As expected we are getting very close to a major turn in Ukraine.The war is lost for the West as Macron recently hinted with his "End of Europe in sight"! Well, let's see how this play out but the omen are not good. As the president of Hungary recently said, we may have crossed the Rubicon.

Making sense of the world through data The focus of this blog is #data #bigdata #dataanalytics #privacy #digitalmarketing #AI #artificialintelligence #ML #GIS #datavisualization and many other aspects, fields and applications of data

Sunday, May 26, 2024

BREAKING: ANOTHER RUSSIAN NUCLEAR RADAR HIT (Video - 28mn)

Thursday, May 23, 2024

China and Russia Just Shocked the US Government With This Move! (Video - 13mn)

A new world order is being implemented step by step. Probably slower than people expect but taking everything into consideration at a relatively fast pace.

The Incoming Commercial Real Estate Crisis No One Seems Prepared For

The US office real estate bubble is huge and will probably bankrupt many American Banks by the middle of next year considering the large amount of refinance necessary which technically cannot happen at 5%+.

Of course this bubble pale compared to the Chinese real estate bubble which is imploding right now. Just as it was the case in Japan 30 years ago, the implosion will not tank the Chinese economy but it will put a severe brake on future growth. All in all, just as the Japan "miracle" ended in a bubble, the Chinese miracle will probably do likewise. To keep growing, China must transform its economy into a more modern one and in so doing enter into direct competition to Europe and the US adding pressure to the country foreign relations.

And just to prove that mankind, at the social level is unable or at the very least very slow to learn anything, Japan is blowing another real estate bubble. Luckily, 2.0 is restricted to central Tokyo and a few other major cities like Osaka and Fukuoka. It is fueled by foreign money taking advantage of the weak Yen to invest massively in the country. Taking no account whatsoever of demand or the ever present risk of a major earthquake. What could go wrong?

Authored by Kevin Stocklin via The Epoch Times

It has been a year since a string of U.S. regional bank failures, together with the collapse of global heavyweight Credit Suisse, caused many to fear that a major financial crisis was imminent.

But, by the summer of 2023, the panicked withdrawals by frightened depositors largely subsided.

In February, however, New York Community Bank (NYCB) appeared to resurrect the crisis when it announced $2.4 billion in losses, fired its CEO, and faced credit downgrades from rating agencies Fitch and Moodys.

In what has become a familiar tale for U.S. regional banks, NYCB’s share price plummeted by 60 percent virtually overnight, erasing billions of dollars from its market value, and its depositors fled en masse.

“I think that there’s more to come,” Peter Earle, a securities analyst and senior research fellow at the American Institute for Economic Research, told The Epoch Times.

Underlying this year’s turbulence is the fact that many regional banks are sitting on large portfolios of distressed commercial real estate (CRE) loans. according to Mr. Earle. And many are attempting to cope through a process called “extend and pretend,” in which they grant insolvent borrowers more time to pay in hopes that things will get better.

“There is trouble out there, and most of it probably won’t be realized because of the ability to roll some of these loans forward and buy a few more years, and maybe things will recover by then,” he said.

“But all it does is it kicks the can down the road, and it basically means a more fragile financial system in the medium term.”

NYCB’s problem was an overwhelming exposure to New York landlords who were struggling to stay solvent. At the start of this year, the bank had on its books more than $18 billion in loans to multifamily, rent-controlled housing developments.

This situation was particularly concerning given that NYCB had been the safe-haven institution that rescued Signature Bank, another failing regional bank, in March 2023.

Much of what took down banks such as Signature Bank in last year’s banking crisis was an unmanageable level of deposits from high net worth and corporate clients that were too large to be insured by the Federal Deposit Insurance Corporation (FDIC).

In Signature Bank’s case, about 90 percent of its deposits were uninsured, and depositors rushed to withdraw their money when the bank came under stress from losses in the cryptocurrency market.

Another source of stress for regional banks was their inability to cope with an aggressive series of interest rate hikes by the Federal Reserve to combat inflation. Many banks that held large bond portfolios yielding low fixed rates found that the value of these portfolios declined sharply, creating unrealized losses.

While these portfolios, often made up of U.S. Treasury securities, were considered safe from a credit perspective, they were subject to market risk, and their loss of value sparked concerns about the banks’ solvency in the event they had to be sold. As stock traders rushed to sell the shares of banks with large exposures to interest rate risk, customers became spooked and raced to withdraw their money.

Consequently, unrealized losses quickly became actual losses as banks were forced to sell bonds and loans at a loss in an increasingly futile attempt to make panicking depositors whole.

Rate Hikes Cease, Problems Remain

Today, while interest rates remain high, they are relatively stable. And yet concerns about the health of U.S. regional banks remain because of their large exposure through CRE, including office buildings, multifamily housing units, and retail spaces.

While CRE loans make up about 13 percent of the balance sheets of the biggest U.S. banks, they make up 44 percent of regional banks’ lending portfolios. CRE loans designated as nonperforming doubled as a percentage of U.S. banks’ portfolios from 0.4 percent in 2022 to 0.81 percent by the end of 2023.

In total, there are about 130 regional banks in the United States, with a little more than $3 trillion in assets. These banks, which each have between $10 billion and $100 billion in assets, are typically more exposed to the boom and bust of local markets but also to specific sectors within those markets where they have been able to operate profitably.

While other credit sectors, such as home mortgages, car loans, and corporate loans, are generally the domain of larger financial institutions, regional banks have found a profitable niche in lending to real estate investors. But in the past several years, commercial landlords have been taking hits from two directions.

Since the introduction of lockdowns and the rise of work-at-home culture during the COVID-19 pandemic, many corporations have viewed office rents as a cost ripe for cutting.

According to an April CRE report by Commercial Edge, the office vacancy rate across the United States was 18.2 percent as of March, an increase of 1.5 percent over the prior year.

“U.S. office vacancy rates have increased in recent years as companies embrace remote and hybrid work and re-examine their office footprints,” the report reads. “The increases are not concentrated in just one market or sector.”

Wednesday, May 22, 2024

Yellen Threatens German Banks With Sanctions; EU Approves Using Russian Asset Profits For Ukraine's Defense

Remember when Central Banks were supposed to be focused on monetary policies and be politically neutral?

What a joke! Now that we see the full weaponization of finance, no wonder why the BRICS are in a rush to create their alternative financial system.

We are now approaching the end of the Bretton Woods and World Bank systems built after the second World War. But instead of implementing a more open system inclusive of the new economic giants, the US is accelerating the demise of what they painstakingly built over almost a century. The crash is fast approaching but unfortunately so is the risk of a world conflagration.

Yellen Threatens German Banks With Sanctions; EU Approves Using Russian Asset Profits For Ukraine's Defense

In a rare moment of tensions among allies, US Treasury Secretary Janet Yellen is demanding that German bank executives get serious about complying with anti-Russia sanctions, warning further that German banks could find themselves under sanctions.

She warned them of secondary sanctions meant to thwart deals with Russian entities in a meeting among bank leaders in Frankfurt. "Russia continues to procure sensitive goods and to expand its ability to domestically manufacture these goods. We must remain vigilant and be more ambitious," Yellen said. "I urge all institutions here to take heightened compliance measures and to increase your focus on Russian evasion attempts."

According to Reuters, "In an unusually direct warning, she told the executives to police sanctions compliance among their banks' foreign branches and subsidiaries and reach out to foreign correspondent banking customers to do the same, especially in high-risk jurisdictions."

"Russia is desperate to obtain critical goods from advanced economies like Germany and the United States," Yellen continued. "We must remain vigilant to prevent the Kremlin’s ability to supply its defense industrial base, and to access our financial systems to do so."

Washington's pressure campaign to force out Russian interests from Europe appears to be bearing fruit:

Earlier this month, Raiffeisen Bank International (RBI) dropped a bid for a 1.5 billion euro ($1.6 billion) industrial stake linked to Russian tycoon Oleg Deripaska after intense U.S. pressure.

The deal's collapse was a fresh setback for the lender, which faces criticism for its ties to Moscow more than two years since Russia's invasion of Ukraine. The pressure also underscored Washington's willingness to take European banks to task over their Russia ties.

A spokesman later said, "RBI will continue to work towards the de-consolidation of its Russian subsidiary."

Meanwhile the European Union has finally approved a US-backed plan to use seized Russian assets to generate profits which will in turn help arm Ukraine.

Associated Press reports that "The 27-nation EU is holding around 210 billion euros ($225 billion) in Russian central bank assets, most of it frozen in Belgium, in retaliation for Moscow’s war against Ukraine. It estimates that the interest on that money could provide around 3 billion euros ($3.3 billion) each year." A first tranche of funds could be available as early as July.

Starting in February, US Treasury Secretary Janet Yellen began getting more vocal on the "moral case" for using Russian assets to aid Ukraine, telling allies they must find a way to "unlock the value" of the hundreds of billions in immobilized Russian assets, also with an eye towards Ukraine's post-war reconstruction.

Previously some Ukrainian officials floated the idea of "reparation bonds" backed by future claims for war damages against Moscow, and utilizing frozen Russian assets. These initiatives have gained steam under US leadership. Most of the $300 billion in frozen Russian assets are held in Europe - particularly France, Germany, and Belgium.

Taxpayer Costs Skyrocket As Two-Thirds Of Jobless Benefit Recipients In Germany Are Migrants

Between the wrong type of immigration, of energy policies and external relations, the suicide on Germany is on tracks. by 2030, what was the richest country in Europe will be on its knees. Not that is matters much since by then Europe will be destroyed, either financially or more ominously militarily. Thankfully meanwhile the country is focusing on net zero, transgenders and Russia bashing. Can countries actually go mad?

Authored by Thomas Brooke via ReMix News,

Nearly two-thirds of German residents receiving unemployment benefits have a migration background, new figures from the Federal Employment Agency have revealed.

The statistics published by the federal agency and cited by the Die Welt broadsheet showed that 63.1 percent of those in receipt of the so-called citizen’s income, or “Bürgergeld,” are of migrant origin, and “most do not have a German passport.”

The German newspaper explained that while employment figures are increasing year-over-year, “because the Federal Republic has long allowed very high immigration of low-skilled people, the number of migrants who are unemployed and receiving social benefits is also increasing.”

The figures define “migration background” as anyone who themselves or whose parents were born without German citizenship, i.e., first- and second-generation migrants.

Of the 3.93 million people eligible for the taxpayer-funded benefit as of December 2023, some 2.48 million were classed as being of a migration background, with 1.83 million recipients not having German citizenship.

The percentage varies considerably among the federal states. In Hesse, Baden-Württemberg, and Hamburg, more than 7 in 10 of all recipients are migrants at 76.4 percent, 74.1 percent, and 72.8 percent, respectively.

There exists a strong correlation between the rise in the migrant population and the percentage of welfare benefits going to migrants, giving weight to the argument that mass immigration of low-skilled workers is not a net benefit to Europe’s largest economy.

In 2013, the percentage of the German population with a migration background was 20 percent, with 43 percent of benefit recipients being migrants. Today, 29 percent of the German population are foreign-born and 63 percent of unemployment benefits are handed to migrants.

In July last year, a response by Parliamentary State Secretary at the Federal Ministry of Labor and Social Affairs Anette Kramme to a request made by the Alternative for Germany MP René Springer revealed that the number of German recipients of welfare benefits had halved since 2010, while the number of foreign nationals receiving payments had doubled.

The cost to the taxpayer has skyrocketed since 2010, with a 122 percent increase on the €6.9 billion bill then to around €15.4 billion a year today.

Springer said at the time that Germany desperately needed to implement “a restrictive immigration policy that effectively prevents immigration into our social systems. The citizens’ income introduced by the federal government, on the other hand, acts like an immigration magnet.”

Tuesday, May 21, 2024

Joe Biden Tariffs Against China Just Backfired on the US Economy! (Video - 14mn)

Tariffs at this stage are not just absurd, they are counterproductive and the symbol of America's decline. Think about Boeing giving back money to its shareholders (and 55 million dollars to its president!) applied to car manufacturing, solar panels, batteries, microchips.

Just to jump to something completely unrelated, if we are as good as containing AI as the Americans are at containing China, may god have pity on us!

Monday, May 20, 2024

Jim Rickards' Last WARNING about the BRICS and the fall of the dollar. (Video - 23mn)

The BRICS have got the US dollar cornered as the dollar is on its last foot.

Great talk by Jim Rickards!

Sunday, May 19, 2024

Ex-CDC Director Says It's High Time To Admit 'Significant Side Effects' Of COVID-19 Vaccines

"Never too late!" comes to mind! In Japan too, some voices are starting to be heard against the mRNA vaccines. They are simply not yet operational and therefore dangerous. Now the real problem is that we've known that from the very beginning. And those who promoted their safety are the same people who also managed to skip the tests. If this is not criminal, what is?

Authored by Tom Ozimek via The Epoch Times (emphasis ours),

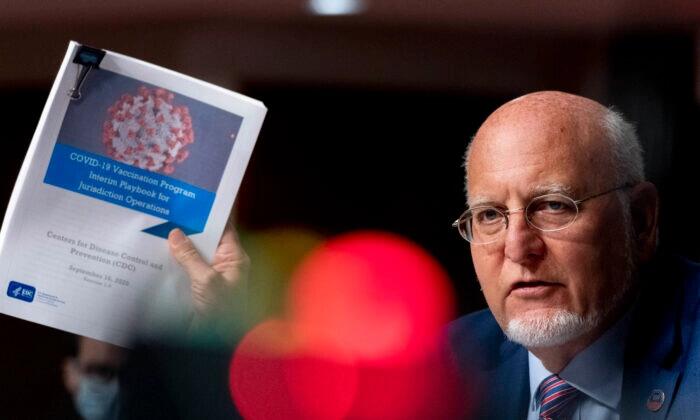

Dr. Robert Redfield, former director of the Centers for Disease Control and Prevention (CDC), said Thursday that many officials who tried to warn the public about potential problems with COVID-19 vaccines were pressured into silence and that it’s high time to admit that there were “significant” side effects that made people sick.

Dr. Redfield made the remarks in a May 16 interview with Chris Cuomo on NewsNation, during which he lamented the loss of public confidence in public health agencies because of a lack of transparency around the vaccines, which he said “saved a lot of lives” but also made some people “quite ill.”

“Those of us that tried to suggest there may be significant side effects from vaccines ... we kind of got canceled because no one wanted to talk about the potential that there was a problem from the vaccines, because they were afraid that that would cause people not to want to get vaccinated,” Dr. Redfield said.

In his role as head of the CDC, Dr. Redfield was part of the Trump administration’s Operation Warp Speed, a project to surge COVID-19 vaccine development at a time during the pandemic when little was known about the virus and rapid vaccine rollout was widely seen as key to getting the outbreak under control and lockdowns lifted.

In September 2020, a few months before the first COVID-19 vaccines were given in the United States, Dr. Redfield testified before the Senate that COVID-19 represented the “most significant public health challenge to face our nation in more than a century,” and that the prevailing view among scientists at the time was that the overall case fatality rate of the disease was somewhere between 0.4 and 0.6 percent in the United States.

“If you were to look right now, individuals under the age of 18, it’s about 0.01 percent, 19 to say 69, it’s more like 0.3 percent. And if you’re over the age of 70, it’s about 5 percent now,” he testified at the time.

While there’s lingering controversy about the severity of COVID-19, a recent study estimates that the global case fatality rate was 8.5 percent in February 2020 but had plunged to 0.27 percent in August 2022, meaning that the estimated relative risk reduction over that time was a whopping 96.8 percent.

In his interview on NewsNation, Dr. Redfield said that the vaccines that were developed as part of Operation Warp Speed were “important” and saved “a lot of lives.” However, despite their benefits, the drawbacks of the vaccines must be a matter of open discussion, he said.

“They’re important for the most vulnerable people, those over 60, 65 years of age. They really aren’t that critical for those that are under 50 or younger. But those vaccines saved a lot of lives, but they also—we have to be honest, some people got significant side effects from the vaccine,” he said.

“I have a number of people that are quite ill and they never had COVID, but they are ill from the vaccine,” he continued. “And we just have to acknowledge that.”

Vaccine Controversy

The severity of COVID-19 remains a matter of debate because it’s unclear whether deaths were overcounted or undercounted due to various factors, such as lack of clarity around the role of underlying medical conditions in fatalities in cases where COVID-19 was listed as the primary cause, or underreporting of asymptomatic infections. Aside from the issue of whether people died “from” COVID-19 or “with” a positive test for SARS-CoV-2, there have also been questions about the role of secondary pneumonia caused by mechanical ventilation.

Either way, a study from January 2023 indicates that the global case fatality rate from COVID-19 has dropped dramatically over the course of the pandemic. Global case fatalities ranged from 1.7 to 39.0 percent in February to March of 2020, according to the study—but fell to below 0.3 percent in July to August 2022.

The researchers estimate that the risk of death from COVID-19 has dropped by 96.8 percent over the course of the pandemic.

Along with a decline in COVID-19 fatalities, there have been growing concerns about vaccine side effects, given that a significant number of vaccinated people have reported various adverse reactions.

The most common COVID-19 vaccine adverse events are those that affect the body generally, with fever, fatigue, and overall discomfort being the top three, according to the U.S. Vaccine Adverse Event Reporting System (VAERS). But there are others.

For instance, heart muscle inflammation (myocarditis) and inflammation of the lining outside the heart (pericarditis) have both officially been acknowledged by the CDC as a known side effect of Moderna’s and Pfizer’s mRNA COVID-19 vaccines.

Nervous system disorders have also been reported, with such disorders being the third most common in the Pfizer trials, coming after general and muscle-related adverse events.

There have also been papers linking spike-protein-based COVID-19 vaccines to skin problems, a dull ringing in the ears known as tinnitus, visual impairments, blood clotting, and even death. Recent reporting from EpochTV’s “American Thought Leaders“ program indicates that the likelihood of death associated with COVID-19 vaccines (in close proximity to the shot rather than proven as caused by it) was over 100 times greater than for flu vaccines.

There are also concerns about a post-vaccination jump in excess deaths and disability.

The CDC still recommends that people of all ages receive a COVID-19 vaccine, saying that the potential side effects do not outweigh the potential harms of getting sick with COVID-19.

In a notice published in late April, the agency again called for adults aged 65 and older to get the latest version of the vaccines.

Saturday, May 18, 2024

We are getting closer to nuclear war! (Video - 53mn)

"We are getting closer to nuclear war!" That's Canadian Preper, so you'd guess he's on the edge of reality. Fine. Except that gold at 2420 dollar per once would tend to agree. At this speed, we'll be well past 3000 by the Summer.

Friday, May 17, 2024

This Is How They Plan To Control All Of Us, And It's Terrifying (Video - 5mn)

No, we are not crazy. The conspiracy is real. Here's the proof!

Ukraine is winning the war!

Go to YouTube and type: " Ukraine is winning the war ". You will be stunned as you get a biblical deluge of whatever can be scra...

-

A rather interesting video with a long annoying advertising in the middle! I more or less agree with all his points. We are being ...

-

In a sad twist, from controlled news to assisted search and tunnel vision, it looks like intelligence is slipping away from humans alm...

-

A little less complete than the previous article but just as good and a little shorter. We are indeed entering a Covid dystopia. Guest Pos...