There is a custom in Japan where for the New Year you build a huge ball of straw on top of a hill, then light a small fire on the side before throwing it down-slope. By the time the ball rolls down to the foot of the hill, it has become a huge ball of fire called Hi-no-kuruma. (You can see that in Nara among other places.)

Likewise, politicians have the same custom but with government budgets. The fall takes 250 years instead of 3 minutes but the resulting explosion is no less impressive. Considering the frequency, only 1 out of 10 generations can enjoy such fireworks, but fortunately, we are that generation. Enjoy!

PS: For those interested in how big is the fire right now, read on. Sparks are already flying all around in Washington.

by Simon Black via Sovereign Man

Earlier this week, leaders from both major parties in the Land of the Free announced a grand bargain that, in theory, should avoid a government shutdown later this month.

According to their agreement, Congress will supposedly cap its ‘discretionary’ spending at $1.6 trillion for Fiscal Year 2024. That’s down from about $1.7 trillion in FY23.

So, yes, technically this $100 billion reduction represents about a 6% decrease over last year. And if we want to be even more cheerful about it, we could call it a 9% decrease on an inflation-adjusted basis.

If we’re being intellectually honest, that’s a step in the right direction for the US. A tiny, tiny, tiny step in the right direction.

How tiny, you ask?

Well, pretty much non-existent; the agreement to cut spending is an almost entirely symbolic gesture that won’t do much good.

Before we go further, it’s important to understand that government spending is generally categorized into three distinct buckets.

The first bucket is interest on the debt. And, at least for now, this is non-negotiable. It has to be paid.

And I don’t mean it ‘has to be paid’ in the moral sense that “America always pays its debts.”

I mean, legally, interest on the debt is automatically paid. Just like your monthly mortgage, interest payments on the US national debt get automatically sucked out of the Treasury Department’s bank account.

The second bucket is what’s known as “Mandatory Spending”, which includes programs like Social Security and Medicare. Just like the interest bucket, Mandatory Spending gets sucked out of the Treasury Department’s bank account every month.

Those two buckets– Interest payments and Mandatory Spending– constitute the vast majority of US federal spending.

The third bucket is known as Discretionary Spending… because it’s at Congress’s discretion.

Discretionary spending is what results from all their debates and arguments over annual appropriations, for everything from the military to the national parks. It also includes supplemental spending for pandemic bailouts, Ukraine, Hunter Biden artwork, etc.

So, the announcement this week was about a $100 billion reduction to Discretionary Spending.

But consider that Mandatory Spending (which Congress doesn’t touch) on Social Security alone surged $281 billion last year… and will likely increase by a similar magnitude this year.

So that single increase to Mandatory Spending will more than wipe out the entire $100 billion Discretionary Spending reduction.

Easy come, easy go.

Then there’s interest on the debt, which increased by $177 billion last fiscal year. It will probably increase by at least that much this year… which, again, more than wipes out the entire $100 billion in Discretionary Spending reduction.

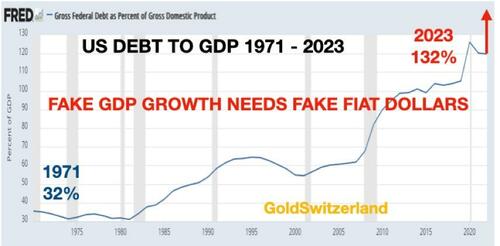

If you drill down into the numbers, you’ll see pretty clearly that there are very few credible paths forward for the United States.

One path is to drastically… and I mean almost entirely… slash Discretionary Spending.

Look at it this way– last year’s Discretionary Spending was $1.7 trillion. The government is claiming that their annual budget deficit last year was also $1.7 trillion.

This means that, in order to balance the budget, they would have to almost completely eliminate ALL discretionary spending. No more military. No more Homeland Security. No more government.

In other words, one of the only ways to balance the budget would be a Zombie Apocalypse in Washington DC.

The second path forward is to make major cuts to Mandatory Spending… which would involve politically unpopular overhauls to Social Security and Medicare.

Few politicians have the courage to do so. And given that they can’t even agree on basic priorities for Discretionary Spending, it seems unlikely that they’ll come together for more difficult cuts to Mandatory Spending.

This leaves the third path forward: to prioritize economic growth and productivity… by slashing regulations and actually make it easy once again for people to do business.

And this approach would really work. If real (i.e. inflation-adjusted) economic growth were 3% or even 3.5%, instead of 2%, then America’s fiscal woes would be over within a decade. And this is totally achievable.

With just 3% real growth, tax revenues would soar, the budget would be balanced, and the national debt would be trivial in comparison to the size of the US economy.

Seems like the obvious approach, right? Except that they’re doing the opposite… foisting even more regulatory burdens onto small business.

It’s no surprise that tax revenue last fiscal year was down 9% from the year before; that’s a testament to not only a weakened economy, but the Byzantine regulatory state that they’ve created over the past few years.

The most recent example is the Corporate Transparency Act (CTA), the completely idiotic and destructive piece of legislation that I discussed last week.

The CTA exists because the government thinks that its tax revenue should be higher. And they’re right– federal tax revenue SHOULD be higher.

But the government never points the finger at themselves. They never conclude that dwindling tax revenues are the result of their criminal mismanagement of the economy, including all the excessive regulations which debilitate business.

No, to them, the only possible reason why tax revenues are down is because of criminal tax evasion. So, their solution is to create even more regulation which forces business owners to file information reports to the government.

The even more pathetic part is that US businesses already must provide this information to the IRS.

But Congress doesn’t care. Instead, they demand that taxpayers provide the exact same information– but in a different format– to a separate agency within the Treasury Department.

Saddling small businesses with more paperwork is hardly the sort of thing that is going to make the US economy more productive.

So, they’re not going to eliminate Discretionary Spending. They’re most likely not going to find the courage or wisdom to cut Mandatory Spending.

And it sure as hell doesn’t look like they’re going to prioritize growth and productivity.

That leads to the fourth and final option: inflation… which, from a historical perspective, is what almost ALWAYS happens in these scenarios.

We’ll talk a lot more about this soon.

Want more articles like this? Sign up here to receive Sovereign Man letters to your email.