What happens when people stop believing? Every single religion has to face this daunting risk. "Green" is no different.

Ecology is about respecting the world around you and understanding that we are part of it. Nature doesn't need to be saved, just not to be systematically destroyed for a quick profit.

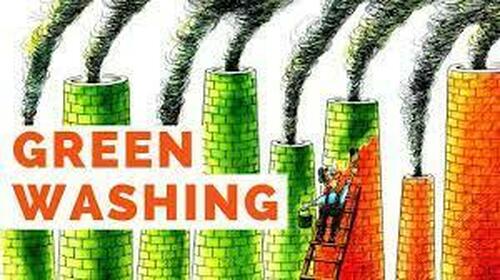

Unfortunately "quick profit" is very much what our modern civilization is all about. So that part cannot change. What can change is green washing our activities and that is very much what "green" is all about.

You create fanciful enemies, CO2 for example, against which "war" is completely meaningless since carbon is THE essential element for life and on you go. Producing "less" carbon, even though the new processes usually consist in exporting carbon production to China (or other countries) and creating new cycles with elements which are far more polluting: Lithium, rare earths and a litany of metallic compounds all worse than what they replace.

What we need is a paradigm shift but the definition is not compatible with changing nothing which is more or less how people understand "green". What about product cycle instead of production and consumption? We're not there yet to put it mildly.

Most investors with supposedly sustainable ISAs unknowingly support banks funding fossil fuels.

Many believe sustainable funds cannot include fossil fuel companies, highlighting a lack of understanding.

Young investors are more skeptical of greenwashing practices by financial institutions.

A majority of investors that picked their ISA based on sustainability credentials actually have their cash in providers classified as ‘worst’ for their environmental impact, new research has revealed.

Analysis from Triodos Bank UK found that investors were failing to understand the sustainability implications of where they put their money.

The research found that a majority of people (55 percent) who have a stocks and shares ISA with a provider classified as the worst on sustainability, according to Ethical Consumer rankings, actually think that their money is in a ‘green‘ ISA.

Investors are also not fully informed about the extent of what labels can be applied to ISAs, especially if they seem counter-intuitive.

For example, half of consumers don’t believe a fund or savings account can be classed as ‘sustainable’ if it includes fossil fuel companies – even those that also invest in renewable energy.

However, a sustainable label can still be slapped on a fund that invests in fossil fuels, especially if the fund claims it is working on engaging with the polluter to pressure it to cut its emissions.

Meanwhile, 55 percent of investors said they didn’t even know if their ISA was using their money in an environmentally friendly way.

Investors are clearly pushing for more sustainable investment, as 47 percent of people said that banks should not be investing in fossil fuel expansion, rising to 57 percent of 18–34 year olds.

Young investors are also more sceptical of the claims made by financial institutions, with 36 percent thinking their ISA providers are likely to be engaging in greenwashing, compared to just 10 percent of over 55s.

Roger Hattam, director of retail banking at Triodos Bank UK, said that the findings demonstrated “the worrying truth about how well-intentioned consumers are being misled about how their money is being invested”.

The Financial Conduct Authority is set to bring in new anti-greenwashing rules later this year, but the research found only 10 percent of investors were aware of the new rules.

However, Hattam described the new rules as “desperately needed”, and more than half (59 percent) of investors said they were concerned about greenwashing in the financial services industry,

“There are millions of consumers wanting their money to align with their values, but this is not yet matched with real industry commitment to clearly signpost what causes their money is actually supporting,” added Hattam.

“As well as actively screening out negatives – such as never investing in fossil fuel companies – to truly invest in people and the planet, banks need to actively fund areas that are changing the world for the better.”

No comments:

Post a Comment