As we have been warning for several years now, what cannot last, won't.

The canary in the financial coal mine is the Yen. At 160 yen per dollar the money is entering junk level and will start having a negative impact on other markets and currencies.

Remember November 2019 when the Repo market started to break apart? A month later we had the Covid crisis.

As we have been warning now for the last year or so: Expect something major happening in the coming few months, most likely during the May/June window.

A dollar rate above 5% is deadly for real estate, individuals and US banks. Lowering rates while inflation is flaring up is almost impossible less the Fed loses credibility. Japan was counting on lower rates to minimize the interest rate spread and the pressure on their currency. Now that it can't happen, Japan is stuck. Raising interest rates even 0.25% is economic suicide. Not raising rates is Yen suicide. The BoJ has finally painted itself in a corner.

We are about to enter choppy waters, in the US, in Japan and of course in Europe. Something is about to break badly. Expect someone, somewhere to preempt such an event. 9, 8, 7, 6, ... The countdown is on!

US equity futures swung between gains and losses and traded near session

highs as US traders walked to their desks on Monday morning after a

rollercoaster day for the Japanese yen, which increasingly looks like

some 3rd world banana republic currency instead of belonging to the

world's 3rd largest economy, and which first plunged below 160 vs the

USD - the lowest level since 1990 amid dismal volumes thanks to the

Japanese market holiday on Monday - only to soar more than 500 pips in

what is now the first confirmed BOJ intervention since

2022. Futures were buoyed by rising earnings optimism as traders looked

ahead to another very busy week for company results, and as of 7:40am,

S&P futures gained 0.2% with Nasdaq futures rising 0.3%, boosted by

another surge in Tesla shares. 10Y Treasury yields fell four basis

points to 4.62% ahead of today's announcement by the Treasury of its

funding needs for the coming quarter, while the dollar weakened. Oil

retreated, with Brent first trading below $89 a barrel, only to rebound

higher amid the endless speculation that a peace deal between Israel and

Hamas is coming that would reduce geopolitical tensions in the Middle

East (spoiler alert: there will be no deal). Gold rose and bitcoin fell.

The Japanese Yen strengthened sharply overnight after crashing to its lowest level since April 1990, breaking 160/USD.

The FT reports that traders in Hong Kong, Australia and London said it was

“highly likely” that the recovery was due to Japan’s finance ministry

selling dollar reserves and purchasing the Japanese currency for the

first time since late 2022.

While

analysts suggested the size and speed of the jump smacked of

intervention, some traders questioned that conclusion and said Japanese

banks sold dollars for customers as it rallied.

Japan’s top currency official, Masato Kanda, chose to keep investors guessing by declining to comment.

"It

is difficult to ignore the bad effects that these violent and abnormal

movements [in currencies] will cause for the nation's economy," Kanda told reporters on Monday.

Dow Jones reported authorities stepped in to support the yen, citing people familiar with the matter.

It

is unlikely to be the last time Japan intervenes in the currency market

this year, given that U.S. interest rates are likely to remain high,

said Alvin Tan, head of Asia foreign-exchange strategy at RBC Capital

Markets.

"We will have a tug of war going forward between Tokyo and the market," he said.

* * *

The yen crashed in early Asia trading, tumbling to match is exact lows from April 1990

in what is being blamed on a 'fat finger' trade or multiple

barrier-option trades being triggered, by sources that have literally no

idea.

The plunge extended Friday's big drop which followed BoJ Governor Ueda's apparent lack of interest in doing anything about the yen's decline, claiming it had 'no impact' on the currency's inflation picture.

“Currency rates is not a target of monetary policy to directly control,” he said.

“But currency volatility could be an important factor

in impacting the economy and prices. If the impact on underlying

inflation becomes too big to ignore, it may be a reason to adjust

monetary policy.”

In fact, policymakers have repeatedly warned that depreciation won’t be tolerated if it goes too far too fast.

Finance

Minister Shunichi Suzuki reiterated after the BoJ meeting that the

government will respond appropriately to foreign exchange moves.

Potential

triggers for interventions are public holidays in Japan on Monday and

Friday next week, which bring the risk of volatility amid thin trading.

“Should

the yen fall further from here, like after the BOJ decision in

September 2022, the possibility of intervention will increase,”

said Hirofumi Suzuki, chief currency strategist at Sumitomo Mitsui

Banking Corp.

“It is not the level but it’s the speed that will trigger the action.”

Well currency volatility is what he has now...

Source: Bloomberg

The sudden drop pushed USDJPY perfectly to its April 1990 highs to the tick...

Source: Bloomberg

The currency pain was all focused in the Japanese market as EUR and GBP strengthened against the USD...

Source: Bloomberg

Perhaps

even more notably, the yen puked relative to the Chinese yuan, hitting

22 for the first time since 1992 and putting further pressure on Beijing

to potentially do something...

Source: Bloomberg

The

question is, of course, what will Japan's MoF/BoJ do now - if anything

as their recent excuses about 'velocity' or some such spin are now out

of the window after a 6-handle standalone surge in their currency in a

few short days (when the rest of the world's currencies are not).

“Authorities

may say they don’t target levels per se, but they do pay close

attention to the trend and the rate of change and current levels suggest

they have to act soon or risk facing a credibility crisis,” said Chris

Weston, head of research at Pepperstone Group Ltd.

“The FX market is almost taking them on like the bond vigilantes of old.”

Specifically as SocGen's FX strategist Kit Juckes noted on Friday, the yen's decline is becoming disorderly, which points to a final, potentially sharp, decline before it finds a floor.

However, as we detailed last week, the problem with intervention is that once the genie is out of the bottle… it’s hard to put it back in.

In other words, the onus should be on the BOJ to step in with a much more hawkish move than the market expects.

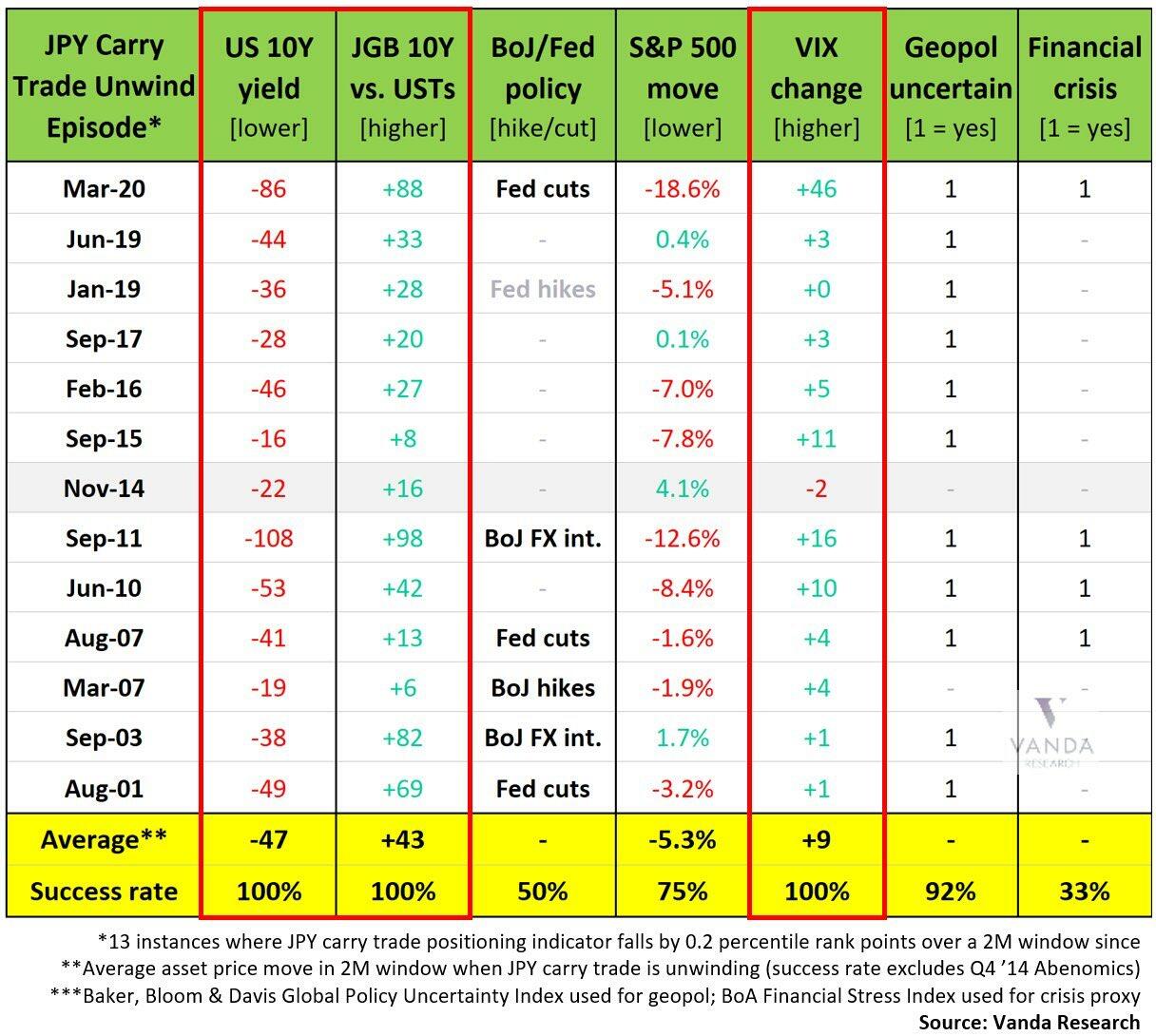

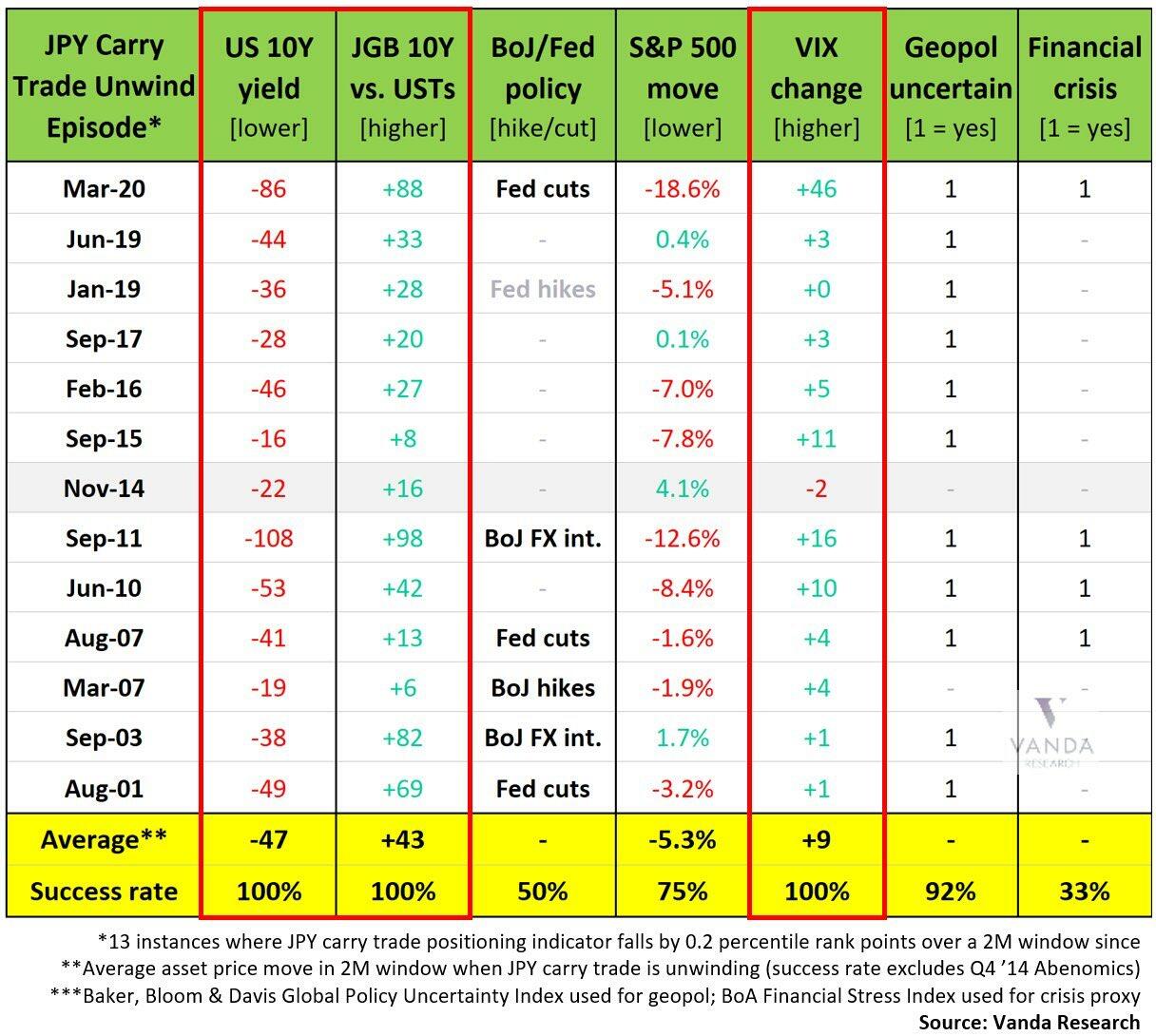

As Viraj Patel from Vanda Research goes on to note that "we’re

at a stage where MoF/BoJ have no choice but to intervene. The best way

would be for BoJ to hike 25bps this week. It’s not about the macro

anymore (BoJ should’ve normalized policy faster last year)."

Instead,

what is going on is that Japan's disastrous handling of its currency

has evolved into a game between speculators and officials: Specs are

short yen for good fundamental reasons (carry). At this stage, a

“surprise” hike to send a signal to markets that they are concerned

about ongoing FX weakness (and don’t test us) would be less costly to

the economy vs. a further devaluation in the yen. It also adds

an additional level of uncertainty to the BoJ/MoF reaction function -

which speculators (long carry trades) don’t like.

Meanwhile, FX

intervention - which unfortunately looks to be the MoF/BoJ’s preferred

route based on recent history - is not even a short-term fix anymore. USD/JPY

dips would be quickly bought into based on recent market chatter. A

hike goes a bit further towards solving the root cause of yen weakness -

even it’s only a marginally better option.

However, not everyone is convinced intervention is imminent.

In a note late last week, Deutsche Bank says the currency's decline is warranted and finally marks the day where the market realizes that Japan is following a policy of benign neglect for the yen.

We

have long argued that FX intervention is not credible and the toning

down of verbal jawboning from the finance minister overnight is on

balance a positive from a credibility perspective. The possibility of

intervention can't be ruled out if the market turns disorderly, but it

is also notable that Governor Ueda played down the importance of the yen

in his press conference today as well as signalling no urgency to hike

rates. We would frame the ongoing yen collapse around the following

points.

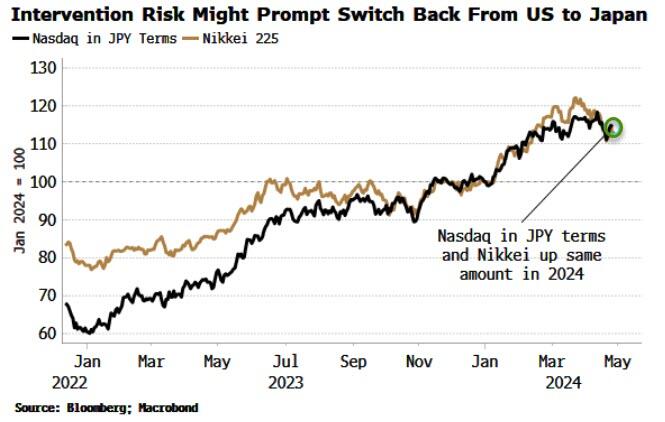

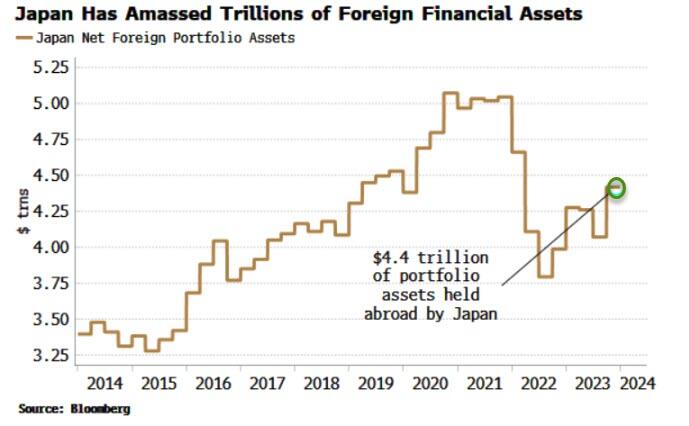

Yen weakness is simply not that bad for Japan. The

tourism sector is booming, profit margins on the Nikkei are soaring and

exporter competitiveness is increasing. True, the cost of imported

items is going up. But growth is fine, the government is helping offset

some of the cost via subsidies and core inflation is not accelerating.

Most importantly, the Japanese are huge foreign asset owners via Japan’s

positive net international investment position. Yen weakness therefore

leads to huge capital gains on foreign bonds and equities, most easily

summarized in the observation that the government pension fund (GPIF)

has roughly made more profits over the last two years than the last

twenty years combined.

There simply isn't an inflation problem. Japan's

core CPI is around 2% and has been decelerating in recent months. The

Tokyo CPI overnight was 1.7% excluding one-off effects. To be sure,

inflation may well accelerate again helped by FX weakness and high wage

growth. But the starting point of inflation is entirely different to the

post-COVID hiking cycles of the Fed and ECB. By extension, the

inflation pain is far less and the urgency to hike far less too. No

where is this more obvious than the fact that Japanese consumer

confidence are close to their cycle highs.

Negative real rates are great.

There is a huge attraction to running negative real rates for the

consolidated government balance sheet. As we demonstrated last year, it

creates fiscal space via a $20 trillion carry trade while also

generating asset gains for Japan's wealthy voting base. This encourages

the persistent domestic capital outflows we have been highlighting as a

key driver of yen weakness over the last year and that have pushed

Japan's broad basic balance to being one of the weakest in the world. It

is not speculators that are weakening the yen but the Japanese

themselves.

The bottom line, Deutscxhe concludes, is that for the JPY to turn stronger the Japanese need to unwind their carry trade. But

for this to make sense the Bank of Japan needs to engineer an expedited

hiking cycle similar to the post-COVID experiences of other central

banks. Time will tell if the BoJ is moving too slow and generating a

policy mistake. A shift in BoJ inflation forecasts to well above

2% over their forecast horizon would be the clearest signal of a shift

in reaction function. But this isn’t happening now.

The Japanese are enjoying the ride.

Finally, it goes without saying that the only true circuit-breaker for yen weakness is lower US yields/weak US macro, which is unlikely until the election if, as so many now speculate, there has

been a directive by the Biden admin to make the economy look as good as

possible ahead of the elections, even if that means manipulating the

data to a grotesque degree.

One added complexity for

MoF/BoJ is that their two options for tackling yen weakness indirectly

adds upward pressure to global rates/yields. They’re caught between a

rock and a hard place… and speculators know (enjoy) this.

And

finally there is China: the longer BOJ/MoF does nothing to curb the

collapse of the yen, a move which is seen a pumping up the country's

exporting base at the expense of other mercantilist nations such as

China, the higher the probability Beijing will retaliate against Tokyo

by devaluing its own currency. At which point all hell will break loose.

But, one way or another, as Goldman noted, it's crunch time for USDJPY.