It takes a long time to grow a debt bubble, but history shows that in reality it is not that long. 80 years on average, a human lifespan. If you take the early 1950s as the start of the current one, we are almost there, close to the end of the current one. What will give first? Debt in China? Profligacy in the US? Distortions in Europe? This article explains this last possibility. I agree. This would explain the Covid madness engulfing the continent...

Authored by Alasdair Macleod via GoldMoney.com,

A Euro Catastrophe Could Collapse It

This article looks at the situation in the euro system in the context of rising interest rates. Central to the problem is role of the ECB, which through monetary inflation embarked on a policy of transferring wealth from fiscally responsible member states to the spendthrift PIGS and France. The consequences of these policies are that the spendthrifts are now ensnared in irreversible debt traps.

Even in a Keynesian context, the ECB’s monetary policy is no longer to stimulate the economy but to keep the spendthrifts afloat. The situation has deteriorated so that Eurozone commercial banks appear to have credit restricted in New York, evidenced by the reluctance of the US banks to enter into repo transactions with them, leading to the market failure in September 2019 when the Fed had to intervene.

An examination of the numbers strongly suggests that even Eurozone banks, insurance companies and pension funds are no longer net buyers of Eurozone government debt. It could be because the terms are unattractive. But if that is the case it is an indictment of the ECB’s asset purchase programmes deliberately suppressing rates to the point where they are unattractive, even to normally compliant investors.

Consequently, without any savings offsets, the ECB has gone full Rudolf Havenstein, and is following similar inflationary policies to those that impoverished Germany’s middle classes and starved its labourers and the elderly in 1920-1923. That the German people are tolerating such an obvious destruction of their currency for the third time in a hundred years is simply astounding.

Institutionalised Madoff

Schemes to pilfer from people without their knowledge always end in disaster for the perpetrators. Central banks using their currency seigniorage are no exception. But instead of covering it up like an institutionalised Madoff they use questionable science to justify their openly fraudulent behaviour. The paradox of thrift is such an example, where penalising savers by suppressing interest rates supposedly for the wider economic benefit conveniently ignores the theft involved. If you can change the way people perceive reality, you can get away with an awful lot.

The mass discovery by the people of the fraud perpetrated on the people by those supposedly representing the people is always the reason behind a cycle of crises and wars. It can take a long period of suffering before an otherwise supine population refuses to continue submitting unquestionably to authority. But the longer the condition exists, the more oppressive the methods that the state uses to defer the inevitable crisis become. Until something finally gives. In the case of the euro, we have seen the system give savers no interest since 2012, while the quantity of money and credit in circulation has debased it by 63% (measured by M3 euro money supply).

Furthermore, prices can be rigged to create an illusion of price stability. The US Fed increased its buying of inflation-linked Treasury bonds (TIPS) since March 2020 at a faster pace than they were issued by the US Treasury, artificially pushing TIPS prices up and creating an illusion that the market is unconcerned about price inflation.

But that is not all. Government statisticians are not above fiddling the figures or presenting figures out of context. We believe the CPI inflation figures are a true reflection of the cost of living, despite the changes over time in the way prices are input. We believe that GDP is economic growth — a questionable concept — and not growth in the quantity of money. We even believe that monetary inflation has nothing to do with prices. Statistics are designed to deceive. As Lord Canning said 200 years ago, “I can prove anything with statistics but the truth”. And that was before computers, which have facilitated an explosion in the quantity of questionable statistics. Can’t work something out? Just look at the stats.

A further difference between Madoff and the state is that the state forces everyone to submit to its monetary frauds by law. And since as law-abiding citizens we respect the law, we even despise those with the temerity to question it. But in the process, we hand enormous power to the monetary authorities, so should not be surprised when that power is abused, as is the case with interest rates and the dilution of the state’s currency. And it follows that the deeper the currency fraud, when something gives, the greater is the ensuing crisis.

The best measure of market distortions from deliberate actions of the monetary authorities we have is the difference between actual bond yields and an estimate of what they should be. In other words, assessments of the height of negative real yields. But any such assessment is inherently subjective, with markets and statistics either distorted, rigged, or unable to provide the relevant yardstick. But it makes sense to assume that the price impact, that is the adjustment to bond prices as markets normalise, is greatest for those where nominal bond yields are negative. This means our focus should be directed accordingly. And the major jurisdictions where this applies is Japan and the Eurozone.

The eurozone’s banking instability

A critique of Japan’s monetary policy must be reserved for a later date, in order to concentrate on monetary and economic conditions in the Eurozone. The ECB first reduced its deposit rate to 0% in July 2012. That was followed by its initial introduction of negative deposit rates of -0.1% in June 2014, followed by -0.2% later that year, -0.3% in 2014, -0.4% in 2016 and finally -0.5% in September 2019. The last move coincided with the repo market blow-up in New York, the day that the transfer of Deutsche Bank’s prime dealership to the Paris based BNP was completed.

We can assume with reasonable certainty that the coincidence of these events showed a reluctance of major US banks to take on either of these banks as repo counterparties, as hedge and money funds with accounts at Deutsche decided to move their accounts elsewhere, which would have blown substantial holes in Deutsche’s and possibly BNP’s balance sheets as well, thereby requiring repo cover. The reluctance of American banks to get involved would have been a strong signal of their reluctance to increasing their counterparty exposure to Eurozone banks.

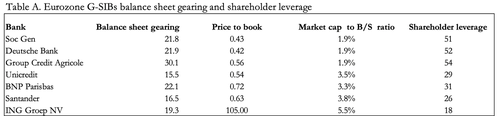

We cannot know this for sure, but it is the logical explanation for what happened. In which case, the repo crisis in New York was an important advance warning of the fragility of the Eurozone’s monetary and banking system. A look at the condition of the major Eurozone global systemically important banks (G-SIBs) in Table A, explains why.

Balance sheet gearing for these banks is roughly double that of the major US banks, and except for Ing Group, deep price-to-book discounts indicate a market assessment of these banks’ credit risk as exceptionally high. Other Eurozone banks with international counterparty business deemed not significant enough to be labelled as G-SIBs but still capable of transmitting systemic risk could be even more highly geared. The reasons for US banks to limit their exposure to the Eurozone banking system on these grounds alone are compelling. And the persistence of price inflation today is a subsequent development, likely to expose these banks as being riskier still because of higher interest rates on their exposure to Eurozone government and commercial bonds, and defaulting borrowers.

The euro credit cycle has been suspended

When banks buy government paper, it is usually because they see it as the risk-free alternative to expanding credit to non-financial private sector actors. In the normal course of an economic cycle, it is inherently cyclical. Both Basel and national regulations enhance the concept that government debt is risk-free, giving it a safe-haven status in times of heightened risk. In a normal bank credit cycle, banks will tend to hold government bills and bonds with less than one year’s maturity and depending on the yield curve will venture out along the curve to five years at most.

These positions are subsequently wound down when the banks become more confident of lending conditions to non-financial borrowers when the economy improves. But when economic conditions become stagnant and the credit cycle is suspended due to lack of recovery, banks can accumulate positions with longer maturities.

Other than the lack of alternative uses of bank credit, this is for a variety of reasons. Trading desks increasingly seek the greater price volatility in longer maturities, central banks encourage increased commercial bank participation in government bond markets, and yield curve permitting, generally longer maturities offer better yields. The more time that elapses between investing in government paper and favouring credit expansion in favour of private sector borrowers, the greater this mission creep becomes.

As we have seen above, the ECB introduced zero deposit rates nearly 10 years ago, and private sector conditions have not generated much in the way of bank credit funding. Lending from all sources including securitisations and bank credit to a) households and b) non-financial corporations since 2008 are shown in Figure 1.

Before the Covid pandemic, total lending to households had declined from $9 trillion equivalent in 2008 to $7.4 trillion in 2019 Q4. And for non-financial corporations, total lending declined marginally over the same period as well. Admittedly, this period included a credit slump and recovery, but on a net basis lending conditions stagnated.

But bank credit for these two sectors will have contracted, allowing for net bond issuance of collateralised consumer debt and by corporations securing cheap finance by issuing corporate bonds at near zero interest rates, which are contained in Figure 1.

Following the start of the pandemic, lending conditions expanded under government direction and borrowing by both sectors increased substantially.

Meanwhile, over the same period bond issuance to governments increased, particularly since the pandemic started, illustrated in Figure 2.

The charts in Figures 1 and 2 support the thesis that credit expansion and bond finance had, until recently, disadvantaged the non-financial private sector. The expansion of government borrowing has been entirely through bonds bought by the ECB, as will be demonstrated when we look at the euro system balance sheet. They confirm that zero and negative rates have not stimulated the Eurozone’s economies as Keynesians theorised. And the increased credit during the pandemic reflects financial support and not a renewed attempt at Keynesian stimulation.

The purpose of debt expansion is important because the moment the supposed stimulus wears off or interest rates rise, we will see bank credit for households and businesses begin to contract again. Only this time, there will be a heightened risk for banks of collateral failure. And higher interest rates will also undermine mark-to-market values for government and corporate bonds on their balance sheets, which could rapidly erode the capital of Eurozone banks, given their exceptionally high gearing shown in Table A above.

Figure 3 charts the euro system’s combined balance sheet since August 2008, the month Lehman failed, when it stood at €1.43 trillion. Greece’s financial crisis ran from 2012-2014, during which time the balance sheet expanded to €3.09 trillion, before partially normalising to €2.01 trillion. In January 2015, the ECB launched its expanded asset purchase programme (APP — otherwise referred to as quantitative easing) to prevent price inflation remaining too low for a prolonged period. The fear was Keynesian deflation, with the HICP measure of price inflation falling to -0.5% at that time, despite the ECB’s deposit rate having been already reduced to -0.2% the previous September.

Between March 2015 and September 2016, the combined purchases by the ECB of public and private sector securities amounted to €1.14 trillion, corresponding to 11.3% of euro area nominal GDP. The APP was “recalibrated” in December 2015, extended to March 2017 and beyond, if necessary, at €60bn monthly. And the deposit rate was lowered to -0.3%. Not even that was enough, with a further recalibration to €80bn monthly in March 2016, with it intended to be extended to the end of the year when it would be resumed at the previous rate of €60bn per month.

The expansion of the ECB’s balance sheet led to the rate of price inflation recovering to 1% in 2017, as one would expect. With the expansion of credit for the non-financial private sector going nowhere (Figures 1 and 2 above), the Keynesian stimulus simply failed in this objective. But when in March 2020 the US Fed reduced its funds rate to 0% and announced QE of $120bn monthly, the ECB did what it had learned to do when in a monetary hole: continue digging even faster. March 2020 saw the ECB increase purchases under the asset purchase programme (APP) and adopt a new programme, the pandemic emergency purchase programme (PEPP). These measures are the reason why the volumes of the Eurosystem’s monthly monetary policy net purchases are higher than ever before, driving its balance sheet total to over €8.5 trillion today.

The ECB’s bond purchases closely matched the funding requirements of national central banks, both being €4 trillion between January 2015 and June 2021. The counterpart to these purchases is an increase in the amount of circulating cash. In other words, the ECB has gone full Rudolf Havenstein. There is no difference in the ECB’s objectives compared with those of Havenstein when he was President of the Reichsbank following the First World War; a monetary policy that impoverished Germany’s middle classes and pushed the labouring class and elderly into starvation by collapsing the paper-mark. Except that today, German society is paying through the destruction of its savings for the spendthrift behaviour of its Eurozone partners rather than that of its own government.

The ECB now has an additional problem with price inflation picking up globally. Producer input prices in Europe are rising strongly with the overall Eurozone HICP rate for November at 4.9% annualised, and doubtless with more rises to come. Oil prices have risen over 50% in a year, and natural gas over 60%, the latter even more on European markets due to a supply crisis of its governments’ own making.

Increasingly, the policy purpose of the ECB is no longer to stimulate the economy, but to ensure that spendthrift member state deficits are financed as cheaply as possible. But how can it do that when on the back of soaring consumer prices, interest rates are now going to rise? Clearly, the higher interest rates go, the faster the ECB will increase its balance sheet because it is committed to not just covering every Eurozone member state’s budget deficit but the interest on their borrowings as well.

But there’s more. In a speech on 12 October, Christine Lagarde, the President of the ECB indicated that it stands ready to contribute to financing the transition to carbon neutral. And in a joint letter to the FT, the President of France and Italy’s Prime Minister called for a relaxation of the EU’s fiscal rules so that they could spend more on key investments. This is a flavour of what they said:

"Just as the rules could not be allowed to stand in the way of our response to the pandemic, so they should not prevent us from making all necessary investments," the two leaders wrote, while noting that "debt raised to finance such investments, which undeniably benefit the welfare of future generations and long-term growth, should be favoured by the fiscal rules, given that public spending of this sort actually contributes to debt sustainability over the long run."

The rules under the Stability and Growth Pact have in fact been suspended, and are planned to be reapplied in 2023, But clearly, these two high spenders feel boxed in. The Stability and Growth Pact will almost certainly be eased — being a charade, rather like the US’s debt ceiling. The trouble is Eurozone governments are too accustomed to inflationary finance to abandon it.

If the ECB could inflate the currency without the consequences being apparent, there would be no problem. But with prices soaring above the mandated 2% target that is no longer true. Up to now, the ECB has been in denial, claiming that price pressures will subside. But we know, or should know, that a rise in the general level of prices is due to monetary expansion, the excessive plucking of leaves from the magic money tree, particularly at an enhanced rate since March 2020 which is yet to be reflected fully at the consumer level. And in its duty to fund the PIGS government deficits, the ECB’s balance sheet expansion through bond purchases is sure to continue.

Furthermore, if bond yields do rise, it will threaten to undermine the balance sheets of the highly geared commercial banks.

The commercial banks position

With the economies of Eurozone member states stifled by the ECB’s management of monetary affairs since the Lehman crisis in 2008 and by more recent covid lockdowns, the accumulation of bad debts at the commercial banks is a growing threat to the entire financial system. Table A above, of the Eurozone G-SIBs’ operational gearing and their share ratings, gives testament to the problem.

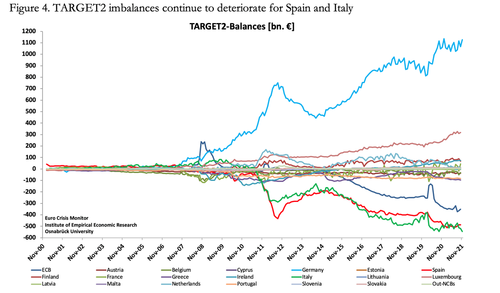

So far, bad debts in Italian and other PIGS banks have been reduced, not by their being resolved, but by them being used as collateral for loans from national central banks. Local bank regulators deem non-performing loans to be performing so they can be hidden from sight in the ECB’s TARGET2 settlement system. Together with the ECB’s asset purchases conducted through national central banks, these probably account for most of the imbalances in the TARGET2 cross-border settlement system, which in theory should not exist.

The position to last October is shown in Figure 4. Liabilities owed to the Bundesbank are increasing again at record levels, while the amounts owed by the Italian and Spanish central banks are also increasing. These balances were before global pressures for rising interest rates materialised. Given the sharp increase in bank lending to households and non-financial corporations since March last year (see Figure 1), bad debts seem certain to accumulate at the banks in the coming months. This is likely to undermine collateral values in Europe’s repo markets, which are mostly conducted in euros and almost certainly exceed €10 trillion, having been recorded at €8.3 trillion at end-2019.[vi] The extent to which national central banks have taken in repo collateral themselves will then become a major problem.

It is against the background of negative Euribor rates that the repo market has grown. It is not clear what role negative rates plays in this growth. While one can see a reason for a bank to borrow at sub-zero rates, it is harder to justify lending at them. And in a repo, the collateral is returned on a pre-agreed basis, so it’s removal from a bank’s books is temporary. Nonetheless, this market has grown to be an integral part of daily transactions between European banks.

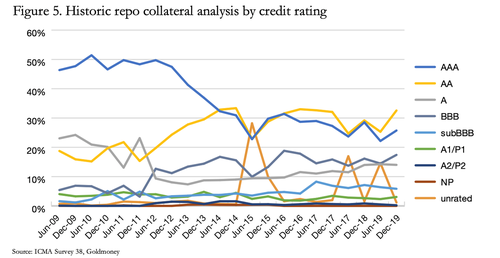

The variations in collateral quality are shown in Figure 5. This differs materially from repo markets in the US, which is almost exclusively for short-term liquidity purposes and uses high quality collateral only (US Treasury bills and bonds and agency debt).

Bonds rated BBB and worse made up 27.7% of the total collateral in December 2019. In Europe and particularly the Eurozone rising interest rates can be expected to undermine collateral ratings, which with increasing Euribor rates will almost certainly contract the size of the market. This heightens the risk of a liquidity-driven systemic failure, as repo liquidity is withdrawn from banks that depend upon it.

Government finances are out of control

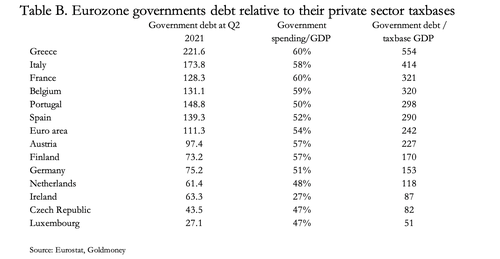

The first column in Table B shows government debt to GDP, which is the conventional yardstick of government debt measurement relative to the economy. The second column shows the proportion of government spending in the total economy relative to GDP, enabling us to derive the third column. The base for government revenue upon which paying down its debt ultimately rests is the private sector, and the third column shows the extent to which and where this true burden lies.

It exposes the impossible position of countries such as Greece, Italy, France, and Belgium, Portugal and Spain, where, besides their own private sector debt burdens, citizens earning their livings without being paid by their governments are assumed by markets to be responsible for underwriting their governments’ debts.

The hope that these countries can grow their way out of their debt is demolished in the context of the actual tax base. It is now widely recognised that will already high levels of taxation further tax increases will undermine these economies.

We can dismiss as hogwash the alterative, the vain hope that yet more stimulus in the form of a further increase in deficits will generate economic recovery, and that higher tax revenues will follow to normalise public finances. It is a populist argument amongst some free marketeers today, citing Ronald Reagan’s and Margaret Thatcher’s successful economic policies. But in those times, the US and UK governments were not nearly so indebted and their economies were able to respond positively to lower taxes. Furthermore, price inflation was declining then while it is increasing today.

And as a paper by Carmen Reinhart and Ken Rogoff pointed out, a nation whose government debt exceeds 90% of GDP has great difficulty growing its way out of it.[vii]Seven of the Eurozone nations already exceed this 90% Rubicon, and their debts are still growing considerably faster than their GDP. At 111% the entire Euro area itself is well above it. Taking account of the smaller proportion of private sector activity relative to those of their governments highlights the difference between the current situation and that of nations that managed to pay down even higher debt levels after the Second World War by gently inflating their way out of a debt trap while their economies progressed in the post-war environment.

Additionally, we should bear in mind future government liabilities, whose net present values are considerably greater than their current debt. Over time, these must be financed. And with rising price inflation, hard costs such as healthcare escalate them even further. The position gets progressively worse as these mandated costs become realised.

There is a solution to it, and that is to cut government spending so that its budget always balances. But for socialising politicians, slashing departmental budgets is the equivalent of eating their own children. It is a reversal of everything they stand for. And it requires welfare legislation to be rescinded to stop the accumulation of future welfare costs. There is no democratic mandate for that.

Conclusion

Rising interest rates globally will affect all major currencies, and for some of them expose systemic risks. An examination of the existing situation and how higher interest rates will affect it points to the Eurozone as being the most likely global weak spot.

The Eurozone’s debt position pitches the entire global financial and economic system further towards a debt crisis than generally realised. Particularly for Greece, Italy, France, Belgium, Portugal, and Spain in that order of indebtedness, the problem is most acute. They only survive because the ECB ensures they can pay their bills by funding them totally through inflation of the quantity of euros in circulation. The ECB’s entire purpose has become to transfer wealth from the more fiscally prudent member states to the spendthrifts by debasing the currency.

In the process, based on figures provided by the Bank for International Settlements the banking system is contracting credit to the private sector, and it is not even accumulating government bonds, which is a surprise. Much like banks in the US, Eurozone banks have become increasingly distracted into financial activities and speculation. The difference is the high level of operational gearing, up to thirty times in the case of one major French bank, while most of the US’s G-SIBs are geared about 11 times on average.

This article points to these disparities between US and EU banking risks having been a factor in the US repo market failure in September 2019. And we can assume that the Americans remain wary of counterparty exposure to Eurozone banks to this day.

That the ECB is funding net government borrowing in its entirety indicates that even investing institutions such as pension funds and insurance companies, along with the banks are sitting on their hands with respect to government debt. It means that savings are not offsetting the inflationary effects of government bond issues. It represents a vote to stay out of what has become a highly troubling and inflationary situation. The question arises as to how long this extraordinary situation can continue.

It must come to an end some time, and by destabilising a highly leveraged banking system the end will be a crisis. With its GDP being similar in size to China’s (which is seeing a more traditional property crisis unfolding at the same time) a banking crisis in the Eurozone could be the trigger for dominoes falling everywhere.

As for the euro’s future, it seems unlikely that the ECB has the capability of dealing with the crisis that will unfold. It has cheated the northern states, particularly Germany, the Netherlands, Finland, Ireland, the Czech Republic, and Luxembourg to the benefit of spendthrifts, particularly the political heavyweights of France, Italy and Spain. It is a rift likely to end the euro system and the ECB itself. The deconstruction of this shabby arrangement should prove the end of the euro and possibly of the European Union itself.