In the new normal nothing ever happens. The Central Banks have our back so why worry? "Spending a life worrying for something that may or may not happen is no way of spending a life!" Fine. But as Hemingway said when he went bankrupt: Little by little then suddenly. For the US too, the sun will Set. It will be suddenly and it may not be in a faraway future.

We've been pointing it out for so long - in fact, for most of our 15 years in existence - that it has become more of a chore than actual reporting, especially since the "number only go up", as it hits a new all time high virtually every day. We are talking, of course, about the exponential curve that is the US debt, arguably one of the most boring and at the same time, most exciting topics of all time (because one day the "number go up no more" and you want to be far, far away when that happens).

Perhaps the catchiest observation we made on the trajectory of US debt was last September when we first noted that it is rising by $1 trillion every three months, or every 100 or so days...

... a soundbite which has since been picked up and stolen by pretty much everyone else in the media, if with the usual 6+ month lag behind us.

Not only has it gotten boring to be ahead of the curve by almost half a year, but pretty much every possible warning that could be said about the exponential increase in the US debt has been - well - said.

And yet, every now and then we are surprised by the latest developments surrounding the unsustainable, exponential trajectory of US debt. Like, for example, the establishment admitting that it is on an unsustainable, exponential trajectory.

That's precisely what happened overnight when in an interview with the oh so very serious Financial Times (which has done everything in its power to keep its readers out of the best performing asset class of all time, bitcoin), the director of the Congressional Budget Office, Phillip Swagel, issued a stark warning that the United States could suffer a similar market crisis as seen in the United Kingdom 18 months ago, during former Prime Minister Liz Truss’s brief stint leading Britain - which briefly sent yields soaring, sparked a run on the pound, led to an immediate restart of QE by the Bank of England and a bailout of various pension funds, not to mention the almost instant resignation of Truss - citing the nation’s "unprecedented" fiscal trajectory.

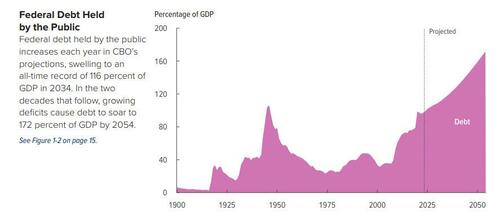

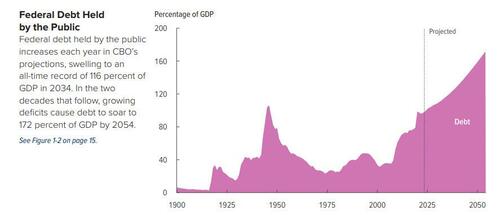

The striking words from the head of the CBO, best known perhaps for publishing doomer debt/GDP projection charts such as this one...

... warned of the dangers of the U.S. facing “what the U.K. faced with former prime minister Truss — where policymakers tried to take an action, and then there’s a market reaction to that action", comes as US government debt continues to break records, fueling concerns about the burden that places on the economy and taking a toll on America’s credit rating.

As a reminder, in September 2022, Truss roiled markets as she pressed for significant tax cuts, including changes lessening the tax burden on wealthier individuals without offsets, as well as other economic measures. The budget proposal spurred a major selloff of British debt, forcing U.K. interest rates to decades-long highs and causing the value of the pound to tank. While Truss defended her agenda as a means to spur economic growth, she stepped down as prime minister after less than two months on the job following the market revolt to her administration.

Meanwhile, it was up to the Bank of England to bail everyone out: the central bank intervened in the market, pledging to buy gilts on “whatever scale is necessary” with Dave Ramsden, a senior official at the central bank, saying at the time that "were dysfunction in this market to continue or worsen, there would be a material risk to UK financial stability.”

Needless to say, by bringing up the catastrophic rule of Truss, who for at least a few days tried to impose a regime of fiscal and monetary austerity which immediately blew up the UK bond market and led to an instant market crisis, Swagel is admitting that there is nothing that can be done to reverse the growth of US debt and to make what is already an exponential chart less exponential. Quite the opposite, in fact.

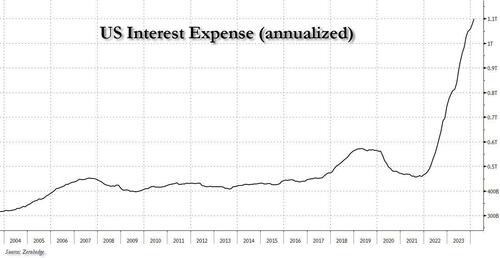

And while Swagel said the U.S. is “not there yet,” he raised concerns of how bond markets could fare as interest rates have climbed. Specifically, he warned that as higher interest rates raise the cost of paying its creditors, on track to reach $1 trillion per year in 2026, bond markets could “snap back."

Well, we have some bad news, because if one calculates total US interest on an actual, annualized basis... we don't have to wait until 2026, we are there already and then some.

Indeed, it seems like it was just yesterday when everyone was talking about US debt interest surpassing $1 trillion (and more than all US defense spending). Well, hold on to your hats, because as of this month, total US interest is now $1.1 trillion, and rising by $100 billion every 4 months (we should probably trademark this before everyone else steals it too).

According to the CBO, US government debt is set to keep rising. “Such large and growing debt would slow economic growth, push up interest payments to foreign holders of US debt, and pose significant risks to the fiscal and economic outlook,” it said in a report last week. “It could also cause lawmakers to feel more constrained in their policy choices.”

Only that will never happen, because a politician who is "constrained" in their policy choices - one who doesn't feed the entitlements beast in hopes of winning votes (while generously spreading pork for friends and family) - is a politician who is fired.

Perhaps afraid he would sound too much like ZeroHedge, the CBO director left a glimmer of hope, saying that the nation has “the potential for some changes that seem modest — or maybe start off modest and then get more serious — to have outsized effects on interest rates, and therefore on the fiscal trajectory.” But we doubt even he believes it.

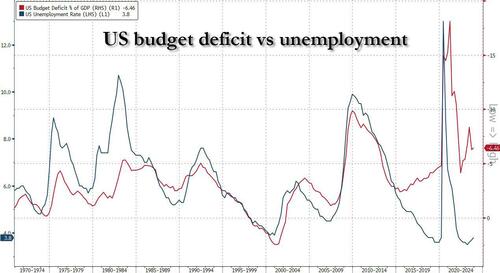

In the CBO’s long-term budget outlook report released last week, the budget agency projected the national deficit would rise “significantly in relation to gross domestic product (GDP) over the next 30 years, reaching 8.5 percent of GDP in 2054.” Which of course, is laughable: the US deficit is already at 6.5% of GDP - a level that traditionally implied there is a major economic crisis - and yet here we are, with unemployment *reportedly* at just 3.8%. Said otherwise, the US deficit will - with 100% certainty - hit 8.5% of GDP during the next recession which will likely be triggered as soon as Trump wins the November election.

The budget scorekeeper attributed the projected growth to rising interest costs, as well as “large and sustained primary deficits, which exclude net outlays for interest." In short, everything is already going to hell to keep "Bidenomics" afloat, but when you also throw in the interest on the debt, well.. that's game over man.

Socialists, and other liberals who are only good at spending other people's money and selling debt until the reserve currency finally breaks, quickly sprung to defense of the debt black hole that the US economy has become.

Bobby Kogan, senior director of federal budget policy at the communist-leaning Center for American Progress think tank, pointed to improved deficit projections in recent years, as well as forecasts from the CBO he said “don’t project anything that looks like a panic.”

“If someone were thinking about, ‘Should I panic or should I not panic?’ I would just say, ‘hey, the underlying situation has gotten better, right?’” Kogan said, adding “there’s been lower, long-term projected deficits in the Biden administration.”

Instead of responding, we will again just show the latest CBO debt forecast chart and leave it up to readers to decide if they should panic or not.

What Kogan said next, however, was chilling: “You either should have been worried a long time ago, or you should be less worried now,” he said. “Because we’ve been on roughly the same path for forever, but to the extent that it’s different, it’s better.”

Actually no, it's not better. It much, much worse, and the fact that supposedly "serious people" are idiots and make such statements is stunning because, well, these are the people in charge!

But he is certainly right that "you should have been worried a long time ago" - we were very worried, and everyone laughed at us, so we decided - you know what, it's not worth the effort, may as well sit back and watch it all sink.

And now bitcoin is at a record $72,000 on its way to $1 million and gold is at a record $2,200 also on its way to... pick some nice round number.... in fact the number doesn't matter if it is denominated in US dollars because very soon, the greenback will go the way of the reichsmark.

And just to make sure that nothing will ever change, even after the US enters the infamous Minsky Moment, shortly after the close we got this headline::

- *UNITED STATES AA+ RATING AFFIRMED BY S&P; OUTLOOK STABLE

Because when nobody dares to tell the truth, why should anything change?

No comments:

Post a Comment