ferdinand, but not before enough "firewood" is piled up for the fire to blow up. We are now witnessing this dreadful process.

Ukraine is not worth to fight a World War for. But the opposition between the US which wants to protect its hegemony and China (and Russia) who want to build a multi-polar world is. Amazingly, the final say is on the shoulders of the rather weak German coalition government and its decision to go ahead with the North Stream 2 pipeline. Would they decide to give the green light to the pipeline, we will still have to rebuild the world financial system, a new Bretton Woods 2.0 scale agreement would take place in late 2022, early 2023. if conversely, they decide to nix the pipeline. The Russian, and the Chinese will conclude that they are in the line of fire and no agreement is possible. In which case, taking over Ukraine, but more fundamentally, decoupling their economies from the West becomes the safe option.

Would we go down this road, which unfortunately is the most likely option at this stage, we may be just months away from another black swan assassination and the beginning of a third world war. Let's hope the German chose wisely and find the strength to say no the the Americans. It won't be easy though as the stakes are so high.

The article below is essential to understand what is at stake with the Epstein papers. This is not about a network of pedophiles and perv...