Making sense of the world through data The focus of this blog is #data #bigdata #dataanalytics #privacy #digitalmarketing #AI #artificialintelligence #ML #GIS #datavisualization and many other aspects, fields and applications of data

Saturday, April 25, 2020

Coronavirus, what happens when you get the statistics wrong?

The truth is out. We've got the data of the pandemic wrong! Now what?

The Wuhan Coronavirus was born under suspicious circumstances. China obfuscated, tried to hide the truth for as long as possible. First reprimanded the doctors who rang the alarm bells, then put the P4 laboratory in Wuhan under military supervision, ordered all samples destroyed and a shut down of independent publications. Finally, the country reacted strongly, putting the city, then the whole Hebei province under a two month long lock-down, while declaring that there was nothing to fear and the W.H.O parroting the Chinese position, prevaricated for months before declaring that a pandemic was on-going.

But thanks to the one major characteristics of this Coronavirus, its very high number of asymptomatic cases (people being sick but showing no symptoms), the virus did spread around the world, first to Korea and Italy, then to all other countries with very few exceptions. Asia reacted quickly by closing down stores early, requesting that people wear masks and comprehensive detection and tracking policies. The results were immediate and the number of cases slowed almost immediately to a crawl. Europe and especially the US did not. The number of sick people exploded and a couple of weeks later the death's curve followed suit.

Early on, based on a very limited number of test, a low R0 (spread of the virus), and an extremely high death rates of close to 3% were calculated, and models showing millions of deaths down the line were built, especially by the London Imperial College in the UK. Most countries panicked and followed the Chinese example of a complete lock-down... and all without exceptions got it wrong! The reason for the mistake was simple and basic; they got their statistics wrong. The extremely high number of asymptomatic cases created an illusion of a high death rate whereas we now know that this was not the case.

In the end, the Wuhan Coronavirus is a dangerous virus. For people with weak immune systems, mostly the old, obese and diabetics, the risk is clearly high and whenever someone gets sick, the road from emergency to respirator to death can be a quick one. But for everybody else... nothing. Not even mild flu symptoms! The one exception which in itself is a scandal is the very high number of doctors and nurses who have succumbed for the simple reasons of high viral loads and poor protection.

But bad statistics were not limited to poor projections, most countries went one step further by declaring that whenever the virus was detected, the causes of death should be attributed to the virus. Consequently, the number of old age people dying from the virus exploded, while the real number of death in most countries stayed flat. Now that the numbers are out, especially in France, we finally know that the total number of death did not show any uptick. 2020 is turning out to be another ordinary year, and in most case a rather low flu season in Europe.

But do not expect any countries to cancel their lock-down order any time soon, and even less to apologize, declaring that they got their numbers and consequently policies wrong! That's unfortunately not how things work.

Responsible people will hide their incompetence behind dubious numbers then politicians will focus their attention of the terrible economic consequences of their failed virus mitigation policies. Few will show that countries who did not implement a complete lockdown of their economies like Sweden did not see the predicted explosion, proving that these policies were an over-reaction.

But the legacy of this failure will be with us for years to come. In the end the virus, beyond a few very limited hot spots will not have killed that many people compared to any other ordinary year, but if, as it seems more or more likely, it becomes the pin which burst the financial bubble, it will then have proved far more dangerous than expected, by showing the weakness of our system and the real risks of the contagion of fear.

It may also have a positive consequence demonstrating that our over centralization and over reliance on the state have become toxic and destructive. But don't count on it. The isolated voices of reason will quickly be drawn in a tsunami of spin and propaganda proving that all the wrong decisions were taken for the right reasons; The destruction of millions of jobs and countless thousands of small businesses, the unfortunate byproduct of the need for precautions. The trampling of individual freedom, an absolute necessity for the better good of all.

It would be great if people kept clapping their hands and banging their pans once a day to remember this terrible episode of failed policies of social engineering. But most probably, they won't. They will be far too busy putting back their lives together and coping with the disastrous economic consequences of a virus most caught without even noticing.

As for the real economy, let's see what happens once the dollars, Euros and Yens stop dropping from the sky. But will they? Or conversely will we see the takeover of the whole economy by the states? We've seen how this worked, rather poorly, in the past. Don't expect miracles, this time won't be different!

Thursday, April 23, 2020

Coronavirus: Who is right?

While trying to understand the arguments about Coronavirus, slowly a clearer picture is emerging. The virus is neither benign not the end of the world, just in-between. Still, the economic consequences of our over-reaction will be beyond our expectations...

The best article I have found which resume this conclusion is the one below.

The Facts That Prove Almost Everyone Is Wrong About This Pandemic

When it comes to COVID-19, most Americans seem to be gravitating toward one of two extremes. Some are treating this pandemic like it is the end of the world, while many others are dismissing it as a “nothingburger”.

But the truth is somewhere in between.

Nobody can deny that lots of people are getting sick and lots of people are dying. In fact, the U.S. death toll has doubled in a little over a week and it has now shot past the 47,000 mark. And as this pandemic progresses, a lot more people are going to get sick and a lot more people are going to die, and this is going to be true whether the lockdowns continue or not. The lockdowns were never going to stop COVID-19, and anyone that believed that was just being delusional.

In most of the United States that is not happening right now, and so in most of the nation the lockdowns should be immediately ended.

But won’t a lot more people start getting sick if that happens?

Of course, and this is something that the “nothingburger” crowd doesn’t understand. Lifting the lockdowns is going to cause the virus to cycle through our population at a much faster rate, and the numbers will get pretty ugly. But as long as the medical system can handle it, lockdowns are not necessary.

What “the end of the world” crowd does not understand is that when you are dealing with a virus that spreads as easily as this one, it is inevitable that most of the population will eventually become infected. You can “flatten the curve” and delay the inevitable with lockdowns, but that also prolongs the pandemic. In the end, roughly the same number of people will get sick and roughly the same number of people will die no matter how the pandemic is “managed”.

Actually, it shows just the opposite.

This pandemic is not going to be over until herd immunity is achieved, and according to Johns Hopkins that does not happen until 70 to 90 percent of a population has developed immunity…

When most of a population is immune to an infectious disease, this provides indirect protection—or herd immunity (also called herd protection)—to those who are not immune to the disease.So let’s do some really quick math.

For example, if 80% of a population is immune to a virus, four out of every five people who encounter someone with the disease won’t get sick (and won’t spread the disease any further). In this way, the spread of infectious diseases is kept under control. Depending how contagious an infection is, usually 70% to 90% of a population needs immunity to achieve herd immunity.

Let’s assume that the study conducted in L.A. County is representative of the nation as a whole and that approximately 4 percent of all Americans have now developed antibodies.

And let’s also assume that herd immunity for COVID-19 will be achieved when 80 percent of the total population has developed antibodies.

If 47,000 Americans have died at the current 4 percent level of exposure, that means that we could potentially be looking at an overall death toll of 940,000 once we hit an 80 percent exposure level.

Does anyone in the “nothingburger” crowd want to try to claim that 940,000 dead Americans is not a big deal?

I keep hearing people say that this virus “is just like the flu”, and that is absolutely absurd. As Mike Adams of Natural News has pointed out, COVID-19 has killed more Americans in the last 17 days than the flu did in the last year…

In the last 17 days, the Wuhan coronavirus has killed more Americans (35,087) than the regular flu kills in an entire year (34,157 for the last year). It obliterates any last shred of the argument — still heard across the independent media — that the coronavirus is “no worse than the flu.”And actually the number of Americans dying from the coronavirus is being seriously undercounted.

The coronavirus remains the No. 1 cause of death in America on a day-to-day basis, clocking in at 2,804 deaths just today. Total deaths in the USA will exceed 46,000 tomorrow, confirming our earlier projection that estimated 46,000 to 93,000 deaths from coronavirus in the USA by the end of July. It’s not even the end of April, and we’re already beyond 45,000. (At the time we made the projection, it was dismissed as “crazy” by the very same people who still claim the coronavirus is “no worse than the flu.” Those are the people who can’t do math.)

In New York City, if someone dies at home they are typically not tested to see if they have the coronavirus. So even though the number of city residents dying at home is now nearly ten times higher than normal, the vast majority of those cases are never showing up in the official numbers.

But the “end of the world” crowd seems to think that if we just keep everyone at home long enough that we can significantly reduce the final death toll from this pandemic, and that just isn’t accurate either.

Right now, the virus continues to spread even though most of the U.S. has now been locked down for weeks. In fact, there were nearly 30,000 more confirmed cases during the 24 hour period that just ended. Whether it does it relatively quickly or relatively slowly, this virus will continue to rip through our population until we eventually get to the point of herd immunity.

“Experts” such as Bill Gates are suggesting that the lockdowns are “buying us time” until our scientists can develop a “vaccine”, but the truth is that is really not much more than a pipe dream.

As I pointed out yesterday, there has never been a successful vaccine for any coronavirus in all of human history, and now that scientists have discovered approximately 30 different strains of the virus that will just make the task of trying to develop a vaccine even more complicated.

Sadly, the reality of the matter is that this virus is going to be with us for a very long time to come. Eventually herd immunity will hopefully be achieved, but until then a lot of people are going to get sick and a lot of people are going to die.

And fear of this virus is going to be with us for a long time to come as well, and that is going to paralyze our economy whether there are lockdowns or not.

The bottom line is that this virus is not going to be stopped, and the economic collapse that has now begun is not going to be stopped either.

But this isn’t the end of the world, and most of us will get through this. Of course even bigger challenges lie beyond the end of this pandemic, but that is a topic for another article.

As of this moment, COVID-19 has killed more than 184,000 people around the globe, and by the end of this pandemic the overall death toll is likely to be much, much higher than that.

There is no way that you can possibly call that a “nothingburger”, and sticking your head in the sand is not going to help anything. But on the other hand, trying to lock down the entire planet is not going to solve this crisis either. It will simply delay the inevitable, because this virus is just going to continue to spread no matter what actions our politicians take.

Friday, April 17, 2020

Confirmation that the Wuhan Coronavirus genome contains HIV sequences (video)

This is a Bombshell:

Now that Dr Montagnier, French Nobel Prize of medecine on the HIV virus has confirmed that the Wuhan coronavirus genome contains HIV sequences in addition to the S protein, it is time for China to come clean and admit that these research were indeed being conducted in Wuhan and that the virus escaped from the laboratory. Here's the interview. (in French unfortunately) #wuhancoronavirus #wuhanvirus #breakingnews #chinacoronavirus #china #HIV #coronavirus #coronaviruswho

Monday, April 13, 2020

The Eurodollar Market is the real Matrix!

This is a superb article from Michel Every at Rabobank which explains the Eurodollar financial market and summarize the risks it represents for the world economy. Could the Eurodollar be the cause of the breakdown of our financial system? Quite possible and even likely! Read on!

Submitted to Zerohedge by Michael Every of Rabobank / April12, 2020

https://www.zerohedge.com/markets/down-rabbit-hole-eurodollar-market-matrix-behind-it-all

Summary

- The Eurodollar system is a critical but often misunderstood driver of global financial markets: its importance cannot be understated.

- Its origins are shrouded in mystery and intrigue; its operations are invisible to most; and yet it controls us in many ways. We will attempt to enlighten readers on what it is and what it means.

- However, it is also a system under huge structural pressures – and as such we may be about to experience a profound paradigm shift with key implications for markets, economies, and geopolitics.

- Recent Fed actions on swap lines and repo facilities only underline this fact rather than reducing its likelihood

All of these are small examples of the multi-faceted global Eurodollar market. Like The Matrix, it is all around us, and connects us. Also just like The Matrix, most are unaware of its existence even as it defines the parameters we operate within. As we shall explore in this special report, it is additionally a Matrix that encompasses an implicit power struggle that only those who grasp its true nature are cognizant of.

Moreover, at present this Matrix and its Architect face a huge, perhaps existential, challenge.

Yes, it has overcome similar crises before...but it might be that the Novel (or should we say ‘Neo’?) Coronavirus is The One.

So, here is the key question to start with: What is the Eurodollar system?

For Neo-phytes

Yet before we go down that particular rabbit hole, let’s start with the basics. In its simplest form, a Eurodollar is an unsecured USD deposit held outside of the US. They are not under the US’ legal jurisdiction, nor are they subject to US rules and regulations.

To avoid any potential confusion, the term Eurodollar came into being long before the Euro currency, and the “euro” has nothing to do with Europe. In this context it is used in the same vein as Eurobonds, which are also not EUR denominated bonds, but rather debt issued in a different currency to the company of that issuing. For example, a Samurai bond--that is to say a bond issued in JPY by a nonJapanese issuer--is also a type of Eurobond.

As with Eurobonds, eurocurrencies can reflect many different underlying real currencies. In fact, one could talk about a Euroyen, for JPY, or even a Euroeuro, for EUR. Yet the Eurodollar dwarfs them: we shall show the scale shortly.

More(pheous) background

So how did the Eurodollar system come to be, and how has it grown into the behemoth it is today? Like all global systems, there are many conspiracy theories and fantastical claims that surround the birth of the Eurodollar market. While some of these stories may have a grain of truth, we will try and stick to the known facts.

A number of parallel events occurred in the late 1950s that led to the Eurodollar’s creation – and the likely suspects sound like the cast of a spy novel. The Eurodollar market began to emerge after WW2, when US Dollars held outside of the US began to increase as the US consumed more and more goods from overseas. Some also cite the role of the Marshall Plan, where the US transferred over USD12bn (USD132bn equivalent now) to Western Europe to help them rebuild and fight the appeal of Soviet communism.

Of course, these were just USD outside of the US and not Eurodollars. Where the plot thickens is that, increasingly, the foreign recipients of USD became concerned that the US might use its own currency as a power play. As the Cold War bit, Communist countries became particularly concerned about the safety of their USD held with US banks. After all, the US had used its financial power for geopolitical gains when in 1956, in response to the British invading Egypt during the Suez Crisis, it had threatened to intensify the pressure on GBP’s peg to USD under Bretton Woods: this had forced the British into a humiliating withdrawal and an acceptance that their status of Great Power was not compatible with their reduced economic and financial circumstances.

With rising fears that the US might freeze the Soviet Union’s USD holdings, action was taken: in 1957, the USSR moved their USD holdings to a bank in London, creating the first Eurodollar deposit and seeding our current UScentric global financial system – by a country opposed to the US in particular and capitalism in general.

There are also alternative origin stories. Some claim the first Eurodollar deposit was made during the Korean War with China moving USD to a Parisian bank.

Meanwhile, the Eurodollar market spawned a widely-known financial instrument, the London Inter Bank Offer Rate, or LIBOR. Indeed, LIBOR is an offshore USD interest rate which emerged in the 1960s as those that borrowed Eurodollars needed a reference rate for larger loans that might need to be syndicated. Unlike today, however, LIBOR was an average of offered lending rates, hence the name, and was not based on actual transactions as the first tier of the LIBOR submission waterfall is today.

Dozer and Tank

So how large is the Eurodollar market today? Like the Matrix - vast. As with the origins of the Eurodollar system, itself nothing is transparent. However, we have tried to estimate an indicative total using Bank for International Settlements (BIS) data for:

- On-balance sheet USD liabilities held by non-US banks;

- USD Credit commitments, guarantees extended, and derivatives contracts of non-US banks (C, G, D);

- USD debt liabilities of non-US non-financial corporations;

- Over-the-Counter (OTC) USD derivative claims of non-US non-financial corporations; and

- Global goods imports in USD excluding those of the US and intra-Eurozone trade.

Indeed, fractional reserve banking means that an initial Eurodollar can be multiplied up (e.g., Eurodollar 100m can be used as the base for a larger Eurodollar loan, and leverage increased further). Yet non-US entities are NOT able to conjure up USD on demand when needed because they don’t have a central bank behind them which can produce USD by fiat, which only the Federal Reserve can.

This power to create the USD that everyone else transacts and trades in is an essential point to grasp on the Eurodollar – which is ironically also why it was created in the first place!

Tri-ffi-nity

Given the colourful history, ubiquitous nature, and critical importance of the Eurodollar market, a second question then arises: Why don’t people know about The Matrix?

The answer is easy: because once one is aware of it, one immediately wishes to have taken the Blue Pill instead.

Consider what the logic of the Eurodollar system implies. Global financial markets and the global economy rely on the common standard of the USD for pricing, accounting, trading, and deal making. Imagine a world with a hundred different currencies – or even a dozen: it would be hugely problematic to manage, and would not allow anywhere near the level of integration we currently enjoy.

However, at root the Eurodollar system is based on using the national currency of just one country, the US, as the global reserve currency. This means the world is beholden to a currency that it cannot create as needed.

When a crisis hits, as at present, everyone in the Eurodollar system suddenly realizes they have no ability to create fiat USD and must rely on national USD FX reserves and/or Fed swap lines that allow them to swap local currency for USD for a period. This obviously grants the US enormous power and privilege.

The world is also beholden to US monetary policy cycles rather than local ones: higher US rates and/or a stronger USD are ruinous for countries that have few direct economic or financial links with the US. Yet the US Federal Reserve generally shows very little interest in global economic conditions – though that is starting to change, as we will show shortly.

A second problem is that the flow of USD from the US to the rest of the world needs to be sufficient to meet the inbuilt demand for trade and other transactions. Yet the US is a relatively smaller slice of the global economy with each passing year. Even so, it must keep USD flowing out or else a global Eurodollar liquidity crisis will inevitably occur.

That means that either the US must run large capital account deficits, lending to the rest of the world; or large current account deficits, spending instead.

Obviously, the US has been running the latter for many decades, and in many ways benefits from it. It pays for goods and services from the rest of the world in USD debt that it can just create. As such it can also run huge publicor private-sector deficits – arguably even with the multitrillion USD fiscal deficits we are about to see.

However, there is a cost involved for the US. Running a persistent current-account deficit implies a net outflow of industry, manufacturing and related jobs. The US has obviously experienced this for a generation, and it has led to both structural inequality and, more recently, a backlash of political populism wanting to Make America Great Again.

Indeed, if one understands the structure of the Eurodollar system one can see that it faces the Triffin Paradox. This was an argument first made by Robert Triffin in 1959 when he correctly predicted that any country forced to adopt the role of global reserve currency would also be forced to run ever-larger currency outflows to fuel foreign appetite – eventually leading to the breakdown of the system as the cost became too much to bear.

Moreover, there is another systemic weakness at play: realpolitik. Atrophying of industry undermines the supply chains needed for the defence sector, with critical national security implications. The US is already close to losing the ability to manufacture the wide range of products its powerful armed forces require on scale and at speed: yet without military supremacy the US cannot long maintain its multi-dimensional global power, which also stands behind the USD and the Eurodollar system.

This implies the US needs to adopt (military-) industrial policy and a more protectionist stance to maintain its physical power – but that could limit the flow of USD into the global economy via trade. Again, the Eurodollar system, like the early utopian version of the Matrix, seems to contain the seeds of its own destruction.

Indeed, look at the Eurodollar logically over the long term and there are only three ways such a system can ultimately resolve itself:

- The US walks away from the USD reserve currency burden, as Triffin said, or others lose faith in it to stand behind the deficits it needs to run to keep USD flowing appropriately;

- The US Federal Reserve takes over the global financial system little by little and/or in bursts; or

- The global financial system fragments as the US asserts primacy over parts of it, leaving the rest to make their own arrangements.

Down the rabbit hole

But back to the rabbit hole that is our present situation. While the Eurodollar market is enormous one also needs to look at how many USD are circulating around the world outside the US that can service it if needed. In this regard we will look specifically at global USD FX reserves.

It’s true we could also include US cash holdings in the offshore private sector. Given that US banknotes cannot be tracked no firm data are available, but estimates range from 40% - 72% of total USD cash actually circulates outside the country. This potentially totals hundreds of billions of USD that de facto operate as Eurodollars. However, given it is an unknown total, and also largely sequestered in questionable cash-based activities, and hence are hopefully outside the banking system, we prefer to stick with centralbank FX reserves.

Looking at the ratio of Eurodollar liabilities to global USD FX reserve assets, the picture today is actually healthier than it was a few years ago.

Indeed, while the Eurodollar market size has remained relatively constant in recent years, largely as banks have been slow to expand their balance sheets, the level of global USD FX reserves has risen from USD1.9 trillion to over USD6.5 trillion. As such, the ratio of structural global USD demand to that of USD supply has actually declined from near 22 during the global financial crisis to around 9.

Yet the current market is clearly seeing major Eurodollar stresses – verging on panic.

Fundamentally, the Eurodollar system is always short USD, and any loss of confidence sees everyone scramble to access them at once – in effect causing an invisible international bank run. Indeed, the Eurodollar market only works when it is a constant case of “You-Roll-Over Dollar”.

Unfortunately, COVID-19 and its huge economic damage and uncertainty mean that global confidence has been smashed, and our Eurodollar Matrix risks buckling as a result.

The wild gyrations recently experienced in even major global FX crosses speak to that point, to say nothing of the swings seen in more volatile currencies such as AUD, and in EM bellwethers such as MXN and ZAR. FX basis swaps and LIBOR vs. Fed Funds (so offshore vs. onshore USD borrowing rates) say the same thing. Unsurprisingly, the IMF are seeing a wide range of countries turning to them for emergency USD loans.

The Fed has, of course, stepped up. It has reduced the cost of accessing existing USD swap lines--where USD are exchanged for other currencies for a period of time--for the Bank of Canada, Bank of England, European Central Bank, and Swiss National Bank; and another nine countries were given access to Fed swap lines with Australia, Brazil, South Korea, Mexico, Singapore, and Sweden all able to tap up to USD60bn, and USD30bn available to Denmark, Norway, and New Zealand. This alleviates some pressure for some markets – but is a drop in the ocean compared to the level of Eurodollar liabilities.

The Fed has also introduced a new FIMA repo facility. Essentially this allows any central bank, including emerging markets, to swap their US Treasury holdings for USD, which can then be made available to local financial institutions. To put it bluntly, this repo facility is like a swap line but with a country whose currency you don't trust.

Allowing a country to swap its Treasuries for USD can alleviate some of the immediate stress on Eurodollars, but when the swap needs to be reversed the drain on reserves will still be there. Moreover, Eurodollar market participants will now not be able to see if FX reserves are declining in a potential crisis country. Ironically, that is likely to see less, not more, willingness to extend Eurodollar credit as a result.

You have two choices, Neo

Yet despite all the Fed’s actions so far, USD keeps going up vs. EM FX. Again, this is as clear an example as one could ask for of structural underlying Eurodollar demand.

Indeed, we arguably need to see even more steps taken by the Fed – and soon. To underline the scale of the crisis we currently face in the Eurodollar system, the BIS concluded at the end of a recent publication on the matter:

“...today’s crisis differs from the 2008 GFC, and requires policies that reach beyond the banking sector to final users. These businesses, particularly those enmeshed in global supply chains, are in constant need of working capital, much of it in dollars. Preserving the flow of payments along these chains is essential if we are to avoid further economic meltdown.In other words, the BIS is making clear that somebody (i.e., the Fed) must ensure that Eurodollars are made available on massive scale, not just to foreign central banks, but right down global USD supply chains. As they note, there are many practical issues associated with doing that – and huge downsides if we do not do so. Yet they overlook that there are huge geopolitical problems linked to this step too.

Channeling dollars to non-banks is not straightforward. Allowing non-banks to transact with the central bank is one option, but there are attendant difficulties, both in principle and in practice. Other options include policies that encourage banks to fill the void left by market based finance, for example funding for lending schemes that extend dollars to non-banks indirectly via banks.”

Notably, if the Fed does so then we move rapidly towards logical end-game #2 of the three possible Eurodollar outcomes we have listed previously, where the Fed de facto takes over the global financial system. Yet if the Fed does not do so then we move towards end-game #3, a partial Eurodollar collapse.

Of course, the easy thing to assume is that the Fed will step up as it has always shown a belated willingness before, and a more proactive stance of late. Indeed, as the BIS shows in other research, the Fed stepped up not just during the Global Financial Crisis, but all the way back to the Eurodollar market of the 1960s, where swap lines were readily made available on large scale in order to try to reduce periodic volatility.

However, the scale of what we are talking about here is an entirely new dimension: potentially tens of trillions of USD, and not just to other central banks, or to banks, but to a panoply of real economy firms all around the Eurodollar universe.

As importantly, this assumes that the Fed, which is based in the US, wants to save all these foreign firms. Yet does the Fed want to help Chinese firms, for example? It may traditionally be focused narrowly on smoothly-functioning financial markets, but is that true of a White House that openly sees China as a “strategic rival”, which wishes to onshore industry from it, and which has more interest in having a politically-compliant, not independent Fed? Please think back to the origins of Eurodollars - or look at how the US squeezed its WW2 ally UK during the 1956 Suez Crisis, or how it is using the USD financial system vs. Iran today.

Equally, this assumes that all foreign governments and central banks will want to see the US and USD/Eurodollar cement their global financial primacy further. Yes, Fed support will help alleviate this current economic and brewing financial crisis – but the shift of real power afterwards would be a Rubicon that we have crossed.

Specifically, would China really be happy to see its hopes of CNY gaining a larger global role washed away in a flood of fresh, addictive Eurodollar liquidity, meaning that it is more deeply beholden to the US central bank? Again, please think back to the origins of Eurodollars, to Suez, and to how Iran is being treated – because Beijing will. China would be fully aware that a Fed bailout could easily come with political strings attached, if not immediately and directly, then eventually and indirectly. But they would be there all the same.

One cannot ignore or underplay this power struggle that lies within the heart of the Eurodollar Matrix.

I know you’re out there

So, considering those systemic pressures, let’s look at where Eurodollar pressures are building most now. We will use World Bank projections for short-term USD financing plus concomitant USD current-account deficit requirements vs. specifically USD FX reserves, not general FX reserves accounted in USD, as calculated by looking at national USD reserves and adjusting for the USD’s share of the total global FX reserves basket (57% in 2018, for example). In some cases this will bias national results up or down, but these are in any case only indicative.

How to read these data about where the Eurodollar stresses lie in Table 1? Firstly, in terms of scale, Eurodollar problems lie with China, the UK, Japan, Hong Kong, the Cayman Islands, Singapore, Canada, and South Korea, Germany and France. Total short-term USD demand in the economies listed is USD28 trillion – around 130% of USD GDP. The size of liabilities the Fed would potentially have to cover in China is enormous at over USD3.4 trillion - should that prove politically acceptable to either side.

Outside of China, and most so in the Cayman Islands and the UK, Eurodollar claims are largely in the financial sector and fall on banks and shadow banks such as insurance companies and pension funds. This is obviously a clearer line of attack/defence for the Fed. Yet it still makes these economies vulnerable to swings in Eurodollar confidence - and reliant on the Fed.

Second, most developed countries apart from Switzerland have opted to hold almost no USD reserves at all. Their approach is that they are also reserve currencies, long-standing US allies, and so assume the Fed will always be willing to treat them as such with swap lines when needed. That assumption may be correct – but it comes with a geopolitical power-hierarchy price tag. (Think yet again of how Eurodollars started and the 1956 Suez Crisis ended.)

Third, most developing countries still do not hold enough USD for periods of Eurodollar liquidity stress, despite the painful lessons learned in 1997-98 and 2008-09. The only exception is Saudi Arabia, whose currency is pegged to the USD, although Taiwan, and Russia hold USD close to what would be required in an emergency. Despite years of FX reserve accumulation, at the cost of domestic consumption and a huge US trade deficit, Indonesia, Mexico, Malaysia, and Turkey are all still vulnerable to Eurodollar funding pressures. In short, there is an argument to save yet more USD – which will increase Eurodollar demand further.

We all become Agent Smith?

In short, the extent of demand for USD outside of the US is clear – and so far the Fed is responding. It has continued to expand its balance sheet to provide liquidity to the markets, and it has never done so at this pace before (Figure 5). In fact, in just a month the Fed has expanded its balance sheet by nearly 50% of the previous expansion observed during all three rounds of QE implemented after the Global Financial Crisis. Essentially we have seen nearly five years of QE1-3 in five weeks! And yet it isn’t enough.

Moreover, things are getting worse, not better. The global economic impact of COVID-19 is only beginning but one thing is abundantly clear – global trade in goods and services is going to be hit very, very hard, and that US imports are going to tumble. This threatens one of the main USD liquidity channels into the Eurodollar system.

Table 2 above also underlines looming EM Eurodollar stress-points in terms of import cover, which will fall sharply as USD earnings collapse, and external debt service. The further to the left we see the latest point for import cover, and the further to the right we see it for external debt, the greater the potential problems ahead.

As such, the Fed is likely to find it needs to cover trillions more in Eurodollar liabilities (of what underlying quality?) coming due in the real global, not financial economy – which is exactly what the BIS are warning about. Yes, we are seeing such radical steps being taken by central banks in some Western countries, including in the US - but internationally too? Are we all to become ‘Agent Smith’?

If the Fed is to step up to this challenge and expand its balance sheet even further/faster, then the US economy will massively expand its external deficit to mirror it.

That is already happening. What was a USD1 trillion fiscal deficit before COVID-19, to the dismay of some, has expanded to USD3.2 trillion via a virus-fighting package: and when tax revenues collapse, it will be far larger. Add a further USD600bn phase three stimulus, and talk of a USD2 trillion phase four infrastructure program to try to jumpstart growth rather than just fight virus fires, and potentially we are talking about a fiscal deficit in the range of 20-25% of GDP. As we argued recently, that is a peak-WW2 level as this is also a world war of sorts.

On one hand, the Eurodollar market will happily snap up those trillions US Treasuries/USD – at least those they can access, because the Fed will be buying them too via QE. Indeed, for now bond yields are not rising and USD still is.

However, such fiscal action will prompt questions on how much the USD can be ‘debased’ before, like Agent Smith, it over-reaches and then implodes or explodes – the first of the logical endpoints for the Eurodollar system, if you recall. (Of course, other currencies are doing it too.)

Is Neo The One?

In conclusion, the origins of the Eurodollar Matrix are shrouded in mystery and intrigue – and yet are worth knowing. Its operations are invisible to most but control us in many ways – so are worth understanding. Moreover, it is a system under huge structural pressure – which we must now recognise.

It’s easy to ignore all these issues and just hope the Eurodollar Matrix remains the “You-Roll-Dollar” market – but can that be true indefinitely based just on one’s belief?

Is the Neo Coronavirus ‘The One’ that breaks it?

_______________________________________________________________

ORACLE: “Well now, ain’t this a surprise?”

ARCHITECT: “You’ve played a very dangerous game.”

ORACLE: “Change always is.”

ARCHITECT: “And how long do you think this peace is going to last?”

ORACLE: “As long as it can….What about the others?”

ARCHITECT: “What others?”

ORACLE: “The ones that want out.”

ARCHITECT: “Obviously they will be freed.”

Saturday, April 11, 2020

Confirmation that the Wuhan Corona Virus is a chimera!

The artificial origin of the Wuhan Corona Virus is now clear.

In spite of Chinese propaganda to the contrary, ALL the assumptions we made two months ago about the virus have been confirmed as the video below makes clear.

The virus escape from the P4 laboratory was an accident, but the research being done was not. The consequences will be far reaching.

(PS: To view the video, click on the YouTube link below. The video is too large to embed in the article. The first part of the documentary, the research side is the most interesting. The second part is political. It veers toward anti communist propaganda and is much less interesting.)

Friday, March 20, 2020

Flattening the Coronavirus curve

Most European governments completely misread the epidemic although they had time to learn from the Chinese experience.

First they misunderstood exponentials, (it starts slowly then goes up fast) and did nothing. Then they over-reacted looking at models saying half the population would get sick with 3% dying and finally settled on the only option left: "Flatten the curve!" The result is that in a month or two, a large chunk of the economy will be gone. There will be hell to pay. Confinement and the dictatorial measures which come together will not be tolerated very long in many countries. The 4th turning is upon us!

But for now, that is indeed the only option left.

Here is a good brief

https://phys.org/news/2020-03-endgame-restart-coronavirus.html

Here is the complete original statistical work from the Imperial College in London:

(The link seems to be broken so I insert a copy of the summary, pdf below)

Impact of non-pharmaceutical interventions (NPIs) to reduce COVID-19 mortality and healthcare demand

Neil M Ferguson, Daniel Laydon, Gemma Nedjati-Gilani, Natsuko Imai, Kylie Ainslie, Marc Baguelin, Sangeeta Bhatia, Adhiratha Boonyasiri, Zulma Cucunubá, Gina Cuomo-Dannenburg, Amy Dighe, Ilaria Dorigatti, Han Fu, Katy Gaythorpe, Will Green, Arran Hamlet, Wes Hinsley, Lucy C Okell, Sabine van Elsland, Hayley Thompson, Robert Verity, Erik Volz, Haowei Wang, Yuanrong Wang, Patrick GT Walker, Peter Winskill, Charles Whittaker, Christl A Donnelly, Steven Riley, Azra C Ghani.

On behalf of the Imperial College COVID-19 Response Team

WHO Collaborating Centre for Infectious Disease Modelling MRC Centre for Global Infectious Disease Analysis Abdul Latif Jameel Institute for Disease and Emergency Analytics Imperial College London

Correspondence: neil.ferguson@imperial.ac.uk

Summary

The global impact of COVID-19 has been profound, and the public health threat it represents is the most serious seen in a respiratory virus since the 1918 H1N1 influenza pandemic. Here we present the results of epidemiological modelling which has informed policymaking in the UK and other countries in recent weeks. In the absence of a COVID-19 vaccine, we assess the potential role of a number of public health measures – so-called non-pharmaceutical interventions (NPIs) – aimed at reducing contact rates in the population and thereby reducing transmission of the virus. In the results presented here, we apply a previously published microsimulation model to two countries: the UK (Great Britain specifically) and the US. We conclude that the effectiveness of any one intervention in isolation is likely to be limited, requiring multiple interventions to be combined to have a substantial impact on transmission.

Two fundamental strategies are possible: (a) mitigation, which focuses on slowing but not necessarily stopping epidemic spread – reducing peak healthcare demand while protecting those most at risk of severe disease from infection, and (b) suppression, which aims to reverse epidemic growth, reducing case numbers to low levels and maintaining that situation indefinitely. Each policy has major challenges. We find that that optimal mitigation policies (combining home isolation of suspect cases, home quarantine of those living in the same household as suspect cases, and social distancing of the elderly and others at most risk of severe disease) might reduce peak healthcare demand by 2/3 and deaths by half. However, the resulting mitigated epidemic would still likely result in hundreds of thousands of deaths and health systems (most notably intensive care units) being overwhelmed many times over. For countries able to achieve it, this leaves suppression as the preferred policy option.

We show that in the UK and US context, suppression will minimally require a combination of social distancing of the entire population, home isolation of cases and household quarantine of their family members. This may need to be supplemented by school and university closures, though it should be recognised that such closures may have negative impacts on health systems due to increased

16 March 2020 Imperial College COVID-19 Response Team

absenteeism. The major challenge of suppression is that this type of intensive intervention package – or something equivalently effective at reducing transmission – will need to be maintained until a vaccine becomes available (potentially 18 months or more) – given that we predict that transmission will quickly rebound if interventions are relaxed. We show that intermittent social distancing – triggered by trends in disease surveillance – may allow interventions to be relaxed temporarily in relative short time windows, but measures will need to be reintroduced if or when case numbers rebound. Last, while experience in China and now South Korea show that suppression is possible in the short term, it remains to be seen whether it is possible long-term, and whether the social and economic costs of the interventions adopted thus far can be reduced.

16 March 2020 Imperial College COVID-19 Response Team

Introduction

The COVID-19 pandemic is now a major global health threat. As of 16th March 2020, there have been 164,837 cases and 6,470 deaths confirmed worldwide. Global spread has been rapid, with 146 countries now having reported at least one case.

The last time the world responded to a global emerging disease epidemic of the scale of the current COVID-19 pandemic with no access to vaccines was the 1918-19 H1N1 influenza pandemic. In that pandemic, some communities, notably in the United States (US), responded with a variety of non-pharmaceutical interventions (NPIs) - measures intended to reduce transmission by reducing contact rates in the general population1. Examples of the measures adopted during this time included closing schools, churches, bars and other social venues. Cities in which these interventions were implemented early in the epidemic were successful at reducing case numbers while the interventions remained in place and experienced lower mortality overall1. However, transmission rebounded once controls were lifted.

Whilst our understanding of infectious diseases and their prevention is now very different compared to in 1918, most of the countries across the world face the same challenge today with COVID-19, a virus with comparable lethality to H1N1 influenza in 1918. Two fundamental strategies are possible2:

(a) Suppression. Here the aim is to reduce the reproduction number (the average number of secondary cases each case generates), R, to below 1 and hence to reduce case numbers to low levels or (as for SARS or Ebola) eliminate human-to-human transmission. The main challenge of this approach is that NPIs (and drugs, if available) need to be maintained – at least intermittently - for as long as the virus is circulating in the human population, or until a vaccine becomes available. In the case of COVID-19, it will be at least a 12-18 months before a vaccine is available3. Furthermore, there is no guarantee that initial vaccines will have high efficacy.

(b) Mitigation. Here the aim is to use NPIs (and vaccines or drugs, if available) not to interrupt transmission completely, but to reduce the health impact of an epidemic, akin to the strategy adopted by some US cities in 1918, and by the world more generally in the 1957, 1968 and 2009 influenza pandemics. In the 2009 pandemic, for instance, early supplies of vaccine were targeted at individuals with pre-existing medical conditions which put them at risk of more severe disease4. In this scenario, population immunity builds up through the epidemic, leading to an eventual rapid decline in case numbers and transmission dropping to low levels.

The strategies differ in whether they aim to reduce the reproduction number, R, to below 1 (suppression) – and thus cause case numbers to decline – or to merely slow spread by reducing R, but not to below 1.

In this report, we consider the feasibility and implications of both strategies for COVID-19, looking at a range of NPI measures. It is important to note at the outset that given SARS-CoV-2 is a newly emergent virus, much remains to be understood about its transmission. In addition, the impact of many of the NPIs detailed here depends critically on how people respond to their introduction, which is highly likely to vary between countries and even communities. Last, it is highly likely that there would be significant spontaneous changes in population behaviour even in the absence of government-mandated interventions.

16 March 2020 Imperial College COVID-19 Response Team

Monday, March 16, 2020

The Corona virus progression curve

This is one of the most important chart to consider in order to understand how different countries will fare against the Corona virus. From this, it is very clear that Asian countries are doing relatively well fighting the virus, European ones not so much. This will have consequences and may end up speeding up Asia's rise and conversely Europe's decline.

Understanding this trend from the Chinese data early on would have been extremely useful for the rest of the world. We lost about a month. From this data, a month is about two factors, so we can now expect that the Corona pandemic will be about 100 times larger than it should have been!

Friday, February 28, 2020

Data mamagement progress

The data learning curve is steep.

To transform data into information, you need to format, clean, parse and segment the data.

To build knowledge, you must undestand the relations beetween data and create a system.

Insight is gained through experimentation and experience.

As for wisdom, I am not quite sure that "data" is the right starting point!

Saturday, February 8, 2020

The magic of haptic technology (video)

The progress of haptic technology are stunning! They offer the possibility to control complex layers of information in a easy and intuitive way, provided we work out intelligent interface. This is the next stage of technology where a whole virtual world will be created offering natural interaction and optimal control. But to really take off, this "world" need to be more secure than the current IoT, therefore probably based on blockchain technology, both distributed and decentralized, the opposite of the current trend. Privacy and people need to be placed back at the center of technological development. The alternative is a smart city for robots controlled by computers with no room left for humans.

Wednesday, February 5, 2020

Creating a data catalog and understanding the importance of metadata

Creating a data catalog may indeed be the easiest way to understand and access data in a company. A data catalog is not about the data itself but about organizing meta-data. It is this organization which will eventually constitute the backbone of the database structure in and efficient organization. Well worth a read, if only to understand better what is possible! #Data #Database #SQL #CRM #Datalake #Datawarehouse

https://www.datasciencecentral.com/profiles/blogs/a-step-by-step-guide-to-build-a-data-catalog

Subscribe to:

Comments (Atom)

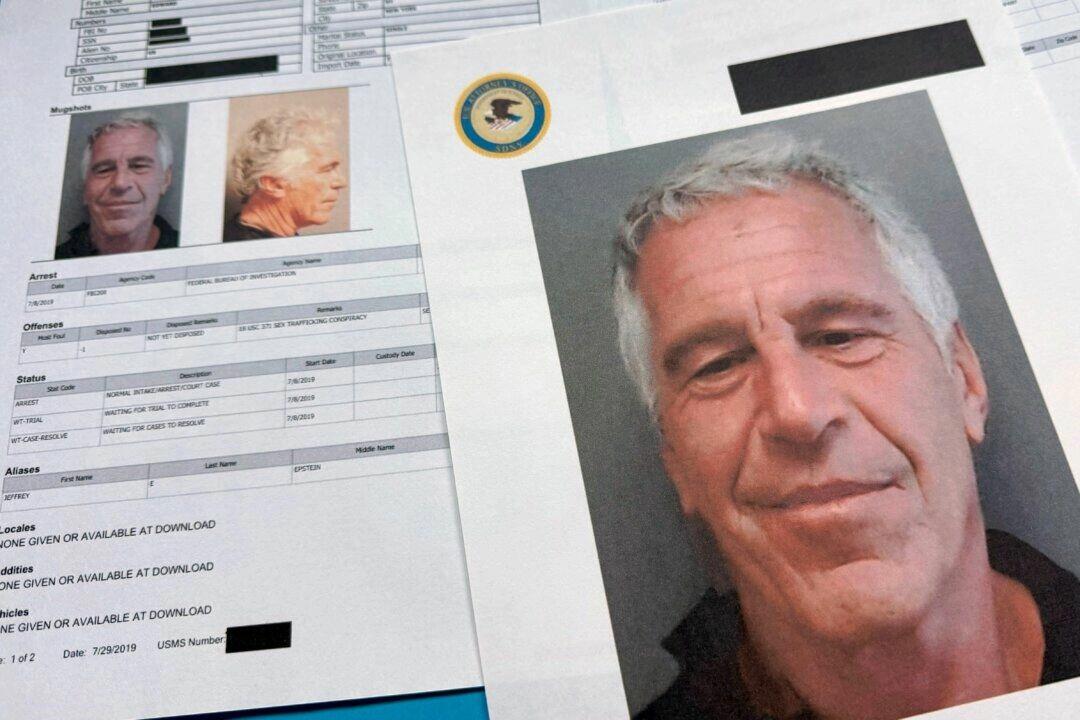

The Unsettling Truths The Epstein Files Reveal About Power And Privilege (Must read)

The article below is essential to understand what is at stake with the Epstein papers. This is not about a network of pedophiles and perv...

-

A rather interesting video with a long annoying advertising in the middle! I more or less agree with all his points. We are being ...

-

A little less complete than the previous article but just as good and a little shorter. We are indeed entering a Covid dystopia. Guest Pos...

-

In a sad twist, from controlled news to assisted search and tunnel vision, it looks like intelligence is slipping away from humans alm...