The report below is a "market report" and as such it contains very little wisdom but within a larger framework, it suddenly becomes something else...

Over the last few months, the VIX (market volatility index) has hovered above 20. This is a high and dangerous level because it implies harsher market conditions. If you want to speculate or protect yourself, the higher the VIX goes, the more expensive derivatives become. This is bad for speculators (or market makers, often the same) but it can be deadly for ordinary companies for whom everything becomes more expensive. Suppose you are a Japanese or German company exporting to Thailand. If you can cover yourself and sell now the Thai Bahts you're going to receive next month, you're safe. You know how much you're going to receive. But if the VIX is very high and consequently the cost of covering the exchange rate is exorbitant, you're not going to do it and the risk of currency loss can be very high, wiping out all your profits. This is not a detail as eventually it will act as a brake on the economy.

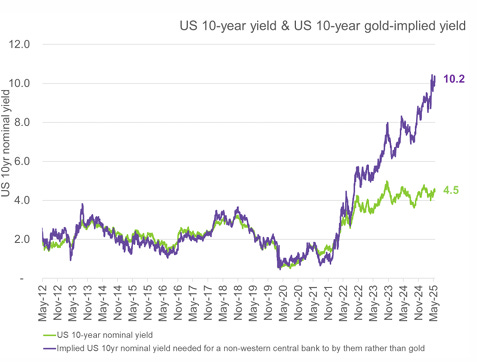

Likewise, the cost of long term borrowing for the US (above 4.5% for 10 years) and for Japan (above 3.5% for 20 years) is skyrocketing in spite of massive buy-backs from the central banks. And here we see one of the reason for the rise, the implied risk premium of confiscation which is below calculated at 5+%.

In both case, what we are witnessing is the breakdown of markets which are already heavily controlled. This is why we literally cannot have a recession at this stage. Everything would break. Over-indebted companies would go belly-up, trade would stop to a standstill and governments would not be able to refinance their huge piles of debt. They would practically be bankrupt.

This is what approaching the storm looks like. The markets, at least on the front pages of the newspapers are doing well, although in the background, slowly the old structures are hissing and cracking like an old galleon in a storm. The interest rates are water rising in the hull. Trade withering are the sails being lowered due to rising winds (the VIX). Implied gold premiums are "other" (mostly long term bonds) goods being thrown overboard to lighten the boat. Let's not take the overused example of the Titanic to illustrate why the fact that the music is still playing on the main deck not necessarily a good sign, but you get the picture. The captain while reassuring the passengers must be getting more and more worried reading reports as this one:

Why Gold Is Replacing Treasuries in Reserve Portfolios

Authored by GoldFix, ZH Edit

SEB (Skandinaviska Enskilda Banken), is a leading financial services group in Northern Europe. They published an interesting (if aggressive) comment on Gold vs Treasuries. Here is that analysis broken down with their original comments attached.

Contents

- The End of a Longstanding Correlation

- Treasuries Now Carry Political Risk

- Quantifying the Risk: A 5% Political Discount

- Gold’s Implied Risk Premium Is 5.7%

- Strategic Drivers Ahead: US–China Conflict, Powell’s Successor

- Gold as Core, Treasuries as Conditional

The End of a Longstanding Correlation

Historically, gold traded inversely to U.S. 10-year real yields. That relationship held for years, reinforcing the idea that gold was a simple reflection of inflation expectations. But the correlation broke decisively in Q1 2022. The turning point wasn’t a macroeconomic event—it was geopolitical.

Following the Russian invasion of Ukraine, Western central banks froze approximately $600 billion in Russian FX reserves, the majority of which were held in U.S. dollars and euro-denominated assets. The move shattered the assumption that sovereign reserves—even in the absence of default—were untouchable. It introduced a new axis of risk: political confiscation.

Treasuries Now Carry Political Risk

To reserve managers in Beijing, Riyadh, and elsewhere outside the G7 framework, the seizure of Russian reserves was a warning. It indicated that access to U.S. Treasuries is contingent on political alignment with Washington. From a portfolio construction standpoint, this amounts to introducing a “confiscation tail-risk” into what was once considered the world’s safest asset.

No formal default occurred. Yet for all practical purposes, the reserves failed. In a sanctions-driven world, the traditional safe haven becomes a conditional one. Holding U.S. government bonds now includes a non-trivial probability of being locked out of your own assets.

Quantifying the Risk: A 5% Political Discount

How do non-Western central banks internalize this new environment? The report offers a plausible scenario: they may now price in a 5% chance (1-in-20 odds) of bond confiscation. If such an outcome carries irreversible consequences, a rational actor would demand at least a 5% additional yield to offset the risk.

Continues here

No comments:

Post a Comment