Great interview! Canadian Preper is, well, preper, so no surprise there. Interviewing Rafi Farber, a Israeli economist is controversial at this point in time, but I guess we're past controversial now. What remains is the message and the line of thinking which I think is brilliant and worth listening to. So here it is:

Making sense of the world through data The focus of this blog is #data #bigdata #dataanalytics #privacy #digitalmarketing #AI #artificialintelligence #ML #GIS #datavisualization and many other aspects, fields and applications of data

Wednesday, May 8, 2024

$#!%&: "THEYRE NOT GOING TO STOP THIS" (Video - 44mn)

Putin Doesn't Bluff

This is a semi "establishment" article from Washington, so many points to disagree with but it is interesting nevertheless as it shows that people are starting to understand the predicament the West has painted itself into.

It is still overly optimistic in thinking that Ukraine will fall in a year or two. Replace that by months to get a more accurate picture. But the direction is unmistakable: Ukraine is about to fall and NATO cannot allow it. Meanwhile, indeed, "Putin doesn't bluff"...

Authored by James Rickards via DailyReckoning.com,

Two weeks ago, the Congress passed (and President Biden signed) four key pieces of legislation related to national security.

Three of the bills provided assistance to Ukraine, Israel and Taiwan. They received the most attention. The one that got the least attention was a mixed bag of provisions, such as a forced divestiture of TikTok.

Included in that bill was something called the REPO Act that authorizes the president to steal any Russian assets, including U.S. Treasury securities, that come under U.S. jurisdiction.

The impact of the REPO Act is limited by the fact that only about $10 billion of Russian sovereign assets are actually under U.S. jurisdiction. Yet the act contemplates that this theft will be a down payment on a much larger theft to be conducted by NATO allies in Europe.

$290 billion of Russian sovereign assets are being held in Europe. The act says that the assets stolen by the U.S. will be contributed to the Common Ukraine Fund.

No doubt, the U.S. will be the most powerful voice in the administration of the $290 billion common fund. The U.S. goal is to use the G7 summit in Apulia, Italy on June 13–15 as a platform for getting the other G7 members to go along with the Common Ukraine Fund and to steal any Russian assets under their jurisdiction.

So these people think that Russia will simply accept this act of theft without retaliating?

“Mirror Imaging”

One of the persistent problems in intelligence analysis is what experts call “mirror imaging.” This is jargon for an analytic flaw in which the analyst assumes that his beliefs and preferences are shared by an adversary. Instead of looking at the adversary as he actually is, the analyst is looking in a mirror while assuming he is looking at the adversary.

This is an extremely dangerous flaw.

You may be rational, but the mullahs who rule Iran are not. You may believe that leaders want economic growth, but Communist Chinese leaders elevate the party over all other considerations including the well-being of their people.

You may assume that Houthi rebels in Yemen want to avoid attacks by the U.S., but they don’t care — they live in caves anyway, so you can’t bomb them into the Stone Age because they’re already there.

Nowhere is this flaw more apparent today than in the U.S. intelligence analysis of Vladimir Putin. In 2008, President Bush said that Ukraine and Georgia should join NATO. A few months later, Putin invaded Georgia, annexed part of its territory and destroyed Georgia’s chances of joining NATO.

Putin Doesn’t Bluff

In 2014, the U.S. backed a coup d’état in Ukraine that deposed a duly elected leader. Three months later, Putin annexed Crimea from Ukraine and made it part of the Russian Federation. In 2021, NATO began formal processes to admit Ukraine as a member.

In February 2022, Russia began a special military operation that’s resulted in 500,000 dead Ukrainian soldiers. Some estimates are even higher. Ukraine’s chances of joining NATO are now zero.

In every case, U.S. analysts did not believe Putin would take the steps he did because they thought it might somehow weaken Putin or Russia. That’s mirror imaging at its worst. The truth is Putin doesn’t bluff. When he says he will do something, he does. When he says he will react to some Western act, the reaction takes place.

Putin said if the West steals Russian assets, Russia will retaliate by seizing billions of dollars of direct foreign investment in Russia owned by major European companies such as Siemens, Total, BP and others.

And sure enough, just days after Biden signed legislation to authorize the theft of Russian assets, a Russian court ordered $440 million be seized from JPMorgan.

The escalation in the asset seizure war has begun. Putin will win in the end. Unfortunately, escalation is also increasing on the geopolitical front. The U.S. and some of its European allies are becoming increasingly desperate about Ukraine’s ability to hold off Russia on the battlefield.

Short on Weapons, Short on Men

The recent $61 billion aid package for Ukraine (about two-thirds of which will go to U.S. defense companies) won’t be nearly enough to reverse the tide. The U.S. and its NATO allies have already given just about all they can afford to give Ukraine without jeopardizing their own security.

The problem isn’t a lack of money but a lack of weapons and ammunition. Before the aid package was approved, critics complained that Ukraine was losing because the U.S. was withholding desperately needed materiel. But that’s not really true.

The Europeans could have simply bought the weapons from the U.S. and delivered them to Ukraine. They didn’t. Why? Because the weapons simply weren’t there. Yes, there will always be a supply of weapons flowing to Ukraine — they’re not going to run out completely.

But Ukraine won’t have nearly enough weapons and ammunition to undertake meaningful offensive operations against the Russians. They’ll just have enough to keep them in the fight, which is the goal of NATO.

Unfortunately for Ukraine, the problems run much deeper than a lack of equipment. They’re also running out of trained manpower. Former commander Valeriy Zaluzhny has suggested Ukraine needs an extra 500,000 troops. But they’re having trouble finding new volunteers. An estimated 650,000 fighting age men have fled Ukraine.

Meanwhile, the Russian army is even larger than it was before the invasion, and Russian industry is churning out weapons and ammunition at astonishing rates.

Will France Cross the (Dnieper) Rubicon?

When you add up Ukraine’s lack of equipment and manpower shortages, you understand why the West is becoming increasingly desperate.

France’s Emmanuel Macron is continuing to say he might send French troops to Ukraine. Just days ago, he reaffirmed that he wouldn’t rule out sending troops if Russia broke through Ukrainian front lines and Ukraine requested it.

Well, it’s only a matter of time until Russia breaks through Ukraine’s remaining primary defenses east of the Dnieper River. Of course Ukraine is going to request French troops since Macron himself made the offer.

Would they be sent to western Ukraine in order to free up Ukrainian soldiers stationed there to go to the front?

Or would they send French troops to the front, thinking that Russia wouldn’t fire on them out of fears of starting a war with France? France is a nuclear power. It has a limited nuclear arsenal (mostly consisting of four ballistic missile submarines).

So France might believe it can deter Russia from advancing.

But Russia has already targeted French “mercenaries” in a missile strike some months back (they were likely Ukrainian and Russian members of the French Foreign Legion). And Russia has warned France that it will attack French soldiers if it sends them to Ukraine.

Remember, Putin doesn’t bluff. But it’s not just France suggesting a willingness to send troops to Ukraine.

Countdown to Nuclear War

I’ve been warning about the dangers of escalation since the U.S. committed itself to Ukraine’s defense. Unfortunately, it’s playing out exactly as I predicted.

On 60 Minutes last night, House Democratic Leader Hakeem Jeffries said, “We can’t let Ukraine fall because if it does, then there’s a significant likelihood that America will have to get into the conflict — not simply with our money, but with our servicewomen and our servicemen.”

Ukraine’s going to fall, one way or the other. It might not be this year or even next year, although those are possibilities. But it will happen.

If Jeffries is correct that the U.S. will commit its military to confront Russia directly, then we’re signing ourselves up for a nuclear war because that’s where military confrontation will ultimately lead.

Every major simulated war game between the U.S. and Russia ends up going nuclear in the end.

Are we really prepared for that?

The "Soft Landing" Lie: A Global Economic Slowdown Is Already Underway

The recession is coming. It is unavoidable, just as day follows night. But this particular recession "cannot" happen because it will blow the bubble of bubbles. This is why war is likewise unavoidable. Since human life is so short, we cannot build "context" and understand what is happening. If we could, we would see cycles like seasons repeating. The Spring, Summer, Autumn, Winter and Spring again of life to borrow the tittle of a Korean movie, but applied to society.

Authored by Brandon Smith via Alt-Market.us,

If people have learned anything from the past few years of Ivy League elites and TV talking heads feeding them economic predictions, I hope they finally understand that the “experts” are usually wrong and that alternative analysts have a far better track record. Whenever establishment economists make a a call the opposite generally turns out to be true.

By extension, alternative economic predictions are usually well ahead of the curve – What we talk about might be labeled “doom mongering” or “conspiracy theory” today. In three years or less it will be treated as common knowledge and the mainstream “experts” will claim that they “saw it coming all along” while taking credit for financial calls they never made.

This has been a long running pattern and it’s something those of us in the alternative media have come to expect.

For my part, I warned for years about the threat of the impending stagflationary crisis which ultimately struck hard in the “post-pandemic” US. The establishment gatekeepers denied such a thing was possible. When it happened, they claimed it was “transitory.” Now, they argue that a soft landing is imminent and there’s nothing to fear from trillions in helicopter money being pumped into the system. They claim nothing of significance will change.

I also predicted that the Fed would create a Catch-22 scenario in which interest rates are raised into economic weakness while inflationary pressures expand. I suggested that the central bank would keep rates higher for far longer than mainstream analysts claimed. This is exactly what has happened. My position is simple – The Federal Reserve is a suicide bomber.

Who are you going to believe? Independent economists who have proven correct time and time again? Or, the Ivory Tower guys who have been consistently wrong? I’ll say this: If success in economics was actually based on merit and correct analysis, people like Paul Krugman or Janet Yellen would have been out of work a long time ago.

As for the ongoing narrative of a soft landing, the question I have to ask is HOW exactly they are going to make that happen? First, let’s clarify why central bankers are the problem (along with the governments they covertly influence)…

Central Banks Are At The Core Of Economic Troubles

There are only two logical reasons for central bank induced inflation: To hide the effects of a massive deflationary slowdown caused by too much debt, or, to deliberately trigger a currency collapse. Both motives could apply at the same time.

Central bankers don’t just facilitate this inflation at the behest of governments, they tell governments what to expect and what to promote to the public. Anyone that claims otherwise has an agenda. Central banks write their own policy and control their own mechanics. Governments have no say whatsoever in their operations, as Alan Greenspan once openly admitted.

The reality is, governments go begging hat in hand to central bankers and the banks decide whether or not to give them that sweet stimulus nectar. Politicians engage in collusion with central banks on a regular basis and they defer to bankers on an array of economic decisions. Economic advisers to the US president almost always include high level central bankers who then cycle right back into the Federal Reserve.

Central banks and their private international counterparts are in control, political leaders are simply pawns. Whenever there’s a crash the public focuses on government while the central banks fade into the background and avoid all scrutiny.

Inflation Addiction And The Ultimate Catch-22

Inflation for banks is a tool for fiscal change, but also social change. It’s not a coincidence that financial crisis events always lead to more centralization of global power into fewer and fewer hands; this is by design. Inflation allows the establishment to delay or initiate a crisis with greater precision.

An even more powerful tool is the WITHHOLDING of stimulus and cheap money once an economy is addicted to the flow of fiat.

I have been arguing for many years that central banks were constructing a situation in which the system is utterly dependent on fiat stimulus in order to maintain the illusion of growth. If the bankers return to lower rates and QE, inflation will continue to explode. If they stay with higher rates and a trickle of stimulus then a global crash is inevitable.

It’s one or the other, there is no soft landing when trillions in money creation are at play in such a short period of time. Central banks must return to near zero rates and QE if they hope to prevent a debt implosion. This might seem like a soft landing scenario at first, but when CPI ramps up (as it is starting to now at the mere mention of rate cuts) consumers will be hit even harder.

I’ll ask this question once again because I don’t think some people are getting it: What if their goal is to create a crash?

The Great Global Slowdown Has Already Started

In the past six months both the World Trade Organization and the World Banks released statements warning of an impending global slowdown. After an initial surge in exports and imports caused by massive pandemic stimulus measures, the effects of the helicopter money are now fading. By the end of 2024, global trade will register the slowest growth since the 1990s.

The UN also suggested growth deceleration was coming in the next year due to falling investments and subdued global trade. Keep in mind that the alternative media has been warning about this outcome for the past couple years at least as covid funding dried up. Globalist institutions are simply informing the public at the last minute; too little, too late.

The World Bank asserts that global trade is flatlining and international trade data supports this theory. China’s export market plunged by 7.5% in March, far more than expected and well below the 2.3% decline predicted by a major poll of mainstream economists by Reuters.

By the end of 2023 European exports declined by 8.8% compared to a year earlier and the union barely avoided a recession (according to official numbers). All hopes in Europe rest on the possibility of a steeper drop in inflation and central bank interest rate cuts. As I have been saying since 2021, don’t get too excited about banks lowering rates. It’s not going to happen at the pace that investors want, it’s not going to bring back QE anytime soon and when they do cut rates CPI will immediately spike once again causing panic among consumers.

I suspect that, after an initial rate cut event and an inflation resurgence, central banks will return to tightening with even higher rates in 2025.

In the US, a net importer of goods rather than a primary exporter, consumer volume has been in steep decline. Due to inflation, Americans are buying less goods while paying more money. And this is how inflation skews economic data. Higher prices on goods make retail sales look great, but in reality people are simply paying a higher price for the same amount of products (or less products).

Consumer credit data shows a steep decline in debt spending; credit card delinquency is at all time highs, APR is at all time highs and debt growth has collapsed in the past couple of months. Considering that the American consumer is a primary driver of global exports, it makes sense that international trade is now plummeting. Consumers are broke. The covid stimulus party is officially over and inflation is dragging the market down.

The IMF has recently noted the signs of global slowdown but, as usual, they argue that a “soft landing” is imminent. In other words, they claim there will be no serious repercussions for the economy. They do mention one interesting caveat in their analysis – The danger of global conflicts “derailing” the supposed recovery.

War leads to rising protectionism, the IMF says, and protectionism is a big no-no. In a world economy based on forced interdependency this is partially true, but the bigger picture is being ignored. The world economy should be built on redundancy, not interdependency. Interdependency creates weakness and the potential for dangerous domino effects. This is a fact that globalists would never willingly admit to.

For now, it appears that the global slowdown will become undeniable in the next six months, either right before the US elections in November, or right after. Central banks have chosen to create this Catch-22 and they are, for whatever reason, stalling the big drop. My theory? They have a scapegoat (or scapegoats) in mind and they’re waiting for the right time to unleash the next chaotic event. Covid is gone, so they’re going to need a war, multiple wars, or political conflict in the west and in many other parts of the world as a distraction.

Japan Is Now Caught In A Doom Loop

A good article from a fellow Japan lover although he arrived at the very peak of the Japan bubble. (It was such a good time before. People will never know!) But that was 35 years ago. Now after all these years "investing" in US treasuries, Japan will need the money back to defend the Yen. So it was all for nothing in the end? Maybe investing in real assets would have been a better idea? Although of course the option was never on the table at the time. That's called monetary colonialism! (An interesting book of monetary policy on the subject is called: Super Imperialism by Michael Hudson.)

By Russell Clark, author of the Capital Flows and Asset Market substack

Japan and Treasuries

My interest in Japan dates from 1991 when I was fresh faced high school exchange student in Kobe. There are no prizes for finding me in the above photo. I was the only “foreigner” in the school, and would go days without seeing anyone else that looked like me or even speaking English. I managed to combine my knowledge and experience in Japan with my other love, economics. I don’t think its too much of an exaggeration to say I owe my career and wealth through studying the Japan experience carefully and then applying those lessons to the rest of the world.

One of the most fascinating things about Japanese, economically speaking, is that almost its entire foreign reserves are made up of US treasuries, with almost no gold. As the right hand side column below shows, the share of gold as foreign exchange reserves is highest for the “old world”, while new powers such as China, Japan, Taiwan and Saudi Arabia have relatively low shares.

In absolute terms, China and Japan are by far the largest holders of foreign exchange reserves.

While China has larger foreign reserves than Japan now, Japan basically “invented” the idea of sovereign bonds as foreign exchange reserves. During the gold standard days, if a country like the US wanted to consume more than it produced, it would need to transfer gold overseas. With limited gold supply, this limited consumption. Moving to a treasury based financial system essentially removed this constraint. The only issue is whether other governments would accept treasuries or not.

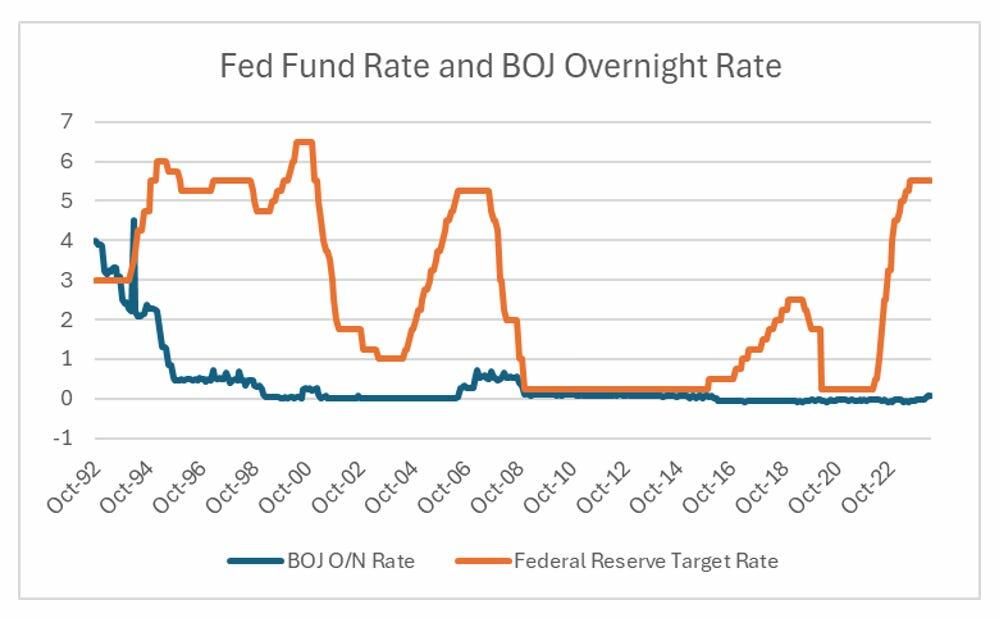

Why did Japan buy treasuries? Well when the bubble economy burst in the early 1990s, the BOJ cut rates to near zero, but the Yen did not collapse as expected.

In fact in the first stages of BOJ interest rates cuts, the Yen actually rallied. The failure of monetary policy to work as it should led the Ministry of Finance to intervene to try and help weaken the Yen, and official buying of US dollar assets took off.

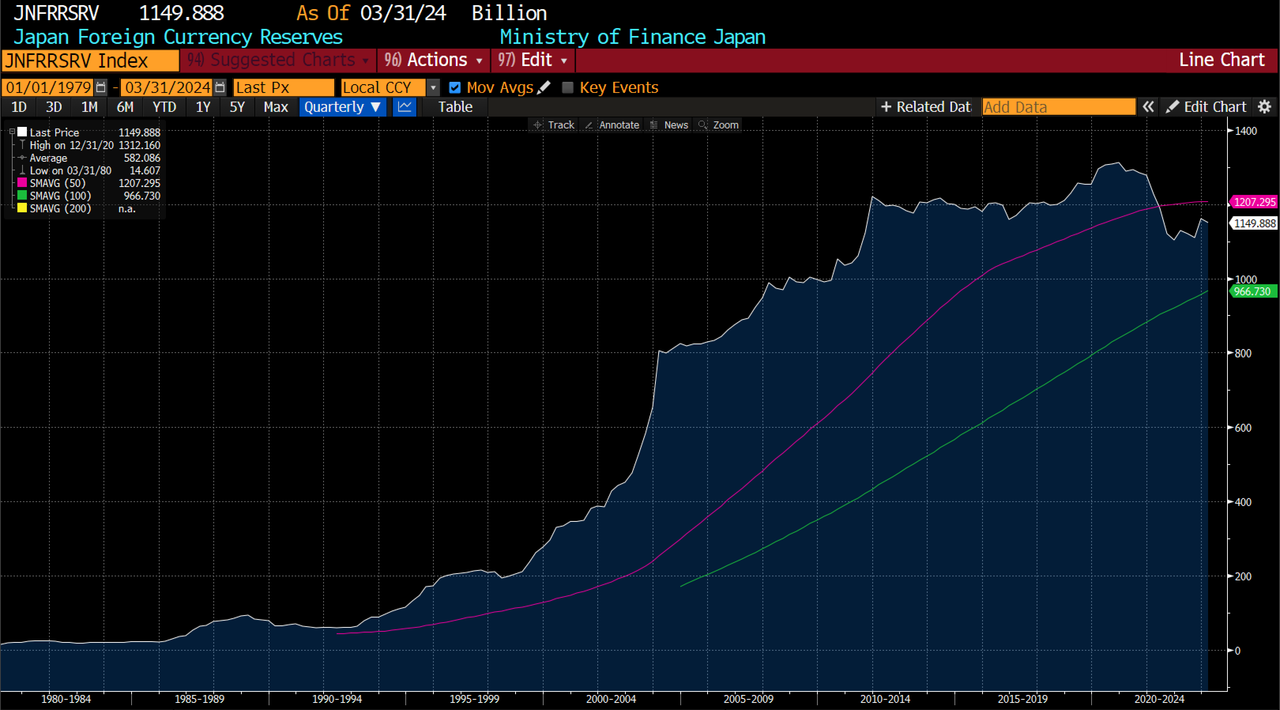

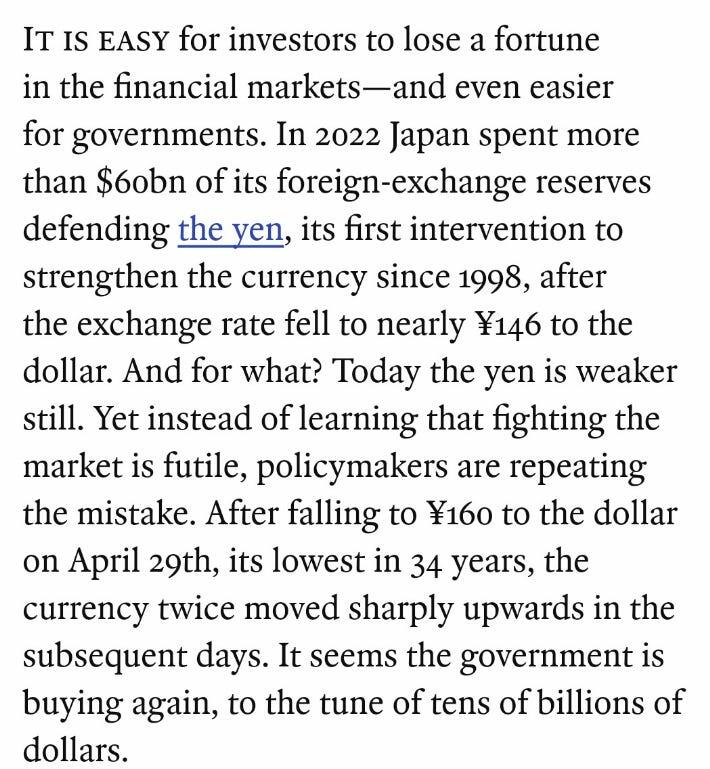

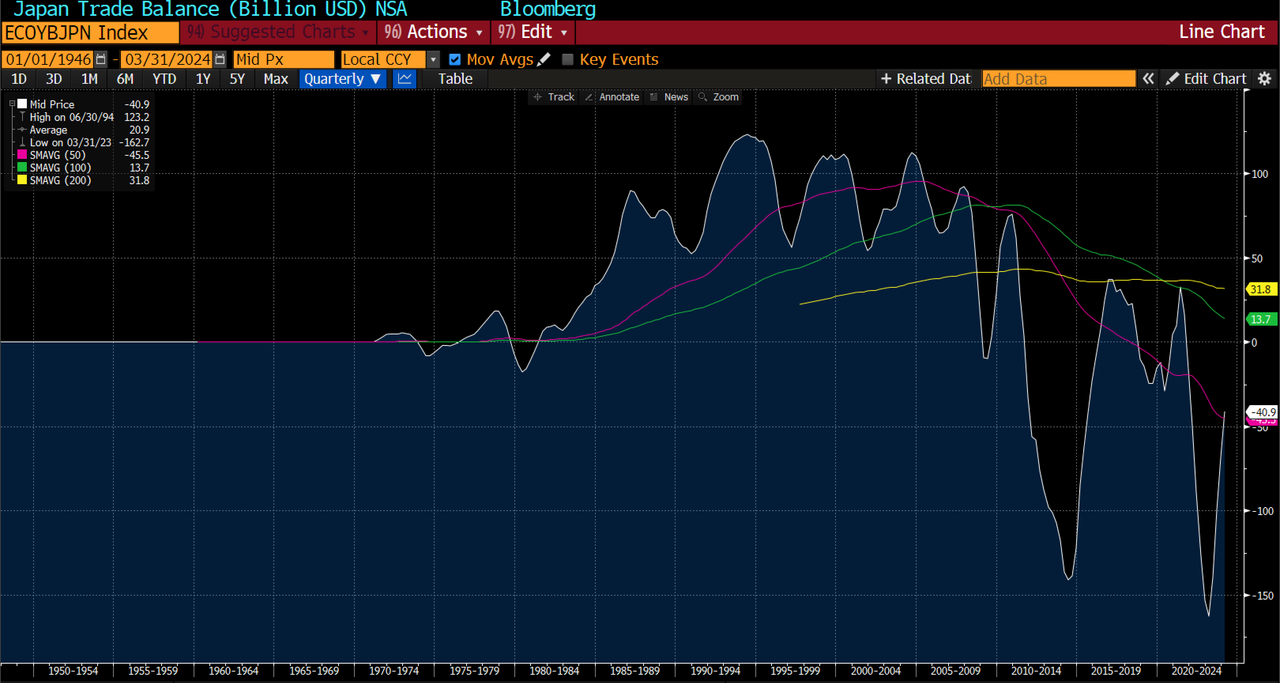

In pro-labor terms, when a government is pro-capital it wants to devalue to reduce the wages of its workers. This creates a trade surplus, which should cause the currency to appreciate, but if the government wants to keep the exchange rate competitive (i.e. keep real wages low), then it needs to buy more and more treasuries. A pro-labor government is happy to see its currency appreciate, and hence does not build foreign currency reserves. What is odd recently is that even as the BOJ remains extremely tardy in its monetary policy response, the Ministry of Finance in Japan has started using foreign reserves to “strengthen” the Yen. As the Economist points out, Japan is currently intervening in the currency market to try and strengthen the Yen.

We don’t know the cost of the foreign exchange intervention at the moment [ZH: we do, it was $59BN], but as can be seen above, Japanese foreign exchange reserves have not been rebuilt since the last intervention in 2022. Japan also does not run the structural trade surplus that it did from 1980 to 2010.

With falling foreign exchange reserves, trade deficit, and the likely increase in defence spending that the Russian-Ukrainian war implies, BOJ policy looks increasingly wrong. Markets seem to agree, with 10 year JGB yields at 13 year highs.

With either a Biden or Trump presidency in 2025, the chances of an austerity driven fiscal policy or a change in trade policy looks unlikely to me. The Japanese may well be caught in a doom loop, where they need to sell more foreign reserves to prop up the currency, which cause US yields to rise, which causes the Yen to weaken further and so on.

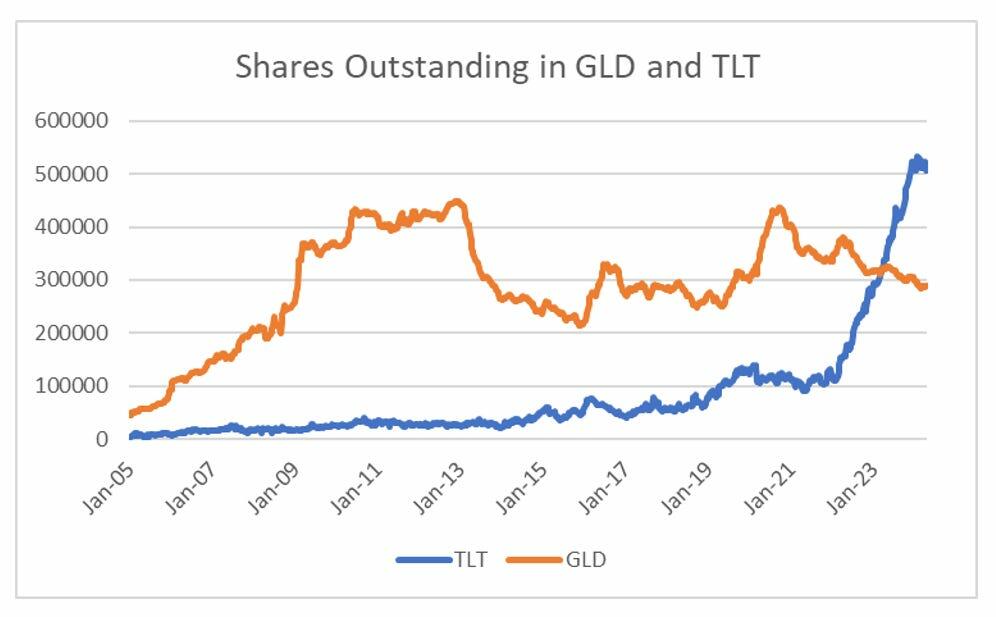

Until and unless the BOJ becomes more aggressive, Treasuries look like to have a systematic buyer turn into a systematic seller. China is likely a seller of treasuries and buyer of gold for political and strategic reasons, and Japan is a seller of treasuries for economic reasons. I am still baffled to why retail investors prefer treasuries to gold.

Japan was the key to understanding why treasuries did so well form 1980 to 2020. I think it is now the key to understanding why treasuries are going to do poorly from 2020 onwards.

Douglas MacGregor Warning: "Russia Forces Decimate Ukraine - Nuclear Shadows Over NATO" (Video - 24mn)

Douglas MacGregor offers a great and intelligent analysis: Economic crash in the West or nuclear war! Unfortunately I agree. Well worth listening!

Everything CHANGES for the US Dollar in 7 Days (Video - 7mn)

The video is longer but only the first 7mn are worth listening to. (The rest is advertising.)

In a nutshell, May 2024 will be a turning point. Ukraine is about to collapse, Putin was just inaugurated, the BRICS will take some important decisions soon, Israel is close to doubling the ante in Gaza, GPT-5 is ready to launch...

The convergence of factors is such that it is safe to say that we will enter a new paradigm in June and things will be different. Let's hope the world can stay a little longer on the brink but the omen are not good. Eventually something is bound to happen and things will change. End of May? Stay tuned.

Tuesday, May 7, 2024

‘We Get Paid to Vaccinate Your Children’: Pediatrician Reveals Details of Big Pharma Payola Scheme

Politicians paid by lobbyists, doctors paid by laboratories, hospital paid by the government for each "declared" Covid patient, and we wonder why things are not working smoothly. They are in fact working rather well for some, just as corrupt African governments do function perfectly for those who benefit directly from their largess. It's just in the long term, meaning unfortunately "now" that performance starts to decline sharply until the system breaks down,

Post by John-Michael Dumais

In an interview on Children’s Health Defense’s “Vax-Unvax” bus, Dr. Paul Thomas exposed the financial incentives pediatricians receive for administering vaccines, including kickbacks of up to $240 per visit.

Can pediatricians afford to run their medical practices without the generous kickbacks they receive for vaccinating every child?

Dr. Paul Thomas, a Dartmouth-trained pediatrician, discussed this dilemma during an April 16 interview with Polly Tommey on Children’s Health Defense’s “Vax-Unvax: The People’s Study” bus tour.

“You cannot stay in business if you’re not giving pretty close to the CDC [Centers for Disease Control and Prevention] [childhood vaccine] schedule,” said Thomas, who ran a general pediatrics practice with 15,000 patients and 33 staff members.

Thomas also addressed the risks and harms of vaccines — including COVID-19 mRNA vaccines — and the importance of boosting our immune systems naturally.

‘We were losing … over a million dollars’

Thomas, author of “The Vaccine-Friendly Plan: Dr. Paul’s Safe and Effective Approach to Immunity and Health-from Pregnancy Through Your Child’s Teen Year,” gave parents in his practice a choice: vaccinate their children on the CDC schedule, vaccinate more slowly by waiting for the child’s immune system to develop or not vaccinate at all.

As more patients refused vaccines, Thomas began to notice the financial impact on his practice.

He and his staff conducted a thorough analysis of their billing records, examining the income generated from vaccine administration fees, markups and quality bonuses tied to vaccination rates.

The results shocked him. “We were losing … over a million dollars in vaccines that were refused.”

He explained that pediatric practices heavily rely on vaccine income to stay afloat, with overhead costs running as high as 80%.

“It is very expensive to run a pediatric office,” he told Tommey. “You need multiple nurses, multiple receptionists, multiple billing people and medical records — it’s a huge operation.”

Three financial incentives for giving vaccines

Pediatricians receive several types of financial incentives for administering vaccines.

The first is the administration fee, which Thomas described as a “Thank you for giving the shot.” He estimated that pediatricians typically receive about $40 for the first antigen and $20 for each subsequent antigen.

“Let’s just say a two-month well-baby visit, there’s a DPT — that’s three shots, three antigens,” he told Tommey, plus “Hib [Haemophilus influenzae type b], Prevnar [pneumococcal], Hep B [hepatitis B], polio, rota [rotavirus] — [that’s] about $240.”

The second way pediatricians profit from vaccines is through a small markup on the cost of the vaccines themselves, though Thomas noted that this is not a significant source of income.

The third and most substantial financial incentive is quality bonuses tied to vaccination rates. Insurance companies offer pediatricians bonus payments for meeting certain benchmarks, typically around 80% of patients being fully vaccinated by age 2.

“I get dinged maybe 10-15% off of those RVUs — relative value units — that are ascribed,” he said, describing the points system used to calculate physician reimbursements.

With his practice’s vaccination rate a mere 1%, Thomas was at risk of losing up to 15% of his overall revenue.

“Really, it effectively means a pediatric practice cannot survive using insurance without doing most of the vaccines, if not all of them,” he said. “And I think that explains the blinders — [why doctors] just won’t go there and look at the fact that these vaccines are causing a lot of harm.”

Neurodevelopmental issues ‘clearly linked to vaccines’

Tommey asked about sudden infant death syndrome (SIDS).

“When you hear the word syndrome, it means we don’t know what it is … [or] what causes it,” Thomas said. “But we actually have a pretty good clue.”

Thomas said six studies examined the correlation between SIDS cases and vaccines. “In one data set, 97% were in the first 10 days after the vaccine. Only 3% were in the subsequent 10 days,” he said.

Other studies showed similar patterns, with 75-90% of SIDS deaths occurring within the first week after vaccination, he said.

Thomas also highlighted the increased risk of neurodevelopmental disorders, allergies and autoimmune diseases in vaccinated children.

“We know without a doubt that things like neurodevelopmental concerns, learning disabilities, ADD, ADHD [attention-deficit/hyperactivity disorder], autism [are] clearly linked to vaccines,” he stated. “The more you vaccinate, the more likely you are to have these problems.”

Vaccinated children are more prone to infections and illness compared to their unvaccinated peers, according to Thomas, who published a study comparing the health outcomes of each group.

“It’s the vaccinated who get more ear infections, more sinus infections, more lung infections,” he said. “Any kind of infection you look at, the vaccinated get more.”

‘Healthy adults just “Boom!” — dropping dead’

The risks associated with vaccines extend beyond childhood. Thomas drew attention to the recent phenomenon of “Sudden Adult Death Syndrome” (SADS) following the COVID-19 vaccine rollout.

“We see it on the news, we see it on the ball fields: healthy adults just ‘Boom!’ — dropping dead,” he said. “And that’s all happened since the COVID jabs.”

Thomas expressed particular concern about the mRNA technology used in COVID-19 vaccine development. He pointed out that despite decades of research, mRNA vaccines have never been proven safe or effective.

He cited previous attempts to develop mRNA vaccines for respiratory syncytial virus (RSV), which consistently failed in animal trials.

“When they got to the animal trials, they would vaccinate the rats,” he said. “When they re-exposed those rats, in one study, 100% of them died.”

The COVID-19 mRNA vaccines’ narrow focus on the spike protein is also problematic because it causes the immune system to become “focused on just one thing,” Thomas said.

“When the [viral] organism mutates, those who are vaccinated can’t recognize this new mutation,” he said, recalling how at a family gathering during the pandemic, it was mostly the vaccinated who contracted COVID-19.

Thomas shared a personal story about his mother’s experience with pulmonary fibrosis after receiving three COVID-19 vaccines.

“After her third COVID shot, she started really running out of energy and then getting short of breath,” he said. “Within a month, her lungs [had a] ground-glass appearance.”

Tommey asked about the risks of vaccine shedding.

“Shedding seems to be happening, and it’s been documented in studies,” he said, explaining that vaccinated individuals can expose others to spike proteins through body fluids and secretions.

‘We can no longer go to our doctors and say, “Fix me”’

Thomas discussed the likelihood of new pandemics being declared in the future, driven by the immense financial gains pharmaceutical companies reaped from the COVID-19 vaccines.

“They made too much money — Pfizer alone made over $100 billion,” he said. “So the power that the public health machinery got to themselves with COVID has to be intoxicating to them.”

In light of this, Thomas stressed the importance of personal health and natural immunity.

“We can no longer go to our doctors and say, ‘Fix me,’ after we’ve trashed our own health,” he said. “So we’ve got to take responsibility for eating right, avoiding stress, getting adequate sleep … [and] boosting our immune system naturally with organic produce.”

Thomas also encouraged people to question public health authorities and make informed decisions about their health.

“I can no longer trust the CDC, the FDA [U.S. Food and Drug Administration], the NIH [National Institutes of Health],” he said. “Some good people work in these institutions, but the institutions themselves are captured.”

Thomas said that when it comes to vaccines or a new pandemic illness, “They’re the last people you want to trust.”

‘Vax Facts’ book coming soon

Thomas shared information about his upcoming book, “Vax Facts,” co-authored with his partner DeeDee Hoover. He said the book provides an easy-to-read, comprehensive guide to understanding the vaccine issue, regardless of one’s current stance.

“This is going to … allow you to really understand it in an organized, reasonable way why it makes sense now to pause” taking vaccines, Thomas said.

Withdrawing From The Rat-Race Is Going Global by Charles Hugh Smith

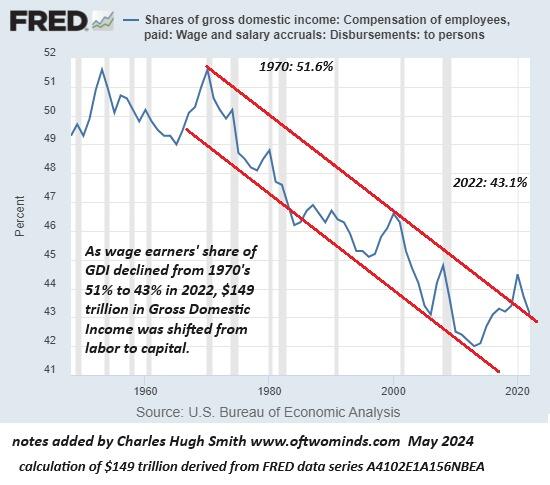

Charles Hugh Smith writes a weekly column in which he highlights some deeper trends of our society. Here, it is the massive withdrawal of millennials from the rat race. It is called "Laying flat" in China, "Hikikomori" in Japan. Nothing new in Asia except for the scale and for the fact that the trend is going global, No surprise there with the massive devaluation of salaries in real value as well as in percentage of domestic income as explained below.

Authored by Charles Hugh Smith via OfTwoMinds blog,

Mere mortals are left in a hopeless situation. In response, they're withdrawing from the competition en masse.

The world has changed over the past two generations in ways that don't fit the heavily promoted narratives of "growth" and "progress." The "growth" and "progress" narratives hold that everything is getting better in every way and every day--next stop, Mars!--but if we consider everyday life, a much different picture emerges.

1. Globalization shifted high-pay work overseas to the benefit of capital, who reaped the profits from global wage arbitrage and to the detriment of workers in developed-nation economies.

The conventional-economic apologists glorified this as a net positive: everyone who lost their jobs to globalization would move up the food chain and get jobs as currency traders, highly paid tech workers, etc.

2. In reality, most were left with lower pay, precarious jobs as developed economies were producing ever larger cohorts of elites--college graduates and increasingly, those with advanced degrees--competing for those highly paid jobs.

Laid-off production-service workers could not compete with the growing army of credentialed elites for the remaining secure, highly paid jobs.

3. At the same time, the lower levels of the university-educated elites could no longer compete due to the overproduction of elites described by historian-author Peter Turchin as a key destabilizing dynamic in eras of social disorder. Two generations ago, a PhD was scarce enough to guarantee a secure job in academia, government or industry. Today, even a PhD from an elite university is little more than a ticket to enter the next round of cut-throat competition for the few tenure-track positions available.

4. This competition for the remaining secure, highly paid jobs was intensified by another change: the mass entry of women into the labor force in the 1970s led to the rise of households in which both spouses had well-compensated jobs in the upper reaches of the economy. These households had far more resources to pour into the advancement of their children, and a heightened awareness of the winner-take-all nature of elite competition.

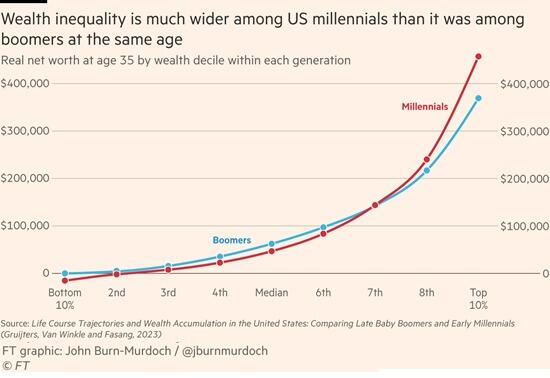

5. As this chart from a Financial Times article depicts, the net result is the Millennial generation is highly unequal in wealth and prospects. Two generations ago, about 20% of the workforce had a college diploma; that percentage has roughly doubled, even as the number of jobs that actually require a university education to do the job has declined. Those with the support of two professional parents entered the competition as early as kindergarten and continued apace into their mid-20s, leaving their less-prepared competitors in the dust.

Meanwhile, labor's share of the economy's income has been declining for 50 years, leaving less income, fewer benefits and less security to divide among the workforce.

6. Concurrent with hyper-globalization, the hyper-financialization of the economy generated competition for productive assets and real-world assets such as housing. Workers in the low-pay, insecure reaches of the economy cannot compete with the wealthy elites (the top 10% own 90% of financial assets) for housing or other assets, while this credit-driven bubble has pushed prices higher, further reducing the purchasing power of wages.

Where one secure income was once enough to support a middle class household that owned the family home and sent the children to college, it now takes two secure incomes to support even the lowest rung of middle class expectations.

7. At the same time, society lost respect for essential work in favor of digital visibility. Validation, respect and being recognized for one's work are no longer available for those doing the work that keeps civilization functioning; recognition and admiration--and envy--are reserved for those with high visibility on social media or mass media.

8. This competition for visibility is not only cut-throat, it is artificial. Reserving recognition and respect for the few with high visibility in the world of screens has generated a great many perverse outcomes. Since mere mortals cannot possibly compete, every competitor must present an artificial self that is a pastiche of what's considered essential to gain media visibility: not just being attractive, but super-attractive, not just wealthy but super-wealthy, not just talented but super-talented, and so on.

Mere mortals are left in a hopeless situation. In response, they're withdrawing from the competition en masse. This abandonment of the competition is largely beneath the surface, as the apologists' happy-story narrative collapses once we recognize the hopelessness and the solution--withdrawal from the economy and society.

BOMBSHELL EVIDENCE! These are actual photographs of Israeli military explosive experts wiring the 91st floor of the World Trade Center for the 9/11 controlled demolition of the Twin Towers

This should be taken with a grain of salt until formally confirmed (which it will never be of course). Still, the probability is very high.

Having seen WTC-7 be demolished (which was confirmed, then denied) it is almost inescapable that the two towers of the World Trade Center were likewise destroyed.

The reason I believe this specific "conspiracy theory" is that almost half a century ago, in 1977, I visited the WTC. A year after its completion. And as it was explained at large later, could see with my own eyes that it was indeed built differently that other towers at the time. Mostly around a very strong core with floors hanging and supported on the periphery by curtain walls. So when the towers fell, I could certainly understand why the walls gave up under pressure, but why would the core? Especially when you know that the steel used for the core was thicker and thicker as you went down and the weight increased.

So even if one or two floors had failed, unlikely it itself, the dynamics of the fall should have been towards a slowing down of the speed as each floor offered more and more resistance and more importantly, the core should NOT have failed at all and therefore should have remained standing up.

I am not alone to believe that: More than 1,000 architects and engineers have asked for a full investigation to take place to understand exactly what took place and how the impossible unfolded. They are still waiting to this day. I guess we'll know the answer no sooner than we know who blew up the Norstream Pipeline!

PS1: I would be rather surprised that people actually took pictures of such a sensitive mission but who knows. Time will tell. Even if the pictures are not real, the suspicion remains.

PS2: The source of this article is the Burning Platform and behind it State of the Nation. These are esoteric sites with interesting articles but were caution is necessary. They sometimes unearth interesting facts and often verge on flat earth nonsense, so again, caution is advised. If you want to walk in the bogs, you'll probably gonna get you shoes dirty. It's the price of being inquisitive and wanting to know.

Notice the “BB18” stamped on the boxes in the first two photos that follow. Also, check out how these Israeli demolition experts are rigged up to accomplish a very serious job on the 91st floor of the World Trade Center.

*BB18 is a three-phase busbar terminal power feed lug, which is intended for use with LPSM/LPSC series fuse holders. They are sold by Littelfuse as seen in this link: These are power feed lugs for use in FUSE holders that were in the boxes photographed on the 91st floor of the WTC before 9/11.

Submitted by Revisionist Historians for World Peace

What’s really quite incredible about this back story is that The New York Times ran a special piece promoting a story that made these demo experts appear to be art students. In other words, the NYT was in on the false flag 9/11 terrorist attacks which was carried out to launch the bogus War on Terror, as well as to pass the utterly treasonous Patriot Act and to establish the nation-destroying Department of Homeland Security.

Art students were given special access to one of the most

secured office buildings in the USA!!! Really?!?!?

Not only that, but this same group of MOSSAD/IDF terrorists actually had a not-for-profit arts organization established in 2011 in Seoul, South Korea put up a website documenting their entire fake story, with pictures and diagrams and videos and all. As follows:

This is the absurd cover story for the controlled demolition

experts who placed the nano-thermite charges in the

World Trade Center prior to 9/11/01.

Conclusion

The criminals actually had the chutzpah to provide hard evidence of their own involvement in the false flag 9/11 terrorist attacks in New York City. They really felt they could commit these crimes against humanity with total impunity and even keep this article posted to this very day with their photos for the whole world to view: https://publicdelivery.org/gelitin-b-thing/.

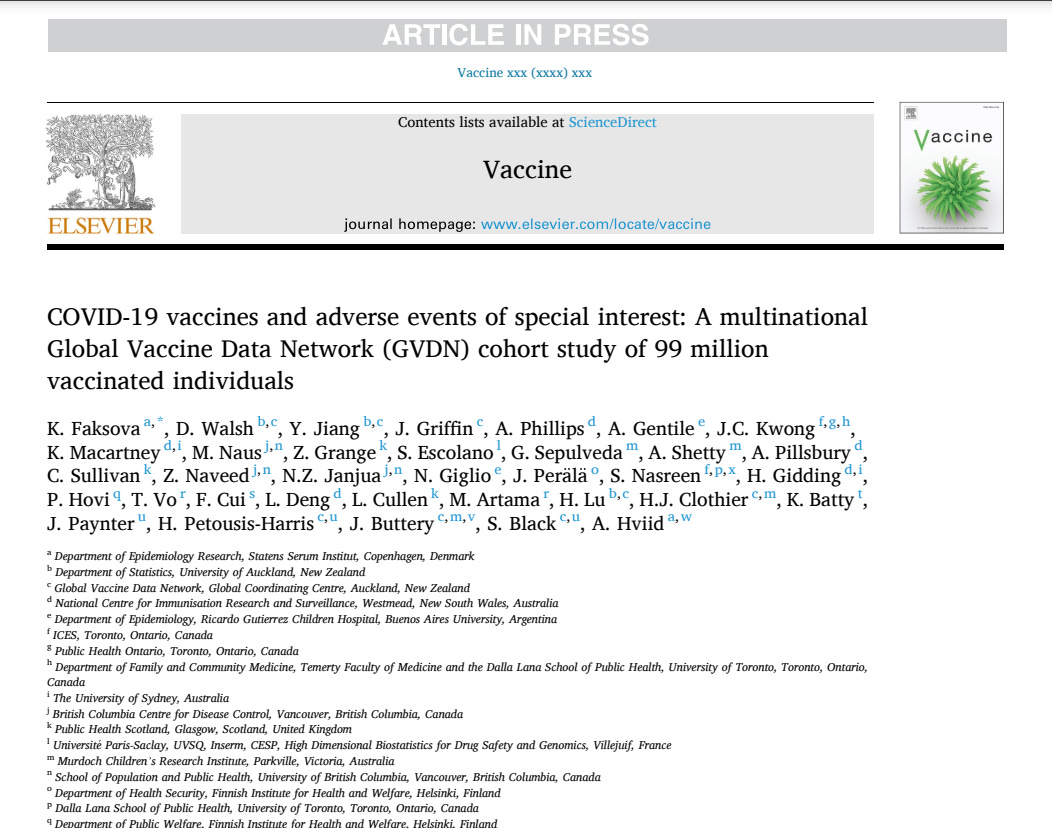

COVID19 vaccines linked to myocarditis, pericarditis, ITP, Guillain Barre Syndrome, Bell’s Palsy, ADEM, PE, Febrile seizures & more

Slowly, very slowly the truth about the Covid Vaccine is starting the emerge. As expected, it is a catastrophe of epic proportion. Mostly useless with countless side effects. It should never have been tested on the population as it was. This was nothing short of a crime but don't expect to read anything in the press about it anytime soon. It will be buried, then ignored just as its countless victims. The medical profession saved society from its "viral" members just as the church saved souls in the Middle Ages by sending them back to their maker! Progress?

Post by Steve Kirsch

That’s the headline from an article by UCSF Professor of Epidemiology and Biostatistics and Medicine Vinay Prasad MD MPH, not some “misinformation spreader.” He’s right.

Executive summary

UCSF Professor of Epidemiology Vinay Prasad MD MPH just published an article entitled “COVID19 vaccines linked to myocarditis, pericarditis, ITP, Guillain Barre Syndrome, Bell’s Palsy, ADEM, PE, Febrile seizures & more.”

In the article, he points out two major reasons that the study of 99 million vaccinated people under-reported safety signals:

- Using electronic health records (EHR) will result in under-reporting of symptoms

- The comparison rates were not age stratified

Prasad also says, “First, let us be clear, the benefit of COVID vaccination is small, uncertain or not present in several populations… absolute benefits to healthy people under 20, 30 or 40 were always minuscule— bordering on zero— and possibly not present. Available data lacks power to show a benefit in 20 year olds.”

He’s right about that too, but it’s even worse than he said. Much worse.

The study failed to recognize significant signals, and showed evidence that side effects were reduced by vaccination. How is that possible?!?

Zero benefit for all

Professor Prasad should have said “the benefit is zero in all populations.”

I’m unaware of any population that can benefit from these shots. Someone show me. Please.

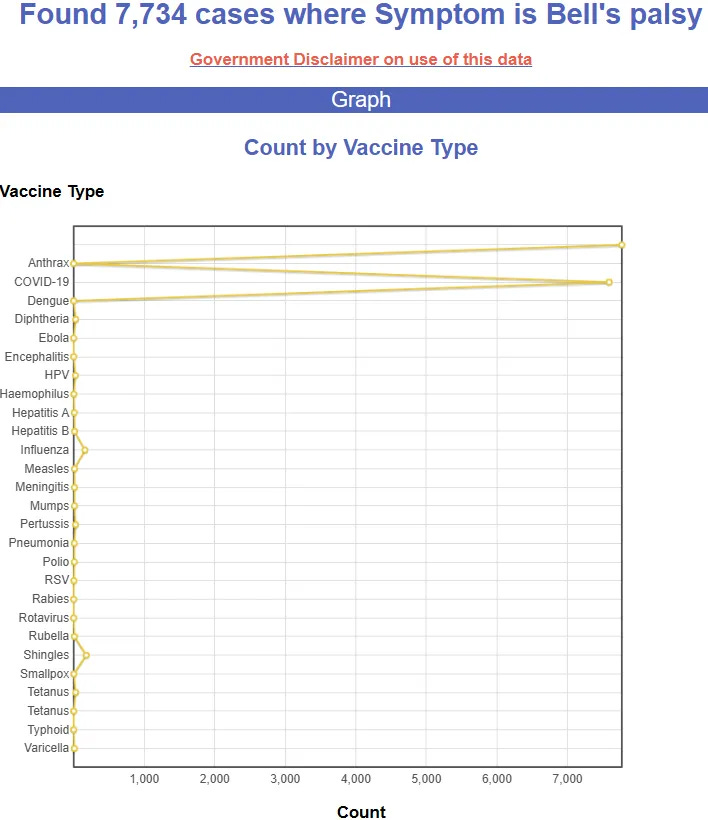

How can the study miss the huge Bell’s palsy signal?

Secondly, the study appears to be incapable of finding a signal.

Let’s look at Bell’s Palsy for example.

The paper shows a mild signal: OE of 1.05 for Pfizer and 1.25 for Moderna.

But the signal in VAERS is off the charts: virtually every single case of Bell’s palsy ever reported in VAERS in the last 35 years is from the COVID vaccines.

If the mRNA COVID vaccines weren’t strongly causing Bell’s palsy at a higher rate than background, how can we explain this VAERS signal? Nobody wants to explain that.

I tried to engage Roger Seheult MD, founder of Medcram who produced a video on VAERS to explain data like this, but he blocked me.

The block was expected. That’s the way real scientists are supposed to respond to those who challenge their work: you block or ignore all challengers. You never respond because you don’t want to risk having someone make you look bad. It’s always better to leave bad information out there than to have to admit you made a mistake and have your reputation damaged!

How can the COVID vaccine reduce side effects? Is it a miracle drug? Or is the study flawed?

Finally, it was also interesting to see that for the 3 vaccines tested, more than half the side effects studied had scenarios where the shots provided a statistically significant benefit:

- Guillain-Barre Syndrome

- Bell’s palsy

- Febrile seizures

- Generalized seizures

- Thrombocytopenia

- Idiopathic thrombocytopenia

- Pulmonary embolism

- Splanchnic vein thrombosis

Seriously?!!?! Vaccines don’t work that way. They always increase side effects. They never reduce them.

Yet, in this paper, in 8 of the 11 side-effects examined in the study Tables 3 and 4, there were one or more table rows (each row is a vaccine type and dose number) where there were one or more statistically significant reductions in incidence.

This does not inspire confidence in this study or in the peer-review process of the top medical journals.

Bottom line: A study showing statistically significant reductions in side effects from a deadly vaccine should cause anyone with a working brain to seriously question the study conclusions.

Summary

A widely acclaimed study of 99M vaccine recipients showed statistically significant reductions in over half of the side effects studied.

That’s simply not possible. There is simply no mechanism of action that could account for such effects.

How these studies are taken seriously by the medical community is truly a mystery to me. That is what an enlightened press should be writing about: how the medical community embraces so obviously flawed peer-reviewed studies.

The Lifespan Of A Country

20 years ago already, we were alone announcing the decline of the West which as we explained then would be a process related to cycle an...

-

A rather interesting video with a long annoying advertising in the middle! I more or less agree with all his points. We are being ...

-

In a sad twist, from controlled news to assisted search and tunnel vision, it looks like intelligence is slipping away from humans alm...

-

A little less complete than the previous article but just as good and a little shorter. We are indeed entering a Covid dystopia. Guest Pos...