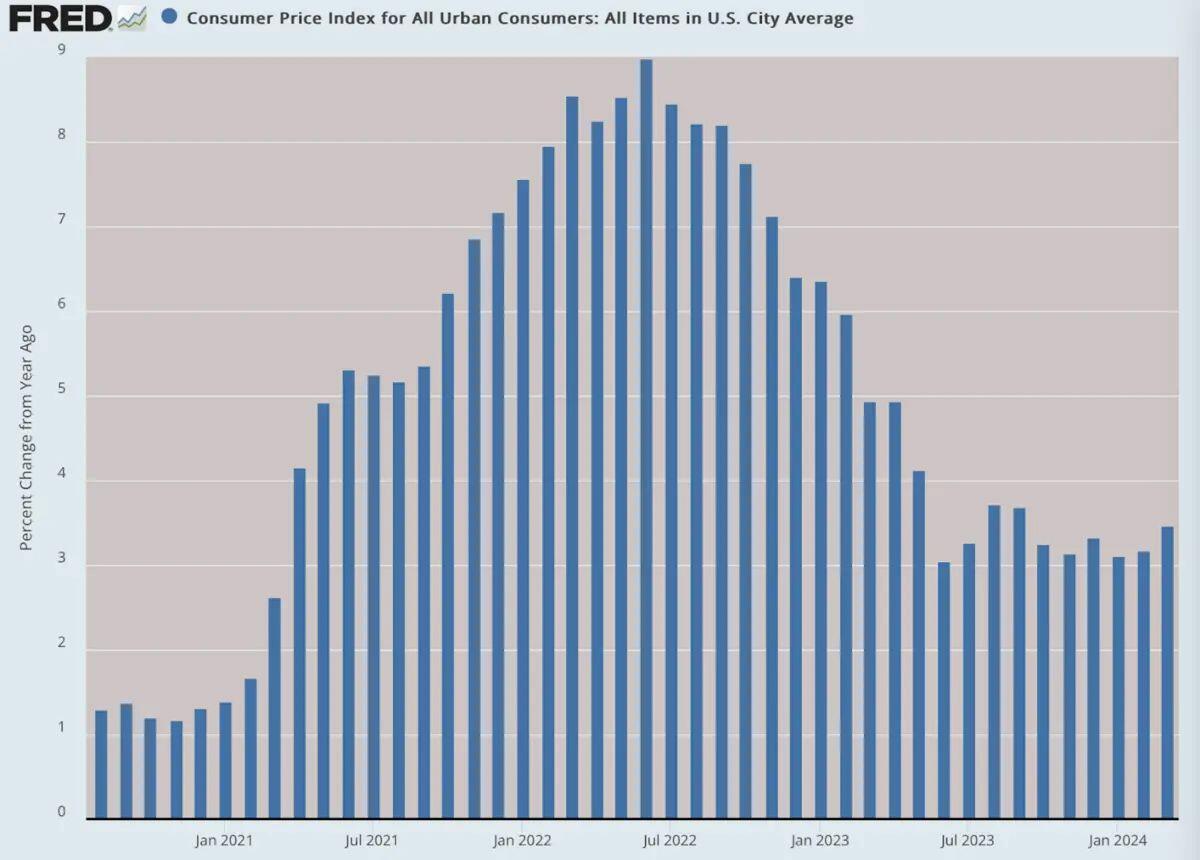

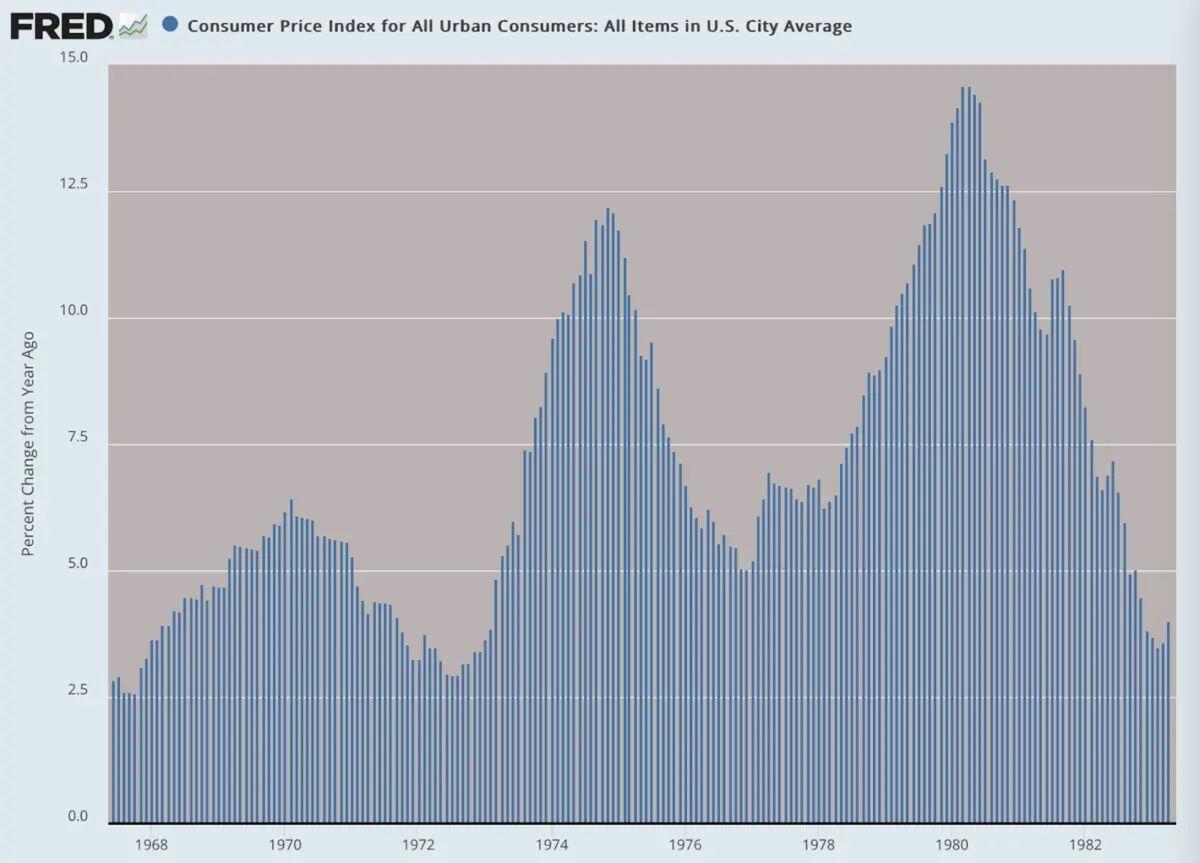

Charles Hugh Smith offers a dismal perspective over the coming years and I still find him overly optimistic in that he believes the system will implode nicely, the economic soft landing applied to social science. The problem with the idea is that it has never happened in the past. What he describes is a projection of the current state of affairs as countries manage somehow to swim among imploding bubbles. This is indeed what Japan did for the last 30 years and what China is confronted to right now. As long as the global supply chain works, somehow, this is indeed a workable option. But sooner than later the global supply chain will break, probably due to war. Then assets will crash massively and suddenly we will find ourselves in a completely different paradigm. What is the likelihood of such a scenario?

Imagine a few bombs over Iran. A massive reaction and more effective bombing of Israel. The Samson-lite option (see the next article) used to dissuade the Mullah. The closing of the Hormuz Strait... Likelihood of happening: 50% Likelihood of transforming the World as we know it: 100%!

Or imagine Ukraine losing badly on the Eastern front, France sending a few soldiers who get killed, more NATO soldiers heading East... Same likelihood of happening, about 50%.

PS: Isn't it what Gold at 2400, the Yen at 154 per USD and Oil above 90 are telling us?

Authored by Charles Hugh Smith via OfTwoMinds blog,

Rather than attempt to evade Caesar's reach, a better strategy might be to 'go gray': blend in, appear average.

Let's start by stipulating that I don't "like" this forecast. I'm

not "talking my book" (for example, promoting nuclear power because I

own shares in a uranium mine) or issuing this forecast because I favor

it. I simply see it as the most likely trajectory of the global

financial system, based on history and the dynamics of human systems.

"Liking" it or not liking it has nothing to do with it: the opinions of Titanic passengers who didn't "like" that the ship was sinking didn't affect the outcome.

You already know the global financial system is untenable. In

a nutshell, the expansion of production and consumption has been funded

by the expansion of credit--money borrowed from future resources and

income. The rate of expanding debt far surpasses the anemic rates of

expanding production, and this rapidly expanding mountain of debt is

perched precariously on the phantom collateral generated by The Everything Bubble,

the astounding expansion of asset prices as those with the lowest cost

access to credit have bid up every asset class, from real estate to gold

to bitcoin to stocks to fine art.

All these assets are phantom collateral because they were bid up on the wings of cheap, abundant credit. History

is rather decisive: all credit-asset bubbles pop, and the price of the

assets round-trips back to pre-bubble valuations. As the bubble pops,

credit shifts from being abundant and near-zero in cost to being scarce

and dear.

The commercial real estate sector (CRE) is a real-time example of this dynamic. Half-empty

buildings are being dumped at a fraction of their peak valuations, and

then sold again for even less or abandoned to default and liquidation.

This is how all bubbles pop; there is no other template supported by

history. Humans cling to magical thinking and grasp at straws rather

than face the unwelcome reality that the cycle has turned and there is

no happy ending for those who believe the "real value" of an asset is

the peak price at the top of the bubble.

Now that we understand the impossibility of keeping The Everything Bubble forever inflated, let's shift our attention to those tasked with keeping the system from collapsing. In

my view, the closest analogy is police officers tasked with protecting

the often ungrateful and undeserving while being plagued by do-gooders

and naysayers who are safely isolated from the wretchedness they demand

the cops deal with in a manner that meets with their refined approval.

In other words, us and them:

only those who share the responsibility for protecting the often

ungrateful and undeserving while being plagued by do-gooders and

naysayers can understand. Outsiders know little of the realities and are

often naive, basing their convictions on what they think "should

happen" rather than the limitations of real life.

This

will be the mindset of the authorities tasked with "saving" the system

we all depend on--especially the wealthiest who have benefited the most. These

is of course the class that feels most entitled to advocate for special

treatment: we're rich and important, so you should listen to us and do

what works for us.

In other words, like the do-gooders, naysayers and whiners telling the cops how to do their jobs. Those

tasked with saving a system sliding toward an inevitable crisis will

have little patience for obstructionists, however well-meaning. The

attitude of those carrying the responsibility for saving the system will

be: do your part, get out of the way, stop whining and be grateful

we're saving the system for your benefit.

Let's now shift to a very common belief of "investors": foreseeing

this crisis, we've piled up "hard money" assets that are safely hidden

from the grubby, illegitimate grasp of authorities. When the crisis

sweeps away the bubble, we'll still be rich, and we'll then scoop up all

the bargain-priced assets, making ourselves even richer.

It gives me no pleasure to say the obvious: please don't be naive. Those

who will be trying to save the system from collapse understand that

every asset is only richly valued now because of the credit bubble. From

their point of view, "investors" who are planning to preserve the

bubble-valuation of their assets and then emerge to snap up everything

for pennies on the dollar are, well, the enemy.

Another

widespread belief holds that the hyper-wealthy always sneak through the

wormhole and emerge with all their goodies intact. This fosters the idea that if they can do it, so can I. History

offers examples on both sides: the great estates of the wealthiest

Romans did not survive intact when the empire crumbled (or put another

way, when control of the shards shifted to a new elite).

As the bottom 99.5% feel the squeeze, their rage at those at the top not paying their fair share will rise exponentially, and

the political pressure on authorities to go after the hyper-wealthy

will become too intense to ignore. Many of those trying to save the

system will have already had enough of coddled billionaires, bankers and

financier grifters.

Another conviction that will be revealed as naive is the faith that the rules will stay unchanged,

allowing us to hoard our stash and emerge unscathed to scoop up the

bargains offered by the less prescient. History is again rather

definitive: the rules will change overnight, and continue changing, as

needed. One "emergency measure" after another will be imposed and become

normalized.

It's important to put ourselves in the shoes

of those struggling with the impossible responsibility of keeping the

system from collapsing. From their point of view, everyone

trying to evade the wealth taxes, windfall taxes, special assessments,

etc. are ungrateful whiners, as what will anyone have if the system

collapses? We're doing you all a favor, taking only 10% in a wealth tax

to preserve the 90% that remains yours.

Another point of naivete is what happens to obstructionists in a full-spectrum surveillance Corporate-state. China

has shown other nation-states how to do it properly: every digital

communication and transaction is monitored, and while VPNs and other

gimmicks offer a few wormholes, the fundamental reality is: it takes an

awful lot of effort to not leave a trail of crumbs, and at some point,

is it worth all the effort? It's much easier to just pay the wealth tax,

the windfall tax, grumble about it, and move on to enjoy life as best

we can.

In China, the local authorities politely invite

transgressors to tea, and offer a suggestion to mend your ways and keep

your nose clean. Those who insist on mucking up the works after the

kindly advice will be neutered one way or another.

The naivete also extends to ways to evade surveillance. We're

all going to get by on barter. Really? Have you actually tried to

exchange stuff with anonymous others? Like many encounters in online

boards, people don't show up, they flake out or decide not to make the

deal. It's tediously time-consuming and frustrating unless you already

have a network of trusted contacts who do this kind of thing all the

time.

In my experience, reciprocity with other

trustworthy productive people works better than barter. Instead of

haggling over price/value, just give stuff away. In a trusted network,

whomever gets the free stuff will scrounge up something to give you for

free in return. These networks tend to have a "node," an outgoing,

friendly, trustworthy person who can find a welcoming home for whatever

is being freely distributed, and pass around what's being given to those

who gave freely of their surplus.

Another point of

naivete is the belief that as an asset soars in value, the authorities

will magically restrain themselves from noticing this juicy target. If

we factor in history and human nature, we will conclude the opposite is

more likely: the authorities will redouble their efforts to track and

collect that which is Caesar's from those trying to evade the collection

of everyone's "fair share."

Given the resources of the

NSA et al., how plausible is it to think little old me is going to leave

no digital crumbs as I go on my merry way? Thanks to

automation of data scraping, it's going to get easier and cheaper to

scrape data looking for miscreants trying to avoid paying "their fair

share."

The whole idea of a wealth tax is it's a tax on all wealth, held anywhere in the world. So

burying assets offshore only works as long as the authorities turn a

blind eye to tax havens. As pressures mount, trusting the eyes to remain

blind might not be as "sure-thing" as many seem to believe.

As specific assets soar in value, a "windfall tax" will become politically appealing. Since

all this soaring wealth is unearned, shouldn't the fortunate owners pay

a bit more due to the windfall nature of their unearned wealth? Of

course they should.

The key point to understand is the

system will have to grab enough collateral to fund itself while

collateral evaporates in the deflation of the Everything Bubble. This will truly be a case of TINA--there is no alternative. Desperation will drive policy extremes few think of as possible, much less inevitable.

Something

else that may be revealed as naive is the faith that moving to another

nation-state will offer secure respite from those demanding we render

unto Caesar that which is Caesar's. This faith overlooks the global

reach of these dynamics: rampant inflation, the debasement of currency,

the increasingly desperate need for collateral and revenue to keep the

system from imploding, the rising cost of risk and credit, the scarcity

of collateral, and so on. How will the nation-state we're moving to

respond to these financial crises? What are the odds that they will

magically escape the crisis, or come up with a painless solution that

doesn't demand any sacrifices of residents? How secure will the rule of

law and the wealth of foreigners be once push comes to shove?

In summary: to understand the next 8 to 10 years, start by having some sympathy for the fox and not just for the hare. Here

we are, trying to save the system that everyone depends on, taking a

modest 10% wealth tax, and the ungrateful wretches are whining and

trying to evade paying their fair share.

Rather than attempt to evade Caesar's reach, a better strategy might be to go gray: blend in, look average: post

photos of kittens and puppies, complain about the cost of groceries,

drive a look-alike vehicle, live in an unremarkable house, render unto

Caesar that which is Caesar's, forget about emerging as one of the rich

who evaded Caesar and get on with enjoying one's private life focused on

well-being, and as difficult as it may be, work up a little gratitude

for those carrying the responsibility for keeping the system from

collapsing. A system that degrades but coheres is a far better place to

live than a system that completely collapses.

It gives me no joy to suggest please don't be naive, but a realistic appraisal of what happens when things unravel suggests there are few limits on "emergency measures" anywhere on the planet and it's best to plan accordingly and focus on what we can control rather than what we can't control.