The end of green policies? Let's hope so. But it's already too late for the economy. The crash is now certain.

Via Consciousness of Sheep

For as long as climate change was off in the distant future,

governments have been able to trade warm words for concrete action. In a

similar vein, a certain kind of green politician has been able to trade

on the pretence that ending fossil fuel use would come at no cost.

Meanwhile, the diesel fuel kept the arteries of the global supply chains

flowing even as ever more coal and gas supplied the heat and power for

the technological engines of economic growth. At the same time, the

rest of us could signal our impotent virtue by recycling our glass,

plastic and used clothes, happy in the pretence that they weren’t being

shipped off to Asia to be incinerated or just dumped in the sea.

It all began to fall apart a couple of decades ago when western

oligarchs, celebrities and the corporate technocracy started to drink

the “green energy” Kool-Aid. Governments began taking climate change

just seriously enough to provide lavish corporate welfare subsidies to

the energy industry to deploy large-scale wind and solar farms in the

pretence that these would achieve something more than lining the pockets

of corporate CEOs. Soon enough, green politicians were sharing

platforms with corporate technocrats to talk about “green growth,” while

environmental activists gathered outside – not to challenge this

blatant abuse of corporate welfare, but to call for even more… at any

cost.

By 2017, real-life James Bond Villain Klaus Schwab was inviting

celebrities, representatives of the technocracy, the godzillionaires and

the political class to fly their carbon-belching private jets to

Switzerland to learn about The Fourth Industrial Revolution,

and to discuss how they could get the little people to cut their carbon

footprints. By 2020, this had morphed in to the Green New Great Reset

in which we – but not they, of course – would own nothing, and allegedly be happy as we ate our insects,

spent our central bank digital basic incomes, and were driven around in

a new fleet of corporate-owned, hydrogen-powered self-driving cars.

There was – to paraphrase Captain Blackadder

– just one teensy-weensy problem with the Great Plan adopted by the

Davos crowd… it was bollocks! Only by ignoring the physicists,

engineers and technicians who were expected to make it happen, and by

listening instead to the siren voices of climate NGOs, bankers and

economists, could the technocracy convince itself that the world could

seamlessly transition to the proposed bright green future. And to our

cost, politicians of all stripes who bought into this nonsense are now

grappling with the inevitable economic consequences.

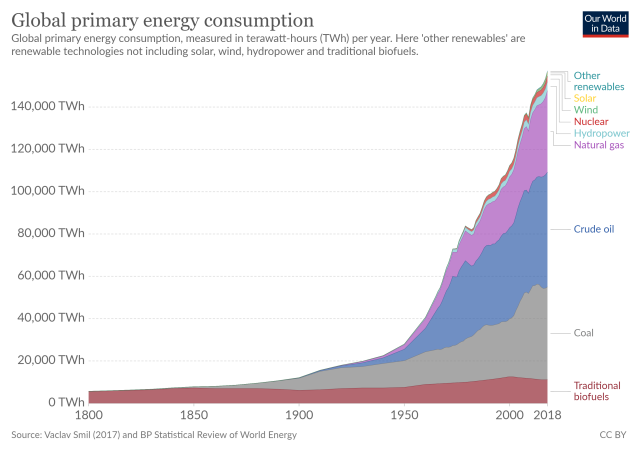

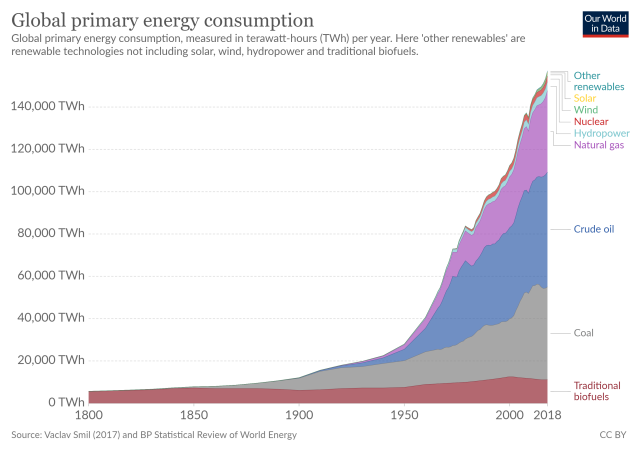

The problem, at is simplest, is that much of what was considered

“green” was largely a conjuring trick. States like Britain and Germany,

which claim to be world leaders simply offshored their most polluting

industries (and a large part of the waste) to less prosperous parts of

the world where governments were happy to load the environmental costs

onto the indigenous population in exchange for tradable foreign

currency. This was the only politically-acceptable means of hiding the

fact that there is simply no way of maintaining even a fraction of the

western standard of living in the event that anyone were foolish enough

to remove the fossil fuels which make up some 80 percent of the energy

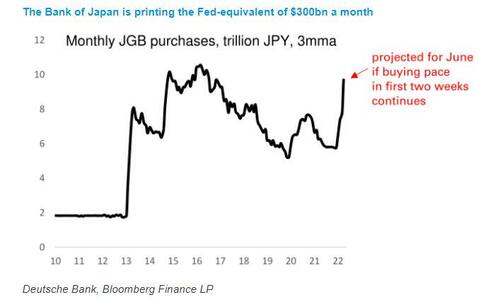

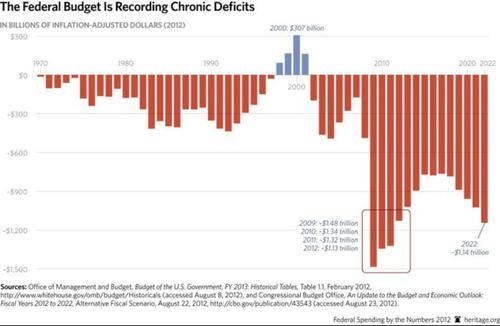

mix in the UK, and 85 percent of the global economy:

Even this is a simplification of the problem because each fuel source

has its uses in specific niches of the global economy and so is not

interchangeable. Wind and solar, for example, cannot generate the heat

required to manufacture steel (although they can recycle it) or,

ironically, to produce the silicon wafers and high-grade glass required

in solar panels.

Things get even more complicated when we consider that the broad

categories of fossil fuels can be sub-divided into different grades.

Coal, for example, can vary from the high-quality anthracite used in the

steel industry all the way to the lignite (brown coal) that Germany

still uses to keep its lights on. Oil comes with different degrees of

sulphur content – sweet to sour – and in a range of specific gravities –

light to heavy. And each of the refineries around the world is set up

to process a particular grade of oil. The same goes for the oil

products, of course – as anyone who ever made the mistake of putting

diesel in a petrol car can tell you. Everything from the ultra-light

butane to the chemical sludge at the bottom of a barrel of oil has some

use to the economy, if not as a fuel, then as a lubricant or as the

chemical base for everything from paint to toothpaste and from plastic

to pharmaceuticals.

The economists behind the Great New Green Reset will tell you that

there is nothing to worry about because of the “law” of infinite

substitutability – the idea that if we run out of an input to the

economy, we will simply find an alternative. Nor is this the only thing

that the economists are simply wrong about. More worryingly, most

economists believe that the economy operates independently of energy.

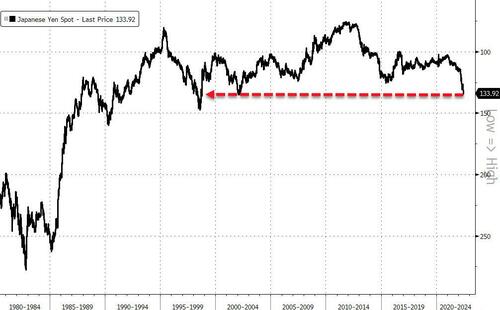

Among other things, this is why they fail to understand that the

current, accelerating stagflation is largely a consequence of their own

past actions.

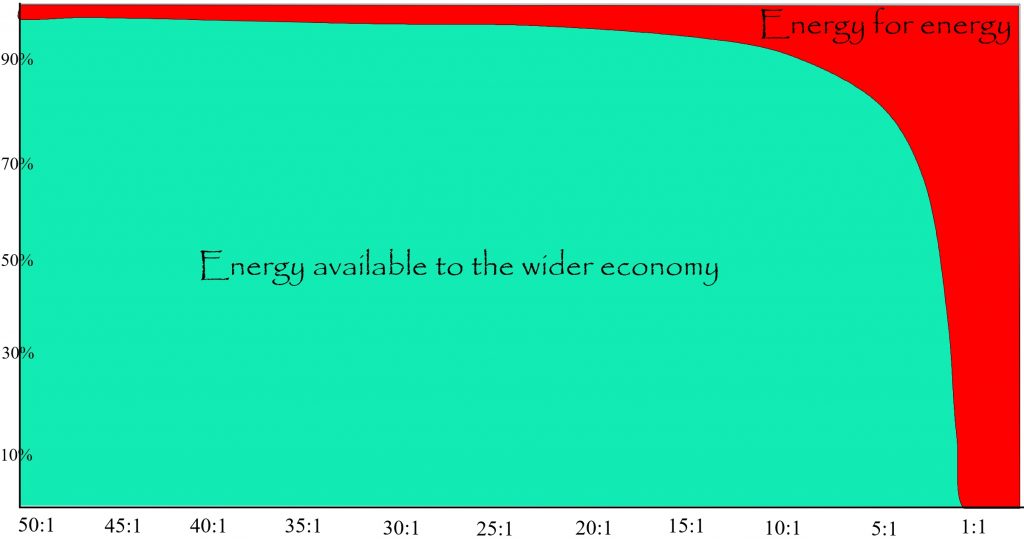

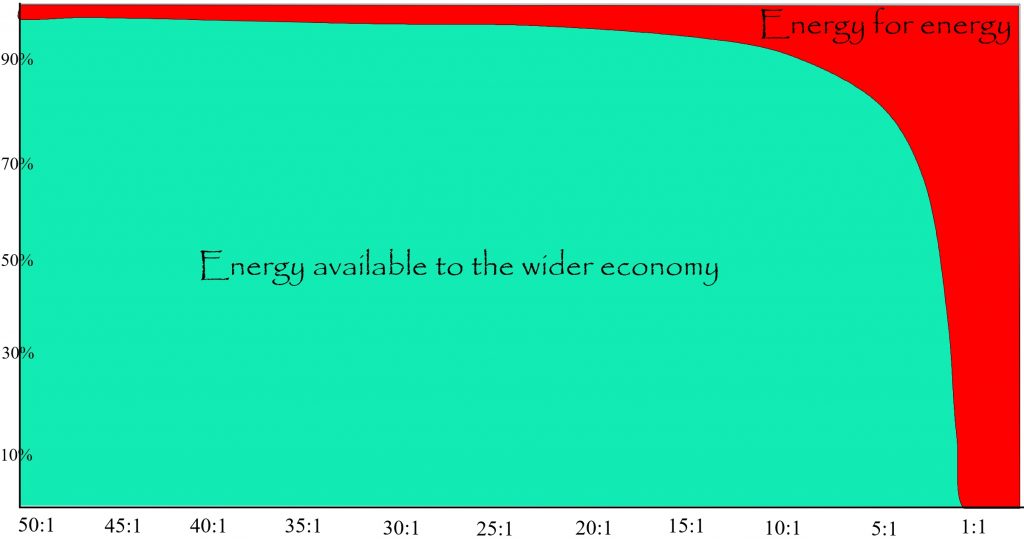

Not only is the economy an energy system (onto which we have imposed a system of monetary claims) but it requires growing

surplus energy to avoid collapse. Before we can use energy, we must

first obtain it. And obtaining energy has an energy cost of its own.

And so, the more energy required to obtain energy, the less surplus

energy is available to power the wider economy, unless we keep growing

the amount of energy produced.

So why might surplus energy fall? Three key reasons are important to

us today. The first is the simple process by which we work our way

from the cheap and easy energy through to the expensive and difficult.

Nobody dug deep coal mines out beneath the North Sea when there were

still seams of coal jutting out of the sides of Welsh hills, just as

nobody spent a fortune hydraulically fracturing a shale deposit when

they could knock a pipe a few feet into the ground to unleash a gusher

of sweet crude. Second, we have been burning fossil fuels at a far

faster rate than we have been discovering new deposits. As a result, we

have already passed peak oil, and are rapidly approaching peak gas and

coal too. Third, for green policy purposes, we have been disinvesting

from further fossil fuel development while adding energy-expensive and

difficult to incorporate energy-harvesting technologies into the energy

mix.

By making the energy cost of energy grow in this way, we strip the

wider economy of the means to prevent a rapid and potentially

catastrophic collapse as we approach a “net energy cliff:”

The sleight of hand used by the purveyors of the Great Green New

Reset is achieved by measuring the energy returned from a non-renewable

renewable energy-harvesting technology (NRREHT) running at capacity at

the point of entry to the system – e.g., at the base of the wind

turbine. This allows proponents to claim energy returns of 15:1 or

more. But the real energy cost of any form of energy to the economy is

at the point of use – e.g., the energy cost of petrol at the filling

station or electricity at the wall socket. So that once the system

balancing costs have been taken into account, the energy returns are

more modest.

It is in this respect that the true energy costs of NRREHTs have their consequences. As energy economist Dieter Helm – a prominent supporter of a managed transition to NRREHTs by the way – argued last January:

“The current crisis was very predictable, and its causes run

deep. A series of simple myths have been spun out to the wider

population, which simply are not true. It is not yet true that

renewables are cheaper than the main fossil fuels once intermittency is

taken into account. Simply ignoring the need for back-up in claims about

renewables costs will not make them go away. It is not true that the

electrification of transport is going to be costless and painless after a

short ‘transition’. It is not true that electric cars have zero

emissions, at least not until we have all low-carbon electricity

generation, and it is not true that cars and car batteries involve

near-zero emissions to make and run. It is not true that heat pumps will

pay for themselves in the near future once all the costs are

considered, and it is not true that they are at least as good as gas,

especially in old houses and in winter, even if the electricity they use

is all zero carbon (which it is not). It is not true that carbon

capture and storage (CCS) is cheap, tried and tested, and without risks.

It is not true that we have a solution to nuclear waste. It is not true

that biomass is generally carbon-neutral, nor is growing maize for

anaerobic digestors, and that there is lots of ‘waste wood’ to turn into

pellets. And so on…

“Wind and solar farms do not pay for the costs of the

intermittency they cause. They therefore have little incentive to

minimise them. It is a nonsense to compare the costs of wind with the

costs of, say, gas or nuclear without including the back-up costs for

wind necessitated by the intermittency…

“In the current energy crisis, it is this intermittency that has

been a major factor in shaping the huge impact of a gas price spike. Low

wind has to be taken into account. 2021 was a year with exceptionally

low wind. The worry comes in winter, with low wind, high pressure, and

cold air over Northern Europe.”

Helm is wrong only in his claim that last winter’s price hikes were

“The first net zero energy crisis.” That accolade surely goes to the national blackout on 9 August 2019,

when the pitfalls of adding too much intermittent supply to the system

was brought home to anyone caught up in the chaos. The point stands

though, the true energy – and thus economic – cost of NRREHTs is far higher than has been claimed. And the consequences of this additional cost are the inflation – as energy cost increases drive up the cost of every product and service which uses energy

– and the stagnation – as ever more of us are obliged to switch

spending away from discretionary purchases in order to manage the rising

cost of essentials – which is set to plunge the western economies into a

depression worse than the 1930s.

This process of decline has been gathering pace ever since the peak

of conventional oil production was reached in 2005. Two acts of

insanity, however, on the part of the western technocracy have

dramatically accelerated the collapse in the past couple of years.

Shutting down the global economy in the face of a relatively mild

pandemic, for example, would prove to be a huge blow to the western

economies. On the one hand this is because the breakdown of

just-in-time supply is not easily overcome. Less obviously though,

investment was pulled from commodity extraction – including fossil fuels

– while the economic indicators on which investment is usually

determined went haywire. This is one reason why energy and commodity

prices spiked upward as economies opened up in the summer and autumn of

2021.

Notably, various “green” leaning technocrats, politicians and

activists wrongly used the example of lockdowns, furlough payments and

stimulus cheques to claim that this provided the basis for a new, green,

sustainable economy. Suddenly they all claimed they wanted to “build

back better.” For much the same reason, the same people – led by German

Green Party foreign minister Annalena Baerbock and economic affairs and

climate action minister Robert Habeck – have used the Russian invasion

of Ukraine as an opportunity for green disaster capitalism,

with a view to ending Europe’s dependence on Russian oil and gas, and

Kazak coal in a matter of months rather than the decades that any sane

transition away from fossil fuels would require.

Slightly less deranged members of the political class at least

imagine that Russian oil and gas can be replaced with expanded output

from Saudi Arabia, Qatar, Venezuela and the USA. In practice though,

output from these states is already at or close to maximum. Moreover,

the manner in which anti-Russian sanctions have been applied

has resulted in most of the world’s commodity-producing states

regarding Europe and the USA as unreliable trading partners and

potentially dangerous places to park wealth. As such, there is little

incentive for them to ramp up production just to bail out western states

– especially given that rising demand and prices mean more income for

them.

This is of little concern to the green-leaning technocrats, NGOs and politicians who have faith

in the ability of their part of a highly advanced industrial global

economy to operate without energy. For them, as with pandemic

lockdowns, oil and gas sanctions are an experiment – in which you and I

are mere guinea pigs – in forcing people to accept forms of

eco-austerity that would otherwise be impossible to impose. Not, of

course, that Europe will be entirely foregoing the Russian oil that

accounts for some 30 percent of its oil imports. Instead, we are about

to be treated to a process of oil laundering,

in which tanker owners will move Russian oil to a third country – such

as India or Turkey – where it will be unloaded and then re-loaded and

provided with new paperwork to prove that it is not Russian.

European consumers will still be using the products of Russian oil, they

will just be paying a huge premium for the privilege.

Gas is even more problematic because of the absence of a sufficient

tanker fleet or the required terminal facilities. As a result, as

Europe cuts itself off from Russian gas, it has little possibility of an

alternative supply, and so must either find an alternative energy

source or lower its economic activity accordingly – a process made all

the harder because of the dependence of NRREHTs electricity generators

on gas as the only viable back-up for the intermittency of renewable

energy.

While Green Party politicians and climate NGOs and activists are not

entirely to blame for the unfolding crisis, their dishonesty may well

cost them dear anyway. Privately, most have been prepared to concede

that a transition away from fossil fuels was always going to come at an

unpalatable price for most people, and crucially within the

grossly unequal western economies there was a high risk of eco-austerity

for the majority. Publicly though, they avoided mentioning this

because they knew that only fools would vote for it. The hope was that

various “environmentally friendly” policies could be smuggled in by

stealth. And for a long time, it didn’t seem to matter because it was

all a long way in the future, by which time it would be someone else’s

problem.

Well, that future has arrived, and the eco-austerity is only just

beginning. Nevertheless, it is already creating big political waves.

We might, for a while, get away with the myth that what is happening is

all the fault of “Madman Putin”

– but that narrative gets very old very quickly for households forced

to choose between food and warmth in the depths of winter. And as Helm points out:

“All of this matters because it means that the current price

shock is not temporary, even if the gas price falls back. We are not

going to get out of gas anytime soon. Indeed with the extra demand for

electricity for transport, the digital technologies and heating too, the

problem will get a lot worse before it gets better. The cost of energy

will keep going up, and the energy strategy and other net zero problems

will contribute to this rise in costs. Whilst the public have been led

to believe that net zero is a free lunch (or at least a manageable 1% of

GDP or less), it is very much not so. Important and worth doing, but a

much bigger cost of living rise than our leaders, and the campaigners

against climate change generally, would like us to believe. They fear

scaring the horses, but they cannot stop us being confronted with the

cost.”

Having burned our bridges with Russia – and increasingly with the 75

percent of the world’s states that have not benefited from the dollar

currency system – there is no law that says we have to go back to an

abundant and relatively cheap supply of fossil fuels anytime soon (or,

indeed, at all). Nor is there any reason for any sane investor to throw

good money after bad on energy investments – particularly in deposits

which have not been economically viable below today’s high prices –

while the energy market is so volatile, and it is far from clear that

businesses and households can afford the increased prices. And even if

investment does begin to flow toward new projects, nothing is going to

change before the coming winter. Even if gas prices have fallen from

last year’s peak, they remain too high for too many people. Petrol

prices, meanwhile, can only go up as the cost of oil laundering arrives

at the pumps – £3.00 per litre ($15 per US gallon) petrol may arrive

sooner than anyone would have wanted.

To make matters worse, high prices may well be accompanied by actual

shortages this winter. Energy and financial media have been tracking a

UK diesel fuel shortage for several months, although this has yet to

break through to the establishment media. John Kemp at Reuters, for example, recently wrote that:

“Britain was experiencing a severe shortage of distillate fuel

oil even before Russia’s invasion of Ukraine, which sanctions now

threaten to make much worse.

“UK diesel and gas oil inventories had fallen to 1.57 million

tonnes by the end of February, down from 2.23 million at the same point a

year earlier, and the lowest seasonal level since 2014/15 and before

that 2008.”

As with so much else of Britain’s economic base, diesel refining was

offshored by successive neoliberal governments, with the result that we

now depend upon imports for 40 percent of the fuel which keeps our

transport, industry and agriculture operating. And where, pray, did we

offshore that diesel production to?

“Russia was the single largest source, accounting for 33% of all distillate imports and 17% of total consumption.”

Kemp claims that Russian diesel can be replaced by supplies from

other oil states, but also concedes that sanctions will raise global

demand considerably. And so, once again, we will experience rationing

by price for an essential fuel which is already trading higher than the wider economy can afford.

Electricity is going to be in short supply this winter too, as we will no longer have sufficient gas to balance the intermittency of wind. As Kirsten Robertson at Metro reported last Monday:

“As a result of further supply issues, ministers in the UK have

reportedly been warned of potential power cuts to as many as six million

households this winter.

“Limits could be imposed on industrial use of gas, including to

gas-fired power stations, causing electricity shortages… As a result,

six million homes could see their electricity rationed, primarily during

morning and evening peaks, in curbs that may last more than a month.

“Worse modelling is reported for a scenario in which Russia cuts off all supplies to the EU.”

In fact, given the EU technocracy’s decision to embargo their own

states, and given the gas shortages and price increases this will cause,

the number of homes and businesses brought within the UK’s long-standing energy rationing plans

will likely be much higher. And even if households escape enforced

rationing by the state, prices are going to be so high that most

households will be self-rationing anyway… even to the point of staying

cold during the long winter evenings. Older Europeans will be at higher

risk of dying from hypothermia this winter than at any time since the

late 1940s.

The UK Government will likely be forced into providing more financial support – similar to the most recent package

– as energy becomes increasingly unaffordable. But blame will be

placed upon green politicians, NGOs and activists whose siren voices

have led us to the very eco-austerity that they swore could never

happen. By the Spring of 2023, it may well be impossible for a Green

Party politician to ever again be elected, while the likely winners –

absent the emergence of a sane left-leaning opposition – are nationalist

populists like the UK’s Nigel Farage, Donald Trump and his supporters in the USA, and Queensland’s Stephen Andrew, who will seek to deny the need to address climate change entirely… evidence of Roger Pielke’s “Iron Laws of climate policy” in action:

“While people are often willing to pay some price for achieving environmental objectives, that willingness has its limits.”

And:

“When policies focused on economic growth confront policies

focused on emission reduction, it is economic growth that will win out

every time.”

Not only have those limits been reached, but they have also been

exceeded to such an extent that a stagflationary economic depression is

inevitable. And one of its many casualties will be that a long-duped

public will never support so-called “green” policies again.